|

市场调查报告书

商品编码

1644867

空调设备:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Air Conditioning Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

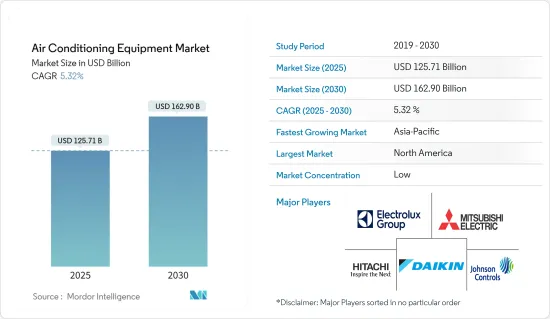

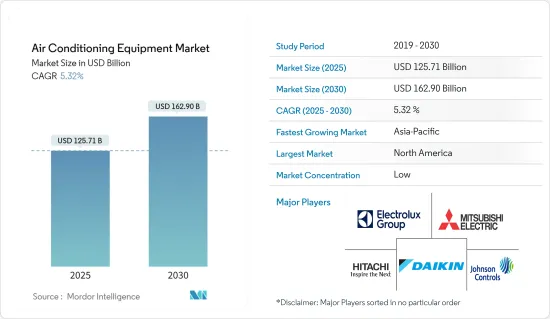

空调设备市场规模预计在 2025 年为 1,257.1 亿美元,预计到 2030 年将达到 1,629 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.32%。

空调的工作原理是从空间中吸收热量,排放室外,并冷却室内的空气。然后,冷却的空气会透过通风系统在整个建筑物内循环。作为 HVAC 系统的重要组成部分,空调对于维持舒适的生活温度至关重要。

通常称为「分离式系统」的空调由室外机中的冷凝器和室内机中的蒸发器组成。除湿的工作原理是将室内暖空气移到冷蒸发器上,使空气凝结并释放水分。分离式系统的特点是室内机和室外机是分开的,但也有整合室外机的「套装」系统。

主要亮点

- 建筑业的成长预计将增加住宅、商业和工业领域对空调设备的需求。住宅、商业和工业领域的建筑支出增加以及建筑许可激增。值得注意的是,在联邦政府对基础设施大量投资的推动下,美国建筑业预计将进一步成长。这一积极趋势不仅限于公共计划,私人商业建筑也正在蓬勃发展。

- 特别是在开发中国家,快速的都市化和经济扩张推动了住宅和商业建筑的激增,从而增加了对空调系统的需求。随着收入的增加,越来越多的家庭和企业能够投资和安装空调设备。

- 气候变迁导致全球气温上升,导致世界各地热浪的频率和强度增加。因此,对空调系统的需求正在激增。这种需求在历史上冷气需求较低的地区尤其明显。

- 空调在美国家庭中比在欧洲家庭中更为普及。这一趋势很大程度上是由美国某些地区的气候需求所推动的。

- 例如,潮湿的南部和干燥的西南部历来需要冷却解决方案。国际能源总署指出,美国西南部中暑警告数量增加,凸显了情势的严重性。此外,美国中南部以其高湿度而闻名,这意味着空调非常普遍。相反,以混合湿润气候和年降水量超过 20 英吋为特征的中西部地区的空调使用量也显着增加。

- 受俄乌衝突和经济放缓影响,空调市场面临重大波动。通货膨胀和利率上升抑制了消费者支出,减少了需求并阻碍了市场成长。此外,美国贸易紧张局势加剧了全球供应链的中断,对两国的空调设备製造商产生了重大影响。

空调设备市场趋势

分离式系统可望大幅成长

- 分离式空调由室外机和室内机组成。在单分体系统中,室内机和室外机透过铜管连接。多分体系统允许将客户选择的最多五个室内机组连接到一个室外机组。多分体空调适用于多房间、大房间和各种气候区。另一个主要优点是室外机占地面积小,易于安装。

- 两家公司联手推出节能、气候友善的分离式空调。例如,LG电子在其2024年产品系列中宣布推出一系列针对印度市场的空调。这些设备拥有先进的技术,并优先考虑能源效率和使用者舒适度。 LG 2024 AC 系列配备了 Energy Manager,这是一项可优化能源使用并确保最佳冷却效果的技术。

