|

市场调查报告书

商品编码

1687298

东协施工机械-市场占有率分析、产业趋势与成长预测(2025-2030年)ASEAN Construction Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

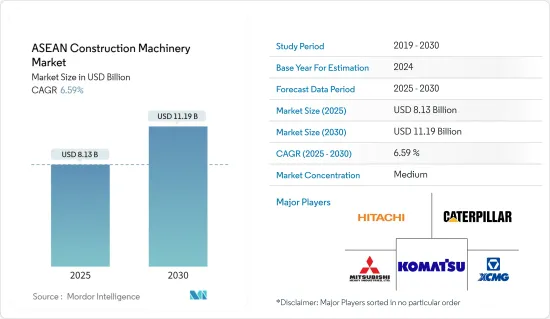

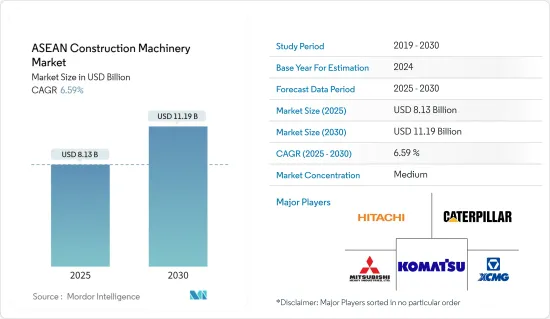

2025年东协施工机械市场规模预估为81.3亿美元,预估至2030年将达111.9亿美元,预测期间(2025-2030年)的复合年增长率为6.59%。

COVID-19 疫情对所研究的市场产生了负面影响,主要是由于建筑和製造业活动的停止。此外,东协各国政府已暂停管道计划并减少现场劳动力。这导致建筑产量下降。然而,由于建设活动的增加,预计市场在预测期内将显着增长,这主要得益于全球政府支持的增加和建设活动的復苏。

从中期来看,东协地区对施工机械的需求将受到基础设施支出增加的推动。此外,随着该地区製造业的成长,世界各地的製造商正计划将业务转移到东南亚国家,因为那里成本更低、国内消费增加、基础设施改善和扩大,从而导致对施工机械的需求增加。

此外,政府鼓励基础设施活动和增加采用电动化、自动化和技术先进的机器的倡议也可能为市场参与企业提供新的机会。建筑业正变得越来越聪明。数位化、连结性和自动化正在推动发展并对建筑计划产生重大影响。此外,租赁公司正在投资新技术以满足对先进施工机械日益增长的需求,以更新、升级的机器取代旧的施工机械。

快速的都市化、工业化、随之而来的政府对基础设施市场发展的投资增加以及全部区域房地产和建设公司的扩张和成长活动等因素预计将推动市场需求。

东协施工机械市场趋势

混凝土和道路建设推动需求

- 去年,新冠疫情对东协建筑业产生了重大影响。严格的封锁和社交距离规定迫使各种规模和收入的建筑工程停顿。结果,施工中通常使用的劳动力和设备都没有被利用。

- 一段时间内销售、出租或租赁机械的企业也受到不利影响。随着建筑业的全面停摆,对大型机械的需求已完全消失。随着中国完全停止贸易,原材料的运输也停止了,因此没有必要使用机器。

- 过去几年,道路施工机械市场取得了显着增长,主要原因是地方政府发起的道路开发项目增加。

- 由于道路建设工程的增加,对施工机械的需求不断增加,而这些机械的进口也刺激了这种需求。新加坡对东协地区以外的重型机械出口多年来一直保持持续成长,主要原因是该地区建筑计划投资的增加。东南亚国协中经济快速成长的例子有菲律宾和泰国。泰国从新加坡进口的重型机械的成长速度在该地区排名第二。

- 随着道路建设活动的活性化,对施工机械的需求也上升,而这些机械的进口也支持了这项需求。近年来,受东协地区建筑计划和投资增加的主要推动,新加坡对东协以外地区的重型机械出口稳步增长。东协高成长机会的例子包括菲律宾和泰国。新加坡对泰国的重型机械出口是该地区成长速度第二快的。

- 因此,东协地区各国政府为推动计划计划、增加政府参与项目规划、协调和资金筹措而采取的各种措施预计将在预测期内推动市场扩张。

越南对施工机械的需求不断增加

越南施工机械市场近期的走势很大程度得益于越南建筑基础设施开发计划的增加。

过去十年来,越南机械设备产业取得了显着成长。 2010年至2019年间,该产业公司的净收入年增率为14.3%,证明了这一点。 2020年,越南拥有超过2,200家机械设备生产企业,总合达46亿美元。

