|

市场调查报告书

商品编码

1683126

冷冻干燥设备和服务:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Lyophilization Equipment And Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

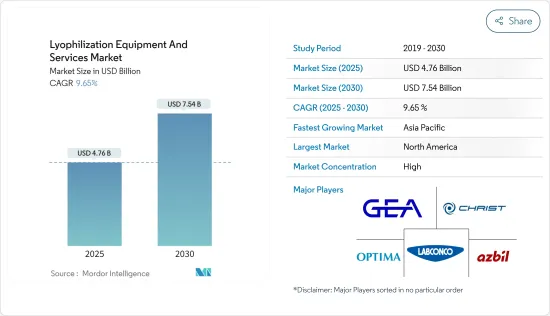

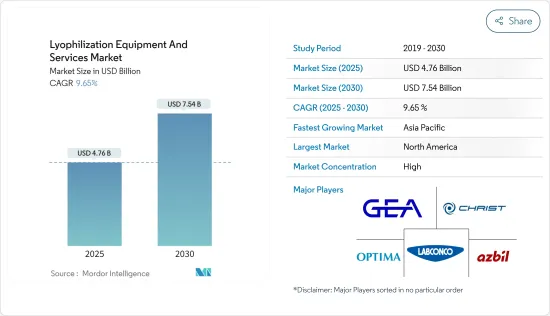

冷冻干燥设备和服务市场规模预计在 2025 年为 47.6 亿美元,预计到 2030 年将达到 75.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 9.65%。

大趋势推动市场成长在製药、生物技术和食品加工行业的主要大趋势的推动下,冷冻干燥设备和服务市场正在经历显着增长。这些驱动因素包括对生物製药日益增长的需求、向个人化医疗的转变以及消费者对保质期较长的方便食品日益增长的偏好。这些行业中冷冻干燥技术的日益广泛应用加上技术的进步推动了这些趋势,刺激了创新和市场扩张。

冷冻干燥产品的需求不断增加:冷冻干燥产品的需求正在迅速增加,尤其是在製药和生物技术领域。冷冻干燥可以延长保质期、提高稳定性和易用性,这对于现代药物开发至关重要。这一趋势对于注射生物製药来说尤其重要,因为它在慢性病管理中发挥着越来越重要的作用。此外,冷冻干燥产品无需低温运输物流,降低了运输和储存成本,使其成为全球医疗保健领域的宝贵解决方案。

冷冻干燥技术的进步:冷冻干燥技术的创新正在透过提高效率、扩充性和安全性来改变市场。与传统的批量方法相比,连续冷冻干燥製程可以提高产量并降低营业成本。无菌冷冻干燥技术采用先进的隔离系统,进一步提高了药品和生技药品的无菌性,并最大限度地降低了污染风险。这项技术进步对于需要精确控制和无菌的产业尤其重要。

扩大应用和工业应用:虽然传统上专注于製药和食品加工,但冷冻干燥在化妆品、营养保健品和工业酵素领域找到了新的应用。在化妆品产业,冷冻干燥可增强活性成分的稳定性和功效,并延长产品的保存期限。在膳食补充剂行业,它有助于保持维生素和矿物质的完整性,满足消费者对高品质膳食补充剂的需求。冷冻干燥技术在这些领域的扩展表明了其对整个行业日益增长的重要性。

持续创新和客製化:客製化冷冻干燥解决方案以满足特定行业需求的趋势日益增长。製造商正在改进冷冻干燥机的设计,以整合先进的自动化和能源效率等功能。用于个人化医疗和生技药品等小众应用的专用设备的开发也在增加。随着企业寻求解决敏感材料和小批量生产带来的独特挑战,这种客製化和持续创新的需求正在塑造市场的未来。

冷冻干燥设备和服务的市场趋势

干燥机类型细分:主导冷冻干燥设备市场

细分市场概况:干燥机类型包括托盘式、歧管式和旋转式冷冻干燥机,占约 45% 的市占率。每种干燥机类型都可以满足特定的行业需求,从製药製造到食品加工。冷冻干燥设备在保存精细材料方面发挥着至关重要的作用,并且在许多不同领域已成为不可或缺的设备。现代冷冻干燥机的多功能性和效率凸显了其优越性,确保了其在冷冻干燥设备市场继续占据主导地位。