- 此外,美的全易系列R290机组的推出也标誌着一个转捩点。 Midia 的可携式R290空调已在欧洲销售一段时间了。世界上最常用的冷冻设备是分离式空调,安装在外墙上。 Midia 的 R290 分离式空调预计将颠覆欧洲市场,并引发欧洲大陆减少能源使用和温室气体排放的变化。

- 此外,2024年4月,三星电子新加坡今天推出了最新的WindFree空调系列。此次产品的推出标誌着三星家电产品线的扩展,旨在改善住宅的生活方式。此系列具有舒适冷却、节能和注重联网生活等特色。

- 此外,LG电子表示,2023年其空调产量约1,203万台。这些产品是在韩国、印度、中国和泰国的工厂生产的。

预计北美将占据较大的市场占有率

- 北美空调设备市场是一个强劲且充满活力的产业,受快速都市化、技术进步、气候变迁和极端天气事件等因素所驱动。

- 由于全球暖化和气候变迁导緻美国都市区以及西南部和南部阳光地带的气温上升,这些地区各种空调系统的使用增加。美国某些地区,例如潮湿的南部和沙漠化的西南部,对空调的需求早已成为现实。

- 国际能源总署指出,美国西南部高温警告数量增加,凸显人类福祉面临的严峻局势。此外,美国南部和中部湿度较高,因此使用空调的情况很普遍。相反,中西部地区属于混合湿润气候,每年降水量超过 20 英吋。预计这些因素将推动该国对空调的需求。

- 此外,根据美国能源部 (DOE) 的数据,高达 75% 的美国家庭都拥有空调。这些机组消耗了全国总发电量的约 6%,每年为房主带来约 290 亿美元的损失。

- 结果,每年约有 1.17 亿吨二氧化碳排放到大气中。随着人们越来越努力地转向更节能的空调和实施其他策略以保持舒适的室内温度,以及减少用于製冷的能源使用,市场潜力预计会增加。

空调产业概况

空调设备产业竞争激烈,国内外企业都积极参与。国际参与者正在透过与当地参与者的合作扩大在该国的业务。随着市场预计扩大并提供更多机会,预计将有更多参与者进入市场。所研究的市场的主要企业包括三菱电机和江森自控。这些主要企业正在采用各种成长策略,如併购、新产品发布、业务扩张、合资和伙伴关係,以巩固其在该市场的地位。

- 2024 年 3 月,三菱电机特灵 HVAC美国有限责任公司 (METUS) 宣布推出 Premier 壁挂式室内机 (MSZ-GS/MSY-GS)。同时,Premier MSZ-GS 室内机相容于单区和多区热泵室外机,包括单区和多区超级加热逆变器 (H2i) 机。 MSY-GS 是一款单区空调,适用于不需要暖气的气候。

- 2024 年 2 月:DAIKIN INDUSTRIES透过专注于关键要素来增强空调。冷媒由全球暖化潜势较低的R32改为HFC-32,更重视环保与节能。此外空调的基本性能也得到了提升。大金的一项重要倡议是,将于 2024 年 11 月推出大楼用多功能空调。该系列拥有业界领先的能源效率,这对于减少您的环境影响和营运负担至关重要。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- 评估影响市场的宏观经济因素

第五章 市场动态

- 市场驱动因素

- 更换现有设备以提高性能

- 政府支持法规,包括透过税额扣抵计划奖励节能

- 市场挑战

- 依赖宏观经济经济状况

第六章 市场细分

- 按类型

- 分离系统(管道式和无管道式)

- 可变冷媒流量 (VRF)

- 空气调节机

- 冷却器

- 风机盘管

- 室内套餐和屋顶

- 其他类型

- 按最终用户产业

- 住宅

- 商业

- 产业

- 按地区

- 北美洲

- 亚洲

- 澳洲和纽西兰

- 欧洲

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Daikin Industries Ltd

- Hitachi Ltd

- Electrolux AB Corporation

- Mitsubishi Electric Corporation

- Johnson Controls

- Haier Group

- Carrier Corporate

- Panasonic Corporation

- Alfa Laval AB

- Lennox International Inc.

