|

市场调查报告书

商品编码

1645051

中东和非洲助焊剂 Stack -市场占有率分析、行业趋势、统计数据、成长预测(2025-2030 年)Middle-East And Africa Frac Stack - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

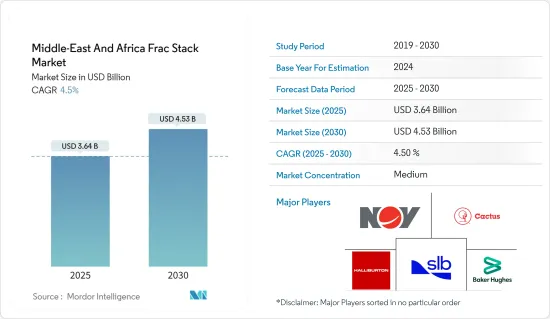

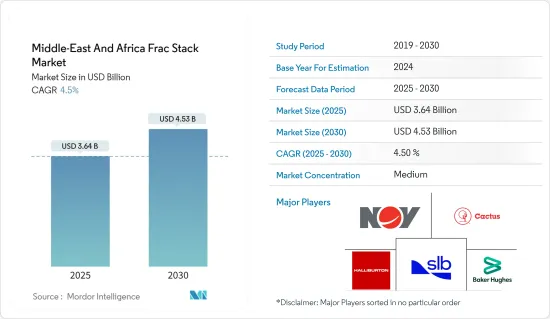

中东和非洲助焊剂市场规模预计在 2025 年为 36.4 亿美元,预计到 2030 年将达到 45.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.5%。

关键亮点

- 从中期来看,预计非传统资源产量增加和能源需求成长等因素将在预测期内推动助焊剂市场的发展。

- 同时,环境问题以及资本市场和奖励的缺乏也限制了市场的成长。

- 随着采用物联网 (IoT) 分析探勘和生产 (E&P) 期间收集的大量资料,进阶分析和模拟软体在解决安全问题和提高水力压裂过程效率方面变得越来越重要。水力压裂作业中的巨量资料分析和物联网系统可能为助焊剂堆迭市场创造巨大的商机。

- 由于页岩气的繁荣,沙乌地阿拉伯预计将成为最大的助焊剂设备市场。这导致页岩蕴藏量的开发增加,而页岩储量需要压裂才能实现经济生产。

中东和非洲的助焊剂堆迭市场趋势

陆上部门预计主导市场

- 受凸显产业动态的几个关键因素的推动,中东和非洲助焊剂市场预计将由陆上部门主导。这项优势的关键催化剂之一是该地区大量的陆上石油和天然气生产活动。

- 中东地区尤其拥有丰富的陆上蕴藏量,需要使用助焊剂堆迭来提高油井的产量。陆上计划的可及性和成本效益对这一领域的持续成长贡献巨大。

- 根据能源研究所《2023年世界能源统计评论》,该地区2022年的石油产量将达到约3,778.6万桶/日,较2021年增加6%以上。随着该地区水力压裂活动的增加,预计产量也将同时增加。

- 此外,陆基作战提供的后勤优势对其优势发挥了关键作用。陆上在运输和基础设施方面面临的挑战通常比海上少。这种物流的简化意味着助焊剂堆迭的更有效率放置,从而降低了操作的复杂性和成本。随着中东和非洲的石油和天然气工业不断扩张,陆上作业的实际优势使这一领域成为助焊剂应用的中心位置。

- 此外,陆上采矿技术的进步和创新进一步增强了该领域的主导地位。水力压裂和储存管理技术的不断改进,提高了陆上作业的效率,推动了对水力压裂堆迭的需求。与不断发展的采矿方法和水力压裂堆迭的利用协同效应,使陆上部门巩固了主导地位。

- 因此,许多公司将重点转向开发非常规传统型蕴藏量,例如页岩气和緻密气,因为与大型海上计划相比,这些储备风险更低,所需资本投入也更少。预计在预测期内,传统型陆上蕴藏物水力压裂的增加将增加对助焊剂装置的需求。

