|

市场调查报告书

商品编码

1683129

亚太硅砂市场:市场占有率分析、产业趋势与成长预测(2025-2030 年)Asia-Pacific Silica Sand - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

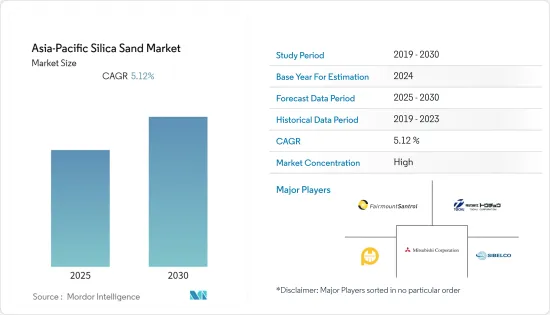

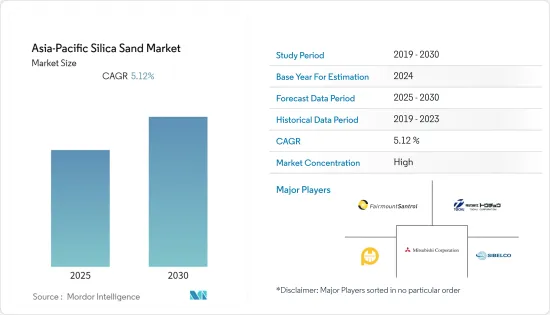

预测期内,亚太地区硅砂市场预计将以 5.12% 的复合年增长率成长。

新冠疫情导致全国范围的封锁、製造活动和供应链的中断以及全球范围内的生产停顿,对 2020 年的市场产生了负面影响。不过,情况在 2021 年开始好转,市场的成长轨迹得以恢復。

关键亮点

- 持续的经济成长导致铸造业建设和使用增加是推动市场发展的关键因素。

- 预计非法采砂和无砂建筑产品的开发将阻碍市场的成长。

- 预计水处理产业的应用开发以及牙科和生物技术领域的沙基治疗方法开发将成为预测期内探索的市场机会。

亚太硅砂市场趋势

玻璃产业需求不断成长

- 玻璃製造业是亚太地区硅砂市场最大的终端用户产业之一。

- 硅砂是玻璃製造业不可或缺的原料,占玻璃製造业原料的50%以上。该材料用于各种玻璃材料,包括容器、平板玻璃、特殊玻璃和玻璃纤维。

- 在玻璃製造的应用领域中,容器子子区隔占消费量最大,其次是平板玻璃和玻璃纤维子区隔。

- 预计该应用领域的市场将极大地受益于亚洲新兴经济体(尤其是印度和中国)快速增长的汽车和建筑行业对平板玻璃和玻璃纤维日益增长的需求。

- 根据国家统计局的数据,中国的建筑业规模是全世界最大的。根据住宅及城乡建设部预测,2025年,中国建筑业占GDP的比重预计仍将维持在6%左右。

- 预计中国的人口趋势将有利于住宅和商业建设活动。人口不断增长引发了公共和私营部门对经济适用住宅群的投资。中国政府已采取倡议,向40个重点城市赠送650万套政府补贴租赁住宅,可容纳约1,300万人居住。

- 此外,韩国、日本等已开发国家在电子领域对特种玻璃的广泛使用享有盛誉,预计将进一步推动玻璃製造业的成长。

- 预计所有上述因素都将在预测期内推动市场成长。

印度预计成长最快

- 印度矿业部将沙子与大理石、黏土等列为小矿物。小矿物约占印度采矿业总量的 12%。

- 印度硅砂用途广泛,如铸造厂的玻璃形成、化学生产、建筑和油漆。

- 无论从收益或市场成长潜力来看,印度都是全球建筑市场领先的国家之一。印度是世界第十大经济体,以购买力平价计算位居世界第三。

- 这导致对商业建筑、购物中心、竞技场、高层建筑、酒店等的需求增加,增加了印度对硅砂的需求。

- 印度建筑业是该国最大的产业之一,占该国GDP的很大一部分。印度的目标是到2025年实现5兆美元的经济成长。因此,基础设施建设将发挥关键作用。印度政府已推出国家基础设施管道(NIP)以及「印度製造」和生产挂钩激励(PLI)计划等倡议,以促进基础设施产业的发展。从历史上看,该国 80% 以上的基础设施支出用于资金筹措交通、电力、水利和灌溉。

