|

市场调查报告书

商品编码

1645133

资料中心机柜:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Data Center Rack - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

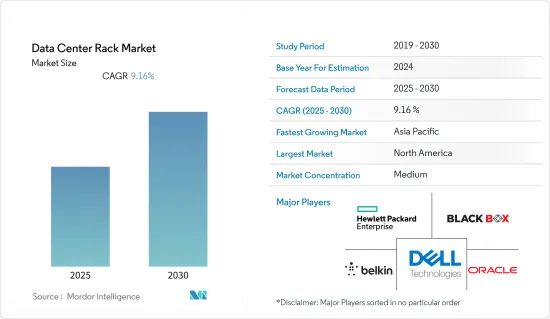

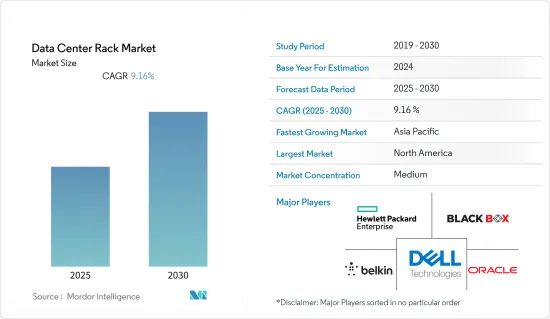

预计预测期内资料中心机柜市场复合年增长率为 9.16%。

资料中心(无论是私人还是公共)对企业都很重要,因为它们託管关键任务应用程式。这些资料中心帮助企业简化讯息,同时为世界各地的使用者和客户提供便捷的存取。由于对云端技术的依赖和支出的增加,资料中心正在经历成长。

主要亮点

- 资料中心已成为许多企业IT基础设施的关键组成部分。每天都会产生大量的资料,企业依赖资料中心来有效率地处理资料和储存。因此,全球资料中心的不断增长的部署是影响资料中心机柜消费的主要驱动因素。此外,大公司对技术服务和投资的需求不断增长也推动了市场成长的变化。

- 这些资料中心机柜主要用于资料中心基础设施管理。这些机架容纳资料中心的伺服器、交换器、电缆和其他设备。随着技术的变化和高密度伺服器的引入,机架基础设施已成为资料中心的关键要素,需要有效地託管伺服器、管理电缆和促进空气流通,以确保资料中心的最佳效能。

- 最初,人们对资料中心的机架基础设施关注甚少,部署时只考虑尺寸和成本。然而,高密度应用的采用以及资料中心冷却和电力的重要性也是影响市场成长的因素。据估计,资料中心消耗的电力中有 39% 用于冷却。因此,企业正在寻找高效的冷却系统来降低能源消耗并提高整体效率。

- 此外,推动市场成长的关键因素是巨量资料分析和IT基础设施现代化趋势。巨量资料分析有助于管理跨多个资料中心处理的复杂且混乱的组织资料。

- 预计预测期内,云端运算需求和进出资料中心的资料流量的不断增长将推动全球需求。据思科称,到 2021 年,云端资料中心的 IP 流量预计将达到每年 19,509 Exabyte ,而传统资料中心的 IP 流量为每年 1,046 Exabyte 。

- COVID-19 对整个经济的业务永续营运产生了负面影响,影响了所有行业各种规模的组织。有效、有效率的服务能够解决变化和问题并满足新的需求,已成为资料中心的策略和营运要务。需求激增主要受到两个因素推动。许多企业和机构普遍转向在家工作,这推动了对处理能力的需求。数位基础设施对全球经济从未如此重要。随着人们在室内度过的时间越来越多,视讯通话、医疗保健、数位学习、电子商务和休閒应用等数位应用也随之增加,对资料处理能力的需求也随之增加。

资料中心机柜市场趋势

预计 BFSI 行业将占主要份额

- 云端运算和资料中心已成为 BFSI 领域的支柱,尤其是在数位化浪潮中。银行和金融领域日益激烈的竞争以及对线上服务的需求正在推动资料中心市场的发展,并最终推动资料中心机柜市场的发展。

