|

市场调查报告书

商品编码

1645097

B2B宅配、快递与小包裹(CEP):市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)B2B Courier Express Parcel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

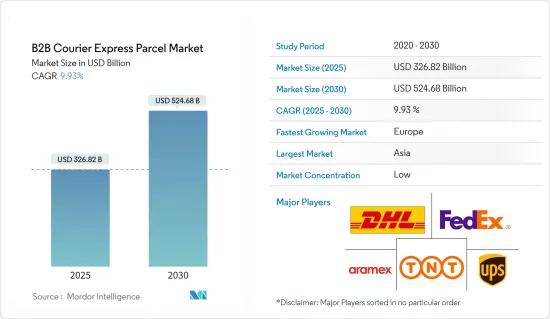

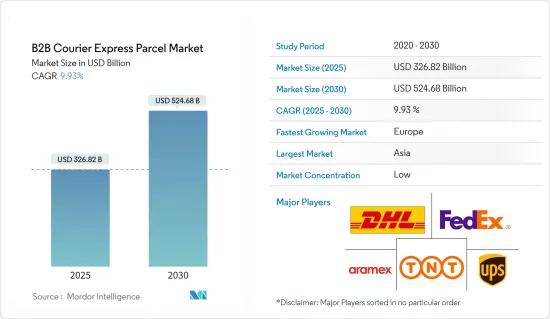

2025 年 B2B宅配、快递和小包裹(CEP) 市场规模估计为 3268.2 亿美元,预计到 2030 年将达到 5246.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 9.93%。

行业特定或专业的市场在 B2B 电子商务中越来越受欢迎。这些入口网站提供特定类别的更广泛的产品以及某些附加价值服务(B2E)。

企业越来越多地使用巨量资料来提供个人化的客户体验。流动商店越来越受欢迎。云端平台正在取代那些未针对这种规模设计的传统平台。

B2B 电子商务公司也正在整合系统和平台,以与客户建立全通路关係。缺乏高品质的客户资料(买家更少、专业服务更少)正在减缓个人化努力。

产业成长和其他挑战(例如订单规模更大、价格波动、商品种类增加以及交货时间缩短)对现有供应链造成压力。

B2B 电子商务由阿里巴巴、乐天、Unite Mercateo World Source、沃尔玛印度和亚马逊商业等公司主导。亚马逊已将 B2B 业务从 AmazonSupply 更名为 AmazonSupply。 2015年,亚马逊更名为Amazon Business,光是一年时间就实现销售额超10亿美元。 2022 年,亚马逊的商品交易总额 (GMV) 达到 350 亿美元。

B2B宅配、快递与小包裹(CEP) 市场趋势

扩大国内 B2B CEP 市场

在大多数地区,国内市场的成长速度快于国际市场,但在某些地区,差距正在显着缩小。

在北美和欧洲,国内市场与国际市场的差距正在缩小。这主要是因为欧洲市场互联互通,国际贸易壁垒较低。国内市场已证明其有能力抓住电子商务提供的机会。

随着消费者偏好的不断变化,消费者要求获得更个人化的电子商务和物流体验,以满足他们的需求并从头到尾提供最大的舒适度。为了满足日益增长的需求,物流平台正在采用人工智慧、物联网和巨量资料等技术来深入了解消费者的偏好并调整他们的体验。

电子商务公司正在扩大在欧洲的网络,以便更好地服务客户。例如,西班牙零售商 DIA 已将其配送服务扩展到从赫罗纳到韦尔瓦的西班牙沿海每个城镇,吸引了超过 500 万新客户。

由于医疗用品需求增加、医疗费用上涨以及对更快、更有效率的送货服务的需求等多种因素,预计未来几年该地区的医疗保健产品宅配服务将会成长。

此外,预计自 2023 年起全球零售总额将成长至疫情前的水平,从而推动市场成长。因此,国内 CEP 市场可望扩大。

北美占据市场主导地位

预计北美的销售额将高于其他地区。该地区蓬勃发展的经济带动了对高科技设备的大量投资。在B2B电子商务方面,美国处于领先地位。北美 B2B 产业的成长主要受到云端处理、人工智慧、巨量资料和分析、行动/社群媒体、网路安全和物联网等新兴技术的使用所推动。

在北美,线上 B2B 市场出现的时间比零售 B2C 和 C2C 电子商务晚得多。零售通路早期采用者所建构的生态系统影响了线上业务的普及,并为B2B电子商务平台创造了良好的前景。零售电子商务平台的成长持续推动线上 B2B 市场空间的演变。

