|

市场调查报告书

商品编码

1683439

绿色和生物基塑胶添加剂:全球市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Global Green & Bio-based Plastic Additives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

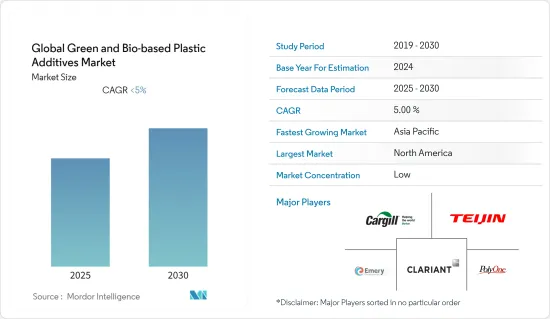

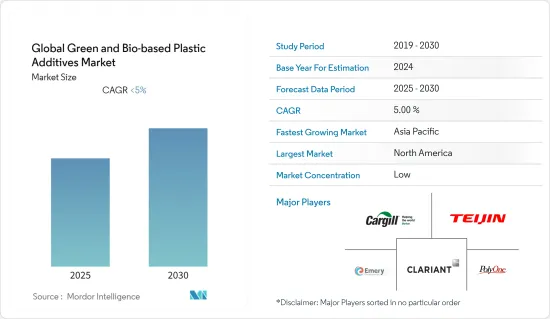

预计预测期内全球绿色和生物基塑胶添加剂市场复合年增长率将低于 5%。

包装应用对生物基塑胶的需求不断增加,推动了市场成长。

预计 COVID-19 的影响和原因将阻碍市场成长。

绿色和生物基塑胶添加剂市场趋势

包装应用需求不断成长

- 绿色生物基塑胶添加剂是添加到塑胶中的生物物质,以积极、环保的方式改善塑胶的最终机械性能、使用性能和其他品质。

- 已开发地区和开发中地区对生物基塑胶添加剂的需求都在增加。包装被认为是全球生物基塑胶添加剂的主要应用之一。

- 塑化剂是最常见的生物基功能添加剂之一,可提高塑胶的柔韧性。需要这些添加剂的塑胶的最终用途包括包装、电子和汽车。

- 北美和欧洲是监管严格的地区,尤其是用于食品包装、瓶子和食品储存的塑胶。因此,企业对生产生物基塑胶产品持开放态度,并正在投资生物基塑胶。

- 北美是生物基塑胶添加剂消费量的最大市场,其次是欧洲。

- 由于近期各地区爆发新冠疫情,预计未来两年绿色和生物基塑胶添加剂市场的成长速度将放缓。

- 预计未来几年环保塑胶应用的开发和发展中地区对塑胶的认识不断提高将推动对绿色和生物基塑胶添加剂的需求。

未来几年亚太地区将占据市场主导地位

- 由于中国、韩国、日本和印度的汽车产业高度发达,以及多年来对发展食品加工厂和电子产品的持续投资,亚太地区有望主导全球市场。

- 近年来,亚太地区的医疗保健产业也快速成长。绿色和生物基塑胶添加剂正在用于医疗设备,因为它们为塑胶产品提供了更高的安全性和灵活性。

- 中国和日本是亚太地区消费品、玩具、电子产品和其他产品的主要生产国。随着企业越来越多地使用生物基塑胶产品,这些领域对绿色和生物基塑胶添加剂的需求近年来逐渐增长。

- 中国从事食品加工行业历史悠久,已崛起为世界主要食品加工国家之一。食品业也是中国收益最高的行业之一,如今远高于其他国家。

- 此外,汽车和建设产业对生质塑胶产品的使用不断增加以及政府对塑胶的监管日益加强,也有望支持亚太地区绿色和生物基塑胶添加剂市场的成长。

绿色及生物基塑胶添加剂产业概况

全球绿色和生物基塑胶添加剂市场是一个分散的市场,许多公司都在竞争。主要参与者包括 Emery Oleochemicals、嘉吉公司、普立万公司、帝人有限公司和科莱恩公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 包装应用对生物基塑胶的需求不断增长

- 其他驱动因素

- 限制因素

- COVID-19 的影响

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争程度

第五章 市场区隔

- 功能类型

- 塑化剂

- 抗菌剂

- 抗静电剂

- 阻燃剂

- 稳定器

- 增强剂

- 其他类型

- 最终用户产业

- 包装

- 电子产品

- 医疗设备

- 纺织品

- 消费品

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作、协议

- 市场占有率/排名分析

- 主要企业策略

- 公司简介

- Clariant AG

- Cargill

- Cathay Industrial Biotech

- FKuR Kunststoff

- Emery Oleochemicals

- PolyOne Corporation

- Kompuestos

- Teijin Limited

- Arkema SA

- Zhejiang Hisun Biomaterials

第七章 市场机会与未来趋势

- 其他机会

The Global Green & Bio-based Plastic Additives Market is expected to register a CAGR of less than 5% during the forecast period.

