|

市场调查报告书

商品编码

1645050

中东和非洲增压压缩机 -市场占有率分析、行业趋势、统计数据、成长预测(2025-2030 年)Middle East And Africa Booster Compressor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

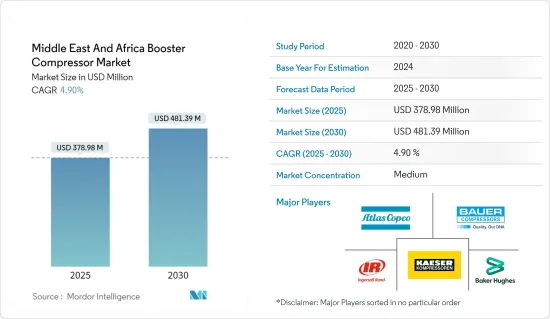

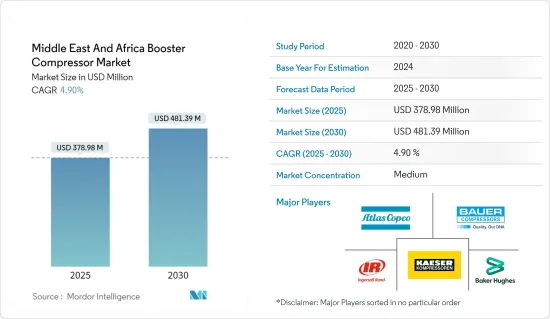

中东和非洲增压压缩机市场规模预计在 2025 年为 3.7898 亿美元,预计到 2030 年将达到 4.8139 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.9%。

关键亮点

- 从中期来看,石油和天然气行业的崛起以及工业化程度的提高等因素预计将推动中东和非洲增压压缩机市场的发展。

- 另一方面,全球市场石油和天然气价格的波动预计会阻碍增压压缩机市场的成长。

- 预计在预测期内,增加研发活动以提高压缩机的效率和品质将提供成长机会。

- 由于能源需求不断增长以及该地区石油和天然气投资不断扩大,沙乌地阿拉伯预计将主导市场。

中东和非洲增压压缩机市场趋势

石油和天然气产业将实现大幅成长

- 中东和非洲的石油和天然气产业正在经历显着成长,推动该区域市场对增压压缩机的需求。有几个重要因素促成了这一预计的扩张。

- 首先,中东地区油气蕴藏量丰富,是全球能源生产的中心。该地区正在进行的探勘和采矿活动需要高效的压缩系统,从而推动了对增压压缩机的需求。全球能源需求的快速成长进一步凸显了中东在满足这项需求方面所扮演的重要角色。

- 根据能源研究所《2023年世界能源统计评论》,该地区2023年的石油产量将达到约37,786,000桶/日,较2021年增长6%以上,预计在预测期内将继续保持类似的趋势。

- 此外,中东石油和天然气产业正在适应技术进步,并专注于效率和生产力。增压压缩机在提高工业中各种製程的效率方面发挥着至关重要的作用,例如透过管道输送天然气和注入石油进行采油。随着业界追求最佳化,采用先进的压缩机技术已变得势在必行,从而促进了增压压缩机市场的成长。

- 例如,2022年4月,沙乌地阿拉伯石油化工综合体公司宣布已与苏尔寿签署协议,以优化其石油化学综合体的能源效率。苏尔寿补充说,它将专注于设计更高效的压缩机系统和其他化学工艺,以降低能耗,使石化综合体更加节能。

- 中东地缘政治情势在带来挑战的同时,也为增压压缩机市场带来了机会。该地区在全球能源贸易中的战略重要性正在鼓励对基础设施和探勘计划的投资。这推动了对增压压缩机的需求,增压压缩机已成为支援这些倡议的重要组成部分。

- 此外,在中东和非洲,超越传统碳氢化合物产业的多元化努力正在促进非石油产业的成长。随着製造业和石化等行业的扩张,对增压压缩机支援各种应用的需求也日益增长。这种向经济多样化的转变将成为增压压缩机市场扩张的催化剂。

- 因此,鑑于上述情况,预计石油和天然气行业在预测期内将实现显着增长。

沙乌地阿拉伯有望成为一个快速成长的市场

- 沙乌地阿拉伯在全球石油和天然气产业的突出地位是这一成长的关键因素之一。作为石油的主要生产国和出口国,沙乌地阿拉伯进行广泛的探勘和开采活动,需要增压压缩机等先进技术来优化这些流程。该国石油和天然气行业的持续扩张和现代化正在刺激对高效压缩系统的需求。

