|

市场调查报告书

商品编码

1683208

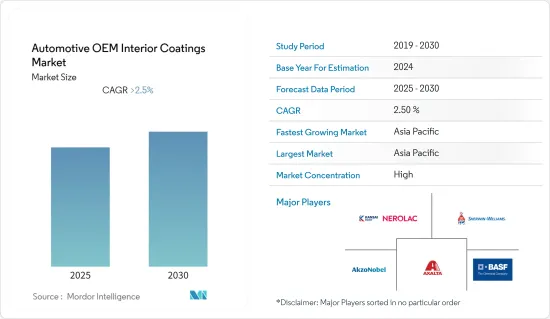

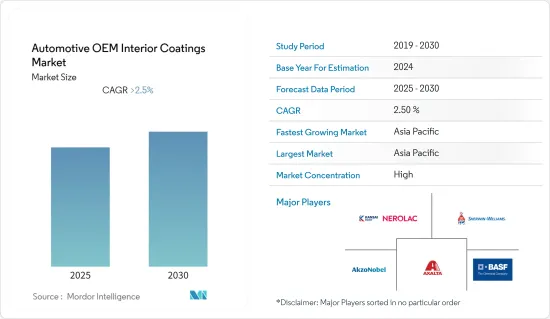

汽车OEM内装涂料:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Automotive OEM Interior Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预测期内,汽车OEM内装涂料市场预计将以超过 2.5% 的复合年增长率成长。

COVID-19 疫情将对汽车产业产生一些短期和长期影响,并可能影响OEM内装涂料市场。来自中国的许多零件供应出现延迟。因此,汽车产业面临全球生产材料短缺的局面。根据OICA统计,2020年全球汽车产量较2019年下降约16%。许多OEM已停止了在欧洲的大部分生产,其中一家德国大型厂商已关闭了在欧洲的大部分製造工厂,其他OEM也长时间停产。随着汽车生产放缓和 COVID-19 疫情进一步加剧了行业形势, OEM汽车内装涂料市场将在短期至中期内受到负面影响,预测期后半段的復苏速度将放缓。

主要亮点

- 从长远来看,疫情危机引发的对个人出行的偏好是推动市场发展的主要因素。最近的趋势是,由于道路和基础设施的不断完善、汽车租赁行业新创新兴企业的创新以及中产阶级可以负担得起的低成本汽车的普及,消费者对个人交通的偏好有所增加。

- 中东和非洲不断增加的投资机会以及即将到来的电动车需求可能会在未来提供机会。

- 亚太地区占据全球市场主导地位,消费量最高的国家是中国、印度、日本和韩国。

汽车OEM内装涂料市场趋势

乘用车市场带来庞大需求

- 在所研究的市场中,乘用车市场的需求最高。

- 在乘用车内装中,各种类型的单组分、多组分、溶剂型和水性涂料用于涂覆各种基材,例如 ABS 和聚碳酸酯。雷射蚀刻涂层也用于这些目的。

- 它用于涂覆各种内部区域,包括中央丛集、仪表丛集、仪表板、扬声器格栅、扶手和扶手边框、方向盘、门饰和把手。这些涂层的主要特性是其高光泽度和光滑的表面。

- 全球乘用车产量自2017年起持续下降。 2020年,新冠疫情加剧了产量下滑趋势,2020年全球乘用车总合为5583万辆,较2019年的6715万辆和2018年的7175万辆持续下降。

- 根据OICA统计,2021年上半年(1月至6月)全球乘用车产量较2020年同期成长逾26%。 2021年上半年产量约28,148,900辆,高于2020年的22,314,111辆。不过,产量为33,248,444辆,仍比2019年低15%。

- 然而,由于社交距离措施导致个人交通偏好发生变化,预计復苏后乘用车领域对汽车OEM内装涂料的需求成长率将高于商用车和其他汽车领域。

亚太地区占市场主导地位

- 亚太地区是汽车OEM内装涂料最大的市场。该区域市场的成长得益于庞大的汽车製造基地和亚太地区不断增加的投资,主要来自中国、印度和东南亚国协等主要经济体。

- 根据OICA统计,2020年,中国、日本、韩国和印度的汽车产量分别约为2523万辆、807万辆、351万辆和339万辆,占全球汽车产量的50%以上。

- 中国是世界上最大的汽车製造业国家。 2018年,产业成长放缓,产销量均出现下降。同样的趋势仍在持续,2019年产量下降了7.5%。汽车产业的表现受到经济转型和美国贸易战的影响。

