|

市场调查报告书

商品编码

1651062

电力零售 -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Electricity Retailing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

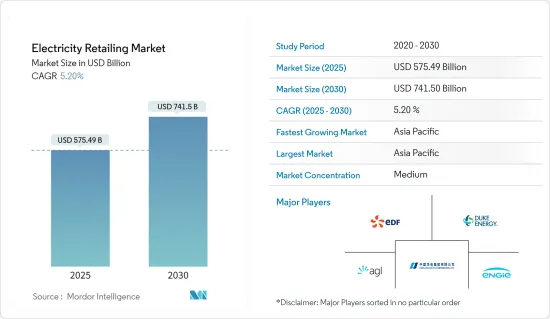

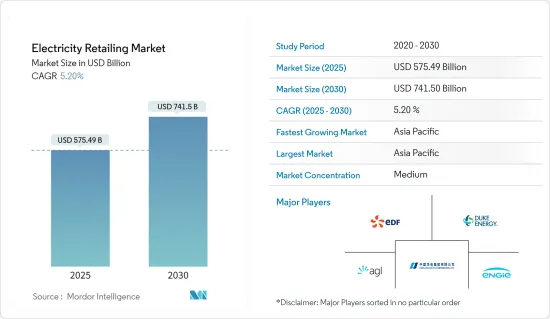

预计 2025 年电力零售市场规模为 5,754.9 亿美元,预计到 2030 年将达到 7,415 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.2%。

关键亮点

- 从中期来看,预计预测期内电力需求的增加和电动车的普及将推动市场发展。

- 另一方面,预计分散式发电的新来源将抑制市场成长。

- 预计预测期内,电力零售市场的技术进步(例如先进的电錶)和撒哈拉以南非洲地区的电力需求将为市场创造机会。

- 由于 2022 年电力消耗需求最高,预计亚太地区将在预测期内占据市场主导地位。

主要市场趋势

住宅市场预计将占据大部分市场份额

- 住宅用电包括照明、暖气、冷气、电器产品、电脑、电子设备、机械和公共运输系统的运作用电。

- 美国占全球发电量的很大份额。 2022年,美国占全球发电量的15.6%。

- 美国能源资讯署预计,2022年美国全社会电力消耗量4.5兆千瓦时,比1950年高出14倍,创历史新高。总终端消费量电量包括销售给消费者的零售电力和直接用电量。

- 此外,2022年住宅部门的零售电力份额为38.9%,比2021年高出3.5%。 2022 年美国住宅部门零售电力总消费量为 1.42 兆千瓦时。

- 智慧电錶是面向未来技术的关键指标,它的采用为智慧电网铺平了道路,它透过常见的无线服务技术实现了配电公司和消费者之间的双向即时通讯。政府对安装智慧电錶的支援预计将增加零售电力需求。在住宅领域,智慧电錶可以提高客户电力服务的可靠性和质量,追踪客户的用电情况,并做出减少能源消费量和节省电费的明智决策。

- 例如,2022年4月,欧盟为清洁能源领域的五个计划拨款约1.34亿美元。塞尔维亚的计划将支持该国电力分配系统中采用智慧电錶。这笔资金将用于克拉列沃、恰克和尼什市智慧电錶安装第一阶段。

- 考虑到以上所有因素,住宅领域预计将占据主要市场占有率。

亚太地区可望主导市场

- 亚太地区拥有全球 50% 以上的人口和 60% 的大城市。随着人口的快速增长和工业化的推进,非洲大陆将迎来数百万新电力用户,未来几年非洲大陆的电力需求将不断增加。

- 根据世界能源资料统计评论,2022年亚太地区初级能源消费量将为277.6艾焦耳,与前一年同期比较去年同期成长2.1%。中国等国家是电力需求最大的国家,占世界能源消费量总量的26.4%。

- 各地方政府也正在采取措施,将现代技术应用于电力零售。亚太地区的许多国家需要更多的输电和配电(T&D)网路。为了向这些地区供应电力,该地区的国家正在大力投资建造输电网路和智慧电錶系统。

- 例如,印度政府根据电力分配部门现代化计划 (RDSS) 于 2023 年 3 月实施了全国智慧计量计划。根据该计划,印度政府计划在全国安装超过2.5亿个智慧电錶。

- 因此,预计亚太地区将在预测期内占据市场主导地位。

竞争格局

全球零售电力市场适度细分。主要企业(不分先后顺序)包括 Engie SA、AGL Energy Ltd.、中国华电集团有限公司 (CHD)、杜克能源公司和法国电力公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概况

- 介绍

- 2028 年市场规模及需求预测(十亿美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 电力需求不断成长

- 电动车日益普及

- 限制因素

- 分散式发电的新来源

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场区隔

- 最终用户

- 住宅

- 商务用

- 工业的

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 英国

- 法国

- 义大利

- 德国

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东和非洲地区

- 北美洲

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Engie SA

- AGL Energy Ltd.

- China Huadian Corporation LTD.(CHD)

- Duke Energy Corporation

- Electricite de France SA.

- Enel SpA

- Keppel Electric Pte. Ltd.

- Tata Power Co. Ltd.