- 例如,2022 年 9 月,TAG Oil Ltd储存了Badr Petroleum Company(“BPCO”)的一份石油服务合同,以开发 Badr 油田(“BED-1”)内的传统型Abu Roash“F”油藏(“ARF”),该油田订单埃及西部沙漠,占地 107 平方公里(26,000 英亩)。

- 因此,鑑于上述情况,预计在预测期内陆上市场将占据主导地位。

沙乌地阿拉伯:预计大幅成长

- 沙乌地阿拉伯作为全球石油生产国发挥关键作用,是石油和天然气探勘和生产活动的中心枢纽。沙乌地阿拉伯丰富的陆上蕴藏量需要高效、先进的开采方法,而助焊剂堆迭已成为优化油井性能的关键组成部分。因此,强劲的陆上石油和天然气产业是沙乌地阿拉伯在助焊剂市场占据主导地位的主要原因。

- 例如,根据能源研究所《2023年世界能源评论》,沙乌地阿拉伯的天然气产量从2021年到2022年增加了5.2%以上。预计 2022 年天然气产量将达到 1,204 亿立方米,而 2021 年为 1,145 亿立方米,这表明该国石油和天然气产业将成长,从而推动压缩机市场的发展。

- 此外,沙乌地阿拉伯政府在其「2030愿景」框架中提出的战略倡议发挥关键作用。作为经济多元化策略的一部分,该公司专注于加强陆上石油和天然气业务,这与对助焊剂装置的日益增长的需求相吻合。沙乌地阿拉伯为实现采矿工艺的现代化和优化所做的努力强化了人们的观点:该国将有望在中东和非洲的助焊剂市场中占据主导地位。

- 沙乌地阿拉伯的地理位置进一步增强了其在助焊剂市场的优势。沙乌地阿拉伯位于中东和非洲地区的中心位置,拥有成本效益的运输和物流,使陆上计划对投资者更具可行性和吸引力。这项战略定位有助于沙乌地阿拉伯在陆上石油和天然气作业中有效部署助焊剂装置,巩固其在区域市场的领先地位。

- 此外,沙乌地阿拉伯对石油和天然气领域技术进步和创新的关注与陆上开采方法日益复杂化相吻合。随着营运商寻求更有效率、更永续的解决方案,对先进助焊剂堆迭的需求正在不断增长。沙乌地阿拉伯致力于采用最尖端科技,这使其在中东和非洲的助焊剂堆迭市场中处于领先地位。

- 2023年5月,沙乌地阿拉伯石油巨头阿美公司接受了石油精製巨头中国石化和法国石油巨头道达尔能源的提案,表示有兴趣投资部分价值约100亿美元的贾富拉页岩气开发计划。中石化和道达尔能源公司正在就投资沙乌地阿拉伯贾富拉油田开发案的可能性进行单独谈判。沙特阿美采用创新的水力压裂工艺,从附近的墨西哥湾沿岸抽水,预计到 2030 年,贾富拉气田每天将生产约 20 亿立方英尺的天然气,总投资额为 240 亿美元。

- 沙乌地阿拉伯法规环境的稳定性和可预测性进一步支持了其在助焊剂市场的优势。稳定的法规结构将增强投资者信心并支持陆上石油和天然气计划的长期规划。这种稳定性对于助焊剂市场持续成长至关重要,因为它使沙乌地阿拉伯营运商能够实施结构化和可靠的部署策略。

- 因此,鑑于上述情况,预计沙乌地阿拉伯在预测期内将经历显着增长。

中东和非洲助焊剂堆迭产业概况

中东和非洲的助焊剂堆迭市场正在变得半固体。主要参与企业(不分先后顺序)包括哈里伯顿公司、斯伦贝谢有限公司、NOV 公司、贝克休斯公司和 Cactus 公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 至2029年的市场规模及需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 提高非传统资源产量

- 该地区能源需求不断增加

- 限制因素

- 环境问题

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场区隔

- 部署位置

- 陆上

- 海上

- 井型

- 水平/偏差

- 按行业

- 2028 年市场规模与需求预测(按地区)

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 奈及利亚

- 其他中东和非洲地区

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Halliburton Company

- Schlumberger Limited

- NOV Inc.

