|

市场调查报告书

商品编码

1644886

北美安全存取服务边际:市场占有率分析、产业趋势和成长预测(2025-2030 年)North America Secure Access Service Edge - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

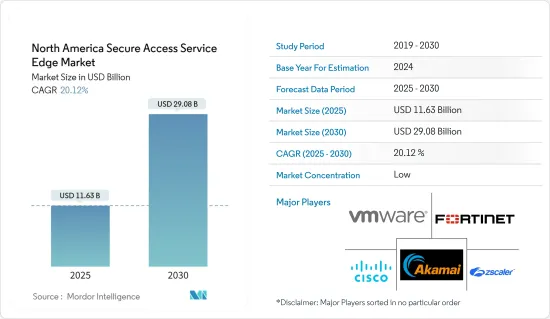

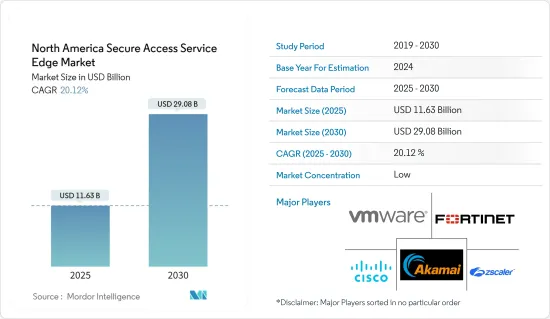

北美安全存取服务边际市场规模预计在 2025 年为 116.3 亿美元,预计到 2030 年将达到 290.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 20.12%。

随着 SASE 变得越来越普及,对有资格部署、管理和支援 SASE 解决方案的人才的需求也越来越大。因此,供应商和独立组织提供的培训和认证计划数量不断增加。为了有效部署和使用这些技术,IT 团队专注于取得 SASE 功能。

关键亮点

- SASE 透过在整个网路上实施统一的安全标准和加密来帮助企业满足严格的合规性要求。在传输过程中和储存在云端应用程式中的资料保护有助于最大限度地减少法规不合规和相关罚款的可能性。例如,医疗保健组织必须遵守严格的监管标准来保护病患资料。

- 由于缺乏足够的安全通讯协定和技术,强烈建议使用 SASE。对于应对日益扩大的威胁、远距工作挑战、云端迁移和合规性要求的组织来说,像 SASE 这样全面、适应性强的安全解决方案变得越来越必要。它不仅将解决这些紧迫的安全问题,还将解决网路安全人才短缺的问题,并确保在面对现代威胁和挑战时的可扩展性、业务永续营运连续性和弹性。

- 资料隐私和法规合规要求是推动 SASE 业务成长的强大力量。企业意识到需要像 SASE 这样的完整安全解决方案来遵守严格的资料隐私法规、避免处罚并保护其品牌。随着隐私法的不断发展和在国际上的传播,对 SASE 作为确保合规性的工具的需求预计将持续增长,使其成为现代网路安全和资料保护工作的重要组成部分。

- 受技术进步和消费者对云端的偏好日益增加的推动,对云端基础的解决方案的需求正在蓬勃发展。技术使用户能够从远端位置存取资料。企业越来越意识到将资料迁移到云端比维护内部部署基础架构更节省成本和资源,这推动了对云端基础的解决方案的需求。

- 随着数位转型工作的快速推进,COVID-19 疫情加速了企业对 SASE 的采用。随着网路融合不断加速云端运算的采用,安全性对于更好地支援日益增加的远端和行动劳动力至关重要。

- 2023 年 3 月,致力于推动网路和安全整合的全球网路安全公司 Fortinet 宣布对其单一供应商 SASE 解决方案 FortiSASE 进行多项增强,为 SaaS、私人应用程式和互联网上的数位资源提供更大的部署灵活性和新的安全存取功能。

北美安全存取服务边际市场趋势

IT 和通讯终端用户产业预计将占据主要市场占有率

- 北美,特别是美国,往往是 IT 和电讯领域主要企业的所在地。该地区拥有强劲的通讯产业、众多的科技公司和对IT基础设施的大量投资。例如,美国IT基础设施服务供应商 Kyndryl 于 2023 年 5 月宣布推出由 Fortinet 支援的託管安全存取服务边际(SASE) 解决方案。该解决方案将 Kyndryl 的网路和保全服务与 Fortinet 的云端交付安全和安全网路解决方案结合,为各行各业的客户设计、建置、维护和升级关键任务网路。这些努力促使 SASE 解决方案在 IT 和电讯终端用户领域广泛采用。