新的零售和批发通路合作伙伴正在将业务转移到线上。美国人口普查局报告称,2022 年第一季电子商务销售额占总销售额的 14.8%,比 2021 年第一季成长 6.8%。零售电子商务的日益普及表明了客户偏好,推动了生态系统的演变,并为市场带来了新的电子商务平台和参与者。也为B2B及其用户创造了新的市场空间。

B2B宅配、速递与小包裹(CEP) 产业概览

B2B CEP 市场高度多样化且充满活力。该行业有几家主要企业,为企业提供广泛的服务。 DHL 是 B2B CEP 市场的主要参与者之一。

DHL 业务遍布全球,提供全面的服务,包括快递、货运代理和供应链解决方案。该公司拥有强大而先进的技术,使其能够为全球企业提供高效可靠的服务。

DHL Global Forwarding 是德国邮政 DHL 集团旗下的空运和海运专家,已成功为其客户格兰富实施了永续物流解决方案。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 当前市场状况

- 政府法规和倡议

- B2B CEP 产业的技术趋势与自动化

- 洞察电子商务产业(国内和国际电子商务)

- 洞察 B2B CEP 产业的新兴企业和创业投资资金筹措

- 宅配概览

- B2B CEP业务中仓储功能及附加价值服务说明

- 逆向物流及当日送达市场洞察

- 了解节日期间(圣诞节、光棍节、黑色星期五等)的送货时间

- COVID-19 对 B2B CEP 市场的影响

第五章 市场动态

- 驱动程式

- 电子商务繁荣

- 当天及隔天送达

- 限制因素

- 监管挑战

- 基础设施限制

- 商业机会

- 最后一哩配送解决方案

- 国际扩张

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者/购买者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 价值链/供应链分析

第六章 市场细分

- 目的地

- 国内的

- 国外

- 按最终用户

- 服务业(BFSI(银行、金融服务、保险))

- 批发零售(电子商务)

- 製造、建设业和公共产业

- 一级产业(农业及其他自然资源)

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 英国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 其他亚太地区

- 拉丁美洲、中东和非洲

- 巴西

- 南非

- GCC

- 其他地区

- 北美洲

第七章 竞争格局

- 公司简介

- DHL

- FedEx

- UPS

- TNT Express

- Aramex

- SF Express

- GLS

- Hermes

- Post Nord

- Royal Mail*

- 其他公司

第 8 章:市场的未来

第 9 章 附录

The B2B Courier Express Parcel Market size is estimated at USD 326.82 billion in 2025, and is expected to reach USD 524.68 billion by 2030, at a CAGR of 9.93% during the forecast period (2025-2030).

Vertical or specialized marketplaces are becoming increasingly popular in B2B e-commerce. These portals provide a wider variety of products in a specific category along with specific value-added services (business-to-everyone).

Companies are increasingly leveraging big data to provide a personalized customer experience. Mobile shops are becoming increasingly popular. Cloud platforms are taking over from legacy platforms that are not designed to handle such scale.

B2B e-commerce companies are also integrating their systems and platforms to create omnichannel relationships with their clients. The lack of high-quality customer data (fewer buyers and less specialized services) is slowing down personalization efforts.

The industry's larger scale and other challenges (such as larger order sizes, variable pricing, more products, and shorter delivery times) are putting pressure on existing supply chains.

B2B e-commerce is dominated by companies such as Alibaba, Rakuten, Unite Mercateo Global Sources, Walmart India, and Amazon Business. Amazon rebranded its B2B operations from AmazonSupply. In 2015, Amazon changed its name to Amazon Business, and in just one year, it achieved sales of more than USD 1 billion. In 2022, Amazon registered a GMV (gross merchandise value) of USD 35 billion.

B2B Courier Express Parcel Market Trends

Expanding Domestic B2B CEP Segment

Domestic markets have been growing more quickly than international markets in most regions, but the gap is narrowing significantly in some regions.

The gap between the domestic and international markets is smaller in North America and Europe. In Europe, this is primarily due to the interconnectedness of the market and the lower barriers to international trade. Domestic markets have proved capable of seizing on the opportunities that e-commerce brings.

Consumer preferences constantly change, so they demand a more personalized e-commerce and logistics experience that pampers them and provides the most excellent ease from beginning to end. To meet this increased demand, logistics platforms employ technologies like AI, IoT, and Big Data to gain insights into consumer preferences and adapt their experiences.

