|

市场调查报告书

商品编码

1741041

CNG 和 LPG 汽车市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测CNG and LPG Vehicles Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

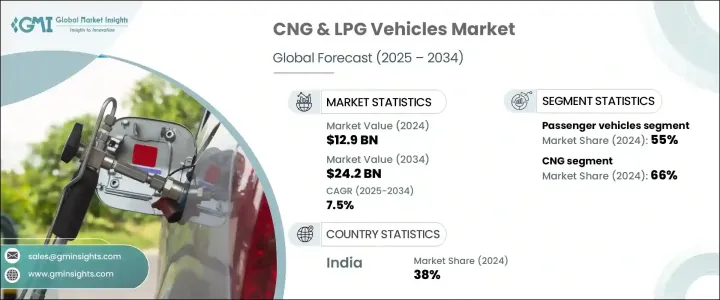

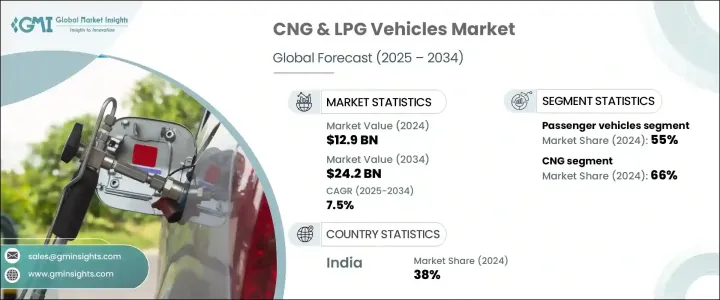

2024年,全球压缩天然气(CNG)和液化石油气(LPG)汽车市场价值129亿美元,预计到2034年将以7.5%的复合年增长率增长,达到242亿美元,这得益于对环保节能汽车需求的激增。民众对气候变迁和空气品质恶化的认识日益增强,促使政府和消费者寻求更环保的出行解决方案。随着能源安全在全球日益受到重视,CNG和LPG汽车正逐渐成为传统汽油和柴油汽车的实用替代品,可大幅节省成本并降低碳排放。世界各国正在推行严格的排放标准,收紧燃油经济性标准,并鼓励使用替代燃料,这使得CNG和LPG汽车成为越来越有吸引力的选择。 CNG引擎的技术进步进一步提升了车辆性能,同时显着减少了有害污染物的排放,为市场未来强劲增长奠定了基础。对清洁能源基础设施、改造解决方案和加油网络扩展的投资正在创建一个支持长期应用的生态系统。此外,燃料价格波动加剧,促使车队营运商和个人消费者探索更经济、更永续的选择,使 CNG 和 LPG 汽车成为未来出行趋势的前沿。

随着各国大力推行兼顾环境责任与经济可行性的交通替代方案,CNG 与 LPG 汽车正成为全球永续发展倡议的重要参与者。各国政府正采取大胆倡议,实施更严格的排放标准,并提供包括退税和补助在内的诱人激励措施,以推动清洁燃料的普及。在多个关键市场,越来越多的车队营运商正从柴油转向 CNG,以实现长期营运成本效益。价格实惠的改装套件日益普及,加上公共运输系统日益青睐经济高效的解决方案,这些因素正在强化成本敏感型消费者对 CNG 和 LPG 汽车的青睐。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 129亿美元 |

| 预测值 | 242亿美元 |

| 复合年增长率 | 7.5% |

乘用车市场在2024年占据55%的市场份额,预计到2034年将以7%的复合年增长率成长,因为买家更重视经济性和环保性能。在商用车方面,以压缩天然气(CNG)为动力的卡车和送货车的兴起正在重塑城市物流,为传统车队提供清洁、节能的替代方案。商用车,尤其是在城市环境中,正受益于营运效率的提高和支持性政策框架。在人口密集的大都市地区,以压缩天然气(CNG)和液化石油气(LPG)为动力的三轮车正在迅速普及,为短途运输提供了实用且经济实惠的解决方案。

2024年,压缩天然气(CNG)在全球CNG和LPG汽车市场占据了66%的主导地位。其领先地位源于其在经济实惠、减少排放以及符合日益严格的环境法规方面提供的显着优势。由于其减少碳足迹和节省成本,CNG将继续成为商用车队和个人消费者的首选。