成长动力与未来预期:对冷冻干燥产品的需求不断增加,推动了干燥机类型的成长。冷冻干燥技术的进步提高了冷冻干燥机的效率,在满足复杂製药和生物技术产品的保存需求方面发挥关键作用。随着生物製药和个人化医疗变得越来越普遍,这一趋势预计将持续下去,进一步推动对先进冷冻干燥设备的需求。

竞争策略与未来颠覆:公司正专注于增强冷冻干燥机的功能,例如节能设计、提高自动化程度以及整合物联网以实现即时流程监控。在技术创新的推动下,製造商正在开发可用于广泛应用的紧凑型、多功能干燥机。然而,新的干燥技术或监管变化等潜在干扰可能会威胁传统冷冻干燥方法的主导地位,因此需要企业保持灵活性。

亚太地区:冷冻干燥市场成长的中心

区域成长动力:亚太地区正成为冷冻干燥设备和服务成长最快的市场,预计 2024 年至 2029 年的复合年增长率为 10%。在製药和生物技术等行业的快速应用推动下,该市场预计到 2029 年将超过 22 亿美元。该地区的成长将受到中国和印度等国家的推动,这些国家正在大力投资国内製药生产和研究能力。

驱动因素和市场预期:中国和印度分别以 10.2% 和 11% 的成长率引领成长。推动这一增长的因素包括药品生产的扩大、生物技术研究的增加以及对优质食品的需求的增加。此外,政府推动本地製造业的倡议和中阶对优质医疗产品日益增长的需求也是推动该地区市场扩张的关键因素。

策略挑战与潜在干扰:为了抓住亚太地区的成长机会,公司正在建立本地製造工厂,与地区参与者伙伴关係,并客製化产品以满足当地的监管要求。然而,各国经济发展和技术采用水准不同,带来了挑战。公司需要製定特定地点的策略来保持竞争力,并应对法律规范的变化和本地竞争对手的崛起等潜在干扰。

冷冻干燥设备和服务业概况

主导市场格局的全球参与者:全球冷冻干燥设备和服务市场由拥有丰富专业知识的领先跨国公司主导。 GEA 集团、Optima Packaging Group 和 Martin Christ Gefriertrocknungsanlagen GmbH 等市场领导凭藉对研发的持续投入、全面的产品系列和全球影响力,保持了相当的市场占有率。这些公司正专注于创新以保持竞争力。

市场领导利用技术专长:主要企业透过整合自动化、物联网和连续处理技术来推动市场创新。例如,GEA 集团在研发方面的大量投资(占销售额的 2.3%)凸显了该产业对冷冻干燥技术进步的承诺。这些公司还透过提供一系列服务(例如维护和流程优化)来增强其价值提案并加强客户关係。

未来市场成功的策略:未来的成功将取决于连续处理和自动化的进步,以及满足对生技药品和个人化药物日益增长的需求的能力。例如,BioPharma Group 用于小规模生产的新型 GMP 冷冻干燥设施证明了个人化医疗中细分能力的重要性。此外,我们与生技和製药公司的策略合作对于在不断变化的环境中保持竞争力至关重要。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素

- 冻干产品需求不断增加

- 冷冻干燥技术的进步

- 市场限制

- 製药和生物技术行业越来越多地使用替代干燥技术

- 冷冻干燥设备的安装和维护成本高

- 波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

5. 市场区隔(市场规模-美元)

- 按方式

- 干燥机类型

- 托盘式冷冻干燥机

- 歧管式冻干机

- 旋转冷冻干燥机

- 其他产品

- 配件

- 真空系统

- CIP 系统

- 干燥室

- 其他配件

- 服务

- 干燥机类型

- 按应用

- 食品加工和包装

- 製药和生物技术製造

- 其他用途

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 其他亚太地区

- 中东和非洲

- GCC

- 南非

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 北美洲

第六章 竞争格局

- 公司简介

- AZBIL KIMMON CO., LTD.(AzbilTelstar, SLU)

- GEA Group Aktiengesellschaft

- Labconco Corporation

- Martin Christ Gefriertrocknungsanlagen GmbH

- Millrock Technology Inc

- Optima Packaging Group GmbH

- ATS(SP Industries)

- Tofflon Science and Technology Co. Ltd

- Lyophilization Technology Inc.

