|

市场调查报告书

商品编码

1644924

欧洲太阳能逆变器市场:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Europe Solar PV Inverters - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

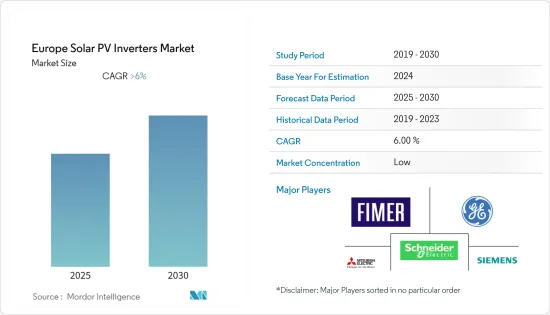

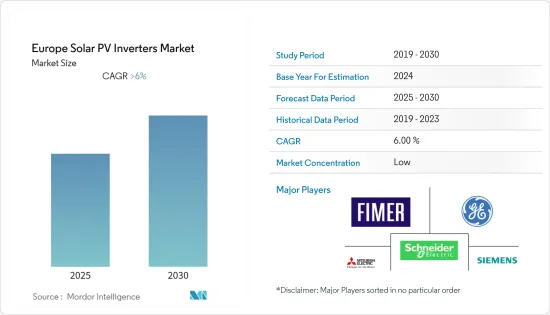

预测期内欧洲太阳能逆变器市场预计复合年增长率将超过 6%

2020 年,市场受到了 COVID-19 的不利影响。目前市场已恢復至疫情前的水准。

关键亮点

- 短期内,由于政府扩大太阳能市场的倡议和对太阳能电气化的投资,欧洲太阳能逆变器市场预计将实现成长。

- 另一方面,预计未来几年来自其他再生能源的竞争将威胁市场成长。

- 预计太阳能逆变器行业的技术发展将为市场提供充足的机会。例如,2022年3月,台湾太阳能变频器製造商台达推出了新的逆变器系列,最高效率可达98.7%,欧洲效率等级可达98.5%。该公告是在荷兰举行的 2022 年国际太阳能解决方案盛会上发布的。

- 由于住宅和公共产业太阳能装置的需求旺盛,预计德国将实现强劲成长。

欧洲光电逆变器市场趋势

集中式逆变器可望主导市场

- 集中逆变器是大型併网设备。它常用于额定输出功率超过100kWp的太阳能发电系统。逆变器通常安装在地板或地面,将从太阳能电池阵列收集的直流电转换为交流电以用于并联型。这些设备的容量范围从大约 50kW 到 1MW,可在室内和室外使用。

- 中央逆变器的最大输入电压通常为 1,000V。一些中央逆变器的输入电压已经达到1,500V。这些逆变器可使光伏阵列的电压高达 1,500V,从而减少系统平衡 (BOS) 组件的数量。

- 此外,2021年欧洲太阳能光电装置容量为647.61 GW,其中集中式逆变器装置容量最大。政府倡议预计将在未来几年进一步增加产能,例如欧盟委员会于 2022 年 10 月成立光伏产业联盟,以扩大创新太阳能光电产品和组件的製造技术。

- 此外,技术发展也有望推动市场发展。例如,2022年1月,阳光电源在阿布达比世界未来能源高峰会上推出了其全新「1+X」中央模组化逆变器,输出容量为1.1兆瓦。本款1+X模组化逆变器可组合8台单元,达到8.8MW的输出功率,并具有DC/ESS接口,可连接能源储存系统(ESS)。

- 预计此类发展将在未来几年推动中央太阳能逆变器市场的发展。

德国可望主导市场

- 以装置容量计算,德国是欧洲最大的太阳能光电市场,确立了其在全球能源和气候安全领域的领先地位。该国的太阳能市场取得了长足的发展。自给自足和具有吸引力的上网电价相结合可能会延续这一趋势,特别是对于 40kW 至 750kW 的大中型商业系统而言。

- 该国太阳能逆变器市场的主要驱动力是上网电价计划,该计划为住宅和中小型企业选择太阳能提供了便利。

- 德国光伏累积设置容量正在经历强劲成长。 2021年太阳能发电装置容量为5,840万千瓦,2020年为5,377千万瓦。 2021与前一年同期比较成长率为9.1%。随着政府和私人投资者即将推出的计划,市场预计将扩大。

- 例如,2022年5月,德国联邦网路局(Bundesnetzagentur)举行了第三次屋顶太阳能光电竞标,平均价格为0.0853欧元/kWh。该机构审查了 171 个竞标(总发电容量为 212 兆瓦),并选定了 163 个计划(总发电容量为 204 兆瓦)。最终价格从 0.07 欧元/kWh到 0.0891 欧元/kWh。

- 此外,2022 年 4 月,德国联邦网路局宣布在太阳能光电竞标中选出了 201 项提案,总合容量为 1.084 吉瓦,高于 2021 年 7 月的 510.34 兆瓦。竞标价格范围为每千瓦时 0.040 欧元至 0.055 欧元。数量加权平均价格为每千瓦时 0.0519 欧元(0.057 美元),高于先前的 0.050 欧元。

- 由于这些新兴经济体的发展,预计该国将在不久的将来占据太阳能光电逆变器市场的最高份额。

欧洲光电逆变器产业概况

欧洲光电逆变器市场较为分散。市场的主要企业(不分先后顺序)包括 Fimer SpA、施耐德电气 SE、三菱电机公司、通用电气公司和西门子股份公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概况

- 介绍

- 2027 年市场规模及需求预测(十亿美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场区隔

- 类型

- 集中式逆变器

- 组串式逆变器

- 微型逆变器

- 应用

- 住宅

- 商业/工业

- 实用规模

- 地区

- 德国

- 法国

- 英国

- 欧洲其他地区

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Fimer SpA

- Siemens AG

- Mitsubishi Electric Corporation

- General Electric Company

- Schneider Electric SE

- SMA Solar Technology AG

- Omron Corporation

- Delta Energy Systems Inc.

