|

市场调查报告书

商品编码

1683221

储粮杀虫剂:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Stored Grain Insecticides - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

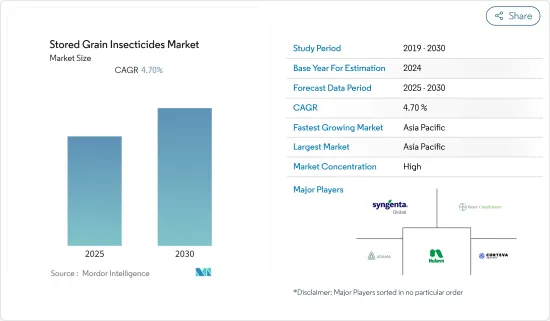

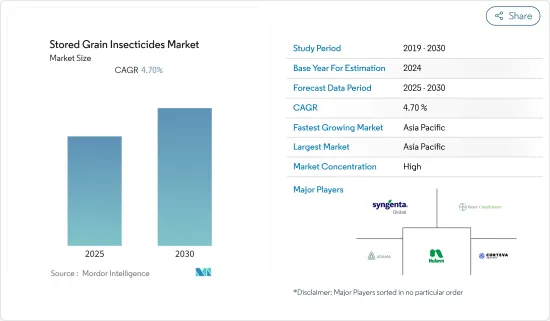

预计预测期内储存谷物杀虫剂市场复合年增长率为 4.7%。

收穫后阶段持续的市场价格上涨压力和对减少收穫后损失的日益关注是推动市场成长的关键因素。这些国家的许多小农户缺乏仓储设施,因此无法储存剩余粮食,导致收穫后损失增加。此外,各国政府也越来越重视解决迫在眉睫的粮食储存危机,并加大资金用于兴建高科技粮食储存筒仓。这可能会增加对昆虫作物保护剂的需求。席捲全球的疫情导致供应链中断,导致粮食库存和储存增加。为了保护储粮免受虫害的侵扰,农民对储粮杀虫剂的需求越来越大。因此,如果 COVID-19 的影响延续到 2021 年第三季度,除物流行业外,预计全球市场将进一步成长。

储粮杀虫剂的市场趋势

储粮害虫-人均损失

每年约有13亿吨粮食因害虫、螨虫、囓齿动物和鸟类的侵扰而浪费。使用杀虫剂是控制筒仓、谷仓和仓库中的昆虫和害虫非常有效的方法。根据联合国粮食及农业组织(FAO)的数据,已开发国家收穫后农业生产平均损失估计每年约为5%,开发中国家%。人们对减少收穫后损失的兴趣日益浓厚,尤其是在印度和中国等新兴经济体,这似乎是研究期间加强仓库杀虫剂销售的一个机会。农药在贸易过程中必不可少,在检疫过程中也很重要。这是因为去除一些作物,特别是园艺作物中的有害物质对于提高出口市场的农产品品质至关重要。在这种情况下,使用杀虫剂进行化学处理是唯一高效的技术。

亚太地区占市场主导地位

根据粮农组织的报告,印度温带作物种植区气温上升导致昆虫活动增加。这导致全国平均气温每上升1°C,水稻、玉米、小麦等作物的产量就会损失约10-25%。在印度,最常见的破坏粮食储存的昆虫是米象、羊甲虫、谷蛾和小谷螟/粮食螟/水稻螟。这些灾害影响了大米、小麦、玉米、高粱、大麦以及其他谷物等多种储存的粮食。这些昆虫对储粮的侵害日益严重,进一步扩大了国内储粮杀虫剂市场。然而,根据国际稻米研究所的报告,印度储存谷物农药的过度使用和滥用正在破坏大米和其他谷物的自然控制机制,这就是印度食品安全与农业部对此类农药的使用实施监管限制的原因。因此,FSSAI 对此类农药的使用实施了监管限制。这可能会在预测期内在一定程度上抑制市场成长。

储粮农药产业概况

储粮农药市场竞争激烈,各类中小企业占相当一部分市场。因此竞争非常激烈。全球大公司之间併购活动的增加也是促进市场整合的重要因素。北美和亚太地区是竞争最激烈的两个地区。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查结果

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素

- 市场限制

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场区隔

- 依产品类型

- 有机磷酸盐

- 拟除虫菊酯

- 生物杀虫剂

- 其他的

- 按应用

- 农场内部

- 非农场

- 出口

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 南美洲其他地区

- 非洲

- 南非

- 非洲其他地区

- 北美洲

第六章 竞争格局

- 最常采用的策略

- 市场占有率分析

- 公司简介

- Bayer CropScience AG

- Degesch America Inc.

