|

市场调查报告书

商品编码

1644902

美国FTL 货运经纪:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)US FTL Freight Brokerage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

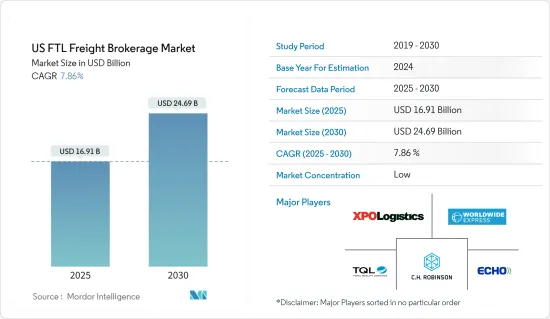

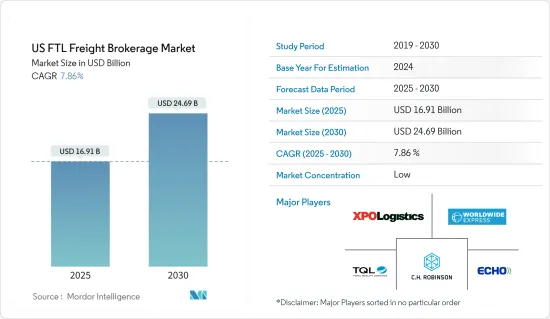

预计 2025 年美国FTL 货运经纪市场规模为 169.1 亿美元,预计到 2030 年将达到 246.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.86%。

主要亮点

- 疫情导緻美国货运和物流业陷入停滞,跨境货运活动被迫暂停。疫情的影响给货场和仓库带来了巨大挑战,许多设施因疫情而减少人员,缩短时间。

- 近年来,受内陆货运需求以及美国、加拿大和墨西哥之间的跨境贸易推动,美国的整车运输(FTL)服务显着增长。美国进出口的与前一年同期比较成长也支持了该国货运经纪产业的发展。货运仲介的重要性日益增加,因为他们可以作为仲介为托运人和承运人提供业务便利。在美国,由于全球电子商务公司的崛起,运输和货运代理服务正在兴起。

- 整车货运经纪业务仍处于成长阶段,对于希望进入国内市场的新托运人来说具有重要的吸引力。然而,现有的托运人正在寻求与经纪人和运输公司签订长期合同,以在国际货运代理行业中占据主导地位。 FTL仲介为托运人提供航运服务并为承运人监控货物运输。许多货运仲介正在加强其数位市场,并采用自动定价、应用程式介面 (API) 连接、资料科学和内部技术等技术。消费者偏好也在变化,促使企业增加对技术和创新的投资和支出。随着科技的进步,传统企业面临来自新兴企业的激烈竞争。例如,北美最大的货运仲介之一 C.H. Robinson 在 2019 年宣布,将在 2024 年前将技术支出增加一倍,以与数位新兴企业竞争。

- 有一种情形正在市场上反覆上演。负载容量包裹的托运人正在支付整车 (FTL) 服务费用以确保更快地运送,但这导致空间浪费和效率低下。新兴企业主要进攻的是这个领域。这是因为它比零担运输或小包裹要简单,而且涉及的份额更大。获得资金最多的新兴企业如 Transfix、Convoy 和 Uber Freight 都专注于货运匹配。他们正利用行动技术和自动化手动任务,越来越多地取代传统仲介。

美国FTL 货运经纪市场趋势

燃料价格波动阻碍市场成长

如果市场条件允许或为了弥补更高的营运成本,运输公司(物流公司)可能会收取更高的运费。因此,如果经纪公司无法提高客户价格,其收入和营业收入可能会下降。 FTL 服务的市场需求增加和即将推出的监管变化可能会减少可用运能并提高承运商的价格。燃料价格不稳定且难以预测。过去五年来燃料价格波动很大。顾客们希望价格下降能转化为燃料节省。如果航运公司不降低价格来反映较低的燃料成本,由于客户寻求替代的运输方式,航运量可能会下降。

