|

市场调查报告书

商品编码

1800733

电动自行车市场按用途、类别、组件、驱动系统、模式、所有权、速度、电池容量、电池整合类型、电池类型、电池电压、马达功率、马达重量、马达类型和地区划分 - 预测至 2032 年E-bike Market by Class, Battery, Motor, Mode, Usage, Speed, Battery Capacity, Component, and Region - Global Forecast to 2032 |

||||||

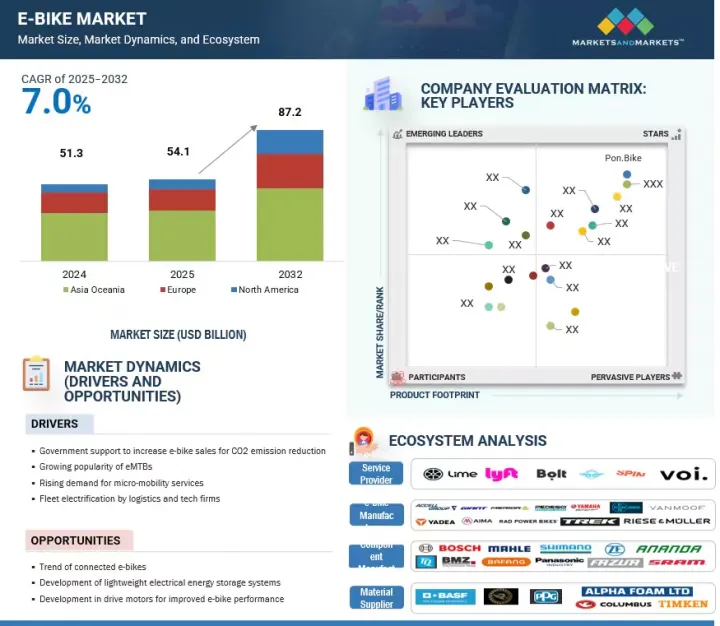

电动自行车市场预计将从 2025 年的 541 亿美元成长到 2032 年的 872 亿美元,复合年增长率为 7.0%。

2019年至2021年,受疫情期间环保意识增强和替代出行需求的推动,电动自行车市场呈现强劲成长。然而,2023年,由于经济放缓和库存调整,部分地区(尤其是欧洲)的销售量出现下滑。 2024年开始復苏,主要集中在亚洲/大洋洲和北美,监管支援和基础设施建设推动了电动自行车的普及。 I类电动自行车继续占据主导地位,但速度更快的III类电动自行车也越来越受欢迎,尤其是在北美。

| 调查范围 | |

|---|---|

| 调查年份 | 2025-2032 |

| 基准年 | 2024 |

| 预测期 | 2025-2032 |

| 对价单位 | 金额(十亿美元) |

| 部分 | 按类别、按组件、按驱动系统、按模式、按所有权、按速度、按电池容量、按电池集成类型、按电池类型、按电池电压、按电机功率、按电机重量、按电机类型、按地区 |

| 目标区域 | 北美洲、欧洲、亚洲/大洋洲 |

由于越野应用和最后一英里都市区配送需求,对电动登山车和货运电动自行车的需求正在快速增长,而增强的电池技术、骑行辅助功能以及不断变化的通勤偏好预计将在长期推动市场扩张。

高马达扭力是电动自行车的显着特征,尤其适用于越野、山地自行车和货运应用。扭力超过 70 NM 的电动自行车可在崎岖地形和重载应用中提供强劲性能,齿轮辅助系统在极端越野条件下可达到 800-1,000 N*m 的扭力输出。这种动力对于在城市物流中处理高达 200 公斤负载的货运电动自行车至关重要,在这种环境中,稳定性和效率对于最后一英里的配送至关重要。欧洲仍然是高扭矩电动自行车的最大市场,这得益于城市物流和高端休閒应用的成长。中置驱动马达的进步,例如博世的 Performance Line CX,可提供高达 85 N*m 的扭力并带有齿轮放大功能,可在保持操控性和电池性能的同时实现高效的动力输出。此外,Ariel Rider 和 Juiced Bikes 等品牌正在进一步提高扭矩阈值,推出 85-110 N*m 范围内的型号,标誌着业界正在转向以动力为中心的解决方案。然而,这一趋势主要集中在北美和欧洲,这些地区的基础设施和消费者支出能够支撑3,000美元以上的价格分布。监管限制,例如许多地区限速25-32公里/小时,继续限制电动自行车的主流普及,使得高扭矩电动自行车成为全球市场中一个独特但不断增长的细分市场。

城市电动自行车因其易用性、舒适性和在城市日常生活中的实用性而迅速受到关注和普及。随着都市化的推进,对电动自行车和其他环保交通途径的需求预计将增加。推动城市电动自行车成长的关键因素是其低电力消耗量、易于维护和经济性。城市电动自行车的价格从 1,000 美元到 3,000 美元不等,适合都市区的短途通勤。大多数城市电动自行车配备 250W 至 500W 的轮毂电机或中置电机,在平坦的都市区地形上也能提供高效的性能。电池容量通常在 360Wh 至 500Wh 之间,一次充电可提供 40 至 80 公里的实际行驶里程,足以满足日常通勤需求。

亚洲和大洋洲 2025 年,亚洲和大洋洲将成为城市电动自行车销售额最大的地区。交通拥挤的城市正在转向微型交通服务,大多数城市/城市自行车用于微型交通,例如 Hellobike(中国)、Anywheel(新加坡)和 Coo Rides(印度)。生产城市电动自行车的知名参与企业包括 Giant Manufacturing Ltd.(台湾)、Yadea Group Holdings Ltd.(中国)、Emotorad(印度)和 Trek Bicycle Corporation(美国)。城市电动自行车的例子包括 Rad Power Bikes RadCity 5 Plus、Tenways CGO600 Pro、Giant Escape+E+3、Trek Verve+ 和 Specialized Turbo Vado 4.0。

俄乌战争、全球经济放缓、通货膨胀、高库存水准以及消费者支出下降等若干宏观经济和地缘政治因素导致欧洲电动自行车销量在 2023 年和 2024 年下降。在该地区最大的市场德国,电动自行车销量从 2023 年的 210 万辆下降约 2.4% 至 2024 年的 205 万辆,因为买家选择保留现有自行车而不是购买新自行车。不过,欧洲各国政府正透过补贴、基础设施升级和绿色旅游计画积极推动电动自行车的普及。例如,买家可以申请高达电动自行车购买价格 25% 的返利,上限为 1,100 美元。此外,2022 年欧洲自行车展上展示的专用车道、充电站和紧凑型标准充电连接器等基础设施建设为市场復苏奠定了基础。

预计2024年,德国、奥地利和比利时等国的电动自行车销量将超过传统自行车,届时电动自行车将占德国自行车总销量的约53%。用于最后一哩配送的电动货运自行车的兴起,尤其是在英国,也反映了其商业用途的成长,并支持市场的长期成长。

本报告研究了全球电动自行车市场,并提供了按用途、类别、组件、驱动系统、模式、所有权、速度、电池容量、电池集成类型、电池类型、电池电压、电机功率、电机重量、电机类型、区域趋势和参与市场的公司概况等细分的市场资讯。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章市场概述

- 电动自行车市场概况,包括市场动态、趋势、OEM 分析和成本细分

- 介绍

- 市场动态

- 主要相关人员和采购标准

- 供应链分析

- 影响客户业务的趋势/中断

- 生态系分析

- 技术分析

- 定价分析

- 全球领先的电动自行车原始设备製造商—生产地点、产能和产品重点

- 贸易分析

- 专利分析

- 监管状况

- 2025-2026年主要会议和活动

- 案例研究分析

- 各国最畅销的电动自行车型号及价格分布

- 电动自行车品牌(按原始设备製造商划分)

- OEM分析:电动自行车零件供应商 x 马达功率

- OEM 分析:OEM X 产品供应

- OEM分析:OEM x 马达类型

- OEM分析:OEM x 电池电压

- 按使用里程

- 投资金筹措场景

- 材料清单

- 总拥有成本

- 人工智慧/生成式人工智慧对电动自行车市场的影响

- 电动自行车电池回收流程、政策与标准

第六章 电动自行车市场(依用途)

- 2032 年市场潜力和机会评估 - 价值和数量(1,000 单位)

- 介绍

- 山地/徒步旅行

- 城市/城区

- 货物

- 其他的

- 关键见解

第七章 电动自行车市场(依类别)

- 2032 年市场潜力和机会评估 - 价值和数量(1,000 单位)

- 介绍

- I类

- II 类

- III 类

- 关键见解

第 8 章 电动自行车市场(按零件)

- 2032 年市场潜力和机会评估 - 价值和数量(1,000 单位)

- 介绍

- 电池

- 电动机

- 附叉架

- 车轮

- 曲柄齿轮

- 煞车系统

- 马达控制器

- 关键见解

第九章电动自行车市场(按驱动系统)

- 2032 年市场潜力与机会评估 - 销售量(1,000 台)

- 介绍

- 电动自行车型号及其驱动系统

- 链条传动

- 皮带传动

第十章 电动自行车市场(按类型)

- 2032 年市场潜力和机会评估 - 价值和数量(1,000 单位)

- 介绍

- 踏板辅助

- 风门

- 关键见解

第 11 章 电动自行车市场(依所有权划分)

- 2032 年市场潜力与机会评估 - 销售量(1,000 台)

- 介绍

- 共用

- 个人

- 关键见解

第十二章 电动自行车市场(按速度)

- 2032 年市场潜力和机会评估 - 价值和数量(1,000 单位)

- 介绍

- 最高速度25公里/小时

- 每小时25至45公里

- 关键见解

第十三章电动自行车市场(按电池容量)

- 2032 年市场潜力和机会评估 - 价值和数量(1,000 单位)

- 介绍

- 小于250W

- 250W~450W

- 450W~<650W

- 650W 或以上

第 14 章电动自行车市场(按电池整合类型)

- 2032 年市场潜力与机会评估 - 销售量(1,000 台)

- 介绍

- 电动自行车型号和电池整合类型

- 融合的

- 外国类型

第 15 章电动自行车市场(按电池类型)

- 2032 年市场潜力和机会评估 - 价值和数量(1,000 单位)

- 介绍

- 锂离子

- 锂离子聚合物

- 铅酸电池

- 其他的

- 关键见解

第十六章 电动自行车市场(以电瓶电压)

- 2032 年市场潜力与机会评估 - 销售量(1,000 台)

- 介绍

- 电动自行车型号和电池电压

- 低于39V

- 39V~45V

- 45V~51V

第 17 章。电动自行车市场(按 Motor Power (NM) 划分)

- 2032 年市场潜力和机会评估 - 价值和数量(1,000 单位)

- 介绍

- 电动自行车型号及马达功率(NM)

- 小于40海里

- 40~70NM

- 超过70海里

第十八章 电动自行车市场(以马达重量)

- 2032 年市场潜力和机会评估 - 价值和数量(1,000 单位)

- 介绍

- 营运数据

- 少于2公斤

- 2kg~2.4kg

- 超过2.4公斤

第 19 章 电动自行车市场(按马达功率(瓦特))

- 2032 年市场潜力与机会评估 - 销售量(1,000 台)

- 介绍

- 电动自行车型号及马达功率

- 小于250W

- 251~350W

- 351~500W

- 501~600W

- 600W以上

第20章电动自行车市场(依马达类型)

- 2032 年市场潜力和机会评估 - 价值和数量(1,000 单位)

- 介绍

- 轮毂式马达

- 中置驱动马达

- 关键见解

第21章 电动自行车市场(按地区)

- 国家级分析、市场规模潜力和机会评估(截至 2032 年),按应用和类别划分 - 价值和数量(千)

- 介绍

- 电动自行车市场应用状况

- 电动自行车市场分类

- 亚洲及大洋洲

- 宏观经济展望

- 亚洲/大洋洲:国家级电动自行车OEM製造工厂

- 亚洲和大洋洲电动自行车市场(按应用)

- 亚洲及大洋洲电动自行车市场(依类别)

- 中国

- 日本

- 印度

- 韩国

- 台湾

- 澳洲

- 北美洲

- 宏观经济展望

- 北美:国家级电动自行车OEM製造工厂

- 北美:电动自行车市场(按应用)

- 北美:电动自行车市场分类

- 美国

- 加拿大

- 欧洲

- 宏观经济展望

- 欧洲:国家级电动自行车OEM製造工厂

- 欧洲:电动自行车市场(按应用)

- 欧洲:电动自行车市场(按类别)

- 德国

- 荷兰

- 法国

- 英国

- 奥地利

- 义大利

- 比利时

- 西班牙

- 瑞士

第22章 竞争态势

- 概述

- 主要参与企业的策略/优势,2023 年 5 月 - 2025 年 3 月

- 电动自行车市场占有率分析(2024年)

- 供应商分析

- 顶级上市/公众公司的收益分析

- 估值矩阵:2024 年电动自行车製造商

- 估值矩阵:2024 年电动自行车零件供应商

- Start-Ups/中小企业估值矩阵:电动自行车製造商,2024 年

- 竞争场景

- 品牌比较

- 2025年企业评估

- 2025年企业财务指标

第23章:公司简介

- 主要参与企业(电动自行车製造商)

- GIANT BICYCLES

- ACCELL GROUP NV

- YADEA TECHNOLOGY GROUP CO., LTD.