- 中国政府计划在 2025 年让至少 5,000 辆燃料电池电动车上路,到 2030 年让至少 100 万辆上路。随着政府推动使用电动、混合动力汽车和燃料电池电动车,预计未来市场将会成长。

- 印度经济正在成长,未来市场机会潜力大。预计未来几年该国经济将进一步成长。儘管货币贬值和商品及服务税改革对国内产出产生了影响,但这些改革的影响正在逐渐消退。此外,政府正在采取措施吸引製造业的外国直接投资(FDI),将印度打造为製造业中心。

- 汽车业是该国最大的製造业之一,僱用了超过 3,700 万名工人,为该国的 GDP 贡献了约 7.5%。 2018年,印度成为全球第四大汽车市场和第七大商用车製造国。

- 据印度工业和国内贸易促进部(DPIIT)称,2000 年 4 月至 2020 年 6 月期间,印度汽车市场吸引了约 2,450 万美元的外国直接投资。这些因素预计将对印度汽车OEM内装涂料市场产生重大影响。

- 印度政府近期将电动车零件的进口关税从 15-30% 下调至 10-15%,同时也为汽车产业提供税收和财政激励措施,以应对近期新冠疫情危机带来的需求衝击。

- 总体而言,儘管国内汽车行业将在未来几年尝试从这场危机中恢復,但预计预测期内对OEM汽车内饰涂料的需求将保持中等至低水平。

汽车OEM内装涂料产业概况

全球汽车OEM内装涂料市场已部分整合,主要企业占全球市场约50%的份额。主要企业包括 PPG Industries Inc、Akzo Nobel NV、Kansai Nerolac Paints Limited、 BASF SE 和 Axalta Coating Systems, LLC。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 个人出行偏好

- 对改进汽车内装的需求不断增加

- 限制因素

- 新冠肺炎疫情的负面影响

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔

- 按树脂

- 环氧树脂

- 聚氨酯

- 丙烯酸纤维

- 其他树脂

- 按图层

- 底漆

- 底涂层

- 透明涂层

- 按车型

- 搭乘用车

- 轻型商用车

- 重型商用车

- 其他车型

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 伊朗

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作、协议

- 市场占有率分析**/排名分析

- 主要企业策略

- 公司简介

- Akzo Nobel NV

- Axalta Coating Systems

- BASF SE

- Fujikura Kasei Co. Ltd

- Kansai Nerolac Paints Limited

- NB Coatings

- PPG Industries

- The Sherwin-Williams Company

- KCC Corporation

第七章 市场机会与未来趋势

- 增加中东和非洲的投资机会

- 未来电动车的需求

The Automotive OEM Interior Coatings Market is expected to register a CAGR of greater than 2.5% during the forecast period.

The outbreak of COVID-19 is likely to bring several short-term and long-term consequences in the automotive industry, which is likely to affect the OEM interior coatings market. The supply of many components from China has been delayed. This has resulted in the automotive industry, globally, running out of materials for production. According to OICA, the global production of automotive fell by around 16% in the year 2020, compared to 2019. Many OEMs shut down the majority of their European production, which includes leading German manufacturers shutting down the majority of their manufacturing units in Europe with other OEMs closing for a longer time. With automotive production slowing down and the COVID-19 pandemic further worsening the situation for the industry, the market for OEM automotive interior coatings is negatively affected in the short-/mid-term with a sluggish recovery rate during the latter part of the forecast period.

Key Highlights

- Over the long term, the major factor driving the market studied is the preference for personal transport owing to the pandemic crisis. The consumer preference for personal transport has grown over the recent years due to better development of roads and infrastructure, startup innovations in the car rental industry, and availability of low-cost cars that are affordable for the middle-class people.

- Rise in investment opportunities in the Middle East and Africa and upcoming demand for electric vehicles are likely to act as opportunities in the future.

- Asia-Pacific dominated the market across the world, with the largest consumption from countries, such as China, India, Japan, and South Korea.

Automotive OEM Interior Coatings Market Trends

Passenger Car Segment to Contribute Significant Demand to the Market

- The passenger cars segment has the largest demand in the market studied.

- In passenger car interiors, various types of single and multi-component and solvent-borne and waterborne coatings are used for coating various substrates, such as ABS and polycarbonate materials. Laser etchable coatings are also used for these purposes.

- They are used for coating various interiors, such as center clusters, meter clusters, instrument panels, speaker grills, armrest and armrest bezels, steering wheels, door trim, and handles. The important characteristics of these coatings are high gloss and a smooth finish.

