|

市场调查报告书

商品编码

1644967

欧洲太阳能追踪器:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Europe Solar Tracker - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

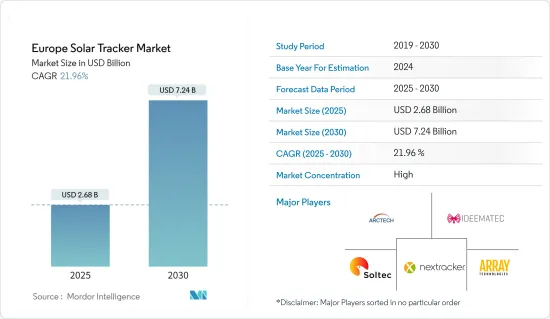

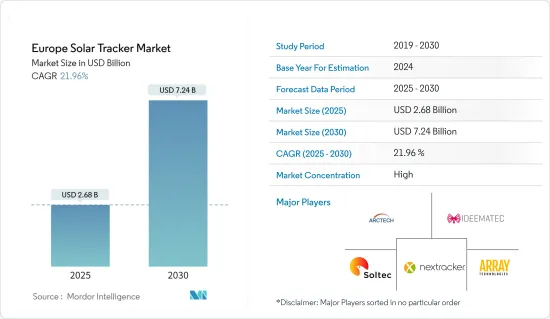

预计 2025 年欧洲太阳能追踪器市场规模为 26.8 亿美元,预计到 2030 年将达到 72.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 21.96%。

关键亮点

- 从长远来看,预计在预测期内,增加对可再生能源的投资以减少俄罗斯对能源进口的依赖并履行其环境承诺将推动市场发展。

- 另一方面,安装追踪系统所需的高额初始投资、其设计的复杂性、维护成本以及太阳能追踪系统的容量限制预计会限制太阳能追踪器的采用。

- 利用人工智慧和物联网来追踪太阳运动并最大化发电的商业化预计将在预测期内为市场带来巨大的成长机会。

欧洲太阳能追踪器市场的趋势

单轴领域占市场主导地位

- 太阳能追踪器透过将太阳能电池板与阳光方向对齐来提高太阳能电池板系统的生产能力。太阳能追踪器改变光伏 (PV) 板的排列方式,使阳光垂直照射到板上,从而实现最大功率输出。然而,距离赤道越远,夏季和冬季之间的太阳角度变化越大,因此越靠北,其效果就越差。

- 单轴太阳能追踪器比固定光伏板装置贵 50%,但可提供 25% 到 35% 的额外容量。其简单的设计可实现每平方公尺最高的光电板密度,并缩短投资回收期。

- 如今,水平单轴追踪器 (HSAT) 是领先的追踪器选择,因为它们可以提供 20-30% 以上的能量,而无需双轴追踪器所增加的成本和复杂性。此外,单轴追踪器系统成本的下降使得 SAT 越来越受欢迎,这阻碍了双轴追踪器市场的成长。

- 单轴追踪器比固定太阳能发电面板装置贵 50%,但能量产量可提高 25-35%。单轴太阳能追踪器的简单设计可实现单位面积太阳能发电面板的最高密度,并缩短投资回收期。同时,双轴追踪器可额外提高10%的容量,但需要额外花费固定光伏板安装的100%的成本。

- 过去十年来,由于对可再生能源产业的投资不断增加,以及政府的优惠政策和该地区多个国家製定的雄心勃勃的可再生能源目标的支持,太阳能光伏(PV)计划的装置容量容量大幅增加。根据国际可再生能源机构(IRENA)的数据,欧洲累积设置容量将成长约20%,从2021年的187.82吉瓦增加到2022年的225.47吉瓦。

- 此外,政府和能源公司也面临增加当前和未来计划发电能力的挑战。使用单轴太阳能追踪器,20% 到 30% 的容量激增可以带来极大的好处。因此,预计在预测期内,它将为参与製造单轴太阳能追踪器系统的公司创造巨大的商机。

德国占据市场主导地位

- 德国是欧洲最大的太阳能市场之一,由于其纬度相对较高,也是该地区对太阳能追踪器需求最大的国家之一。德国也是太阳能追踪器研发中心,一些全球最大的太阳能追踪器製造商,包括 Ideatec 和 Emerging Nations,都位于德国。

- 德国正逐步淘汰煤炭和核能,面临严重的能源危机。因此,德国近年来一直积极扩大其太阳能发电能力。 2021年11月,德国承诺在2030年关闭其燃煤发电能力。 2030年,德国计画安装200GW太阳能光电发电容量来满足其能源需求。

- 由于德国仅使用太阳能光电技术,因此在太阳能光电领域如此大规模的投入预计将为相关太阳能追踪器的需求提供可靠的动力,预计在预测期内将显着提振德国太阳能追踪器市场。根据国际可再生能源机构的预测,德国累积设置容量将增加约12%,即从2021年的59.37吉瓦增加到2022年的66.55吉瓦。

