|

市场调查报告书

商品编码

1683482

美国宠物食品包装:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)U.S. Pet Food Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

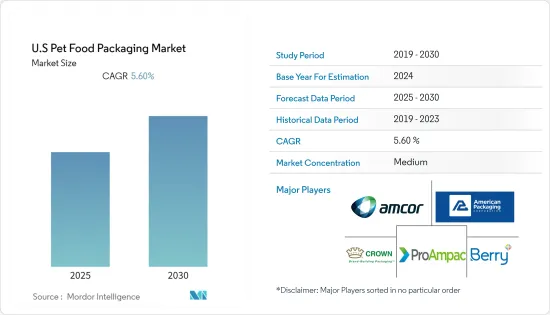

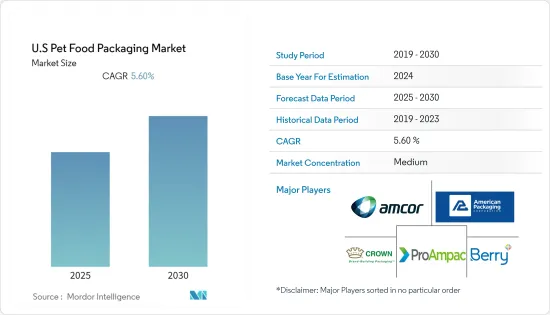

预计预测期内美国宠物食品包装市场复合年增长率为 5.6%。

主要亮点

- 美国的宠物拥有量正在增加,推动了宠物食品包装的需求。根据2021-2022年美国宠物产品协会(APPA)全国宠物主人调查,2020年,美国家庭宠物的比例从67%增加到创纪录的70%。

- 宠物饲主非常重视宠物的健康,因此愿意在宠物的食物上投入更多。这推动了饲主对保护性、资讯性和永续包装的需求增加。

- 全国各地的各种组织都在努力加速永续性。例如,2021年2月,美国非营利组织宠物永续联盟(PSC)宣布Flex Forward第一阶段完成。 Flex Forward 是一个回收零售包装的试点项目,旨在减少垃圾掩埋废弃物,并为宠物行业提供永续的包装解决方案,此前该项目已超过收集 5,000 磅旧宠物食品和零食软质塑胶包装的目标。

- 新冠疫情对美国宠物食品产业造成了严重影响。由于製造和包装之间存在直接的联繫,它也影响宠物食品包装的成长。例如,2021 年 6 月,宠物食品协会 (PFI) 向美国农业部 (USDA) 提交了一份报告,详细说明了宠物食品和零食製造商因 COVID-19 疫情而遇到的供应链限制。该协会指出,运输和供应链基础设施的若干挑战,以及宠物食品产业与美国其他市场的互联互通,导致了 2020 年和 2021 年的供不应求和其他中断。

- 此外,随着向永续产品的转变不断进行,日本也出现了具有类似目标的新宠物食品品牌。例如,2021 年 8 月,塔吉特公司宣布推出宠物食品品牌 Kindful。品牌提供可回收包装,符合零售商的环保目标。市场竞争日益激烈,更加重视开发创新的包装解决方案。

美国宠物食品包装市场的趋势

全国范围内宠物拥有量的增加正在推动市场成长。

- 美国饲养的宠物数量大幅增加,带动了宠物食品包装的需求。根据美国宠物产品协会 (APPA) 2021-2022 年调查,美国养宠物家庭的比例已从估计的 67% 增加到估计的 70%。千禧世代占比最大,为 32%,其次是战后婴儿潮世代,占 27%,X 世代占 24%。当 1988 年首次进行调查时,美国家庭的比例为 56%。

- 此外,过去一年宠物支出也有所增加,35% 的宠物饲主表示,过去 12 个月他们在宠物和宠物用品(包括食品、保健产品和其他宠物护理用品)上的支出比前一年更多。此外,约14%的受访者证实他们在疫情期间养了新宠物。

- 越来越多的零售商意识到宠物用品的获利潜力,有些甚至推出了自有品牌。例如,塔吉特于 2021 年 8 月推出了其宠物类别的最新自有品牌,专注于猫粮和狗粮。 Kindful 拥有超过 50 种产品,从湿粮、干粮到零食和配料,并使用鸡肉、草饲牛肉和永续捕捞的鱼类等原料。