- Huawei Technologies Co Ltd.

- KACO New Energy GmBH

第七章 市场机会与未来趋势

简介目录

Product Code: 93176

The Europe Solar PV Inverters Market is expected to register a CAGR of greater than 6% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Currently, the market has reached pre-pandemic levels.

Key Highlights

- Over the short term, the European solar PV inverters market is expected to grow due to the factors such as government initiatives to expand the solar power market and investment in electrification using solar energy.

- On the other hand, the competition from other renewables is anticipated to threaten market growth in the coming years.

- Nevertheless, the technological developments in the solar PV inverters industry are predicted to create ample opportunities for the market. For example, in March 2022, Delta, the Taiwanese solar inverters maker, introduced a new inverter series that can achieve maximum efficiency of 98.7% and a European efficiency rating of 98.5%. It was unveiled at the Solar Solutions International Event 2022 in the Netherlands.

- Germany is expected to witness significant growth due to the high demand for solar PV installations in the residential and utility-scale sectors.

Europe Solar PV Inverters Market Trends

Central Inverters Expected to Dominate the Market

- A central inverter is a large grid feeder. It is often used in solar photovoltaic systems with rated outputs over 100 kWp. Typically, floor or ground-mounted inverters convert DC power collected from a solar array into AC power for grid connection. These devices range in capacity from around 50 kW to 1 MW and can be used indoors or outdoors.

- A central inverter typically has a maximum input voltage of 1,000 V. Certain central inverters already have a 1,500 V input voltage. These inverters allow PV arrays based on a maximum voltage of 1,500 V, requiring fewer BOS (balance of system) components.

- Moreover, in 2021, the solar PV installed capacity in the European region was recorded as 647.61 GW, in which the maximum installations were of central inverters. The capacity is expected to increase even more in the future due to the government initiatives like the establishment of the Solar Photovoltaic Industry Alliance by the European Commission in October 2022 to scale up manufacturing technologies of innovative solar photovoltaic products and components.

- Furthermore, technological developments are also expected to drive the market. For example, in January 2022, Sungrow launched its new '1+X' central modular inverter with an output capacity of 1.1 MW at the World Future Energy Summit in Abu Dhabi. This 1+X modular inverter can be combined into eight units to reach a power of 8.8 MW and features a DC/ESS interface for connecting energy storage systems (ESS).

- Such developments are forecasted to drive the central solar PV inverters market in the coming years.

Germany Expected to Dominate the Market

- Germany is the largest solar photovoltaic market in Europe regarding installed capacity, which justifies it being one of the front runners in energy and climate security across the world. The country has witnessed significant developments in the solar PV market. It is likely to continue to do so due to a combination of self-consumption with attractive feed-in premiums, especially for medium- to large-scale commercial systems ranging from 40 kW to 750 kW.

- The major driver for the country's solar inverters market has been the FiT scheme, which has made it lucrative for homeowners as well as small businesses to opt for solar power.

- The cumulative solar photovoltaic installed capacity in Germany has witnessed significant growth. The solar PV installed capacity was 58.4 GW in 2021 and 53.7 GW in 2020. There has been 9.1% year-on-year growth in 2021 compared to the previous year. The market is expected to expand due to the upcoming projects implemented by the government and private investors.

- For example, in May 2022, Germany's Federal Network Agency, the Bundesnetzagentur, concluded the third rooftop PV tender with an average price of EUR 0.0853/kWh. The agency reviewed 171 bids with a total capacity of 212 MW and selected 163 projects totaling 204 MW. The final prices ranged between EUR 0.07 /kWh and EUR 0.0891/kWh.

- In addition, in April 2022, the German Federal Network Agency announced that the agency had selected 201 proposals with a combined output of 1.084 GW under the solar auction, up from 510.34 MW in July 2021. The bids in the round ranged from EUR 0.040 to EUR 0.055 per kWh. The volume-weighted average price stood at EUR 0.0519 (USD 0.057) per kWh, up from EUR 0.050 per kWh in the previous round.

- Owing to such developments, the country is expected to have the highest share in the solar PV inverters market in the near future.

Europe Solar PV Inverters Industry Overview

The European solar PV inverters market is fragmented in nature. Some of the key players in the market (in no particular order) include Fimer SpA, Schneider Electric SE, Mitsubishi Electric Corporation, General Electric Company, and Siemens AG.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Central Inverters

- 5.1.2 String Inverters

- 5.1.3 Micro Inverters

- 5.2 Application

- 5.2.1 Residential

- 5.2.2 Commercial & Industrial

- 5.2.3 Utility-scale

- 5.3 Geography

- 5.3.1 Germany

- 5.3.2 France

- 5.3.3 United Kingdom

- 5.3.4 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Fimer SpA

- 6.3.2 Siemens AG

- 6.3.3 Mitsubishi Electric Corporation

- 6.3.4 General Electric Company

- 6.3.5 Schneider Electric SE

- 6.3.6 SMA Solar Technology AG

- 6.3.7 Omron Corporation

- 6.3.8 Delta Energy Systems Inc.

- 6.3.9 Huawei Technologies Co Ltd.

- 6.3.10 KACO New Energy GmBH

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219