- YAMAHA MOTOR CO., LTD.

- PEDEGO

- PON.BIKE

- AIMA TECHNOLOGY GROUP CO., LTD.

- MERIDA INDUSTRY CO. LTD.

- TREK BICYCLE CORPORATION

- SPECIALIZED BICYCLE COMPONENTS, INC.

- 电动自行车元件供应商

- ROBERT BOSCH GMBH

- SAMSUNG SDI CO. LTD.

- PANASONIC HOLDINGS CORPORATION

- BAFANG ELECTRIC(SUZHOU)CO., LTD.

- BROSE FAHRZEUGTEILE

- SHIMANO INC.

- JOHNSON MATTHEY

- PROMOVEC A/S

- BMZ GROUP

- WUXI TRUCKRUN MOTOR CO., LTD

- ANANDA DRIVE TECHNIQUES(SHANGHAI)CO., LTD.

- MAHLE GMBH

- ZF FRIEDRICHSHAFEN AG

- SRAM LLC

- TQ GROUP

- 其他公司

- HERO LECTRO E-CYCLES

- CUBE

- FUJI-TA BICYCLE CO., LTD.

- ELECTRIC BIKE COMPANY

- RAD POWER BIKES LLC

- VANMOOF

- BH BIKES

- BROMPTON BICYCLE LIMITED

- RIESE & MULLER GMBH

- MYSTROMER AG

- COWBOY

第 24 章建议

第25章 附录

The e-bike market is projected to grow from USD 54.1 billion in 2025 to USD 87.2 billion by 2032 at a CAGR of 7.0%. The market witnessed strong growth between 2019 and 2021 due to increased environmental awareness and demand for alternative mobility during the pandemic. However, 2023 saw a decline in sales across some regions, particularly Europe, due to economic slowdowns and inventory corrections. Recovery began in 2024, led by Asia Oceania and North America, where supportive regulations and improved infrastructure fueled adoption. Class-I e-bikes continued to dominate, but Class-III models were gaining traction, especially in North America, due to their higher speed capabilities.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2025-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Billion) |

| Segments | Class, Battery, Motor, Mode, Usage, Speed, Battery Capacity, Component, and Region |

| Regions covered | North America, Europe, Asia Oceania |

The demand for e-MTBs and cargo e-bikes is rising rapidly, driven by off-road applications and urban last-mile delivery needs. Enhanced battery technology, rider assist features, and shifting commuter preferences are expected to support long-term market expansion.

">70 NM motor-powered e-bikes are projected to be the fastest-growing segment over the forecast period."

High motor torque is a defining feature in the evolving e-bike landscape, particularly for off-road, mountain biking, and cargo applications. E-bikes with >70 NM torque offer robust performance for demanding terrains and heavy-duty tasks, with gear-assisted systems reaching torque outputs of 800-1,000 N*m in extreme off-road conditions. This power is essential in urban logistics for cargo e-bikes handling loads of up to 200 kg, where stability and efficiency are critical for last-mile delivery. Europe remains the largest market for high-torque e-bikes, supported by urban logistics growth and premium recreational use. Advancements in mid-drive motors, like Bosch's Performance Line CX offering up to 85 N*m with gear amplification, have enabled efficient power delivery while maintaining handling and battery performance. Additionally, brands such as Ariel Rider and Juiced Bikes are pushing torque thresholds further with 85-110 N*m models, signaling an industry shift toward power-centric solutions. However, this trend is mainly concentrated in North America and Europe, where infrastructure and consumer spending can support the USD 3,000+ price range. Regulatory constraints, such as 25-32 km/h speed limits in many regions, continue to restrict mainstream adoption, making high-torque e-bikes a specialized but growing segment in the global market.

"City/urban bikes are projected to be the largest segment during the forecast period."

City or urban e-bikes have quickly gained attention and popularity due to their ease of use, comfort, and practicality for daily city life. As urbanization increases, the demand for e-bikes and other eco-friendly forms of transport is also expected to grow. The main factor driving the growth of city/urban e-bikes is their low electricity consumption, and they are easy to maintain, making them economical. City/urban e-bikes are priced between USD 1,000 and USD 3,000, and they are more suitable for city homeowners for short-distance commutes. Most urban e-bikes are equipped with 250W to 500W hub or mid-drive motors, providing efficient performance across flat urban terrain. Battery capacities generally range between 360Wh and 500Wh, delivering practical ranges of 40-80 km per charge, sufficient for daily commutes.

Asia Oceania is the region with the most significant city/urban e-bike sales in terms of value in 2025. Cities with traffic congestion are shifting towards micro-mobility services, and most city/urban bikes are used for micro-mobility, like Hellobike (China), Anywheel (Singapore), and Coo Rides (India). Prominent players who manufacture city/urban e-bikes are Giant Manufacturing Ltd. (Taiwan), Yadea Group Holdings Ltd. (China), Emotorad (India), and Trek Bicycle Corporation (US). Examples of city/urban e-bikes include Rad Power Bikes RadCity 5 Plus, Tenways CGO600 Pro, Giant Escape+ E+ 3, Trek Verve+, and Specialized Turbo Vado 4.0.

"Europe is estimated to be the second-largest e-bike market in 2025 due to the rising demand for e-bikes."

E-bike sales in Europe declined in 2023 and 2024 due to several macroeconomic and geopolitical factors, including the Russia-Ukraine war, global economic slowdown, inflation, high inventory levels, and reduced consumer spending. Germany, the region's largest market, saw a decline from 2.1 million units in 2023 to 2.05 million in 2024, a ~2.4% drop, as buyers opted to maintain existing bikes rather than purchase new ones. However, governments across Europe are actively promoting e-bike adoption through subsidies, infrastructure upgrades, and green mobility programs. For example, buyers can claim up to 25% of an e-bike's purchase price, with a rebate cap of USD 1,100. Additionally, infrastructure development such as dedicated lanes, charging stations, and compact standardized charging connectors showcased at Eurobike 2022 is reinforcing the market foundation for a rebound.

In 2024, e-bike sales in countries like Germany, Austria, and Belgium surpassed traditional bicycles, with Germany's e-bikes accounting for ~53% of total bike sales. The rise of e-cargo bikes for last-mile delivery, particularly in the UK, also reflects a growing commercial application, supporting the market's long-term growth.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and strategy directors, and executives from various key organizations operating in this market.

Here's the breakdown of the interviews conducted:

- By Company Type: OEM - 80%, Tier I - 20%

- By Designation: D Level - 30%, C Level - 60%, and Others - 10%

- By Region: North America - 10%, Europe - 60%, Asia Oceania - 30%,

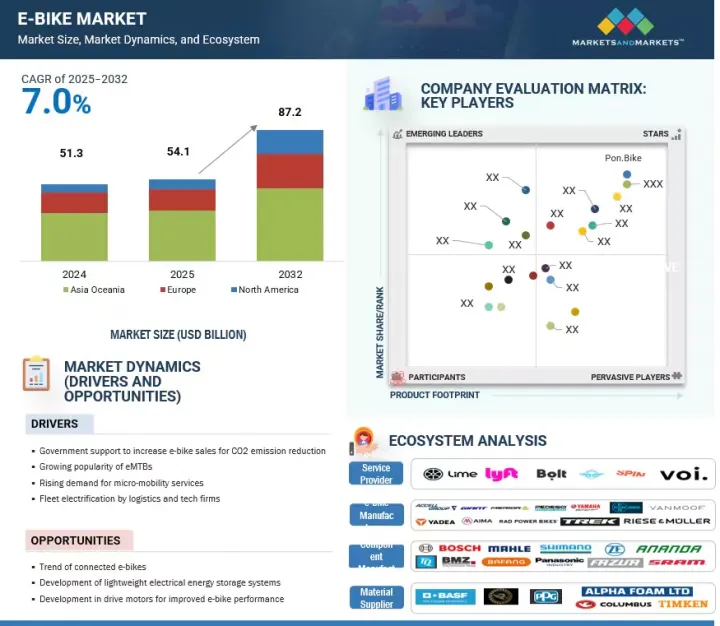

The key players in the e-bike market are Giant Manufacturing Co., Ltd. (Taiwan), Yamaha Motor Company (Japan), Accell Group NV (Netherlands), Yadea Group Holdings, Ltd. (China), and Pedego (US). Major companies' key strategies to maintain their position in the global e-bike market are strong global networking, mergers and acquisitions, partnerships, and technological advancements.

Key Benefits of Buying the Report:

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the e-bike market and the sub-segments. The report discusses ups and downs in e-bike sales, allowing component suppliers to plan their strategies. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report will also help stakeholders understand the market pulse and provide information on key market drivers, restraints, challenges, and opportunities. It will help in understanding the drive unit supplier market share, e-bike display system market share by key suppliers, and OEM analysis.

The report further provides insights into the following points:

- Market Dynamics: Analysis of key drivers (government support to increase e-bike sales to reduce CO2 emissions, growing popularity of e-MTBs, rising demand for micro-mobility services), restraints (high stagnant inventory of e-bikes, government regulations, and lack of infrastructure, e-bike conversion kits), opportunities (trend toward connected e-bikes, development of lightweight electrical energy storage systems, development in drive motors for increased e-bike performance), and challenges (challenges in importing to EU and US from China, high cost of e-bikes) influencing the growth of the e-Bike market

- Product Development/Innovation: Detailed insights on upcoming technologies and product & service launches in the e-bike market

- Market Development: Comprehensive market information (the report analyses the authentication and brand protection market across varied regions)

- Market Diversification: Exhaustive information about products & services, untapped geographies, recent developments, and investments in the e-bike market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Pon. Bike (Netherlands), Accell Group N.V. (Netherlands), Giant Manufacturing Co., Ltd. (Taiwan), Yadea Group Holdings, Ltd. (China), and Merida Bicycle (Taiwan) in the e-bike market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.4 MARKET SCOPE

- 1.4.1 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNIT CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources for eBike sales/market sizing

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interview participants

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH: BY REGION, CLASS, AND USAGE

- 2.2.2 TOP-DOWN APPROACH: BY BATTERY TYPE AND MOTOR TYPE

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.4.1 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

- 2.5 RESEARCH ASSUMPTIONS AND RISK ASSESSMENT

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- 3.1 REPORT SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN EBIKE MARKET

- 4.2 EBIKE MARKET, BY MODE

- 4.3 EBIKE MARKET, BY MOTOR TYPE

- 4.4 EBIKE MARKET, BY CLASS

- 4.5 EBIKE MARKET, BY USAGE

- 4.6 EBIKE MARKET, BY BATTERY TYPE

- 4.7 EBIKE MARKET, BY SPEED

- 4.8 EBIKE MARKET, BY OWNERSHIP

- 4.9 EBIKE MARKET, BY COMPONENT

- 4.10 EBIKE MARKET, BY MOTOR WEIGHT

- 4.11 EBIKE MARKET, BY BATTERY CAPACITY

- 4.12 EBIKE MARKET, BY MOTOR POWER

- 4.13 EBIKE MARKET, BY MOTOR POWER (WATT)

