|

市场调查报告书

商品编码

1683455

日本电池市场:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Japan Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

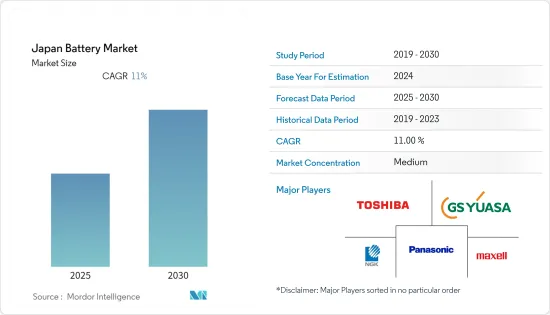

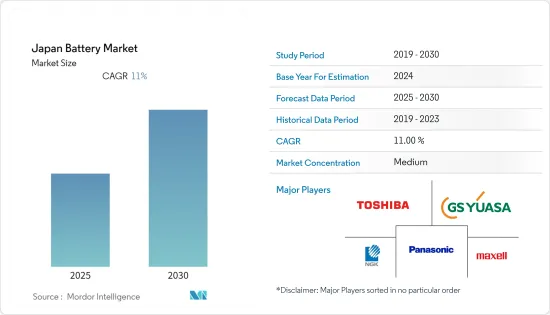

预计预测期内日本电池市场的复合年增长率将达到 11%。

新冠肺炎疫情为市场带来了负面影响。目前市场已恢復至疫情前的水准。

关键亮点

- 预计电动车的普及率不断提高、家用电子电器的需求不断增加以及可再生能源设施数量的不断增加等因素将推动市场的发展。

- 然而,由于对锂离子电池的需求增加,尤其是电动车的需求,矿物价格大幅上涨。在某些情况下,矿产供应短缺,这可能会在预测期内抑制市场成长。

- 新兴市场在电池化学研发方面的发展预计将为未来日本电池市场提供重大成长机会。

日本电池市场趋势

二次电池领域预计将占据市场主导地位

- 在二次电池中,电极反应是可逆的,因此当施加外部电压时电极会恢復到其原始状态。因此,二次电池既可用作能源来源,也能源储存系统。二次电池通常具有容量和初始电压较低、自放电率高以及充电寿命不稳定等特点。此外,儘管每个电池都相对昂贵,但从长远来看这些电池是具有成本效益的。

- 日本广泛使用的二次电池包括铅酸电池、碱性电池、锂离子电池。

- 铅酸电池是各种终端应用中最常用且最常见的二次电池,包括运输、工业、商业、住宅和电网储存。但由于严格的铅排放法规和优势(成本优势、重量轻、持续改进等),锂离子电池越来越多地部署在大电流应用中,例如家用电子电器产品、电池能源储存系统、电动车和无线电动工具。

- 然而,由于铅酸电池的比能量低、循环寿命有限、重量能量比较差,预计在二次电池领域增长缓慢。日本可充电铅酸电池出口额大幅下降,从2018年的1.28亿美元下降到2021年的8,300万美元,下降超过30%。

- 日本最受欢迎的二次电池是锂离子电池。锂离子电池可以快速充电,并且比同类电池的使用寿命更长。据日本电池工业称,近年来汽车使用的锂离子电池数量大幅增加。

- 日本各地电动车(EV)的日益普及,以及人们对气候变迁的日益关注,可能为二次电池製造商创造积极的商业前景。

- 日本的目标是到2050年实现「从油井到车轮零排放」措施,重点关注能源供应和汽车创新,与全球零排放努力保持一致。透过将所有汽车替换为电动车,每辆车可减少约 80% 的温室气体排放量,其中每辆乘用车可减少约 90% 的温室气体排放量。

- 因此,鑑于上述情况,预计预测期内二次电池领域将占据日本市场的主导地位。

可再生能源的普及预计将推动市场

- 日本是亚太地区最大的可再生能源市场之一。 2021年,全国可再生能源装置容量达111.86吉瓦,与前一年同期比较去年同期成长4.67%以上。

- 太阳能、水力、风能和生质能源是该国主要的再生能源来源。根据英国石油公司的《世界能源统计评论》,到2021年,可再生能源发电将占总发电量的12%左右,占初级能源结构的6.6%左右。

- 过去十年,日本太阳能发电装置容量从2011年的489万千瓦成长至2021年的约7,400万千瓦。不过,太阳能在日本能源结构中的比例仍然较低。根据BP《2022年世界能源统计报告》,2021年太阳能发电量为86.3TWh,仅占总发电量的8.5%左右。

