|

市场调查报告书

商品编码

1651055

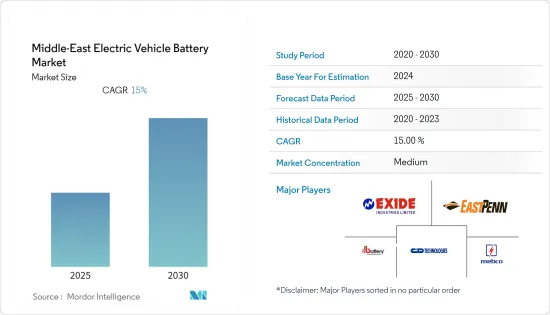

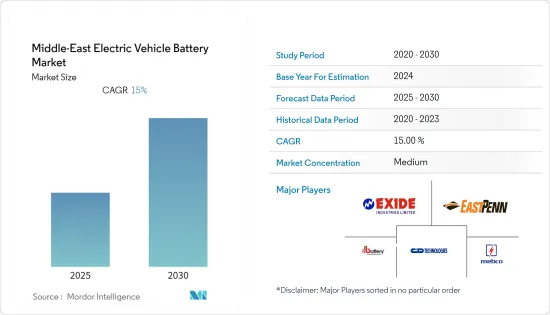

中东电动车电池:市场占有率分析、产业趋势与成长预测(2025-2030 年)Middle-East Electric Vehicle Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预计预测期内中东电动车电池市场复合年增长率将达到 15%。

2020 年,新冠疫情对市场产生了负面影响。目前市场已恢復至疫情前的水准。

关键亮点

- 从长远来看,预计市场将受到阿拉伯联合大公国、沙乌地阿拉伯和阿曼等中东各国和地区日益普及电动车以及政府措施的推动。

- 然而,电动车成本高、钴等关键原材料的供需缺口以及缺乏充电基础设施预计将抑制市场成长。

- 增加对公共充电基础设施的投资以及提高电动车的效率预计将在不久的将来为市场成长创造巨大的机会。

- 由于电动车在全国的普及,阿联酋有望主导市场。

中东电动车电池市场趋势

锂离子电池可望占据市场主导地位

- 锂主要用于电池应用,製造锂电池。 2021年,电池应用领域在中东地区占有最大份额。

- 锂离子电池可分为两类:一次性电池和可充电电池。一次性锂电池使用金属锂作为负极。这些电池比其他标准电池具有更长的寿命(更高的充电密度)。这些电池用于寿命较长的关键设备,例如植入多年的心律调节器和其他电子医疗设备。

- 同样在 2021 年 11 月,澳洲锂探勘和开发公司 Lepidico 宣布已与 AD Ports Group 工业城和自由区丛集的子公司阿布达比哈利法工业区 (KIZAD) 签署协议,建立中东首个利用工程製程的锂离子电池生产设施。工厂用地面积约57,000平方公尺。此外,Lepidico还将投资9,500万美元在阿布达比建造化学转化工厂,初期投资期为25年。

- 此外,2022年3月,杜拜Regency Group与Seashore Group成立的合资企业宣布,计划于2023年1月前推出阿联酋首个电池回收设施,并在两年后推出该地区首个高科技锂离子电池生产工厂。

- 近年来,中东地区的电动车销量大幅成长,这可能是受该地区政府减少二氧化碳排放的主导的推动。 2020 年电动车销量约为 4,421 辆,2021 年将增至 7,554 辆。

- 考虑到以上所有因素,预计预测期内锂离子电池将主导中东电动车市场。

阿拉伯联合大公国发展迅速

- 阿拉伯联合大公国是中东地区领先的经济体之一。近年来,该国乘用车销量不断成长,2020 年乘用车销量约 15.4 万辆,2021 年将上升至 20.8 万辆。

- 然而,OEM製造商正在竞相加快投入资源在阿联酋生产全电动车车型的进程。杜拜一直致力于实现电气化的长期目标。近年来,杜拜推出了多项倡议,鼓励居民做出更永续的选择。