- 4.14 EBIKE MARKET, BY BATTERY VOLTAGE

- 4.15 EBIKE MARKET, BY BATTERY INTEGRATION

- 4.16 EBIKE MARKET, BY DRIVE SYSTEM

- 4.17 EBIKE MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 Market overview of eBike market with market dynamics, trends, OEM Analysis, Cost Breakdown, and others

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Government support to increase eBike sales for CO2 emission reduction

- 5.2.1.1.1 Europe

- 5.2.1.1.2 North America

- 5.2.1.1.3 Asia Oceania

- 5.2.1.2 Growing popularity of electric mountain and cargo bikes

- 5.2.1.2.1 Electric mountain and cargo bike models and their technical specifications

- 5.2.1.3 Growth of micro mobility services and Mobility-as-a-Service (MaaS)

- 5.2.1.1 Government support to increase eBike sales for CO2 emission reduction

- 5.2.2 RESTRAINTS

- 5.2.2.1 Limited charging infrastructure for eBikes

- 5.2.2.2 Varied government regulations and lack of proper infrastructure

- 5.2.2.3 eBike conversion kits

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Trend of connected eBikes

- 5.2.3.2 Development of lightweight electrical energy storage systems

- 5.2.3.3 Developments in drive motors for improved performance of eBikes

- 5.2.4 CHALLENGES

- 5.2.4.1 High price of eBikes

- 5.2.4.2 Challenges in importing to European Union and US from China

- 5.2.4.2.1 China to European Union: Import requirements

- 5.2.4.2.2 China to US: Import requirements

- 5.2.1 DRIVERS

- 5.3 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.3.1 FOOD DELIVERY

- 5.3.2 POSTAL SERVICES

- 5.3.3 MUNICIPAL SERVICES

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 All-wheel drive

- 5.7.1.2 Motor drive

- 5.7.1.3 Battery technology

- 5.7.1.4 Electric mountain bikes

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Swappable batteries

- 5.7.2.2 Integration of intelligent features

- 5.7.2.3 Folding eBikes for urban mobility

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Aftermarket eBike kit

- 5.7.3.2 Subscription and sharing services

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PRICING ANALYSIS

- 5.8.1 BY OEM AND TYPE, 2025

- 5.8.2 BY REGION

- 5.8.3 BY KEY COUNTRY

- 5.9 LEADING GLOBAL E-BIKE OEMS - PRODUCTION FOOTPRINT, CAPACITY, AND PRODUCT FOCUS

- 5.10 TRADE ANALYSIS

- 5.10.1 EXPORTS

- 5.10.1.1 China

- 5.10.1.2 Germany

- 5.10.1.3 Netherlands

- 5.10.1.4 Taipei, Chinese

- 5.10.2 IMPORTS

- 5.10.2.1 Germany

- 5.10.2.2 US

- 5.10.2.3 Netherlands

- 5.10.2.4 France

- 5.10.2.5 Belgium

- 5.10.1 EXPORTS

- 5.11 PATENT ANALYSIS

- 5.11.1 INTRODUCTION

- 5.12 REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.2 REGULATORY ANALYSIS OF EBIKE MARKET, BY REGION/COUNTRY

- 5.12.2.1 European Union

- 5.12.2.2 China

- 5.12.2.3 India

- 5.12.2.4 Japan

- 5.12.2.5 US

- 5.13 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.14 CASE STUDY ANALYSIS

- 5.14.1 COMODULE CONNECTIVITY: THEFT-PROOF URBAN ARROW CARGO EBIKES

- 5.14.2 NYE SOLUTION: REQUIREMENT OF LUBRICANTS FOR ROTARY MOTOR GEAR OF EBIKES

- 5.14.3 COMODULE: LAUNCH OF IOT INTEGRATIONS FOR SHIMANO DRIVETRAINS

- 5.14.4 BINOVA DRIVE UNIT: CONTACTLESS TORQUE SENSORS

- 5.14.5 MAHLE GROUP: NEW GENERATION OF DRIVE SYSTEM FOR EBIKES

- 5.14.6 REVONTE ONE DRIVE SYSTEM: DEVELOPMENT OF NEW DRIVE SYSTEM FOR EBIKES WITH AUTOMATIC TRANSMISSION

- 5.15 TOP-SELLING EBIKE MODELS VS. PRICE RANGE BY COUNTRY

- 5.15.1 US

- 5.15.2 CANADA

- 5.15.3 GERMANY

- 5.15.4 NETHERLANDS

- 5.15.5 UK

- 5.15.6 JAPAN

- 5.15.7 CHINA

- 5.16 LIST OF EBIKE BRANDS PER OEM

- 5.17 OEM ANALYSIS: EBIKE COMPONENT SUPPLIERS X MOTOR POWER

- 5.17.1 EBIKE MOTOR SUPPLIERS VS MOTOR POWER

- 5.18 OEM ANALYSIS: OEM X BREATH OF THE PRODUCT OFFERED

- 5.18.1 OEM X BREATH OF THE PRODUCT OFFERED

- 5.19 OEM ANALYSIS: OEM X MOTOR TYPE

- 5.19.1 EBIKE OEM VS MOTOR TYPE

- 5.20 OEM ANALYSIS: OEM X BATTERY VOLTAGE

- 5.20.1 EBIKE OEM VS BATTERY VOLTAGE

- 5.21 DISTANCE DRIVEN PER APPLICATION

- 5.21.1 EMTB: DISTANCE VS. RIDING TIME

- 5.21.2 EBIKE: DISTANCE VS. SYSTEM WEIGHT

- 5.21.3 EBIKE: BATTERY VOLTAGE VS. MILES

- 5.22 INVESTMENT AND FUNDING SCENARIO

- 5.23 BILL OF MATERIALS

- 5.24 TOTAL COST OF OWNERSHIP

- 5.24.1 TOTAL COST OF OWNERSHIP (GLOBAL)

- 5.24.2 TOTAL COST OF OWNERSHIP FOR EBIKES IN INDIA, EBIKE VS. E2W VS. ICE 2W

- 5.24.2.1 Total cost of ownership (India)

- 5.24.3 COST BREAKDOWN

- 5.25 IMPACT OF AI/GEN AI ON EBIKE MARKET

- 5.25.1 IMPACT AND RECOMMENDATIONS

- 5.26 EBIKE BATTERY RECYCLING PROCESS, POLICIES, AND STANDARDS

- 5.26.1 RECYCLING PROCESS OVERVIEW

- 5.26.2 POLICIES AND STANDARDS, BY REGION

- 5.26.3 RECENT DEVELOPMENTS (2024-2025)

- 5.26.4 KEY PLAYERS IN EBIKE BATTERY RECYCLING

6 EBIKE MARKET, BY USAGE

- 6.1 Market Size Potential and Opportunity Assessment To 2032 - Value (USD Million) & Volume (Thousand Units)

- 6.1 INTRODUCTION

- 6.2 MOUNTAIN/TREKKING

- 6.2.1 AGILE FRAME STRUCTURE FOR EASY OFF-ROAD CYCLING TO DRIVE GROWTH

- 6.2.1.1 Mountain eBike, model-wise motor power and battery weight

- 6.2.1 AGILE FRAME STRUCTURE FOR EASY OFF-ROAD CYCLING TO DRIVE GROWTH

- 6.3 CITY/URBAN

- 6.3.1 DESIGNED FOR FREQUENT, SHORT, AND MODERATE-PACE RIDES

- 6.3.1.1 City/Urban eBike, model-wise motor power and battery weight

- 6.3.1 DESIGNED FOR FREQUENT, SHORT, AND MODERATE-PACE RIDES

- 6.4 CARGO

- 6.4.1 RISE IN E-COMMERCE INDUSTRY TO DRIVE MARKET

- 6.4.1.1 Cargo eBike, model-wise motor power and battery weight

- 6.4.1 RISE IN E-COMMERCE INDUSTRY TO DRIVE MARKET

- 6.5 OTHER USAGES

- 6.5.1 OTHER EBIKE USAGES, MODEL-WISE MOTOR POWER AND BATTERY WEIGHT

- 6.6 PRIMARY INSIGHTS

7 EBIKE MARKET, BY CLASS

- 7.1 Market Size Potential and Opportunity Assessment To 2032 - Value (USD Million) & Volume (Thousand Units)

- 7.1 INTRODUCTION

- 7.2 CLASS I

- 7.2.1 RAPIDLY GROWING SEGMENT OF EBIKE MARKET

- 7.2.1.1 Production and model insights for Class I eBike OEMs

- 7.2.1 RAPIDLY GROWING SEGMENT OF EBIKE MARKET

- 7.3 CLASS II

- 7.3.1 REGULATORY SUPPORT IN NORTH AMERICA TO DRIVE MARKET

- 7.3.1.1 Production and model insights for Class II eBike OEMs

- 7.3.1 REGULATORY SUPPORT IN NORTH AMERICA TO DRIVE MARKET

- 7.4 CLASS III

- 7.4.1 MOST REGULATED CLASS OF EBIKES

- 7.4.1.1 Production and model insights for Class III eBike OEMs

- 7.4.1 MOST REGULATED CLASS OF EBIKES

- 7.5 PRIMARY INSIGHTS

8 EBIKE MARKET, BY COMPONENT

- 8.1 Market Size Potential and Opportunity Assessment To 2032 - Value (USD Million) & Volume (Thousand Units)

- 8.1 INTRODUCTION

- 8.2 BATTERY

- 8.2.1 ADVANCEMENT IN BATTERY TECHNOLOGIES FOR HIGH-PERFORMANCE EBIKES TO DRIVE MARKET

- 8.2.1.1 Comprehensive overview of leading eBike battery manufacturers

- 8.2.1 ADVANCEMENT IN BATTERY TECHNOLOGIES FOR HIGH-PERFORMANCE EBIKES TO DRIVE MARKET

- 8.3 ELECTRIC MOTOR

- 8.3.1 CONSTANT DEVELOPMENTS IN EBIKE MOTORS AND GROWING DEMAND FOR HIGH PERFORMANCE TO DRIVE MARKET

- 8.3.1.1 Comprehensive overview of leading eBike motor manufacturers

- 8.3.1 CONSTANT DEVELOPMENTS IN EBIKE MOTORS AND GROWING DEMAND FOR HIGH PERFORMANCE TO DRIVE MARKET

- 8.4 FRAME WITH FORK

- 8.4.1 INCREASING DEMAND FOR TITANIUM AND CARBON FIBER FOR LIGHTWEIGHT FRAMES TO DRIVE MARKET

- 8.4.1.1 Comprehensive overview of eBike frame with fork manufacturers

- 8.4.1 INCREASING DEMAND FOR TITANIUM AND CARBON FIBER FOR LIGHTWEIGHT FRAMES TO DRIVE MARKET

- 8.5 WHEEL

- 8.5.1 RISING DEMAND FOR PERFORMANCE EBIKES TO BOOST NEED FOR DURABLE, HIGH-QUALITY WHEEL SYSTEMS

- 8.5.1.1 Comprehensive overview of eBike wheel manufacturers

- 8.5.1 RISING DEMAND FOR PERFORMANCE EBIKES TO BOOST NEED FOR DURABLE, HIGH-QUALITY WHEEL SYSTEMS

- 8.6 CRANK GEAR

- 8.6.1 NORTH AMERICA TO DOMINATE MARKET

- 8.6.1.1 Comprehensive overview of eBike crank gear manufacturers

- 8.6.1 NORTH AMERICA TO DOMINATE MARKET

- 8.7 BRAKE SYSTEM

- 8.7.1 INCREASE IN SPEED LIMIT REGULATIONS TO DRIVE MARKET

- 8.7.1.1 Comprehensive overview of eBike brake system manufacturers

- 8.7.1 INCREASE IN SPEED LIMIT REGULATIONS TO DRIVE MARKET

- 8.8 MOTOR CONTROLLER

- 8.8.1 ADVANCEMENT IN MOTOR CONTROLLERS FOR HIGH-PERFORMANCE EBIKES TO DRIVE MARKET

- 8.8.1.1 Comprehensive overview of eBike motor controller manufacturers

- 8.8.1 ADVANCEMENT IN MOTOR CONTROLLERS FOR HIGH-PERFORMANCE EBIKES TO DRIVE MARKET

- 8.9 PRIMARY INSIGHTS

9 EBIKE MARKET, BY DRIVE SYSTEM

- 9.1 Market Size Potential and Opportunity Assessment To 2032 - Volume (Thousand Units)