- 此外,网路即服务 (NaaS) 对于 IT 和电讯组织至关重要,因为它提供了无缝通讯、资料传输和云端连接所需的网路基础设施。这些组织严重依赖强大、可扩展的网路解决方案。例如,2023 年 7 月,美国电信业者Lumen Technologies 宣布了其网路即服务 (NaaS) 平台的旗舰功能,这是其转型通讯产业计画的一部分。 Lumen 透过为消费者提供购买、使用和管理网路服务的弹性,将传统电讯转移到云端。

- 总体而言,SASE 市场中 IT 和通讯终端用户垂直领域的成长受到该领域独特的网路安全需求、安全远端存取需求、安全通讯服务以及数位转型和云端采用的更广泛趋势的推动。

- 5G突破性的延迟、吞吐量和可靠性能力将支援新的工业、商业和消费者服务。 5G 可能会鼓励全球 SASE 供应商更全面地看待网路并制定最佳实践来应对新的安全威胁。 5G的出现将为网路即服务解决方案供应商提供提高网路成本效率的巨大机会。在通讯产业,网路自动化程度的提高和其他技术的整合正在推动对 5G 的需求。

- 据 GSMA 称,预计北美 5G 普及速度将在短期内放缓,且预测结果将根据 COVID-19 疫情的影响进行修改。然而,与 COVID-19 先前的预测相比,2023 年至 2025 年间,5G 使用量预计将增加 1,300 万个连线。

预计美国将占较大市场占有率

- 美国是一个已开发经济体,非常倾向于采用和接受先进技术、发展网路自动化以及普及云端基础的服务,为安全接入服务边际市场做出了贡献。此外,终端用户产业数位化的提高以及思科系统公司 (Cisco Systems Inc.)、威睿公司 (Vmware Inc.)、Palo Alto Networks、Versa Networks Inc. 和 Akamai Technologies 等知名供应商的出现也促进了市场的成长。

- 此外,随着企业数位转型快速加速,安全性也越来越多地转移到云端。此外,随着终端用户产业大量采用云端服务,需要保护网路基础架构并降低复杂性以提高速度和灵活性。预计这将为未来几年的市场供应商提供巨大的成长机会。

- 根据交付模式,网路即服务(NaaS)领域预计将在未来几年在美国见证显着成长。由于云端解决方案在各行业的渗透、物联网和工业 4.0 的出现以及 DDoS 和资料外洩的增加,预计市场将大幅成长。所有这些因素预计将推动美国对网路即服务 (NaaS) 的需求。根据GSMA预测,到2025年,北美工业物联网(IoT)和消费者连线数量预计将成长至约54亿。

- 此外,该国有三大云端服务供应商:亚马逊网路服务、微软的 Azure 和谷歌云端。它也被认为是 5G、自动驾驶、物联网、区块链、人工智慧和游戏等重大技术创新的中心。整合 SASE 功能可以将零信任安全功能整合到企业架构中,这对于实现可信任的网路安全态势至关重要。透过这种方式,SASE 解决方案有望改变最终用户网路和安全架构,降低网路风险、成本和复杂性。

- 市场上的供应商正在利用这一机会并推出创新的 SASE 解决方案,以透过 SASE 解决方案增强网路弹性。例如,2023 年 4 月,埃森哲与 Palo Alto Networks 联合上市了由 Palo Alto Networks 基于 AI 的 Prisma SASE 提供支援的安全存取服务边际(SASE) 解决方案。该解决方案使企业能够提高其网路弹性并加快其业务转型努力。

北美安全存取服务边际产业概览

北美安全接入服务边际市场主要参与者包括思科系统公司、VMware 公司、Fortinet 公司、Akamai 技术公司和 Zscaler 公司。该市场的参与企业正在采取合作和收购等策略来加强其产品供应并获得可持续的竞争优势。

