|

市场调查报告书

商品编码

1645047

新加坡液化天然气储存槽:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Singapore LNG Storage Tank - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

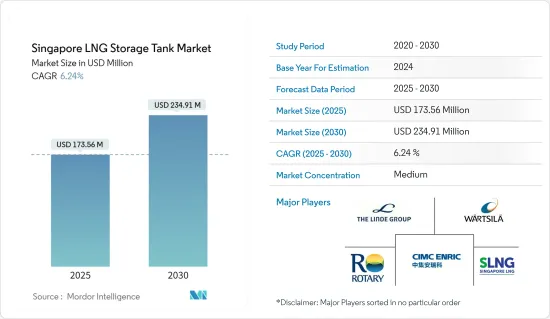

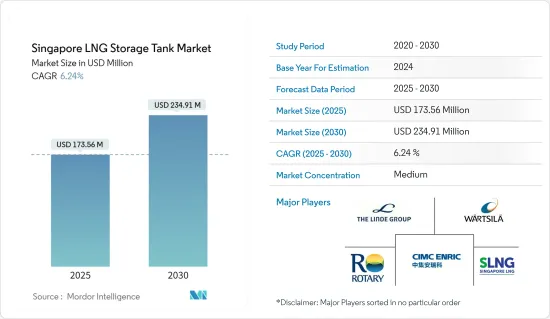

新加坡液化天然气储存槽市场规模预计在 2025 年为 1.7356 亿美元,预计到 2030 年将达到 2.3491 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.24%。

主要亮点

- 从中期来看,预计预测期内新加坡对液化天然气的需求增加和液化天然气作为燃料的消费量增加将推动市场发展。

- 另一方面,预计可再生能源的采用增加和天然气价格的波动将在预测期内抑制市场。

- 然而,浮体式液化天然气(LNG)接收站开发的进步在预测期内仍将为市场带来巨大的成长机会。

新加坡液化天然气储存槽市场趋势

独立式水箱成长迅猛

- 独立式储槽是用来运输液化天然气的储存槽。油箱结构足够坚固,可以承受货物的负载。这些罐子由铝合金或 9% 镍钢製成,外面有一层隔热材料层。

- 这些罐体完全自支撑,不构成船舶结构的一部分。这些油箱也不会增加船体的强度。油箱被焊接到圆柱形裙边或绑在焊接到船体结构的支架上。

- 自立式罐型坚固可靠,几乎所有大型LPG运输船均采用此型罐,但由于各种非技术原因,尚未开发用于LNG运输。这些罐子的设计目的是为了无需任何外部支撑就能支撑重量。

- 它们通常是大型圆柱形储罐,由材料製成,设计用于承受储存液化天然气时的极端低温和高压。独立式储槽通常用于大型液化天然气储存应用,如LNG接收站、液化天然气运输船和液化天然气加气站。

- 独立式水箱分为A、B、C型。 A 型油箱采用经典的船舶结构分析程序进行设计。由于一旦储槽结构被破坏,可能会发生气体洩漏,因此 A 型储槽需要一个整体式二次屏障,能够捕获任何逸出的气体并将气体蒸气输送到受控区域。

- 根据能源研究所2023年世界能源统计,液化天然气进口量较2021年成长4.6%,达52亿立方公尺。综观过去五年的趋势,从2017年到2022年,新加坡的液化天然气进口量呈指数级增长。因此,自立式储槽将在解决液化天然气消费量的急剧增长中发挥重要作用。

- 有鑑于上述情况,由于新加坡的液化天然气消费量不断增加,预计预测期内独立式储槽将在新加坡液化天然气储存槽市场见证显着成长。

液化天然气需求成长推动市场

- SLNG 指出,由于新加坡严重依赖天然气发电,目前的 SLNG 终端在确保天然气稳定供应方面发挥着至关重要的作用。 SLNG终端拥有两座码头和四个LNG储存槽,总合容量为80万立方公尺。