- 此外,美国电子商务产业的成长正在推动宠物食品产品的普及。例如,根据 APPA 的数据,在疫情爆发之前,大约 60% 的宠物饲主会在实体店亲自购买宠物用品。然而,在疫情期间,实体店购买的比例下降到 41%,接近 46% 的饲主更喜欢在网路上购买并送货上门。预计在预测期内,包装宠物食品产品的推广普及将有利于该地区包装产业的成长。

袋装占主要市场占有率

- 据估计,拉炼闭合机制和轻量化包装等增强消费者便利性的功能将推动包装袋的需求。同时,对于宠物食品製造商来说,包装袋重量轻有助于降低运输成本。

- 立式袋已成为宠物零食的首选,理想情况下,它们可以在零售商店上脱颖而出。虽然包装供应商提供多种配置的包装袋,但自立袋将多个图形面板组合在一起,并在所研究的市场中创造了可衡量的提升。

- 随着技术的发展,包装机的多功能性和效率可实现各种各样的形式。数位化和高清图形技术的进步使得宠物食品领域的包装设计富有创意,可以在各种材料上以经济高效的方式製作出引人注目的摄影、图形和色彩。

- 此外,袋子的实际可回收性尚未完全实现。这引起业界高度关注。这推动了市场参与者根据市场趋势对包装材料进行创新。例如,2021 年 1 月,ProAmpac 宣布推出正在申请专利的 ProActive Recycle Ready Retort RT-3000,以满足可回收蒸馏包装的需求。 RT-3000 袋明确指定用于宠物食品和人类使用,并且有立式袋和三边封袋两种形式。它也符合欧盟和 FDA 关于蒸馏应用中的食品接触的规定。

美国宠物食品包装产业概况

美国宠物食品包装市场竞争适中,由于新参与企业的增加,正进入分散阶段。领先公司采用的一些基本策略包括提供客製化产品、推出新的包装形式以及使用新材料进行创新。市场的一些主要参与者包括 Amcor Plc.、American Packaging Corporation、Crown Holdings Inc. 和 ProAmpac LLC。最近的趋势包括:

- 2020 年 9 月-Amcor 与雀巢合作推出可回收的宠物食品柔性杀菌袋。两家公司在产品开发过程中进行了合作,在真实条件下测试材料的耐热性、机械性能、储存稳定性和可回收性。柔性蒸馏包装是金属罐的现代替代品,由于其重量轻、资源效率高且易于运输,可以改善数百种消费品的碳足迹。

- 2020 年 3 月-TC Transcontinental 宣布在 TC Transcontinental Packaging 内部成立回收小组。 2020年,该集团计划购买设备,将从分类设施和其他商业、工业和农业来源回收的软塑胶转化为再生塑胶颗粒。该公司也正在考虑该领域的收购可能性。回收集团的成立预计将为 TC Transcontinental 作为艾伦·麦克阿瑟基金会「新塑胶经济全球承诺」的签署方实现其目标做出贡献。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素

- 多个高端品牌进入市场,强调利用包装作为获取竞争优势的手段

- 随着全国宠物拥有量的增加,对机能性食品的需求不断增加

- 市场限制

- 在永续性、耐用性和不断变化的法规之间寻找平衡的持续挑战

- 评估 COVID-19 对宠物食品包装市场的影响(本节涵盖的主要主题包括对需要大量包装的电子商务宠物产品的需求不断增长、饲主模式的演变等)

- 宠物食品包装市场的最新创新

第五章美国宠物食品市场状况

- 宠物食品市场概览

- 宠物食品类型

第六章美国宠物食品包装市场依材料类型细分

- 纸和纸板

- 金属

- 塑胶

第七章美国宠物食品包装市场依产品类型细分

- 小袋

- 折迭式纸盒

- 金属罐

- 包包

- 其他类型

第 8 章美国宠物食品包装市场按宠物食品类型细分

- 干粮

- 湿食

- 冷藏/冷冻

第 9 章美国宠物食品包装市场细分:按动物

- 狗粮

- 猫粮

- 其他动物(鱼、鸟等)

第 10 章 竞争情报-公司简介

- Amcor PLC.

- American Packaging Corporation

- Crown Holdings Inc.

