|

市场调查报告书

商品编码

1644873

中国汽车物流:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)China Automotive Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

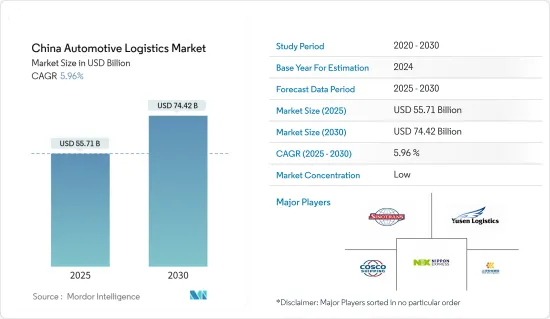

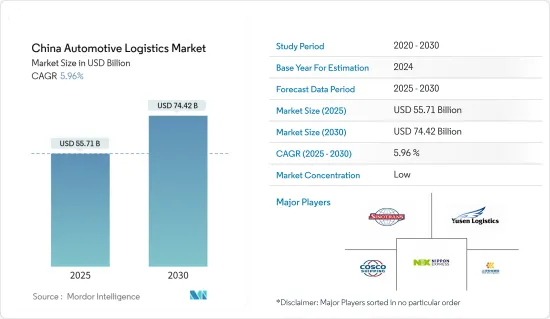

2025年中国汽车物流市场规模预估为557.1亿美元,预估至2030年将达744.2亿美元,预测期间(2025-2030年)复合年增长率为5.96%。

主要亮点

- 中国汽车产业正在经历重大转型,中国政府也推出措施刺激汽车消费。这些措施包括财税支持、加速淘汰老旧柴油货车、优化二手车交易管道等。此外,各国政府还推出了对新能源汽车的补贴,并投资基础设施建设以支持汽车产业,这些都可能会促进汽车市场的发展。

- 中国仍然是世界上最大的汽车市场,年销量和产量均排名第一。预计2025年国内产量将达3,500万台。此外,由于全球对电动车的兴趣日益浓厚,中国汽车在海外的销售也显着增长。 《环球时报》报道,10月中国製造业出现改善迹象,财新中国製造业采购经理人指数(PMI)上升1点至50.3。

- 电动车市场的快速成长在该产业的发展轨迹中发挥着举足轻重的作用。在电动车领域占据主导地位的中国,汽车出口量显着成长。事实证明,加强物流基础设施(例如建造仓库设施和专用运输路线)是有效的。政府的支持性政策,例如对电动车製造商的补贴和对充电基础设施的投资,进一步推动了这一成长。

- 为了解决车辆运输和零件处理的复杂性,公司越来越多地采用人工智慧和物联网技术来优化物流并提高效率。例如,从 2024 年初开始,最大的汽车製造商之一上汽集团部署了整合物联网感测器和人工智慧演算法的自动化仓库系统。因此,人工智慧和物联网的整合正在成为业界的标准实践,推动进一步的进步并在效率和可靠性方面树立新的标竿。

- 汽车产业的成长、汽车销售的增加以及出口的增加预计将推动该国汽车物流市场的发展。

中国汽车物流市场趋势

中国对新能源汽车的投资推动市场成长

2024 年 JD Power 中国新能源汽车-汽车性能、执行和布局(NEV-APEAL)研究强调了汽车物流市场的一个关键趋势:中国新能源汽车 (NEV) 的稳步崛起。中国新能源车的 NEV-APEAL 平均得分为 789 分(满分 1,000 分),较 2023 年上升了 13 分。这种持续上升的趋势显示消费者对新能源汽车的接受度和满意度不断提高,这反过来又刺激了对精简物流解决方案的需求。

新能源汽车产业的快速成长正在重塑相关产业链,其中电池产业尤为突出。动力电池在决定车辆的电池寿命、安全性和总成本方面起着至关重要的作用。中国製造商明显偏好磷酸锂铁(LFP)电池,这与西方市场对锂镍锰钴(NMC)电池的倾向不同。到2024年4月,新乘用车零售渗透率将超过50%。这项变化不仅凸显了新能源汽车在市场上的快速成长,也凸显了对促进新能源汽车分销的专业物流服务的需求日益增长。

新能源汽车市场的快速成长,正在扩大汽车物流领域客製化运输和处理服务的需求。这种激增的需求不仅扩大了供应链,而且还刺激了基础设施发展并促进了永续的物流实践。随着物流公司不断满足这些不断变化的需求,它们在开闢新的收益来源的同时,也正在改变中国汽车格局方面发挥关键作用。

综上所述,中国新能源汽车的快速发展不仅正在再形成物流市场,也正在为汽车领域带来重大变革。消费者接受度的不断提高和向永续实践的转变给物流公司带来了挑战和机会,最终促进了整个汽车生态系统的演变。

