|

市场调查报告书

商品编码

1762541

冷冻干燥服务市场:产业趋势及全球预测 - 依冷冻干燥生物製剂类型、依初级包装系统类型、依主要地区Lyophilization Services Market : Industry Trends and Global Forecasts - Distribution by Type of Biologic Lyophilized, Type of Primary Packaging System and Key Geographies |

||||||

冷冻干燥服务市场:概览

预计2035年,全球冷冻干燥服务市场规模将从目前的26亿美元成长至49亿美元,预测期内年复合成长率为6.3%。

市场区隔包括以下参数的市场规模与机会分析:

冷冻干燥生物製品类型

- 抗体

- 细胞与基因治疗药物

- 疫苗

- 其他生物製品

初级包装系统类型

- 小瓶

- 注射器

- 卡式瓶

- 安瓿瓶

- 其他

主要地区

- 北美

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和北非

冷冻干燥服务市场:成长与趋势

冷冻干燥是一种药物稳定技术,可透过冷冻干燥去除多余的溶剂(例如水),同时保留药物的化学性质。冷冻干燥技术通常使用实验室冷冻干燥机、非无菌冷冻干燥机和可灭菌冷冻干燥机等专用设备进行冷冻干燥。值得注意的是,多年来,冷冻干燥已成为实现更长、更符合商业可行性的保存期限以及稳定干燥生物製剂的首选方法。然而,生物相似药和新型生物製剂的快速成长,以及生物製剂冷冻干燥製程的挑战,使得利害关係人更加依赖在该领域提供多学科专业知识的服务提供者。

此外,一些市场领导者加速探索冷冻干燥技术的进步和创新,以提高营运效率并实现干燥过程中的製程控制。使整个製程更加高效。例如,连续冷冻干燥系统和自动化冷冻干燥系统等现代技术鼓励行业领导者采用这些技术,并满足客户客製化的冷冻干燥服务需求。

冷冻干燥服务市场:关键洞察

本报告分析了冷冻干燥服务市场的现状,并探讨了潜在的成长机会。主要调查结果包括:

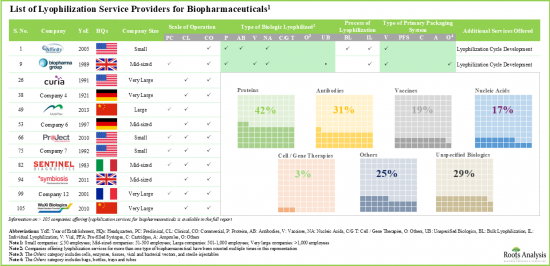

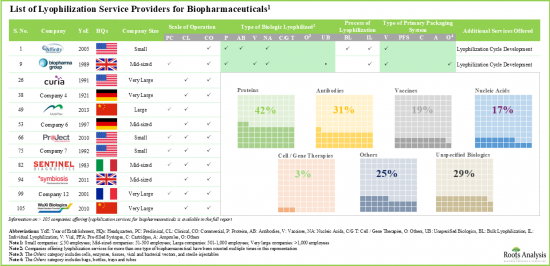

- 目前,超过 105 家服务提供者声称拥有为各种生物疗法药物(包括蛋白质、抗体、核酸和细胞/基因疗法)提供冷冻干燥服务的必要专业知识。

- 目前的市场格局高度分散,新进业者和现有企业都位于关键地区。

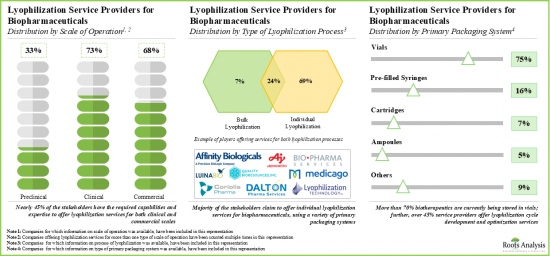

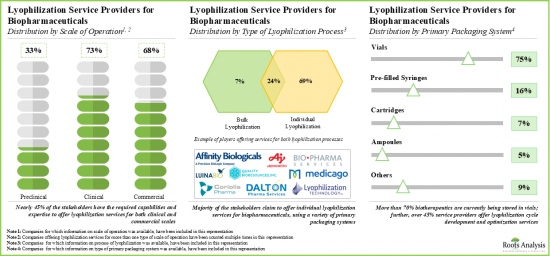

- 利害关係人利用其专业知识提供各种规模的冷冻干燥服务。此外,小瓶已成为储存生物製剂的首选初级包装系统。

- 为了因应不断变化的监管环境,服务提供者扩展其产品组合,以满足客户的客製化需求。

- 合作活动的增加表明了人们对该领域日益成长的兴趣;事实上,与生物製剂冷冻干燥相关的合作数量已达到两年来的最高水准。

- 为了满足日益成长的需求,许多公司采取扩张措施,以增强其服务组合,包括建立新设施和扩大现有产能。

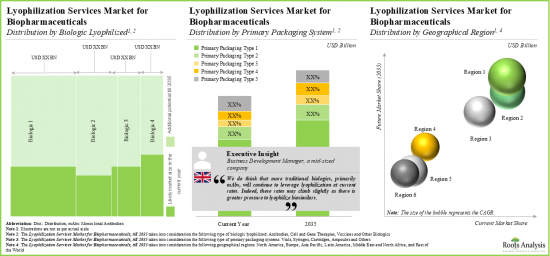

- 预计到2035年,该市场将保持稳定成长,预计机会将均匀分布在各种类型的生物製剂冷冻干燥、初级包装系统和地理区域。

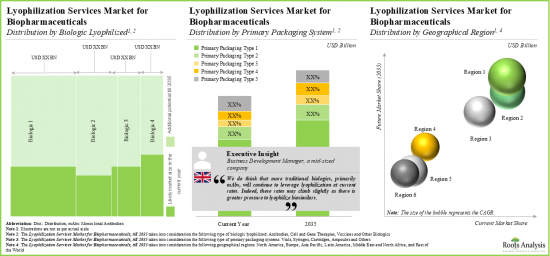

冷冻干燥服务市场:主要细分市场

根据冷冻干燥的生物製品类型,市场细分为抗体、细胞和基因治疗、疫苗以及其他生物製品。目前,抗体领域在全球冷冻干燥服务市场中占有最大占有率。由于用于治疗多种疾病的标靶药物需求不断成长,这一趋势在未来几年可能保持不变。

