|

市场调查报告书

商品编码

1851030

託管列印服务:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Managed Print Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

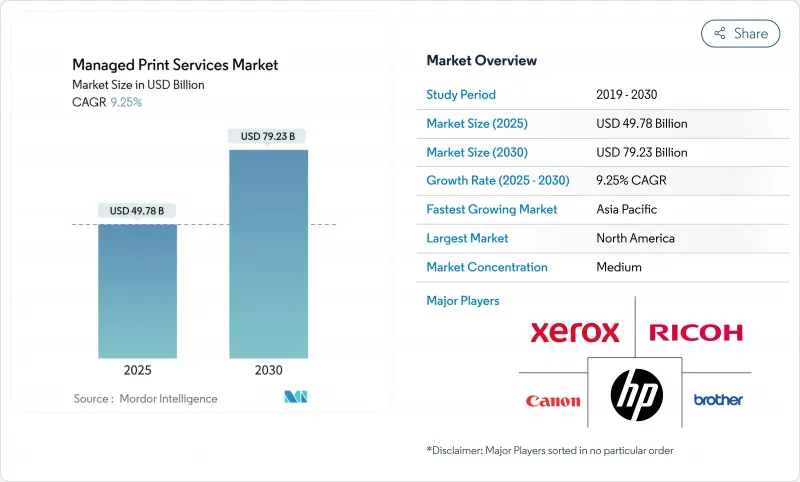

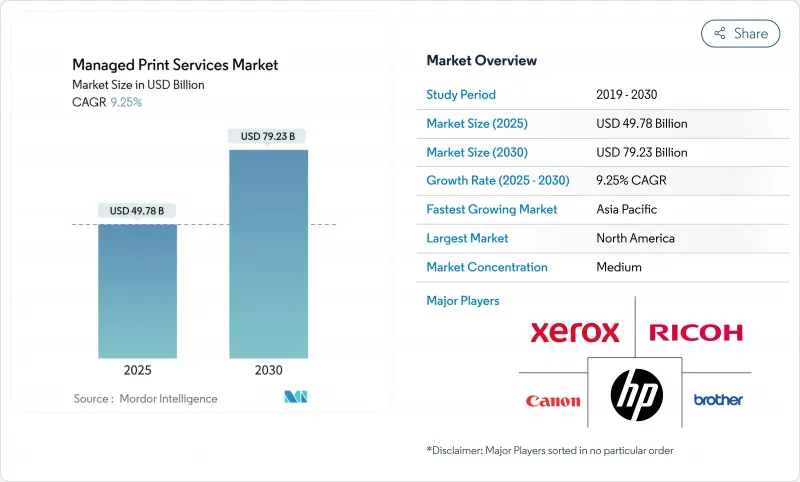

根据估计和预测,到 2025 年,託管列印服务市场规模将达到 497.8 亿美元,到 2030 年将达到 792.3 亿美元,年复合成长率为 9.25%。

云端连接、混合办公基础设施和订阅定价模式正在推动越来越多的大型企业和中小企业采用预测性维护技术。安全可靠的设备群、即时物联网诊断和自动耗材补充对于降低整体拥有成本和减少非计划性停机时间至关重要。需求也反映了永续性的要求,这些要求奖励那些能够量化双面列印使用率、减少碳排放和减少纸张废弃物的供应商。随着以硬体为中心的传统企业努力捍卫市场份额,对抗专注于人工智慧主导优化、整合分析、工作流程自动化和设备即服务(DaaS)的参与企业,竞争格局正在改变。亚太地区的成长势头最为显着,该地区的大型製造企业和出口导向型企业将预测性维护视为提高营运效率的关键因素。

全球託管列印服务市场趋势与洞察

优化远距办公列印基础设施,推动北美MPS(管理列印服务)的普及

混合办公模式使得分散式列印成为成本和安全隐患,迫使企业将装置管理集中到云端。为了在支援员工在总部、分公司和家中进行列印的同时确保合规性,企业正在采用安全列印发布、用户身份验证和加密作业路由等措施。夏普 Synappx 云端列印解决方案正是为了满足这一需求而生,它仅保留作业元元资料,旨在强化美国金融机构和医疗保健系统所推崇的零信任原则。订阅定价模式允许用户按需付费,无需伺服器维护,并提供仪表板来衡量永续性指标。