- 2024 年 4 月,CloudCover 与 SHI International伙伴关係,扩大其进阶威胁预防网路安全平台的全球影响力。 SHI 是端到端 IT 解决方案的全球领导者,拥有无与伦比的供应链,并提供 CloudCover 专有的 XDR/SASE(安全即服务)平台作为其安全产品组合的一部分。 CloudCover 提供先进的网路风险管理,提供微秒的风险感知和控制。此外,我们正在建立一个包含责任保护方法的网路内网路安全保险系统。

- 2024 年 1 月,技术基础设施服务供应商Kyndryl 与思科合作推出了两项先进的保全服务。这些服务旨在为客户提供更好的安全控制并能够主动应对网路事件。新服务-采用思科安全存取的 Kyndryl Consult Security Services Edge (SSE) 以及采用思科安全存取的 Kyndryl Managed SSE,代表了网路安全解决方案的重大发展。

- 2023 年 8 月,由 AI/ML 提供支援的统一安全存取服务边际(SASE) 的全球供应商 Versa Networks 宣布对 VersaAI 进行一系列增强,包括新的嵌入式产生 AI 功能(可即时识别恶意行为)、安全的生成 AI 工具,以及增强的网路和安全营运绩效。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 购买者/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 评估宏观经济因素对市场的影响

第五章 市场动态

- 市场驱动因素

- 越来越需要结合 SD-WAN、FWaaS、SWG、CASB 和 ZTNA 功能的单一网路架构

- 缺乏安全程序和工具

- 强制遵守资料保护和监管法律

- 市场限制

- 缺乏有关云端资源、云端安全架构和 SD-WAN 策略的知识

- 难以管理和保护分散式资料存取和网络

第六章 市场细分

- 依产品类型

- NaaS(Network-as-a-Service)

- SaaS(Security-as-a-Service)

- 按组织规模

- 大型企业

- 中小型企业

- 按行业

- BFSI

- 资讯科技/通讯

- 零售

- 医疗

- 政府

- 製造业

- 其他的

- 按国家

- 美国

- 加拿大

第七章 竞争格局

- 公司简介

- Cisco Systems Inc.

- VMware Inc.

- Fortinet Inc.

- Akamai Technologies Inc.

- Zscaler Inc.

- Cloudflare Inc.

- Versa Networks Inc.

- Broadcom Corporation

- Forcepoint

- Aryaka Networks Inc.

- McAfee Corp.

- Citrix Systems Inc.

- Barracuda Networks Inc

- Verizon Communications Inc.

- Juniper Networks Inc.

- Aruba Networks

第八章投资分析

第九章:未来市场展望

The North America Secure Access Service Edge Market size is estimated at USD 11.63 billion in 2025, and is expected to reach USD 29.08 billion by 2030, at a CAGR of 20.12% during the forecast period (2025-2030).

Demand for qualified individuals to implement, manage, and support SASE solutions increases as SASE adoption spreads. As a result, the number of training and certification programs provided by vendors and independent groups has increased. To enable the efficient deployment and use of these technologies, IT teams are concentrating on gaining competence in SASE.

Key Highlights

- SASE helps enterprises achieve strict compliance requirements by enforcing uniform security standards and encryption across the network. It minimizes the chances of regulatory infractions and related fines by safeguarding data during transmission and when kept in cloud applications. For instance, a healthcare institution is expected to abide by stringent regulatory standards for protecting patient data, including safeguarding data during information and idle state.

- The use of SASE is strongly encouraged by the shortage of sufficient security protocols and technologies. An all-encompassing and adaptable security solution like SASE is becoming increasingly necessary for organizations dealing with an expanding threat landscape, remote work issues, cloud migrations, and compliance obligations. In addition to addressing these urgent security issues, it closes the cybersecurity talent gap and guarantees scalability, business continuity, and resilience in the face of contemporary threats and difficulties.

- The mandatory observance of data privacy and regulatory legislation is a strong force behind expanding the SASE business. Businesses are realizing the necessity of a complete security solution like SASE to assist them in complying with strict data protection rules, avoiding penalties, and safeguarding their brand. The demand for SASE as a tool for assuring compliance is anticipated to grow as privacy legislation continues to change and spread internationally, making it an essential part of contemporary cybersecurity and data protection initiatives.