根据初级包装系统的类型,市场细分为小瓶、注射器、卡式瓶、安瓿瓶和其他类型。目前,小瓶领域在全球冷冻干燥服务市场中占有最大占有率。然而,由于对自动给药注射剂和预充式註射器的需求不断成长,预计注射器市场在预测期内将以更高的年复合成长率成长。

依主要地区划分,市场分为北美、欧洲、亚太地区、拉丁美洲、中东和北非、拉丁美洲。目前,北美在全球冷冻干燥服务市场占据主导地位,占据最大的收入占有率。此外,未来几年亚太地区市场可能会以更高的年复合成长率成长。

进入冷冻干燥服务市场的公司范例

- Baxter BioPharma Solutions

- CordenPharma

- Coriolis Pharma

- Curia

- Emergent BioSolutions

- LSNE Contract Manufacturing

- Lyophilization Technology

- Northway Biotech

- ProJect Pharmaceutics

- Vetter Pharma

目录

第1章 前言

第2章 执行摘要

第3章 引言

- 章节概述

- 冷冻干燥概述

- 生物製剂冷冻干燥

- 冷冻干燥设备及其关键技术组件

- 用于生物製剂冷冻干燥的初级包装系统

- 冷冻干燥週期的开发与最佳化

- 结论

第4章 市场格局

- 章节概述

- 生物製剂冷冻干燥服务提供者:市场格局

第5章 基准分析

- 章节概述

- 研究方法

- 基准分析:同业组

第6章 公司简介:北美生物製剂冷冻干燥服务提供者

- 章节概述

- Baxter BioPharma Solutions

- Curia

- Emergent BioSolutions

- LSNE Contract Manufacturing

- Lyophilization Technology

第7章 公司简介:欧洲生物製剂冷冻干燥服务提供者

- 章节概述

- CordenPharma

- Coriolis Pharma

- Northway Biotech

- ProJect Pharmaceutics

- Vetter Pharma

第8章 公司简介:亚太地区生物製剂冷冻干燥服务提供者

- 章节概述

- BioZed Engineering

- CinnaGen

- MabPlex

- Samsung Biologics

- WuXi Biologics

第9章 合作伙伴与合作

- 章节概述

- 合作伙伴模式

- 生物製品冷冻干燥服务:合作伙伴与合作列表

第10章 近期拓展

- 章节概述

- 生物製品冷冻干燥服务:近期拓展列表

第11章 研究与分析

- 章节概述

- 生物製品冷冻干燥服务:参与者列表

第12章 案例研究 I:冷冻干燥週期开发与最佳化

- 章节概述

- 冷冻干燥週期发展

- 冷冻干燥週期最佳化

- 冷冻干燥週期开发与最佳化:服务提供者列表

第13章 案例研究2:冷冻干燥的替代方法

- 章节概述

- 冷冻干燥的替代方法

第14章 市场预测与机会分析

- 章节概述

- 预测研究方法与关键假设

- 全球生物製品冷冻干燥服务市场(~2035年)

- 生物製品冷冻干燥服务市场:依冷冻干燥生物製品类型

- 生物製品冷冻干燥服务市场:依初级包装系统类型

- 生物製品冷冻干燥服务市场区域:依初级包装系统类型

第15章 结论

第16章 高层洞察

附录1:表格资料

附录2:公司与组织清单

LYOPHILIZATION SERVICES MARKET: OVERVIEW

As per Roots Analysis, the global lyophilization services market is estimated to grow from USD 2.6 billion in the current year to USD 4.9 billion by 2035, at a CAGR of 6.3% during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Type of Biologic Lyophilized

- Antibodies

- Cells and Gene Therapies

- Vaccines

- Other Biologics

Type of Primary Packaging System

- Vials

- Syringes

- Cartridges

- Ampoules

- Others

Key Geographies

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and North Africa

LYOPHILIZATION SERVICES MARKET: GROWTH AND TRENDS

Lyophilization is a drug stabilization technique that involves removing excess solvents, such as water, through freeze-drying while preserving the chemical properties of the substance. Notably, lyophilization utilizes specialized equipment, including laboratory freeze dryers, non-sterile freeze dryers, and sterilizable lyophilizers. It is worth highlighting that over the years, lyophilization has emerged as the preferred approach to achieve longer and commercially viable shelf lives, enabling stable and dry biopharmaceutical formulations. However, characterized by a rapidly growing pipeline of biosimilars and novel biologics, and the existing challenges associated with lyophilization of biotherapeutics, stakeholders are increasingly relying on service providers that offer multidisciplinary expertise in this domain.

In addition, several market leaders are accelerating their research for lyophilization technology advancements and innovations to improve working efficiency and achieve process control during the drying process. This has resulted in improved productivity and efficiency of the overall process. For instance, latest technologies, such as continuous freeze-drying systems and automated lyophilization systems, are encouraging industrial leaders to adopt these technologies and meet the customized lyophilization services requirements of clients.

LYOPHILIZATION SERVICES MARKET: KEY INSIGHTS

The report delves into the current state of the lyophilization services market and identifies potential growth opportunities within industry. Some key findings from the report include:

- Presently, over 105 service providers claim to have the required expertise to offer lyophilization services for a variety of biotherapeutics, including proteins, antibodies, nucleic acids and cell / gene therapies.

- The current market landscape is highly fragmented, featuring the presence of both new entrants and established players based in key geographical regions.

- Leveraging their expertise, stakeholders are offering lyophilization services at different scales of operation; further, vials emerged as the preferred choice of primary packaging system for storing biologics.

- In order to successfully navigate the evolving regulatory landscape, service providers are expanding their portfolios to cater to customized requests of their clients.

- The growing interest in this domain is evident from the rise in partnership activity; in fact, the maximum number of collaborations related to lyophilization of biopharmaceuticals were signed in the past two years.

- To keep pace with the growing demand, many companies have undertaken expansion initiatives, such as establishing new facilities or expanding their existing capabilities, to strengthen their service portfolio.

- The market is expected to grow at a steady rate till 2035; the projected opportunity is anticipated to be well distributed across various types of biologic lyophilized, primary packaging systems and geographical regions.

LYOPHILIZATION SERVICES MARKET: KEY SEGMENTS

Antibodies Segment holds the Largest Share of the Lyophilization Services Market

Based on the type of biologics lyophilized, the market is segmented into antibodies, cell and gene therapies, vaccines, and other biologics. At present, the antibodies segment holds the maximum share of the global lyophilization services market. This trend is likely to remain the same in the coming years owing to the increasing demand for target-specific drugs for the treatment of a myriad of diseases.

