|

市场调查报告书

商品编码

1644933

北美单轴太阳能追踪器:市场占有率分析、产业趋势和成长预测(2025-2030 年)North America Single Axis Solar Tracker - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

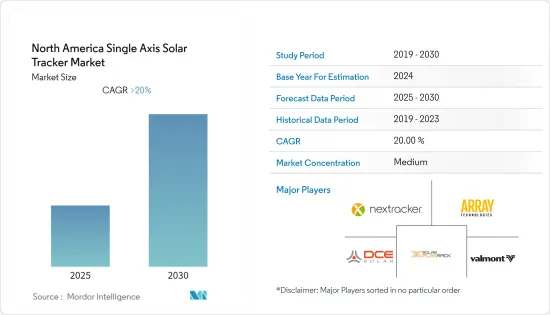

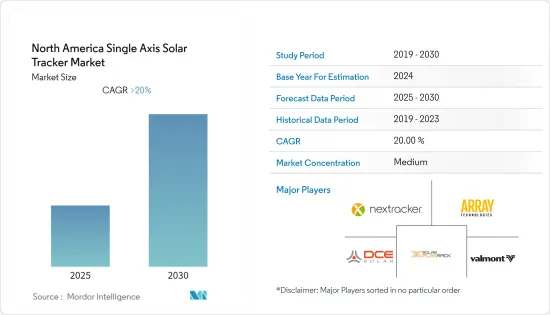

预测期内,北美单轴太阳能追踪器市场预计将以超过 20% 的复合年增长率成长。

2020 年,市场受到了 COVID-19 的不利影响。目前市场已经恢復到疫情前的水准。

关键亮点

- 从中期来看,政府的支持政策和满足可再生能源电力需求的努力等因素预计将为太阳能电池板和太阳能追踪器创造一个利润丰厚的市场。

- 另一方面,安装追踪系统所需的高额初始投资、其设计的复杂性、维护成本以及太阳能追踪系统的容量有限,预计将限制太阳能追踪器的采用。

- 能源公司和政府面临着增加现有计划和未来计划的发电能力的挑战。透过安装单轴太阳能追踪器,可以实现20%到30%的容量成长。预计这将为未来参与製造太阳能追踪系统的公司创造巨大的商机。

- 由于太阳能光电安装量的增加,美国将主导市场成长。

北美单轴太阳能追踪器市场趋势

美国主导市场成长

- 太阳能在美国变得比以前更容易获得和普及。仅在过去十年里,太阳能发电的年均成长率就达到42%。过去10年,该国的太阳能发电能力增加了30倍。 2021年美国总设备容量将达119.8吉瓦,较上年成长约25%。

- 此外,分散式太阳能也在全国各大市场取得长足发展。自2010年起,分散式太阳能发电系统产生的能量已经超过了太阳能光电装置的产生的能量。分散式太阳能市场主要受到太阳能投资税额扣抵(ITC)等强有力的联邦激励措施、成本的快速下降以及私营和公共部门对绿能日益增长的需求的推动。

- 此外,美国太阳能产业协会 (SEIA) 还提高了其「太阳能+十年」目标,计划到 2030 年使太阳能占美国发电量的 30%。该集团先前的目标是到2030年实现20%的减排目标,此次修改与政府最近的清洁能源目标一致,同时考虑到应对气候变迁和减少电力产业碳排放的紧迫性日益增加。

- 2022年上半年住宅太阳能发电累积设置容量约2,561千万瓦。根据太阳能产业协会 (SEIA) 的数据,2021 年,太阳能占电网新增发电量的 46%。截至年终,美国共有约 270 万个分散式住宅太阳能係统。

- 2022年上半年美国商业光电装置容量为1,589千万瓦。此外,到 2022 年上半年,美国的太阳能容量将超过 130 吉瓦 (GW),足以为 2,300 万户家庭供电。