- E.ON SE

- Iberdrola SA

第七章 市场机会与未来趋势

- 透过电力零售业的数位技术提高客户参与

简介目录

Product Code: 50000761

The Electricity Retailing Market size is estimated at USD 575.49 billion in 2025, and is expected to reach USD 741.50 billion by 2030, at a CAGR of 5.2% during the forecast period (2025-2030).

Key Highlights

- Over the medium period, the increase in the demand for electricity and the rising adoption of electric vehicles is expected to drive the market in the forecast period.

- On the other hand, new sources of distributed electricity generation are expected to restrain the market's growth.

- Nevertheless, advancements in the technology of the electricity retail market, like advanced meter and the requirement of power in the sub-Saharan Africa region, is expected to create opportunity for the market in the forecast period.

- Asia-Pacific is expected to dominate the market in the forecast period owing to the highest demand for electricity consumption in 2022.

Key Market Trends

Residential Segment is Expect to have a Significant Share in the Market

- Residential electricity use includes using electricity for lighting, heating, cooling, refrigeration, and operating appliances, computers, electronics, machinery, and public transportation systems.

- The United States has a significant share in World's electricity generation. In 2022, the country's share was 15.6% of the World's electricity generation.

- According to U.S. Energy Information Administration, total electricity consumption in the United States was about 4.05 trillion kWh in 2022, the highest amount recorded and 14 times greater than electricity use in 1950. Total electricity end-use consumption includes retail electricity sales to consumers and direct electricity use.

- Additionally, in 2022, the residential sector's retail electricity share was 38.9% of total electricity retail sales, 3.5% higher than in 2021. The total retail electricity consumption of the residential sector in the United States accounted for 1.42 trillion kWh in 2022.

- The adoption of smart meters, a significant measure of future-ready technologies, paves the way for the smart grid by enabling two-way real-time communication between distribution companies and consumers through general package radio services technologies. With supportive government policies for installing smart meters, the demand for retail electricity is expected to increase. In the residential sector, using smart meters can help improve the reliability and quality of electricity service for customers, track their electricity usage, and make informed decisions about reducing their energy consumption and saving money on their bills.

- For instance, in April 2022, European Union allocated around USD 134 million for five projects in the clean energy sector, including Advanced System for Remote Meter Reading Project. The project in Serbia will help the introduction of smart metering in the electricity distribution system in Serbia. The funds will be used for the first phase of smart meter deployment in Kraljevo, Cacak, and Nis.

- Thus, owing to the above points, the residential segment is expected to hold a significant market share.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific is home to more than 50% of the global population and 60% of the large cities. The continent will face increasing demand for power in the future as millions of new customers are gaining access to electricity, with rapid population growth and industrialization.

- According to the Statistical Review of World Energy Data, in 2022, Asia-Pacific's total primary energy consumption accounted for 277.6 Exajoules, an annual growth rate of 2.1% compared to the previous year. A country like China has the highest electricity demand, accounting for 26.4 % of total world energy consumption.

- Various regional governments are also taking steps to apply modern technology in electricity retailing. Many countries in Asia-Pacific need more transmission and distribution (T&D) networks, and hence, electricity is not available in some of the remote and rural areas. To bring electricity to these areas, the countries in the region are investing heavily in building a transmission line network and smart metering system.

- For instance, in March 2023, the government of India implemented a nationwide Smart Meter program in the Revamped Distribution Sector Scheme (RDSS). Under this scheme, the government of India aims to install over 25 crore Smart Meters is envisaged across the country.

- Thus, owing to the above points, Asia-Pacific is expected to dominate the market in the forecast period.

Competitive Landscape

The global electricity retailing market is moderately fragmented. Some of the major companies (in no particular order) include Engie SA, AGL Energy Ltd., China Huadian Corporation LTD. (CHD), Duke Energy Corporation., and Electricite de France SA., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increase in the Demand for Electricity

- 4.5.1.2 Rising Adoption of Electric Vehicles

- 4.5.2 Restraints

- 4.5.2.1 New Sources of Distributed Electricity Generation

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 End-User

- 5.1.1 Residential

- 5.1.2 Commercial

- 5.1.3 Industrial

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States of America

- 5.2.1.2 Canada

- 5.2.1.3 Rest of the North America

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 France

- 5.2.2.3 Italy

- 5.2.2.4 Germany

- 5.2.2.5 Rest of the Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 South Korea

- 5.2.3.5 Rest of the Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of the South America

- 5.2.5 Middle-East & Africa

- 5.2.5.1 United Arab Emirates

- 5.2.5.2 Saudi Arabia

- 5.2.5.3 Rest of the Middle-East & Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Engie SA

- 6.3.2 AGL Energy Ltd.

- 6.3.3 China Huadian Corporation LTD. (CHD)

- 6.3.4 Duke Energy Corporation

- 6.3.5 Electricite de France SA.

- 6.3.6 Enel S.p.A.

- 6.3.7 Keppel Electric Pte. Ltd.

- 6.3.8 Tata Power Co. Ltd.

- 6.3.9 E.ON SE

- 6.3.10 Iberdrola SA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Using Digital Technologies in Electricity Retailing to Improve Customer Engagement

02-2729-4219

+886-2-2729-4219