By Type of Primary Packaging System, Syringes is the Fastest Growing Segment of the Global Lyophilization Services Market

Based on the type of primary packaging system, the market is segmented into vials, syringes, cartridges, ampoules, and others. At present, the vials segment holds the maximum share of the global lyophilization services market. However, the market for syringes segment is expected to grow at a higher CAGR during the forecast period owing to the growing demand for automated drug delivery injections and prefilled syringes.

North America Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia-Pacific, Latin America, Middle East and North Africa and Latin America. Currently, North America dominates the global lyophilization services market and accounts for the largest revenue share. Further, the market in Asia-Pacific is likely to grow at a higher CAGR in the coming future.

Example Players in the Lyophilization Services Market

- Baxter BioPharma Solutions

- CordenPharma

- Coriolis Pharma

- Curia

- Emergent BioSolutions

- LSNE Contract Manufacturing

- Lyophilization Technology

- Northway Biotech

- ProJect Pharmaceutics

- Vetter Pharma

LYOPHILIZATION SERVICES MARKET: RESEARCH COVERAGE

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the global lyophilization services market, focusing on key market segments, including [A] type of biologic lyophilized, [B] type of primary packaging system and [C] key geographies.

- Market Landscape: A comprehensive evaluation of the companies offering lyophilization services, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters, [D] the scale of operation, [E] regulatory certification / accreditation, [F] type of biologic lyophilized, [G] the process of lyophilization, [H] type of primary packaging system and [I] additional services offered by the firms.

- Benchmark Analysis: A comprehensive benchmark analysis of various service providers segregated into three peer groups based on the location of their headquarters. Additionally, the companies were further distributed across key geographies, based on their employee count, into three categories, namely [A] small, [B] mid-sized and [C] large / very large, highlighting the top players in the lyophilization services market, based on their respective capabilities.

- Company Profiles: In-depth profiles of key players that are currently engaged in offering lyophilization services for biopharmaceuticals, focusing on [A] overview of the company, [B] lyophilization service offerings for biopharmaceuticals, [C] dedicated facilities and [D] recent developments and an informed future outlook.

- Partnerships and Collaborations: An insightful analysis of the deals inked by stakeholders in this domain, based on several parameters, such as [A] year of partnership, [B] type of partnership, [C] most active players (in terms of the number of partnerships signed) and [D] geographical distribution.

- Recent Expansions: In-depth analysis of the various expansion initiatives undertaken by lyophilization service providers for biopharmaceuticals, based on several parameters, such as [A] year of expansion, [B] type of expansion, [C] company size, [D] location of headquarters, [E] location of expanded facility, [F] most active players (in terms of number of recent expansions) and [G] geographical distribution.

- Survey Analysis: An insightful analysis presenting additional insights on lyophilization services offered for biopharmaceuticals, based on several parameters, such as [A] type of biologic lyophilized, [B] type of primary packaging system, [C] scale of operation, [D] availability of lyophilization cycle development / optimization capabilities and [E] location of a dedicated manufacturing facility for lyophilization.

- Case Study 1: A detailed discussion on lyophilization cycle development and optimization services, highlighting the important parameters and techniques required for these processes.

- Case Study 2: A comprehensive discussion on the alternative approaches to the lyophilization process, such as [A] spray drying, [B] spray freeze dryer, [C] atmospheric spray freeze dryer, and [D] vacuum foam drying.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Scope of the Report

- 1.2. Research Methodology

- 1.2.1. Research Assumptions

- 1.2.2. Project Methodology

- 1.2.3. Forecast Methodology

- 1.2.4. Robust Quality Control

- 1.2.5. Key Considerations

- 1.2.5.1. Demographics

- 1.2.5.2. Economic Factors

- 1.2.5.3. Government Regulations

- 1.2.5.4. Supply Chain

- 1.2.5.5. COVID Impact / Related Factors

- 1.2.5.6. Market Access

- 1.2.5.7. Healthcare Policies

- 1.2.5.8. Industry Consolidation

- 1.3 Key Questions Answered

- 1.4. Chapter Outlines

2. EXECUTIVE SUMMARY

3. INTRODUCTION

- 3.1. Chapter Overview

- 3.2. Overview of Lyophilization

- 3.2.1. Historical Evolution

- 3.2.2. Underlying Principles

- 3.2.3. Advantages and Disadvantages

- 3.3. Lyophilization of Biopharmaceuticals

- 3.3.1. Need for Lyophilization of Biopharmaceuticals

- 3.3.2. Lyophilization Process

- 3.3.2.1. Formulation and Filling

- 3.3.2.2. Freezing

- 3.3.2.3. Primary Drying

- 3.3.2.4. Secondary Drying

- 3.4. Lyophilizer and its Key Components

- 3.5. Primary Packaging Systems Used for Lyophilization of Biopharmaceuticals

- 3.6. Lyophilization Cycle Development and Optimization

- 3.7. Concluding Remarks

4. MARKET LANDSCAPE

- 4.1. Chapter Overview

- 4.2. Lyophilization Service Providers for Biopharmaceuticals: Overall Market Landscape

- 4.2.1. Analysis by Year of Establishment

- 4.2.2. Analysis by Company Size

- 4.2.3. Analysis by Location of Headquarters

- 4.2.4. Analysis by Scale of Operation

- 4.2.5. Analysis by Regulatory Certification / Accreditation

- 4.2.6. Analysis by Type of Biologic Lyophilized

- 4.2.7. Analysis by Process of Lyophilization

- 4.2.8. Analysis by Type of Primary Packaging System

- 4.2.9. Analysis by Additional Services Offered

5. BENCHMARK ANALYSIS

- 5.1. Chapter Overview

- 5.2. Methodology

- 5.3. Benchmark Analysis: Peer Groups

- 5.3.1. Benchmark Analysis: North America (Peer Group I)

- 5.3.2. Benchmark Analysis: North America (Peer Group II)

- 5.3.3. Benchmark Analysis: North America (Peer Group III)

- 5.3.4. Benchmark Analysis: Europe (Peer Group IV)

- 5.3.5. Benchmark Analysis: Europe (Peer Group V)

- 5.3.6. Benchmark Analysis: Europe (Peer Group VI)

- 5.3.7. Benchmark Analysis: Asia Pacific and Rest of the World (Peer Group VII)

- 5.3.8. Benchmark Analysis: Asia Pacific and Rest of the World (Peer Group VIII)

