|

市场调查报告书

商品编码

1683441

非洲的 CNG 和 LPG 车辆:市场占有率分析、行业趋势和成长预测(2025-2030 年)Africa CNG And LPG Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

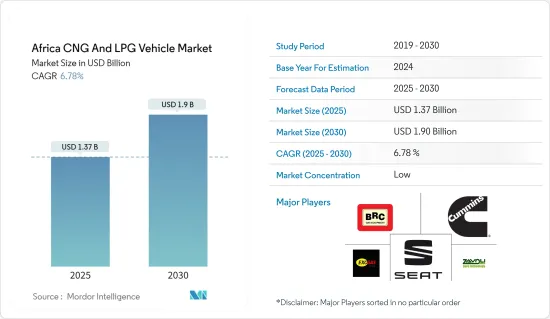

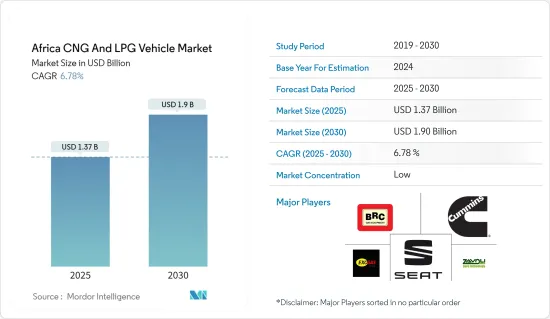

预计 2025 年非洲 CNG 和 LPG 汽车市场规模为 13.7 亿美元,预计 2030 年将达到 19 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.78%。

非洲的运输部门正逐步转向更清洁、更永续的燃料。这主要是受环境问题的推动,以及政府为减少对传统石化燃料的依赖、推广更清洁能源来源所采取的措施。因此,作为传统汽油和柴油汽车的可行替代品,CNG 和 LPG 汽车市场正日益受到青睐。

儘管与其他地区相比,非洲对 CNG 和 LPG 汽车的采用速度仍然相对较慢,但人们对这些替代燃料技术的兴趣和投资正在增长。整个非洲大陆各国的市场规模各不相同,有些地区由于法律规范和市场发展支持而经历更快的成长。

人们越来越意识到传统汽车对环境的影响,包括空气污染和温室气体排放,这促使消费者和政策制定者要求使用更清洁的替代燃料。 CNG 和 LPG 通常比汽油和柴油具有成本优势,因此对于希望降低燃料成本的车队营运商和个人车主来说,它们是一种有吸引力的选择。

许多非洲政府已经实施了政策和奖励来鼓励采用替代燃料,包括税收优惠、补贴和监管措施,如排放标准和燃料授权。

投资扩大加油基础设施,包括 CNG 和 LPG 站和发行网络,对私人投资者和政府机构来说是一个巨大的机会。

考虑到这些因素,预计预测期内 CNG 和 LPG 汽车的需求将呈现正成长率。

非洲 CNG 和 LPG 汽车市场趋势

压缩天然气具有最高的成长潜力

CNG燃料成本低,降低了车辆每公里行驶成本,鼓励许多车辆用户,特别是计程车营运商,改装传统燃料车辆。

非洲大陆近一半的二氧化碳排放排放南非,使其成为世界第十二大排放。这主要是由于燃煤发电、运输和采矿加剧了环境污染。约翰尼斯堡是撒哈拉以南非洲最大的城市,也是世界上污染第八大的城市。约翰尼斯堡正在采取重要措施制定气候行动计划,以实现2025年全国排放达到高峰的目标。这一目标的推动因素是采用 CNG 汽车,这种汽车经济实惠,是汽油汽车的最佳替代品。

在研究和测试的每种情况下,CNG 都被证明在燃料成本和效率方面比竞争燃料更便宜。与柴油或汽油相比,差异为35%至75%,与电动车相比,差异为20%,与油电混合动力车相比,差异为60%。

这些 CNG 燃料可使引擎噪音降低 50%,二氧化碳排放量降低 7% 至 16%。随着燃料技术的研究和创新不断,仍处于研发早期阶段的生物压缩天然气被视为完全消除二氧化碳排放的可能替代方案。燃料价格和购买车辆的成本是两个最大的经济因素。

与汽油和柴油相比,CNG 通常可以节省成本。天然气成本低廉,加上政府对 CNG 应用的激励和补贴潜力,使其成为希望降低燃料成本的车队营运商和私人车主在经济上有吸引力的选择。