流量的下降将对经纪公司的毛利率和营业利润产生负面影响。如果燃料价格上涨,卡车运输公司预计会收取更高的费用来弥补增加的营运成本。如果经纪公司无法继续将这些增加的成本全部转嫁给客户,则其毛利和营业利润可能会下降。燃料成本上涨也可能导致交通方式收入结构发生重大变化,因为客户可能会选择使用其他交通方式。运输方式的大幅转变会导致经纪公司的毛利率降低,进而对经营业绩产生不利影响。乌克兰与俄罗斯的战争也导致燃料价格上涨,因为俄罗斯是第三大石油生产国。

建筑业是一个快速成长的终端用户领域

儘管部分建筑业在短期内面临挑战,美国中长期成长前景仍维持不变。预计未来四个季度美国建设产业将稳定成长。在美国,有些计划正处于规划阶段,而其他项目在因全球疫情而推迟一年后终于恢復计划。儘管面临原材料价格上涨、建材短缺和技术纯熟劳工短缺等全球和供应链相关的挑战,住宅建筑业在未来 4-8 个季度仍可能继续保持稳定成长。

美国的低利率、对大户型住宅的强劲需求以及低住宅库存有力地支撑了住宅。未来几个季度,医疗保健和教育产业可能会成为关注的焦点。 2021年11月,美国国会通过了1兆美元的基础建设支出法案。

该基础设施法案提案美国未来八年新增联邦政府支出5,500亿美元,用于升级道路、桥樑和高速公路,以及实现城市交通系统和铁路客运网络的现代化。虽然新的基础设施支出法案低于最初提案,美国在各个基础设施领域投入的1兆美元很可能将在未来四到八个季度继续支持该国建设产业的成长。

美国FTL 货运经纪行业概况

美国FTL 货运经纪市场相对分散,既有知名的区域性和全球性公司,也有各种规模较小的本地公司。该行业的主要企业包括 C.H. Robinson、Echo Global Logistics、Worldwide Express、Landstar System Inc.、Schneider、SunteckTTS、GlobalTranz、J.B. Hunt Transport Inc.、Hub Group 和 BNSF Logistics LLC。 Convoy、Uber Freight 和 uShip 等新参与企业正在竞相抢占较大的市场份额,它们提供价格透明度、线上装载板和货运市场占有率,允许透过行动应用程式预订货运,从而消除预订和付款过程中的人为互动。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查背景

- 研究假设和市场定义

第二章 研究与参与框架

- 研究框架

- 二次调查

- 初步调查

- 资料三角测量与洞察生成

- 计划流程和结构

- 参与框架

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场动态

- 市场驱动因素

- 对高效率运输的需求日益增加

- 电子商务产业的成长

- 市场挑战/限制

- 激烈的竞争影响市场

- 燃油价格波动

- 市场机会

- 采用尖端技术

- 关注物流的永续性

- 市场驱动因素

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链/供应链分析

- 美国物流业(概况、趋势、研发、关键统计等)

- 主要政府法规及倡议

- 票价洞察

- 技术简介

- 对美国海关部门的定性和定性洞察

- 芝加哥至伊利诺州 - FTL 货运经纪洞察

- 洞察货运仲介市场的薪资和薪资结构

- 评估新冠肺炎对市场的影响

第五章 市场区隔

- 按最终用户

- 製造和汽车

- 石油和天然气、采矿和采石

- 农业、渔业和林业

- 建设业

- 经销与贸易

- 其他最终用户

第六章 竞争格局

- 公司简介

- CH Robinson

- Total Quality Logistics

- XPO Logistics Inc.

- Echo Global Logistics

- Worldwide Express

- Coyote Logistics

- Landstar System Inc.

- Schneider

- Suntecktts

- Globaltranz

- JB Hunt Transport Inc.

- Hub Group

- BNSF Logistics LLC

- Kag Logistics Inc.