- Baker Hughes Company

- Cactus Inc.

- National Energy Services Reunited Corp.

- Oil States International Inc.

- The Weir Group PLC

- SPM Oil & Gas Inc.

- Superior Energy Services Inc.

第七章 市场机会与未来趋势

- 先进分析与模拟技术

简介目录

Product Code: 50001813

The Middle-East And Africa Frac Stack Market size is estimated at USD 3.64 billion in 2025, and is expected to reach USD 4.53 billion by 2030, at a CAGR of 4.5% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as increasing production from unconventional resources and growing energy demand are expected to drive the frac stack market during the forecast period.

- On the other hand, environmental concerns and a lack of capital markets and incentives are restraining market growth.

- Nevertheless, with the adoption of the Internet of Things (IoT) to analyze a large amount of data collected during exploration and production (E&P), advanced analytics and simulation software have become increasingly important in addressing safety concerns and improving the efficiency of the fracking process. Big Data analytics and IoT systems in fracking operations are likely to lead to significant opportunities for the frac stack market.

- Due to the shale boom, Saudi Arabia is expected to be the largest market for frac stacks. This has led to increased exploitation of shale reserves that need to be fractured for economic production.

Middle-East And Africa Frac Stack Market Trends

The Onshore Sector is Expected to Dominate the Market

- The dominance of the onshore segment is anticipated in the Middle-East and African frac stack market, driven by several key factors that underscore the industry dynamics. One primary catalyst for this dominance is the considerable onshore oil and gas production activities in the region.

- The Middle East, in particular, hosts extensive onshore reserves, and the prevalent exploration and extraction operations necessitate the use of frac stacks to enhance well productivity. The accessibility and cost-effectiveness associated with onshore projects contribute significantly to the sustained growth of this segment.

- According to the Energy Institute Statistical Review of World Energy 2023, in 2022, the oil production in the region was around 37,786 thousand barrels per day, which was a growth of over 6% compared to 2021. As the fracking activities increase in the region, the production is expected to increase simultaneously.

- Additionally, the logistical advantages offered by onshore operations play a crucial role in their dominance. Onshore sites generally present fewer challenges in terms of transportation and infrastructure compared to offshore counterparts. This logistical ease translates into more efficient deployment of frac stacks, reducing operational complexities and costs. As the oil and gas industry in Middle-East and Africa continues to expand, the practical advantages associated with onshore operations position this segment as a focal point for frac stack utilization.

- Moreover, the technological advancements and innovations in onshore extraction techniques further bolster the dominance of this segment. Continuous improvements in hydraulic fracturing technologies and reservoir management techniques enhance the efficiency of onshore operations, driving the demand for frac stacks. The synergy between evolving extraction methods and frac stack utilization reinforces the onshore segment's leading position in the market.

- As a result, a number of operating companies have shifted their focus to the exploitation of unconventional onshore reserves, such as shale and tight gas reserves, which present lower risk and require a lower capital investment than large offshore projects. During the forecast period, there is expected to be an increase in the demand for frac stacks due to the increased hydraulic fracking of unconventional onshore reserves.

- For instance, in September 2022, TAG Oil Ltd was awarded a petroleum services contract by Badr Petroleum Company ("BPCO") to develop the unconventional Abu Roash "F" reservoir ("ARF") within the Badr Oil Field ("BED-1"), a 107 km2 (26,000 acres) concession located in the Western Desert of Egypt.

- Therefore, as per the points mentioned above, the onshore segment is expected to dominate the market during the forecast period.