第八章投资分析

第九章:市场的未来

The Air Conditioning Equipment Market size is estimated at USD 125.71 billion in 2025, and is expected to reach USD 162.90 billion by 2030, at a CAGR of 5.32% during the forecast period (2025-2030).

An air conditioner extracts heat from a space and expells it outside, cooling indoor air. This cooled air is then circulated throughout a building via ventilation. Air conditioners are crucial in maintaining comfortable living temperatures as a pivotal HVAC system component.

Commonly referred to as "split systems," air conditioners consist of an outdoor unit, the condenser, and an indoor unit, the evaporator. Dehumidification occurs as warm indoor air moves over the cold evaporator, causing the air to condense and shed moisture, akin to how condensation forms on chilled glass. While split systems feature distinct indoor and outdoor units, there's also a "packaged" system where elements are integrated into a single outdoor unit.

Key Highlights

- The growing construction sector is expected to boost the demand for AC equipment in the residential, commercial, and industrial sectors. The increasing construction spending and a surge in building permits across residential, commercial, and industrial sectors. Notably, the US construction sector is set for further growth, supported by significant federal investments in infrastructure. This positive trend isn't limited to public projects; private commercial construction is also gaining momentum.

- Rapid urbanization and economic expansion, especially in developing nations, are fueling a surge in residential and commercial construction, driving the demand for air conditioning systems. With increasing incomes, a growing number of households and businesses can now invest in and deploy air conditioning units.

- The escalation of global temperatures due to climate change has heightened the frequency and intensity of heatwaves worldwide. Consequently, there has been a surge in the demand for air conditioning systems. This demand is particularly pronounced in regions that historically had lower cooling needs.

- Air conditioning is significantly more prevalent in American households than in European ones. This trend is largely attributed to the climatic demands of specific US regions.

- For instance, the humid South and arid Southwest have historically necessitated cooling solutions. Highlighting the severity of the situation, the IEA has noted a rise in heat alerts in the Southwestern United States, underscoring the health risks. Moreover, central and southern US regions, known for their high humidity, exhibit a higher prevalence of air conditioning. Conversely, the Midwest, characterized by a mixed-humid climate and annual precipitation exceeding 20 inches, also sees a notable uptake in air conditioner usage.

- The air conditioning equipment market faced substantial disruptions due to the Russia-Ukraine conflict and an economic slowdown. Rising inflation and interest rates curbed consumer spending, dampening demand and stalling market growth. Additionally, the trade tensions between the United States and China exacerbated global supply chain disruptions, significantly affecting AC manufacturers in both nations.

Air Conditioning Equipment Market Trends

Split System is Expected to Register Significant Growth

- A split air conditioner consists of an outdoor unit and an indoor unit. In single-split systems, an interior and outdoor unit are connected by copper pipe. In multi-split systems, up to five indoor units of customer choice can be connected to one outside unit. The multi-split is appropriate for many rooms or large rooms and various climatic zones. The outdoor unit's small footprint and easy installation are major benefits.

- The firms are collaborating to provide energy-efficient and climatic-friendly split air conditioners. For instance, in its 2024 product lineup, LG Electronics introduced a series of air conditioners tailored for the Indian market. These units boast advanced technology, prioritizing energy efficiency and user comfort. LG's 2024 AC range has the Energy Manager, a technology that optimizes energy usage and guarantees top-notch cooling.

- Furthermore, introducing Midea's All Easy Series R290 units is a tipping point. Midea's portable R290 air conditioners have been available in Europe for some time. The most often used appliances for cooling spaces globally are split air conditioners mounted on an exterior wall. The R290 split air conditioners from Midea are expected to disrupt the European market and spark a change that will lower the continent's energy use and greenhouse gas emissions.

- Furthermore, in April 2024, Samsung Electronics Singapore unveiled its newest WindFree Air Conditioner series today. This launch marks an expansion of Samsung's lineup of home appliances aimed at enhancing homeowners' lifestyles. The series boasts features like comfort cooling, energy-saving capabilities, and a focus on connected living.