- The demand for cloud-based solutions surges due to the growing technological advances and consumer propensity toward the cloud. Technology allows the user to access data from remote locations. The increasing realization among companies about the cost and resource efficiency of shifting data to the cloud rather than maintaining on-premise infrastructure is driving the demand for cloud-based solutions among enterprises.

- The COVID-19 pandemic accelerated the enterprise's SASE adoption as digital transformation initiatives advanced rapidly. As cloud adoption continues to accelerate through the convergence of networking, security is critical to better support an increasingly remote and mobile workforce.

- In March 2023, Fortinet, the global cybersecurity firm driving the convergence of networking and security, announced several enhancements to FortiSASE, Fortinet's single-vendor SASE solution, enabling additional deployment flexibility and new secure access capabilities for digital resources across SaaS, private applications, and the internet.

North America Secure Access Service Edge Market Trends

IT and Telecom End-user Industry is Expected to Hold Significant Market Share

- North America, particularly the United States, is often a major player in the IT and telecom sectors. The region boasts a robust telecommunications industry, numerous technology companies, and significant investment in IT infrastructure. For instance, in May 2023, Kyndryl, a US-based supplier of IT infrastructure services, introduced a managed secure access service edge (SASE) solution powered by Fortinet that intends to assist clients in implementing advanced network security measures. The solution combines Kyndryl's network and security services with Fortinet's cloud-delivered security and secure networking solutions to design, construct, maintain, and upgrade mission-critical networking for clients across sectors. Such initiatives led to substantial adoption of SASE solutions in the IT and telecom end-user vertical.

- Moreover, network-as-a-service (NaaS) is essential for IT and telecom organizations because it provides the network infrastructure necessary for seamless communication, data transfer, and cloud connectivity. These organizations rely heavily on robust and scalable networking solutions. For instance, in July 2023, Lumen Technologies, a US-based telecom company, introduced its flagship feature on its network-as-a-service (NaaS) platform as a part of its plan to transform the telecom sector. Lumen is transforming traditional telecom into the cloud by giving consumers flexibility in purchasing, utilizing, and managing networking services.

- Overall, the IT and telecom end-user vertical growth in the SASE market is driven by the sector's specific cybersecurity needs, the imperative for secure remote access, the protection of telecommunications services, and the broader trends of digital transformation and cloud adoption.

- 5G's revolutionary latency, throughput, and reliability capabilities will support new industrial, business, and consumer services. It will encourage the global SASE vendors to embrace a more holistic view of the network and develop best practices to combat new security threats. Network as a service solution provider will get more lucrative opportunities to improve the network's cost efficiency with the advent of 5G. The rising integration of network automation and other technologies in the telecom industry is increasing the demand for 5G.

- According to GSMA, the forecasts revised for the impact of the COVID-19 pandemic expect a short-term slowdown in using 5G in North America. However, from 2023 to 2025, the 5G take-up is expected to account for 13 million more connections compared to the pre-COVID-19 forecast.

United States is Expected to Hold Significant Market Share

- The United States is a developed economy with a significant inclination toward implementing and accepting advanced technology, development in network automation, and surge in cloud-based services, thereby contributing to the secure access service edge market. Moreover, the growing digitization among end-user industries, coupled with the presence of prominent market vendors like Cisco Systems Inc., Vmware Inc., Palo Alto Networks, Versa Networks Inc., and Akamai Technologies, contribute to the market's growth.

- Further, security is moving to the cloud with the rapid acceleration of the digital transformation of businesses. Additionally, the significant adoption of cloud services in the end-user industries necessitates securing the network infrastructure and reducing complexity to improve speed and agility. This is analyzed to create substantial growth opportunities for market vendors in the coming years.

- By offering type, the network-as-a-service segment is analyzed to witness substantial growth in the United States over the coming years. The market is expected to grow significantly, owing to the greater penetration of cloud solutions across various industry verticals, the advent of IoT and Industry 4.0, and the growing number of DDoS and data breaches. All these factors are expected to drive the demand for network-as-a-service offerings in the United States. According to GSMA, in North America, by 2025, the number of industrial Internet of Things (IoT) and consumer connections is expected to increase to about 5.4 billion.