- 资料中心对于金融服务来说已经变得至关重要。银行部门使用的机架需要额外的保护,以防止盗窃和损坏等风险。有了机架,银行服务提供者就拥有了一个平台来託管他们的系统并保护它们免受不可预见的物理风险。这些机架是模组化的,允许银行服务提供者根据需要进行升级。

- 机架供应商正在开发特定产品以满足该行业日益增长的需求。近日,NetRack针对银行和保险业推出了iRack/iRack Block。

- 北美和欧洲等已开发地区拥有强大的 BFSI 影响力,且数位服务的渗透率更高。这主要归功于这些地区的数位化意识水平较高。除此之外,亚太地区由于拥有庞大的此类服务的消费群,也经历着强劲的成长。中国和印度等国家正经历银行业向云端服务的明显转变。

- 线上付款的兴起进一步增加了 BFSI 领域对资料中心的需求。银行和金融业务将客户资讯安全地储存在资料中心(本地和云端)、交易所和分店中。

- 由于全球冠状病毒疫情的影响,数位银行解决方案的采用预计将加速,并进一步采用容器化、云端处理、微服务、API 和区块链等技术。因此,金融和银行业预计将为资料中心提供一些成长机会。

北美占有最大市场占有率

- 行动宽频的快速普及、巨量资料分析和云端运算的兴起是推动北美新资料中心基础设施需求的因素之一。该地区还拥有大量资料中心。许多公司正在从硬体转向基于软体的服务,预计这将成为资料中心安装的迎合市场。此外,根据 Cloud Scene 的数据,美国有超过 2,500 个资料中心,加拿大有超过 250 个资料中心。

- 美国拥有全球最多的资料中心,由于超大规模资料中心的兴起,巨量资料和流量正在强劲成长。据思科称,到2021年终,全球资料中心储存的巨量资料量预计将达到Exabyte,其中美国预计将占据很大份额。

- 此外,资料中心机柜供应商在该地区拥有强大的影响力,推动着该地区的市场发展。其中包括 Kendall Howard LLC、Belkin International Inc.、Martin International、HPE、Dell EMC、Black Box Corporation 和 Chatsworth Products。

- 透过提供整合电源、冷却和IT基础设施的产品,领先的供应商正在吸引更多的消费者并占领更大的市场占有率。该地区的主机託管、互联网和云端服务供应商对大型设施计划的投资不断增加,推动了对机架和机架选项的需求。

- 此外,美国政府启动了资料中心优化倡议(DCOI),以整合该国许多资料中心,以便在改善纳税人的投资的同时为公民提供更好的服务。这个整合资料资料并关闭表现不佳的资料中心。迄今为止,校方已关闭了北维吉尼亚州超过 3,215 平方英尺的校园空间。

资料中心机柜产业概况

资料中心机柜市场细分为中型细分市场。技术的变化和高密度伺服器的采用使得机架基础设施成为资料中心的关键方面。为了确保资料中心的最佳效能,需要有效率地託管伺服器、管理电缆并促进气流。整体来看,现有竞争对手之间的竞争非常激烈。大型企业的新创新策略正在推动资料中心机柜市场的发展。

2022 年 2 月,亚马逊公司 (Amazon.com Inc.) 的子公司 Amazon Web Services Inc. 宣布,AWS 本地区域是一种基础设施部署,它扩展了 AWS 区域,并将运算、储存、资料库和其他 AWS 服务置于人口密集、工业和资讯技术 (IT) 中心附近的云端边缘。

2022年1月,瑞典领先的研究机构和创新合作伙伴RISE Research Institutes与全球数位基础设施和连续性解决方案供应商Vertiv建立了新的伙伴关係。 Vertiv 与 Facebook、爱立信、Vattenfall、ABB、LTU 和诺尔布滕地区等创始合作伙伴一起以白金级别参与资料中心系统技术伙伴关係计画。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 购买者和消费者的议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- COVID-19 对资料中心机柜市场的影响评估

第五章 市场动态

- 市场驱动因素

- 扩大资料中心设施的采用

- 云端运算的日益普及推动了对超大规模资料中心的投资

- 预计 BFSI 行业将占主要份额

- 市场限制

- 刀锋伺服器的使用增加

第六章 市场细分

- 按框架单位

- 袖珍的

- 中等的

- 大的

- 按最终用户产业

- BFSI

- 资讯科技/通讯

- 製造业

- 零售

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Kendall Howard LLC

- Belkin International Inc.