永续性和碳足迹要求将加速欧盟企业MPS的实施

根据欧盟气候变迁政策,经检验的二氧化碳减排量是采购标准之一。双面列印预设设定、自动碳粉回收和纸张使用分析已证实,与单面列印工作流程相比,可减少 60% 的排放,达到企业气候责任监测机构设定的到 2030 年碳足迹减少 30-33% 的基准。因此,企业正将多年期管理列印服务 (MPS) 合约授予那些能够提供审核的生命週期分析和低能耗设备的供应商,尤其註重那些获得「蓝天使」或「EPEAT 金级」认证的设备。

斯堪的纳维亚的数位转型导致办公室印刷量下降

北欧企业在电子签章和数位存檔领域处于领先地位,实现了每位员工列印页数两位数的下降。随着基准列印量的下降,传统的按页计费模式面临困境,迫使服务供应商拓展业务,转向工作流程数位化和内容管理。北欧的经验预示着其他成熟经济体在电子帐单发票成为强制性要求和无纸化目标日益普及的情况下,也将出现类似的需求。

细分市场分析

到2024年,印表机和影印机製造商将透过将设备、韧体和耗材捆绑到整合服务合约中,占据41%的託管列印服务市场份额。惠普在列印领域创下了销售纪录。在2025财年,惠普的印刷业务收入达到42亿美元,利润率为19.5%,显示其盈利主要来自硬体。系统整合商/经销商以10.8%的复合年增长率成长,利用其多厂商中立性为受监管客户建构客製化设备群。他们的成长表明,客户更重视服务而非设备品牌。独立软体供应商正透过针对工作流程瓶颈并整合可覆盖各种硬体的分析和列印安全API,提供利基解决方案,从而拓展託管列印服务市场。

客户越来越倾向于与能够量化运作、安全合规性和环境指标的合作伙伴签订合同,而不是按墨粉数量付费。製造商也积极回应,向整合商开放设备遥测数据,共同开发分析工具,并资助通路培训。同时,经销商可以透过开发垂直领域的专业服务(例如 HIPAA 合规性模板),来拓展先前由原始设备製造商 (OEM) 主导的全国客户群。

到2024年,本地部署仍将占据託管列印服务市场65%的份额,主要集中在金融服务、国防和公共产业等产业,这些产业的管治政策限制了外部资料传输。然而,随着企业将列印伺服器迁移到SaaS平台,云端采用率将以每年11.2%的速度成长,从而减轻修补程式管理、伫列管理和驱动程式验证的负担。夏普的Synappx架构将原始文件置于防火墙后,仅保护元资料。这种设计模式在确保云端可扩展性的同时,也降低了主权风险。目前,供应商正在推出混合产品,这些产品可以编配本地输出以处理敏感工作流程,并将标准作业的列印任务发送到云端,使企业能够在保持风险管理的同时轻鬆采用公共云端。

网路保险的先决条件进一步加速了云端技术的普及,SaaS 供应商获得 SOC-2、ISO 27001 和 FedRAMP 认证的速度甚至超过了许多公司对其内部列印伺服器审核的速度。早期采用者报告称,支援工单减少了 30-40%,使 IT 人员能够专注于更高价值的专案。因此,託管列印服务产业正在从装置故障修復转向由不断更新的云端分析支援的持续优化。

託管列印服务市场按通路类型(印表机/影印机製造商、系统整合商/经销商、独立软体供应商 (ISV))、部署类型(本地部署、云端基础)、组织规模(中小企业 (SME)、大型企业)、最终用户行业(银行、金融服务和保险 (BFSI)、医疗保健、IT 和电信、其他)以及地区进行细分。市场预测以美元计价。

区域分析

北美在託管列印服务市场占据领先地位,市占率高达37%,这得益于其成熟的IT生态系统、早期云端采用以及严格的管治标准。企业通常会将安全列印发布功能与其识别及存取管理套件集成,以简化零信任部署。此外,北美还拥有强大的通路生态系统,OEM厂商、经销商和独立软体开发商携手合作,提供从文件撷取到归檔的端到端自动化解决方案。许多美国财富500强企业已承诺在2030年前实现碳中和,并依靠列印设备优化来减少范围3的碳排放。

亚太地区成长最快,预计到2030年复合年增长率将达到12.1%。中国製造商正在寻求预测性维护分析技术来弥补劳动力短缺,确保全天候生产。Canon抓住了这一机会,其印刷业务的销售额预计将在2024年达到25,227亿日圆(约168亿美元)。印度的外包中心正越来越多地将安全拉式列印技术纳入西方客户要求的ISO 27001合规架构中。日本和韩国正努力平衡先进的机器人技术与传统的纸本工作流程,使云端列印编配成为数位转型的桥樑技术。东南亚的中小型企业正在采用订阅式MPS模式来避免资本支出,从而推动了列印量稳步快速成长。