- 例如,根据能源研究所《2023年世界能源评论》,沙乌地阿拉伯的天然气产量从2021年到2022年增加了5.2%以上。预计2022年该国的天然气产量将达到1,204亿立方米,而2021年为1,145亿立方米,这表明该国的石油和天然气产业正在崛起,从而推动压缩机市场的发展。

- 沙乌地阿拉伯政府的「2030愿景」倡议也是影响这项局势的重要因素。这个变革愿景旨在实现经济多元化,减少对石油收入的依赖,并促进工业部门的繁荣。随着沙乌地阿拉伯致力于加强其非石油产业,从製造业到石化业等各种应用对增压压缩机的需求日益增加。这种经济多元化策略符合增压压缩机市场的成长轨迹,并为市场相关人员指明了新的途径。

- 2022年9月,沙乌地阿拉伯政府宣布将投资106亿美元用于11个城市的基础建设。该计划是透过石油和天然气行业发展城市以增加国内工业并减少收入。

- 此外,沙乌地阿拉伯对大型基础设施计划的投资也为增压压缩机市场的预期成长做出了重大贡献。像 NEOM 和红海计划这样的大型开发专案需要强大的压缩系统来支援整体的各种应用。增压压缩机整合到这些计划中已变得至关重要,为市场扩张创造了环境。

- 作为全球能源贸易关键中转站,其战略位置提升了该国在增压压缩机市场的重要性。随着全球对能源资源的需求不断增加,沙乌地阿拉伯在促进透过管道运输石油和天然气方面的作用预计将扩大。这导致对增压压缩机的需求增加,以维持这些广泛的管道网路中的最佳压力水平。

- 因此,鑑于上述情况,预计沙乌地阿拉伯市场将在预测期内实现显着成长。

中东和非洲增压压缩机产业概况

中东和非洲的增压压缩机市场减少了一半。市场的主要企业(不分先后顺序)包括阿特拉斯·科普柯集团、贝克休斯公司、Bauer Compressors、Kaeser Kompressoren 和英格索兰公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概况

- 介绍

- 至2028年市场规模及需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 石油和天然气产业成长不断扩大

- 产业扩张

- 限制因素

- 石油和天然气价格波动加剧

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场区隔

- 应用

- 石油和天然气

- 过程

- 化工和石化

- 发电

- 其他的

- 市场分析:2028 年前各地区市场规模及需求预测(按地区)

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 卡达

- 埃及

- 奈及利亚

- 南非

- 其他中东和非洲地区

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- Companies Profiles

- Atlas Copco Group

- Kaeser Kompressoren

- Boge Kompressoren Otto Boge GmbH & Co. KG

- Sauer Compressors

- Bauer Kompressoren

- Ingersoll Rand PLC

- Baker Hughes Company

第七章 市场机会与未来趋势市场机会与未来趋势

- 技术进步

简介目录

Product Code: 50001812

The Middle East And Africa Booster Compressor Market size is estimated at USD 378.98 million in 2025, and is expected to reach USD 481.39 million by 2030, at a CAGR of 4.9% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the increasing oil and gas sector coupled with increasing industrialization are expected to drive the booster compressor market in Middle-East and Africa.

- On the other hand, the fluctuations in the oil and gas prices in the global market are expected to hinder the growth of the booster compressor market.

- Nevertheless, increasing R&D activities to improve compressor efficiency and quality are expected to provide growth opportunities in the forecast period.

- Saudi Arabia is expected to dominate the market due to the increasing demand for energy and growing oil and gas investments in the region.

Middle East And Africa Booster Compressor Market Trends

Oil and Gas Segment to Witness Significant Growth

- The oil and gas sector in Middle-East and Africa is poised for significant growth, thereby driving the demand for booster compressors in the regional market. Several key factors contribute to this anticipated expansion.

- Firstly, the Middle East holds substantial reserves of oil and gas, making it a focal point for global energy production. The continuous exploration and extraction activities in this region necessitate efficient compression systems, elevating the demand for booster compressors. The burgeoning demand for energy on a global scale further accentuates the pivotal role of the Middle East in meeting these requirements.

- According to the Energy Institute Statistical Review of World Energy 2023, in 2023, the oil production in the region was around 37,786 thousand barrels per day, which was a growth of over 6% compared to 2021, and a similar trend is expected to be followed during the forecasted period.

- Moreover, the oil and gas industry in the Middle East has been adapting to technological advancements, emphasizing efficiency and productivity. Booster compressors play a crucial role in enhancing the efficiency of various processes within the industry, such as gas transportation through pipelines and the injection of gas for oil recovery. As the industry strives for optimization, the incorporation of advanced compressor technologies becomes imperative, contributing to the growth of the booster compressor market.