- 无论从收益或市场成长潜力来看,印度都是全球建筑市场领先的国家之一。印度是世界第十大经济体,以购买力平价计算位居世界第三。预计到 2030年终,中国的房地产行业规模将达到 1 兆美元,不断增长的城市人口将带来对额外 2,500 万套住房的需求。

- 由于建筑业和铸造业的成长,印度硅砂市场预计将出现健康成长。

亚太石英砂产业概况

亚太地区硅砂市场部分整合。主要企业包括三菱商事株式会社、东忠商事株式会社、Sibelco、PUM GROUP 和 Fairmount Santrol。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 由于经济持续成长,建筑业增加

- 在铸造业的应用日益广泛

- 其他驱动因素

- 限制因素

- 非法采砂

- 开发无砂建筑产品

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔(市场规模(基于数量))

- 最终用户产业

- 玻璃製造

- 铸件

- 化学製造

- 建造

- 油漆和涂料

- 陶瓷和耐火材料

- 滤

- 石油和天然气回收

- 其他的

- 地区

- 中国

- 印度

- 日本

- 韩国

- 印尼

- 泰国

- 马来西亚

- 新加坡

- 菲律宾

- 越南

第六章 竞争格局

- 併购、合资、合作、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Chongqing Changjiang River Moulding Material(Group)Co. Ltd.

- Fairmount Santrol

- Mitsubishi Corporation

- Mangal Minerals

- PUM GROUP

- JFE MINERAL Co., LTD.

- Raghav Productivity Enhancers Limited

- Sibelco

- Shivam Chemicals

- TOCHU CORPORATION

- Xinyi Golden Ruite Quartz Materials Co. Ltd.

第七章 市场机会与未来趋势

- 在水处理产业的应用日益广泛

- 牙科和生物技术领域的沙基治疗发展

The Asia-Pacific Silica Sand Market is expected to register a CAGR of 5.12% during the forecast period.

Due to the COVID-19 outbreak, nationwide lockdowns worldwide, disruption in manufacturing activities and supply chains, and production halts negatively impacted the market in 2020. However, the conditions started recovering in 2021, restoring the market's growth trajectory.

Key Highlights

- The major factor driving the market studied is consistent economic growth leading to increased construction and use in the foundry industry.

- Illegal mining of sand and the development of sand-free construction products are expected to hinder the market's growth.

- Increasing application in the water treatment Industry and the development of sand-based treatments in dentistry and biotechnology are expected to act as opportunities for the market studied in the forecast period.

Asia-Pacific Silica Sand Market Trends

Increasing Demand from the Glass Industry

- The glass manufacturing industry was one of the largest end-user industries of the Asia-Pacific silica sand market.

- Silica sand is an inevitable part of the glass manufacturing industry and accounts for more than 50% of the raw materials used. The material is used in various glass materials, including containers, flat and specialty glass, and fiberglass.

- The container sub-segment accounted for the largest consumption in the glass manufacturing application segment and was followed by the flat glass and the fiberglass sub-segments.

- The market in this application segment is expected to benefit heavily from the increasing demand for flat glass and fiberglass from the rapidly growing automotive and construction sectors in the emerging economies in Asia, especially India and China.

- China's construction sector is the largest industry in the world and according to the National Bureau of Statistics. As per the forecast given by the Ministry of Housing and Urban-Rural Development, China's construction sector is expected to maintain a 6% share of the country's GDP going into 2025.