欧洲凭藉其高度成熟的数位化水准和永续性政策的挑战,依然保持着优势。欧盟《企业永续性发展报告指令》要求企业记录其生命週期影响,促使企业进行广泛的设备审核和整合。尤其是在北欧市场,儘管列印页数有所下降,但企业正在将数位化融入剩余的设备采购中。德国、英国和法国透过复杂的多站点企业和公共部门合约来维持需求,这些合约需要BSI C5等高阶安全认证。供应商透过提供碳足迹仪錶板和与列印指标挂钩的自动碳抵销购买功能来脱颖而出。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 优化远距办公和列印基础设施,以推动北美地区 MPS 的普及

- 永续性和碳足迹要求将加速欧盟企业MPS的实施

- 市场成长受中小企业转型为订阅式服务模式驱动

- 医疗保健和政府部门对列印设备的安全性和合规性要求日益提高

- 物联网赋能的车队分析透过减少亚洲大型企业的停机时间,推动市场成长

- 市场限制

- 北欧地区因数位转型导致的办公室列印量下降阻碍了市场发展

- 资料主权问题阻碍了政府云端基础支付系统(MPS)的部署。

- 供应商锁定和合约复杂性阻碍了中小企业的发展。

- 新兴南亚市场对资本支出转变为营运支出会计核算的抵制是市场限制因素。

- 价值链分析

- 监理展望

- 波特五力分析

- 买方的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 评估影响市场的宏观经济趋势

第五章 市场规模与成长预测数据

- 按频道类型

- 印表机/影印机製造商

- 系统整合/经销商

- 独立软体供应商(ISV)

- 透过部署模式

- 本地部署

- 云端基础的

- 按组织规模

- 中小企业

- 大公司

- 按最终用户行业划分

- BFSI

- 卫生保健

- 资讯科技/通讯

- 政府

- 教育

- 其他终端用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 北欧国家

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 中东

- 海湾合作委员会(沙乌地阿拉伯、阿联酋、卡达)

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Xerox Corporation

- Ricoh Company, Ltd.

- HP Inc.

- Canon Inc.

- Brother Industries, Ltd.

- Lexmark International, Inc.

- Konica Minolta, Inc.

- Samsung Electronics Co., Ltd.

- Kyocera Document Solutions Inc.

- Sharp Corporation

- Epson(Seiko Epson Corporation)

- Toshiba Tec Corporation

- FujiFilm Business Innovation Corp.

- Dell Technologies Inc.

- PrintFleet(ECI Software Solutions)

- PaperCut Software International

- Quadient SA

- Arc Document Solutions, Inc.

- EFI(Electronics For Imaging, Inc.)

- FlexPrint Managed Print Solutions

- OKI Electric Industry Co., Ltd.

- Pitney Bowes Inc.

- Wipro Ltd.

第七章 市场机会与未来展望

The managed print services market size is estimated at USD 49.78 billion in 2025 and is is forecast to reach USD 79.23 billion by 2030, expanding at a 9.25% CAGR.

Cloud connectivity, hybrid-work infrastructure, and subscription pricing are converging to lift adoption across large enterprises and an expanding base of small and medium businesses. Security-rich fleets, real-time IoT diagnostics, and automated consumables replenishment are proving decisive in lowering total cost of ownership and reducing unplanned downtime. Demand also reflects mounting sustainability mandates that reward providers able to quantify duplex usage, carbon savings, and paper-waste avoidance. Competitive positioning is shifting as hardware-centric incumbents blend analytics, workflow automation, and device-as-a-service bundles to defend share against cloud-native entrants specializing in AI-driven optimisation. Regional momentum is most pronounced in Asia-Pacific, where large manufacturers and export-oriented enterprises view predictive maintenance as an operational efficiency lever.

Global Managed Print Services Market Trends and Insights

Remote Work Print Infrastructure Optimisation Driving MPS Adoption in North America

Hybrid work has turned distributed print into a cost and security risk, prompting firms to consolidate device management in the cloud. Enterprises are adopting secure-print release, user authentication, and encrypted job routing to maintain compliance while supporting employees who print at headquarters, branch offices, or home. Sharp's Synappx Cloud Print targets this requirement, retaining job metadata only and reinforcing Zero Trust principles, a design favoured by US-based financial institutions and healthcare systems. Subscription pricing aligns spending to usage, eliminates server upkeep, and offers dashboards that benchmark sustainability metrics.