- 为了正确利用屋顶光伏 (PV) 和大型太阳能发电工程的太阳能,需要一个强大的电池储存系统,因为太阳能是间歇性的且夜间不可用。电池储存系统在阳光不足或没有阳光时提供电力,透过防止电压突然突波和下降来帮助稳定电网。

- 日本有望成为全球併网电池计划的领导者之一,目前已有多个大型电池计划正在规划和建设中。例如,2022年7月,Orix与关西电力的合资公司宣布将在日本西部建造和营运大型电池储能係统。该计划的容量为 48MW/113MWh,预计将于 2024 年投入营运。

- 2022年2月,经济产业省公布了适用于10至250千瓦太阳能发电设施的上网电价计画(FIT)和适用于2022年透过竞标系统选出的250千瓦或以上太阳能发电工程计画(FIP)。该部已将10千瓦至50千瓦太阳能发电系统的上网电价(FIT)设定为0.096美元/千瓦时,50千瓦至250千瓦太阳能发电系统的上网电价(FIT)设定为0.087美元/千瓦时。因此,预计可再生能源在日本能源结构中的份额不断增加将在预测期内推动日本储能电池市场的发展。

- 因此,可再生能源的不断增加的应用将推动对电池储能係统的需求,这反过来将在预测期内推动日本的电池市场的发展。

日本电池产业概况

日本的电池市场是分散的。该市场的主要企业(不分先后顺序)包括松下电器产业株式会社、麦克赛尔株式会社、GS Yuasa International Ltd、NGK Insulators Ltd. 和东芝株式会社。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 2028 年市场规模与需求预测(十亿美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- PESTLE分析

第五章 市场区隔

- 电池类型

- 一次电池

- 二次电池

- 科技

- 锂离子电池

- 铅酸电池

- 其他的

- 应用

- 汽车电池(HEV、PHEV、EV)

- 工业电池(动力、固定(电信、UPS、能源储存系统(ESS) 等))

- 便携式电池(例如家用电子电器产品)

- SLI 电池

- 其他的

第六章 竞争格局

- 併购、合资、合作、协议

- 主要企业策略

- 公司简介

- Panasonic Corporation

- Maxell, Ltd.

- GS Yuasa International Ltd

- NGK Insulators Ltd

- Toshiba Corporation

- Contemporary Amperex Technology Co Ltd

- LG Energy Solution

- EEMB Battery

- B & B Battery Co. Ltd

- Furukawa Battery Co. Ltd

第七章 市场机会与未来趋势

简介目录

Product Code: 71543

The Japan Battery Market is expected to register a CAGR of 11% during the forecast period.

The outbreak of COVID-19 negatively impacted the market. Currently, the market has reached pre-pandemic levels.

Key Highlights

- Factors such as the increasing adoption of electric vehicles, along with the increasing demand for consumer electronics and increasing renewable energy installations, are expected to drive the market.

- However, with the increasing demand for lithium-ion batteries, especially in electric cars, there is a substantial growth in mineral prices. In some cases, there is a shortage of mineral supply, which is likely to act as a restraint for the market growth during the forecast period.

- Advancements in the research and development of battery chemistries are expected to be a significant growth opportunity for the Japan Battery market in the future.

Japan Battery Market Trends

Secondary Battery Segment Expected to Dominate the Market

- In secondary batteries, electrode reactions are reversible, implying that applying an external voltage reconstructs the electrodes to their original state. Accordingly, secondary batteries act as both energy sources and energy storage systems. In general, secondary batteries have a low capacity and initial voltage, high self-discharge rates, and varying recharge life ratings. Moreover, these batteries are cost-efficient over the long term, even though individual batteries can be comparatively more expensive.

- Secondary batteries that are widely used in Japan include lead-acid batteries, alkaline storage batteries, and lithium-ion batteries.

- Lead-acid batteries are the most frequently used and available rechargeable batteries for various end-use applications, such as transportation, industrial, commercial, residential, and grid storage. However, due to stringent lead emission standards and benefits (such as cost advantages, lightweight, and ongoing improvements), lithium-ion batteries are increasingly deployed in high-drain applications, such as consumer electronics, battery energy storage systems, electric vehicles, and cordless electric power tools.

- However, lead-acid batteries are set to witness moderate growth in the secondary battery segment owing to their low specific energy, limited cycle life, and poor weight-to-energy ratio. The export value of rechargeable lead-acid batteries in Japan registered a considerable decline of more than 30%, from USD 128 million in 2018 to USD 83 million in 2021.