第七章 市场机会与未来趋势

The Lyophilization Equipment And Services Market size is estimated at USD 4.76 billion in 2025, and is expected to reach USD 7.54 billion by 2030, at a CAGR of 9.65% during the forecast period (2025-2030).

Megatrends Driving Market Growth: The Lyophilization Equipment and Services Market is experiencing significant growth, propelled by key megatrends across pharmaceutical, biotechnology, and food processing industries. These drivers include the rising demand for biopharmaceuticals, the shift toward personalized medicine, and the growing consumer preference for convenience foods with extended shelf lives. The increasing use of lyophilization in these industries, combined with technological advancements, supports these trends, fostering innovation and market expansion.

Rising Demand for Lyophilized Products: The demand for lyophilized products has risen sharply, especially within the pharmaceutical and biotech sectors. Lyophilization offers extended shelf life, stability, and ease of use, which are critical for modern drug development. This trend is particularly relevant for injectable biopharmaceuticals, which play an increasingly prominent role in managing chronic diseases. Moreover, lyophilized products eliminate the need for cold chain logistics, reducing transportation and storage costs, making them a valuable solution in global healthcare.

Technological Advancements in Lyophilization Methods: Innovations in lyophilization technology are transforming the market, driving enhanced efficiency, scalability, and safety. Continuous freeze-drying processes, which outperform traditional batch systems, allow for greater throughput and lower operating costs. Aseptic lyophilization technologies further enhance the sterility of pharmaceuticals and biologics, incorporating advanced isolator systems to minimize contamination risks. This technological progress is particularly significant in industries requiring precise control and sterile conditions.

Expanding Applications and Industry Adoption: While traditionally dominated by pharmaceuticals and food processing, lyophilization is finding new applications in cosmetics, nutraceuticals, and industrial enzymes. In cosmetics, lyophilization enhances the stability and potency of active ingredients, extending product shelf life. In the nutraceutical industry, it helps preserve the integrity of vitamins and minerals, meeting consumer demand for high-quality health supplements. The expansion of lyophilization into these sectors indicates its growing importance across a broader range of industries.

Continuous Innovation and Customization: There is a growing trend toward customized lyophilization solutions tailored to specific industry needs. Manufacturers are enhancing freeze-dryer designs, integrating features like advanced automation and energy efficiency. The development of specialized equipment for niche applications, such as personalized medicine and biologics, is also on the rise. This demand for customization and continuous innovation is shaping the future of the market, as companies seek to meet the unique challenges posed by sensitive materials and small-batch production.

Lyophilization Equipment & Services Market Trends

Dryer Type Segment: Dominating the Lyophilization Equipment Landscape

Segment Overview: The dryer type segment, encompassing tray, manifold, and rotary freeze dryers, commands nearly 45% of the market. Each dryer type serves specific industry needs, from pharmaceutical manufacturing to food processing. Freeze-drying equipment plays a crucial role in preserving sensitive materials, making it indispensable across multiple sectors. The versatility and efficiency of modern freeze dryers underscore their dominance, ensuring their continued prominence in the lyophilization equipment market.

Growth Drivers and Future Expectations: The rise in demand for lyophilized products is fueling the growth of the dryer type segment. Advances in lyophilization technology are making freeze dryers more efficient, thus playing a critical role in meeting the preservation needs of complex pharmaceuticals and biotech products. This trend is set to continue as biopharmaceuticals and personalized medicine become more prevalent, driving further demand for sophisticated freeze-drying equipment.

Competitive Strategies and Future Disruptions: Companies are focusing on enhancing freeze dryer capabilities with energy-efficient designs, increased automation, and integration of IoT for real-time process monitoring. The drive for innovation is pushing manufacturers to create compact, versatile dryers that cater to a wide range of applications. However, potential disruptions, such as new drying technologies or regulatory changes, could challenge the dominance of traditional freeze-drying methods, requiring companies to remain agile.