- 例如,作为推进阿联酋绿色交通解决方案议程的一部分,到2030年实现25%的城市出行无人驾驶,该市已在2025年前在全酋长国完成大量充电站的建设。已註册的电动车在2021年之前将免收充电费,并在2022年之前免收停车费。

- 此外,2022 年 5 月,杜拜投资公司 M Glory Holding Group 宣布可能很快就会开设一家电动车製造厂,这表明其作为阿联酋製造业扩大策略的一部分,将进入竞争激烈的电动车市场。该工厂投资 15 亿澳元,将建在杜拜工业城,总占地 93,000平方公尺,将成为中东地区最大的工厂之一,目标是每年生产 55,000 辆电动车。这将导致汽车对电动车电池的使用增加。

- 此外,2022年9月,阿布达比哈利法工业区宣布将建造一个25,000平方公尺的电动车组装工厂,由智慧电动车(EV)公司NWTN运营,从事电动车製造、研发和车辆测试。该设施将由 NWTN 运营,这是一家从事电动车 (EV) 製造、研发和车辆检测的智慧电动汽车公司。

- 因此,基于上述几点和该国最近的趋势,预计阿联酋在预测期内将大幅成长。

中东电动车电池产业概况

中东的电动车电池市场是细分的。主要企业(不分先后顺序)包括 C&D Technologies Inc.、East Penn Manufacturing Co. Ltd.、Exide Industries Ltd.、First National Battery Pty Ltd 和 Middle East Battery Company (MEBCO)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 2027 年市场规模及需求预测(十亿美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场区隔

- 电池类型

- 铅酸电池

- 锂离子电池

- 其他电池类型

- 汽车模型

- 纯电动车 (BEV)

- 插电式混合动力汽车(PHEV)

- 混合动力电动车 (HEV)

- 地区

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 阿曼

- 其他中东地区

第六章 竞争格局

- 併购、合资、合作、协议

- 主要企业策略

- 公司简介

- East Penn Manufacturing Co. Inc

- C&D Technologies Inc.

- Exide Industries Ltd

- First National Battery Pty Ltd

- Middle East Battery Company(MEBCO)

- GS Yuasa Corporation

- Mebco

- Tesla Inc.

第七章 市场机会与未来趋势

The Middle-East Electric Vehicle Battery Market is expected to register a CAGR of 15% during the forecast period.

COVID-19 negatively impacted the market in 2020. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Over the long term, Factors such as the growing usage of electric vehicles across various countries and Middle-Eastern regions such as the United Arab Emirates, Saudi Arabia, and Oman with supportive government policies are expected to drive the market.

- On the other note, the high cost of electric vehicles, the demand-supply gap of vital raw materials such as cobalt, and the lack of charging infrastructure are expected to restrain the market's growth.

- Nevertheless, increasing investments in deploying the public charging infrastructure clubbed with the increasing efficiency of the electric vehicle are expected to create a significant opportunity for the market's growth in the near future.

- The United Arab Emirates is expected to dominate the market due to the growing usage of electric vehicles across the country.

Middle-East Electric Vehicle Battery Market Trends

Lithium-ion Battery is Expected to Dominate the Market

- Lithium is majorly used in battery applications for the production of lithium batteries. The battery application segment accounted for the largest share of the Middle-Eastern region in 2021.

- Lithium-ion batteries can be categorized into two segments, namely, disposable and rechargeable. Disposable lithium batteries use lithium in the metallic form as an anode. These batteries have a longer life (high charge density) than other standard batteries. These batteries find applications in critical devices with long life, such as pacemakers and other electronic medical devices implanted for many years.