6. COMPANY PROFILES: LYOPHILIZATION SERVICE PROVIDERS FOR BIOPHARMACEUTICALS IN NORTH AMERICA

- 6.1. Chapter Overview

- 6.2. Baxter BioPharma Solutions

- 6.2.1. Company Overview

- 6.2.2. Lyophilization Service Offerings for Biopharmaceuticals

- 6.2.3. Dedicated Biopharmaceutical Lyophilization Facilities

- 6.2.4. Recent Developments and Future Outlook

- 6.3. Curia

- 6.3.1. Company Overview

- 6.3.2. Lyophilization Service Offerings for Biopharmaceuticals

- 6.3.3. Dedicated Biopharmaceutical Lyophilization Facilities

- 6.3.4. Recent Developments and Future Outlook

- 6.4. Emergent BioSolutions

- 6.4.1. Company Overview

- 6.4.2. Lyophilization Service Offerings for Biopharmaceuticals

- 6.4.3. Dedicated Biopharmaceutical Lyophilization Facilities

- 6.4.4. Recent Developments and Future Outlook

- 6.5. LSNE Contract Manufacturing

- 6.5.1. Company Overview

- 6.5.2. Lyophilization Service Offerings for Biopharmaceuticals

- 6.5.3. Dedicated Biopharmaceutical Lyophilization Facilities

- 6.5.4. Recent Developments and Future Outlook

- 6.6. Lyophilization Technology

- 6.6.1. Company Overview

- 6.6.2. Lyophilization Service Offerings for Biopharmaceuticals

- 6.6.3. Dedicated Biopharmaceutical Lyophilization Facilities

- 6.6.4. Recent Developments and Future Outlook

7. COMPANY PROFILES: LYOPHILIZATION SERVICE PROVIDERS FOR BIOPHARMACEUTICALS IN EUROPE

- 7.1. Chapter Overview

- 7.2. CordenPharma

- 7.2.1. Company Overview

- 7.2.2. Lyophilization Service Offerings for Biopharmaceuticals

- 7.2.3. Dedicated Biopharmaceutical Lyophilization Facilities

- 7.2.4. Recent Developments and Future Outlook

- 7.3. Coriolis Pharma

- 7.3.1. Company Overview

- 7.3.2. Lyophilization Service Offerings for Biopharmaceuticals

- 7.3.3. Dedicated Biopharmaceutical Lyophilization Facilities

- 7.3.4. Recent Developments and Future Outlook

- 7.4. Northway Biotech

- 7.4.1. Company Overview

- 7.4.2. Lyophilization Service Offerings for Biopharmaceuticals

- 7.4.3. Dedicated Biopharmaceutical Lyophilization Facilities

- 7.4.4. Recent Developments and Future Outlook

- 7.5. ProJect Pharmaceutics

- 7.5.1. Company Overview

- 7.5.2. Lyophilization Service Offerings for Biopharmaceuticals

- 7.5.3. Dedicated Biopharmaceutical Lyophilization Facilities

- 7.5.4. Recent Developments and Future Outlook

- 7.6. Vetter Pharma

- 7.6.1. Company Overview

- 7.6.2. Lyophilization Service Offerings for Biopharmaceuticals

- 7.6.3. Dedicated Biopharmaceutical Lyophilization Facilities

- 7.6.4. Recent Developments and Future Outlook

8. COMPANY PROFILES: LYOPHILIZATION SERVICE PROVIDERS FOR BIOPHARMACEUTICALS IN ASIA PACIFIC

- 8.1. Chapter Overview

- 8.2. BioZed Engineering

- 8.2.1. Company Overview

- 8.2.2. Lyophilization Service Offerings for Biopharmaceuticals

- 8.2.3. Dedicated Biopharmaceutical Lyophilization Facilities

- 8.2.4. Recent Developments and Future Outlook

- 8.3. CinnaGen

- 8.3.1. Company Overview

- 8.3.2. Lyophilization Service Offerings for Biopharmaceuticals

- 8.3.3. Dedicated Biopharmaceutical Lyophilization Facilities

- 8.3.4. Recent Developments and Future Outlook

- 8.4. MabPlex

- 8.4.1. Company Overview

- 8.4.2. Lyophilization Service Offerings for Biopharmaceuticals

- 8.4.3. Dedicated Biopharmaceutical Lyophilization Facilities

- 8.4.4. Recent Developments and Future Outlook

- 8.5. Samsung Biologics

- 8.5.1. Company Overview

- 8.5.2. Lyophilization Service Offerings for Biopharmaceuticals

- 8.5.3. Dedicated Biopharmaceutical Lyophilization Facilities

- 8.5.4. Recent Developments and Future Outlook

- 8.6. WuXi Biologics

- 8.6.1. Company Overview

- 8.6.2. Lyophilization Service Offerings for Biopharmaceuticals

- 8.6.3. Dedicated Biopharmaceutical Lyophilization Facilities

- 8.6.4. Recent Developments and Future Outlook

9. PARTNERSHIPS AND COLLABORATIONS

- 9.1. Chapter Overview

- 9.2. Partnership Models

- 9.3. Lyophilization Services for Biopharmaceuticals: List of Partnerships and Collaborations

- 9.3.1. Analysis by Year of Partnership

- 9.3.2. Analysis by Type of Partnership

- 9.3.3. Analysis by Year and Type of Partnership

- 9.3.4. Most Active Players: Analysis by Number of Partnerships

- 9.3.5. Analysis by Geography

- 9.3.5.1. Intercontinental and Intracontinental Deals

- 9.3.5.2. International and Local Deals

10. RECENT EXPANSIONS

- 10.1. Chapter Overview

- 10.2. Lyophilization Services Market for Biopharmaceuticals: List of Recent Expansions

- 10.2.1. Analysis by Year of Expansion

- 10.2.2. Analysis by Type of Expansion

- 10.2.3. Analysis by Year and Type of Expansion

- 10.2.4. Analysis by Company Size and Location of Headquarters

- 10.2.5. Analysis by Location of Expanded Facility

- 10.2.6. Active Players: Analysis by Number of Recent Expansions

- 10.2.7. Analysis by Geography

11. SURVEY ANALYSIS

- 11.1. Chapter Overview

- 11.2. Lyophilization Services Market for Biopharmaceuticals: List of Participating Companies