- 9.1 INTRODUCTION

- 9.2 EBIKE MODELS AND THEIR DRIVE SYSTEMS

- 9.3 CHAIN DRIVE

- 9.3.1 COMPATIBLE WITH VARIOUS GEAR SYSTEMS

- 9.4 BELT DRIVE

- 9.4.1 RISING FOCUS TOWARD URBAN RIDING

10 EBIKE MARKET, BY MODE

- 10.1 Market Size Potential and Opportunity Assessment To 2032 - Value (USD Million) & Volume (Thousand Units)

- 10.1 INTRODUCTION

- 10.2 PEDAL ASSIST

- 10.2.1 IDEAL FOR COMMUTING AND LIGHT CARGO TRANSPORT

- 10.3 THROTTLE

- 10.3.1 GROWING DEMAND FOR LAST-MILE DELIVERIES TO DRIVE GROWTH

- 10.4 PRIMARY INSIGHTS

11 EBIKE MARKET, BY OWNERSHIP

- 11.1 Market Size Potential and Opportunity Assessment To 2032 - Volume (Thousand Units)

- 11.1 INTRODUCTION

- 11.2 SHARED

- 11.2.1 COST-EFFECTIVENESS OF SHARED OWNERSHIP TO DRIVE MARKET

- 11.3 PERSONAL

- 11.3.1 MINIMAL MAINTENANCE COSTS OF PERSONAL EBIKES TO DRIVE MARKET

- 11.4 PRIMARY INSIGHTS

12 EBIKE MARKET, BY SPEED

- 12.1 Market Size Potential and Opportunity Assessment To 2032 - Value (USD Million) & Volume (Thousand Units)

- 12.1 INTRODUCTION

- 12.2 UP TO 25 KM/H

- 12.2.1 EUROPE AND ASIA OCEANIA TO DRIVE MARKET

- 12.3 25-45 KM/H

- 12.3.1 NORTH AMERICA TO DRIVE MARKET

- 12.4 PRIMARY INSIGHTS

13 EBIKE MARKET, BY BATTERY CAPACITY

- 13.1 Market Size Potential and Opportunity Assessment To 2032 - Value (USD Million) & Volume (Thousand Units)

- 13.1 INTRODUCTION

- 13.2 <250W

- 13.2.1 IDEAL FOR ENTRY-LEVEL CITY EBIKES, COMPACT FOLDING BIKES, AND LOW-SPEED ELECTRIC CYCLES

- 13.2.1.1 Model-wise motor power and battery capacity, <250W

- 13.2.1 IDEAL FOR ENTRY-LEVEL CITY EBIKES, COMPACT FOLDING BIKES, AND LOW-SPEED ELECTRIC CYCLES

- 13.3 >250W-<450W

- 13.3.1 GROWING DEMAND FOR LONG-RANGE EBIKES IN EUROPE AND NORTH AMERICA TO DRIVE GROWTH

- 13.3.1.1 Model-wise motor power and battery capacity, >250W-<450W

- 13.3.1 GROWING DEMAND FOR LONG-RANGE EBIKES IN EUROPE AND NORTH AMERICA TO DRIVE GROWTH

- 13.4 >450W-<650W

- 13.4.1 NEED FOR COST-EFFECTIVE AND EFFICIENT OPTIONS TO DRIVE MARKET

- 13.4.1.1 Model-wise motor power and battery capacity,>450W-<650W

- 13.4.1 NEED FOR COST-EFFECTIVE AND EFFICIENT OPTIONS TO DRIVE MARKET

- 13.5 >650W

- 13.5.1 INCREASING DEMAND FOR HIGH-POWERED EBIKES TO DRIVE MARKET

- 13.5.1.1 Model-wise Motor Power and Battery Capacity,>650W

- 13.5.1 INCREASING DEMAND FOR HIGH-POWERED EBIKES TO DRIVE MARKET

14 EBIKE MARKET, BY TYPE OF BATTERY INTEGRATION

- 14.1 Market Size Potential and Opportunity Assessment To 2032 - Volume (Thousand Units)

- 14.1 INTRODUCTION

- 14.2 EBIKE MODELS AND THEIR TYPES OF BATTERY INTEGRATION

- 14.3 INTEGRATED

- 14.3.1 OFFERS CLEAN AESTHETICS AND BETTER WEIGHT DISTRIBUTION

- 14.4 EXTERNAL

- 14.4.1 EASY BATTERY SWAPPING AND CHARGING PROVIDING FLEXIBILITY ACROSS VEHICLE MODELS

15 EBIKE MARKET, BY BATTERY TYPE

- 15.1 Market Size Potential and Opportunity Assessment To 2032 - Value (USD Million) & Volume (Thousand Units)

- 15.1 INTRODUCTION

- 15.2 LITHIUM-ION

- 15.2.1 RANGE, WEIGHT, AND LONGEVITY OF LITHIUM-ION BATTERIES IDEAL FOR EBIKES

- 15.3 LITHIUM-ION POLYMER

- 15.3.1 BETTER RANGE AND LESSER WEIGHT THAN LITHIUM-ION BATTERIES

- 15.4 LEAD-ACID

- 15.4.1 CHEAPEST OF ALL EBIKE BATTERIES

- 15.5 OTHER BATTERY TYPES

- 15.6 PRIMARY INSIGHTS

16 EBIKE MARKET, BY BATTERY VOLTAGE

- 16.1 Market Size Potential and Opportunity Assessment To 2032 - Volume (Thousand Units)

- 16.1 INTRODUCTION

- 16.2 EBIKE MODELS AND THEIR BATTERY VOLTAGES

- 16.3 LESS THAN 39V

- 16.3.1 WELL-SUITED FOR FOLDING EBIKES

- 16.3.1.1 Key market insights, less than 39V batteries

- 16.3.1 WELL-SUITED FOR FOLDING EBIKES

- 16.4 39V TO 45V

- 16.4.1 CUSTOMIZABLE BATTERY PREFERRED BY EBIKE ENTHUSIASTS

- 16.4.1.1 Key market insights, 39V to 45V batteries

- 16.4.1 CUSTOMIZABLE BATTERY PREFERRED BY EBIKE ENTHUSIASTS

- 16.5 45V TO 51V

- 16.5.1 IDEAL FOR PERFORMANCE-ORIENTED BIKES IN DEMANDING CONDITIONS

- 16.5.1.1 Key market insights, 45V to 51V batteries

- 16.5.1 IDEAL FOR PERFORMANCE-ORIENTED BIKES IN DEMANDING CONDITIONS

17 EBIKE MARKET, BY MOTOR POWER (NM)

- 17.1 Market Size Potential and Opportunity Assessment To 2032 - Value (USD Million) & Volume (Thousand Units)

- 17.1 INTRODUCTION

- 17.2 EBIKE MODEL VS. MOTOR POWER (NM)

- 17.3 <40 NM

- 17.3.1 GROWING SALES OF AFFORDABLE EBIKES REQUIRING LESS MOTOR POWER TO DRIVE GROWTH

- 17.4 >40-<70 NM

- 17.4.1 HIGH DEMAND FOR CITY AND MULTI-PURPOSE EBIKES TO DRIVE GROWTH

- 17.5 >70 NM

- 17.5.1 RISING DEMAND FOR MOUNTAIN AND TREKKING BIKES TO DRIVE GROWTH

18 EBIKE MARKET, BY MOTOR WEIGHT

- 18.1 Market Size Potential and Opportunity Assessment To 2032 - Value (USD Million) & Volume (Thousand Units)

- 18.1 INTRODUCTION

- 18.2 OPERATIONAL DATA

- 18.3 < 2 KG

- 18.3.1 RISING DEMAND FOR CITY EBIKES TO DRIVE MARKET

- 18.4 > 2 KG -< 2.4 KG

- 18.4.1 SIGNIFICANT INVESTMENTS IN MICRO-MOBILITY PROJECTS TO DRIVE MARKET

- 18.5 > 2.4 KG

- 18.5.1 INCREASING USE OF HIGH-POWER MOTORS TO DRIVE MARKET

19 EBIKE MARKET, BY MOTOR POWER (WATT)

- 19.1 Market Size Potential and Opportunity Assessment To 2032 - Volume (Thousand Units)

- 19.1 INTRODUCTION

- 19.2 EBIKE MODELS AND THEIR MOTOR POWERS

- 19.3 <250W

- 19.3.1 LOW POWERED AND COST-EFFECTIVE

- 19.4 251-350W

- 19.4.1 OFFER HIGHER ASSISTANCE LEVELS

- 19.5 351-500W

- 19.5.1 OFFERS BALANCED PERFORMANCE AND ENERGY EFFICIENCY

- 19.6 501-600W

- 19.6.1 GOOD OPTION FOR RIDERS FREQUENTLY NAVIGATING INCLINES

- 19.7 >600W

- 19.7.1 RISE IN DEMAND FOR MOUNTAIN EBIKES

20 EBIKE MARKET, BY MOTOR TYPE

- 20.1 Market Size Potential and Opportunity Assessment To 2032 - Value (USD Million) & Volume (Thousand Units)

- 20.1 INTRODUCTION

- 20.2 HUB MOTOR

- 20.2.1 EXTRA TRACTION PROVIDED BY ALL-WHEEL DRIVE-LIKE SYSTEMS TO DRIVE MARKET

- 20.3 MID-DRIVE MOTOR

- 20.3.1 GEAR RATIO TO KEEP MID MOTOR SEGMENT AHEAD OF HUB MOTOR SEGMENT

- 20.4 PRIMARY INSIGHTS

21 EBIKE MARKET, BY REGION

- 21.1 Country-level Analysis, Market Size Potential and Opportunity Assessment to 2032, By Usage and By Class - Value (USD Million) & Volume (Thousand Units)

- 21.1 INTRODUCTION

- 21.1.1 EBIKE MARKET: BY USAGE

- 21.1.2 EBIKE MARKET: BY CLASS

- 21.2 ASIA OCEANIA

- 21.2.1 MACROECONOMIC OUTLOOK

- 21.2.2 ASIA OCEANIA: COUNTRY-LEVEL EBIKE OEM MANUFACTURING PLANT

- 21.2.3 ASIA OCEANIA EBIKE MARKET, BY USAGE

- 21.2.4 ASIA OCEANIA EBIKE MARKET, BY CLASS

- 21.2.5 CHINA

- 21.2.5.1 Traffic congestion in urban cities to drive market

- 21.2.6 JAPAN

- 21.2.6.1 Presence of major eBike component innovators to drive market

- 21.2.7 INDIA

- 21.2.7.1 Growing fuel prices to drive market

- 21.2.8 SOUTH KOREA

- 21.2.8.1 Government initiatives to reduce carbon emissions to drive market

- 21.2.9 TAIWAN

- 21.2.9.1 Growing eBike exports to drive market

- 21.2.10 AUSTRALIA

- 21.2.10.1 eBike tourism to drive market

- 21.3 NORTH AMERICA

- 21.3.1 MACROECONOMIC OUTLOOK

- 21.3.2 NORTH AMERICA: COUNTRY-LEVEL EBIKE OEM MANUFACTURING PLANT

- 21.3.3 NORTH AMERICA: EBIKE MARKET, BY USAGE

- 21.3.4 NORTH AMERICA: EBIKE MARKET, BY CLASS

- 21.3.5 US

- 21.3.5.1 Increasing awareness about sustainable transportation solutions to drive market

- 21.3.6 CANADA

- 21.3.6.1 Investment in shared mobility infrastructure to drive market

- 21.4 EUROPE

- 21.4.1 MACROECONOMIC OUTLOOK

- 21.4.2 EUROPE: COUNTRY-LEVEL EBIKE OEM MANUFACTURING PLANT

- 21.4.3 EUROPE: EBIKE MARKET, BY USAGE

- 21.4.4 EUROPE: EBIKE MARKET, BY CLASS

- 21.4.5 GERMANY

- 21.4.5.1 Rising demand for trekking eBikes to drive market

- 21.4.6 NETHERLANDS

- 21.4.6.1 Incentives offered by government to promote eBike adoption to drive market

