|

市场调查报告书

商品编码

1683542

日本电动自行车:市场占有率分析、行业趋势和统计、成长预测(2025-2029 年)Japan E-bike - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

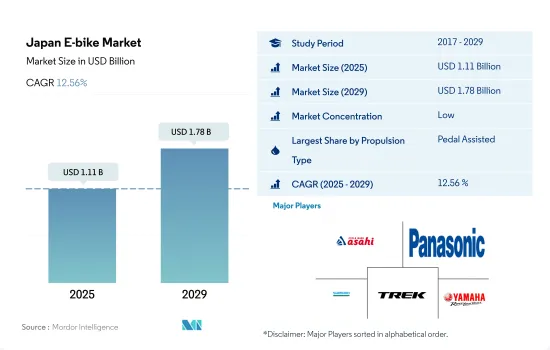

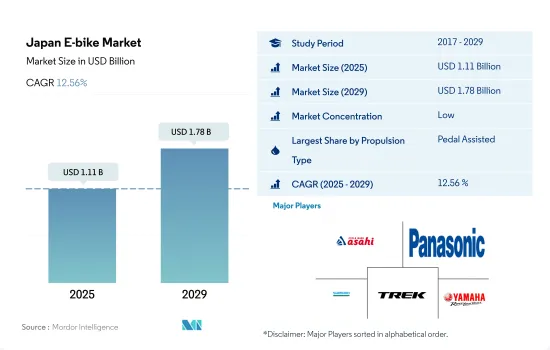

日本电动自行车市场规模预计在 2025 年为 11.1 亿美元,预计到 2029 年将达到 17.8 亿美元,预测期内(2025-2029 年)的复合年增长率为 12.56%。

推进系统细分市场概览

- 日本是对电动自行车较为熟悉的亚洲国家。电动式自行车被引入日本市场,并为老年人提供了帮助,因为骑自行车在日常活动中不需要太多的体力。像 Pedelec 这样的电动式自行车的基本优势在于它们易于用于跑腿和通勤等日常活动。日本的电动自行车拥有者大部分都购买了助力电动式自行车,因为他们居住在多山丘的住宅区。

- 由于地形崎岖,日本的公路网绵延128万公里,由数百座桥樑和隧道组成。远距骑行在日本各地非常普遍,因为该国拥有大量高速公路,且交通流量不大。 2021年,电动式自行车(pedelecs)的价格预计通常在7万至15万日圆之间,此类自行车约占日本新自行车销量的12.2%。

- 在日本,使用轻便摩托车举办的活动数量从 2011 年的约 23,140 场下降到 2020 年的不到 7,000 场。道路上的自行车越多,发生事故的可能性就越小。年轻人对上坡骑行等运动的兴趣日益浓厚,以及对健康积极生活方式的认识不断增强,预计将在未来几年推动市场需求。助力自行车对于短距离骑乘来说很方便,但在不久的将来,高速电动自行车可能会成为最方便的选择。此外,随着功率和速度能力的提升,未来几年消费者可能倾向于选择高速电动自行车。

日本电动自行车市场趋势

日本电动自行车的普及率一直稳定提高,反映出市场渗透率和消费者接受度的不断提高。

- 日本电动自行车市场正迅速成为都市区最受欢迎的交通途径。电动自行车比汽车更灵活、更快,因为它们更易于操纵并且可以轻鬆避开减慢车辆速度的障碍物。

- 近年来,日本的电动自行车销售一直在增加,老年人和有小孩的双收入父母的需求不断增长。当电动式自行车首次引进日本市场时,主要目标族群是老年人。电动式自行车,例如脚踏自行车,方便通勤。对老年人来说,其好处是他们用较少的体力就能进行日常生活。然而,近年来,越来越多的学龄前儿童家长使用便捷的电动自行车送孩子到托儿所。

- 商业活动的恢復和封锁期间实施的贸易限制的解除,导致日本电动自行车的采用率增加。贸易限制的取消有利于日本的进出口活动。由于电动自行车具有燃油经济性好、节省时间等特点和优势,预计日本电动自行车的普及率仍将持续提高。

在日本,很大一部分通勤者每天的通勤距离在 5 至 15 公里之间,这表明他们强烈偏好这个距离。

- 自行车文化在该国越来越受欢迎。近年来,日本对自行车的需求不断增加。越来越多的人使用自行车往返于学校、市场和工作场所等各个地方。到2020年,将会有更多的人使用自行车来锻炼身体以及前往5至15公里范围内的市场、办公室等附近场所。因此,与 2019 年相比,2020 年日本对自行车的需求增加。