- The world passenger car production has been in a steady decline since 2017. The COVID-19 has further aggravated this decline in 2020, as a total of 55.83 million cars were produced in 2020, a steady decline from 67.15 million units and 71.75 million units in 2019 and 2018, respectively, was registered.

- According to OICA, in the first half of 2021 (January-June), the global passenger vehicle production has increased by more than 26% when compared to the same period in 2020. In the first six months, the production has increased from 2,23,14,111 units in 2020, to reach about 2,81,48,90 in 2021. However, the production is still less by 15% compared to 2019, which is 3,32,48,444 units.

- However, the demand for automotive OEM interior coatings from the passenger cars segment is expected to increase with a higher rate relative to the commercial and other vehicles segments post-recovery, owing to the change in mobility preferences for personal mode of transport in the wake of social distancing measures.

Asia-Pacific Region to dominate the Market

- Asia-Pacific is the largest market for automotive OEM interior coatings. Growth in the regional market is driven by the huge automotive production base coupled with increased investments in the Asia-Pacific region, primarily from major economies, such as China, India, and ASEAN countries.

- According to OICA, around 25.23 million, 8.07 million, 3.51 million, and 3.39 million units of vehicles were produced in China, Japan, South Korea, and India, respectively, contributing to over 50% of the global automobile production in the year 2020.

- The Chinese automotive manufacturing industry is the largest in the world. The industry witnessed a slowdown in 2018, wherein the production and sales declined. A similar trend continued, with the production witnessing a 7.5% decline during 2019. The performance of the automotive industry was affected by the economic shifts and China's trade war with the United States.

- The Chinese government is planning to have a minimum of 5,000 fuel cell electric vehicles by 2025 and 1 million by 2030. With government promoting the use of electric, hybrid, and fuel cell electric vehicles, the market is expected to grow in the future.

- India is a growing economy and holds great potential for future market opportunities. The country's economy is expected to further grow in the coming years. Despite demonetization and GST reforms affecting the national production volume, the impact of these reforms is slowly waning. Moreover, the country's government has been taking initiatives to attract Foreign Direct Investments (FDIs) in the manufacturing sector, to make India a manufacturing hub.

- The automotive industry is one of the largest manufacturing sectors in the country and contributes about 7.5% to the nation's GDP, by employing more than 37 million workers. In 2018, India became the fourth-largest automobile market in the world and the seventh-largest commercial vehicle manufacturer.

- According to the Department of Promotion Industry and Internal Trade (DPIIT) around USD 24.5 million worth FDIs were attracted by the Indian automobiles market between the period of April 2000 to June 2020. Factors such as these will show a significant impact on the automotive OEM interior coatings market in the country.

- The Indian government has recently reduced customs duty on the import of components for electric vehicles from a range of 15-30% to 10-15%, along with tax breaks and fiscal packages for the automotive industry, to fight the recent demand shocks amid COVID-19 crisis.

- Overall, the demand for the automotive OEM interior coatings is expected to be moderate to low during the forecast period, while the automotive industry in the country will try to recover from this crisis in the coming years.

Automotive OEM Interior Coatings Industry Overview

The global automotive OEM interior coatings market is partially consolidated in nature, with the top players accounting for around 50% of the global market. The major companies include PPG Industries Inc, Akzo Nobel N.V., Kansai Nerolac Paints Limited, BASF SE, and Axalta Coating Systems, LLC, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Mobility Preference for Personal Transport

- 4.1.2 Growing Demand for Better Interiors in Vehicles

- 4.2 Restraints

- 4.2.1 Detrimental Impact of COVID-19

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Resin

- 5.1.1 Epoxy

- 5.1.2 Polyurethane

- 5.1.3 Acrylic

- 5.1.4 Other Resins

- 5.2 Layer

- 5.2.1 Primer

- 5.2.2 Base Coat

- 5.2.3 Clear Coat

- 5.3 Vehicle Type

- 5.3.1 Passenger Car

- 5.3.2 Light Commercial Vehicles

- 5.3.3 Heavy Commercial Vehicles

- 5.3.4 Other Vehicle Types

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Iran

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Akzo Nobel N.V.

- 6.4.2 Axalta Coating Systems

- 6.4.3 BASF SE

- 6.4.4 Fujikura Kasei Co. Ltd

- 6.4.5 Kansai Nerolac Paints Limited

- 6.4.6 NB Coatings

- 6.4.7 PPG Industries

- 6.4.8 The Sherwin-Williams Company

- 6.4.9 KCC Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rise in Investment Opportunities in the Middle-East and Africa

- 7.2 Upcoming Demand for Electric Vehicles