2024年,印度的CNG和LPG汽车市场规模达24亿美元,占全球市场份额的38%。快速的都市化、传统燃料价格的通膨压力以及大力扶持替代燃料的公共政策,共同推动了这一成长。各大城市正稳步转向更清洁的公共交通方式,其中CNG公车和计程车引领了这一趋势。内燃机汽车的CNG套件改装,进一步加速了城市景观的转型。

丰田、现代汽车公司、马恆达、塔塔汽车、福特汽车公司、通用汽车、大众集团、依维柯、曼恩集团和本田等领先汽车製造商正在大力投资产品创新,扩大其 CNG 和 LPG 汽车产品组合,并加强其分销网络。许多公司正在与燃料供应商合作,以改善加油基础设施,尤其是在新兴市场。混合动力 CNG 技术、智慧车辆整合和车队合作模式等策略正在帮助企业在不断发展的 CNG 和 LPG 汽车市场中站稳脚跟。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 燃料供应商

- 零件製造商

- 汽车製造商(OEM)

- 改装商和售后市场供应商

- 分销和零售基础设施

- 利润率分析

- 川普政府关税

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 供给侧影响(原料)

- 受影响的主要公司

- 对产业的影响

- 技术与创新格局

- 专利分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- CNG技术的快速进步

- 日益重视永续旅游

- 对经济高效的交通运输的需求日益增长

- 比汽油动力汽车的维修成本更低

- 产业陷阱与挑战

- 前期成本较高

- 与汽油动力汽车相比性能下降

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- 越野车

5.3 三轮车

- 商用车

- 轻型商用车(LCV)

- 中型商用车(MCV)

- 重型商用车(HCV)

第六章:市场估计与预测:按燃料,2021 - 2034 年

- 主要趋势

- 液化石油气

- 天然气

第七章:市场估计与预测:按引擎系统,2021 - 2034 年

- 主要趋势

- 专用系统

- 双燃料

- 双燃料

第八章:市场估计和预测:按拟合,2021 - 2034 年

- 主要趋势

- OEM

- 售后市场

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十章:公司简介

- Ashok Leyland

- Bajaj Auto

- Ford Motor Company

- General Motors

- Honda

- Hyundai Motor Company

- Isuzu Motors

- IVECO

- Kia Motors

- Landi Renzo

- Mahindra & Mahindra

- MAN SE

- Maruti Suzuki

- Renault

- SEAT

- Skoda Auto

- Tata Motors

- Toyota

- Volkswagen Group

- Westport Fuel Systems

The Global CNG and LPG Vehicles Market was valued at USD 12.9 billion in 2024 and is estimated to grow at a CAGR of 7.5% to reach USD 24.2 billion by 2034, driven by the surging demand for environmentally friendly and fuel-efficient vehicles. Growing public awareness about climate change and deteriorating air quality has pushed both governments and consumers toward greener mobility solutions. As energy security gains prominence worldwide, CNG and LPG vehicles are emerging as practical alternatives to traditional gasoline and diesel vehicles, offering substantial cost savings and lower carbon emissions. Countries around the world are rolling out aggressive emission norms, tightening fuel economy standards, and incentivizing alternative fuel adoption, making CNG and LPG vehicles an increasingly attractive choice. Technological advancements in CNG engines are further elevating vehicle performance while significantly cutting down harmful pollutants, positioning the market for strong future growth. Investment in clean energy infrastructure, retrofitting solutions, and the expansion of refueling networks is creating an ecosystem that supports long-term adoption. Moreover, rising fuel price volatility is pushing fleet operators and individual consumers to explore more economical and sustainable options, putting CNG and LPG vehicles at the forefront of future mobility trends.

CNG and LPG vehicles are becoming vital players in global sustainability initiatives as nations push for transportation alternatives that balance environmental responsibility with economic feasibility. Governments are taking bold steps by implementing stricter emission norms and offering attractive incentives, including tax rebates and grants, to drive the adoption of cleaner fuels. In several key markets, fleet operators are increasingly transitioning from diesel to CNG to realize long-term operational cost benefits. The availability of affordable retrofitting kits, combined with the growing presence of public transportation systems that favor cost-effective solutions, is reinforcing the trend toward CNG and LPG vehicle adoption among cost-sensitive consumers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.9 Billion |

| Forecast Value | $24.2 Billion |

| CAGR | 7.5% |

The passenger vehicles segment dominated the market with a 55% share in 2024 and is projected to grow at a CAGR of 7% through 2034, as buyers prioritize affordability and environmental performance. On the commercial side, the rise of CNG-powered trucks and delivery vans is reshaping urban logistics by offering clean, fuel-efficient alternatives to traditional fleets. Commercial vehicles, particularly in urban environments, are benefiting from operational efficiencies and supportive policy frameworks. In dense metropolitan areas, three-wheelers running on CNG and LPG are gaining rapid traction, offering a practical and affordable solution for short-distance transportation.