- 疫情期间实施的限制和障碍对日本自行车市场产生了巨大的正面影响。越来越多的日本人短距离出行选择步行或骑自行车代替使用其他汽车。此外,性能更强大、电池寿命更长的电动自行车的出现也鼓励人们选择骑自行车进行週末活动和锻炼,与 2020 年相比,2021 年日本骑行 5-15 公里通勤者的数量进一步增加。

- 随着人们骑自行车前往附近地点的习惯逐渐养成,使用自行车进行短距离出行变得很普遍。目前,许多人每天骑自行车到当地的市场或职场,距离为5至15公里。由于骑自行车更有利于健康、排放碳通勤并且可以避免交通拥堵而节省时间,越来越多的人喜欢骑自行车上班。由于这些因素,预计预测期内日本 5 至 15 公里通勤人数将会增加。

日本电动自行车产业概况

日本电动自行车市场较为分散,前五大企业占了37.20%的市场。市场的主要企业是:Asahi Cycle、Panasonic Cycle Technology、Shimano Inc.、Trek Bicycle Corporation 和 Yamaha Bicycles(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第二章 报告要约

第 3 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 自行车销量

- 人均国内生产毛额

- 通货膨胀率

- 电动自行车普及率

- 每天出游 5 至 15 公里的人口/通勤者百分比

- 自行车出租

- 电动自行车电池价格

- 电池化学价格表

- 超本地化配送

- 自行车道

- 徒步人数

- 电池充电容量

- 交通拥堵指数

- 法律规范

- 价值链与通路分析

第五章 市场区隔

- 推进类型

- 踏板辅助

- 高速电动自行车

- 油门辅助

- 应用程式类型

- 货运/公用设施

- 城市/城区

- 健行

- 电池类型

- 铅酸电池

- 锂离子电池

- 其他的

第六章 竞争格局

- 主要策略趋势

- 市场占有率分析

- 业务状况

- 公司简介

- Asahi Cycle Co. Ltd

- Bridgestone Cycle Co. Ltd

- Fujikom Co. Ltd

- Giant Manufacturing Co. Ltd.

- Kawasaki Motors Corporation Japan

- Maxon Motor AG

- Panasonic Cycle Technology Co. Ltd

- Shimano Inc.

- Trek Bicycle Corporation

- Yamaha Bicycles

第七章:执行长的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源和进一步阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 92156

The Japan E-bike Market size is estimated at 1.11 billion USD in 2025, and is expected to reach 1.78 billion USD by 2029, growing at a CAGR of 12.56% during the forecast period (2025-2029).

PROPULSION SEGMENT MARKET OVERVIEW

- Japan is an Asian country that is no stranger to electric bikes. Electric power-assisted bicycles were introduced to the Japanese market, aiding the elderly by requiring less physical strength to navigate their daily life on a bicycle. The fundamental advantage of motorized bicycles, such as pedelecs, is the ease with which they may be used in daily life, such as doing errands or commuting. The majority of pedelec owners in Japan purchased their pedal-assist electric bicycles because they live in a residential area with a high number of slopes.

- Due to the island's rough geography, Japan's road system comprises more than 1.28 million kilometres of length and hundreds of bridges and tunnels. Because there are so many highways in Japan with little traffic, long-distance cycling is extremely common throughout much of the country. In 2021, pedal electric cycles (pedelecs), which make up around 12.2 percent of all new bicycle sales in Japan, will typically cost between 70 and 150 thousand Japanese yen.

- In Japan, the number of events using motorised bicycles has decreased from approximately 23.14 thousand in 2011 to fewer than 7,000 in 2020. The increased number of bicycles on the road reduces the likelihood of an accident. Rising youth interest in sports such as uphill cycling, as well as increased awareness of a healthy and active lifestyle, are expected to fuel market demand in the future years. The pedal-assist bicycle is useful for short distances, but the speed Pedelec will be the most convenient option in the near future. Furthermore, as power and speed capabilities improve, consumers will most likely gravitate toward the Speed Pedelec category in the coming years.

Japan E-bike Market Trends

Japan exhibits a consistent increase in E-Bike adoption rates, reflecting growing market penetration and consumer acceptance.