- Further, the country has three major cloud service providers: Amazon Web Services, Microsoft's Azure, and Google Cloud. It is also considered the hub for major technological innovations such as 5G, autonomous driving, IoT, blockchain, artificial intelligence, and gaming. Integrating SASE capabilities converges zero trust security capabilities into enterprise architectures, which is paramount in achieving a trusted network security posture. Thus, SASE solutions are analyzed to transform the end-user's network and security architecture to reduce cyber risk, costs, and complexity.

- Market vendors are capitalizing on the opportunity and launching innovative SASE solutions to enhance cyber resiliency through SASE solutions. For instance, in April 2023, Accenture and Palo Alto Networks collaborated to deliver joint secure access service edge (SASE) solutions powered by the Palo Alto Networks AI-powered Prisma SASE. The solution will enable organizations to improve cyber resilience and accelerate business transformation efforts.

North America Secure Access Service Edge Industry Overview

The North American secure access service edge market is fragmented with the presence of major players like Cisco Systems Inc., VMware Inc., Fortinet Inc., Akamai Technologies Inc., and Zscaler Inc. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- April 2024: CloudCover formed a partnership with SHI International to extend the global reach of its advanced threat-prevention cybersecurity platform. SHI, a global leader in end-to-end IT solutions with an unparalleled supply chain, offers CloudCover's unique XDR/SASE security-as-a-service platform as part of its security portfolio. CloudCover delivers advanced cyber risk management, providing microsecond risk awareness and control. Additionally, it has established an in-network cybersecurity insurance system with methods that embed liability protection.

- January 2024: Kyndryl, a technology infrastructure services provider, introduced two advanced security services in partnership with Cisco. These services aim to enhance customers' security controls and enable proactive responses to cyber incidents. The new offerings, Kyndryl Consult Security Services Edge (SSE) with Cisco Secure Access and Kyndryl Managed SSE with Cisco Secure Access, represent a significant advancement in cybersecurity solutions.

- August 2023 - Versa Networks, the global provider in AI/ML powered Unified Secure Access Service Edge (SASE), announced a set of enhancements to VersaAI that includes new embedded generative AI capabilities to identify malicious behaviors in real-time, secure generative AI tools, and enhance network and security operational excellence.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Impact of Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Need For a Single Network Architecture that combines SD-WAN, FWaaS, SWG, CASB, and ZTNA Capabilities

- 5.1.2 Lack of Security Procedures and Tools

- 5.1.3 Mandatory Compliance with Data Protection and Regulatory Legislation

- 5.2 Market Restraints

- 5.2.1 Lack of Knowledge on Cloud Resources, Cloud Security Architecture, and SD-WAN strategy

- 5.2.2 Difficult in Accessing Such Dispersed Data While Managing And Safeguarding These Networks

6 MARKET SEGMENTATION

- 6.1 By Offering Type

- 6.1.1 Network-as-a-Service

- 6.1.2 Security-as-a-Service

- 6.2 By Organization Size

- 6.2.1 Large Enterprises

- 6.2.2 Small and Medium Enterprises

- 6.3 By EndUser Vertical

- 6.3.1 BFSI

- 6.3.2 IT and Telecom

- 6.3.3 Retail

- 6.3.4 Healthcare

- 6.3.5 Government

- 6.3.6 Manufacturing

- 6.3.7 Other End-user Industries

- 6.4 By Country

- 6.4.1 United States

- 6.4.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems Inc.

- 7.1.2 VMware Inc.

- 7.1.3 Fortinet Inc.

- 7.1.4 Akamai Technologies Inc.

- 7.1.5 Zscaler Inc.

- 7.1.6 Cloudflare Inc.

- 7.1.7 Versa Networks Inc.

- 7.1.8 Broadcom Corporation

- 7.1.9 Forcepoint

- 7.1.10 Aryaka Networks Inc.

- 7.1.11 McAfee Corp.

- 7.1.12 Citrix Systems Inc.

- 7.1.13 Barracuda Networks Inc

- 7.1.14 Verizon Communications Inc.

- 7.1.15 Juniper Networks Inc.

- 7.1.16 Aruba Networks