Sustainability and Carbon Footprint Mandates Accelerating EU Corporate MPS

EU climate policies now make verified CO2 reduction a procurement criterion. Duplex defaults, automated toner recycling, and paper-use analytics enable documented 60% emissions cuts relative to single-sided workflows, satisfying Corporate Climate Responsibility Monitor benchmarks that call for 30-33% footprint reductions by 2030. Corporates therefore award multi-year MPS contracts to providers demonstrating auditable lifecycle analytics and low-energy devices, putting a premium on fleets certified to Blue Angel or EPEAT Gold standards.

Declining Office Print Volumes Amid Digital Transformation in Nordics

Scandinavian corporations lead in e-signatures and digital archives, cutting per-employee print by double digits. Traditional cost-per-page models suffer as baseline volumes drop, prompting providers to broaden scopes to workflow digitisation and content management. Nordic lessons foreshadow demand in other mature economies as e-invoicing becomes compulsory and paper elimination targets spread.

Other drivers and restraints analyzed in the detailed report include:

- Shift Toward Subscription-based Everything-as-a-Service Models Among SMEs

- Rising Print-Device Security and Compliance Requirements in Healthcare and Government

- Data Sovereignty Concerns Hindering Cloud-based MPS in Government Agencies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Printer/Copier Manufacturers owned a 41% stake of managed print services market share in 2024 by bundling devices, firmware, and consumables into integrated service agreements. Their captive install base, intellectual property, and direct field-service networks create switching costs that defend renewals. HP logged Printing segment revenue of USD 4.2 billion with a 19.5% margin in FY25, demonstrating hardware-anchored profitability. System Integrators/Resellers, expanding at 10.8% CAGR, capitalise on multi-vendor neutrality to architect bespoke fleets for regulated clients. Their growth signals customer appetite for service depth over device brand. Independent Software Vendors target workflow bottlenecks, embedding analytics and print-security APIs that overlay diverse hardware, thereby widening the managed print services market for niche solutions.

Customers increasingly award contracts to partners able to quantify uptime, security compliance, and environmental metrics rather than sell per-unit toner. Manufacturers answer by opening device telemetry to integrators, co-developing analytics, and funding channel training. Resellers, meanwhile, cultivate vertical specialisation-such as HIPAA compliance templates-that lets them penetrate national account rosters previously dominated by OEMs.

On-premise fleets still represent 65% of managed print services market size in 2024, anchored by financial services, defence, and utilities whose governance policies restrict external data transit. Yet cloud deployments will grow 11.2% annually as enterprises migrate print servers to SaaS platforms, offloading patching, queue management, and driver certification. Sharp's Synappx architecture secures metadata only, leaving raw documents behind the firewall, a design pattern that mitigates sovereignty risks while capturing cloud scalability. Providers now package hybrid offerings that orchestrate on-premise output for sensitive workflows and cloud spooling for standard jobs, enabling firms to ease into public-cloud adoption while maintaining risk controls.

Cyber insurance prerequisites further accelerate cloud, given that SaaS vendors certify against SOC-2, ISO 27001, and FedRAMP faster than many enterprises can audit internal print servers. Early movers report 30-40% support ticket reductions, freeing IT staff for higher-value initiatives. The managed print services industry therefore pivots from device break-fix toward continuous optimisation supported by always-updated cloud analytics.

Managed Print Services Market is Segmented by Channel Type (Printer/Copier Manufacturers, System Integrators/Resellers, Independent Software Vendors (ISVs)), Deployment Mode (On-Premise, Cloud-Based), Organization Size (Small and Medium Enterprises (SMEs), Large Enterprises), End-User Vertical (BFSI, Healthcare, IT and Telecom, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America heads the managed print services market with a 37% slice, underpinned by mature IT ecosystems, early cloud adoption, and stringent governance standards. Enterprises routinely integrate secure-print release with identity-and-access-management suites, streamlining Zero Trust rollouts. Channel ecosystems are deep, with OEMs, resellers, and ISVs collaborating to deliver end-to-end automation from document capture to archiving. The market also benefits from aggressive sustainability commitments by US Fortune 500 firms, many of which have pledged carbon neutrality by 2030 and rely on print fleet optimisation for scope-3 reductions.

Asia-Pacific is the fastest climber, logging a 12.1% CAGR to 2030. Chinese manufacturers procure predictive-maintenance analytics to offset labour shortages and ensure 24 X 7 production, an opportunity seized by Canon, whose Printing Group sales hit Yen 2,522.7 billion (USD 16.8 billion) in 2024. India's outsourcing hubs increasingly embed secure pull printing in ISO 27001 compliance frameworks demanded by Western clients. Japan and South Korea balance advanced robotics with paper-workflow legacies, making cloud print orchestration a bridge technology for digital transformation. Southeast Asian SMEs adopt subscription MPS to avoid capex, contributing incremental but rapid volumes.

