|

市场调查报告书

商品编码

1645138

智慧虚拟助理 (IVA):市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Intelligent Virtual Assistant (IVA) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

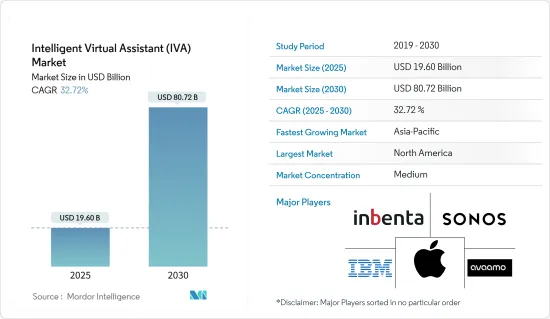

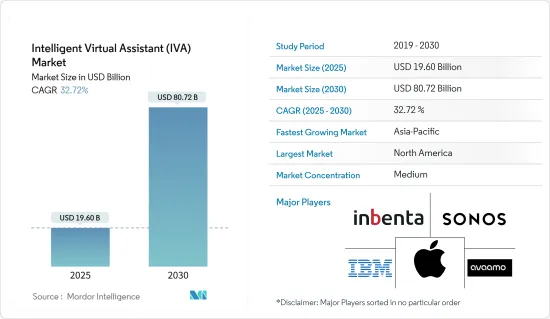

智慧虚拟助理 (IVA) 市场规模预计在 2025 年为 196 亿美元,预计到 2030 年将达到 807.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 32.72%。

主要亮点

- 深度神经网路、机器学习和人工智慧领域的其他进步正在使越来越多的虚拟助理成为可能。聊天机器人和智慧扬声器是虚拟助理的两个例子,它们正在零售、BFSI 和医疗保健等终端用户行业中使用。虚拟助理充当个人助理,是消费者参与的重要形式。它藉助 Apple 的 Siri 并为连网家庭和汽车提供易于使用的介面,帮助用户完成各种家务。

- 此外,虚拟助理越来越多地承担客户服务代理的角色。对于企业而言,虚拟助理可以透过更消费者友善的方式改善客户和品牌体验。例如,云端客服中心供应商 Five9 与 Inference Solutions 合作推出了Five9 虚拟助理。该系统使用对话式人工智慧来自动执行手动任务并回答客服中心的常见问题。

- 例如,在医疗保健行业,虚拟助理可以帮助客户找到医生办公室、填写和补充处方笺以及接收付款提醒。

- 医疗保健产业认可的虚拟助理包括 Apple 的 Siri、Microsoft 的 Cortana 和 Google 的 Assistant。中小企业也在推动智慧虚拟助理(IVA)背后的技术,并且是健康智慧虚拟助理(IVA)的关键组成部分。例如,Next IT 的 Alme of Healthcare 是一个虚拟助手,可以主动回答患者的问题和请求,并专注于慢性病管理。目前,它已被医疗保健提供者大规模采用。

- 除了医疗保健之外,零售企业也在流行的通讯应用程式中使用聊天机器人,为客户提供更好的体验。达美乐和其他商店正在使用人工智慧和机器学习来支援类似聊天机器人的虚拟助手,让顾客可以直接透过 Facebook Messenger 下订单。

- 2020 年春季智慧音讯报告证实,约 77% 的美国成年人因 COVID-19 疫情改变了日常生活习惯。在这些变化中,越来越多的人使用语音助手,这对市场成长是一个积极因素。

- 公司也推出产品来帮助人们在不确定的时期保持清醒。例如,由 Wipro Ventures 支援的、专门从事对话式介面的深度学习软体公司 Avaamo推出计划 COVID。 COVID-19 智慧虚拟助理 (IVA) 可供所有人使用,可以帮助您用简单的英语快速找到答案。

智慧虚拟助理 (IVA) 市场趋势

智慧音箱推动市场成长

- 如今,智慧扬声器的预期功能包括播放音乐和控制智慧家庭设备。随着智慧音箱的兴起,语音助理有望为使用者的互联生活带来更多效用。在短时间内,声控扬声器已经成为人们日常生活的一部分。原因包括多工处理能力和使用科技的能力、人们说话的速度比打字的速度(速度)以及人机介面的增加。