- 21.4.7 FRANCE

- 21.4.7.1 Government incentives for purchase of cargo eBikes to drive market

- 21.4.8 UK

- 21.4.8.1 Cycle-to-Work scheme to drive market

- 21.4.9 AUSTRIA

- 21.4.9.1 Shift toward electric mobility to drive market

- 21.4.10 ITALY

- 21.4.10.1 Mobility Bonus for higher eBike sales to drive market

- 21.4.11 BELGIUM

- 21.4.11.1 Government initiatives toward infrastructural development to drive market

- 21.4.12 SPAIN

- 21.4.12.1 Bike-sharing schemes to drive market

- 21.4.13 SWITZERLAND

- 21.4.13.1 Growing demand for cargo eBikes to drive market

22 COMPETITIVE LANDSCAPE

- 22.1 OVERVIEW

- 22.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, MAY 2023-MARCH 2025

- 22.3 EBIKE MARKET SHARE ANALYSIS, 2024

- 22.3.1 NORTH AMERICA: EBIKE MARKET SHARE ANALYSIS, 2024

- 22.3.2 EUROPE: EBIKE MARKET SHARE ANALYSIS, 2024

- 22.3.3 ASIA OCEANIA: EBIKE MARKET SHARE ANALYSIS, 2024

- 22.3.4 EBIKE DISPLAY MARKET SHARE ANALYSIS, 2024

- 22.3.5 EBIKE BATTERY MARKET SHARE ANALYSIS, 2024

- 22.3.6 OEM-LEVEL EBIKE MARKET SHARE ANALYSIS, 2023-2024

- 22.3.7 EBIKE DRIVE UNIT MARKET SHARE ANALYSIS FOR KEY PLAYERS, 2023-2024

- 22.3.8 EBIKE BATTERY MANAGEMENT SYSTEM MARKET: LIST OF MAJOR BATTERY MANAGEMENT SYSTEM SUPPLIERS

- 22.3.9 EBIKE CONNECTIVITY ECU MARKET: LIST OF MAJOR CONNECTIVITY ECU SUPPLIERS

- 22.3.10 EBIKE INVERTER MARKET: LIST OF MAJOR INVERTER SUPPLIERS

- 22.3.11 LIST OF EBIKE MANUFACTURERS IN CHINA

- 22.3.12 LIST OF PLAYERS WITH GRAVEL EBIKE PRODUCT OFFERINGS

- 22.4 SUPPLIER ANALYSIS

- 22.4.1 MOTOR SUPPLIERS TO KEY OEMS

- 22.4.2 INVERTER SUPPLIERS TO KEY OEMS

- 22.4.3 BATTERY AND BATTERY MANAGEMENT SYSTEM SUPPLIERS TO KEY OEMS

- 22.4.4 COMPONENTS AS A PACKAGE TO OEMS

- 22.4.5 IOT SERVICES BY TOP PLAYERS

- 22.4.5.1 Robert Bosch GmbH

- 22.4.5.1.1 eBike Connect

- 22.4.5.1.2 eBike Flow App

- 22.4.5.2 Specialized Bicycle Components, Inc.

- 22.4.5.2.1 Mission Control App

- 22.4.5.2.2 The Specialized App

- 22.4.5.3 Shimano Inc.

- 22.4.5.3.1 E-Tube

- 22.4.5.4 Yamaha Motor Co., Ltd.

- 22.4.5.4.1 Yamaha My Ride App

- 22.4.5.5 Giant Bicycles

- 22.4.5.5.1 RideControl App

- 22.4.5.6 Fazua GmbH

- 22.4.5.6.1 FAZUA Rider App

- 22.4.5.7 MAHLE GmbH

- 22.4.5.7.1 MySmart Bike App

- 22.4.5.7.2 SmartBike Lab App

- 22.4.5.8 Velco

- 22.4.5.8.1 Velco Rider App

- 22.4.5.9 Powunity GmbH

- 22.4.5.9.1 PowUnity App

- 22.4.5.10 FIT

- 22.4.5.10.1 FIT eBike Control App

- 22.4.5.11 Porsche digital

- 22.4.5.11.1 Cyklaer App

- 22.4.5.12 ESB

- 22.4.5.12.1 ESB.APP

- 22.4.5.13 Haibike

- 22.4.5.13.1 eConnect App

- 22.4.5.14 Hyena Inc

- 22.4.5.14.1 Rider App

- 22.4.5.15 Strava

- 22.4.5.15.1 Strava App

- 22.4.5.16 Brose

- 22.4.5.16.1 Brose eBike App

- 22.4.5.17 Garmin Ltd

- 22.4.5.17.1 Garmin Connect App

- 22.4.5.18 Komoot

- 22.4.5.18.1 Komoot App

- 22.4.5.19 Ride with GPS

- 22.4.5.19.1 Ride with GPS app

- 22.4.5.20 TrainerRoad

- 22.4.5.20.1 TrainerRoad App

- 22.4.5.21 Epic Ride Weather

- 22.4.5.21.1 Epic Ride Weather App

- 22.4.5.1 Robert Bosch GmbH

- 22.5 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS

- 22.6 COMPANY EVALUATION MATRIX: EBIKE MANUFACTURERS, 2024

- 22.6.1 STARS

- 22.6.2 EMERGING LEADERS

- 22.6.3 PERVASIVE PLAYERS

- 22.6.4 PARTICIPANTS

- 22.6.5 COMPANY FOOTPRINT

- 22.7 COMPANY EVALUATION MATRIX: EBIKE COMPONENT SUPPLIERS, 2024

- 22.7.1 STARS

- 22.7.2 EMERGING LEADERS

- 22.7.3 PERVASIVE PLAYERS

- 22.7.4 PARTICIPANTS

- 22.7.5 COMPANY FOOTPRINT

- 22.8 STARTUP/SME EVALUATION MATRIX: EBIKE MANUFACTURERS, 2024

- 22.8.1 PROGRESSIVE COMPANIES

- 22.8.2 RESPONSIVE COMPANIES

- 22.8.3 DYNAMIC COMPANIES

- 22.8.4 STARTING BLOCKS

- 22.8.5 COMPETITIVE BENCHMARKING

- 22.9 COMPETITIVE SCENARIO

- 22.9.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 22.9.2 DEALS

- 22.9.3 EXPANSIONS

- 22.9.4 OTHER DEVELOPMENTS

- 22.10 BRAND COMPARISON

- 22.11 COMPANY VALUATION, 2025

- 22.12 COMPANY FINANCIAL METRICS, 2025

23 COMPANY PROFILES

- 23.1 KEY PLAYERS (EBIKE MANUFACTURERS)

- 23.1.1 GIANT BICYCLES

- 23.1.1.1 Business overview

- 23.1.1.2 Products offered

- 23.1.1.3 Recent developments

- 23.1.1.3.1 Product launches

- 23.1.1.3.2 Deals

- 23.1.1.3.3 Expansions

- 23.1.1.3.4 Other developments

- 23.1.1.4 MnM view

- 23.1.1.4.1 Key strengths

- 23.1.1.4.2 Strategic choices

- 23.1.1.4.3 Weaknesses and competitive threats

- 23.1.2 ACCELL GROUP N.V.

- 23.1.2.1 Business overview

- 23.1.2.2 Products offered

- 23.1.2.3 Recent developments

- 23.1.2.3.1 Product launches

- 23.1.2.3.2 Deals

- 23.1.2.3.3 Expansions

- 23.1.2.3.4 Other developments

- 23.1.2.4 MnM view

- 23.1.2.4.1 Key strengths

- 23.1.2.4.2 Strategic choices

- 23.1.2.4.3 Weaknesses and competitive threats

- 23.1.3 YADEA TECHNOLOGY GROUP CO., LTD.

- 23.1.3.1 Business overview

- 23.1.3.2 Products offered

- 23.1.3.3 Recent developments

- 23.1.3.3.1 Product launches

- 23.1.3.3.2 Expansions

- 23.1.3.4 MnM View

- 23.1.3.4.1 Key strengths

- 23.1.3.4.2 Strategic choices

- 23.1.3.4.3 Weaknesses and competitive threats

- 23.1.4 YAMAHA MOTOR CO., LTD.

- 23.1.4.1 Business overview

- 23.1.4.2 Products offered

- 23.1.4.3 Recent developments

- 23.1.4.3.1 Product launches

- 23.1.4.3.2 Deals

- 23.1.4.3.3 Expansions

- 23.1.4.4 MnM view

- 23.1.4.4.1 Key strengths

- 23.1.4.4.2 Strategic choices

- 23.1.4.4.3 Weaknesses and competitive threats

- 23.1.5 PEDEGO

- 23.1.5.1 Business overview

- 23.1.5.2 Products offered

- 23.1.5.3 Recent developments

- 23.1.5.3.1 Product launches

- 23.1.5.3.2 Deals

- 23.1.5.3.3 Expansions

- 23.1.5.4 MnM view

- 23.1.5.4.1 Key strengths

- 23.1.5.4.2 Strategic choices

- 23.1.5.4.3 Weaknesses and competitive threats

- 23.1.6 PON.BIKE

- 23.1.6.1 Business overview

- 23.1.6.2 Products offered

- 23.1.6.3 Recent developments

- 23.1.6.3.1 Deals

- 23.1.6.3.2 Other developments

- 23.1.7 AIMA TECHNOLOGY GROUP CO., LTD.

- 23.1.7.1 Business overview

- 23.1.7.2 Products offered

- 23.1.7.3 Recent developments

- 23.1.7.3.1 Product launches

- 23.1.7.3.2 Deals

- 23.1.8 MERIDA INDUSTRY CO. LTD.

- 23.1.8.1 Business overview

- 23.1.8.2 Products offered

- 23.1.8.3 Recent developments

- 23.1.8.3.1 Product launches

- 23.1.8.3.2 Deals

- 23.1.9 TREK BICYCLE CORPORATION

- 23.1.9.1 Business overview

- 23.1.9.2 Products offered

- 23.1.9.3 Recent developments

- 23.1.9.3.1 Product launches

- 23.1.9.3.2 Deals

- 23.1.10 SPECIALIZED BICYCLE COMPONENTS, INC.

- 23.1.10.1 Business overview

- 23.1.10.2 Products offered

- 23.1.10.3 Recent developments

- 23.1.10.3.1 Deals

- 23.1.1 GIANT BICYCLES

- 23.2 EBIKE COMPONENT SUPPLIERS

- 23.2.1 ROBERT BOSCH GMBH

- 23.2.1.1 Business overview

- 23.2.1.2 Products offered

- 23.2.1.3 Recent developments

- 23.2.1.3.1 Product launches/developments/enhancements

- 23.2.1.3.2 Deals

- 23.2.2 SAMSUNG SDI CO. LTD.

- 23.2.2.1 Business overview

- 23.2.2.2 Products offered

- 23.2.2.3 Recent developments

- 23.2.2.3.1 Product launches

- 23.2.3 PANASONIC HOLDINGS CORPORATION

- 23.2.3.1 Business overview

- 23.2.3.2 Products offered

- 23.2.3.2.1 Deals

- 23.2.4 BAFANG ELECTRIC (SUZHOU) CO., LTD.

- 23.2.4.1 Business overview

- 23.2.4.2 Products offered

- 23.2.4.3 Recent developments

- 23.2.4.3.1 Product launches/developments

- 23.2.4.3.2 Deals

- 23.2.4.3.3 Expansions

- 23.2.5 BROSE FAHRZEUGTEILE

- 23.2.5.1 Business overview

- 23.2.5.2 Products offered

- 23.2.5.3 Recent developments

- 23.2.5.3.1 Product enhancements

- 23.2.5.3.2 Deals

- 23.2.5.3.3 Other developments

- 23.2.6 SHIMANO INC.

- 23.2.6.1 Business overview

- 23.2.6.2 Products offered

- 23.2.6.3 Recent developments

- 23.2.6.3.1 Product launches

- 23.2.7 JOHNSON MATTHEY

- 23.2.7.1 Business overview

- 23.2.7.2 Products offered

- 23.2.7.3 Recent developments

- 23.2.7.3.1 Deals

- 23.2.8 PROMOVEC A/S

- 23.2.8.1 Business overview

- 23.2.8.2 Products offered

- 23.2.8.3 Recent developments

- 23.2.8.3.1 Deals

- 23.2.9 BMZ GROUP

- 23.2.9.1 Business overview

- 23.2.9.2 Products offered

- 23.2.9.3 Recent developments

- 23.2.9.3.1 Deals

- 23.2.9.3.2 Expansions

- 23.2.10 WUXI TRUCKRUN MOTOR CO., LTD

- 23.2.10.1 Business overview

- 23.2.10.2 Products offered

- 23.2.11 ANANDA DRIVE TECHNIQUES (SHANGHAI) CO., LTD.