- ProAMpac LLC

- Constantia Flexibles

- TC Transcontinental

- Polymerall LLC

- Mondi Group

- Sonoco Products Company

- Berry Global Inc.

第 11 章:市场的未来

The U.S Pet Food Packaging Market is expected to register a CAGR of 5.6% during the forecast period.

Key Highlights

- Pet ownership in the United States has been increasing, which drives the demand for pet food packaging. According to the 2021-2022 American Pets Products Association (APPA) National Pet Owners Survey, in 2020, pet ownership in the United States increased from 67% of households to an all-time high of 70%.

- As pet owners take their pets' wellness exceptionally seriously, they are willing to invest more in their foods. This is leading to increasing demand from pet owners for protective, informative, and sustainable packaging.

- Various organizations in the country are making efforts to accelerate sustainability in the country. For instance, in February 2021, the Pet Sustainability Coalition (PSC), a US-based non-profit organization, announced the completion of phase I of Flex Forward. Flex Forward is a return-to-retail packaging pilot program aimed at reducing landfill waste and delivering sustainable packaging solutions to the pet industry after exceeding the collection goal of 5,000 pounds of used flexible plastic pet food and treat packaging.

- The COVID-19 pandemic has severely impacted the pet food industry in the United States. It also affects the growth of pet food packaging due to the direct correlation between manufacturing and packaging. For instance, in June 2021, Pet Food Institute (PFI) submitted a report to the US Department of Agriculture (USDA) detailing the supply chain constraints seen by pet food and treat manufacturers due to the COVID-19 pandemic. The association pointed out several issues in the transportation and supply chain infrastructure and how the pet food industry's interconnected nature with other markets in the United States caused supply shortages and other disruptions in 2020-2021.

- In addition, with the growing shift toward sustainable products, new pet food brands are coming up in the country with similar agendas. For instance, in August 2021, Target Corp. announced the launch of the pet food brand, Kindful. The brand offers recyclable packaging, which is in line with the retailer's environmental goals-the increasing competition in the market, leading to a strong focus on developing innovative packaging solutions.

US Pet Food Packaging Market Trends

Increasing Pet Ownership across the Country to Drive the Growth of the Market.

- Pet ownership in the United States is increasing significantly, driving the demand for pet food packaging. According to the American Pet Products Association's (APPA) 2021-2022 Survey, pet ownership has increased from an estimated 67% of U.S. households that own a pet to an estimated 70%. Millennials were revealed to be the largest cohort of pet owners at 32%, followed closely by Boomers at 27% and Gen X at 24%. The percentage is up from 56% of the U.S. households back in 1988 when the first-year survey was conducted.

- Furthermore, the pet spending increased during the past year, with 35% of pet owners stating they spent more on their pet/pet supplies - including food, wellness-related products, and other pet care items - in the last 12 months than in the preceding year. Moreover, about 14% percent of survey respondents confirmed that they obtained a new pet during the pandemic.

- A growing number of retail stores are realizing the profit potential of pet products, with a few even establishing their private labels. For instance, In August 2021, Target launched its latest private label in the pet category, focusing on cat and dog food. Kindful includes more than 50 products ranging from wet and dry food to treats and toppers made with ingredients including poultry, pasture-raised beef, and fish caught through sustainable means.

- Moreover, the growth of the e-commerce industry in the United States has increased the penetration of pet food products in the country. For instance, according to APPA, about 60% of pet owners usually purchased pet products in person at brick-and-mortar stores before the pandemic. However, during the pandemic, in-person shopping dropped to 41%, aligning more closely with the 46% of pet owners who prefer to purchase online with purchases shipped to their homes. The increased outreach of packaged pet food products is expected to favor the growth of the packaging industry in this region during the forecast period.

Pouches to Hold a Significant Market Share

- Pouch demand is estimated to be bolstered by features that foster convenience for consumers, including zippered closure mechanisms and light reduced weight. On the other hand, pouches serve reduced transportation costs due to their lightweight for the pet food manufacturers.

- Stand-up pouches emerged as a top choice for pet treats (ideally for retail-shelf attention). With packaging vendors making pouches available in many configurations, stand-up pouches gather multiple graphics panels and create measurable lifts in the market studied.