- Also, in November 2021, Australian lithium exploration and development company Lepidico announced the signing of an agreement with Khalifa Industrial Zone Abu Dhabi (KIZAD), a subsidiary of AD Ports Group's Industrial Cities & Free Zone cluster, to establish the first lithium-ion battery production facility in the Middle East, utilizing a first of its kind designed process. The plant covers a land area of around 57,000 sqm. Additionally,y Lepidico plans to invest USD 95 million for the chemical conversion plant in Abu Dhabi for an initial term of 25 years.

- Furthermore, in March 2022, a joint venture between Dubai's Regency Group and Seashore Group announced their plans to launch the first battery recycling facility in the UAE by January 2023 and the region's first hi-tech lithium-ion battery production plant in two years.

- In the last couple of years, there has been a significant rise in EV sales in the Middle East region, which can be ascribed to the government initiative to lower carbon emissions in the region. In 2020, the total EV sales were around 4,421 units which increased to 7,554 units in 2021.

- Owing to the o above points, Lithium-ion battery is expected to dominate the Middle-East Electric Vehicle Market during the forecast period.

United Arab Emirates to Grow Significantly

- The United Arab Emirates is one of the leading economies in the Middle East region. In the last couple of years, the country witnessed a rise in passenger car sales; in 2020, the passenger car sales were around 1,54 thousand units which increased to 208 thousand units in 2021.

- However, OEM manufacturers are competing to expedite the process of dedicating resources to create fully electric models in the United Arab Emirates. Dubai has been working toward its long-term goal of electrification. It has launched several initiatives over the past few years to encourage sustainable choices among its residents.

- For instance, to promote the United Arab Emirates' plans for green mobility solutions and as part of its plan to have 25% of the city's trips converted into driverless journeys by 2030, the city completed the construction of a significant number of charging stations in the emirate by 2025. It exempts registered electric vehicles from charging fees until 2021 and parking fees until 2022.

- Further, in May 2022, M Glory Holding Group, an investment company in Dubai, announced it is soon likely to open an EV manufacturing plant, marking its foray into the highly competitive EV market amid the UAE's strategy to expand its manufacturing sector. The AED 1.5 billion facility at Dubai Industrial City - which will have a total land area of 93,000 square meters - will be one of the largest in the Middle East and aims to make 55,000 EVs a year. This, in turn, culminates in the growth in the usage of EV batteries for vehicles.

- Additionally, in September 2022, Khalifa Industrial Zone Abu Dhabi announced that it would construct a 25,000 square meter electric vehicle assembly facility, which will be operated by NWTN, an intelligent electric vehicle (EV) company for the manufacturing, research and development, and vehicle testing of electric vehicles. This will aid in the usage of EV batteries across the country.

- Therefore, owing to the above points and the country's recent developments, the United Arab Emirates is expected to grow significantly in the forecast period.

Middle-East Electric Vehicle Battery Industry Overview

The Middle-East Electric Vehicle Battery Market is fragmented. Some of the key players (in no particular order) include C&D Technologies Inc., East Penn Manufacturing Co. Inc., Exide Industries Ltd, First National Battery Pty Ltd, and Middle East Battery Company (MEBCO).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lead-acid Battery

- 5.1.2 Lithium-ion Battery

- 5.1.3 Other Battery Types

- 5.2 Vehicle Type

- 5.2.1 Battery Electric Vehicle (BEV)

- 5.2.2 Plug-in Hybrid Electric Vehicle (PHEV)

- 5.2.3 Hybrid Electric Vehicle (HEV)

- 5.3 Geography

- 5.3.1 Saudi Arabia

- 5.3.2 The United Arab Emirates

- 5.3.3 Oman

- 5.3.4 Rest of Middle-East

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 East Penn Manufacturing Co. Inc

- 6.3.2 C&D Technologies Inc.,

- 6.3.3 Exide Industries Ltd,

- 6.3.4 First National Battery Pty Ltd

- 6.3.5 Middle East Battery Company (MEBCO)

- 6.3.6 GS Yuasa Corporation

- 6.3.7 Mebco

- 6.3.8 Tesla Inc.