- 因此,基于上述因素,预计美国将在预测期内占据北美单轴太阳能追踪器市场的大部分份额。

政府支持措施和利用再生能源来源满足电力需求

- 2021年北美可再生能源发电量为714.1TWh,与前一年同期比较成长约12.7%。

- 在加拿大,联邦政府宣布2025年,建筑物和业务使用的100%电力将来自可再生能源。该目标支持联邦政府最快在2025年将温室气体排放减少40%的目标。此外,埃德蒙顿、维多利亚、圭尔夫和尼尔森等几个城市已承诺在未来几年内实现 100%可再生能源,预计将为单轴太阳能追踪器市场创造一些机会。

- 根据清洁能源产业组织加拿大可再生能源协会 (CanREA)委託的报告,安大略省在未来十年内屋顶太阳能发电量可能达到 3GW,到 2030 年每年可节省高达 2.44 亿加元(1.93 亿美元)。

- 墨西哥政府也设定了雄心勃勃的目标,到 2024 年可再生能源占比达到 35%,到 2050 年达到 50%,高于 2018 年的 6.4%。此外,竞标在该国大规模部署可再生能源中发挥关键作用。继2015年和2016年两次成功举行可再生能源竞标之后,2017年举行了第三轮竞标,其中太阳能光伏赢得了可再生能源计划中的最大份额(55%),共签订了1.3吉瓦的太阳能光伏容量总合。

- 此外,由于2021-2035年国家公用事业电子和能源系统发展计画等政府倡议,墨西哥的公共产业产业预计将显着成长。该计划预计将使该国增加清洁可再生能源发电量,以减少空气污染。

- 平均价格为每兆瓦时 18.93 美元,为当时有记录以来的最低价格。三次竞标共分配了约4.8吉瓦的太阳能发电容量,对约40座太阳能发电厂的累积投资额约为50亿美元。

- 儘管墨西哥制定了雄心勃勃的目标并设立了清洁能源证书(CEC)计划来支持该国的可再生能源发展,但该国欠发达的电网预计将对未来太阳能的扩张构成威胁,尤其是对该国偏远地区正在开发的大型太阳能发电厂。

- 预计上述因素将在研究期间推动单轴太阳能追踪器市场的需求。

北美单轴太阳能追踪器产业概况

北美单轴太阳能追踪器市场适度细分。该市场的主要企业(不分先后顺序)包括 Nextracker Inc、Array Technologies Inc、Solar Flexrack、DCE Solar 和 Valmont Industries, Inc。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 2027 年市场规模及需求预测(十亿美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场区隔

- 地区

- 美国

- 加拿大

- 墨西哥

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Nextracker Inc

- Solar Flexrack

- DCE Solar

- Valmont Industries, Inc

- Array Technologies Inc

- FTC Solar, Inc

- Arctech Solar Holding Co

- GameChange Solar

- Solvest Inc.

- Deger Canada Inc

第七章 市场机会与未来趋势

简介目录

Product Code: 93203

The North America Single Axis Solar Tracker Market is expected to register a CAGR of greater than 20% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Over the medium term, factors such as supportive government policies and efforts to meet power demand using renewable energy sources are expected to create a favorable market for solar panels as well as for solar trackers.

- On the other hand, the high initial investment required to install a tracking system, design complexity, maintenance cost, and the limited capacity of solar tracking systems is expected to restrain the usage of solar trackers.

- Nevertheless, energy companies and governments are facing a challenge to increase the power capacity, not only for future projects but also for active projects. With the installation of single-axis solar trackers, a capacity surge of 20%-30% can be achieved. This, in turn, is expected to create a significant amount of opportunities for the companies involved in solar tracking system manufacturing in the upcoming future.

- United States to dominate the market growth, due to to the increasing solar PV installation in the country.

North America Single Axis Solar Tracker Market Trends

United States to Dominate the Market Growth

- Solar power has become more accessible and prevalent in the United States than ever before. In the last decade alone, solar has experienced an average annual growth rate of 42%. Since the last decade, solar installations in the country have grown 30-fold. Total installed capacity in the United States reached 119.8 GW in 2021, representing an increase of about 25% compared to the previous year's value.

- Furthermore, distributed solar energy is also making significant progress across all the major markets in the country. Since 2010, the energy generated from the distributed solar system exceeded that of the solar utility installation. The distributed solar power generation market is mainly driven by strong federal policies like the solar Investment Tax Credit (ITC), rapidly declining costs, and increasing demand across the private and public sector for clean electricity.