- 11.2.1. Analysis by Seniority Level of Respondents

- 11.2.2. Analysis by Type of Biologic Lyophilized

- 11.2.3. Analysis by Type of Primary Packaging System

- 11.2.4. Analysis by Scale of Operation

- 11.2.5. Analysis by Additional Services Offered

- 11.2.6. Analysis by Location of Lyophilization Facility

- 11.2.7. Analysis by Share of Lyophilization Operations Outsourced

- 11.2.8. Analysis by Likely Market Size

- 11.2.9. Analysis of Likely Market Share by Type of Biologic Lyophilized

- 11.2.10. Analysis of Likely Market Share by Geography

12. CASE STUDY I: LYOPHILIZATION CYCLE DEVELOPMENT AND OPTIMIZATION

- 12.1. Chapter Overview

- 12.2. Lyophilization Cycle Development

- 12.3. Lyophilization Cycle Optimization

- 12.4. Lyophilization Cycle Development and Optimization: List of Service Providers

- 12.4.1. Analysis by Company Size

- 12.4.2. Analysis by Location of Headquarters

- 12.4.3. Analysis by Type of Service Offered

- 12.4.4. Lyophilization Cycle Development and Optimization Service Providers: Company Snapshots

13. CASE STUDY II: ALTERNATIVE APPROACHES TO LYOPHILIZATION

- 13.1. Chapter Overview

- 13.2. Alternative Approaches to Lyophilization

- 13.2.1. Spray Drying

- 13.2.1.1. Spray Drying Process

- 13.2.1.2. Applications of Spray Drying

- 13.2.1.3. Spray Drying of Biopharmaceuticals

- 13.2.1.4. Spray Drying Service Providers for Biopharmaceuticals

- 13.2.1.5. Comparison of Lyophilization and Spray Drying

- 13.2.2. Spray Freeze Drying

- 13.2.3. Atmospheric Spray Freeze Drying

- 13.2.4. Vacuum Foam Drying

- 13.2.1. Spray Drying

14. MARKET FORECAST AND OPPORTUNITY ANALYSIS

- 14.1. Chapter Overview

- 14.2. Forecast Methodology and Key Assumptions

- 14.3. Global Lyophilization Services Market for Biopharmaceuticals, Till 2035

- 14.4. Lyophilization Services Market for Biopharmaceuticals: Distribution by Type of Biologic Lyophilized

- 14.4.1. Lyophilization Services Market for Antibodies, Till 2035

- 14.4.2. Lyophilization Services Market for Cell and Gene Therapies, Till 2035

- 14.4.3. Lyophilization Services Market for Vaccines, Till 2035

- 14.4.4. Lyophilization Services Market for Other Biologics, Till 2035

- 14.5. Lyophilization Services Market for Biopharmaceuticals: Distribution by Type of Primary Packaging System

- 14.5.1. Lyophilization Services Market for Biopharmaceuticals for Vials, Till 2035

- 14.5.2. Lyophilization Services Market for Biopharmaceuticals for Syringes, Till 2035

- 14.5.3. Lyophilization Services Market for Biopharmaceuticals for Cartridges, Till 2035

- 14.5.4. Lyophilization Services Market for Biopharmaceuticals for Ampoules, Till 2035

- 14.5.5. Lyophilization Services Market for Biopharmaceuticals for Other Primary Packaging Systems, Till 2035

- 14.6. Lyophilization Services Market for Biopharmaceuticals: Distribution by Geography

- 14.6.1. Lyophilization Services Market for Biopharmaceuticals in North America, Till 2035

- 14.6.2. Lyophilization Services Market for Biopharmaceuticals in Europe, Till 2035

- 14.6.3. Lyophilization Services Market for Biopharmaceuticals in Asia Pacific, Till 2035

- 14.6.4. Lyophilization Services Market for Biopharmaceuticals in Middle East and North Africa, Till 2035

- 14.6.5. Lyophilization Services Market for Biopharmaceuticals in Latin America, Till 2035

- 14.6.6. Lyophilization Services Market for Biopharmaceuticals in Rest of the World, Till 2035

15. CONCLUDING REMARKS

16. EXECUTIVE INSIGHTS

- 16.1. Chapter Overview

- 16.2. Company A

- 16.2.1. Company Snapshot

- 16.2.2. Interview Transcript

- 16.3. Company B

- 16.3.1. Company Snapshot

- 16.3.2. Interview Transcript

- 16.4. Company C

- 16.4.1. Company Snapshot

- 16.4.2. Interview Transcript

- 16.5. Company D

- 16.5.1. Company Snapshot

- 16.5.2. Interview Transcript

- 16.6. Company E

- 16.6.1. Company Snapshot

- 16.6.2. Interview Transcript

- 16.7. Company F

- 16.7.1. Company Snapshot

- 16.7.2. Interview Transcript

- 16.8. Company G

- 16.8.1. Company Snapshot

- 16.8.2. Interview Transcript

- 16.9. Company H

- 16.9.1. Company Snapshot

- 16.9.2. Interview Transcript

- 16.10. Company I

- 16.10.1. Company Snapshot

- 16.10.2. Interview Transcript

- 16.11. Company J

- 16.11.1. Company Snapshot

- 16.11.2. Interview Transcript

17. APPENDIX 1: TABULATED DATA

18. APPENDIX 2: LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Table 4.1 List of Lyophilization Service Providers for Biopharmaceuticals

- Table 5.1 Benchmark Analysis: Information on Peer Groups

- Table 6.1 Leading Lyophilization Service Providers for Biopharmaceuticals in North America

- Table 6.2 Baxter BioPharma Solutions: Company Snapshot

- Table 6.3 Baxter BioPharma Solutions: Lyophilization Service Offerings for Biopharmaceuticals

- Table 6.4 Baxter BioPharma Solutions: Information on Dedicated Biopharmaceutical Lyophilization Facilities

- Table 6.5 Baxter BioPharma Solutions: Recent Developments and Future Outlook

- Table 6.6 Curia: Company Snapshot

- Table 6.7 Curia: Lyophilization Service Offerings for Biopharmaceuticals

- Table 6.8 Curia: Information on Dedicated Biopharmaceutical Lyophilization Facilities

- Table 6.9 Curia: Recent Developments and Future Outlook

- Table 6.10 Emergent BioSolutions: Company Snapshot

- Table 6.11 Emergent BioSolutions: Lyophilization Service Offerings for Biopharmaceuticals

- Table 6.12 Emergent BioSolutions: Information on Dedicated Biopharmaceutical Lyophilization Facilities

- Table 6.13 Emergent BioSolutions: Recent Developments and Future Outlook

- Table 6.14 LSNE Contract Manufacturing: Company Snapshot

- Table 6.15 LSNE Contract Manufacturing: Lyophilization Service Offerings for Biopharmaceuticals