- 此外,德国太阳能追踪器製造商在智慧、更有效率的太阳能追踪器的研发方面也处于全球领先地位。预计这将降低德国国内市场的太阳能追踪器成本,从而增加预测期内的需求。

- 2021年11月,德国太阳能追踪器製造商Ideatec发布了其单埠太阳能追踪器。此款水平单轴追踪器的典型尺寸为1952.5米,追踪范围为55度。该系统最多可容纳 180 块太阳能发电面板,每个追踪器有 6 串。该系统可与任何类型的太阳能模组集成,包括高功率产品,可承受高达 180 公里/小时的风速,并配有雪感测器。此追踪器系统采用天文演算法 3D自我调整回溯,范围为 60 度,可选地面高度高达 500 奈米 (nm)。

- 2021 年 10 月,Wattmanufactur 在石勒苏益格-弗伦斯堡/石勒苏益格-荷尔斯泰地区启动了 10 兆瓦的 Rottorf Solarpark,这是世界上最大的单轴追踪器太阳能园区之一。到2022年,该园区的发电量预计将增加近7兆瓦。太阳能追踪器技术将使太阳能园区在早上和晚上产生更多的电力。此外,追踪技术允许安装旋转模组,以最大限度地发挥土壤遮荫潜力,同时允许持续进行全田灌溉,从而提高计划的永续性。

- 德国是一个成熟的太阳能市场,预计太阳能补贴将在预测期内逐步取消。此外,德国土地价格高,人们对土地使用和生态永续性到担忧。由于太阳能生产商注重提高效率和发电量,同时减少土地使用,这些因素预计将在预测期内增加新型太阳能追踪系统的吸引力。

欧洲太阳能追踪器产业概况

欧洲太阳能追踪器市场正在整合。市场的主要企业(不分先后顺序)包括 Arctech Solar、Array Technologies、Ideatec、Soltec Power Holdings SA 和 Nextracker Inc.

Nextracker Inc. 投入大量资源进行研发,以维持和扩大其差异化技术和创新领导地位并提升客户价值。此外,该公司的销售和行销策略专注于与参与公共规模太阳能发电工程的开发、建造、所有权和维护的关键相关人员建立长期关係。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概况

- 介绍

- 至2028年市场规模及需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 丰富的太阳能资源

- 限制因素

- 初期投资成本高

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场区隔

- 轴类型

- 单轴

- 双轴

- 地区

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- Companies Profiles

- Soltec Power Holdings SA

- Arctech Solar Holding Co. Ltd.

- Array Technologies

- Ideematec Deutschland GmbH

- Nextracker Inc.

- DCE Solar

- Convert Italia SpA

- PV Hardware

- Solar Flexrack

第七章 市场机会与未来趋势

- 太阳能设备的技术进步

The Europe Solar Tracker Market size is estimated at USD 2.68 billion in 2025, and is expected to reach USD 7.24 billion by 2030, at a CAGR of 21.96% during the forecast period (2025-2030).

Key Highlights

- Over the long term, rising investments in renewable energy to reduce dependence on Russian energy imports and achieve environmental commitments are expected to drive the market during the forecast period.

- On the other hand, the high initial investment required to install a tracking system, design complexity, maintenance cost, and limited capacity of solar tracking systems is expected to restrain the usage of solar trackers.

- Nevertheless, the commercialization of the usage of artificial intelligence and the internet of things to track the sun's movement and maximize power output is expected to be a significant growth opportunity for the market during the forecast period.

Europe Solar Tracker Market Trends

Single-Axis segment to dominate the market

- A solar tracker enhances the production capacity of the solar panel system by aligning the solar panel with the direction of sunlight. The solar tracker alters the alignment of the photovoltaic (PV) panel so that the sunlight falls perpendicularly on the panel and gives maximum power output. However, they are less effective when they move farther toward the northern regions because the variance of the solar angle is higher between the summer and winter seasons in locations far from the equator.

- The single-axis solar tracker is 50% more costly than a fixed PV panel setup but provides an extra 25%-35% surge in capacity. Its simple design offers the highest density of PV panel placement per square and a shorter payback time.

- Currently, horizontal single-axis trackers (HSAT) are the leading choice among trackers since they can deliver 20-30% more energy without the added cost and complexities of dual-axis tracking systems. In addition, the decline in single-axis tracking system costs is increasing the popularity of SATs, which in turn is hindering the growth of the dual-axis tracker market.

- The single-axis tracker is 50% more costly than a fixed photovoltaic panel setup but provides an extra 25%-35% surge in energy yield. Single-axis solar trackers' simple design offers the highest density of photovoltaic panel placement per square area and a shorter payback time. At the same time, dual-axis trackers provide an extra 10% capacity enhancement but cost an extra 100% of a fixed PV panel setup.