越南机场扩建等许多公共基础设施计划都是在官民合作关係模式下实施的。越南政府计划在未来五年内投资 110 亿美元用于机场建设,计划预计将于 2022 年启动。

到2030年,政府计划投资650亿美元用于道路建设。到2030年,公路网路建设预计将占交通运输领域总投资的48%左右。隆城机场(160亿美元)、胡志明市地铁(62亿美元)、南北高速公路(185亿美元)、河内环城公路(3.68亿美元)、海云2号隧道(3.12亿美元)和岘港莲照港(1.47亿美元)都是预计于2022年完工的大型公路建设计划。

考虑到越南正在进行和即将开展的所有建设活动,预计起重机市场在预测期内将实现稳步增长,从而推动该国的施工机械市场的发展。

东协施工机械产业概况

东协施工机械市场的特点是国际和区域参与企业众多,市场竞争日益激烈。领先的公司正在成倍地增加其研发支出,以将创新与卓越的性能相结合。预计终端市场对高性能、高效、安全的搬运设备的需求将在预测期内加剧市场竞争。

2022年3月,铱星通讯公司宣布与住友建机共同开发了链带式挖土机。透过此次合作,SCM 初步将铱星的短突发资讯服务整合到其远端 CARE 服务平台中。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 建设活动的增加推动了市场

- 市场限制

- 高昂的设备成本可能会阻碍市场

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 机器类型

- 起重机

- 挖土机

- 装载机

- 后铲

- 平土机马达

- 其他机器

- 应用

- 混凝土和道路建设

- 土木工程

- 物料输送

- 地区

- 印尼

- 泰国

- 越南

- 新加坡

- 马来西亚

- 菲律宾

- 其他东南亚国协

第六章竞争格局

- 供应商市场占有率

- 公司简介

- Hitachi Construction Machinery Co.

- Caterpillar Inc.

- Mitsubishi Corporation

- Komatsu Ltd.

- Xuzhou Construction Machinery Group Co., Ltd.

- Liebherr Group

- CNH Industrial

- JC Bamford Excavators Ltd(JCB)

第七章 市场机会与未来趋势

The ASEAN Construction Machinery Market size is estimated at USD 8.13 billion in 2025, and is expected to reach USD 11.19 billion by 2030, at a CAGR of 6.59% during the forecast period (2025-2030).

The COVID-19 pandemic had a negative impact on the market studied, primarily attributed to halted construction and manufacturing activities. In addition, governments across the ASEAN countries paused the pipeline projects and reduced the workforce over the sites. This has led to a reduction in construction output. However, the market is anticipated to witness significant growth during the forecast period due to the increase in construction activities, which is likely to be primarily attributed to increasing government support and restoration of construction activities worldwide.

Over the medium term, demand for construction machinery in the ASEAN region is driven by increased infrastructure spending. Additionally, with growth in the manufacturing industry in the region, manufacturers from all across the world are planning to shift their operations to the Southeast Asian nations due to lower costs, increasing domestic consumption, and improving and expanding infrastructure, which, in turn, resulted in higher demand for construction machinery.

Moreover, the government initiatives encouraging infrastructure activities and the rising adoption of technologically advanced machinery, both electrified and autonomous, tend to offer new opportunities for players operating in the market. The construction industry is getting smarter. Digitalization, connectivity, and automation are driving the development forward, substantially impacting construction projects. Moreover, renting companies are geared to invest in new technologies to cope with the growing demand for advanced construction machinery and replace the older ones with new or upgraded machinery fleet.

Factors such as rapid urbanization, industrialization, followed by rising government investments in the development of infrastructure, and expansion and growth activities of the real estate and construction companies across the region are expected to enhance demand in the market.

ASEAN Construction Machinery Market Trends

Concrete and Road Construction To Propel The Demand

- COVID-19 significantly impacted the ASEAN construction sector over the past year. Construction work of all sizes and incomes was forced to stop due to the strict lockdown and social distance regulations. As a result, neither the labor nor the equipment typically employed for construction was utilized.

- Companies that sold, rented, or leased out the machinery for a set time were negatively impacted. The demand for heavy-duty equipment was completely lost due to the construction industry's complete shutdown. Due to China's complete closure to trade, there was no need to use the machinery because raw material transportation was also stopped.