- 目前天然气约占该国能源消耗总量的四分之一。其中,约94.3%用于发电业(包括热电联产),约0.9%来自石油产品,约4.1%来自其他能源来源。

- 此外,新加坡正积极寻求能源来源多元化,减少对煤炭和石油等传统石化燃料的依赖。与这些燃料相比,液化天然气的排放更低,是一种更清洁的替代品。液化天然气的使用将有助于欧洲国家实现气候变迁目标并减少空气污染。

- 天然气是新加坡能源转型的选择之一。新加坡自己不生产液化天然气。然而,政府的目标是成为液化天然气贸易的全球枢纽。新加坡已成为亚洲的全球石油产品枢纽。液化天然气对新加坡政府未来的经济发展和能源安全计画至关重要。

- 新加坡拥有重要的贸易港口,在国际航运领域中居世界领先地位。此外,与新加坡相邻的麻六甲海峡和新加坡海峡是海上运输的重要通道,许多油轮、货柜船、货船和客船停靠新加坡,并依靠该港提供淡水、食物、船员换班和燃油补给等补给。鑑于其战略定位,预计在研究期间,液化天然气作为燃料库燃料将支持新加坡液化天然气业务的成长。

- 鑑于上述情况,预计液化天然气需求的成长将推动新加坡液化天然气储存槽市场的发展。

新加坡液化天然气储存槽产业概况。

新加坡的液化天然气储存槽市场正变成半固体。主要参与者(不分先后顺序)包括林德集团、瓦锡兰集团、中集安瑞科控股有限公司、Rotary Engineering Pte.Ltd、新加坡液化天然气公司私人有限公司等。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 2029 年市场规模与需求预测(美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 液化天然气需求不断增加

- 新加坡液化天然气燃料消耗量增加

- 限制因素

- 天然气价格上涨

- 增加可再生能源的采用

- 驱动程式

- 供应链分析

- PESTLE分析

第五章 市场区隔

- 产品类型

- 独立

- 非自立式储罐

- 材料类型

- 钢

- 镍钢

- 铝合金

- 其他的

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- 市场公司

- Rotary Engineering Pte. Ltd.

- Cryolor

- CIMC Enric Holdings Ltd.

- Balanced Engineering and Construction Pte Ltd.

- C-LNG Solutions Pte. Ltd.

- Singapore LNG Corporation Pte Ltd.

- Woodside Energy

- Wartsila Corporation

- Mcdermott International Inc

- Linde PLC

- 市场公司

第七章 市场机会与未来趋势

- 浮体式天然气储存槽的开发

简介目录

Product Code: 50001809

The Singapore LNG Storage Tank Market size is estimated at USD 173.56 million in 2025, and is expected to reach USD 234.91 million by 2030, at a CAGR of 6.24% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, rising demand for LNG and increased consumption of LNG as fuel in Singapore are expected to drive the market during the forecast period.

- On the other hand, the rising adoption of renewable energy and fluctuating natural gas prices are expected to restrain the market during the forecast period.

- Nevertheless, with the advancement in technology to develop floating LNG terminals, it remains a significant growth opportunity for the market during the forecast period.

Singapore LNG Storage Tank Market Trends

Self-supporting Tanks to Witness Significant Growth

- Self-supporting tanks are tanks used for the carriage of liquefied natural gas. It is strong enough by virtue of its construction to accept any loads imposed on it by the cargo. These tanks are made from aluminum alloy or 9% nickel steel with layers of insulation on the outside.

- These tanks are entirely self-supporting and do not form part of the ship's hull structure. These tanks do not contribute to the hull strength of a ship either. The tanks are welded to cylindrical skirts or tied to supporters welded to the ship structure.

- The self-supporting tank type is strong and reliable and has been used by almost all large LPG carriers but has not been developed for LNG for various nontechnical reasons. These tanks are designed to support their weight without any external support.

- They are typically large, cylindrical tanks that are constructed with materials and designs that can withstand the extremely low temperatures and high pressures associated with LNG storage. Self-supporting tanks are often used for large-scale LNG storage applications, such as LNG terminals, LNG vessels, and LNG fueling stations.

