|

市场调查报告书

商品编码

1683535

西北欧柴油发电机组:市场占有率分析、产业趋势与成长预测(2025-2030 年)North West Europe Diesel Generator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

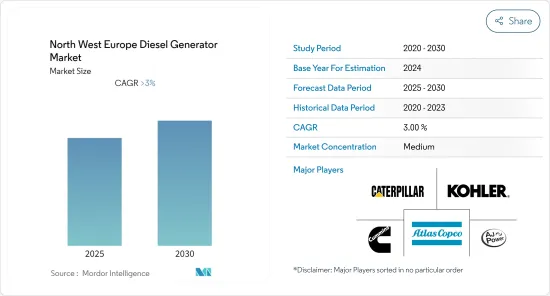

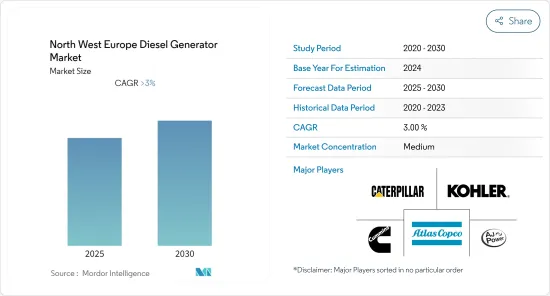

预测期内,西北欧柴油发电机市场预计复合年增长率超过 3%

主要亮点

- 由于柴油泵被各类终端用户采用且比动态泵具有优势,预计在预测期内柴油泵的需求将大幅增长。

- 预测期内,混合可再生能源发电系统的发展可能为发电机市场创造若干机会。

- 预计英国将主导市场,需求主要由国内各终端产业推动。

西北欧柴油发电机市场趋势

工业领域主导市场

- 在停电期间(以避免生产风险)以及电网接入有限的地区,工业运作主要依赖柴油发电机产生的电力。

- 包括采矿业、製造业、农业和建设业在内的工业部门将占能源消耗的最大份额,预测期内将占50%以上。因此,製药和製造设施等行业对持续可靠电力供应的需求日益增加,预计将推动柴油发电机的需求。

- 然而,西北欧的工业成长集中在高薪的服务业,而不是大规模製造业。但也有一些例外,如钢铁和汽车产业,德国和英国主导地位。但这些市场也面临成长挑战,尤其是随着中国钢铁和电动车占领欧洲市场。

- 截至2021年,欧盟是仅次于中国的世界第二大钢铁生产国。 2021年,欧盟钢铁产量将超过1.77亿吨/年,占全球产量的11%。其中大部分来自德国,产量为40.1公吨。钢铁业是电力消耗大户,钢铁生产需要大量可靠的能源。德国等许多国家仍在其钢铁业使用柴油发电机,并将其作为国家发展工作的骨干。

- 此外,预计在预测期内,政府(尤其是英国和德国)扩大工业部门的措施将推动对柴油发电机的需求。

英国占市场主导地位

- 英国是世界上最发达的国家之一。它也是欧洲地区工业化程度最高的国家之一,能源需求持续成长。随着能源需求的不断增加,经济各领域对不间断电力供应的需求也日益增加。

- 英国电网需要尖峰时段的备用电源。为了满足这一峰值需求,国家电网输电公司 (NGET) 一直使用柴油发电机 (DG) 组为变电站的冷却风扇、泵浦和照明等关键活动提供备用电源。

- 截至 2021 年,英国各地的新建设订单均大幅成长。公共新建住宅订单数为139.6,民间新建住宅订单数为109.6,全部新建住宅数为111.6,民间工业数为167.8。预计这将推动西北欧柴油发电机市场的发展。

- 英格兰和威尔斯的 250 多个 NGET 站点均使用备用发电机,其中大多数是柴油发电机。这些系统为 NGET 在停电时提供恢復能力。

- 英国有许多不同行业经常使用发电机,包括农业、通讯和建筑。

- 近几个月来,该国的建设活动一直在增加。 2022 年 1 月,建筑业产量成长 1.1%,为 2019 年 9 月以来的最高水准。继 2021 年 12 月成长 2.0% 之后,连续第三个月成长超过 1.0%。

- 由于电力需求的增加和建设产业的兴起,预计预测期内英国柴油发电机市场将会成长。

西北欧柴油发电机产业概况。

西北欧柴油发电机市场中等分散。市场的主要企业包括阿特拉斯·科普柯有限公司、卡特彼勒公司、康明斯公司、AJ Power 有限公司和科勒公司。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 2027 年市场规模与需求预测

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 容量

- 小于75kVA

- 75至350kVA以下

- 350kVA以上

- 最终用户

- 住宅

- 商业的

- 工业的

- 应用

- 备用电源

- 主用电力和抑低尖峰负载

- 地区

- 英国

- 德国

- 爱尔兰

- 荷兰

- 其他西北欧国家

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Atlas Copco Ltd.