- Transplace*

第七章:市场的未来

第 8 章 附录

第九章 凭证

- 客户名单

- 产业内类似案例

第 10 章:出版商

The US FTL Freight Brokerage Market size is estimated at USD 16.91 billion in 2025, and is expected to reach USD 24.69 billion by 2030, at a CAGR of 7.86% during the forecast period (2025-2030).

Key Highlights

- The full truckload freight brokerage market in the United States experienced a strong hit by the pandemic, as the freight transportation and logistics industry slowed down in the country due to pandemic restrictions and the closing of cross-border shipments. The impact of the pandemic has created massive challenges in freight yards and warehouses, where many facilities struggling with COVID-19 conditions have cut their staffing levels and reduced operating hours at loading and receiving docks.

- In recent years, the US has experienced substantial growth in full-truckload (FTL) services owing to the demand from inland freight movement and cross-border trade between the United States, Canada, and Mexico. The increase in year-on-year growth of the United States exports and imports also supports the development of the freight brokerage industry in the nation. The significance of freight brokers is growing owing to their role as intermediaries and facilitating the business of both shippers and carriers. Transport and freight forwarding services are on the rise in the United States due to the number of e-commerce companies emerging globally.

- Full truckload freight brokerage is still in a growth phase and is a major attraction for new shippers looking to penetrate the domestic market. However, established shippers seek long-term contracts with brokerage firms and carriers to gain a leading position in the international freight forwarding industry. FTL brokers facilitate the shipping service for shippers and monitor carriers' shipments. Many freight brokerage firms are strengthening their digital marketplace and are adopting technology, such as automated pricing, application programming interface (API) connectivity, data science, and internally facing technology. Companies are increasing their investments and spending on technologies and innovations as consumer preferences are also changing. With the increasing technological advancements, traditional players face intense competition from startups. For instance, C.H. Robinson, one of the largest freight brokers in North America, announced in 2019 that it would double its technology spending through 2024 to compete with digital startups.

- The market has seen one scenario play out repeatedly. Shippers with less-than-truckload-size loads are paying for full truckload (FTL) service to ensure faster delivery of goods, resulting in space and inefficiencies. Startups have mostly attacked this sector. This is because it is less complex than LTL and parcel and contains a larger piece of the pie. The most funded startups, like Transfix, Convoy, and Uber Freight, focus on freight matching. They are replacing traditional brokers by utilizing mobile technology and automating manual operations.

US FTL Freight Brokerage Market Trends

Fluctuating Fuel prices Hampering the Growth of the Market

Carriers (logistics companies) may charge higher rates if market conditions warrant or cover higher operating costs. As a result, if brokerage firms cannot increase pricing for their customers, revenues, and income from operations may decrease. The increased market demand for FTL services and pending regulatory changes may reduce available capacity and raise carrier pricing. Fuel prices can be volatile and challenging to forecast. Over the last five years, fuel prices have fluctuated dramatically. Clients anticipate that lower prices will pass them on to fuel savings. If carriers do not lower their prices to reflect decreases in fuel costs, shipment volume may suffer as customers seek alternative shipping options.

This volume decrease would harm the brokerage companies' gross profits and operating income. In the event of rising fuel prices, carriers can be expected to charge higher fees to cover higher operating expenses. The gross profit of brokerage firms and income from operations may decrease if they cannot continue to pass through to their clients the total amount of these increased costs. Higher fuel costs could also cause material shifts in the percentage of revenue by transportation mode, as clients may elect to utilize alternative transportation modes. Any material shifts to transportation modes concerning which brokerage firms realize lower gross profit margins could impair operating results. The Ukraine-Russia war also caused a spike in fuel prices as Russia is the third-largest producer of crude oil.

Construction Sector is the Fastest-growng End-user Segment

Despite near-term challenges in certain construction sectors, the medium to long-term growth story in the United States remains intact. The construction industry in the United States is expected to grow steadily over the next four quarters. In the United States, several projects are working their way through the planning phase, whereas others have finally resumed after a year of global pandemic-related delays. Despite the challenges associated with the global supply chain, such as rising raw material prices, shortage of building materials, and lack of skilled labor, the residential construction sector will continue its stable growth over the four to eight quarters.