- As technologies are evolving, the versatility and efficiency of packaging machines allow many different kinds of formats. Better digital and HD capabilities advances in graphics enable creative package designs in the pet food sector, resulting in eye-catching photos, graphics, and colors on various materials that can be produced cheaper.

- Furthermore, the actual recyclability has not been achieved fully for pouches. This accounts for significant concerns in the industry. This is driving the players operating in the market to innovate the material used for packaging to be in line with the market trends like this. For instance, in January 2021, ProAmpac announced the launch of patent-pending ProActive Recycle Ready Retort RT-3000 to meet the need for recycle-ready retort packaging. Explicitly made for pet and human food, RT-3000 pouches are offered in stand-up and three-side seal configurations. It is also EU and FDA compliant for food contact in retort applications.

US Pet Food Packaging Industry Overview

The United States Pet Food Packaging Market is moderately competitive and moving towards the fragmented stage as new players enter the market. The fundamental strategy adopted by the major players includes offering customized products, introducing new packaging formats, and the innovation of new materials, among others. Some of the major players operating in the market include Amcor Plc., American Packaging Corporation, Crown Holdings Inc., and ProAmpac LLC., among others. Some of the recent developments are:

- September 2020 - Amcor, in collaboration with Nestle, launched the recyclable flexible retort pouch for Pet food. The partners collaborated during the product development process, testing for heat resistance, machine performance, shelf-life, and recyclability in the real world. Flexible retort packaging is a modern alternative to metal cans, and it can improve the carbon footprint of hundreds of consumer products owing to its lightweight, resource efficiency, and ease of transportation.

- March 2020 - TC Transcontinental announced the creation of a Recycling Group within TC Transcontinental Packaging. In 2020, the group intended to purchase equipment to convert flexible plastics recovered from sorting facilities and another commercial, industrial, and agricultural sources into recycled plastic granules. It will also be on the lookout for potential acquisitions of companies in this sector. The establishment of the Recycling Group is expected to contribute to the achievement of TC Transcontinental's objectives as a signatory of the Ellen MacArthur Foundation's New Plastics Economy Global Commitment.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Entry of Several Premium Category Brands with Higher Emphasis on the Use of Packaging as a Means of Gaining Competitive Advantage

- 4.2.2 Growing Demand for Functional Foods, coupled with Rise in Pet Ownership across the Country

- 4.3 Market Restraints

- 4.3.1 Ongoing Challenges Related to Finding a Trade-off between Sustainability, Durability, and Evolving Regulations

- 4.3.2 Assessment of the COVID-19 Impact on the Pet Food Packaging Market (Key themes covered in this section include growth in demand for e-commerce pet products that require higher volume packaging, evolving ownership patterns, etc.)

- 4.3.3 Recent Innovations in the Pet Food Packaging Market

5 PET FOOD MARKET LANDSCAPE IN THE UNITED STATES

- 5.1 Pet Food Market Overview

- 5.2 Types of Pet Food

6 THE US PET FOOD PACKAGING MARKET SEGMENTATION - BY MATERIAL TYPE

- 6.1 Paper and Paperboard

- 6.2 Metal

- 6.3 Plastic

7 THE US PET FOOD PACKAGING MARKET SEGMENTATION - BY PRODUCT TYPE

- 7.1 Pouches

- 7.2 Folding Cartons

- 7.3 Metal Cans

- 7.4 Bags

- 7.5 Other Types

8 THE US PET FOOD PACKAGING MARKET SEGMENTATION - BY PET FOOD TYPE

- 8.1 Dry Food

- 8.2 Wet Food

- 8.3 Chilled and Frozen

9 THE US PET FOOD PACKAGING MARKET SEGMENTATION - BY ANIMAL

- 9.1 Dog Food

- 9.2 Cat Food

- 9.3 Other Animals (Fish, Bird, etc.)

10 COMPETITIVE INTELLIGENCE - COMPANY PROFILES

- 10.1 Amcor PLC.

- 10.2 American Packaging Corporation

- 10.3 Crown Holdings Inc.

- 10.4 ProAMpac LLC

- 10.5 Constantia Flexibles

- 10.6 TC Transcontinental

- 10.7 Polymerall LLC

- 10.8 Mondi Group

- 10.9 Sonoco Products Company

- 10.10 Berry Global Inc.