仓储业推动市场成长

各个服务领域正在推动市场成长。随着中国汽车产业的扩张,仓储产业对整个供应链至关重要。为了容纳不断增长的货物量,公司正在大力投资扩大仓库容量。

此外,随着电子商务的兴起和汽车产量的增加,汽车製造商正在寻求强大的仓储解决方案来管理波动的存量基准。例如,日物流于 2024 年扩大了在中国的仓储业务,并整合了自动化储存和搜寻系统,以加强库存管理并最大限度地缩短处理时间。

此外,也正在引进利用物联网技术进行即时库存监控的先进库存管理系统。例如,中远航运实施了智慧库存管理解决方案,以实现整个网路中汽车零件的准确追踪。

总之,中国汽车产业的成长很大程度上得益于运输、仓储和库存管理服务的进步。这些技术创新对于满足日益增长的市场对效率和可靠性的需求至关重要。

中国汽车物流产业概况

中国汽车物流市场高度分散,竞争激烈,除了国际公司外,还有多家国内汽车物流公司。 DHL、日本通运等国际企业与上汽安吉物流、日物流等本土公司竞争。此外还有许多其他参与者,例如中国远洋运输(集团)有限公司(COSCO)、HYCX集团和中国外运股份有限公司。

汽车行业的参与者正在透过整合最尖端科技来客製化多样化产品。例如,最近深圳将在2024年建成一座人工智慧整合工厂,这将为供应链带来重大转变,而供应链则是任何製造业的支柱。借助先进的分析技术,这些工厂现在可以准确预测原材料需求、优化存量基准并确保及时采购。这不仅可以最大限度地降低您的持有成本,还可以减少浪费。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 当前市场状况

- 市场驱动因素

- 新能源汽车销售成长

- 政府措施和支持

- 市场限制

- 美国贸易战

- 供应链中断

- 市场机会

- 数位转型

- 拓展新兴市场

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者和消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- 政府法规和倡议

- 中国汽车产业概况(概况、发展趋势、统计等)

- 地缘政治与疫情将如何影响市场

第五章 市场区隔

- 按类型

- 整车

- 汽车零件

- 按服务

- 运输

- 仓储、配送和库存管理

- 其他服务

第六章 竞争格局

- 市场集中度概览

- 公司简介

- China Ocean Shipping(Group)Company

- SAIC Anji Logistics

- BLG Logistics

- HYCX Group

- Yusen Logistics Co. Ltd

- DHL

- Nippon Express

- GEODIS

- Sinotrans Co. Ltd

- DHL Supply Chain

- Apex Group*

- 其他公司

第七章:市场的未来

第 8 章 附录

- 宏观经济指标(按活动分類的 GDP 分布、运输和仓储业对经济的贡献等)

- 贸易统计 出口与进口统计

- 汽车业相关外贸统计数据

The China Automotive Logistics Market size is estimated at USD 55.71 billion in 2025, and is expected to reach USD 74.42 billion by 2030, at a CAGR of 5.96% during the forecast period (2025-2030).

Key Highlights

- China's automotive industry underwent substantial shifts which in response, the Chinese government has implemented measures to rejuvenate automobile consumption. These measures include providing fiscal and taxation support, accelerating the elimination of obsolete diesel trucks, and optimizing second-hand vehicle trading channels. Additionally, the government has introduced subsidies for new energy vehicles and invested in infrastructure development to support the automotive sector, such initiatives will keep the market afloat.

- China remains the world's largest vehicle market, leading in both annual sales and manufacturing output. Projections indicate that domestic production will hit 35 million vehicles by 2025. Furthermore, bolstered by a global surge in interest for electric vehicles, Chinese automobile sales overseas have seen notable growth. In October, signs of improvement emerged in China's manufacturing sector, highlighted by a 1 percentage point uptick in the Caixin China General Manufacturing Purchasing Managers' Index (PMI), reaching 50.3, as reported by Global Times.

- The swift growth of the electric vehicle market plays a pivotal role in this industry's trajectory. With its dominant stance in the electric vehicle arena, China has recorded a pronounced uptick in vehicle exports. Enhancements in logistics infrastructure, marked by upgraded warehouse facilities and specialized transport corridors, have been instrumental. The government's supportive policies, which include subsidies for electric vehicle manufacturers and investments in charging infrastructure, have further fueled this growth.

- To navigate the complexities of vehicle transportation and parts handling, companies are increasingly turning to AI and IoT technologies, aiming to optimize logistics and boost efficiency. For instance, from the begining of 2024, SAIC Motor Corporation, one of the largest automotive manufacturers, has rolled out an automated warehousing system integrated with IoT sensors and AI algorithms. As a result, the integration of AI and IoT is becoming a standard practice in the industry, driving further advancements and setting new benchmarks for efficiency and reliability.

- This growing automotive sector, increasing vehicle sales, and exports are expected to drive the country's automotive logistics market.

China Automotive Logistics Market Trends

Chinese Investment in NEVs (New Energy Vehicles) Driving the Market Growth

The 2024 J.D. Power China New Energy Vehicle - Automotive Performance, Execution and Layout (NEV-APEAL) Study underscores a pivotal trend in the automotive logistics market: the steady ascent of New Energy Vehicles (NEVs) in China. Chinese NEVs have achieved an average NEV-APEAL score of 789 out of 1000, marking a notable 13-point rise from 2023. This consistent upward trend signals an increasing consumer acceptance and satisfaction with NEVs, subsequently fueling the demand for streamlined logistics solutions.