Europe exhibits high digital maturity yet remains lucrative owing to sustainability policy headwinds. Companies must document lifecycle impacts under the EU Corporate Sustainability Reporting Directive, prompting widespread fleet audits and device consolidation. Nordic markets, in particular, show declining page volumes but buy workflow digitisation layered onto remaining devices. Germany, the United Kingdom, and France sustain demand through complex multi-site enterprises and public-sector contracts that require advanced security certifications such as BSI C5. Providers differentiate by offering carbon-footprint dashboards and automated carbon offset purchasing tied to print metrics.

- Xerox Corporation

- Ricoh Company, Ltd.

- HP Inc.

- Canon Inc.

- Brother Industries, Ltd.

- Lexmark International, Inc.

- Konica Minolta, Inc.

- Samsung Electronics Co., Ltd.

- Kyocera Document Solutions Inc.

- Sharp Corporation

- Epson (Seiko Epson Corporation)

- Toshiba Tec Corporation

- FujiFilm Business Innovation Corp.

- Dell Technologies Inc.

- PrintFleet (ECI Software Solutions)

- PaperCut Software International

- Quadient SA

- Arc Document Solutions, Inc.

- EFI (Electronics For Imaging, Inc.)

- FlexPrint Managed Print Solutions

- OKI Electric Industry Co., Ltd.

- Pitney Bowes Inc.

- Wipro Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Remote Work Print Infrastructure Optimization Driving MPS Adoption in North America

- 4.2.2 Sustainability and Carbon Footprint Mandates Accelerating EU Corporate MPS

- 4.2.3 Shift Toward Subscription-based Everything-as-a-Service Models Among SMEs Drives the Market

- 4.2.4 Rising Print-Device Security and Compliance Requirements in Healthcare and Government

- 4.2.5 IoT-Enabled Fleet Analytics Reducing Downtime in Large Asian Enterprises Drives the Market

- 4.3 Market Restraints

- 4.3.1 Declining Office Print Volumes Amid Digital Transformation in Nordics Hinders the Market

- 4.3.2 Data Sovereignty Concerns Hindering Cloud-based MPS in Government Agencies

- 4.3.3 Vendor Lock-in Perception and Contract Complexity Discouraging SMEs

- 4.3.4 Capex-to-Opex Accounting Shift Resistance in Emerging South Asian Markets Restraints the Market

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Buyers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Assessment of Macro Economic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Channel Type

- 5.1.1 Printer/Copier Manufacturers

- 5.1.2 System Integrators/Resellers

- 5.1.3 Independent Software Vendors (ISVs)

- 5.2 By Deployment Mode

- 5.2.1 On-Premise

- 5.2.2 Cloud-based

- 5.3 By Organization Size

- 5.3.1 Small and Medium Enterprises (SMEs)

- 5.3.2 Large Enterprises

- 5.4 By End-user Vertical

- 5.4.1 BFSI

- 5.4.2 Healthcare

- 5.4.3 IT and Telecom

- 5.4.4 Government

- 5.4.5 Education

- 5.4.6 Other End-user Verticals

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Nordics

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 GCC (Saudi Arabia, UAE, Qatar)

- 5.5.5.1.2 Turkey

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Xerox Corporation

- 6.4.2 Ricoh Company, Ltd.

- 6.4.3 HP Inc.

- 6.4.4 Canon Inc.

- 6.4.5 Brother Industries, Ltd.

- 6.4.6 Lexmark International, Inc.

- 6.4.7 Konica Minolta, Inc.

- 6.4.8 Samsung Electronics Co., Ltd.

- 6.4.9 Kyocera Document Solutions Inc.

- 6.4.10 Sharp Corporation

- 6.4.11 Epson (Seiko Epson Corporation)

- 6.4.12 Toshiba Tec Corporation

- 6.4.13 FujiFilm Business Innovation Corp.

- 6.4.14 Dell Technologies Inc.

- 6.4.15 PrintFleet (ECI Software Solutions)

- 6.4.16 PaperCut Software International

- 6.4.17 Quadient SA

- 6.4.18 Arc Document Solutions, Inc.

- 6.4.19 EFI (Electronics For Imaging, Inc.)

- 6.4.20 FlexPrint Managed Print Solutions

- 6.4.21 OKI Electric Industry Co., Ltd.

- 6.4.22 Pitney Bowes Inc.

- 6.4.23 Wipro Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment