|

市场调查报告书

商品编码

1687260

宠物食品包装:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Pet Food Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

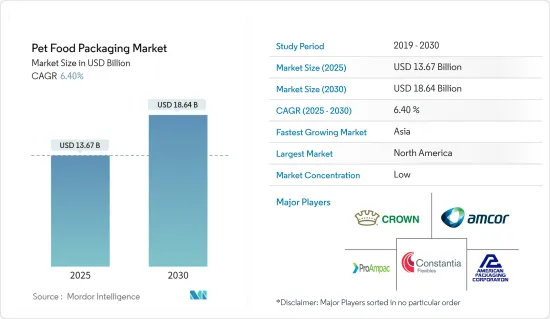

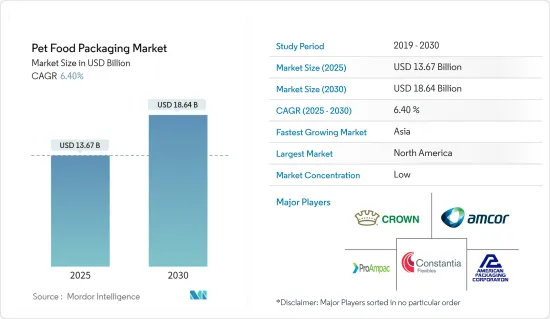

宠物食品包装市场规模预计在 2025 年为 136.7 亿美元,预计到 2030 年将达到 186.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.4%。

宠物食品包装正在经历显着的成长。适当的包装对于保持宠物食品的新鲜度和营养价值至关重要,可以保护宠物食品免受污染物、湿气和空气的影响。适当的包装可确保食品免受害虫和其他可能影响食品品质的环境因素的侵害。这使得宠物饲主更容易处理、储存和分配食物。

关键亮点

- 随着越来越多的人养宠物作为伴侣,以及饲主对维护宠物健康的意识不断提高,宠物食品包装市场也受到越来越多的关注。人们对宠物健康的日益关注推动了先进的防溢包装的采用,以确保宠物食品的品质。 2023 年收容所动物统计资料显示,进入收容所的狗的数量比离开收容所的狗的数量多 3%。具体而言,220万隻狗找到了新家,62.5万隻狗与饲主团聚,56.1万隻狗在机构之间转移。

- 美国宠物产品协会报告称,2023-2024 年,约有 6,510 万美国家庭拥有至少一隻狗。紧随其后的是猫和淡水鱼,分别约有 4,650 万户和 1,110 万户。随着越来越多的宠物饲主将宠物视为家庭成员,对优质宠物食品的需求也不断增加。

- 随着社会契约的变化以及将宠物视为忠诚的家庭成员越来越成为一种社会规范,优质宠物食品类别的成长和发展似乎是自然而然的。新品牌的出现和 SKU 的激增以及戏剧性的包装正在推动宠物食品行业的发展。此外,宠物食品的网路销售正在成长,从而产生了对支援运输和处理的包装的需求。根据加拿大农业及农业食品部的报告,到 2023 年,宠物食品网路零售业%。宠物食品在线销售的扩张可能会为所研究的市场创造需求。

- 食品安全法规的日益严格为宠物食品包装市场的成长带来了许多挑战。更严格的食品安全法规要求製造商投资合规的包装材料、技术和製程。这意味着更高的生产成本,小企业可能难以负担。如果发现包装不合规,加强监管可能会导致检查更加频繁,并增加召回的可能性。召回可能会损害品牌声誉并导致经济损失。

- 此外,通货膨胀率上升推高了原料、能源和运输成本,增加了与宠物食品包装生产相关的成本。包装成本的增加反过来可能会提高宠物食品本身的价格。此外,随着通货膨胀影响生活成本,消费者变得更加重视预算。这种优先事项的转变可能会导致消费者将注意力集中在基本开支上,而减少在优质或特殊宠物食品及其相关包装上的支出。

