|

市场调查报告书

商品编码

1645103

亚太增压压缩机:市场占有率分析、产业趋势与成长预测(2025-2030 年)Asia-Pacific Booster Compressor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

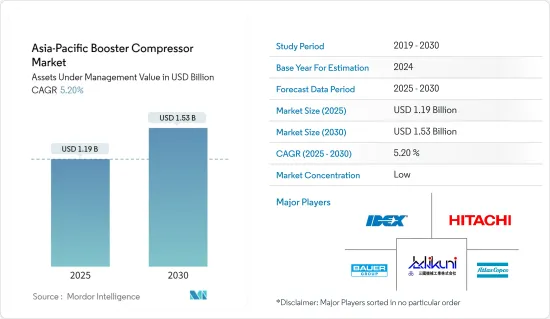

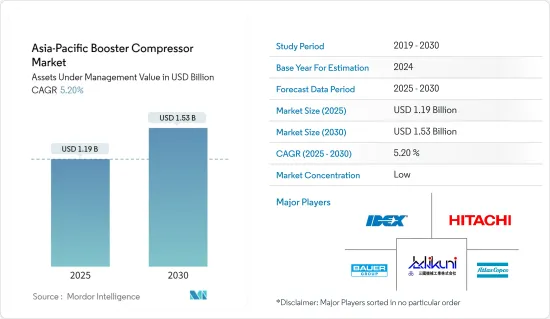

亚太地区增压压缩机市场规模(基于管理资产)预计将从 2025 年的 11.9 亿美元成长到 2030 年的 15.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.2%。

关键亮点

- 从中期来看,各种因素都在推动增压压缩机市场的成长,包括全部区域工业计划数量的增加以及各种应用对天然气的需求不断增加。

- 另一方面,由于使用现有的压缩系统来避免新安装的高昂支出,该技术的高安装成本也可能抑制市场成长。

- 预计从煤炭发电厂到天然气发电厂的快速转变以及车辆中天然气使用的增加将为主要企业提供有利可图的成长机会,以在未来几年维持其市场地位。

- 由于能源消耗的增加,预计中国将在预测期内占据市场主导地位。

亚太地区增压压缩机市场趋势

预计石油和天然气产业将主导市场

- 增压压缩机用于石油和天然气价值链的许多应用,涵盖从上游、下游到中游的所有环节。在天然气管道传输系统的中游段,采用此技术的比例最大。目前,世界正趋向于增加天然气消费以满足能源需求,加速天然气输送网路的成长。

- 2023 年亚太地区天然气消费量将达到 905 亿立方英尺/天 (bcf/d),比 2016 年成长 34%。这一增长主要是由于工业、商业和住宅领域越来越多地转向更清洁的能源产出方法。为了平衡供需状况,全国各地正在铺设多条天然气管道。

- 澳洲拥有遍布全国的管道网路。该国的天然气管道容量远超过石油管线。 2023年,天然气输送管将超过4.2万公里,以高压方式将天然气从生产基地高效输送到大、小城市的郊区。

- 该国非常热衷于开发新的管道以支援现有的基础设施并进一步发展天然气出口能力和能力。例如,2023年8月,APA集团位于西澳大利亚的新北部金矿区互联互通(NGI)管道正式开通。这条长达580公里的地下管道将把丹皮尔市与班伯里天然气管道和金矿区天然气管道连接起来,为现有和新的天然气产区和天然气储存基础设施提供更好的通道,特别是珀斯盆地。

- 马来西亚拥有亚洲最大的天然气管道网路之一,天然气发行系统(NGDS)总长约2,468公里,可满足该国国内的天然气需求。该国管道公司正在不断实施新计划。

- 2023 年 8 月,工业气体公司空气产品公司表示将在槟城峇六拜自由工业区和峇都交湾工业建设、拥有和营运两家氮气工厂。该公司计划进一步扩大这两个地区的管道网络。此次对额外产能和基础设施的策略性投资旨在加强该公司在马来西亚北部的主导地位及其满足市场需求的能力。

- 预计这些发展将推动亚太地区增压压缩机市场的未来成长。

中国可望主导市场

- 中国的高都市化正在不断增加能源消耗,从而带来发电工程和新的燃料供应运输系统的增加。天然气是中国最受欢迎的发电能源之一。

- 根据BP世界能源统计报告,2023年该国以天然气为基础的发电量约为297.8TWh。政府对更清洁的电力来源实施了严格的监管,刺激了未来几年大量天然气发电厂计划。

