|

市场调查报告书

商品编码

1683226

切割设备:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Cutting Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

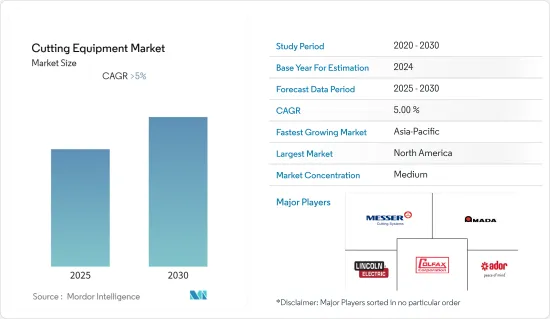

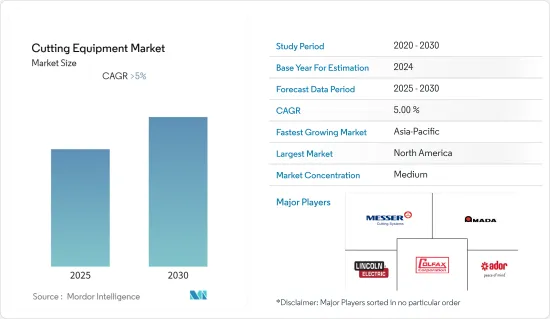

预测期内,切割设备市场预计将以超过 5% 的复合年增长率成长。

主要亮点

- 新冠肺炎疫情对切割设备业务产生了显着的负面影响。资金投入不足、劳动力流失、供应链中断等问题正在影响汽车、建筑、製造等产业,导致目标商标产品製造商的订单不稳定。美国、德国、中国、印度和其他国家的工厂运作正在放缓。建设产业、汽车业和其他行业的需求均呈现负成长。

- 市场成长主要受到全球汽车、航太等多个终端用户产业需求不断增长的推动。氧燃料切割技术由于其速度快、成本相对较低、切割精度高等优点而被广泛应用。为了满足不断增长的需求,先进的切割技术正在不断发展,公司也在增加对研发 (R&D) 活动的投资,以在製造效率、产品定价和产品能力方面取得竞争优势。

- 此外,对金属製品的需求不断增加、重型工业设备的发展、製造流程的进步以及最新技术的采用也在推动市场的发展。此外,由于研究区域部分地区缺乏熟练劳动力,对自动化设备的需求也增加。

- 一些已开发国家的主要企业已经开始在其製造过程中使用机器人(工业切割机器人),以减少对人力的依赖。金属加工市场比其他行业更容易受到波动的影响,因此这些传统的切割过程可能会出现适度的成长。由于切割机是工具机市场的子区隔,工具机市场的成长对于目前正在研究的市场来说是一个正面的讯号。

- 中国是世界工具机市场领导者。在全球范围内,与成形技术相比,工具机产业占据了生产量的很大份额。如今,雷射切割被广泛用于切割陶瓷。陶瓷因其导热性和电绝缘性能在许多行业中发挥重要作用。这些特性使得陶瓷具有广泛的用途。

切割设备市场趋势

汽车产业前景光明

在汽车行业,製造商采用多种切割技术来获得高品质的边缘和切口。随着全球各地汽车产业的进步,该产业对切割设备的机会也日益增加。切割机在汽车工业中发挥重要作用,并以多种方式用于製造汽车零件、车架等。

雷射切割用于汽车製造的各个阶段。汽车产业不断变化的格局迫使设备製造商满足要求并製造专门的切削工具。

自2020年以来,受新冠疫情和汽车半导体短缺影响,全球汽车领域需求疲软、生产停摆。受晶片短缺影响,预计2021年全球将有约1,130万辆汽车停产,2022年预计还将有700万辆汽车因汽车产业供应链中断而停产。据Statista 称,全球汽车销量在疫情期间下滑,但目前已恢復,2021 年达到 6,670 万辆。

就产量而言,预计亚太地区将出现最大成长,其次是北美。这可能会增加对製造过程中使用的切割设备和其他机械的需求。

亚太地区创下最高成长率

分析表明,未来几年亚太地区(APAC)的成长速度将超过其他地区。该地区拥有最多的製造工厂,也是切割机最常用的地区。由于中国拥有庞大的製造业,预计将成为该地区的主要参与者。此外,汽车是中国的支柱产业之一,中国仍然是世界上最大的汽车市场。