- For instance, in April 2022, a petrochemical complex company in Saudi Arabia announced that it had signed a contract with Sulzer to optimize the energy efficiency in its petrochemical complex. Sulzer further added that it would focus on designing more efficient compressor systems and other chemical processes to reduce energy consumption and make the petrochemical complex more energy efficient.

- While presenting challenges, the geopolitical landscape of the Middle East also offers opportunities for the booster compressor market. The region's strategic importance in the global energy trade encourages investments in infrastructure and exploration projects. This, in turn, fuels the demand for booster compressors as they become integral components in supporting these initiatives.

- Furthermore, the diversification efforts in the Middle East and Africa, beyond traditional hydrocarbon-based industries, contribute to the growth of non-oil sectors. As industries such as manufacturing and petrochemicals expand, the need for booster compressors to support various applications increases. This shift towards a more diversified economic landscape acts as a catalyst for the booster compressor market's expansion.

- Therefore, as per the points mentioned above, the oil and gas segment is expected to witness significant growth during the forecasted period.

Saudi Arabia is Expected to be the Fastest-growing Market

- One of the primary drivers contributing to this growth is the country's prominent standing in the global oil and gas industry. As a leading producer and exporter of oil, Saudi Arabia engages in extensive exploration and extraction activities, necessitating advanced technologies, including booster compressors, to optimize these processes. The continuous expansion and modernization of the country's oil and gas sector fuel the demand for efficient compression systems.

- For instance, according to the Energy Institute Review of World Energy 2023, gas production in Saudi Arabia increased by more than 5.2% between 2021 and 2022. In 2022, gas production was 120.4 billion cubic meters (bcm) 2022 compared to 114.5 bcm in 2021, signifying the country's increasing oil and gas sector, which drives the compressor market.

- The Vision 2030 initiative, spearheaded by the Saudi Arabian government, is another influential factor shaping the landscape. This transformative vision aims to diversify the economy, reduce dependency on oil revenue, and foster a thriving industrial sector. As Saudi Arabia focuses on enhancing non-oil industries, a heightened demand for booster compressors in various applications, ranging from manufacturing to petrochemicals, has emerged. This economic diversification strategy aligns with the booster compressor market's growth trajectory, presenting new avenues for market players.

- As per this initiative, in September 2022, the Saudi Arabian government announced that it would invest USD 10.6 Billion in 11 cities to develop the infrastructure in those cities. The plan is to develop cities to increase industries in the country and reduce their income through the oil and gas sector.

- Furthermore, Saudi Arabia's commitment to investing in mega infrastructure projects contributes significantly to the anticipated growth in the booster compressor market. Large-scale developments, such as NEOM and the Red Sea Project, necessitate robust compression systems to support diverse applications across industries. The integration of booster compressors in these projects becomes integral, fostering a conducive environment for market expansion.

- The Kingdom's strategic geographical location, serving as a critical transit point for global energy trade, amplifies its importance in the booster compressor market. With the increasing demand for energy resources worldwide, Saudi Arabia's role in facilitating the transportation of oil and gas through pipelines is expected to escalate. This, in turn, propels the requirement for booster compressors to maintain optimal pressure levels in these extensive pipeline networks.

- Therefore, as per the points mentioned above, Saudi Arabia is expected to witness significant growth in the market during the forecasted period.

Middle East And Africa Booster Compressor Industry Overview

The Middle-East and African booster compressor market is semi-fragmented. Some of the major players in the market (in no particular order) include Atlas Copco Group, Baker Hughes Company, Bauer Compressors, Kaeser Kompressoren, and Ingersoll Rand PLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Growth in the Oil and Gas Sector

- 4.5.1.2 Industrial Expansion

- 4.5.2 Restraints

- 4.5.2.1 Increasing Fluctuations in Oil and Gas Prices

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGEMENTATION

- 5.1 Application

- 5.1.1 Oil and Gas

- 5.1.2 Process

- 5.1.3 Chemical and Petrochemical

- 5.1.4 Power Generation

- 5.1.5 Other Applications

- 5.2 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)})

- 5.2.1 Saudi Arabia

- 5.2.2 United Arab Emirates

- 5.2.3 Qatar

- 5.2.4 Egypt

- 5.2.5 Nigeria

- 5.2.6 South Africa

- 5.2.7 Rest of Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Companies Profiles

- 6.3.1 Atlas Copco Group

- 6.3.2 Kaeser Kompressoren

- 6.3.3 Boge Kompressoren Otto Boge GmbH & Co. KG

- 6.3.4 Sauer Compressors

- 6.3.5 Bauer Kompressoren

- 6.3.6 Ingersoll Rand PLC

- 6.3.7 Baker Hughes Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements

02-2729-4219

+886-2-2729-4219