宠物食品包装市场趋势

预计干粮市场将占据相当大的份额。

- 干宠物食品保质期长,易于储存,为宠物饲主和零售商提供了便利。这种稳定性和对冷藏的最低需求是它如此受欢迎的原因。根据官方资讯来源,2023 年印度干狗粮市场规模估计约 4.82 亿美元。预计到 2028 年底,这一数字将进一步成长,达到约 9.63 亿美元。保存期限、大量购买和保存期限等因素是干狗粮占印度整个狗粮市场 88% 以上的关键原因。预计这些因素将推动市场成长。

- 干粮水分活度低,微生物学上稳定,保存期限长。然而,干粮通常不像湿粮或半湿粮那样受宠物欢迎,可能是因为它的味道不太吸引人。相比之下,有些宠物更喜欢干燥宠物食品,因为它的质地。这推动了干宠物食品包装市场的成长。

- 此外,全球宠物主人数量的不断增长也导致对各种宠物食品的需求增加,包括干宠物食品,干宠物食品因其实用性和成本效益而受到青睐。根据官方资料,到2023年,印度的宠物狗数量将超过3,300万隻。预计到2028年,这数字将超过5,100万隻。受人喜爱的狗的数量导致全国范围内宠物食品销量增加。

- 干宠物食品的包装过去很简单,知名品牌都使用纸袋。雀巢普瑞纳等公司正在尝试新的包装概念。他们正在测试新的纸本材料和顾客可以自备填充用容器的系统。根据截至 2023 年 6 月 18 日当週的 IRI资料,雀巢普瑞纳宠物护理是美国最畅销的干狗粮品牌,创造了约 25 亿美元的收益。

- 据英国宠物食品协会称,2023年英国狗粮市场价值将达18.4亿英镑(约2.33亿美元)。随着宠物食品销售的成长,对包装材料的需求也在成长。这种成长意味着宠物食品包装製造商可以期待更多用于製造各种包装解决方案的塑胶、纸张和金属等材料的订单。

- 此外,干宠物食品的生产成本比湿食品低,这使其成为製造商和消费者经济可行的选择,也是其受欢迎程度的原因之一。此外,可重复密封的包装袋和环保材料等先进的包装技术正在增强干燥宠物食品的吸引力。这些技术创新正在提高便利性和永续性,推动市场成长。

预计北美市场将出现显着成长

- 北美对宠物食品包装市场的成长做出了重大贡献。美国和加拿大等国家是世界上宠物拥有率最高的国家之一。如此庞大的宠物主人群体推动了对各种宠物食品产品及其包装的巨大需求。根据加拿大农业和食品部统计,几年前,加拿大的宠物数量约为 2,793 万隻,其中包括狗、猫、鱼、小型哺乳动物和爬虫类。预测显示,到 2025 年,这一数字将超过 2,850 万。

- 在北美,宠物食品包装需求的不断增长与宠物饲养量(尤其是救援犬)的成长趋势密切相关。随着该地区宠物拥有量的扩大,尤其是救援犬受到关注,对宠物食品的需求自然也会增加。宠物拥有量的增加推动了对宠物食品的需求,扩大了对宠物包装的需求,并为包装製造商提供了有利可图的机会。

- 此外,宠物人性化是重塑宠物照护模式的关键趋势。 Mondi 的研究显示,75% 的参与者倾向于在优先考虑永续包装的品牌上花费更多。因此,宠物食品领域的品牌将永续性放在首位,并将其解决方案与这些企业价值观结合。此外,Mondi 等公司凭藉 BarrierPac Recyclable 等产品引领此领域。这些解决方案包括利用塑胶层压板的预製袋和FFS卷材。这些层压板在接受软包装的地区是可回收的,并且可以透过店内投递退回,并保持其原始功能。

- BASF美国公司是使用水性乳液「JONCRYL HPB 1702」的可持续宠物食品包装的先驱。此创新解决方案可满足宠物食品市场所需的耐油性和食品安全认证。

- 此外,美国宠物产品协会报告称,预计到 2023 年,美国宠物产业的支出将达到 1,470 亿美元,上年度的 905 亿美元大幅成长。随着宠物支出的增加,对宠物食品的需求也在增加,对包装的需求也随之增加,以支持这种成长的生产和消费。

- 北美是包装创新的中心,各组织投资于独特的材料和技术,以提高包装的效率、功能性和美观性。预计这些因素将推动北美宠物食品包装市场的发展,使其成为关键地区。

宠物食品包装市场概览

宠物食品包装市场是细分的。主要参与企业包括 Amcor Group GmbH、American Packaging Corporation、ProAmpac LLC、Constantia flexibles Group GmbH 和 Crown Holdings Inc. 随着宠物食品产品的技术创新和宠物食品包装市场竞争的加剧,製造商正在选择高品质和可持续的包装来吸引更多客户。

- 2024 年 7 月,Mondi 推出了“FlexiBag Reinforced”,这是一系列基于单一 PE 的可回收包装解决方案,增强了其预製塑胶袋产品组合。据 Mondi 称,这些袋子具有优异的机械性能,包括增强的抗穿刺性、增加的刚度和改善的密封性。可调节的屏障保护可提供中等至高的抗脂肪、氧气和湿气能力,确保内容物的新鲜度。 Mondi 特别强调宠物食品产业是这项创新功能的重点目标。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场动态

- 市场驱动因素

- 对高级产品和品牌产品的需求不断增加

- 提高维护宠物健康的意识

- 市场限制

- 加强食品安全监管

第六章 宠物食品市场现状

- 宠物食品产业概况

- 宠物食品类型

- 按动物类型分类的宠物食品

第七章市场区隔

- 按材质

- 纸和纸板

- 金属

- 塑胶

- 依产品类型

- 小袋

- 折迭式纸盒

- 金属罐

- 包包

- 其他的

- 依食物类型

- 干粮

- 湿粮

- 冷藏/冷冻

- 按动物

- 狗粮

- 猫粮

- 其他动物

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第八章竞争格局

- 公司简介

- American Packaging Corporation

- ProAmpac LLC

- Constantia Flexibles Group GmbH

- Amcor Group GmbH

- Crown Holdings Inc.

- Coveris Holdings

- Polymerall LLC

- Mondi PLC

- Sonoco Products Company

- Berry Global Inc.

- Ardagh Group SA

- Wipak

- Silgan Holdings Inc.

第九章投资分析

第十章:市场的未来

The Pet Food Packaging Market size is estimated at USD 13.67 billion in 2025, and is expected to reach USD 18.64 billion by 2030, at a CAGR of 6.4% during the forecast period (2025-2030).

Pet food packaging is growing significantly. Proper packaging is essential for maintaining the freshness and nutritional value of pet food by protecting it from contaminants, moisture, and air. Proper packaging ensures the food remains safe from pests and other environmental factors that could compromise its quality. This makes it easier for pet owners to handle, store, and dispense food.

Key Highlights

- The pet food packaging market is gaining traction due to the growing adoption of pets as companions and the increasing awareness among owners about maintaining a pet's health. Growing concerns over pet health are driving the adoption of advanced, spill-proof packaging for pet food, ensuring its quality is preserved. Data from Shelter Animals Count in 2023 revealed that 3% more dogs entered shelters than exited. Specifically, 2.2 million dogs found new homes, 625,000 were reunited with their owners, and 561,000 were moved between organizations.

- In 2023-2024, the American Pet Products Association Inc. reported that around 65.1 million US households had at least one dog. Cats and freshwater fish followed, with about 46.5 million and 11.1 million households, respectively. As pet owners increasingly view their pets as family, there is an increasing demand for premium and high-quality packaged pet food.

- As the social contract shifts and treating pets as faithful family members is more of a social norm, the growth and development of the premium pet food category emerged as a natural consequence. The emergence of new brand players and the proliferation of SKUs unleashing dramatic packaging drive the pet food industry. In addition, online pet food sales are rising, which boosts demand for packaging that supports shipping and handling. As reported by Agriculture and Agri-Food Canada, online retailing in India saw pet food making up 14.5% of its sales in 2023. Such expansion in online pet food sales may create demand in the studied market.