- The e-bike market in Japan is quickly becoming the most popular mode of transportation in urban areas. E-bikes are more agile and quicker than cars as they are extremely maneuverable and can readily dodge obstacles that cause a vehicle to slow down.

- In recent years, the number of e-bikes sold in Japan has increased, showing significant demand from a growing number of older people and working parents with young children. Older people were the major target demographic when electric power-assist bicycles were first introduced to the Japanese market. Motorized bicycles, such as pedelecs, are more convenient to commute. The elderly benefit from these bicycles as they allow them to exert less physical strength to navigate their everyday lives. However, in recent years, parents of preschool children have grown to rely on the convenience of e-bikes while dropping their children at daycare centers.

- Due to the resumption of business activities and the removal of trade restrictions imposed during lockdown, the adoption of e-bikes increased in Japan. Lifting trade regulations has benefited the country's import and export activities. Due to e-bikes features and benefits, such as fuel efficiency and time savings, their adoption rate is projected to increase in Japan in the future.

Japan maintains a high percentage of commuters traveling 5-15 km daily, indicating a strong preference for this travel distance.

- The bicycle culture is gaining popularity in the country. Over the years, bicycle demand in Japan has increased. The usage of bicycles for commuting to various places, such as schools, marketplaces, and job sites, is increasing in the country. In 2020, more people started using bicycles to travel a distance of 5-15 km for exercising and going to nearby places, such as markets or offices. Therefore, the demand for bicycles in Japan increased in 2020 compared to 2019.

- The restrictions and barriers imposed during the pandemic significantly and favorably affected the bicycle market in Japan. For short trips, more Japanese choose to walk or bike instead of using other automobiles. The availability of e-bikes with more sophisticated features and longer battery lives also encouraged individuals to choose bicycles for weekend activities and exercise, further boosting the number of commuters in Japan who traveled 5-15 km on bicycles in 2021 compared to 2020.

- Bicycle use for short trips became common as people habitually used bicycles to commute to nearby places. Currently, many individuals commute daily by bicycle, covering a distance of 5-15 km to local markets and workplaces. More people prefer to commute by bicycle due to the growing health benefits, carbon-free commuting, and saving time by avoiding traffic. These factors are anticipated to increase the number of people commuting a distance of 5-15 km in Japan during the forecast period.

Japan E-bike Industry Overview

The Japan E-bike Market is fragmented, with the top five companies occupying 37.20%. The major players in this market are Asahi Cycle Co. Ltd, Panasonic Cycle Technology Co. Ltd, Shimano Inc., Trek Bicycle Corporation and Yamaha Bicycles (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Bicycle Sales

- 4.2 GDP Per Capita

- 4.3 Inflation Rate

- 4.4 Adoption Rate Of E-bikes

- 4.5 Percent Population/commuters With 5-15 Km Daily Travel Distance

- 4.6 Bicycle Rental

- 4.7 E-bike Battery Price

- 4.8 Price Chart Of Different Battery Chemistry

- 4.9 Hyper-local Delivery

- 4.10 Dedicated Bicycle Lanes

- 4.11 Number Of Trekkers

- 4.12 Battery Charging Capacity

- 4.13 Traffic Congestion Index

- 4.14 Regulatory Framework

- 4.15 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Propulsion Type

- 5.1.1 Pedal Assisted

- 5.1.2 Speed Pedelec

- 5.1.3 Throttle Assisted

- 5.2 Application Type

- 5.2.1 Cargo/Utility

- 5.2.2 City/Urban

- 5.2.3 Trekking

- 5.3 Battery Type

- 5.3.1 Lead Acid Battery

- 5.3.2 Lithium-ion Battery

- 5.3.3 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Asahi Cycle Co. Ltd

- 6.4.2 Bridgestone Cycle Co. Ltd

- 6.4.3 Fujikom Co. Ltd

- 6.4.4 Giant Manufacturing Co. Ltd.

- 6.4.5 Kawasaki Motors Corporation Japan

- 6.4.6 Maxon Motor AG

- 6.4.7 Panasonic Cycle Technology Co. Ltd

- 6.4.8 Shimano Inc.

- 6.4.9 Trek Bicycle Corporation

- 6.4.10 Yamaha Bicycles

7 KEY STRATEGIC QUESTIONS FOR E BIKES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219