|

市场调查报告书

商品编码

1645163

日本即时付款:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Japan Real Time Payment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

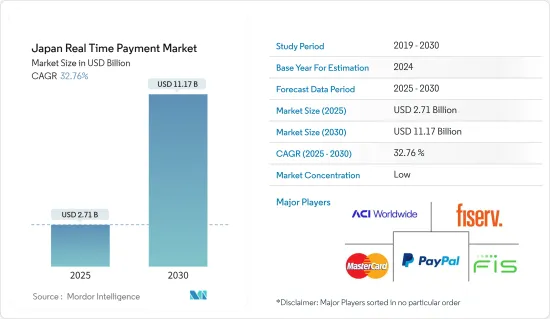

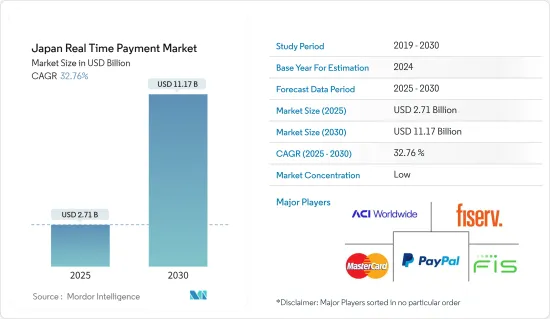

日本即时付款市场规模预计在 2025 年为 27.1 亿美元,预计到 2030 年将达到 111.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 32.76%。

关键亮点

- 由于消费者对于速度和便利性的需求不断增长,以及技术和监管支援的付款解决方案推动人们持续远离现金,即时付款系统正在迅速普及。

- 智慧型设备的普及和网路零售业的蓬勃发展正在推动日本即时付款的快速发展。此外,智慧型手机和其他连网装置的广泛使用以及消费者对即时的不断提高的期望也反映出消费者对即时付款的需求日益增长。

- 日本政府采取的财政诱因、标准化和市场发展等倡议也推动了即时付款市场的成长。例如,政府正计划透过数位平台推出工资平台,这可能进一步促进消费者的采用。政府也设定了目标,到 2025 年将无现金付款占所有交易的比例从约 20% 扩大到约 40%。

- 然而,对现金(传统方式)的高度依赖、高昂的实施成本以及偏好传统付款系统的消费者需求低是阻碍日本即时付款市场成长的一些挑战。

- 在日本,一些市场参与企业正在扩大他们的即时付款服务。 2022年12月,Adyen在日本推出了统一商务解决方案,提供了连结不同线上和线下分销管道的付款管道。预计此类供应商的采用将在预测期内推动市场成长。

- 新冠疫情的爆发对即时付款市场产生了重大影响。中国对数位转型和先进技术基础设施的重视,推动了即时付款解决方案的广泛采用。此外,疫情加速了无现金付款的趋势,并导致行动付款解决方案和电子钱包的使用增加。随着各家公司竞相提供更便利、更安全的解决方案,也刺激了即时付款产业的技术创新。

日本即时付款市场趋势

数位付款的兴起正在推动市场

- 数位付款在日本已十分普及且越来越受欢迎。最常用的数位付款方式包括二维码付款、行动付款和非接触感应卡付款。这种采用是由于数位付款管道提供的便利性和安全性的提高。

- 数位付款透过多种方式提供快速且有效率的付款基础设施,帮助促进即时付款,包括即时汇款、即时处理、轻鬆对帐和方便用户存取。根据 FIS 的数据, 与前一年同期比较日本 POS 现金付款份额年减 15%(上年下降 7.8%)。消费者选择数位付款以避免在疫情期间接触货币。

- 日本政府预计,到2025年,无现金付款预计将占日本所有交易的至少40%,比2021年成长约20%。日本政府认为,数位付款的扩张将促进旅游业并刺激该国金融领域的创新。这最终将导致对即时付款的需求增加。

- 此外,日本政府计划在2023年春季之前推出一项系统,让企业无需使用银行帐户即可进行数位付款,目前有30%的企业正在考虑引进该系统。这些努力进一步支持了即时付款市场的成长。

- 日本年轻人已成为消费经济的重要组成部分,他们要求数位化变革以适应他们精通科技的习惯。此外,透过向消费者提供奖励和现金回馈来推广数位付款的重大政治努力也有助于推动日本数位付款的采用。

智慧型手机普及率上升推动市场

- 日本智慧型手机的高普及率在各种形式的即时付款的成长中发挥关键作用,包括行动付款、行动银行、提高可近性和改善用户体验。智慧型手机的广泛使用使得消费者能够更方便地使用数位付款方式,从而促进了市场的成长。

- 在日本,到2021年,约有92%的30至39岁族群将透过智慧型手机上网。对于 20 多岁的人来说,这一比例略低。根据内务部,80岁以上老人中,只有12.1%使用行动电话上网(日本)。

- 根据内务部2021年9月的一项调查,日本民众在使用网路时感到不安的原因中,绝大多数是担心个人资讯和浏览器记录被洩露的风险,超过90%的人提到了这一点。随后又出现了电脑病毒攻击、虚假帐单和诈骗行为。