- Caterpillar Inc.

- Cummins Inc.

- AJ Power Ltd.

- Kohler Co.

- Enrogen Ltd.

- Hyundai Power Products

- PR INDUSTRIAL Srl

- Inmesol SLU

- Doosan Corporation

第七章 市场机会与未来趋势

简介目录

Product Code: 92016

The North West Europe Diesel Generator Market is expected to register a CAGR of greater than 3% during the forecast period.

Key Highlights

- The diesel segment is expected to witness significant demand during the forecast period, owing to its adoption by various end-users and its advantages when compared to dynamic pumps.

- Development of hybrid renewable energy systems is likely to create several opportunities for the electric generators market in the forecast period.

- The United Kingdom is expected to dominate the market, with a majority of the demand coming from various end-use industries across the country.

North West Europe Diesel Generator Market Trends

Industrial Sector to Dominate the Market

- Industrial operations are mainly dependent on electricity generated from diesel generators during power outages (to avoid production risks) and in regions where grid access is limited.

- The industrial sector, which includes mining, manufacturing, agriculture, and construction, accounts for the largest share of energy consumption, accounting for more than 50% during the forecast period. Therefore, the increasing demand for continuous and reliable power supply in industries like the pharmaceutical industries and manufacturing facilities, is expected to escalate the demand for diesel generators.

- However, the growth of industries in the North-western region of Europe has been focused on high-income service jobs and not on large-scale manufacturing industries. However, there are a few exceptions such as in the case of Steel and Automotive industries where Germany and the United Kingdom play a leading role. However, these markets have also been facing difficulties in growth especially as Chinese Steel and Electric vehicles capture the European markets.

- As of 2021, the European Union is the second largest producer of steel in the world after China. In 2021,its output was over 177 million tonnes of steel a year, accounting for 11% of global output. Mostly coming from Germany at 40.1 Metric ton. Steel industry is a major consumer of power and requires large of amount of reliable energy for steel manufacturing. Many countries like Germany still use diesel generators for the steel industry, which act as a backbone for country's development work.

- Furthermore, government initiatives to expand the industrial sector, especially in the United Kingdom and Germany, are expected to continue propelling the demand for diesel generators over the forecast period.

The United Kingdom to Dominate the Market

- The United Kingdom is one of the most developed countries in the world. It is also one of the most industrialized countries in the European region with an ever-increasing demand for energy. With the increasing demand for energy, there is also an increasing need for an uninterrupted power supply among various sectors of the economy.

- The United Kingdom's national grid requires power backup sources that can be used when there is peak demand. The National Grid Electricity Transmission (NGET) has been using Diesel generators (DG) sets to accommodate this peak demand and provide backup power to substations for key activities such as cooling fans, pumps, and lighting, enabling it to continue to perform its crucial role in the electricity transmission system.

- As of 2021, the new orders for construction across the United Kingdom have witnessed significant growth. The New housing public order includes 139.6 orders, New housing private 109.6, all new housing 111.6, and private industrial 167.8 orders. This is expected to drive the North West Europe diesel generators market.

- Backup generators are used at over 250 NGET sites across England and Wales, the majority of which are diesel-powered. These systems provide NGET with the resilience to recover from a loss of power supply event.

- There are various sectors such as agriculture, telecommunication, construction etc., within the United Kingdom that have generators being utilized on a regular basis.

- The construction activity around the country has been increasing in the past few months. The construction output increased by 1.1% in volume terms in January 2022 and is at its highest level since September 2019; this follows an increase of 2.0% in December 2021 and is the third consecutive monthly growth greater than 1.0%.

- The United Kingdom diesel generator market is expected to increase in the forecast period due to the increase in the electricity demand and the rising construction industry.

North West Europe Diesel Generator Industry Overview

The North West Europe Diesel Generator Market is moderately fragmented. The key players in the market include Atlas Copco Ltd., Caterpillar Inc., Cummins Inc., AJ Power Ltd., and Kohler Co., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Capacity

- 5.1.1 Below 75 kVA

- 5.1.2 75-350 kVA

- 5.1.3 Above 350 kVA

- 5.2 End-User

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Industrial

- 5.3 Application

- 5.3.1 Standby Backup Power

- 5.3.2 Prime Power and Peak Shaving Power

- 5.4 Geography

- 5.4.1 United Kingdom

- 5.4.2 Germany

- 5.4.3 Ireland

- 5.4.4 Netherlands

- 5.4.5 Rest of Northwest Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Atlas Copco Ltd.

- 6.3.2 Caterpillar Inc.

- 6.3.3 Cummins Inc.

- 6.3.4 AJ Power Ltd.

- 6.3.5 Kohler Co.

- 6.3.6 Enrogen Ltd.

- 6.3.7 Hyundai Power Products

- 6.3.8 PR INDUSTRIAL Srl

- 6.3.9 Inmesol SLU

- 6.3.10 Doosan Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219