- 23.2.11.1 Business overview

- 23.2.11.2 Products offered

- 23.2.11.3 Recent developments

- 23.2.11.3.1 Product launches

- 23.2.11.3.2 Deals

- 23.2.11.3.3 Expansions

- 23.2.11.3.4 Other developments

- 23.2.12 MAHLE GMBH

- 23.2.12.1 Business overview

- 23.2.12.2 Products offered

- 23.2.12.3 Recent developments

- 23.2.12.3.1 Product Launches/developments

- 23.2.12.3.2 Deals

- 23.2.12.3.3 Other developments

- 23.2.13 ZF FRIEDRICHSHAFEN AG

- 23.2.13.1 Business overview

- 23.2.13.2 Products offered

- 23.2.13.3 Recent developments

- 23.2.13.3.1 Product launches/developments

- 23.2.14 SRAM LLC

- 23.2.14.1 Business overview

- 23.2.14.2 Products offered

- 23.2.14.3 Recent developments

- 23.2.14.3.1 Deals

- 23.2.15 TQ GROUP

- 23.2.15.1 Business overview

- 23.2.15.2 Products offered

- 23.2.15.3 Recent developments

- 23.2.15.3.1 Product launches

- 23.2.1 ROBERT BOSCH GMBH

- 23.3 OTHER PLAYERS

- 23.3.1 HERO LECTRO E-CYCLES

- 23.3.2 CUBE

- 23.3.3 FUJI-TA BICYCLE CO., LTD.

- 23.3.4 ELECTRIC BIKE COMPANY

- 23.3.5 RAD POWER BIKES LLC

- 23.3.6 VANMOOF

- 23.3.7 BH BIKES

- 23.3.8 BROMPTON BICYCLE LIMITED

- 23.3.9 RIESE & MULLER GMBH

- 23.3.10 MYSTROMER AG

- 23.3.11 COWBOY

24 RECOMMENDATIONS

- 24.1 ASIA OCEANIA TO BE MAJOR MARKET FOR EBIKES

- 24.2 CITY/URBAN EBIKES AND DEVELOPMENTS IN DRIVE MOTORS TO BE KEY FOCUS FOR MANUFACTURERS

- 24.3 RISING DEMAND FOR MID MOTOR COMPARED TO HUB MOTOR

- 24.4 RISING DEMAND FOR >250 W AND <450 W BATTERY CAPACITY IN EBIKES

- 24.5 CONCLUSION

25 APPENDIX

- 25.1 KEY INSIGHTS OF INDUSTRY EXPERTS

- 25.2 DISCUSSION GUIDE

- 25.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 25.4 CUSTOMIZATION OPTIONS

- 25.4.1 BY DESIGN

- 25.4.1.1 Foldable

- 25.4.1.2 Unfoldable

- 25.4.2 BY FRAME MATERIAL

- 25.4.2.1 Carbon fiber

- 25.4.2.2 Carbon steel

- 25.4.2.3 Aluminum

- 25.4.2.4 Aluminum alloy

- 25.4.3 EMTB MARKET, BY TYPE

- 25.4.3.1 Light

- 25.4.3.2 Trekking

- 25.4.3.3 Enduro

- 25.4.4 CITY E-BIKE MARKET, BY TYPE

- 25.4.4.1 Speed

- 25.4.4.2 Foldable

- 25.4.5 MARKET SHARE ANALYSIS, BY CLASS

- 25.4.6 TECHNICAL SPECIFICATIONS OF EBIKES, BY OEM AND COUNTRY

- 25.4.6.1 US

- 25.4.6.2 Canada

- 25.4.6.3 Germany

- 25.4.6.4 Netherlands

- 25.4.6.5 UK

- 25.4.6.6 France

- 25.4.6.7 China

- 25.4.6.8 Japan

- 25.4.1 BY DESIGN

- 25.5 RELATED REPORTS

- 25.6 AUTHOR DETAILS

List of Tables

- TABLE 1 EBIKE NOMENCLATURE, BY REGION/COUNTRY

- TABLE 2 CURRENCY EXCHANGE RATES, 2021-2024

- TABLE 3 RESEARCH ASSUMPTIONS AND RISK ASSESSMENT

- TABLE 4 EUROPE: COUNTRY-WISE INCENTIVES/REBATE PROGRAMS TO BOOST EBIKE SALES

- TABLE 5 NORTH AMERICA: COUNTRY-WISE INCENTIVES/REBATE PROGRAMS TO BOOST EBIKE SALES

- TABLE 6 ASIA OCEANIA: COUNTRY-WISE INCENTIVES/REBATE PROGRAMS TO BOOST EBIKE SALES

- TABLE 7 ELECTRIC MOUNTAIN AND CARGO BIKE MODELS AND THEIR TECHNICAL SPECIFICATIONS

- TABLE 8 EBIKE CLASSIFICATION AND REGULATIONS

- TABLE 9 KEY BUYING CRITERIA FOR TOP 3 EBIKE USAGES

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 EBIKE USAGES

- TABLE 11 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 12 AVERAGE SELLING PRICE OF EBIKES, BY USAGE AND KEY PLAYERS, 2025

- TABLE 13 AVERAGE SELLING PRICE OF EBIKES, BY REGION, 2021-2025

- TABLE 14 AVERAGE SELLING PRICE OF EBIKES, BY KEY COUNTRY, 2025

- TABLE 15 LEADING GLOBAL E-BIKE OEMS - PRODUCTION FOOTPRINT, CAPACITY, AND PRODUCT FOCUS

- TABLE 16 CHINA: EXPORT DATA FOR HS CODE 871160: EBIKE EXPORT SHARE, BY COUNTRY, 2020-2024

- TABLE 17 GERMANY: EXPORT DATA FOR HS CODE 871160: EBIKE EXPORT SHARE, BY COUNTRY, 2020-2024

- TABLE 18 NETHERLANDS: EXPORT DATA FOR HS CODE 871160: EBIKE EXPORT SHARE, BY COUNTRY, 2020-2024

- TABLE 19 TAIPEI, CHINESE: EXPORT DATA FOR HS CODE 871160: EBIKE EXPORT SHARE, BY COUNTRY, 2020-2024

- TABLE 20 GERMANY: IMPORT DATA FOR HS CODE 871160: EBIKE IMPORT SHARE, BY COUNTRY, 2020-2024

- TABLE 21 US: IMPORT DATA FOR HS CODE 871160: EBIKE IMPORT SHARE, BY COUNTRY, 2020-2024

- TABLE 22 NETHERLANDS: IMPORT DATA FOR HS CODE 871160: EBIKE IMPORT SHARE, BY COUNTRY, 2020-2024

- TABLE 23 FRANCE: IMPORT DATA FOR HS CODE 871160: EBIKE IMPORT SHARE, BY COUNTRY, 2020-2024

- TABLE 24 BELGIUM: IMPORT DATA FOR HS CODE 871160: EBIKE IMPORT SHARE, BY COUNTRY, 2020-2024

- TABLE 25 EBIKE MARKET: KEY PATENTS, FEBRUARY 2021-MAY 2025

- TABLE 26 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 27 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 28 ASIA OCEANIA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 29 EUROPEAN UNION: EBIKE REGULATIONS

- TABLE 30 CHINA: EBIKE REGULATIONS

- TABLE 31 INDIA: EBIKE REGULATIONS

- TABLE 32 JAPAN: EBIKE REGULATIONS

- TABLE 33 US: EBIKE REGULATIONS

- TABLE 34 CALIFORNIA: EBIKE REGULATIONS

- TABLE 35 EBIKE MARKET: KEY CONFERENCES AND EVENTS IN 2025-2026

- TABLE 36 US: TOP EBIKE SUPPLIERS AND THEIR TOP-SELLING MODELS VS. PRICE RANGE

- TABLE 37 CANADA: TOP EBIKE SUPPLIERS AND THEIR TOP-SELLING MODELS VS. PRICE RANGE

- TABLE 38 GERMANY: TOP EBIKE SUPPLIERS AND THEIR TOP-SELLING MODELS VS. PRICE RANGE

- TABLE 39 NETHERLANDS: TOP EBIKE SUPPLIERS AND THEIR TOP-SELLING MODELS VS. PRICE RANGE

- TABLE 40 UK: TOP EBIKE SUPPLIERS AND THEIR TOP-SELLING MODELS VS. PRICE RANGE

- TABLE 41 JAPAN: TOP EBIKE SUPPLIERS AND THEIR TOP SELLING MODELS VS. PRICE RANGE

- TABLE 42 CHINA: TOP EBIKE SUPPLIERS AND THEIR TOP-SELLING MODELS VS. PRICE RANGE

- TABLE 43 LIST OF EBIKE BRANDS PER OEM

- TABLE 44 FACTORS AFFECTING RANGE OF EBIKES

- TABLE 45 EBIKE: BATTERY VOLTAGE VS. MILES

- TABLE 46 LIST OF FUNDING IN 2022-2024

- TABLE 47 TOTAL COST OF OWNERSHIP OF EBIKES

- TABLE 48 5-YEAR TOTAL COST OF OWNERSHIP OF EBIKES IN INDIA

- TABLE 49 RECENT DEVELOPMENTS

- TABLE 50 POLICIES AND STANDARDS, BY REGION

- TABLE 51 RECENT DEVELOPMENTS (2024-2025)

- TABLE 52 KEY PLAYERS IN EBIKE BATTERY RECYCLING

- TABLE 53 EBIKE MARKET, BY USAGE, 2021-2024 (THOUSAND UNITS)

- TABLE 54 EBIKE MARKET, BY USAGE, 2025-2032 (THOUSAND UNITS)

- TABLE 55 EBIKE MARKET, BY USAGE, 2021-2024 (USD MILLION)

- TABLE 56 EBIKE MARKET, BY USAGE, 2025-2032 (USD MILLION)

- TABLE 57 MOUNTAIN/TREKKING EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 58 MOUNTAIN/TREKKING EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 59 MOUNTAIN/TREKKING EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 60 MOUNTAIN/TREKKING EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 61 CITY/URBAN EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 62 CITY/URBAN EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 63 CITY/URBAN EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 64 CITY/URBAN EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 65 CARGO EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 66 CARGO EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 67 CARGO EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 68 CARGO EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 69 OTHER USAGES: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 70 OTHER USAGES: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 71 OTHER USAGES: EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 72 OTHER USAGES: EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 73 EBIKE MARKET, BY CLASS, 2021-2024 (THOUSAND UNITS)

- TABLE 74 EBIKE MARKET, BY CLASS, 2025-2032 (THOUSAND UNITS)

- TABLE 75 EBIKE MARKET, BY CLASS, 2021-2024 (USD MILLION)

- TABLE 76 EBIKE MARKET, BY CLASS, 2025-2032 (USD MILLION)

- TABLE 77 CLASS I E-BIKE OEM - PRODUCT LINE, MANUFACTURING FACILITIES & TECHNICAL DETAILS

- TABLE 78 CLASS I EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 79 CLASS I EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 80 CLASS I EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 81 CLASS I EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 82 CLASS II EBIKE OEM - PRODUCT LINE, MANUFACTURING FACILITIES & TECHNICAL DETAILS

- TABLE 83 CLASS II EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 84 CLASS II EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 85 CLASS II EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 86 CLASS II EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 87 CLASS III EBIKE OEM - PRODUCT LINE, MANUFACTURING FACILITIES, AND TECHNICAL DETAILS

- TABLE 88 CLASS III EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 89 CLASS III EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 90 CLASS III EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 91 CLASS III EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 92 EBIKE MARKET, BY COMPONENT, 2021-2024 (THOUSAND UNITS)

- TABLE 93 EBIKE MARKET, BY COMPONENT, 2025-2032 (THOUSAND UNITS)

- TABLE 94 EBIKE MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 95 EBIKE MARKET, BY COMPONENT, 2025-2032 (USD MILLION)