Saudi Arabia is Expected to Witness Significant Growth

- The Kingdom's prominent role as a global oil producer positions it as a central hub for oil and gas exploration and production activities. Saudi Arabia's vast onshore reserves necessitate efficient and advanced extraction methods, with frac stacks emerging as crucial components to optimize well performance. The robust onshore oil and gas sector, therefore, contributes significantly to the expected dominance of Saudi Arabia in the frac stack market.

- For instance, according to the Energy Institute Review of World Energy 2023, gas production in Saudi Arabia increased by more than 5.2% between 2021 and 2022. In 2022, gas production was 120.4 bcm compared to 114.5 bcm in 2021, signifying the country's increasing oil and gas sector, which drives the compressor market.

- Furthermore, the strategic initiatives outlined in the Vision 2030 framework by the Saudi Arabian government play a pivotal role. As part of this economic diversification strategy, the focus on enhancing onshore oil and gas operations aligns with the growing demand for frac stacks. Saudi Arabia's commitment to modernizing and optimizing its extraction processes reinforces the notion that the country is poised to dominate the frac stack market in Middle-East and Africa.

- The geographical advantage of Saudi Arabia further enhances its dominance in the frac stack market. The country's central location in the region facilitates cost-effective transportation and logistics, making onshore projects more feasible and attractive for investors. This strategic positioning contributes to Saudi Arabia's ability to efficiently deploy frac stacks in its onshore oil and gas operations, solidifying its position as a frontrunner in the regional market.

- Additionally, Saudi Arabia's focus on technological advancements and innovation in the oil and gas sector aligns with the increasing complexity of onshore extraction methods. As operators seek more efficient and sustainable solutions, the demand for advanced frac stacks rises. The Kingdom's commitment to adopting cutting-edge technologies positions it at the forefront of the evolving frac stack market in the Middle East and Africa.

- In May 2023, Saudi Arabia's oil behemoth, Aramco, is receptive to proposals from refining giant Sinopec Corp and the French oil major TotalEnergies, considering their interest in investing in a portion of the Jafurah shale gas development project valued at approximately USD 10 billion. Both Sinopec and TotalEnergies are engaged in separate discussions regarding potential investments in the Jafurah development situated in Saudi Arabia. Leveraging an innovative fracking method utilizing seawater from the nearby Gulf coast, Saudi Aramco anticipates the Jafurah field to yield around 2 billion cubic feet of gas daily by 2030, with a projected total investment of USD 24 billion.

- The stability and predictability of Saudi Arabia's regulatory environment further support its dominance in the frac stack market. A stable regulatory framework enhances investor confidence and encourages long-term planning for onshore oil and gas projects. This stability is a crucial factor for the sustained growth of the frac stack market, as operators in Saudi Arabia can implement well-structured and reliable deployment strategies.

- Therefore, as per the above-mentioned points, the country is expected to witness significant growth during the forecasted period.

Middle-East And Africa Frac Stack Industry Overview

The Middle-East and African frac stack market is semi-consolidated. Some of the major players (in no particular order) include Halliburton Company, Schlumberger Limited, NOV Inc., Baker Hughes Company, and Cactus Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Production from Unconventional Sources

- 4.5.1.2 Growing Energy Demand in the Region

- 4.5.2 Restraints

- 4.5.2.1 Environmental Concerns

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Location of Deployment

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 Well Type

- 5.2.1 Horizontal and Deviated

- 5.2.2 Vertical

- 5.3 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)})

- 5.3.1 Saudi Arabia

- 5.3.2 United Arab Emirates

- 5.3.3 Nigeria

- 5.3.4 Rest of Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Halliburton Company

- 6.3.2 Schlumberger Limited

- 6.3.3 NOV Inc.

- 6.3.4 Baker Hughes Company

- 6.3.5 Cactus Inc.

- 6.3.6 National Energy Services Reunited Corp.

- 6.3.7 Oil States International Inc.

- 6.3.8 The Weir Group PLC

- 6.3.9 SPM Oil & Gas Inc.

- 6.3.10 Superior Energy Services Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Advance Analysis and Simulation Technology

02-2729-4219

+886-2-2729-4219