- Martin International Enclosures

- Black Box Corporation

- Rittal GmbH & Co. KG

- Vertiv Group Corporation

- Hewlett Packard Enterprise

- Dell EMC

- Schneider Electric SE

- Fujitsu Corporation

- Oracle Corporation

- Legrand SA

第八章投资分析

第九章:市场的未来

The Data Center Rack Market is expected to register a CAGR of 9.16% during the forecast period.

Whether private or public, data centers are critical to enterprises hosting mission-critical applications. These data centers help organizations streamline information while enabling easy access to users and customers from anywhere worldwide. Data centers have witnessed growth due to the increasing dependence and spending on cloud technologies.

Key Highlights

- Data centers have become a key component in IT infrastructure for many organizations. With large amounts of data being generated daily, companies rely on data centers to efficiently handle data and storage. Therefore, the growing deployment of data centers worldwide is the major driving factor influencing the consumption of data center racks. The increasing demand for technology services and investments from major companies are also changing the market's growth.

- These data center racks are deployed primarily for infrastructure management in the data centers. These racks host servers, switches, cables, and other equipment in the data center. With changing technologies and the adoption of high-density servers, rack infrastructure has become a crucial aspect in data centers, with the need to host servers effectively, manage cables, and facilitate airflow to ensure the optimum performance of data centers.

- Initially, the focus on rack infrastructure in data centers was minimum, with size and cost being the only considerations during deployment. However, the adoption of high-density applications and the importance of cooling and power in the data center also are influential factors in the growth of the market. It is estimated that 39% of the power consumed by the data center is spent on cooling. Thus, companies demand efficient cooling systems to reduce energy consumption and improve overall efficiency.

- Additionally, the key factors driving the market's growth are Big data analytics and the modernization of IT infrastructure trends. Big data analytics aids in the management of complex and jumbled-up organizational data that is processed across multiple data centers.

- The growing cloud demand and data traffic moving from and within the data centers are expected to bolster global demand during the forecast period. Per Cisco, the cloud data center IP traffic is expected to reach 19,509 exabytes annually by 2021, compared to 1,046 exabytes per year of traditional data center traffic.

- COVID-19 negatively influenced business continuity across all economics, affecting organizations of all sizes in every industry. Effective and efficient services that simultaneously accommodate new needs and counteract change and problems have become a strategic and operational necessity for data centers. Two main factors are fueling the tremendous rise in demand. The need for processing power was brought on by the widespread shift of many enterprises and institutions to working from home. Never before had digital infrastructure been more crucial to the global economy. As we all spent more time indoors, the corresponding increase in digital applications for video calling, healthcare, e-learning, and e-commerce, together with those for leisure led to a rise in the demand for data capabilities.

Data Center Rack Market Trends

BFSI Sector Expected to Hold a Significant Share

- Cloud and data centers have become the backbone of the BFSI sector, especially during the digitization movement. The increasing competition and the demand for online services in the banking and financial sectors drive the market for data centers and, by extension, data center racks.

- Data centers have become very crucial for financial services. The racks used in the banking sector require additional protection against theft, damage, and other risks. Racks enable the banking service providers to have a platform that hosts the systems and protects them from unforeseen physical risks. These racks are modular, owing to which the banking service providers can upgrade when required.

- The rack providers are developing particular products for this segment to cater to the increasing demand from this sector. The most recent was by NetRack, which launched iRack/iRack Block to cater to the banking and insurance sectors.

- The strong presence of BFSI in developed regions, like North America and Europe led to increased penetration of digital services. This is primarily owing to the higher degree of awareness related to digitization in these regions. Along with this, Asia-Pacific is also growing substantially due to a huge consumer base for these services. Countries like China and India are witnessing a strong shift toward cloud services in the banking sector.

- The growing scope of online payment further increases the need for data centers in the BFSI sector. Banks and financial institutions securely store customer information in both on-premise and cloud data centers, as well as on the trading floors and in branch operations.

- Due to the global coronavirus disruption, the adoption of digital banking solutions is expected to adopt further technologies like containerization, cloud computing, microservices, APIs, and blockchain. Hence, the financial and banking industry is expected to provide several growth opportunities for data centers.