- The increasing adoption of food safety regulations poses several challenges to the growth of the pet food packaging market. Stricter food safety regulations require manufacturers to invest in compliant packaging materials, technologies, and processes. This leads to higher production costs, which can be difficult for smaller companies to absorb. Tighter regulations may result in more frequent inspections and a higher likelihood of recalls if packaging is found to be non-compliant. Recalls can damage a brand's reputation and lead to financial losses.

- Moreover, increasing inflation drives up costs for raw materials, energy, and transportation, raising the expenses associated with pet food packaging production. This uptick in packaging material costs can, in turn, elevate the prices of the pet food products themselves. Furthermore, as inflation impacts the cost of living, consumers are likely to adopt a budget-conscious approach. This shift in priorities may lead them to focus on essential expenses, shortening their spending on premium or specialty pet foods and their associated packaging.

Pet Food Packaging Market Trends

The Dry Food Segment is Expected to Hold a Considerable Share in the Market

- Dry pet food is convenient for pet owners and retailers due to its longer shelf life and ease of storage. This stability and minimal need for refrigeration boost its popularity. According to an official source, the market value of dry dog food in India was approximately USD 482 million in 2023. This was forecast to increase further and reach approximately USD 963 million by the end of 2028. Factors such as storage, bulk purchase, and shelf life were the primary reasons for dry dog food to have a share of over 88% of all dog food in India. Such factors are expected to propel the market's growth.

- Dry pet foods have a long shelf life due to low water activity and consequent microbiological stability. However, they are typically less appealing to pets than moist or semi-moist pet foods, probably due to their low flavor appeal. In contrast, some pets may prefer dry pet foods due to their textural qualities. This drives the growth of the dry pet food packaging market.

- In addition, the rising number of pet owners globally contributes to increased demand for all types of pet food, including dry pet food, which is often preferred for its practicality and cost-effectiveness. As per official data, India had a pet dog population exceeding 33 million in 2023. Projections indicate this figure will surpass 51 million by 2028. The number of pet dogs has led to increased pet food sales nationwide.

- Packaging for dry pet food has usually been simple, with major brands using paper bags. Companies like Nestle Purina are trying new packaging ideas. They are testing new paper materials and a system where customers bring their containers for refills. Data from IRI for the week ending June 18, 2023, showed Nestle Purina PetCare as the top-selling dry dog food brand in the United States, earning about USD 2.5 billion.

- According to the UK Pet Food, the market value for dog food in the UK was GBP 1840 million (about USD 2303 million) in 2023. As pet food sales grow, so does the need for packaging materials. This increase means pet food packaging manufacturers can expect more orders for materials like plastic, paper, and metal, which are used to make various packaging solutions.

- Furthermore, dry pet food has a lower production cost than wet food, making it a more economically viable option for manufacturers and consumers, contributing to its widespread use. Also, advances in packaging technology, such as resealable pouches and eco-friendly materials, enhance dry pet food's appeal. These innovations improve convenience and sustainability, driving the market's growth.

North America is Expected to Witness a Significant Growth in the Market

- North America significantly contributes to the growth of the pet food packaging market. Countries like the United States and Canada have some of the highest pet ownership rates globally. This large pet owner base drives substantial demand for various pet food products and their packaging. According to Agriculture and Agri-Food Canada, Canada's pet population, encompassing dogs, cats, fish, small mammals, and reptiles, stood at around 27.93 million a few years ago. Projections indicate this number is expected to surpass 28.5 million by 2025.

- In North America, the rising demand for pet food packaging aligns closely with the growing trend of pet adoption, particularly for rescue dogs. As pet ownership expands in the region, especially with a focus on rescue dogs, the need for pet food naturally escalates. This uptick in pet ownership boosts the demand for pet food and amplifies the need for its packaging, presenting lucrative opportunities for packaging manufacturers.