- Over the past few years, the road construction equipment market has witnessed significant growth, mainly due to increased road development programs initiated by regional governments.

- The need for construction equipment has been rising in response to the increase in road construction operations, and the importation of these machines is fueling this demand. The primary factors, led by the rising investment in building projects in the ASEAN region, have helped Singapore's heavy machinery exports to the rest of the ASEAN region rise consistently over the years. The Philippines and Thailand are two instances of ASEAN countries with fast economic growth. Thailand's imports of heavy machinery from Singapore have increased at the second-fastest rate in the region.

- With the rise in road construction activities, the demand for construction machinery has been increasing, which is supported by importing these machines. Exports of heavy machinery from Singapore to the rest of the ASEAN region have grown steadily over the years, supported by the key drivers and increased investment in construction projects in the ASEAN region. Two examples of high-growth opportunities in ASEAN are the Philippines and Thailand, among others. Singapore's heavy machinery exports to Thailand have the second-fastest growth in the region.

- Thus, various measures implemented by governments in the ASEAN area to promote infrastructure projects and increase government engagement in project planning, coordination, and financing are anticipated to fuel market expansion during the forecast period.

Increasing Demand for Construction Machinery in Vietnam

Vietnam's rising construction and infrastructure development projects are mostly to credit for the country's recent growth in the market for construction equipment.

Vietnam's machinery and equipment industry has grown significantly over the past ten years. This is demonstrated by the fact that between 2010 and 2019, the net revenue reported by businesses in this industry grew by 14.3% annually. Until 2020, Vietnam had over 2,200 businesses that produced machinery and equipment, bringing in a combined USD 4.6 billion.

Under the Public-Private Partnership model, a number of public infrastructure projects are undertaken, such as the expansion of Vietnam's airport. The Vietnamese government intends to invest USD11 billion in airport development over the following five years, with the project scheduled to begin in 2022.

By 2030, the government intends to spend 65 billion on road improvements. By 2030, the building of a road network is anticipated to account for around 48% of all investments made in the transportation sector. The Long Thanh Airport (USD16 billion), the Ho Chi Minh City Metro (USD6.2 billion), the North-South Express (USD18.5 billion), the Hanoi Ring Road (USD368 million), the Hai Van Tunnel 2 (USD312 million), and the Lien Chieu Port in Da Nang (USD147 million) are all significant road construction projects that will be completed in 2022.

Considering all the ongoing and future construction activities in Vietnam, the crane market is expected to witness steady growth over the forecast period, propelling the country's construction machinery market.

ASEAN Construction Machinery Industry Overview

The ASEAN construction machinery market is characterized by numerous international and regional players, resulting in a highly competitive market environment. The big players have increased their R&D expenditure exponentially to integrate innovation with excellence in performance. The demand for high-performance, highly efficient, and safe handling equipment from the end market is expected to make the market more competitive over the forecast period.

In March 2022, Iridium Communications Inc. announced that it had jointly developed a Link-Belt excavator with Sumitomo Construction Machinery Co., Ltd. Through this partnership, SCM initially integrated Iridium's Short Burst Data Service into its Remote CARE service platform.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Construction Activity May Drive the Market

- 4.2 Market Restraints

- 4.2.1 High Equipment Cost may Hamper the Market

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value USD Million)

- 5.1 Machinery Type

- 5.1.1 Cranes

- 5.1.2 Excavators

- 5.1.3 Loaders

- 5.1.4 Backhoe

- 5.1.5 Motor Graders

- 5.1.6 Other Machinery Types

- 5.2 Application

- 5.2.1 Concrete and Road Construction

- 5.2.2 Earth Moving

- 5.2.3 Material Handling

- 5.3 Geography

- 5.3.1 Indonesia

- 5.3.2 Thailand

- 5.3.3 Vietnam

- 5.3.4 Singapore

- 5.3.5 Malaysia

- 5.3.6 Philippines

- 5.3.7 Rest of ASEAN

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Hitachi Construction Machinery Co.

- 6.2.2 Caterpillar Inc.

- 6.2.3 Mitsubishi Corporation

- 6.2.4 Komatsu Ltd.

- 6.2.5 Xuzhou Construction Machinery Group Co., Ltd.

- 6.2.6 Liebherr Group

- 6.2.7 CNH Industrial

- 6.2.8 JC Bamford Excavators Ltd (JCB)