|

市场调查报告书

商品编码

1683417

脂肪族烃溶剂和稀释剂:市场占有率分析、产业趋势和统计、成长预测(2025-2030 年)Aliphatic Hydrocarbon Solvents and Thinners - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

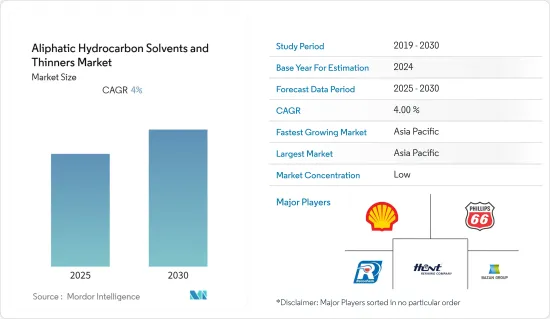

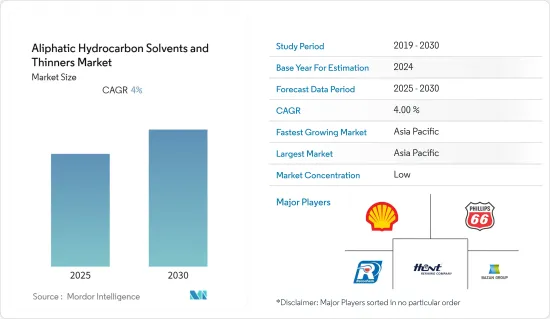

预测期内,脂肪族烃溶剂和稀释剂市场预计复合年增长率为 4%。

由于全球被覆剂的使用越来越多,预计预测期内脂肪族烃溶剂和稀释剂市场将会成长。

亚太地区占据全球市场主导地位,其中消费量最高的国家是中国、印度、日本和东南亚国协。

脂肪族烃溶剂和稀释剂市场趋势

扩大油漆和涂料的应用

- 脂肪族溶剂属于脂肪族化合物的范畴。脂肪族溶剂不含苯环。它们是饱和长直链(正构烷烃)、支链(异烷烃)或环状烷烃的混合物。这些溶剂是透过蒸馏原油以获得适当沸腾范围的馏分,然后进行处理以改善颜色和气味而生产的。

- 建筑业的兴起推动了脂肪族溶剂作为油漆和被覆剂中稀释剂和稀释剂的使用范围扩大,从而扩大了市场。

- 除了针对建筑业优化的建筑胶粘剂、油漆和被覆剂外,加工商还使用这些溶剂作为清洗和脱脂剂。

- 据估计,自2018年与前一年同期比较英国将建造27,000至50,000套住宅,将推动市场成长。

- 汽车和其他行业对油漆和被覆剂的需求不断增加,扩大了脂肪族烃溶剂和稀释剂的使用。

- 因此,由于油漆和涂料在建筑领域的应用日益广泛,中国、英国、美国、印度和日本等国家在这一市场中发挥重要作用。

亚太地区占市场主导地位

- 预计预测期内亚太地区将主导脂肪族烃溶剂和稀释剂市场。由于中国、印度和日本等国家的需求旺盛,脂肪族烃溶剂和稀释剂市场正在成长。

- 最大的脂肪族烃溶剂和稀释剂生产商位于亚太地区。脂肪族烃溶剂和稀释剂生产的主要企业包括荷兰皇家壳牌公司、Recochem Inc、Phillips 66、mg organics pvt。有限公司

- 2018年,印度政府宣布投资31.65兆美元,根据「智慧城市计画」建设100座城市。未来五年,100 个智慧城市和 500 个城市可以吸引价值 2 兆印度卢比(约 281.8 亿美元)的投资,为油漆和被覆剂中使用脂肪族烃溶剂和稀释剂创造空间。

- 随着中国政府启动大规模建设计画,包括未来十年将2.5亿人迁移到新的特大城市,建设活动有足够的空间,因此未来几年脂肪族烃溶剂和稀释剂市场将会扩大。

- 除了油漆和被覆剂之外,这些脂肪族烃溶剂和稀释剂还用于黏合剂、密封剂、橡胶製造以及包括汽车工业在内的各种最终用途。

- 除了油漆和被覆剂外,脂肪族烃溶剂和稀释剂也被用作汽车工业的清洁剂和脱脂剂。

- 上述因素和政府支持正在推动预测期内(2020-2025 年)脂肪族烃溶剂和稀释剂市场需求的增加。

脂肪族烃溶剂和稀释剂产业概况

全球脂肪族烃溶剂和稀释剂市场部分分散,只有少数几家公司占主导市场占有率。主要参与者包括荷兰皇家壳牌、亨特炼油公司、Recochem Inc、Phillips 66 和 Gadiv Petrochemical Industries Ltd.。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 越来越多地使用油漆和涂料作为稀释剂和稀释剂

- 由于用途广泛而需求不断增加

- 限制因素

- 严格的环境法规

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔

- 脂肪族烃溶剂型

- 己烷

- 庚烷

- 矿物油精

- 汽油

- 其他的

- 应用

- 画

- 胶水

- 清洗和脱脂

- 橡胶製造

- 其他的

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作、协议

- 市场占有率/排名分析

- 主要企业策略

- 公司简介

- BASF SE

- Brenntag Canada, Inc.