North America to Hold Maximum Market Share

- The rapid growth of mobile broadband with an increase in big data analytics coupled with cloud computing are some of the factors driving the demand for new data center infrastructures in the North American region. The region also comprises a considerable amount of data centers. Multiple enterprises are switching from hardware to software-based services, and they are anticipated to be an addressable market for data center installations. Moreover, according to the cloud scene, there are more than 2500 data centers in the United States and more than 250 data centers in Canada.

- The United States has the highest number of data centers globally, and it is witnessing robust growth in terms of the volume of big data and traffic due to the increase in the number of hyperscale data centers. According to Cisco, the volume of big data in data center storage globally is expected to reach 403 exabytes by the end of 2021, of which a huge share would likely be attributed to the United States.

- Moreover, the region has a strong foothold of data center racks providers, driving the region's market. Some of them include Kendall Howard LLC, Belkin International Inc., Martin International, HPE, Dell EMC, Black Box Corporation, and Chatsworth Products.

- The leading vendors offer an integrated power, cooling, and IT infrastructure to attract a higher number of consumers and gain a larger market share. The region is likely to witness higher investment in mega facilities projects, contributed heavily by colocation, internet, and cloud service providers, thereby boosting the demand for racks and rack options.

- Moreover, the US government commenced the Data Center Optimization Initiative (DCOI) to deliver better services to the public while increasing the taxpayers' return on investment by consolidating many data centers in the country. The consolidation process includes the process of building hyper-scale data centers and shut-off the underperforming ones. To date, the government has closed over 3,215 sq ft of campus in Northern Virginia.

Data Center Rack Industry Overview

The data center rack market is medium fragmented. With changing technologies and the adoption of high-density servers, rack infrastructure has become an important aspect of data centers, with the need to host servers effectively, manage cables, and facilitate airflow to ensure the optimum performance of data centers. Overall, the competitive rivalry among the existing competitors is high. The new innovative strategies of large companies are driving the data center racks market.

In February 2022, the first 16 AWS Local Zones in the United States have been completed, and 32 new AWS Local Zones will be launched in 26 other countries, according to Amazon Web Services Inc. (AWS), an affiliate of Amazon.com Inc. and this is to enable customers to deploy applications that require single-digit millisecond latency closer to end users or on-premises data centers, AWS Local Zones are a type of infrastructure deployment that extends AWS Regions to place compute, storage, database, and other AWS services at the edge of the cloud near large population, industry, and information technology (IT) centers.

In January 2022, a major Swedish research institute and innovation partner, RISE Research Institutes, and Vertiv, a global provider of digital infrastructure and continuity solutions formed a new partnership. Vertiv is joining founding partners, including Facebook, Ericsson, Vattenfall, ABB, LTU, and the Norrbotten region, by entering the partnership program for data center systems technologies at the platinum level.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

- 4.4 Assessment of Impact of COVID-19 on the Data Center Racks Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Deployment of Data Center Facilities

- 5.1.2 Growing Cloud Computing Adoption Leading to Investment in Hyperscale Data Centers

- 5.1.3 BFSI Sector Expected to Hold a Significant Share

- 5.2 Market Restraints

- 5.2.1 Increasing Utilization of Blade Servers

6 MARKET SEGMENTATION

- 6.1 By Rack Units

- 6.1.1 Small

- 6.1.2 Medium

- 6.1.3 Large

- 6.2 By End-user Industry

- 6.2.1 BFSI

- 6.2.2 IT and Telecom

- 6.2.3 Manufacturing

- 6.2.4 Retail

- 6.2.5 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Kendall Howard LLC

- 7.1.2 Belkin International Inc.

- 7.1.3 Martin International Enclosures

- 7.1.4 Black Box Corporation

- 7.1.5 Rittal GmbH & Co. KG

- 7.1.6 Vertiv Group Corporation

- 7.1.7 Hewlett Packard Enterprise

- 7.1.8 Dell EMC

- 7.1.9 Schneider Electric SE

- 7.1.10 Fujitsu Corporation

- 7.1.11 Oracle Corporation

- 7.1.12 Legrand SA