|

市场调查报告书

商品编码

1683424

欧洲施工机械市场:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Europe Construction Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

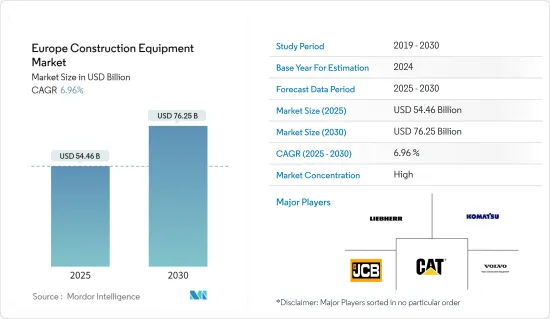

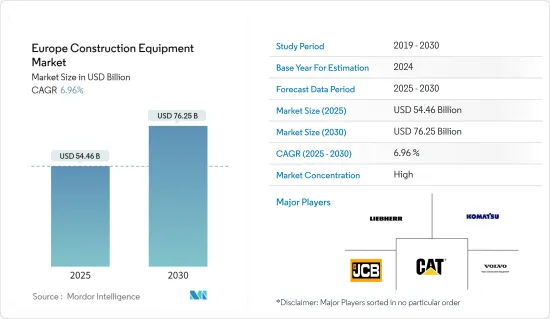

预计2025年欧洲施工机械市场规模为544.6亿美元,到2030年预计将达到762.5亿美元,预测期内(2025-2030年)的复合年增长率为6.96%。

快速的都市化和工业化、政府对基础设施建设的投资不断增加以及全部区域房地产和建设公司的扩张和增长是预计将推动市场需求的一些因素。

此外,新兴经济体正在大力投资基础建设,以解决交通拥堵、人口成长和交通基础设施老化等问题。它还专注于超级高铁和抗震结构等技术创新,以升级现有基础设施。这些因素正在推动欧洲施工机械市场的销售成长。

对经济高效机械的需求,加上降低排放气体的监管压力,促使施工机械製造商选择电动式和混合动力汽车,而不是传统的液压和机械汽车。因此,施工机械电动化进程正在加速。

一些公司采取了更好地服务客户的策略,例如开发先进技术和推出新型施工机械型号,以大幅提高市场占有率。例如

关键亮点

- 2023年6月,卡特彼勒公司推出了先进的Cat 995轮式装载机。与前代产品相比,这款新机型的效能提升了 19%。此外,它还可减少每小时燃料消费量高达 13%,并提高 8% 的效率。

- 2023 年 3 月,卡特彼勒 (Caterpillar Inc.) 推出了新的 Cat Smart 平土机 Blade 和 Smart Dozer Blade 选项。 GB120 和 GB124 智慧平土机铲刀的新型外部控制套件将这些铲刀的使用范围扩展到 Cat D 和 D2 系列 SSL 和 CTL 机器,从而使持有旧型号的客户能够运作智慧铲刀。

此外,自动化和电动化等技术先进的设备的出现,以及政府促进基础设施发展的倡议,为产业参与者开闢了新的机会。建筑业正变得越来越智慧化。数位化、连结性和自动化正在加速发展,对建筑计划产生重大影响。

租赁公司也准备投资新技术,以满足对先进施工机械日益增长的需求,并且预计在用新款或升级车型替换老旧车辆时,新机械的销量会更低。

欧洲施工机械市场趋势

电力驱动系统可望推动市场成长

由于电动建筑机械具有成本效益和环境永续性等诸多优势,建筑业正迅速转向电动施工机械。日益增长的环境问题成为欧洲国家采用电动施工机械的一个主要因素。由于限制碳排放和促进永续性的严格规定,建设公司正在寻找传统柴油动力施工机械的环保替代品。

电动施工机械零排放、低噪音,是噪音污染严重的都市区建筑工地的理想选择,提供更环保的选择。此外,电动施工机械的长期成本较低。电动式施工机械虽然初期投资较高,但运作成本比传统柴油动力施工机械低。

此外,技术进步使得电动式施工机械更加强大,使其成为希望在不牺牲品质的情况下节省电动式的施工机械建设公司的好选择。

施工机械製造领域的主要企业正在欧洲积极推出新型施工机械,进一步推动市场成长。例如

- 2023年9月,柳工在欧洲推出了一款新型21吨电动轮式装载机。这款电动轮式装载机配备423kWh磷酸锂铁电池,体现了业界对电动技术的承诺。

- 2023年7月,小松株式会社向欧洲推出了新型3吨级电动迷你挖土机PC33E-6。该电动挖土机配备了35kWh锂离子电池,符合电气化日益增长的趋势。

- 2023年6月,电池电动挖土机EC230成功部署在欧洲和亚洲的多个业务应用。目前它仅向欧洲的部分客户发售。 23 吨的 EC230 电动挖土机的性能可与传统柴油挖土机相媲美,同时还具有零排放、更低噪音和振动、更佳可控性和更低总拥有成本等优势。操作员报告称,其挖掘力与沃尔沃 EC200E 柴油机相当,同时循环时间更快,噪音显着降低。