- In addition, according to LG Electronics, in 2023, it produced approximately 12.03 million air conditioners. These units were manufactured across facilities in South Korea, India, China, and Thailand.

North America is Expected to Hold Significant Market Share

- The air conditioning equipment market in North America is a robust and dynamic industry driven by factors such as rapid urbanization, technological advancements, climate change, and extreme weather.

- The rise in temperature in American cities and the sunbelt regions of Southwestern and southern America, caused by global warming and climate change, has led to greater use of different air conditioning systems in these areas. The necessity of cool air in specific US regions, like the humid South and the desert Southwest, has been a longstanding reality.

- The IEA has noted a rise in heat alerts in the Southwestern United States, underscoring the difficult conditions for human well-being. Additionally, the use of air conditioning is more common in the southern and central regions of the United States because of the higher levels of humidity found in those areas. Conversely, the Midwest encounters a mixed-humid climate with an annual rainfall exceeding 20 inches. These factors are expected to propel the demand for air conditioners in the country.

- Furthermore, according to the Department of Energy (DOE), a substantial 75% of US households own air conditioning units. These units consume roughly 6% of the nation's total electricity production, leading to an annual cost of approximately USD 29 billion for homeowners.

- As a result, approximately 117 million metric tons of carbon dioxide are emitted into the atmosphere annually. The growing initiatives to shift towards more energy-efficient air conditioners and implement other strategies to maintain comfortable indoor temperatures, as well as the goal of reducing energy usage for cooling purposes, are expected to enhance the market's potential.

Air Conditioning Equipment Industry Overview

The air conditioning equipment landscape is highly competitive, with several local and international players active. International participants operate in the country through partnerships with regional players. With the market expected to broaden and yield more opportunities, more players are expected to enter. The key players in the market studied include Mitsubishi Electric and Johnson Controls, among others. These major players have adopted various growth strategies, such as mergers and acquisitions, new product launches, expansions, joint ventures, partnerships, and others, to strengthen their position in this market.

- March 2024: Mitsubishi Electric Trane HVAC US LLC (METUS) announced the introduction of Premier Wall-mounted Indoor Units (MSZ-GS/MSY-GS). At the same time, Premier MSZ-GS Indoor Units are compatible with single-zone and multi-zone heat pump outdoor units, including single- and multi-zone Hyper-Heating INVERTER (H2i) units. The MSY-GS is a single-zone, cooling-only air conditioner for climates with unnecessary heating.

- February 2024: Daikin Industries Ltd enhanced its air conditioners by focusing on critical elements. This includes shifting to HFC-32, an R32 refrigerant with low global warming potential, emphasizing its eco-friendliness and energy efficiency. Additionally, Daikin has bolstered the fundamental performance of its air conditioning units. In a significant move, Daikin is set to launch the VRV 7 multi-air conditioner series for buildings in November 2024. This series boasts the industry's top energy efficiency and is pivotal in lessening environmental footprints and operational burdens.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Replacement of Existing Equipment With Better Performing Ones

- 5.1.2 Supportive Government Regulations Including Incentives for Saving Energy Through Tax Credit Programs

- 5.2 Market Challenges

- 5.2.1 Dependence on Macro-economic Conditions

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Split System (Ducted and Ductless)

- 6.1.2 Variable Refrigerant Flow (VRF)

- 6.1.3 Air Handling Units

- 6.1.4 Chillers

- 6.1.5 Fan Coils

- 6.1.6 Indoor Packaged and Roof Tops

- 6.1.7 Other Types

- 6.2 By End-user Industry

- 6.2.1 Residential

- 6.2.2 Commercial

- 6.2.3 Industrial

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Asia

- 6.3.3 Australia and New Zealand

- 6.3.4 Europe

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Daikin Industries Ltd

- 7.1.2 Hitachi Ltd

- 7.1.3 Electrolux AB Corporation

- 7.1.4 Mitsubishi Electric Corporation

- 7.1.5 Johnson Controls

- 7.1.6 Haier Group

- 7.1.7 Carrier Corporate

- 7.1.8 Panasonic Corporation

- 7.1.9 Alfa Laval AB

- 7.1.10 Lennox International Inc.