- 此外,调查也发现,许多日本人在使用网路时都会感到焦虑,而且这种倾向在老年人身上更为明显。预计这些趋势将阻碍日本各阶层即时付款市场的成长。个人资讯的洩漏也可能影响年轻一代的付款习惯。

- 此外,智慧型手机的普及导致了国内商品和服务的买卖增加,因此,行动商务的成长也促进了市场扩张。根据行动内容论坛预测,到2021年日本行动商务市场规模将达到约4.9兆日圆。

日本即时付款产业概况

日本的即时付款市场细分化,参与企业众多。快速变化的客户偏好使得市场更具吸引力,并吸引了大量投资。由于巨大的成长潜力,服务供应商正在采取扩张、合作、交易和收购等策略性倡议。

2022 年 8 月,任务关键型即时付款软体的全球领导者 ACI Worldwide 宣布与日本领先的国内中央付款网路 Japan Card Network, Inc. (CARDNET) 达成协议,以对其数位付款基础设施进行现代化改造。 ACI 与 CARDNET 合作,为 CARDNET 客户带来最新的数位付款技术和下一代解决方案。

2022年3月,全球领先的付款服务商Worldline宣布进入日本,处理全国零售商的信用卡卡片付款。日本是经济成熟的国家,消费者的消费习惯保守且非常安全,因此卡片付款有很大的发展潜力。 Worldline 也于 2022 年 3 月扩大了在日本的业务,为当地企业提供信用卡卡片付款。为了在日本发展,这家法国付款供应商与当地付款解决方案和网路服务供应商(NSP) Vesca 合作。 Vesca 将充当 Worldline 在日本的技术推动者和接受层。 Worldline 预计于 2022 年初推出。这些服务包括信用卡收单和 POS 卡接受和处理。据该公司表示,希望在未来几个月内增强其电子商务能力。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 购买者/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 国内付款环境的演变

- 推动该地区无现金交易成长的主要市场趋势

- 评估新冠肺炎对市场的影响

第五章 市场动态

- 市场驱动因素

- 智慧型手机普及率不断提高

- 政府措施加速即时付款解决方案的采用

- 市场问题

- 对付款安全的担忧

- 对现金的依赖

- 市场机会

- 政府政策变化鼓励数位付款成长

- 数位付款产业的关键法规和标准

- 全球监管状况

- 可能成为监管障碍的经营模式

- 随着商业环境的改变而出现的发展空间

- 关键用案例和使用案例分析

第六章 市场细分

- 依付款类型

- P2P

- P2B

第七章 竞争格局

- 公司简介

- Fiserv Inc.

- Paypal Holdings Inc.

- Mastercard Inc.

- FIS Global

- VISA Inc.

- Apple Inc.

- Alipay(Ant Financial)

- SIA SpA

- Finastra

- ACI Worldwide Inc.

第八章投资分析

第九章:市场的未来

The Japan Real Time Payment Market size is estimated at USD 2.71 billion in 2025, and is expected to reach USD 11.17 billion by 2030, at a CAGR of 32.76% during the forecast period (2025-2030).

Key Highlights

- Real-time payment systems were proliferating due to increased consumer adoption for speed and convenience and the continued shift away from cash with payment solutions enabled by innovation and regulation.

- The growing adoption of smart devices and booming online retail commerce drive the rapid adoption of real-time payments in the country. Also, the rising tide of real-time payments reflects growing consumer demand for real-time transactions, driven due to the ubiquity of smartphones and other connected devices, which have catalyzed consumer expectations for immediacy.

- Several initiatives by the Japanese government, including financial incentives, standardization, and infrastructure development, are also adding growth to the real-time payment market. For instance, the government is planning to introduce a platform for wages through a digital platform which could further contribute to the adoption among consumers. Also, the government has set a target of growing cashless payments to around 40% of all transactions by 2025, up from approximately 20%.

- However, the larger dependence of the population on cash (traditional method), cost of implementation, and low consumer demand as they prefer traditional payment systems are the factors challenging the growth of the real-time payment market in Japan.

- Several market players are expanding their offering of real-time payment systems in the country. In December 2022, Adyen launched its unified commerce solution in Japan to provide a payment platform that connects different online and offline sales channels. Such introductions from the vendors are expected to fuel the market growth during the forecast period.

- The outbreak of the COVID-19 pandemic greatly impacted the real-time payment market. With the country's focus on digital transformation and its advanced technology infrastructure, real-time payment solutions had widespread adoption. Additionally, the pandemic accelerated the trend toward cashless payment methods, leading to greater use of mobile payment solutions and e-wallets. This also helped spur innovation in the real-time payment industry as companies compete to offer more convenient and secure solutions.

Japan Real-Time Payment Market Trends

Digital Payment Adoption Will Drive the Market

- Digital payments have been widely adopted and are growing in popularity in the country. Mostly used digital payment methods include QR code payments, mobile payments, contactless card payments, and others. This adoption is driven by the convenience and increased security offered by digital payment platforms.