- Furthermore, pet humanization is a pivotal trend reshaping the pet care landscape. A survey by Mondi revealed that 75% of participants are inclined to spend more on brands that prioritize sustainable packaging. As a result, brands in the pet food sector are aligning their solutions with these corporate values, placing sustainability at the forefront. Moreover, companies like Mondi lead the range with offerings like BarrierPack Recyclable. These solutions, which include premade pouches and FFS roll-stock, utilize plastic laminates. These laminates are recyclable in regions that accept flexible packaging and can be returned through store drop-off while maintaining their intended functionality.

- BASF America is pioneering sustainable pet food packaging using its water-based emulsion, JONCRYL HPB 1702. This innovative solution meets the pet food market's demands for grease resistance and food safety certifications.

- Moreover, in 2023, the US pet industry spending reached an impressive USD 147 billion, marking a substantial increase from the USD 90.5 billion recorded in prior years, as the American Pet Products Association Inc. reported. As pet expenditures rise, so does the demand for pet food, leading to an increased need for packaging to support this heightened production and consumption.

- North America is a hub for packaging innovation, with organizations investing in unique materials and technologies to improve packaging efficiency, functionality, and aesthetics. These factors are expected to drive the North American pet food packaging market, making it a critical region.

Pet Food Packaging Market Overview

The pet food packaging market is fragmented. Some of the key players are Amcor Group GmbH, American Packaging Corporation, ProAmpac LLC, Constantia Flexibles Group GmbH, and Crown Holdings Inc. With innovation in pet food products and rising competition in the pet food packaging market, manufacturers opt for quality and sustainable packaging to attract more customers.

- July 2024: Mondi introduced 'FlexiBag Reinforced,' a new line of recyclable, mono-PE-based packaging solutions, enhancing its premade plastic bags portfolio. According to Mondi, these bags boast superior mechanical properties, including enhanced puncture resistance, increased stiffness, and better sealability. The adjustable barrier protection offers medium to high resistance against fat, oxygen, and moisture, ensuring content freshness. Mondi specifically highlights the pet food industry as a prime target for this innovative feature.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Demand for Premium and Branded Products

- 5.1.2 Increasing Awareness about Maintaining Pet's Health

- 5.2 Market Restraints

- 5.2.1 Increasing Adoption of Food Safety Regulations

6 PET FOOD MARKET LANDSCAPE

- 6.1 Pet Food Industry Overview

- 6.2 Types of Pet Food

- 6.3 Pet Food by Animal Type

7 MARKET SEGMENTATION

- 7.1 By Material

- 7.1.1 Paper and Paperboard

- 7.1.2 Metal

- 7.1.3 Plastic

- 7.2 By Product Type

- 7.2.1 Pouches

- 7.2.2 Folding Cartons

- 7.2.3 Metal Cans

- 7.2.4 Bags

- 7.2.5 Other Product Types

- 7.3 By Type of Food

- 7.3.1 Dry Food

- 7.3.2 Wet Food

- 7.3.3 Chilled and Frozen

- 7.4 By Animal

- 7.4.1 Dog Food

- 7.4.2 Cat Food

- 7.4.3 Other Animal

- 7.5 By Geography

- 7.5.1 North America

- 7.5.2 Europe

- 7.5.3 Asia-Pacific

- 7.5.4 Latin America

- 7.5.5 Middle East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 American Packaging Corporation

- 8.1.2 ProAmpac LLC

- 8.1.3 Constantia Flexibles Group GmbH

- 8.1.4 Amcor Group GmbH

- 8.1.5 Crown Holdings Inc.

- 8.1.6 Coveris Holdings

- 8.1.7 Polymerall LLC

- 8.1.8 Mondi PLC

- 8.1.9 Sonoco Products Company

- 8.1.10 Berry Global Inc.

- 8.1.11 Ardagh Group SA

- 8.1.12 Wipak

- 8.1.13 Silgan Holdings Inc.