- Table 6.16 LSNE Contract Manufacturing: Information on Dedicated Biopharmaceutical Lyophilization Facilities

- Table 6.17 LSNE Contract Manufacturing: Recent Developments and Future Outlook

- Table 6.18 Lyophilization Technology: Company Snapshot

- Table 6.19 Lyophilization Technology: Lyophilization Service Offerings for Biopharmaceuticals

- Table 6.20 Lyophilization Technology: Information on Dedicated Biopharmaceutical Lyophilization Facilities

- Table 6.21 Lyophilization Technology: Recent Developments and Future Outlook

- Table 7.1 Leading Lyophilization Service Providers for Biopharmaceuticals in Europe

- Table 7.2 CordenPharma: Company Snapshot

- Table 7.3 CordenPharma: Lyophilization Service Offerings for Biopharmaceuticals

- Table 7.4 CordenPharma: Information on Dedicated Biopharmaceutical Lyophilization Facilities

- Table 7.5 CordenPharma: Recent Developments and Future Outlook

- Table 7.6 Coriolis Pharma: Company Snapshot

- Table 7.7 Coriolis Pharma: Lyophilization Service Offerings for Biopharmaceuticals

- Table 7.8 Coriolis Pharma: Information on Dedicated Biopharmaceutical Lyophilization Facilities

- Table 7.9 Coriolis Pharma: Recent Developments and Future Outlook

- Table 7.10 Northway Biotech: Company Snapshot

- Table 7.11 Northway Biotech: Lyophilization Service Offerings for Biopharmaceuticals

- Table 7.12 Northway Biotech: Information on Dedicated Biopharmaceutical Lyophilization Facilities

- Table 7.13 Northway Biotech: Recent Developments and Future Outlook

- Table 7.14 ProJect Pharmaceutics: Company Snapshot

- Table 7.15 ProJect Pharmaceutics: Lyophilization Service Offerings for Biopharmaceuticals

- Table 7.16 ProJect Pharmaceutics: Information on Dedicated Biopharmaceutical Lyophilization Facilities

- Table 7.17 Vetter Pharma: Company Snapshot

- Table 7.18 Vetter Pharma: Lyophilization Service Offerings for Biopharmaceuticals

- Table 7.19 Vetter Pharma: Information on Dedicated Biopharmaceutical Lyophilization Facilities

- Table 7.20 Vetter Pharma: Recent Developments and Future Outlook

- Table 8.1 Leading Lyophilization Service Providers for Biopharmaceuticals in Asia Pacific

- Table 8.2 BioZed Engineering: Company Snapshot

- Table 8.3 BioZed Engineering: Lyophilization Service Offerings for Biopharmaceuticals

- Table 8.4 BioZed Engineering: Information on Dedicated Biopharmaceutical Lyophilization Facilities

- Table 8.5 BioZed Engineering: Recent Developments and Future Outlook

- Table 8.6 CinnaGen: Company Snapshot

- Table 8.7 CinnaGen: Lyophilization Service Offerings for Biopharmaceuticals

- Table 8.8 CinnaGen: Information on Dedicated Biopharmaceutical Lyophilization Facilities

- Table 8.9 CinnaGen: Recent Developments and Future Outlook

- Table 8.10 MabPlex: Company Snapshot

- Table 8.11 MabPlex: Lyophilization Service Offerings for Biopharmaceuticals

- Table 8.12 MabPlex: Information on Dedicated Biopharmaceutical Lyophilization Facilities

- Table 8.13 MabPlex: Recent Developments and Future Outlook

- Table 8.14 Samsung Biologics: Company Snapshot

- Table 8.15 Samsung Biologics: Lyophilization Service Offerings for Biopharmaceuticals

- Table 8.16 Samsung Biologics: Information on Dedicated Biopharmaceutical Lyophilization Facilities

- Table 8.17 Samsung Biologics: Recent Developments and Future Outlook

- Table 8.18 WuXi Biologics: Company Snapshot

- Table 8.19 WuXi Biologics: Lyophilization Service Offerings for Biopharmaceuticals

- Table 8.20 WuXi Biologics: Information on Dedicated Biopharmaceutical Lyophilization Facilities

- Table 8.21 WuXi Biologics: Recent Developments and Future Outlook

- Table 9.1 Lyophilization Services for Biopharmaceuticals: List of Partnerships and Collaborations, Since 2018

- Table 10.1 Lyophilization Services for Biopharmaceuticals: List of Recent Expansions, Since 2018

- Table 11.1 Lyophilization Services Market for Biopharmaceuticals: List of Respondents

- Table 12.1 Lyophilization Cycle Development and Optimization: List of Service Providers

- Table 12.2 BSP Pharmaceuticals: Company Snapshot

- Table 12.3 CuriRx: Company Snapshot

- Table 12.4 GILYOS: Company Snapshot

- Table 12.5 Pierre Fabre: Company Snapshot

- Table 12.6 Singota Solutions: Company Snapshot

- Table 13.1 Spray Drying for Biopharmaceuticals: List of Service Providers

- Table 13.2 Comparison of Lyophilization and Spray Drying Process

- Table 16.1 Pharmaceutical International: Company Snapshot

- Table 16.2 Curia: Company Snapshot

- Table 16.3 Emergent BioSolutions: Company Snapshot

- Table 16.4 Liof Pharma: Company Snapshot

- Table 16.5 Vibalogics: Company Snapshot

- Table 16.6 Samsung Biologics: Company Snapshot

- Table 16.7 Bioserv: Company Snapshot

- Table 16.8 Symbiosis Pharmaceutical Services: Company Snapshot

- Table 16.9 Patheon: Company Snapshot

- Table 16.10 Baxter BioPharma Solutions: Company Snapshot

- Table 17.1 Lyophilization Service Providers for Biopharmaceuticals: Distribution by Year of Establishment

- Table 17.2 Lyophilization Service Providers for Biopharmaceuticals: Distribution by Company Size

- Table 17.3 Lyophilization Service Providers for Biopharmaceuticals: Distribution by Location of Headquarters

- Table 17.4 Lyophilization Service Providers for Biopharmaceuticals: Distribution by Scale of Operation

- Table 17.5 Lyophilization Service Providers for Biopharmaceuticals: Distribution by Regulatory Certification / Accreditation

- Table 17.6 Lyophilization Service Providers for Biopharmaceuticals: Distribution by Type of Biologic Lyophilized