- Calumet Specialty Products Partners, LP

- Exxon Mobil Corporation

- Gadiv Petrochemical Industries Ltd

- Honeywell International Inc.

- Hunt Refining Company

- mg organics pvt. ltd

- Phillips 66

- Recochem Inc

- Royal Dutch Shell

第七章 市场机会与未来趋势

The Aliphatic Hydrocarbon Solvents and Thinners Market is expected to register a CAGR of 4% during the forecast period.

Aliphatic Hydrocarbon Solvents and Thinners market is expected to grow during the forecast period owing to growing application in paints and coatings across the globe.

Asia-Pacific region dominated the market across the globe with the largest consumption from the countries such as China, India, Japan and ASEAN countries.

Aliphatic Hydrocarbon Solvents & Thinners Market Trends

Growing Application in Paints & Coatings

- Aliphatic solvents are in the category of aliphatic compounds. Aliphatic solvents do not contain a benzene ring. They are mixtures of saturated, long straight chain (normal-paraffin), branched chain (iso-paraffin) or cyclic paraffins. These solvents are produced by the distillation of crude oil by the appropriate boiling point range fraction, and then are treated to improve their color and odor.

- The increasing buildings & construction sector is attributing to the growing application ofaliphatic solvents as thinners and diluents in paints and coatings thereby increasing its market.

- In addition to the construction adhesives, paints and coatings optimized for the construction industry, processors also use these solvents as cleaning and degreasing agents

- It is estimated that in United Kingdom around 27,000 - 50,000 new homes are built year-over-year from 2018 which in turn increases scope for this market

- Growing demand for paints and coatings from automotive sector and other industries are in turn increasing the application ofaliphatic hydrocarbon solvents and thinners

- Hence, growing application of paints & coatings in buildings & construction sector in countries like China, United Kingdom, United States, India, Japan are playing a major role in this market.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific region is expected to dominate the market foraliphatic hydrocarbon solvents and thinnersduring the forecast period. Due to the high demand application from countries like China, India and Japan the market foraliphatic hydrocarbon solvents and thinnershas been increasing.

- The largest producers of aliphatic hydrocarbon solvents and thinners are located in Asia-Pacific region. Some of the leading companies in the production of aliphatic hydrocarbon solvents and thinner are Royal Dutch Shell, Recochem Inc, Phillips 66, mg organics pvt. ltd

- In 2018, the Indian government has announced an investment worth USD 31,650 billion for the construction of 100 cities, under the smart cities plan. 100 smart cities and 500 cities are likely to invite investments worth INR 2 trillion (~USD 28.18 billion), over the coming five years creating scope for the application ofaliphatic hydrocarbon solvents and thinnersin paints andcoatings.

- The Chinese government has rolled out massive construction plans, including making provisions for the movement of 250 million people to its new megacities, over the next ten years creating a major scope for construction activity thereby increasing the market foraliphatic hydrocarbon solvents and thinnersover the coming years.

- Apart from paints & coatings these aliphatic hydrocarbon solvents and thinners are also used in adhesives & sealants, in rubber manufacturing and others which have multiple application in various end-user industries like automotive and others

- In automotive industry apart from paints and coatings thesealiphatic hydrocarbon solventsand thinners are used as cleansers and degreasing agents

- The aforementioned factors coupled with government support are contributing to the increasing demand for aliphatic hydrocarbon solvents and thinners market during the forecast period (2020-2025).

Aliphatic Hydrocarbon Solvents & Thinners Industry Overview

The global aliphatic hydrocarbon solvents and thinners market is partially fragmented with players accounting for a marginal share of the market. Few companies include are Royal Dutch Shell, Hunt Refining Company, Recochem Inc, Phillips 66, Gadiv Petrochemical Industries Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Application in Paints & Coatings as Diluents and Thinners

- 4.1.2 Growing Demand Owing to their Wide Range of Applications

- 4.2 Restraints

- 4.2.1 Stringent Environmental Regulations

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Aliphatic Hydrocarbon Solvent Type

- 5.1.1 Hexane

- 5.1.2 Heptane

- 5.1.3 Mineral Spirits

- 5.1.4 Gasoline

- 5.1.5 Others

- 5.2 Application

- 5.2.1 Paints & Coatings

- 5.2.2 Adhesives

- 5.2.3 Cleaning & Degreasing

- 5.2.4 Rubber Manufacturing

- 5.2.5 Others

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Brenntag Canada, Inc.

- 6.4.3 Calumet Specialty Products Partners, L.P

- 6.4.4 Exxon Mobil Corporation

- 6.4.5 Gadiv Petrochemical Industries Ltd

- 6.4.6 Honeywell International Inc.

- 6.4.7 Hunt Refining Company

- 6.4.8 mg organics pvt. ltd

- 6.4.9 Phillips 66

- 6.4.10 Recochem Inc

- 6.4.11 Royal Dutch Shell