Asia-Pacific: The Epicenter of Lyophilization Market Growth

Regional Growth Dynamics: The Asia-Pacific region is emerging as the fastest-growing market for lyophilization equipment and services, with a projected CAGR of 10% between 2024 and 2029. By 2029, the market is expected to exceed USD 2.2 billion, driven by rapid adoption across industries such as pharmaceuticals and biotechnology. The region's growth is led by countries like China and India, which are investing heavily in domestic pharmaceutical manufacturing and research capabilities.

Driving Forces and Market Expectations: China and India are leading the charge with growth rates of 10.2% and 11%, respectively. Factors driving this growth include expanding pharmaceutical production, increased biotech research, and rising demand for high-quality food products. Government initiatives aimed at boosting local manufacturing and the burgeoning middle class's demand for quality healthcare products are also critical drivers of market expansion in the region.

Strategic Imperatives and Potential Disruptions: To capture the growth opportunities in Asia-Pacific, companies are establishing local manufacturing plants, forming partnerships with regional players, and tailoring products to meet local regulatory requirements. However, varying levels of economic development and technology adoption across countries pose challenges. Companies need to craft region-specific strategies to remain competitive and navigate potential disruptions, such as shifting regulatory frameworks or emerging local competitors.

Lyophilization Equipment & Services Industry Overview

Global Players Dominate the Market Landscape: The global lyophilization equipment and services market is dominated by large, multinational players with specialized expertise. Market leaders such as GEA Group, Optima Packaging Group, and Martin Christ Gefriertrocknungsanlagen GmbH maintain significant market shares due to their continuous investment in R&D, comprehensive product portfolios, and global reach. These companies focus heavily on innovation to maintain their competitive edge.

Market Leaders Leverage Technological Expertise: Key players are driving market innovation by integrating automation, IoT, and continuous processing technologies. For instance, GEA Group's significant investment in R&D (2.3% of revenue) highlights the industry's commitment to advancing lyophilization technology. These companies also offer a range of services, including maintenance and process optimization, enhancing their value propositions and strengthening customer relationships.

Strategies for Future Market Success: Future success will depend on advancements in continuous processing and automation, as well as the ability to meet the growing demand for biologics and personalized medicine. For example, Biopharma Group's new GMP freeze-drying facility for small-batch production demonstrates the importance of niche capabilities in personalized medicine. Strategic collaborations with biotech and pharmaceutical firms will also be crucial for maintaining competitiveness in this evolving landscape.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for Lyophilized Products

- 4.2.2 Technological Advancements in Lyophilization Methods

- 4.3 Market Restraints

- 4.3.1 Increasing Utilization of Alternative Drying Techniques in the Pharmaceutical and Biotechnology Industries

- 4.3.2 High Setup and Maintenance Cost of Freeze-Drying Equipment

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD)

- 5.1 By Modality

- 5.1.1 Dryer Type

- 5.1.1.1 Tray-style Freeze Dryers

- 5.1.1.2 Manifold Freeze Dryers

- 5.1.1.3 Rotary Freeze Dryers

- 5.1.1.4 Other Products

- 5.1.2 Accessories

- 5.1.2.1 Vacuum Systems

- 5.1.2.2 CIP (Clean-in-place) Systems

- 5.1.2.3 Drying Chamber

- 5.1.2.4 Other Accessories

- 5.1.3 Services

- 5.1.1 Dryer Type

- 5.2 By Application

- 5.2.1 Food Processing and Packaging

- 5.2.2 Pharmaceutical and Biotech Manufacturing

- 5.2.3 Other Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 AZBIL KIMMON CO., LTD. (AzbilTelstar, SLU)

- 6.1.2 GEA Group Aktiengesellschaft

- 6.1.3 Labconco Corporation

- 6.1.4 Martin Christ Gefriertrocknungsanlagen GmbH

- 6.1.5 Millrock Technology Inc

- 6.1.6 Optima Packaging Group GmbH

- 6.1.7 ATS (SP Industries)

- 6.1.8 Tofflon Science and Technology Co. Ltd

- 6.1.9 Lyophilization Technology Inc.