- Syngenta AG

- Corteva AgriScience

- Nufarm Ltd

- Douglas Products

- Adama Agricultural Solutions Ltd.

- UPL Limited

第七章 市场机会与未来趋势

第八章 COVID-19 影响评估

The Stored Grain Insecticides Market is expected to register a CAGR of 4.7% during the forecast period.

Sustaining market pressure for better prices during the post-harvest stage and increasing focus on the reduction of post-harvest losses are the major factors driving the market growth. Lack of storage facilities in many small scale farms across various countries led to the inability to store surplus grains resulting in increased post harvest losses. Additionally, the respective governments are increasingly focusing toward keeping pace with its looming food storage crises and has increased the contribution toward the construction of high-tech grain storage silos. This is likely to augment the demand for insect grain protectants. The prevailing pandemic across the globe has resulted in increased stocking and storage of grains due to the disruption of supply chain. In order to protect the stored grains from pest infestation, farmers tend to demand the stored grains insecticide at an increasing level. Hence apart from logistics sector, the impact of COVID-19 if extended to the third quarter of 2021,the market is further observed to grow across the globe.

Stored Grain Insecticide Market Trends

Stored grain pest- per capita loss

Owing to the infestation of pests, mites, rodents, and birds, around 1,300 million metric ton of food grains are being wasted annually. The use of insecticides is a very effective method to control insects and pests in silos, grain bins, and warehouses. According to Food and Agricultural Organization (FAO), the average production loss of the post-harvest produce is estimated to be around 5% in the developed countries, 7% in industrialized countries, and around 7% in developing countries, annually. The increasing concerns toward reducing post-harvest losses, especially from the emerging economies, such as India and China, seems to be an opportunity, which can enhance the sales of warehouse insecticides during the study period. Insecticides are mandatory for trade processes and are important for the quarantine process, as elimination of toxic substances from few crops, especially horticulture crops, is essential to increase the quality of produce in the export market. In such cases, chemical treatment with insecticides is only the technique available, which works with high efficiency.

Asia Pacific Dominates the Market

According to a report by FAO, insect activity is on the rise because of the increasing temperature in the temperate crop-growing regions of India. This, in turn, is leading to the nationwide losses in the cultivation of crops, such as rice, corn, and wheat, by about 10-25% with per degree Celsius rise in mean surface temperature. The most common insects damaging grain storages in India are the rice weevil, the khapra beetle, the grain moth, and the lesser grain/ hooded-grain/ paddy borer. These affect a host of stored grains ranging from rice, wheat, maize, jowar, barley, and other grains. The increase in infestation of stored grains by such insects is further enhancing the market for stored grain insecticides in the country. However, according to reports by IRRI, the overuse and misuse of stored grain insecticides in India is disrupting the natural control mechanisms of rice and other grains, and hence, the FSSAI has set a maximum regulatory limit to the usage of such insecticides. This is going to deter the growth of the market to some extent in the said forecast period.

Stored Grain Insecticide Industry Overview

The storage grain insecticide market is highly competitive, with various small- and medium-sized companies coining reasonable shares in the world. This has resulted in a very stiff competition. The increasing merger and acquisition activities by the major players in different parts of the world is one of the major factors for the consolidated nature of the market. North America and the Asia-Pacific are the two regions showing maximum competitor activities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions and Market Definition

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Organophosphate

- 5.1.2 Pyrethroids

- 5.1.3 Bio-Insecticides

- 5.1.4 Others

- 5.2 By Application type

- 5.2.1 On Farm

- 5.2.2 Off Farm

- 5.2.3 Export shipments

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Spain

- 5.3.2.5 Italy

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Rest of South America

- 5.3.5 Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Rest of Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adapted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Bayer CropScience AG

- 6.3.2 Degesch America Inc.

- 6.3.3 Syngenta AG

- 6.3.4 Corteva AgriScience

- 6.3.5 Nufarm Ltd

- 6.3.6 Douglas Products

- 6.3.7 Adama Agricultural Solutions Ltd.

- 6.3.8 UPL Limited