- Table 17.7 Lyophilization Service Providers for Biopharmaceuticals: Distribution by Process of Lyophilization

- Table 17.8 Lyophilization Service Providers for Biopharmaceuticals: Distribution by Type of Primary Packaging System

- Table 17.9 Lyophilization Service Providers for Biopharmaceuticals: Distribution by Additional Services Offered

- Table 17.10 Benchmark Analysis: Asia Pacific and Rest of the World, Peer Group VII

- Table 17.11 Benchmark Analysis: Asia Pacific and Rest of the World, Peer Group VIII

- Table 17.12 Partnerships and Collaborations: Cumulative Year-wise Trend, Since 2018

- Table 17.13 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 17.14 Partnerships and Collaborations: Distribution by Year and Type of Partnership

- Table 17.15 Most Active Players: Distribution by Number of Partnerships

- Table 17.16 Partnerships and Collaborations: Intercontinental and Intracontinental Deals

- Table 17.17 Partnerships and Collaborations: International and Local Deals

- Table 17.18 Recent Expansions: Cumulative Year-wise Trend, Since 2018

- Table 17.19 Recent Expansions: Distribution by Type of Expansion

- Table 17.20 Recent Expansions: Distribution by Year and Type of Expansion

- Table 17.21 Recent Expansions: Distribution by Company Size and Location of Headquarters

- Table 17.22 Recent Expansions: Distribution by Location of Expanded Facility

- Table 17.23 Recent Expansions: Distribution by Location of Expanded Facility and Type of Expansion

- Table 17.24 Active Players: Distribution by Number of Recent Expansions

- Table 17.25 Recent Expansions: Distribution by Geography

- Table 17.26 Survey Analysis: Distribution by Geographical Location of Respondents

- Table 17.27 Survey Analysis: Distribution by Seniority Levels of Respondents

- Table 17.28 Survey Analysis: Distribution by Type of Biologic Lyophilized

- Table 17.29 Survey Analysis: Distribution by Type of Primary Packaging System

- Table 17.30 Survey Analysis: Distribution by Scale of Operation

- Table 17.31 Survey Analysis: Distribution by Additional Services Offered

- Table 17.32 Survey Analysis: Distribution by Location of Lyophilization Facility

- Table 17.33 Survey Analysis: Distribution by Share of Lyophilization Operations Outsourced

- Table 17.34 Survey Analysis: Distribution by Likely Current Market Size

- Table 17.35 Survey Analysis: Distribution of Likely Market Share by Type of Biologic Lyophilized

- Table 17.36 Survey Analysis: Distribution Likely Market Share by Geography

- Table 17.37 Lyophilization Cycle Development and Optimization Service Providers: Distribution by Company Size

- Table 17.38 Lyophilization Cycle Development and Optimization Service Providers: Distribution by Location of Headquarters

- Table 17.39 Lyophilization Cycle Development and Optimization Service Providers: Distribution by Type of Service Offered

- Table 17.40 Global Lyophilization Services Market for Biopharmaceuticals, Till 2035 (USD Billion)

- Table 17.41 Lyophilization Services Market for Biopharmaceuticals: Distribution by Type of Biologic Lyophilized (USD Billion)

- Table 17.42 Lyophilization Services Market for Antibodies, Till 2035 (USD Billion)

- Table 17.43 Lyophilization Services Market for Cell and Gene Therapies, Till 2035 (USD Billion)

- Table 17.44 Lyophilization Services Market for Vaccines, Till 2035 (USD Billion)

- Table 17.45 Lyophilization Services Market for Other Biologics, Till 2035 (USD Billion)

- Table 17.46 Lyophilization Services Market for Biopharmaceuticals: Distribution by Type of Primary Packaging System (USD Billion)

- Table 17.47 Lyophilization Services Market for Biopharmaceuticals Stored in Vials, Till 2035 (USD Billion)

- Table 17.48 Lyophilization Services Market for Biopharmaceuticals Stored in Syringes, Till 2035 (USD Billion)

- Table 17.49 Lyophilization Services Market for Biopharmaceuticals Stored in Cartridges, Till 2035 (USD Billion)

- Table 17.50 Lyophilization Services Market for Biopharmaceuticals Stored in Ampoules, Till 2035 (USD Billion)

- Table 17.51 Lyophilization Services Market for Biopharmaceuticals Stored in Other Primary Packaging Systems, Till 2035 (USD Billion)

- Table 17.52 Lyophilization Services Market for Biopharmaceuticals: Distribution by Geography (USD Billion)

- Table 17.53 Lyophilization Services Market for Biopharmaceuticals in North America, Till 2035 (USD Billion)

- Table 17.54 Lyophilization Services Market for Biopharmaceuticals in Europe, Till 2035 (USD Billion)

- Table 17.55 Lyophilization Services Market for Biopharmaceuticals in Asia Pacific, Till 2035 (USD Billion)

- Table 17.56 Lyophilization Services Market for Biopharmaceuticals in Middle East and North Africa, Till 2035 (USD Billion)

- Table 17.57 Lyophilization Services Market for Biopharmaceuticals in Latin America, Till 2035 (USD Billion)

- Table 17.58 Lyophilization Services Market for Biopharmaceuticals in Rest of the World, Till 2035 (USD Billion)

List of Figures

- Figure 2.1 Executive Summary: Overall Market Landscape

- Figure 2.2 Executive Summary: Partnerships and Collaborations

- Figure 2.3 Executive Summary: Recent Expansions

- Figure 2.4 Executive Summary: Survey Analysis

- Figure 2.5 Executive Summary: Market Forecast

- Figure 3.1 Historical Evolution of Lyophilization

- Figure 3.2 Phase Diagram of Water

- Figure 3.3 Sublimation of Ice Crystals

- Figure 3.4 Key Steps Involved in Formulation and Filling of Biopharmaceuticals

- Figure 3.5 Key Components of Lyophilizer

- Figure 4.1 Lyophilization Service Providers for Biopharmaceuticals: Distribution by Year of Establishment

- Figure 4.2 Lyophilization Service Providers for Biopharmaceuticals: Distribution by Company Size

- Figure 4.3 Lyophilization Service Providers for Biopharmaceuticals: Distribution by Location of Headquarters

- Figure 4.4 Lyophilization Service Providers for Biopharmaceuticals: Distribution by Scale of Operation

- Figure 4.5 Lyophilization Service Providers for Biopharmaceuticals: Distribution by Regulatory Certification / Accreditation