- 此外,消费者通常更喜欢价格实惠且具有高端功能的产品。由于 Whole Foods 商店的促销策略以及在网路和电视广告上以 Alexa 为重点的广告,亚马逊 Alexa 在消费者中获得了巨大的吸引力。亚马逊也降低了部分产品的价格,以提高竞争力。

- 例如,NPR、路透社、《纽约时报》和 CNN 等出版商以及《田纳西人报》、《IndyStar》和《德克萨斯论坛报》等当地新闻提供商正在製作旨在透过智慧扬声器收听的简短音讯简报。

最着名的智慧音箱是亚马逊 Echo 和 Google Nest 系列,但也有许多第三方音箱,例如 Sonos One,内建了 Alexa 和 Google Assistant。这些公司正在推出新产品以满足日益增长的市场需求。预计智慧音箱将推动快速消费品和杂货电子商务的下一波浪潮。公司正在寻求将语音技术融入其更广泛的跨通路策略中。

预计北美将占很大份额

- 由于该地区的许多千禧世代更喜欢自助服务选项和通讯应用程序,该地区的企业可能会选择 IVA 服务来满足他们的需求,有助于推动该地区的市场成长。

- 该地区蓬勃发展的银行业和医疗保健业正在大力投资聊天机器人,以实现客户个人化。北美公司是银行业最早采用人工智慧辅助聊天机器人的公司之一。

- 例如,市场领导者 Nuance Communications 发现,美国10,000 名临床医生中有 80% 认为虚拟助理将在未来几年彻底改变医疗保健。消费者对自助服务选项的高度偏好推动了通讯应用程式的成长,表明全部区域采用 IVA 聊天机器人的环境良好。

- 企业也投入大量资金,借助人工智慧和机器学习改进 IVA 技术,以支援自动化决策系统。最近,亚马逊在亚马逊语音服务 API 中新增了通知功能。因此,借助此最新的语音通知功能,Alexa 可以向您显示许多新内容,例如购物更新、即将推出的优惠、购物节的详细资讯以及许多其他更新。此类语音搜寻通知预计将成为未来几年的热门趋势。

- 美国仍然是智慧音箱普及的关键市场。根据 NPR 最新的智慧音讯报告,大约 24% 的美国人(18 岁及以上)拥有至少一台智慧音箱,平均每位拥有者拥有不只一台。大多数美国人都拥有 Alexa。自从亚马逊推出 Echo 以来,它在美国已经大受欢迎,并且正在与其他顶级竞争对手竞争。

智慧虚拟助理 (IVA) 产业概览

智慧虚拟助理 (IVA) 市场竞争适中,有几家大公司。就市场占有率而言,目前少数几家公司占据主导地位。然而,随着综合语音和手势识别技术的进步,新参与者正在增加其在市场上的份额,并企业发展。最近的一些市场发展趋势包括:

2022 年 9 月,开发自动化客户互动平台的 eGain Corporation 宣布推出适用于 IBM Watson Assistant 的预先建置连接器。这是与 IBM 合作的成果。该连接器利用 eGain 独特的 BYOBTM(自带机器人)架构,使得商业用户可以轻鬆地将 Watson Assistant 与 eGain 平台集成,且无需编写程式码。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业相关人员分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- 技术简介

- 虚拟助理(IVA)市场的影响评估

第五章 市场动态

- 市场驱动因素

- 越来越注重改善专业服务的客户体验

- 智慧音箱推动市场成长

- 市场限制

- 越来越偏好人际交往

第六章 市场细分

- 按产品

- 聊天机器人

- 智慧音箱

- 按使用者介面

- Text-to-Text

- Text-to-Speech

- 自动语音辨识

- 按最终用户

- 聊天机器人

- 零售

- BFSI

- 卫生保健

- 电信

- 旅游与饭店

- 其他最终用户产业

- 智慧音箱

- 个人

- 商业的

- 聊天机器人

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 拉丁美洲

- 巴西

- 阿根廷

- 其他拉丁美洲国家

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 北美洲

第七章 竞争格局

- 公司简介

- Avaamo Inc.

- EdgeVerve Systems Limited(An Infosys Company)

- SMOOCH.ai

- Inbenta Technologies Inc.

- Creative Virtual Ltd.

- Serviceaide Inc.