受全部区域上述发展的推动,该领域预计在预测期内将显着增长。

预计德国将占据相当大的市场份额

德国施工机械市场受到加强基础设施能力的投资增加、政府注重建设高效的公路运输网络以及对动力机械等先进设备的需求的推动。日益扩张的建筑业对于施工机械的需求庞大。

- 2023 年 10 月,BEOS AG 授予 Implenia 及其合资伙伴 Dressler Bau GmbH 订单,在柏林莫阿比特区建设开创性的城市园区「BERLIN DECKS」的另外两个部分。 Implenia 是该计划的技术负责人。

- 2023年9月,德国联邦政府和德国铁路(DB)宣布了自1994年铁路改革以来最大规模、最雄心勃勃的铁路网络和车站基础建设计划。

- 该宣言是在 2023 年 9 月中旬在法兰克福举行的联邦数位事务和运输部主办的铁路高峰会上发表的。

在市场上运营的各种国内外製造公司也在积极推出新产品并扩大业务范围,以满足日益增长的国内需求,这可能会对目标市场产生积极影响。

考虑到上述因素,预计该市场在预测期内将显着成长。

欧洲施工机械行业概况

欧洲施工机械市场由利勃海尔和沃尔沃设备等主导参与企业垄断。为了提高各行业的业务效率,开发融入先进技术的新产品的趋势日益增长。

2024年2月,小松宣布,计划在2024年4月于巴黎举办的Intermat 2024展览会上向欧洲设备买家展示其新型3吨级电动迷你挖土机PC33E-6。小松表示,新型电动迷你挖土机旨在提高零排放驾驶的标准。据报道,PC33E-6 具有一流的功能和出色的性能,可使施工现场更安全、更干净、更安静。

2023年12月,久保田公司宣布将于2024年春季在欧洲市场推出电动迷你挖土机KX038-4e。久保田正在扩大其常用于都市区建筑工程的迷你挖土机产品线,包括电动型号,旨在实现建筑领域的碳中和。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 扩大基础建设投资

- 市场限制

- 全部区域施工机械租赁服务快速扩张

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第 5 章 市场区隔(市场规模(美元))

- 按机器类型

- 起重机

- 伸缩式搬运

- 挖土机

- 装载机和后铲

- 平土机马达

- 其他机器类型

- 按驱动类型

- 内燃机

- 电动/混合动力

- 按国家

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

- 其他欧洲国家

第六章 竞争格局

- 供应商市场占有率

- 公司简介

- Liebherr Group

- JCB Limited

- Volvo Construction Equipment

- CNH Industrial NV

- Hitachi Construction Machinery Co. Ltd

- Deere & Company

- Atlas Copco Group

- Manitou Group

- Sandvik Group

- Caterpillar Inc.

第七章 市场机会与未来趋势

The Europe Construction Equipment Market size is estimated at USD 54.46 billion in 2025, and is expected to reach USD 76.25 billion by 2030, at a CAGR of 6.96% during the forecast period (2025-2030).

Rapid urbanization and industrialization, as well as the growing government investments in infrastructure development and the expansion and growth of real estate and construction companies throughout the region, are some of the factors that are anticipated to boost demand in the market.

Additionally, emerging economies invest significantly in infrastructure development to address traffic congestion, population growth, and aging transportation infrastructure. They also focus on innovations such as the hyperloop and earthquake-resistant construction to upgrade their existing infrastructure. Due to these factors, the construction equipment market in Europe is experiencing sales growth.

The demand for cost-effective machines, combined with regulatory pressures for lower emissions, is pressuring construction equipment manufacturers to choose electric and hybrid vehicles over traditional hydraulic and mechanical vehicles. As a result, progress in the electrification of construction equipment is accelerating.

Some companies are adopting strategies to gain a significant market share, such as developing advanced technology and launching new construction equipment to cater to their customers better. For instance:

Key Highlights

- In June 2023, Caterpillar Inc. introduced the advanced Cat 995 Wheel Loader. This new model boasts a significant 19% improvement over its predecessor. Additionally, it promises a reduction in hourly fuel consumption by up to 13% and an efficiency boost of 8%.

- In March 2023, Caterpillar announced the new Cat Smart Grader Blade and Smart Dozer Blade options. The new external control kit for the GB120 and GB124 smart grader blades expands the use of these blades to Cat D and D2 series SSL and CTL machines, enabling customers with previous model fleets to run smart blades.

Additionally, the emergence of technologically advanced equipment, both autonomous and electrified, and government initiatives promoting infrastructure development present new business opportunities for industry participants. The building industry is becoming more intelligent. Development is being accelerated by digitalization, connectivity, and automation, which have a significant impact on building projects.

It is also expected that rental companies will undercut sales of new equipment because they are prepared to invest in new technologies to meet the rising demand for sophisticated construction equipment and replace their outdated fleets with new or upgraded models.