The swift growth of the NEV sector is reshaping associated industrial chains, with a pronounced focus on the battery sector. Power batteries play a pivotal role in influencing a vehicle's battery life, safety, and overall cost. Chinese manufacturers have shown a clear preference for lithium Iron Phosphate (LFP) batteries, setting themselves apart from the Western markets that lean towards Lithium Nickel Manganese Cobalt (NMC) batteries. By April 2024, new passenger cars achieved a retail penetration rate exceeding 50%, a milestone previously held by traditional petrol vehicles. This shift not only highlights the burgeoning dominance of NEVs in the market but also accentuates the escalating demand for specialized logistics services to facilitate their distribution.

The surging NEV market is amplifying the demand for customized transport and handling services within the automotive logistics domain. This burgeoning demand is not just expanding the supply chain but is also catalyzing infrastructure development and promoting sustainable logistics practices. As logistics firms pivot to address these evolving demands, they unlock fresh revenue streams, simultaneously playing a pivotal role in the transformation of China's automotive landscape.

In conclusion, the rapid advancement of NEVs in China is not only reshaping the logistics market but also driving significant changes in the automotive sector. The increasing consumer acceptance and the shift towards sustainable practices present both challenges and opportunities for logistics companies, ultimately contributing to the evolution of the entire automotive ecosystem.

Warehousing Segment Fuels Growth in the Market

Various service segments are fueling market growth. With the expansion of China's automotive industry, the warehouse segment has become pivotal in the overall supply chain. In response to increasing goods volumes, companies are significantly investing in expanding their warehouse capacities.

Moreover, with the rise of e-commerce and increased vehicle production, automotive manufacturers are seeking robust warehousing solutions to manage fluctuating inventory levels. For example, in 2024, Yusen Logistics expanded its warehousing operations in China, integrating automated storage and retrieval systems to enhance inventory management and minimize handling times.

Furthermore, there's a growing adoption of advanced inventory management systems leveraging IoT technology for real-time stock monitoring. For instance, COSCO Shipping has deployed smart inventory management solutions, enabling precise tracking of automotive components throughout its network.

In conclusion, the growth of China's automotive industry is significantly driven by advancements in transportation, warehousing, and inventory management services. These innovations are essential in meeting the increasing demands for efficiency and reliability in the market.

China Automotive Logistics Industry Overview

The Chinese automotive logistics market is highly fragmented and competitive, with the presence of several local automotive logistics companies in the country apart from international firms. International players like DHL and Nippon Express compete with local players like SAIC Anji Logistics and Yusen Logistics. And many other players including China Ocean Shipping (Group) Company (COSCO), HYCX Group, Sinotrans Limited, etc.

Players in the automotive sector are tailoring a diverse array of services by integrating cutting-edge technologies. For instance, Recently in 2024, Shenzhen's updtaed with AI-integrated factories, the supply chain - the backbone of any manufacturing setup - has undergone a significant transformation. With the help of advanced analytics, these factories can now accurately predict raw material needs, optimize inventory levels, and ensure timely procurement. This not only minimizes holding costs but also reduces wastage.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Current Market Scenario

- 4.2 Market Drivers

- 4.2.1 Growing New Energy Vehicles Sales

- 4.2.2 Government Initiatives and Support

- 4.3 Market Restraints

- 4.3.1 Trade War between China and the United States

- 4.3.2 Supply Chain Disruptions

- 4.4 Market Opportunities

- 4.4.1 Digital Transformation

- 4.4.2 Expansion into Emerging Markets

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Industry Value Chain Analysis

- 4.7 Government Regulations and Initiatives

- 4.8 Overview of China's Automotive Industry (Overview, Development and Trends, Statistics, etc.)

- 4.9 Impact of Geopolitics and Pandemic on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Finished Vehicle

- 5.1.2 Auto Component

- 5.2 By Service

- 5.2.1 Transportation

- 5.2.2 Warehousing, Distribution, and Inventory Management

- 5.2.3 Other Services

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 China Ocean Shipping (Group) Company

- 6.2.2 SAIC Anji Logistics

- 6.2.3 BLG Logistics

- 6.2.4 HYCX Group

- 6.2.5 Yusen Logistics Co. Ltd

- 6.2.6 DHL

- 6.2.7 Nippon Express

- 6.2.8 GEODIS

- 6.2.9 Sinotrans Co. Ltd

- 6.2.10 DHL Supply Chain

- 6.2.11 Apex Group*

- 6.3 Other Companies

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 Macroeconomic Indicators (GDP Distribution by Activity, Transport and Storage Sector-contribution to Economy, etc.)

- 8.2 Trade Statistics: Imports and Exports

- 8.3 External Trade Statistics related to the Automotive Sector