- 中国是世界上最大的天然气进口国,正在寻求减少燃煤发电厂的发电量,从而增加对天然气的需求以满足其能源需求。例如,2023年10月,GE Vernova的天然气发电业务与哈尔滨电气宣布,国投旗下吉能(舟山)燃气发电公司已订单两台GE 9HA.02燃气涡轮机的订单,将用于中国浙江省舟山群岛的一座新的联合循环发电厂。

- 中国是亚太地区最大的原油和天然气生产国,2023年约占该地区原油和天然气总产量的57.6%和33.8%。预计2023年原油产量为419.8万桶/日,与前一年同期比较成长2.1%,较2020年成长7.6%。

- 截至 2023 年 1 月,中国在建天然气管道约 17,800 公里(价值约 219 亿美元),印度在建天然气管道 14,300 公里(价值约 207 亿美元),这一距离可绕地球四分之三以上。

- 增压压缩机市场也受到中国为满足该国日益增长的天然气需求而规划的新天然气输送管道的推动。 2022 年 10 月,中国国家发展和改革委员会 (NDRC)核准建造一条连接四川省(中国西南部)天然气田和湖北省(中国中部)的天然气管道,输送能力为每年 200 亿立方英尺。建设工程预计于 2022 年 12 月开工,并于 2024年终完工。该计划由中国管道集团西南管道公司开发。

- 这些新兴市场的发展很可能带动中国增压压缩机市场的未来成长。

亚太地区增压压缩机产业概况

亚太地区增压压缩机市场呈现细分化。市场的主要企业包括 IDEX India Private Ltd、日立、Bauer Kompressoren、Mikuni Kikai Kogyo 和阿特拉斯·科普柯有限公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 2029 年市场规模与需求预测(十亿美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 工业计划成长

- 各种用途对天然气的需求不断增加

- 限制因素

- 安装成本高

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 投资分析

第五章 市场区隔

- 冷却类型

- 空气冷却

- 水冷

- 最终用户

- 石油和天然气

- 化学

- 发电

- 其他的

- 地区

- 中国

- 印度

- 印尼

- 马来西亚

- 泰国

- 越南

- 其他亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- IDEX India Private Ltd

- Hitachi Ltd

- Bauer Kompressoren

- Mikuni Kikai Kogyo Co. Ltd

- Atlas Copco Ltd

- Haskel International, Inc.

- Kirloskar Pneumatic Co. Ltd

- General Electric Company

- Ingersoll-Rand PLC

- Aircomp Enterprise

- 市场排名分析

- 其他知名公司名单

第七章 市场机会与未来趋势

- 从燃煤发电厂转向燃气发电厂

- 汽车汽油使用量增加

简介目录

Product Code: 50002214

The Asia-Pacific Booster Compressor Market size in terms of assets under management value is expected to grow from USD 1.19 billion in 2025 to USD 1.53 billion by 2030, at a CAGR of 5.2% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, various factors, such as the growth in industrial projects across the region and the escalating natural gas demand for various applications, are driving the growth of the booster compressor market.

- On the other hand, since the technology involves high installation costs, the use of existing compression systems to avoid the high expenditure on new installations could constrain market growth.

- Nevertheless, there is a rapid transition from coal to gas power stations, as well as a rise in the use of gas in motor vehicles, which is expected to provide lucrative growth opportunities for key players to maintain their position in the market in the coming years.

- China is expected to dominate the market during the forecast period due to the increase in energy consumption.

Asia-Pacific Booster Compressor Market Trends

The Oil and Gas Segment is Expected to Dominate the Market

- Booster compressors are used in a number of applications in the oil and gas value chain, covering all the sectors from upstream and downstream to the midstream. The maximum deployment was observed in the midstream segment in the gas pipeline transit systems. The world is currently drifting toward high natural gas consumption for energy requirements, upscaling the growth of gas transmission networks.

- The natural gas consumption in Asia-Pacific in 2023 was recorded as 90.5 billion cubic feet per day (bcf/day), an increase of 34% compared to 2016. The growth was primarily due to the increased inclination toward cleaner methods of energy generation in the industrial, commercial, and residential sectors. Many cross-country and national gas pipelines are being laid down to balance the supply-demand scenario.

- Australia has an extensive pipeline network all over the country. The country's gas pipeline capacity dominates the landscape relative to oil pipelines. The country has more than 42,000 km of natural gas transmission pipelines in 2023 that efficiently transported gas under high pressure from where it is produced to the outskirts of cities both large and small.

- The country is very keen on developing new pipelines to support its existing infrastructure and further develop its gas exporting capacity and capability. For instance, in August 2023, The APA Group's new Northern Goldfields Interconnect (NGI) pipeline in Western Australia was officially opened. The 580-kilometer buried pipeline connects Dampier City to the Bunbury Natural Gas Pipeline and the Goldfields Gas Pipeline, providing better access to existing and new natural gas production regions and gas storage infrastructure, especially in the Perth Basin.