- TABLE 96 EBIKE BATTERY MANUFACTURERS - PRODUCT OFFERINGS & TECHNICAL SPECIFICATIONS

- TABLE 97 BATTERY: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 98 BATTERY: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 99 BATTERY: EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 100 BATTERY: EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 101 EBIKE ELECTRIC MOTOR MANUFACTURERS - PRODUCT OFFERINGS & TECHNICAL SPECIFICATIONS

- TABLE 102 ELECTRIC MOTOR: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 103 ELECTRIC MOTOR: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 104 ELECTRIC MOTOR: EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 105 ELECTRIC MOTOR: EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 106 EBIKE FRAME WITH FORK MANUFACTURERS - PRODUCT OFFERINGS & HIGHLIGHTS

- TABLE 107 FRAME WITH FORK: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 108 FRAME WITH FORK: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 109 FRAME WITH FORK: EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 110 FRAME WITH FORK: EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 111 EBIKE WHEEL MANUFACTURERS - PRODUCT OFFERINGS & HIGHLIGHTS

- TABLE 112 WHEEL: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 113 WHEEL: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 114 WHEEL: EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 115 WHEEL: EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 116 EBIKE CRANK GEAR MANUFACTURERS - PRODUCT OFFERINGS & HIGHLIGHTS

- TABLE 117 CRANK GEAR: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 118 CRANK GEAR: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 119 CRANK GEAR: EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 120 CRANK GEAR: EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 121 EBIKE BRAKE SYSTEM MANUFACTURERS - PRODUCT OFFERINGS & HIGHLIGHTS

- TABLE 122 BRAKE SYSTEM: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 123 BRAKE SYSTEM: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 124 BRAKE SYSTEM: EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 125 BRAKE SYSTEM: EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 126 EBIKE MOTOR CONTROLLER MANUFACTURERS - PRODUCT OFFERINGS & HIGHLIGHTS

- TABLE 127 MOTOR CONTROLLER: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 128 MOTOR CONTROLLER: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 129 MOTOR CONTROLLER: EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 130 MOTOR CONTROLLER: EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 131 EBIKE MARKET: SUPPLIER ANALYSIS, BY COMPANY NAME, MODEL, AND DRIVE SYSTEM

- TABLE 132 EBIKE MARKET, BY DRIVE SYSTEM, 2021-2024 (THOUSAND UNITS)

- TABLE 133 EBIKE MARKET, BY DRIVE SYSTEM, 2025-2032 (THOUSAND UNITS)

- TABLE 134 CHAIN DRIVE: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 135 CHAIN DRIVE: EBIKE MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 136 BELT DRIVE: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 137 BELT DRIVE: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 138 EBIKE MARKET, BY MODE, 2021-2024 (THOUSAND UNITS)

- TABLE 139 EBIKE MARKET, BY MODE, 2025-2032 (THOUSAND UNITS)

- TABLE 140 EBIKE MARKET, BY MODE, 2021-2024 (USD MILLION)

- TABLE 141 EBIKE MARKET, BY MODE, 2025-2032 (USD MILLION)

- TABLE 142 PEDAL-ASSIST EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 143 PEDAL-ASSIST EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 144 PEDAL-ASSIST EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 145 PEDAL-ASSIST EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 146 THROTTLE-MODE EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 147 THROTTLE-MODE EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 148 THROTTLE-MODE EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 149 THROTTLE-MODE EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 150 EBIKE MARKET, BY OWNERSHIP, 2021-2024 (THOUSAND UNITS)

- TABLE 151 EBIKE MARKET, BY OWNERSHIP, 2025-2032 (THOUSAND UNITS)

- TABLE 152 SHARED EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 153 SHARED EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 154 PERSONAL EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 155 PERSONAL EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 156 EBIKE MARKET, BY SPEED, 2021-2024 (THOUSAND UNITS)

- TABLE 157 EBIKE MARKET, BY SPEED, 2025-2032 (THOUSAND UNITS)

- TABLE 158 EBIKE MARKET, BY SPEED, 2021-2024 (USD MILLION)

- TABLE 159 EBIKE MARKET, BY SPEED, 2025-2032 (USD MILLION)

- TABLE 160 UP TO 25 KM/H EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 161 UP TO 25 KM/H EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 162 UP TO 25 KM/H EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 163 UP TO 25 KM/H EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 164 25-45 KM/H EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 165 25-45 KM/H EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 166 25-45 KM/H EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 167 25-45 KM/H EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 168 EBIKE MARKET, BY BATTERY CAPACITY, 2021-2024 (THOUSAND UNITS)

- TABLE 169 EBIKE MARKET, BY BATTERY CAPACITY, 2025-2032 (THOUSAND UNITS)

- TABLE 170 EBIKE MARKET, BY BATTERY CAPACITY, 2021-2024 (USD MILLION)

- TABLE 171 EBIKE MARKET, BY BATTERY CAPACITY, 2025-2032 (USD MILLION)

- TABLE 172 <250W EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 173 <250W EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 174 <250W EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 175 <250W EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 176 >250W-<450W EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 177 >250W-<450W EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 178 >250W-<450W EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 179 >250W-<450W EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 180 >450W-<650W EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 181 >450W-<650W EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 182 >450W-<650W EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 183 >450W-<650W EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 184 >650W EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 185 >650W EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 186 >650W EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 187 >650W EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 188 EBIKE MARKET: SUPPLIER ANALYSIS, BY COMPANY NAME, MODEL, AND BATTERY INTEGRATION

- TABLE 189 EBIKE MARKET, BY TYPE OF BATTERY INTEGRATION, 2021-2024 (THOUSAND UNITS)

- TABLE 190 EBIKE MARKET, BY TYPE OF BATTERY INTEGRATION, 2024-2030 (THOUSAND UNITS)

- TABLE 191 INTEGRATED BATTERIES: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 192 INTEGRATED BATTERIES: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 193 EXTERNAL BATTERIES: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 194 EXTERNAL BATTERIES: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 195 EBIKE MARKET, BY BATTERY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 196 EBIKE MARKET, BY BATTERY TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 197 EBIKE MARKET, BY BATTERY TYPE, 2021-2024 (USD MILLION)

- TABLE 198 EBIKE MARKET, BY BATTERY TYPE, 2025-2032 (USD MILLION)

- TABLE 199 LITHIUM-ION: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 200 LITHIUM-ION: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 201 LITHIUM-ION: EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 202 LITHIUM-ION: EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 203 LITHIUM-ION POLYMER: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 204 LITHIUM-ION POLYMER: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 205 LITHIUM-ION POLYMER: EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 206 LITHIUM-ION POLYMER: EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 207 LEAD-ACID: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 208 LEAD-ACID: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 209 LEAD-ACID: EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 210 LEAD-ACID: EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 211 OTHER BATTERY TYPES: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 212 OTHER BATTERY TYPES: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 213 OTHER BATTERY TYPES: EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 214 OTHER BATTERY TYPES: EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 215 EBIKE MARKET: SUPPLIER ANALYSIS, BY COMPANY NAME, MODEL, AND BATTERY VOLTAGE

- TABLE 216 EBIKE MARKET, BY BATTERY VOLTAGE, 2021-2024 (THOUSAND UNITS)

- TABLE 217 EBIKE MARKET, BY BATTERY VOLTAGE, 2025-2032 (THOUSAND UNITS)

- TABLE 218 LESS THAN 39V BATTERIES: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 219 LESS THAN 39V BATTERIES: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 220 39V TO 45V BATTERIES: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 221 39V TO 45V BATTERIES: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 222 45V TO 51V BATTERIES: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 223 45V TO 51V BATTERIES: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 224 EBIKE MARKET: SUPPLIER ANALYSIS, BY COMPANY NAME, MODEL, AND POWER (NM)

- TABLE 225 TORQUE LEVELS BY EBIKE TYPE & OEM MOTOR OFFERINGS

- TABLE 226 EBIKE MARKET, BY MOTOR POWER, 2021-2024 (THOUSAND UNITS)

- TABLE 227 EBIKE MARKET, BY MOTOR POWER, 2025-2032 (THOUSAND UNITS)

- TABLE 228 EBIKE MARKET, BY MOTOR POWER, 2021-2024 (USD MILLION)

- TABLE 229 EBIKE MARKET, BY MOTOR POWER, 2025-2032 (USD MILLION)

- TABLE 230 <40 NM: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 231 <40 NM: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 232 <40 NM: EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 233 <40 NM: EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 234 >40-<70 NM: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 235 >40-<70 NM: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 236 >40-<70 NM: EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 237 >40-<70 NM: EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 238 >70 NM: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 239 >70 NM: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 240 >70 NM: EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 241 >70 NM: EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 242 E-BIKE MOTORS, BY COMPANY NAME AND MOTOR WEIGHT (KG)

- TABLE 243 EBIKE MARKET, BY MOTOR WEIGHT, 2021-2024 (THOUSAND UNITS)

- TABLE 244 EBIKE MARKET, BY MOTOR WEIGHT, 2025-2032 (THOUSAND UNITS)

- TABLE 245 EBIKE MARKET, BY MOTOR WEIGHT, 2021-2024 (USD MILLION)

- TABLE 246 EBIKE MARKET, BY MOTOR WEIGHT, 2025-2032 (USD MILLION)

- TABLE 247 < 2 KG MOTOR EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 248 < 2 KG MOTOR EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 249 < 2 KG MOTOR EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 250 < 2 KG MOTOR EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 251 > 2 KG-< 2.4 KG MOTOR EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 252 > 2 KG-< 2.4 KG MOTOR EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 253 > 2 KG-< 2.4 KG MOTOR EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 254 > 2 KG-< 2.4 KG MOTOR EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 255 > 2.4 KG MOTOR EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 256 > 2.4 KG MOTOR EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 257 > 2.4 KG MOTOR EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 258 > 2.4 KG MOTOR EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 259 EBIKE MARKET SUPPLIER ANALYSIS, BY COMPANY NAME, MODEL, AND MOTOR POWER

- TABLE 260 EBIKE MARKET, BY MOTOR POWER (WATT), 2021-2024 (THOUSAND UNITS)

- TABLE 261 EBIKE MARKET, BY MOTOR POWER (WATT), 2025-2032 (THOUSAND UNITS)

- TABLE 262 <250W MOTOR POWER: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 263 <250W MOTOR POWER: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 264 251-350W MOTOR POWER: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 265 251-350W MOTOR POWER: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 266 351-500W MOTOR POWER: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 267 351-500W MOTOR POWER: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 268 501-600W MOTOR POWER: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 269 501-600W MOTOR POWER: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 270 >600W MOTOR POWER: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 271 >600W MOTOR POWER: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 272 EBIKE MARKET, BY MOTOR TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 273 EBIKE MARKET, BY MOTOR TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 274 EBIKE MARKET, BY MOTOR TYPE, 2021-2024 (USD MILLION)

- TABLE 275 EBIKE MARKET, BY MOTOR TYPE, 2025-2032 (USD MILLION)

- TABLE 276 HUB MOTOR: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 277 HUB MOTOR: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 278 HUB MOTOR: EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 279 HUB MOTOR: EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 280 MID MOTOR: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 281 MID MOTOR: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 282 MID MOTOR: EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 283 MID MOTOR: EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 284 EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 285 EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 286 EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 287 EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 288 EBIKE MARKET, BY USAGE, 2021-2024 (THOUSAND UNITS)

- TABLE 289 EBIKE MARKET, BY USAGE, 2025-2032 (THOUSAND UNITS)

- TABLE 290 EBIKE MARKET, BY USAGE, 2021-2024 (USD MILLION)

- TABLE 291 EBIKE MARKET, BY USAGE, 2025-2032 (USD MILLION)

- TABLE 292 EBIKE MARKET, BY CLASS, 2021-2024 (THOUSAND UNITS)

- TABLE 293 EBIKE MARKET, BY CLASS, 2025-2032 (THOUSAND UNITS)

- TABLE 294 EBIKE MARKET, BY CLASS, 2021-2024 (USD MILLION)

- TABLE 295 EBIKE MARKET, BY CLASS, 2025-2032 (USD MILLION)

- TABLE 296 ASIA OCEANIA: COUNTRY LEVEL EBIKE OEM MANUFACTURING PLANT

- TABLE 297 ASIA OCEANIA: EBIKE MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 298 ASIA OCEANIA: EBIKE MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 299 ASIA OCEANIA: EBIKE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 300 ASIA OCEANIA: EBIKE MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 301 ASIA OCEANIA: EBIKE MARKET, BY USAGE, 2021-2024 (THOUSAND UNITS)