在非洲,CNG加气基础设施仍不够发达,但建立CNG加气站和分销网络的势头强劲。预计改善和扩大基础设施将鼓励更多人采用 CNG 汽车,从而促进市场的成长。

考虑到这些因素,预计压缩天然燃料的需求将在预测期内出现最高成长。

埃及主导非洲市场

预计埃及将在其他非洲国家中占据市场主导地位。由于营业成本低,该国老式传统燃料汽车的转换率正在上升。

根据转换计划,埃及政府正在投入大量资金建设在该国推广 CNG 汽车所需的基础设施。该转换计画旨在透过鼓励车主利用低成本优势和获得融资的机会,以及促进和扩大天然气加气站和转换中心的基础设施,将车辆转换率提高到每月约 2,600 辆。此外,埃及加油站营运商 Gastec 已与 Eni 建立战略合作伙伴关係,在埃及各地开发多能源站,提供柴油和汽油以外的替代燃料。

埃及正透过各种政府政策和措施积极推动 CNG 和 LPG 汽车的引进。这些措施包括减税、补贴和有利于替代燃料汽车的法规等奖励。这种支持为市场成长创造了有利的环境,鼓励消费者和企业采用 CNG 和 LPG 汽车。

埃及在其 CNG 和 LPG 基础设施上投入了大量资金,包括完善的加油站和转换中心网路。这项广泛的基础设施为全国各地的车主提供了使用替代燃料的便捷,与其他基础设施欠发达的非洲国家相比,其普及率更高。

埃及在 CNG 和 LPG 汽车的製造、分销和服务领域处于该地区领先地位。本地行业参与企业的存在以及与国际製造商和技术提供者的合作正在促进埃及市场的成长和发展。

考虑到这些新兴市场的发展和因素,预计埃及将在预测期内引领非洲的 CNG 和 LPG 汽车市场。

非洲 CNG 和 LPG 汽车产业概况

非洲 CNG 和 LPG 汽车市场较为分散,许多公司仅占有较小的市场占有率。非洲 CNG 和 LPG 汽车市场的知名企业包括 ExoGas、Seat SA、Volkswagen AG 和 BRC Gas Equipments。这些公司正在大力投资 CNG 和 LPG 汽车的研发。

例如,2022年8月,CNG控股与斯堪尼亚合作交付了南非首批专用天然气卡车。此次推出的CNG卡车均符合欧盟VI标准。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 加油基础设施投资将推动市场成长

- 市场限制

- 法规结构不足预计将抑制市场成长

- 波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 燃料类型

- 压缩天然气

- 液化石油气

- 汽车模型

- 搭乘用车

- 商用车

- 分销管道

- OEM

- 售后市场

- 国家名称

- 埃及

- 奈及利亚

- 南非

- 摩洛哥

- 衣索比亚

- 非洲其他地区

第六章 竞争格局

- 供应商市场占有率

- 公司简介

- Seat SA

- ExoGas

- BRC Gas Equipments

- Cummins Inc.

- Zavoli

- Valtec

- African Gas Equipment

- Iveco SpA

- Volkswagen AG

- AB Volvo

- Ford Motor Company

第七章 市场机会与未来趋势

The Africa CNG And LPG Vehicle Market size is estimated at USD 1.37 billion in 2025, and is expected to reach USD 1.90 billion by 2030, at a CAGR of 6.78% during the forecast period (2025-2030).

Africa's transportation sector is undergoing a gradual shift toward cleaner and more sustainable fuels, primarily driven by a focus on environmental concerns and the reduction on the dependence on traditional fossil fuels and government policies that promote cleaner energy sources. Thus, the market for CNG and LPG vehicles is gaining traction as viable alternatives to conventional gasoline and diesel vehicles.

While the adoption of CNG and LPG vehicles in Africa is still relatively modest compared to other regions, there is a growing interest and investment in these alternative fuel technologies. The market size varies across different countries within the continent with some regions experiencing faster growth rates due to supportive regulatory frameworks and infrastructure development.

The increasing awareness about the environmental impact of conventional vehicles, including air pollution and greenhouse gas emissions, is prompting consumers and policymakers to seek cleaner alternatives. CNG and LPG typically offer cost advantages over gasoline and diesel, making them attractive options for fleet operators and individual vehicle owners seeking to lower fuel expenses.

Many African governments are implementing policies and incentives to encourage the adoption of alternative fuels, including tax incentives, subsidies, and regulatory measures such as emissions standards and fuel mandates.

Investment in expanding refueling infrastructure, including CNG/LPG stations and distribution networks, presents a significant opportunity for private investors and government agencies.

Considering these factors, demand for CNG and LPG vehicles is expted to witness positive growth rate during the forecast period.

Africa CNG and LPG Vehicle Market Trends

Compressed Natural Gas will Hold Highest Growth Potential

The low fuel cost of compressed natural gas, which reduces the per kilometer driving cost of the vehicles, is encouraging more vehicle users, especially taxi fleet operators, to convert their conventional fuel vehicles.