- The most popular secondary battery in Japan is the lithium-ion battery. It has a fast charging ability and offers longer life when compared to its counterparts. According to the Battery Association of Japan, sales of lithium-ion batteries for vehicles in terms of volume witnessed significant growth in recent years.

- The rising adoption of electric vehicles (EVs) across the country, coupled with a growing focus on climate change, is likely to create a positive business scenario for secondary battery manufacturers.

- By 2050, Japan aims to realize a 'Well-to-Wheel Zero Emission' policy, in line with the global efforts to eliminate emissions, with a focus on energy supply and vehicle innovation. Replacing all vehicles with EVs can reduce greenhouse gas emissions by around 80% per vehicle, including an approximate 90% reduction per passenger vehicle.

- Therefore, owing to the above points, the secondary battery segment is expected to dominate the Japanese market during the forecast period.

Increasing Renewable Energy Installations Expected to Drive the Market

- Japan is one of the largest renewable energy markets in the Asia-Pacific region. The country's renewable energy installed capacity reached 111.86 GW in 2021, representing an increase of over 4.67% compared to the previous year's value.

- Solar, hydro, wind, and bioenergy are the major renewable energy sources in the country. According to the BP statistical review of World Energy, in 2021, renewable energy sources accounted for approximately 12% of the total electricity generation mix and 6.6% of the primary energy mix in the country.

- Over the last decade, Japan's installed solar energy capacity has grown from 4.89 GW in 2011 to approximately 74 GW in 2021. However, the share of solar energy in the country's energy mix is still low. According to the BP Statistical Review of World Energy 2022, solar generation was 86.3 TWh in 2021, accounting for only about 8.5% of its total electricity generation.

- As solar energy is intermittent and unavailable at night, competent battery storage systems are necessary to properly utilize solar energy from rooftop photovoltaic (PV) and large-scale utility solar projects. Battery storage systems provide power during low and no sunlight hours and provide grid stability, preventing sudden voltage surges and sags.

- Japan is expected to become one of the global leaders in grid-connected battery storage projects, with several large-scale battery storage projects in the pipeline and under construction. For instance, in July 2022, a joint venture of Orix and Kansai Electric (KEPCO) announced that it would build and operate a large-scale battery storage system in western Japan. The project will have a capacity of 48MW/113MWh and will begin operation by 2024.

- In February 2022, the Ministry of Economy, Trade and Industry (METI) published the feed-in tariffs (FITs) that it proposes to apply to solar installations with a capacity of 10 to 250 kW, as well as the feed-in premiums (FIPs) to solar projects over 250 kW selected through the auction scheme in 2022. The ministry set a fixed FIT of USD 0.096/kWh for PV systems with capacities between 10 kW and 50 kW and a FIT of USD 0.087/kWh for installations between 50 kW and 250 kW. Thus, increasing renewable energy share in the country's energy mix is likely to drive the battery market in Japan for energy storage applications during the forecast period.

- Therefore, owing to the above points, increasing renewable energy installations fuelling the demand for battery energy storage systems, thus, in turn, driving the Japan battery market during the forecast period.

Japan Battery Industry Overview

The Japan battery market is fragmented. Some of the major players in the market (in no particular order) include Panasonic Corporation, Maxell, Ltd., GS Yuasa International Ltd, NGK Insulators Ltd., and Toshiba Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Primary Battery

- 5.1.2 Secondary Battery

- 5.2 Technology

- 5.2.1 Lithium-ion Battery

- 5.2.2 Lead-Acid Battery

- 5.2.3 Others

- 5.3 Application

- 5.3.1 Automotive Batteries (HEV, PHEV, EV)

- 5.3.2 Industrial Batteries (Motive, Stationary (Telecom, UPS, Energy Storage Systems (ESS), etc.)

- 5.3.3 Portable Batteries (Consumer Electronics, etc.)

- 5.3.4 SLI Batteries

- 5.3.5 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Panasonic Corporation

- 6.3.2 Maxell, Ltd.

- 6.3.3 GS Yuasa International Ltd

- 6.3.4 NGK Insulators Ltd

- 6.3.5 Toshiba Corporation

- 6.3.6 Contemporary Amperex Technology Co Ltd

- 6.3.7 LG Energy Solution

- 6.3.8 EEMB Battery

- 6.3.9 B & B Battery Co. Ltd,

- 6.3.10 Furukawa Battery Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219