- TABLE 302 ASIA OCEANIA: EBIKE MARKET, BY USAGE, 2025-2032 (THOUSAND UNITS)

- TABLE 303 ASIA OCEANIA: EBIKE MARKET, BY USAGE, 2021-2024 (USD MILLION)

- TABLE 304 ASIA OCEANIA: EBIKE MARKET, BY USAGE, 2025-2032 (USD MILLION)

- TABLE 305 ASIA OCEANIA: EBIKE MARKET, BY CLASS, 2021-2024 (THOUSAND UNITS)

- TABLE 306 ASIA OCEANIA: EBIKE MARKET, BY CLASS, 2025-2032 (THOUSAND UNITS)

- TABLE 307 ASIA OCEANIA: EBIKE MARKET, BY CLASS, 2021-2024 (USD MILLION)

- TABLE 308 ASIA OCEANIA: EBIKE MARKET, BY CLASS, 2025-2032 (USD MILLION)

- TABLE 309 CHINA: EBIKE MARKET, BY USAGE, 2021-2024 (THOUSAND UNITS)

- TABLE 310 CHINA: EBIKE MARKET, BY USAGE, 2025-2032 (THOUSAND UNITS)

- TABLE 311 CHINA: EBIKE MARKET, BY USAGE, 2021-2024 (USD MILLION)

- TABLE 312 CHINA: EBIKE MARKET, BY USAGE, 2025-2032 (USD MILLION)

- TABLE 313 CHINA: EBIKE MARKET, BY CLASS, 2021-2024 (THOUSAND UNITS)

- TABLE 314 CHINA: EBIKE MARKET, BY CLASS, 2025-2032 (THOUSAND UNITS)

- TABLE 315 CHINA: EBIKE MARKET, BY CLASS, 2021-2024 (USD MILLION)

- TABLE 316 CHINA: EBIKE MARKET, BY CLASS, 2025-2032 (USD MILLION)

- TABLE 317 JAPAN: EBIKE MARKET, BY USAGE, 2021-2024 (THOUSAND UNITS)

- TABLE 318 JAPAN: EBIKE MARKET, BY USAGE, 2025-2032 (THOUSAND UNITS)

- TABLE 319 JAPAN: EBIKE MARKET, BY USAGE, 2021-2024 (USD MILLION)

- TABLE 320 JAPAN: EBIKE MARKET, BY USAGE, 2025-2032 (USD MILLION)

- TABLE 321 JAPAN: EBIKE MARKET, BY CLASS, 2021-2024 (THOUSAND UNITS)

- TABLE 322 JAPAN: EBIKE MARKET, BY CLASS, 2025-2032 (THOUSAND UNITS)

- TABLE 323 JAPAN: EBIKE MARKET, BY CLASS, 2021-2024 (USD MILLION)

- TABLE 324 JAPAN: EBIKE MARKET, BY CLASS, 2025-2032 (USD MILLION)

- TABLE 325 INDIA: EBIKE MARKET, BY USAGE, 2021-2024 (THOUSAND UNITS)

- TABLE 326 INDIA: EBIKE MARKET, BY USAGE, 2025-2032 (THOUSAND UNITS)

- TABLE 327 INDIA: EBIKE MARKET, BY USAGE, 2021-2024 (USD MILLION)

- TABLE 328 INDIA: EBIKE MARKET, BY USAGE, 2025-2032 (USD MILLION)

- TABLE 329 INDIA: EBIKE MARKET, BY CLASS, 2021-2024 (THOUSAND UNITS)

- TABLE 330 INDIA: EBIKE MARKET, BY CLASS, 2025-2032 (THOUSAND UNITS)

- TABLE 331 INDIA: EBIKE MARKET, BY CLASS, 2021-2024 (USD MILLION)

- TABLE 332 INDIA: EBIKE MARKET, BY CLASS, 2025-2032 (USD MILLION)

- TABLE 333 SOUTH KOREA: EBIKE MARKET, BY USAGE, 2021-2024 (THOUSAND UNITS)

- TABLE 334 SOUTH KOREA: EBIKE MARKET, BY USAGE, 2025-2032 (THOUSAND UNITS)

- TABLE 335 SOUTH KOREA: EBIKE MARKET, BY USAGE, 2021-2024 (USD MILLION)

- TABLE 336 SOUTH KOREA: EBIKE MARKET, BY USAGE, 2025-2032 (USD MILLION)

- TABLE 337 SOUTH KOREA: EBIKE MARKET, BY CLASS, 2021-2024 (THOUSAND UNITS)

- TABLE 338 SOUTH KOREA: EBIKE MARKET, BY CLASS, 2025-2032 (THOUSAND UNITS)

- TABLE 339 SOUTH KOREA: EBIKE MARKET, BY CLASS, 2021-2024 (USD MILLION)

- TABLE 340 SOUTH KOREA: EBIKE MARKET, BY CLASS, 2025-2032 (USD MILLION)

- TABLE 341 TAIWAN: EBIKE MARKET, BY USAGE, 2021-2024 (THOUSAND UNITS)

- TABLE 342 TAIWAN: EBIKE MARKET, BY USAGE, 2025-2032 (THOUSAND UNITS)

- TABLE 343 TAIWAN: EBIKE MARKET, BY USAGE, 2021-2024 (USD MILLION)

- TABLE 344 TAIWAN: EBIKE MARKET, BY USAGE, 2025-2032 (USD MILLION)

- TABLE 345 TAIWAN: EBIKE MARKET, BY CLASS, 2021-2024 (THOUSAND UNITS)

- TABLE 346 TAIWAN: EBIKE MARKET, BY CLASS, 2025-2032 (THOUSAND UNITS)

- TABLE 347 TAIWAN: EBIKE MARKET, BY CLASS, 2021-2024 (USD MILLION)

- TABLE 348 TAIWAN: EBIKE MARKET, BY CLASS, 2025-2032 (USD MILLION)

- TABLE 349 AUSTRALIA: EBIKE MARKET, BY USAGE, 2021-2024 (THOUSAND UNITS)

- TABLE 350 AUSTRALIA: EBIKE MARKET, BY USAGE, 2025-2032 (THOUSAND UNITS)

- TABLE 351 AUSTRALIA: EBIKE MARKET, BY USAGE, 2021-2024 (USD MILLION)

- TABLE 352 AUSTRALIA: EBIKE MARKET, BY USAGE, 2025-2032 (USD MILLION)

- TABLE 353 AUSTRALIA: EBIKE MARKET, BY CLASS, 2021-2024 (THOUSAND UNITS)

- TABLE 354 AUSTRALIA: EBIKE MARKET, BY CLASS, 2025-2032 (THOUSAND UNITS)

- TABLE 355 AUSTRALIA: EBIKE MARKET, BY CLASS, 2021-2024 (USD MILLION)

- TABLE 356 AUSTRALIA: EBIKE MARKET, BY CLASS, 2025-2032 (USD MILLION)

- TABLE 357 NORTH AMERICA: COUNTRY-LEVEL EBIKE OEM MANUFACTURING PLANT

- TABLE 358 NORTH AMERICA: EBIKE MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 359 NORTH AMERICA: EBIKE MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 360 NORTH AMERICA: EBIKE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 361 NORTH AMERICA: EBIKE MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 362 NORTH AMERICA: EBIKE MARKET, BY USAGE, 2021-2024 (THOUSAND UNITS)

- TABLE 363 NORTH AMERICA: EBIKE MARKET, BY USAGE, 2025-2032 (THOUSAND UNITS)

- TABLE 364 NORTH AMERICA: EBIKE MARKET, BY USAGE, 2021-2024 (USD MILLION)

- TABLE 365 NORTH AMERICA: EBIKE MARKET, BY USAGE, 2025-2032 (USD MILLION)

- TABLE 366 NORTH AMERICA: EBIKE MARKET, BY CLASS, 2021-2024 (THOUSAND UNITS)

- TABLE 367 NORTH AMERICA: EBIKE MARKET, BY CLASS, 2025-2032 (THOUSAND UNITS)

- TABLE 368 NORTH AMERICA: EBIKE MARKET, BY CLASS, 2021-2024 (USD MILLION)

- TABLE 369 NORTH AMERICA: EBIKE MARKET, BY CLASS, 2025-2032 (USD MILLION)

- TABLE 370 US: EBIKE MARKET, BY USAGE, 2021-2024 (THOUSAND UNITS)

- TABLE 371 US: EBIKE MARKET, BY USAGE, 2025-2032 (THOUSAND UNITS)

- TABLE 372 US: EBIKE MARKET, BY USAGE, 2021-2024 (USD MILLION)

- TABLE 373 US: EBIKE MARKET, BY USAGE, 2025-2032 (USD MILLION)

- TABLE 374 US: EBIKE MARKET, BY CLASS, 2021-2024 (THOUSAND UNITS)

- TABLE 375 US: EBIKE MARKET, BY CLASS, 2025-2032 (THOUSAND UNITS)

- TABLE 376 US: EBIKE MARKET, BY CLASS, 2021-2024 (USD MILLION)

- TABLE 377 US: EBIKE MARKET, BY CLASS, 2025-2032 (USD MILLION)

- TABLE 378 CANADA: EBIKE MARKET, BY USAGE, 2021-2024 (THOUSAND UNITS)

- TABLE 379 CANADA: EBIKE MARKET, BY USAGE, 2025-2032 (THOUSAND UNITS)

- TABLE 380 CANADA: EBIKE MARKET, BY USAGE, 2021-2024 (USD MILLION)

- TABLE 381 CANADA: EBIKE MARKET, BY USAGE, 2025-2032 (USD MILLION)

- TABLE 382 CANADA: EBIKE MARKET, BY CLASS, 2021-2024 (THOUSAND UNITS)

- TABLE 383 CANADA: EBIKE MARKET, BY CLASS, 2025-2032 (THOUSAND UNITS)

- TABLE 384 CANADA: EBIKE MARKET, BY CLASS, 2021-2024 (USD MILLION)

- TABLE 385 CANADA: EBIKE MARKET, BY CLASS, 2025-2032 (USD MILLION)

- TABLE 386 EUROPE: COUNTRY-LEVEL EBIKE OEM MANUFACTURING PLANT

- TABLE 387 EUROPE: EBIKE MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 388 EUROPE: EBIKE MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 389 EUROPE: EBIKE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 390 EUROPE: EBIKE MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 391 EUROPE: EBIKE MARKET, BY USAGE, 2021-2024 (THOUSAND UNITS)

- TABLE 392 EUROPE: EBIKE MARKET, BY USAGE, 2025-2032 (THOUSAND UNITS)

- TABLE 393 EUROPE: EBIKE MARKET, BY USAGE, 2021-2024 (USD MILLION)

- TABLE 394 EUROPE: EBIKE MARKET, BY USAGE, 2025-2032 (USD MILLION)

- TABLE 395 EUROPE: EBIKE MARKET, BY CLASS, 2021-2024 (THOUSAND UNITS)

- TABLE 396 EUROPE: EBIKE MARKET, BY CLASS, 2025-2032 (THOUSAND UNITS)

- TABLE 397 EUROPE: EBIKE MARKET, BY CLASS, 2021-2024 (USD MILLION)

- TABLE 398 EUROPE: EBIKE MARKET, BY CLASS, 2025-2032 (USD MILLION)

- TABLE 399 GERMANY: EBIKE MARKET, BY USAGE, 2021-2024 (THOUSAND UNITS)

- TABLE 400 GERMANY: EBIKE MARKET, BY USAGE, 2025-2032 (THOUSAND UNITS)

- TABLE 401 GERMANY: EBIKE MARKET, BY USAGE, 2021-2024 (USD MILLION)

- TABLE 402 GERMANY: EBIKE MARKET, BY USAGE, 2025-2032 (USD MILLION)

- TABLE 403 GERMANY: EBIKE MARKET, BY CLASS, 2021-2024 (THOUSAND UNITS)

- TABLE 404 GERMANY: EBIKE MARKET, BY CLASS, 2025-2032 (THOUSAND UNITS)

- TABLE 405 GERMANY: EBIKE MARKET, BY CLASS, 2021-2024 (USD MILLION)