- The installed capacity of solar photovoltaic (PV) projects has grown significantly over the last decade due to increasing investments in the renewable energy industry supported by favorable government policies and ambitious renewable energy targets set by several countries in the region. According to the International Renewable Energy Agency (IRENA), the cumulative installed solar PV capacity in Europe grew by around 20%, i.e., from 187.82 GW in 2021 to 225.47 GW in 2022.

- Furthermore, governments and energy companies face the challenge of increasing the power capacity for current and future projects. With single-axis solar trackers, the 20%-30% capacity surge can be very beneficial. It, in turn, is expected to create significant opportunities for the companies involved in single-axis solar tracking system manufacturing during the forecast period.

Germany to dominate the market

- Germany is one of the largest markets for solar PV in Europe, and due to its relatively higher latitude, it is also one of the region's largest countries for solar tracker demand. The country is also a hub for research and development of solar trackers, with several of the world's largest solar tracker producers, such as Ideematec and Deger Energie, based in Germany.

- As Germany phases out coal and nuclear from its energy mix, it faces an acute energy crisis. Due to this, Germany aggressively increased its solar PV capacity over the past few years. In November 2021, Germany committed to closing its coal-fired generation capacity by 2030. In 2030, Germany aims to fulfill its energy requirements by installing 200 GW of solar capacity.

- As Germany almost exclusively uses solar PV technology, such large-scale commitments in the solar PV sector are expected to provide a definite impetus to the demand for associated solar trackers, which is expected to significantly boost the German solar tracker market during the forecast period. According to the International Renewable Energy Agency, Germany's cumulative installed solar PV capacity grew by around 12%, i.e., from 59.37 GW in 2021 to 66.55 GW in 2022.

- Additionally, German solar tracker manufacturers are global leaders in the research and development of intelligent and more efficient solar trackers. This is expected to reduce the cost of solar trackers in the German domestic market, increasing demand during the forecast period.

- In November 2021, German solar tracker manufacturer Ideematec unveiled a one-in-portrait solar tracker. The horizontal single-axis tracker has a typical size of 1952.5 m, and its tracking range is 55 deg. The system can use up to 180 photovoltaic panels and six strings per tracker. The system can be integrated with all kinds of solar modules, including high-power products, is capable of withstanding winds of up to 180 km per hour, and is equipped with a snow sensor. The tracking system employs the astronomical algorithm 3D adaptive back-tracking, and its range and ground clearance can be increased to 60 degrees and 500 nanometers (nm) upon request.

- In October 2021, Wattmanufactur commenced operation at the 10 MW Lottorf solar park in the district of Schleswig-Flensburg/Schleswig-Holstei, one of the world's largest single-axis tracker solar parks. By 2022, the park's capacity was expected to increase by nearly 7 MW. Due to its solar tracker technology, the solar park will generate significantly more energy in the morning and evening hours. Additionally, the tracker technology allows the installation of rotating modules, which maximizes the shading possibility of the soil but at the same time continues to offer a full-surface irrigation possibility, improving the project's sustainability.

- As Germany is a mature solar market, solar subsidies are expected to be discontinued within the forecast period. Additionally, Germany has high land prices and concerns about land use patterns and ecological sustainability. Due to such factors, solar energy producers are focused on increasing efficiency and generation while reducing land use, which is expected to improve the attractiveness of novel solar tracker systems during the forecast period.

Europe Solar Tracker Industry Overview

The European solar tracker market is consolidated. Some of the major players in the market (in no particular order) include Arctech Solar, Array Technologies, Ideematec, Soltec Power Holdings SA, and Nextracker Inc., among others.

Nextracker Inc. commits significant resources to research and development efforts in order to maintain and extend differentiated technology and innovation leadership and to enhance value for their customers. Moreover, the company's sales and marketing strategy is focused on building long-term relationships with key stakeholders involved in developing, building, owning, and maintaining utility-scale solar projects.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecasts in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Abundant Solar Resource

- 4.5.2 Restraints

- 4.5.2.1 High Initial Investment Cost

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGEMENTATION

- 5.1 Axis Type

- 5.1.1 Single-Axis

- 5.1.2 Dual-Axis

- 5.2 Geography

- 5.2.1 Germany

- 5.2.2 United Kingdom

- 5.2.3 France

- 5.2.4 Italy

- 5.2.5 Spain

- 5.2.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Companies Profiles

- 6.3.1 Soltec Power Holdings SA

- 6.3.2 Arctech Solar Holding Co. Ltd.

- 6.3.3 Array Technologies

- 6.3.4 Ideematec Deutschland GmbH

- 6.3.5 Nextracker Inc.

- 6.3.6 DCE Solar

- 6.3.7 Convert Italia SpA

- 6.3.8 PV Hardware

- 6.3.9 Solar Flexrack

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements in Solar Energy Equipment