- The self-supporting tanks are divided into A, B, and C types. The A-type tanks are designed using the classical ship-structural analysis procedure. Due to the possibility of gas leakage in the case of a break in the tank structure, A-type tanks are required to have a complete secondary barrier that can collect the leaking gas and transfer the gas vapor to a controlled area.

- According to the Energy Institute Statistical Review of World Energy 2023 data, the LNG imports rose by 4.6% when compared to 2021, reaching 5.2 Billion cubic meters. The past five-year trend, from 2017 to 2022, shows an exponential increase in the import of LNG in Singapore. Hence, for such an exponential increase in consumption of LNG, the Self-Supporting Tanks play a major role.

- Thus, with the above-mentioned points, due to the rising consumption of LNG in Singapore, the Self-Supporting Tanks is expected to witness significant growth in the Singapore LNG Storage Tank market during the forecast period.

Rising Demand for LNG to Drive the Market

- Singapore's heavy reliance on natural gas to generate electricity, the current SLNG terminal plays a key role in enabling undisrupted natural gas supply, SLNG noted. It has two jetties and four LNG storage tanks, with a total capacity of 800,000 cubic meters.

- Natural gas currently represents around a quarter of the country's overall energy consumption. About 94.3% of that gas is used in the power generation sector (including in combined heat and power plants), around 0.9% of power is generated from petroleum products, and 4.1% is generated from other energy sources.

- Further, Singapore has actively sought to diversify its energy sources and reduce reliance on traditional fossil fuels like coal and oil. LNG offers a cleaner alternative, with lower emissions compared to these fuels. Using LNG helps European countries meet their climate goals and reduce air pollution.

- Natural gas is one of the options for the energy transition in Singapore. Singapore does not produce LNG on its own. However, the government aims to become the global hub for LNG trade. Singapore is already a global hub for petroleum products in Asia. LNG is critical to the Singapore government's future economic development and energy security plans.

- Singapore has one of the leading trade ports and is one of the global leaders in international marine shipping. In addition, the Straits of Malacca and the Singapore Strait, adjacent to Singapore, have become integral passages for maritime transport, with many tankers, containers, cargo, and passenger ships halting at Singapore and relying on the ports for resupplies of water, food, crew changes, and fuel refilling, because of its strategic location, LNG as a bunkering fuel is expected to support the growth of LNG businesses in Singapore during the study period.

- Thus, on the basis of the above points, the rising demand for LNG is expected to drive the Singapore LNG storage tank market.

Singapore LNG Storage Tank Industry Overview

The Singaporean LNG storage tank market is semi-consolidated. Some of the major players (in no particular order) include Linde PLC, Wartsila Corporation, CIMC Enric Holdings Ltd, Rotary Engineering Pte. Ltd, and Singapore LNG Corporation Pte Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Rising Demand for LNG

- 4.5.1.2 Increased Consumption of LNG as Fuel in Singapore

- 4.5.2 Restraints

- 4.5.2.1 Highly Fluctuating Natural Gas Prices

- 4.5.2.2 Rising Adoption of Renewable Energy

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Product type

- 5.1.1 Self-supporting

- 5.1.2 Non-Self-supporting Tanks

- 5.2 Material type

- 5.2.1 Steel

- 5.2.2 Nickel Steel

- 5.2.3 Aluminum Alloys

- 5.2.4 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Market Players

- 6.3.1.1 Rotary Engineering Pte. Ltd.

- 6.3.1.2 Cryolor

- 6.3.1.3 CIMC Enric Holdings Ltd.

- 6.3.1.4 Balanced Engineering and Construction Pte Ltd.

- 6.3.1.5 C-LNG Solutions Pte. Ltd.

- 6.3.1.6 Singapore LNG Corporation Pte Ltd.

- 6.3.1.7 Woodside Energy

- 6.3.1.8 Wartsila Corporation

- 6.3.1.9 Mcdermott International Inc

- 6.3.1.10 Linde PLC

- 6.3.1 Market Players

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Floating LNG Storage Tanks

02-2729-4219

+886-2-2729-4219