The residential construction sector largely remains supported by low lending rates, strong demand for bigger homes, and low housing inventory in the United States. Over the next few quarters, the healthcare and education sectors will receive more attention. In November 2021, the US Congress passed a USD 1 trillion infrastructure spending bill.

The infrastructure legislation proposes USD 550 billion in new federal expenditure over the next eight years in the United States for the upgrade of roads, bridges, and highways and modernizing the city transit systems and passenger rail networks. While the new infrastructure spending bill falls short of the original USD 2.3 trillion proposals, the USD 1 trillion spending on various United States infrastructure sectors will keep supporting the growth of the construction industry over the next four to eight quarters in the country.

US FTL Freight Brokerage Industry Overview

The US FTL freight brokerage market is relatively fragmented, with prominent regional, global, and various small- and medium-sized local players. Major players in the industry include CH Robinson, Echo Global Logistics, Worldwide Express, Landstar System Inc., Schneider, SunteckTTS, GlobalTranz, JB Hunt Transport Inc., Hub Group, and BNSF Logistics LLC. New entrants such as Convoy, Uber Freight, uShip, etc., are trying to gain significant market share by offering price transparency, online load boards, and freight marketplaces for booking freight via mobile apps and removing human interaction in the freight booking and payment process.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Background

- 1.2 Study Assumptions and Market Definition

2 RESEARCH AND ENGAGEMENT FRAMEWORKS

- 2.1 Research Framework

- 2.2 Secondary Research

- 2.3 Primary Research

- 2.4 Data Triangulation and Insight Generation

- 2.5 Project Process and Structure

- 2.6 Engagement Frameworks

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Dynamics

- 4.2.1 Market Drivers

- 4.2.1.1 Increasing demand for efficient transportation

- 4.2.1.2 Growing eCommerce industry

- 4.2.2 Market Challenges/Restraints

- 4.2.2.1 Intense competition affecting the market

- 4.2.2.2 Fluctuating fuel prices

- 4.2.3 Market Opportunities

- 4.2.3.1 Adoption of advanced technologies

- 4.2.3.2 Focus on sustainability in logistics

- 4.2.1 Market Drivers

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Industry Value Chain / Supply Chain Analysis

- 4.5 US Logistics Industry (Overview, Trends, R&D, Key Statistics, etc.)

- 4.6 Key Government Regulations and Initiatives

- 4.7 Insights into Freight Rates

- 4.8 Technology Snapshot

- 4.9 Qualitative and Qualitative Insights into the US Customs Clearance Sector

- 4.10 Insights into Chicago and Illinois - FTL Freight Brokerage

- 4.11 Insights into Wages and Pay Structure in the Freight Brokerage Market

- 4.12 Assessment on the Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By End User

- 5.1.1 Manufacturing and Automotive

- 5.1.2 Oil and Gas, Mining, and Quarrying

- 5.1.3 Agriculture Fishing, and Forestry

- 5.1.4 Construction

- 5.1.5 Distributive Trade

- 5.1.6 Other End Users

6 COMPETITIVE LANDSCAPE

- 6.1 Overview

- 6.2 Company Profiles

- 6.2.1 CH Robinson

- 6.2.2 Total Quality Logistics

- 6.2.3 XPO Logistics Inc.

- 6.2.4 Echo Global Logistics

- 6.2.5 Worldwide Express

- 6.2.6 Coyote Logistics

- 6.2.7 Landstar System Inc.

- 6.2.8 Schneider

- 6.2.9 Suntecktts

- 6.2.10 Globaltranz

- 6.2.11 J.B. Hunt Transport Inc.

- 6.2.12 Hub Group

- 6.2.13 BNSF Logistics LLC

- 6.2.14 Kag Logistics Inc.

- 6.2.15 Transplace*

7 FUTURE OF THE MARKET

8 APPENDIX

9 CREDENTIALS

- 9.1 Illustrative List of Clients

- 9.2 Similar Engagements Within the Industry