- Figure 4.6 Lyophilization Service Providers for Biopharmaceuticals: Distribution by Type of Biologic Lyophilized

- Figure 4.7 Lyophilization Service Providers for Biopharmaceuticals: Distribution by Process of Lyophilization

- Figure 4.8 Lyophilization Service Providers for Biopharmaceuticals: Distribution by Type of Primary Packaging System

- Figure 4.9 Lyophilization Service Providers for Biopharmaceuticals: Distribution by Additional Services Offered

- Figure 5.1 Benchmark Analysis: Distribution by Company Size

- Figure 5.2 Benchmark Analysis: North America (Peer Group I)

- Figure 5.3 Benchmark Analysis: North America (Peer Group II)

- Figure 5.4 Benchmark Analysis: North America (Peer Group III)

- Figure 5.5 Benchmark Analysis: Europe (Peer Group IV)

- Figure 5.6 Benchmark Analysis: Europe (Peer Group V)

- Figure 5.7 Benchmark Analysis: Europe (Peer Group VI)

- Figure 5.8 Benchmark Analysis: Asia Pacific and Rest of the World (Peer Group VII)

- Figure 5.9 Benchmark Analysis: Asia Pacific and Rest of the World (Peer Group VIII)

- Figure 9.1 Partnerships and Collaborations: Cumulative Year-wise Trend, Since 2018

- Figure 9.2 Partnerships and Collaborations: Distribution by Type of Partnership

- Figure 9.3 Partnerships and Collaborations: Distribution by Year and Type of Partnership

- Figure 9.4 Most Active Players: Distribution by Number of Partnerships

- Figure 9.5 Partnerships and Collaborations: Intercontinental and Intracontinental Deals

- Figure 9.6 Partnerships and Collaborations: International and Local Deals

- Figure 10.1 Recent Expansions: Cumulative Year-wise Trend, Since 2018

- Figure 10.2 Recent Expansions: Distribution by Type of Expansion

- Figure 10.3 Recent Expansions: Distribution by Year and Type of Expansion

- Figure 10.4 Recent Expansions: Distribution by Company Size and Location of Headquarters

- Figure 10.5 Recent Expansions: Distribution by Location of Expanded Facility

- Figure 10.6 Recent Expansions: Distribution by Location of Expanded Facility and Type of Expansion

- Figure 10.7 Active Players: Distribution by Number of Recent Expansions

- Figure 10.8 Recent Expansions: Distribution by Geography

- Figure 11.1 Survey Analysis: Distribution by Geographical Location of Respondents

- Figure 11.2 Survey Analysis: Distribution by Seniority Levels of Respondents

- Figure 11.3 Survey Analysis: Distribution by Type of Biologic Lyophilized

- Figure 11.4 Survey Analysis: Distribution by Type of Primary Packaging System

- Figure 11.5 Survey Analysis: Distribution by Scale of Operation

- Figure 11.6 Survey Analysis: Distribution by Additional Services Offered

- Figure 11.7 Survey Analysis: Distribution by Location of Lyophilization Facility

- Figure 11.8 Survey Analysis: Distribution by Share of Lyophilization Operations Outsourced

- Figure 11.9 Survey Analysis: Distribution by Likely Current Market Size

- Figure 11.10 Survey Analysis: Distribution of Likely Market Share by Type of Biologic Lyophilized

- Figure 11.11 Survey Analysis: Distribution of Likely Market Share by Geography

- Figure 12.1 Lyophilization Cycle Development and Optimization Service Providers: Distribution by Company Size

- Figure 12.2 Lyophilization Cycle Development and Optimization Service Providers: Distribution by Location of Headquarters

- Figure 12.3 Lyophilization Cycle Development and Optimization Service Providers: Distribution by Type of Service Offered

- Figure 13.1 Key Steps Involved in Spray Drying Process

- Figure 14.1 Global Lyophilization Services Market for Biopharmaceuticals, Till 2035 (USD Billion)

- Figure 14.2 Lyophilization Services Market for Biopharmaceuticals: Distribution by Type of Biologic Lyophilized, (USD Billion)

- Figure 14.3 Lyophilization Services Market for Antibodies, Till 2035 (USD Billion)

- Figure 14.4 Lyophilization Services Market for Cell and Gene Therapies, Till 2035 (USD Billion)

- Figure 14.5 Lyophilization Services Market for Vaccines, Till 2035 (USD Billion)

- Figure 14.6 Lyophilization Services Market for Other Biologics, Till 2035 (USD Billion)

- Figure 14.7 Lyophilization Services Market for Biopharmaceuticals: Distribution by Type of Primary Packaging System, (USD Billion)

- Figure 14.8 Lyophilization Services Market for Biopharmaceuticals Stored in Vials, Till 2035 (USD Billion)

- Figure 14.9 Lyophilization Services Market for Biopharmaceuticals Stored in Syringes, Till 2035 (USD Billion)

- Figure 14.10 Lyophilization Services Market for Biopharmaceuticals Stored in Cartridges, Till 2035 (USD Billion)

- Figure 14.11 Lyophilization Services Market for Biopharmaceuticals Stored in Ampoules, Till 2035 (USD Billion)

- Figure 14.12 Lyophilization Services Market for Biopharmaceuticals Stored in Other Primary Packaging Systems, Till 2035 (USD Billion)

- Figure 14.13 Lyophilization Services Market for Biopharmaceuticals: Distribution by Geography, (USD Billion)

- Figure 14.14 Lyophilization Services Market for Biopharmaceuticals in North America, Till 2035 (USD Billion)

- Figure 14.15 Lyophilization Services Market for Biopharmaceuticals in Europe, Till 2035 (USD Billion)

- Figure 14.16 Lyophilization Services Market for Biopharmaceuticals in Asia Pacific, Till 2035 (USD Billion)

- Figure 14.17 Lyophilization Services Market for Biopharmaceuticals in Middle East and North Africa, Till 2035 (USD Billion)

- Figure 14.18 Lyophilization Services Market for Biopharmaceuticals in Latin America, Till 2035 (USD Billion)

- Figure 14.19 Lyophilization Services Market for Biopharmaceuticals in Rest of the World, Till 2035 (USD Billion)

- Figure 15.1 Concluding Remarks: Overall Market Landscape

- Figure 15.2 Concluding Remarks: Benchmark Analysis

- Figure 15.3 Concluding Remarks: Partnership and Collaborations

- Figure 15.4 Concluding Remarks: Recent Expansions

- Figure 15.5 Concluding Remarks: Market Forecast