- Digital payments are helping to facilitate real-time payments by providing a fast and efficient payment infrastructure in various ways, including instant transfer, real-time processing, easy reconciliation, and convenient access to the users. According to FIS, Japan's share of cash point-of-sale payments fell 15% yearly (YoY) in 2021, compared to a 7.8% YoY reduction the year before. Consumers have opted for digital payments to avoid touching currency during the pandemic.

- According to the government of Japan, cashless transactions are expected to account for at least 40% of all transactions in Japan by 2025, up around 20% from 2021. It believes that expanding digital payments will boost tourism and stimulate financial sector innovation in the country. This will eventually lead to a greater demand for real-time payments.

- Furthermore, the Japanese government is planning to introduce a system for companies to pay salaries digitally without going through bank accounts by spring 2023, and 30% of companies are considering implementing this system. Such initiatives are further supporting the growth of the real-time payment market.

- The younger population in Japan is becoming a significant part of the consumer economy and demanding a change to digital to match their technology-friendly habits. Also, massive political efforts to bring digital payment adoption by giving consumer rewards and cash rebates are likely to grow the adoption of digital payments in Japan.

Increased Smartphone Penetration to drive the Market

- Increasing smartphone penetration in Japan is playing a key role in the growth of real-time payments in various ways, such as mobile payments, mobile banking, increased accessibility, and improved user experience. It is contributing to market growth by making digital payment methods more accessible and convenient for consumers.

- In Japan, about 92% of persons aged 30 to 39 will use smartphones to access the internet in 2021. In the case of those in their twenties, the percentage was slightly lower. According to the Ministry of Internal Affairs and Communications, only 12.1% of those aged 80 and older used cell phones to access the internet (Japan).

- According to a survey conducted by the Ministry of Internal Affairs and Communications (Japan) in September 2021, a leak of one's personal information or browser history was by far the most common reason for Japanese respondents to feel insecure when using the internet, with more than 90% mentioning it. Computer virus attacks and fake billings or frauds followed privacy concerns.

- Furthermore, the survey revealed that most people in Japan feel anxious when using the internet, with the older generations having a higher tendency to feel this way. Such trends are expected to hamper the growth of the real-time payments market in every demography of the Japanese population. Leaking personal information is something that can also impact the payments habit of the younger population.

- The growth of M-commerce is also contributing to the market growth as the smartphone penetration increased the buying and selling of goods and services in the country. According to the Mobile Content Forum, the m-commerce market size in Japan reached around JPY 4.9 trillion as of 2021.

Japan Real-Time Payment Industry Overview

The Japanese real-time payment market is fragmented due to the presence of many players operating in the market. The market has become an attractive choice due to rapidly changing customer tastes, attracting considerable investment. Because of the immense potential growth, service providers are undergoing strategic initiatives such as expansion, partnership, agreement, acquisitions, etc.

In August 2022, ACI Worldwide, the global leader in mission-critical, real-time payments software, announced an agreement with Japan's leading central domestic payment network, Japan Card Network, Inc., CARDNET, to modernize its digital payments infrastructure. The agreement would see ACI work with CARDNET to provide the latest digital payments technology and next-generation solutions to CARDNET's customers.

In March 2022, Worldline, a global leader in payments services, announced its entrance into Japan, where it will handle credit card payments for retailers across the country. Japan has large development potential for card payments because it is an economically mature, very secure nation with conservative consumer habits. Also, in March 2022, Worldline expanded its business into Japan, where it now provides credit card payment processing to local businesses. For its growth in Japan, the French payment provider teamed with local payment solutions and network service provider (NSP) Vesca. Vesca will serve as a technical enabler in the country, acting as Worldline's acceptance layer. Worldline intends to launch its service in early 2022. These services will comprise credit card acquisition and point-of-sale card acceptance and processing. According to the corporation, the company wants to increase its e-commerce capabilities in the following months.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness- Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Evolution of the Payments Landscape in the Country

- 4.4 Key Market Trends Pertaining to the Growth of Cashless Transaction in the Region

- 4.5 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Smartphone Penetration

- 5.1.2 Government Initiatives are Accelerating the Adoption of Real-Time Payment Solutions

- 5.2 Market Challenges

- 5.2.1 Payment Security Related Concerns

- 5.2.2 Existing Dependence on Cash

- 5.3 Market Opportunities

- 5.3.1 Changes in Government Policies Encouraging the Growth of Digital Payments

- 5.4 Key Regulations and Standards in the Digital Payments Industry

- 5.4.1 Regulatory Landscape Across the World

- 5.4.2 Business Models with Potential Regulatory Roadblocks

- 5.4.3 Scope for Development in Lieu of Evolving Business Landscape

- 5.5 Analysis of Major Case Studies and Use-Cases

6 Market Segmentation

- 6.1 By Type of Payment

- 6.1.1 P2P

- 6.1.2 P2B

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Fiserv Inc.

- 7.1.2 Paypal Holdings Inc.

- 7.1.3 Mastercard Inc.

- 7.1.4 FIS Global

- 7.1.5 VISA Inc.

- 7.1.6 Apple Inc.

- 7.1.7 Alipay (Ant Financial)

- 7.1.8 SIA SpA

- 7.1.9 Finastra

- 7.1.10 ACI Worldwide Inc.