The compressed natural gas (CNG) segment held a commanding 66% share of the global CNG and LPG vehicles market in 2024. Its leadership stems from the clear benefits it offers in terms of affordability, reduced emissions, and compliance with increasingly stringent environmental regulations. CNG continues to emerge as a preferred choice for both commercial fleets and individual consumers, thanks to its reduced carbon footprint and cost savings.

India's CNG and LPG Vehicles Market generated USD 2.4 billion in 2024, capturing a 38% share of the global market. Rapid urbanization, inflationary pressures on conventional fuel prices, and robust public policies favoring alternative fuels are driving this growth. Major cities are witnessing a steady shift toward cleaner public transportation options, with CNG buses and taxis leading the way. Retrofitting of internal combustion engine vehicles with CNG kits is further accelerating this transition across urban landscapes.

Leading automakers like Toyota, Hyundai Motor Company, Mahindra and Mahindra, Tata Motors, Ford Motor Company, General Motors, Volkswagen Group, IVECO, MAN SE, and Honda are heavily investing in product innovations, expanding their CNG and LPG vehicle portfolios, and strengthening their distribution networks. Many are collaborating with fuel providers to improve refueling infrastructure, especially in emerging markets. Strategies such as hybridized CNG technologies, smart vehicle integrations, and fleet partnership models are helping companies solidify their foothold in the evolving CNG and LPG vehicles market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Fuel providers

- 3.2.2 Component manufacturers

- 3.2.3 Vehicle manufacturers (OEMs)

- 3.2.4 Retrofitters and aftermarket suppliers

- 3.2.5 Distribution and retail infrastructure

- 3.3 Profit margin analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on the industry

- 3.4.1.1 Supply-side impact (raw materials)

- 3.4.1.1.1 Price volatility in key materials

- 3.4.1.1.2 Supply chain restructuring

- 3.4.1.1.3 Production cost implications

- 3.4.1.2 Demand-side impact (selling price)

- 3.4.1.2.1 Price transmission to end markets

- 3.4.1.2.2 Market share dynamics

- 3.4.1.1 Supply-side impact (raw materials)

- 3.4.2 Key companies impacted

- 3.4.1 Impact on the industry

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rapid advancements in CNG technology

- 3.9.1.2 Increasing emphasis on sustainable mobility

- 3.9.1.3 Rising need for cost-effective transportation

- 3.9.1.4 Lower maintenance cost than petrol-powered vehicles

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Higher upfront costs

- 3.9.2.2 Reduced performance compared to petrol-powered vehicles

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Passenger vehicles

- 5.2.1 Hatchback

- 5.2.2 Sedan

- 5.2.3 SUV

5.3 Three-wheelers

- 5.4 Commercial vehicles

- 5.4.1 Light Commercial Vehicles (LCV)

- 5.4.2 Medium Commercial Vehicles (MCV)

- 5.4.3 Heavy Commercial Vehicles (HCV)

Chapter 6 Market Estimates & Forecast, By Fuel, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 LPG

- 6.3 CNG

Chapter 7 Market Estimates & Forecast, By Engine System, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Dedicated system

- 7.3 Bi-fuel

- 7.4 Dual fuel

Chapter 8 Market Estimates & Forecast, By Fitting, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Ashok Leyland

- 10.2 Bajaj Auto

- 10.3 Ford Motor Company

- 10.4 General Motors

- 10.5 Honda

- 10.6 Hyundai Motor Company

- 10.7 Isuzu Motors

- 10.8 IVECO

- 10.9 Kia Motors

- 10.10 Landi Renzo

- 10.11 Mahindra & Mahindra

- 10.12 MAN SE

- 10.13 Maruti Suzuki

- 10.14 Renault

- 10.15 SEAT

- 10.16 Skoda Auto

- 10.17 Tata Motors

- 10.18 Toyota

- 10.19 Volkswagen Group

- 10.20 Westport Fuel Systems