Growing demand for bio-based plastics for packaging applications and other reasons are driving the market growth.

The impact of COVID-19 and reasons are expected to hinder the market growth.

Green and Bio-Based Plastic Additives Market Trends

Growing Demand for Packaging Applications

- Green and bio-based plastic additives are bio substances that are added to plastics to increase the final and mechanical properties, performance, and other qualities in a positive and environmental friendly way.

- The demand for bio-based plastics additives has been growing in developed as well as in developing regions because of environmental rules that are being implemented by the respective governments. Packaging is considered as one of the major applications for biobased plastic additives globally.

- Plasticizers are one of the most common functional bio-based additives that can improve the flexibility of plastics. Some of the end-use applications of plastics that require these additives are packaging, electronics, automotive, etc.

- North America and Europe are the regions that have high regulations on plastics, especially which are being used for food packaging, bottles, food storage purposes, and others. So, companies are looking forward to making bio-based plastic products and invest in bio-based plastics.

- North America is the largest market in the consumption of bio-based plastic additives followed by Europe as these regions have more demand from food processing units and other end-user industries, compared to other regions.

- Recently, the outbreak of COVID-19 in all regions is expected to decrease the growth rate of green and bio-based plastic additives market for the next two years as many production units have been closed due to lockdown and the outputs are not expected to witness any significant growth in near future.

- Increasing applications for environmentally friendly plastics, growing awareness in developing regions on plastics are expected to grow the demand for green & bio-based plastic additives through the years to come.

Asia-Pacific Region to Dominate the Market in the coming years

- Asia-Pacific is expected to dominate the global market owing to the highly developed automobile sector in China, Korea, Japan, and India, coupled with the continuous investments done in the region to advance the food processing plants and electronics through the years.

- The medical sector in the Asia-Pacific is also growing rapidly in recent years. Green and bio-based plastic additives are being used for medical devices, as these offer more safety and flexibility to the plastic products.

- China and Japan are leading countries in the production of consumer goods, toys, electronics, and other products in Asia-Pacific. As companies have been inclining to use more biobased plastic products, the demand for green & bio-based plastic additives for these segments is growing gradually in recent times.

- China entered the food processing industry long back and has been emerging as one of the leading food processing countries in the world. Also, the food sector is one of the highest revenue generators in China, much higher than any other country in recent times.

- Also, increasing usage of bio-plastic products in automobiles and construction industries, and rising government regulations on plastics, are expected to support the growth of the green and bio-based plastic additives market in the Asia-Pacific region.

Green and Bio-Based Plastic Additives Industry Overview

The global green & bio-based plastic additives market is fragmented in nature with many players competing in the market. Some of the major companies are Emery Oleochemicals, Cargill Inc, PolyOne Corporation, Teijin Limited, and Clariant AG, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for Bio-based Plastics for Packaging Applications

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Impact of COVID-19

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Functionality Type

- 5.1.1 Plasticizers

- 5.1.2 Antimicrobial Agents

- 5.1.3 Antistatic Agents

- 5.1.4 Flame-Retardants

- 5.1.5 Stabilizers

- 5.1.6 Reinforcing Agents

- 5.1.7 Other Types

- 5.2 End-user Industry

- 5.2.1 Packaging

- 5.2.2 Electronics

- 5.2.3 Medical Devices

- 5.2.4 Textiles

- 5.2.5 Consumer Goods

- 5.2.6 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Clariant AG

- 6.4.2 Cargill

- 6.4.3 Cathay Industrial Biotech

- 6.4.4 FKuR Kunststoff

- 6.4.5 Emery Oleochemicals

- 6.4.6 PolyOne Corporation

- 6.4.7 Kompuestos

- 6.4.8 Teijin Limited

- 6.4.9 Arkema S.A.

- 6.4.10 Zhejiang Hisun Biomaterials

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Other Opportunities