在东协,製造业是该地区成长要素之一。该地区经济运营成本低,吸引了许多来自大型製造地的企业。近年来,中国工资上涨、监管趋严以及向高附加价值製造业转变,推高了营运成本。

为了取代中国曾经扮演的角色,企业正转向东协地区建立低附加价值生产网络,这些网络也日益融入全球製造业价值链。分析认为,切割设备製造商应聚焦成长市场,服务新兴製造业,并调整销售管道以提升销售量。

切割机产业概况

切割设备市场高度分散,既有大型全球企业,也有中小型本地企业,其中相当一部分企业占据市场占有率。市场的主要企业包括林肯电气公司、梅塞尔切割系统、科尔法克斯公司、阿多尔焊接公司和AMADA公司。对主要国家製造基地的分析表明,许多全球性企业都在主要国家设有基地。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

- 分析方法

- 研究阶段

第三章执行摘要

第四章 市场概况与动态

- 当前市场状况

- 市场动态

- 驱动程式

- 限制因素

- 机会

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者/购买者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 全球製造业(概况、趋势、研发、关键统计等)

- 政府对製造业的主要法规和倡议

- 金属加工产业概况(概述、关键指标、主要发展等)

- 技术简介

- 切削刀具和刀柄见解

- COVID-19 市场影响

第五章 市场区隔

- 依技术分类

- 雷射

- 电浆

- 水刀

- 框架

- 其他技术

- 按最终用户

- 车

- 航太和国防

- 电气和电子

- 建造

- 其他最终用户

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 埃及

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争格局

- 市场集中度概览

- 公司简介

- The Lincoln Electric Company

- Messer Cutting Systems

- Genstar Technologies

- Colfax Corporation

- Linde Group

- Struers

- Ador Welding Ltd.

- GCE Group

- DAIHEN Corporation

- Hypertherm

- Amada Miyachi

- Koike Aronson, Inc

- Kennametal

- TRUMPF GmbH+Co. KG

- Bystronic Laser AG*

第七章 市场机会与未来趋势

第 8 章 附录

- GDP 分布(依活动)- 主要国家

- 资本流动洞察 – 主要国家

- 经济统计 – 製造业、对经济的贡献(主要国家)

- 全球製造业统计

The Cutting Equipment Market is expected to register a CAGR of greater than 5% during the forecast period.

Key Highlights

- The COVID-19 outbreak had a significant negative impact on the cutting equipment business. The absence of capital equipment investment, worker migration, interrupted supply chains, and other issues affect the automotive, construction, manufacturing, and other industries, which results in inconsistent orders from original equipment manufacturers. It has slowed down factory operations in the United States, Germany, China, India, and other nations. Negative demand has resulted in the construction, automotive, and other industries.

- The growth of the market is primarily driven by the increasing demand from several end-user industries, such as automotive, aerospace, and others, across the world. Oxy-fuel cutting technology is widely used due to its high speed, relatively low cost, and precision cuts. Owing to the growing demand, advanced cutting technologies are evolving, and companies are investing more in research and development (R&D) activities to gain a competitive advantage in terms of manufacturing efficiency, product pricing, and product capabilities.

- Furthermore, the market is also driven by the growing demand for fabricated metal products, the development of heavy industrial equipment, advancements in manufacturing processes, and the adoption of the latest technologies. Additionally, the demand for automated equipment is also increasing due to the shortage of skilled personnel in some of the regions studied.

- Major companies in several developed countries have started using robotics (industrial cutting robots) for their manufacturing processes to reduce their dependency on manpower. The metal fabrication market may be less prone to wild fluctuations than other industries, which will allow these conventional cutting processes to grow moderately. Since cutting machines are a sub-segment of the machine tool market, the growth of the machine tool market is a positive sign for the current market studied.

- China is the global leader in the machine tool market. Worldwide, the machine tooling sector represented a major share in terms of production volume when compared to forming technology. Nowadays, laser cutting is commonly used to cut ceramics. Ceramics play an important role in many industries owing to their thermal conductivity and electrical insulation. This kind of property has made ceramics useful for different applications.