- Ipsoft Inc.

- Kore.ai Inc.

- IBM Corporation

- 智慧音箱供应商

- Amazon.com Inc.

- Google LLC(Alphabet Inc.)

- Alibaba Group

- Sonos Inc.

- Harman-Kardon Inc

- Apple Inc.

- Bose Corporation

- Xiaomi Inc.

- Baidu Inc.

第八章投资分析

第九章:未来市场展望

The Intelligent Virtual Assistant Market size is estimated at USD 19.60 billion in 2025, and is expected to reach USD 80.72 billion by 2030, at a CAGR of 32.72% during the forecast period (2025-2030).

Key Highlights

- Deep neural networks, machine learning, and other advances in AI are making more virtual assistants possible. Chatbots and smart speakers are two examples of virtual assistants that are used in retail, BFSI, and healthcare, among other end-user industries. A virtual assistant acting as a personal assistant is a significant consumer-facing form. With the aid of Apple's Siri or by providing an easy-to-use interface for connected homes or autos, it aids users in completing various chores.

- Another use on the rise is virtual assistants adopting the customer service agent role. For enterprises, virtual assistants improve customer and brand experiences with a more consumer-friendly approach. For example, Five9, a cloud contact center provider, launched Five9 Virtual Assistant in partnership with Inference Solutions. The system leverages conversational artificial intelligence to automate manual tasks and answer common questions in the contact center.

- The capabilities of these assistants can also be changed based on the end user, which makes the customer experience better in a certain industry.For example, in the healthcare industry, a virtual assistant can help a customer find a doctor's office, fill and refill a prescription, and get payment reminders.

- Some virtual personal assistants that have gained recognition across the healthcare sector are Apple's Siri, Microsoft's Cortana, and Google's Assistant. Small and medium-sized businesses also drive the technology behind intelligent virtual assistants, making them important parts of health-intelligent virtual assistants. For example, Next IT's Alme of Healthcare is a virtual assistant that focuses on managing chronic diseases and actively answers patients' questions and requests. This is currently being adopted on a massive scale by healthcare providers.

- Aside from healthcare, retail companies also use chatbots in popular messaging apps to give their customers a better experience.Domino's and other stores use AI and machine learning to power virtual assistants like chatbots, which let customers place orders directly through Facebook Messenger.

- The Spring 2020 Smart Audio Report confirmed that the COVID-19 outbreak caused about 77% of US adults to change their normal routines. During these changes, more people used voice assistants, which was good for market growth.

- Companies are also rolling out offerings that help people stay aware of these uncertain times. For example, Avaamo, a deep-learning software company that specializes in conversational interfaces and is backed by Wipro Ventures, launched Project COVID, a COVID-19 Intelligent Virtual Assistant that can be used by anyone and helps find answers quickly in plain English.

Intelligent Virtual Assistant (IVA) Market Trends

Smart Speakers to Drive the Market Growth

- The characteristics expected from a smart speaker nowadays include playing music and controlling smart home devices. An increasing number of smart speakers is believed to give voice assistants more utility in a connected user's life. In a short period of time, voice-activated speakers have become a part of people's routines. Reasons for this include the ability to use the technology while multitasking, the fact that people speak more quickly than they type (speed), and increasing human interfaces.

- Further, consumers frequently like products that are both affordable and packed with high-end features. Due to its promotional tactics at a Whole Foods store and Alexa-focused advertisements on both the web and television commercials, Amazon Alexa achieved tremendous momentum among consumers. Amazon also lowered the price of several of its products to obtain a competitive edge.

- Publishers and media companies are trying out new content and ways for smart speakers to interact with it.For instance, publishers like NPR, Reuters, the New York Times, CNN, and local news providers, such as the Tennessean, IndyStar, and Texas Tribune, are all creating short audio briefings designed to be heard on smart speakers.

Among the most well-known smart speakers are the Amazon Echo and Google Nest ranges of products, but there are plenty of third-party speakers, like the Sonos One, which come with both Alexa and Google Assistant built-in. These companies are rolling out new products to cater to the increasing market demand. Smart speakers are forecast to drive the next wave of FMCG and grocery e-commerce. Companies are thinking of integrating voice technology into a broader cross-channel strategy.