- Further, the Solar Energy Industries Association (SEIA) is increasing its goal for Solar+ Decade, aiming for solar to account for 30% of the United States' electricity generation by 2030. The organization's previous goal was 20% by 2030, and this revision aligns with the recent government's clean energy targets while accounting for the growing urgency to tackle climate change and reduce carbon emissions in the electricity sector.

- In H1 2022, the country had cumulative installed capacity of around 25.61 GW of residential solar PV capacity. According to Solar Energy Industries Association (SEIA), in 2021, solar energy accounted for 46% of all new electricity generating capacity added to the grid. At the end of 2021, there were approximately 2.7 million distributed residential PV systems in the United States.

- In H1 2022, the total PV installed capacity in the commercial sector in the United States was 15.89 GW. Further, in till H1 2022, the United States has more than 130 gigawatts (GW) of solar energy capacity, which is enough to power 23 million homes which are additionally expected to rise till the end of 2022 and continue to surge significantly during the forecast period owing to a large portfolio of projects and supportive federal policies.

- Therefore, based on the above-mentioned factors, United States is expected to have a significant share in the North America single axis solar tracker market during the forecast period.

Supportive Government Policies And Efforts To Meet Power Demand Using Renewable Energy Sources

- North America generated 714.1 TWh of electricity from renewables in 2021, an increase of about 12.7% over the previous year.

- In Canada, the federal government announced that by 2025, 100% of the electricity used in their buildings and operations will be from renewable energy sources. This target is in support of a target to reduce the Federal Government's greenhouse gas emissions by 40% as early as 2025. Several provinces have set targets for increased percentages of renewables, and several cities, such as Edmonton, Victoria, Guelph, and Nelson, have committed to 100% renewable energy in the coming years, which is expected to create several opportunities for the single-axis solar tracker market.

- According to a report commissioned by the clean energy industry body - the Canadian Renewable Energy Association (CanREA), reaching 3 GW of rooftop solar in Ontario this decade could bring annual savings of up to CAD 244 million (USD 193 million) in 2030.

- Mexico's government also set an ambitious target of 35% renewable electricity by 2024 and 50% by 2050, up from 6.4% in 2018. Moreover, auctions have played an important role in large-scale renewable energy deployment in the country. After two successful renewable energy auctions in 2015 and 2016, the third round of auction was held in 2017, with solar getting the largest share of renewable energy projects (55%) for a total 1.3 GW of solar capacity contracted.

- Further, Mexico is expected to have significant growth in the utility sector on account of government initiatives, such as the 2021-2035 Development Program of the National Electrical System. The country is likely to increase power generation from clean renewable sources to reduce air pollution as per the program.

- An average price of USD 18.93 per MWh set a world record low at the time. Altogether, the three auctions allocated around 4.8 GW of solar generation capacity, with a cumulative investment of around USD 5 billion for about 40 solar power plants.

- Despite the ambitious targets and the clean energy certificate (CEC) scheme to support the development of renewable energy in the country, the underdeveloped power grid of Mexico is expected to pose a threat for future solar expansion, especially the large-scale solar PV plants that are developed in the remote areas of the country.

- The above-mentioned factors are expected to drive the demand for single axis solar tracker market over the study period.

North America Single Axis Solar Tracker Industry Overview

North America single-axis solar tracker market is moderately fragmented. Some of the key players in the market (in no particular order) include Nextracker Inc, Array Technologies Inc., Solar Flexrack, DCE Solar, and Valmont Industries, Inc, among others

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Geography

- 5.1.1 United States

- 5.1.2 Canada

- 5.1.3 Mexico

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Nextracker Inc

- 6.3.2 Solar Flexrack

- 6.3.3 DCE Solar

- 6.3.4 Valmont Industries, Inc

- 6.3.5 Array Technologies Inc

- 6.3.6 FTC Solar, Inc

- 6.3.7 Arctech Solar Holding Co

- 6.3.8 GameChange Solar

- 6.3.9 Solvest Inc.

- 6.3.10 Deger Canada Inc

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219