Europe Construction Equipment Market Trends

The Electric Drive Type is Expected to Drive the Growth of the Market

The construction industry has been rapidly shifting toward electric construction equipment because of its many advantages, including cost-effectiveness and environmental sustainability. Growing environmental concerns are a major factor in European nations' growing acceptance of electric construction equipment. Due to stringent regulations to curb carbon emissions and foster sustainability, construction companies seek environmentally friendly substitutes for conventional diesel-powered equipment.

With zero emissions and reduced noise levels, electric construction equipment provides a more environmentally friendly option that is perfect for urban construction sites where noise pollution is an issue. In addition, long-term costs are lower for electric construction equipment. Electric equipment has lower running costs than traditional diesel-powered equipment, even though the initial investment may be higher.

Furthermore, owing to technological advancements, electric construction equipment now performs much more efficiently, making it a good choice for building companies trying to save costs without sacrificing quality.

Key players in the construction equipment manufacturing sector are actively introducing new models of construction equipment in the European region, further driving market growth. For instance:

- In September 2023, LiuGong unveiled a new 21-tonne electric wheeled loader in Europe. This electric wheel loader features a substantial 423kWh lithium iron phosphate battery, exemplifying the industry's commitment to electric technology.

- In July 2023, Komatsu Ltd introduced the PC33E-6, a novel 3-ton class electric mini excavator in Europe. This electric excavator is powered by a 35kWh lithium-ion battery, aligning with the growing trend toward electrification.

- In June 2023, the battery-electric EC230 excavator showed success in a number of commercial applications in Europe and Asia. It is currently offered for sale to a limited number of European clients. Along with the same performance as its conventional diesel counterpart, the 23-ton EC230 Electric excavator also has the advantages of zero emissions, low noise, low vibration, improved controllability, and a lower total cost of ownership. Operators have reported that it achieves a digging force comparable to the Volvo EC200E diesel equivalent, which is achieved with a faster cycle time and significantly reduced noise.

The segment is expected to witness substantial growth during the forecast period, driven by the advancements listed above across the region.

Germany is Expected to Hold a Considerable Market Share in the Market

The construction equipment market in Germany is being driven by rising investments in enhancing infrastructural capability, the government's focus on building efficient road transportation networks, and the demand for advanced equipment such as electric-powered equipment. The country's expanding construction industry has a massive demand for construction equipment.

- In October 2023, BEOS AG gave Implenia and its joint venture partner Dressler Bau GmbH the construction of two more sections of the groundbreaking BERLIN DECKS city campus in Berlin-Moabit. Implenia is the project's technical lead.

- The German Federal Government and Deutsche Bahn (DB) unveiled the largest and most extensive infrastructure program for the railway network and stations since the 1994 railway reform in September 2023.

- This declaration was made in Frankfurt during the Railway Summit hosted by the Federal Ministry for Digital Affairs and Transport in mid-September 2023.

Various domestic and international manufacturing companies operating in the market are also actively engaging in launching new products and expanding their business presence to cater to the increasing demand in the country, which would positively impact the target market.

Based on the aforementioned points, the market studied is expected to witness significant growth during the forecast period.

Europe Construction Equipment Industry Overview

The European construction equipment market is consolidated, with dominant players like Liebherr and Volvo Equipment. A growing trend is the development of new products that are equipped with advanced technologies to enhance the entire industry's operational efficiency.

In February 2024, Komatsu announced that its new PC33E-6 3-ton class electric mini excavator was expected to make its equipment debut for European equipment buyers at the Intermat 2024 fair in Paris in April 2024. Komatsu claims that the new electric mini excavator is intended to raise the bar for emission-free operations. According to reports, the PC33E-6 will provide class-leading features and outstanding performance to improve construction site safety, cleanliness, and quietness.

In December 2023, Kubota Corporation announced the launch of the KX038-4e electric mini excavator to the European market in the spring of 2024. Kubota aims to achieve carbon neutrality in construction by expanding its range of mini excavators, which are commonly utilized for construction work in urban areas, and include an electric model.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growing Investments in Infrastructure Deployment

- 4.2 Market Restraints

- 4.2.1 Rapid Expansion of Construction Equipment Rental Services Across the Region

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in USD)

- 5.1 By Machinery Type

- 5.1.1 Cranes

- 5.1.2 Telescopic Handling

- 5.1.3 Excavators

- 5.1.4 Loaders and Backhoe

- 5.1.5 Motor Graders

- 5.1.6 Other Machinery Types

- 5.2 By Drive Type

- 5.2.1 IC Engine

- 5.2.2 Electric and Hybrid

- 5.3 By Country

- 5.3.1 Germany

- 5.3.2 United Kingdom

- 5.3.3 France

- 5.3.4 Russia

- 5.3.5 Spain

- 5.3.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Liebherr Group

- 6.2.2 JCB Limited

- 6.2.3 Volvo Construction Equipment

- 6.2.4 CNH Industrial NV

- 6.2.5 Hitachi Construction Machinery Co. Ltd

- 6.2.6 Deere & Company

- 6.2.7 Atlas Copco Group

- 6.2.8 Manitou Group

- 6.2.9 Sandvik Group

- 6.2.10 Caterpillar Inc.