Cutting Equipment Market Trends

Positive Outlook for the Automotive Industry

In the automotive industry, manufacturers are adopting several cutting technologies to get high-quality edges and cuts. As the automotive industry around the world gets better, there are more opportunities for cutting equipment in this industry. Cutting equipment is a big part of the automotive industry and is used in a number of ways to make car parts, frames, and other things.

Laser cutting is used at various stages of automotive manufacturing. The ever-changing landscape of the automotive industry is putting pressure on equipment manufacturers to meet requirements and create special cutting tools.

The COVID-19 pandemic and automotive semiconductor shortages resulted in lower demand and production halts for the worldwide automobile sector since 2020. Around 11.3 million vehicles were removed from production globally in 2021 as a result of the chip shortage, and predictions predict that seven more million vehicles will be removed from production in 2022 as a result of supply chain disruptions in the automotive industry. After experiencing a decline during the pandemic, global auto sales began to rebound, reaching 66.7 million units sold in 2021, according to Statista.

When it comes to production volumes, APAC is expected to grow the most, followed by North America. This is likely to increase the need for cutting equipment and other machines used in the manufacturing process.

Asia-Pacific to Register Highest Growth Rate

Analysis suggests that Asia-Pacific (APAC) will grow faster than other regions over the next few years.The region has the highest number of manufacturing plants, where the adoption of cutting machines is substantial. China is expected to be the major country in the region owing to its vast manufacturing sector. Additionally, automotive is one of China's pillar industries, and it continues to be the largest vehicle market in the world.

In ASEAN, the manufacturing sector has been one of the region's key economic growth drivers. The economies in this region have low operating costs, which attract many businesses from larger manufacturing bases. In recent times, China has seen rising wages and tighter regulations, which have led to an increase in operating costs as it shifts towards higher-value manufacturing.

To replace the role that China once played, companies are looking to the ASEAN region for lower-value production networks, which have also been largely integrated into global manufacturing value chains. As per the analysis, cutting equipment manufacturers should align their distribution channels to focus on the growing markets by serving the emerging manufacturing sectors to increase their sales.

Cutting Equipment Industry Overview

The cutting equipment market is fairly fragmented in nature, with the presence of large global players and small and medium-sized local players, with quite a few players who occupy the market share. Some of the major players in the market are The Lincoln Electric Company, Messer Cutting Systems, Colfax Corporation, Ador Welding Ltd., and Amada. When analyzing major countries' manufacturing establishments, it is revealed that many of the global companies have a footprint in the major countries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW AND DYNAMICS

- 4.1 Current Market Scenario

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.2 Restraints

- 4.2.3 Opportunities

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers / Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Global Manufacturing Sector (Overview, Trends, R&D, Key Statistics, etc.)

- 4.5 Key Government Regulations and Initiatives for Manufacturing Sector

- 4.6 Metal Working Industry Snapshot (Overview, Key Metrics, Developments, etc.)

- 4.7 Technology Snapshot

- 4.8 Insights on Cutting Tools and Tool Holders

- 4.9 Impact of COVID - 19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Technology

- 5.1.1 Laser

- 5.1.2 Plasma

- 5.1.3 Waterjet

- 5.1.4 Flame

- 5.1.5 Other Technologies

- 5.2 By End-user

- 5.2.1 Automotive

- 5.2.2 Aerospace and Defense

- 5.2.3 Electrical and Electronics

- 5.2.4 Construction

- 5.2.5 Other End-Users

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 UAE

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Egypt

- 5.3.5.4 South Africa

- 5.3.5.5 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 The Lincoln Electric Company

- 6.2.2 Messer Cutting Systems

- 6.2.3 Genstar Technologies

- 6.2.4 Colfax Corporation

- 6.2.5 Linde Group

- 6.2.6 Struers

- 6.2.7 Ador Welding Ltd.

- 6.2.8 GCE Group

- 6.2.9 DAIHEN Corporation

- 6.2.10 Hypertherm

- 6.2.11 Amada Miyachi

- 6.2.12 Koike Aronson, Inc

- 6.2.13 Kennametal

- 6.2.14 TRUMPF GmbH + Co. KG

- 6.2.15 Bystronic Laser AG*

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 APPENDIX

- 8.1 GDP Distribution, by Activity-Key Countries

- 8.2 Insights on Capital Flows-Key Countries

- 8.3 Economic Statistics-Manufacturing Sector, Contribution to Economy (Key Countries)

- 8.4 Global Manufacturing Industry Statistics