Nearly half of the CO2 emissions on the African continent come from South Africa, which is the 12th largest emitter of the gas in the world. This is mostly attributed to coal-fired power generation, transportation, and mining making the environmental pollution worsen. The largest metropolis in sub-Saharan Africa, Johannesburg, ranked as the eighth most polluted city in the world. The nation is taking significant steps to develop a climate plan to reach the peak of its national emissions by 2025. This is fuelled by adopting economical and best alternative of gasoline vehicles that is CNG powered vehicles.

In every situation examined and tested, CNG has been proven to be less expensive than competing fuels in terms of fuel cost and efficiency. The difference varies between 35% and 75% when compared to diesel and gasoline, 20% when compared to electric vehicles, and 60% when compared to gasoline-electric hybrid vehicles as well.

These CNG fuels offer an engine efficiency that is 50% quieter and offers a low CO2 rate of between 7% and 16%. With ongoing research and innovation in fuel technology, Bio-CNG, which is still in its early stages of development, has been seen as a potential alternative to cut CO2 emissions completely. The price of fuel and the cost of purchasing the vehicle are the two main economic considerations at play.

CNG typically offers cost savings compared to gasoline and diesel fuels. The lower cost of natural gas, coupled with potential government incentives and subsidies for CNG adoption, makes it an economically attractive option for fleet operators and individual vehicle owners looking to reduce fuel expenses.

While infrastructure for CNG refueling is still developing in Africa, there is momentum in establishing CNG filling stations and distribution networks across the continent. The improvement and expansion of infrastructure is expected to faclitate greater adoption of CNG vehicles and contribute to market growth.

Considering these factors, the demand for compressed natural fuel is anticipated to experience the highest growth potential during the forecast period.

Egypt Dominates the Market in Africa

Egypt is expected to dominate the market over other African countries. The conversion rate of old conventional fuel-based vehicles in the country is rising because of the low operational cost.

Under the conversion program initiative, Egypt's government is spending heavily on providing the infrastructure required for the promotion of CNG vehicles in the country. The conversion program aims to increase the conversion rate of vehicles to about 2,600 per month by encouraging owners to utilize the low-cost advantages and access to finance, aiming to facilitate and expand the infrastructure of natural gas fueling stations and conversion centers. Egyptian fuel station operator Gastec has also strategically partnered itself with Eni in order to develop multi-energy stations across the country which will offer alternative fuels apart from diesel and gasoline.

Egypt has demonstrated a proactive approach toward promoting the adoption of CNG and LPG vehicles through various government policies and initiatives. These include incentives such as tax breaks, subsidies, and regulations that favor alternative fuel vehicles. Such support creates a favorable environment for market growth and encourages consumers and businesses to embrace CNG and LPG vehicles.

Egypt has invested significantly in building out infrastructure for CNG and LPG including a comprehensive network of refueling stations and conversion centers. This extensive infrastructure provides convenient access to alternative fuels for vehicle owners across the country, thereby facilitating higher adoption rates compared to other African nations where infrastructure may be less developed.

Egypt has emerged as a leader in the region in the manufacturing, distribution, and servicing of CNG and LPG vehicles. The presence of local industry players, along with partnerships with international manufacturers and technology providers, contributes to the growth and development of the market in Egypt.

Considering these developments and factors, Egypt is expted to lead the Africa CNG and LPG vehicle market during the forecast period.

Africa CNG and LPG Vehicle Industry Overview

The African CNG and LPG vehicle market is fragmented, and many players account for a small market share. Some of the prominent companies in the African CNG and LPG Vehicle Market are ExoGas, Seat SA, Volkswagen AG, BRC Gas Equipments and others. These players are investing heavily in the research and development of CNG and LPG vehicles.

For instance, in August 2022, CNG Holdings and Scania, with their mutual alliances, delivered South Africa's first dedicated natural gas truck. The CNG trucks that were introduced follow the Euro VI compliance standards.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Investments in Refueling Infrastructure Is Driving the Market Growth

- 4.2 Market Restraints

- 4.2.1 Inadequate Regulatory Frameworks is Anticipated to Restrain the Market Growth

- 4.3 Porters Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Fuel Type

- 5.1.1 Compressed Natural Gas

- 5.1.2 Liquified Petroleum Gas

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 Sales Channel

- 5.3.1 OEM

- 5.3.2 Aftermarket

- 5.4 Country

- 5.4.1 Egypt

- 5.4.2 Nigeria

- 5.4.3 South Africa

- 5.4.4 Morocco

- 5.4.5 Ethiopia

- 5.4.6 Rest of Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Seat SA

- 6.2.2 ExoGas

- 6.2.3 BRC Gas Equipments

- 6.2.4 Cummins Inc.

- 6.2.5 Zavoli

- 6.2.6 Valtec

- 6.2.7 African Gas Equipment

- 6.2.8 Iveco S.p.A

- 6.2.9 Volkswagen AG

- 6.2.10 AB Volvo

- 6.2.11 Ford Motor Company