E-commerce companies are expanding their networks in Europe to provide better services to customers. For instance, the Spanish retailer DIA is expanding its delivery services to all towns along the Spanish coastline, from Girona to Huelva, reaching more than 5 million new customers.

Courier services for healthcare products are expected to grow in the coming years in the region due to several factors, such as the increasing demand for medical supplies, rising healthcare spending, and the need for faster and more efficient delivery services.

Also, from 2023, it was expected that the total retail sales globally would grow at pre-pandemic levels and drive the growth of the market. As a result, the domestic CEP segment was expected to expand.

North America is Dominating the Market

North America's revenue is expected to be higher than other regions. The region's strong economy means that there is ample investment in high-tech equipment. When it comes to B2B e-commerce, the United States leads the way. The growth of the B2B sector in North America is largely due to the use of advanced technologies such as cloud computing, AI, big data & analytics, mobility / social media, cybersecurity, and IoT.

Online B2B marketplaces came into being much later than retail B2C or C2C e-commerce options in North America. The ecosystem created by these early adopters of retail channels influenced the popularity of online operations and gave rise to promising prospects for B2B e-commerce platforms. The growth of retail e-commerce platforms continues to drive the evolution of B2B online marketspaces online.

New retail or wholesale channel partners are moving their operations online. The US Census Bureau reported that e-commerce sales made up 14.8% of total sales in Q1 2022, which was a 6.8 % increase from Q1 2021. The increasing popularity of retail e-commerce shows customer preference, which drives the evolution of the ecosystem and brings new e-commerce platforms and players into the market. It also creates a new market space for B2B and its users.

B2B Courier Express Parcel Industry Overview

The B2B CEP market is quite diverse and dynamic. In this industry, several key players provide a wide range of services to businesses. One of the prominent players in the B2B CEP market is DHL.

With a strong global presence, DHL is offering a comprehensive suite of services, such as express delivery, freight transportation, and supply chain solutions. The company has robust and advanced technology that enables it to provide efficient and reliable services to businesses worldwide.

DHL Global Forwarding, the air and ocean freight specialist of Deutsche Post DHL Group, successfully implemented sustainable logistics solutions for its customer Grundfos.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Government Regulations and Initiatives

- 4.3 Technological Trends and Automation in the B2B CEP Industry

- 4.4 Insights into the E-commerce Industry (Domestic and International E-commerce)

- 4.5 Insights into Startups and Venture Capital Funding in the B2B CEP Industry

- 4.6 Brief on Courier Rates

- 4.7 Elaboration on Storage Functions and Value-added Services in the B2B CEP Business

- 4.8 Insights into Reverse Logistics and Same-day Delivery Market

- 4.9 Insights into Deliveries During Festive Season (Christmas, Singles' Day, Black Friday, etc.)

- 4.10 Impact of COVID-19 on the B2B CEP Market

5 MARKET DYNAMICS

- 5.1 Drivers

- 5.1.1 E-commerce Boom

- 5.1.2 Same-day and Next-day Delivery

- 5.2 Restraints

- 5.2.1 Regulatory Challenges

- 5.2.2 Infrastructure Limitations

- 5.3 Opportunities

- 5.3.1 Last Mile Delivery Solutions

- 5.3.2 International Expansion

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers/ Buyers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

- 5.5 Value Chain/Supply Chain Analysis

6 MARKET SEGMENTATION

- 6.1 Destination

- 6.1.1 Domestic

- 6.1.2 International

- 6.2 End User

- 6.2.1 Services (BFSI (Banking, Financial Services and Insurance))

- 6.2.2 Wholesale and Retail Trade (E-commerce)

- 6.2.3 Manufacturing, Construction, and Utilities

- 6.2.4 Primary Industries (Agriculture and Other Natural Resources)

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.1.3 Mexico

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 France

- 6.3.2.3 United Kingdom

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 South Korea

- 6.3.3.4 India

- 6.3.3.5 Rest of Asia-Pacific

- 6.3.4 LAMEA

- 6.3.4.1 Brazil

- 6.3.4.2 South Africa

- 6.3.4.3 GCC

- 6.3.4.4 Rest of LAMEA

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Overview (Market Concentration and Major Players)

- 7.2 Company Profiles

- 7.2.1 DHL

- 7.2.2 FedEx

- 7.2.3 UPS

- 7.2.4 TNT Express

- 7.2.5 Aramex

- 7.2.6 SF Express

- 7.2.7 GLS

- 7.2.8 Hermes

- 7.2.9 Post Nord

- 7.2.10 Royal Mail*

- 7.3 Other Companies