North America is Expected to Hold a Major Share

- Since many millennials in the region prefer self-service options and messaging apps, businesses in the region are likely to choose IVA services to meet their needs, which will help the market grow in the region.

- The region's robust banking and healthcare sectors have actively invested in chatbots for customer personalization. The early adopters of AI-assisted chatbots in the banking sector are from North America.

- For instance, Nuance Communications, a prominent player in the market, revealed that 80% of 10,000 US clinicians believe virtual assistants will drastically change healthcare in the next few years. Such high consumer inclination toward self-service options has led to the growth of messaging applications, indicating the favorable environment for adopting IVA chatbots across regions.

- Also, companies are putting more money into improving IVA technology with the help of AI and machine learning to support automated decision-making systems. This is expected to drive the market across the region.Recently, Amazon added a notification capability to the Amazon Voice Services API. Therefore, this latest voice notification feature allows Alexa to indicate some new content, such as shopping updates, upcoming offers, shopping festival details, and many other updates. These voice search notifications are expected to become the latest trend in the coming years.

- The US remains an important market for smart speaker adoption. According to the latest Smart Audio Report from NPR, around 24% of Americans (18+) own at least one smart speaker, and the average owner has more than one. The majority of Americans own Alexa. Since Amazon first introduced the Echo, it has become popular in the United States, challenging other top competitors.

Intelligent Virtual Assistant (IVA) Industry Overview

The intelligent virtual assistant market is moderately competitive and has several significant players. In terms of market share, some of the players currently dominate the market. However, with the advancement of integrated speech and gesture recognition technologies, new players are increasing their market presence and expanding their business footprint across emerging economies. Some of the recent developments in the market are:

In September 2022, eGain Corporation, which makes a platform for automating customer interactions, said that a pre-built connector for IBM Watson Assistant was available. This was done in partnership with IBM. The connector uses eGain's unique BYOBTM (Bring Your Own Bot) architecture to make integrating the Watson Assistant with the eGain platform easy and code-free for business users.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Stakeholder Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Industry Value Chain Analysis

- 4.5 Technology Snapshot

- 4.6 Assessment of COVID-19 Impact on the Intelligent Virtual Assistant (IVA) Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Focus to Improve Customer Experience across Professional Services

- 5.1.2 Smart Speakers to Drive the Market Growth

- 5.2 Market Restraints

- 5.2.1 Increasing Preference for Live Person Interaction

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 Chatbots

- 6.1.2 Smart Speakers

- 6.2 By User Interface

- 6.2.1 Text-to-Text

- 6.2.2 Text-to-Speech

- 6.2.3 Automatic Speech Recognition

- 6.3 By End-User

- 6.3.1 Chatbots

- 6.3.1.1 Retail

- 6.3.1.2 BFSI

- 6.3.1.3 Healthcare

- 6.3.1.4 Telecom

- 6.3.1.5 Travel and Hospitality

- 6.3.1.6 Other End-User Industries

- 6.3.2 Smart Speakers

- 6.3.2.1 Personal

- 6.3.2.2 Commercial

- 6.3.1 Chatbots

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.2.4 Spain

- 6.4.2.5 Rest of Europe

- 6.4.3 Asia Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Rest of Asia Pacific

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Argentina

- 6.4.4.3 Rest of Latin America

- 6.4.5 Middle East and Africa

- 6.4.5.1 UAE

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 South Africa

- 6.4.5.4 Rest of Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Avaamo Inc.

- 7.1.2 EdgeVerve Systems Limited (An Infosys Company)

- 7.1.3 SMOOCH.ai

- 7.1.4 Inbenta Technologies Inc.

- 7.1.5 Creative Virtual Ltd.

- 7.1.6 Serviceaide Inc.

- 7.1.7 Ipsoft Inc.

- 7.1.8 Kore.ai Inc.

- 7.1.9 IBM Corporation

- 7.2 Smart Speaker Vendors

- 7.2.1 Amazon.com Inc.

- 7.2.2 Google LLC (Alphabet Inc.)

- 7.2.3 Alibaba Group

- 7.2.4 Sonos Inc.

- 7.2.5 Harman-Kardon Inc

- 7.2.6 Apple Inc.

- 7.2.7 Bose Corporation

- 7.2.8 Xiaomi Inc.

- 7.2.9 Baidu Inc.