- Malaysia has one of the most extensive natural gas pipeline networks in Asia, totaling about 2,468 km for the Natural Gas Distribution System (NGDS) to meet the domestic demand for gas in Malaysia. The pipeline companies in the country are constantly executing new projects.

- In August 2023, Air Products, an industrial gas company, announced that it would build, own, and operate two nitrogen plants in Penang's Bayan Lepas Free Industrial Zone and Batu Kawan Industrial Park. The company is expected to extend its pipeline network further in both areas. This strategic investment in additional capacity and infrastructure was intended to strengthen the company's leading position in Northern Malaysia and its capability to meet market needs.

- Developments like these are expected to boost the growth of the Asia-Pacific booster compressor market in the future.

China is Expected to Dominate the Market

- A high urbanization rate in China has led to an escalation of energy consumption, which has led to a rise in power generation projects and new fuel supply transit systems. Natural gas is one of the most prevalent power generation sources in China.

- According to the BP Statistical Review of World Energy, the country's natural gas-based power generation was around 297.8 TWh in 2023. The government laid down stringent regulations for cleaner power generation sources, spurring numerous gas-based power plant projects for the coming years.

- China is the largest importer of natural gas globally, and as the nation tries to reduce electricity generation through coal-fired power plants, the demand for natural gas is increasing to meet the energy requirements. For example, in October 2023, GE Vernova's Gas Power business and Harbin Electric announced that the SDIC (State Development & Investment Corp. Ltd) Jineng (Zhoushan) Gas Power Generation Co. Ltd ordered two GE 9HA.02 gas turbines for a new combined cycle power plant in the Zhoushan archipelago in Zhejiang Province, China.

- China is the largest crude oil and natural gas producer in the Asia-Pacific region; it accounted for around 57.6% and 33.8% of the total production of crude oil and natural gas, respectively, in the region in 2023. In 2023, 4198 thousand barrels per day of crude oil were produced, an increase of 2.1% over the previous year and an increase of 7.6% over 2020.

- As of January 2023, nearly 17,800 kilometers of gas pipelines were under construction in China, worth around USD 21.9 billion, and 14,300 km in India, worth around USD 20.7 billion, a distance circling over three-quarters of Earth.

- The booster compressor market is also driven by the country's new gas transmission pipeline plans to meet the growing natural gas demand in China. In October 2022, the Chinese National Development and Reform Commission (NDRC) approved the construction of a 20 billion cubic feet/year natural gas pipeline connecting gas fields in Sichuan province (southwestern China) to Hubei province (central China). Construction was expected to begin in December 2022, and the project is expected to be completed by the end of 2024. The project was developed by PipeChina's Southwest Pipeline Company.

- Such developments are likely to lead to the growth of the Chinese market for booster compressors in the future.

Asia-Pacific Booster Compressor Industry Overview

The Asia-Pacific booster compressor market is fragmented. Some of the key players in the market include IDEX India Private Ltd, Hitachi Ltd, Bauer Kompressoren, Mikuni Kikai Kogyo Co. Ltd, and Atlas Copco Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growth in Industrial Projects

- 4.5.1.2 Escalating Natural Gas Demand for Various Applications

- 4.5.2 Restraints

- 4.5.2.1 High Installation Costs

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Cooling Type

- 5.1.1 Air-cooled

- 5.1.2 Water-cooled

- 5.2 End User

- 5.2.1 Oil and Gas

- 5.2.2 Chemical

- 5.2.3 Power Generation

- 5.2.4 Other End Users

- 5.3 Geography

- 5.3.1 China

- 5.3.2 India

- 5.3.3 Indonesia

- 5.3.4 Malaysia

- 5.3.5 Thailand

- 5.3.6 Vietnam

- 5.3.7 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 IDEX India Private Ltd

- 6.3.2 Hitachi Ltd

- 6.3.3 Bauer Kompressoren

- 6.3.4 Mikuni Kikai Kogyo Co. Ltd

- 6.3.5 Atlas Copco Ltd

- 6.3.6 Haskel International, Inc.

- 6.3.7 Kirloskar Pneumatic Co. Ltd

- 6.3.8 General Electric Company

- 6.3.9 Ingersoll-Rand PLC

- 6.3.10 Aircomp Enterprise

- 6.4 Market Ranking Analysis

- 6.5 List of Other Prominent Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Transition from coal to gas power stations

- 7.2 Rise in the use of gas in motor vehicles

02-2729-4219

+886-2-2729-4219