- The country's demographics are expected to favor housing and commercial construction activities. The growing population has triggered public and private sector investments in affordable residential colonies. China's government has taken the initiative to gift 40 critical cities with 6.5 million government-subsidized rental homes that are supposed to accommodate around 13 million people.

- Moreover, the use of specialty glass in the reputable electronics sector in developed countries such as South Korea and Japan is expected to aid further the growth of the glass manufacturing industry, which in turn, may increase the demand for silica sand in the region.

- All the factors as mentioned above are expected to drive the market growth during the forecast period.

India is expected to Witness the Fastest Growth

- The Indian Ministry of Mines has classified sand as a minor mineral along with marble, clay, and others. The minor minerals account for about 12% of the entire mining industry in India.

- Silica sand in India is used for various applications, such as glass formation in foundries, chemical production, construction, paints, etc.

- India is one of the major countries in the global construction market, both in terms of revenue and market growth potential. India represents the tenth-largest economy in the world and the third-largest in purchasing power parity.

- This has increased demand for commercial buildings, shopping malls, arenas, high-rise buildings, and hotels, boosting the demand for silica sand in India.

- India's construction sector is one of the largest industries in the country, contributing a significant share of its GDP. India aims to achieve a goal of a USD 5 trillion economy by 2025. As a result, infrastructure development will play a critical role. The government has launched the National Infrastructure Pipeline (NIP) along with other initiatives such as the Make in India and Production-Linked Incentives (PLI) schemes to boost the growth of the infrastructure sector. Historically, more than 80% of the nation's infrastructure spending has been spent on funding transportation, power, water, and irrigation.

- India is one of the major countries in the global construction market, both in terms of revenue and market growth potential. India represents the tenth-largest economy in the world and the third-largest in purchasing power parity. The real estate industry in the country is anticipated to reach USD 1 trillion by the end of 2030, with the rising urban population expected to create additional demand for 25 million additional residential units.

- India's silica sand market is expected to grow at a healthy rate because of the growing construction and foundry industry.

Asia-Pacific Silica Sand Industry Overview

The Asia-Pacific silica sand market is partially consolidated in nature. The major companies include Mitsubishi Corporation, TOCHU CORPORATION, Sibelco, PUM GROUP, and Fairmount Santrol, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Consistent Economic Growth Leading to Increase in Construction

- 4.1.2 Increasing Use in the Foundry Industry

- 4.1.3 Others Drivers

- 4.2 Restraints

- 4.2.1 Illegal Mining of Sand

- 4.2.2 Development of Sand-free Construction Products

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 End User Industry

- 5.1.1 Glass Manufacturing

- 5.1.2 Foundry

- 5.1.3 Chemical Production

- 5.1.4 Construction

- 5.1.5 Paints and Coatings

- 5.1.6 Ceramics and Refractories

- 5.1.7 Filtration

- 5.1.8 Oil and Gas Recovery

- 5.1.9 Other End User Industries

- 5.2 Geography

- 5.2.1 China

- 5.2.2 India

- 5.2.3 Japan

- 5.2.4 South Korea

- 5.2.5 Indonesia

- 5.2.6 Thailand

- 5.2.7 Malaysia

- 5.2.8 Singapore

- 5.2.9 Philippines

- 5.2.10 Vietnam

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Chongqing Changjiang River Moulding Material (Group) Co. Ltd.

- 6.4.2 Fairmount Santrol

- 6.4.3 Mitsubishi Corporation

- 6.4.4 Mangal Minerals

- 6.4.5 PUM GROUP

- 6.4.6 JFE MINERAL Co., LTD.

- 6.4.7 Raghav Productivity Enhancers Limited

- 6.4.8 Sibelco

- 6.4.9 Shivam Chemicals

- 6.4.10 TOCHU CORPORATION

- 6.4.11 Xinyi Golden Ruite Quartz Materials Co. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Application in the Water Treatment Industry

- 7.2 Development of Sand based Treatments in Dentistry and Biotechnology