|

市场调查报告书

商品编码

1910708

欧洲电动自行车市场-份额分析、产业趋势、统计数据和成长预测(2026-2031)Europe E-Bike - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

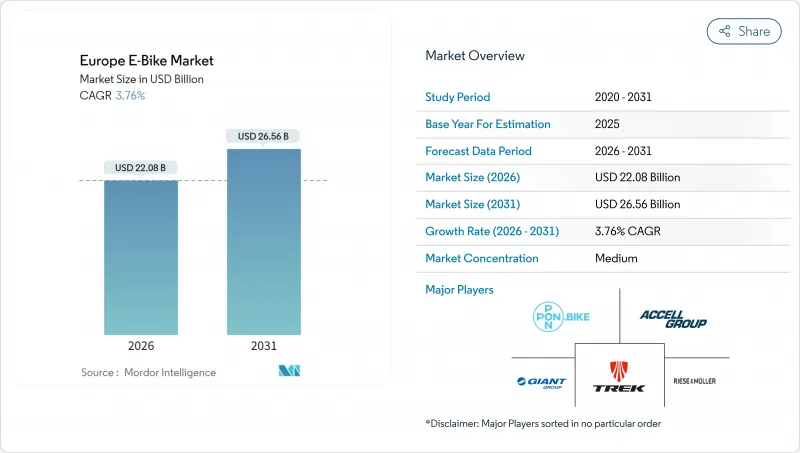

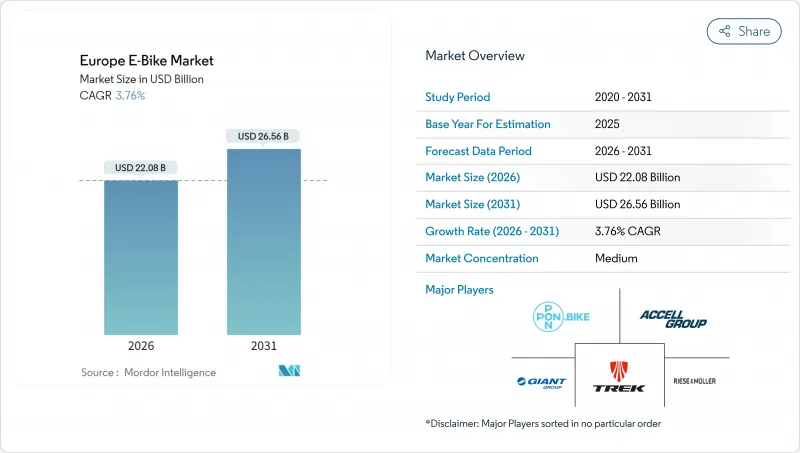

欧洲电动自行车市场预计将从 2025 年的 212.8 亿美元成长到 2026 年的 220.8 亿美元,预计到 2031 年将达到 265.6 亿美元,2026 年至 2031 年的复合年增长率为 3.76%。

强劲的潜在需求,包括企业车队、最后一公里物流和通勤替代出行等需求,抵消了疫情后库存调整的影响。受保护自行车网路的扩张、对中国产电动自行车反倾销税延长五年以及电池技术的进步,共同维持了定价权并保障了利润率。租赁模式将大规模采购转化为可预测的营运支出,正在加速企业用户的使用;而欧盟内部的在地化生产则降低了关税风险并缩短了前置作业时间。高速电动电动式自行车监管法规的逐步统一,以及固体微型电池的技术突破,预计将扩大高性能车型的潜在市场。

欧洲电动自行车市场趋势与洞察

企业自行车租赁热潮

税收优惠的租赁模式将电动自行车从可选项转变为员工福利。薪资扣款可降低30%至50%的实际成本,进而为高阶车型的普及铺路,避免价格意外。车队管理使原始设备製造商 (OEM) 能够了解市场需求,实现准时生产并降低库存风险。 NAVIT 等平台统一了跨国人力资源规则,加速了法国和荷兰等劳动市场紧张地区的扩张。

采购补贴和税收优惠

国家和地方政府的慷慨激励措施压低了实际价格,并提前刺激了需求。法国继续为每辆电动自行车提供高达4000欧元(约464.6万日元)的补贴;荷兰允许雇主对电动自行车的成本折旧免税额;比利时则通过工资扣除和租赁相结合的方式,提供远低于标价的折扣。由于换代週期可预测,製造商正在调整生产计画,以配合补贴期,从而平衡库存并保障中价位产品的销售。这些措施正在维持经济成长。

与一般自行车相比,初始成本较高

电动自行车的平均价格远高于传统自行车,而且溢价也相当高。即使在德国降价之后,入门级车型的价格很少下降,高昂的电池更换成本进一步推高了其终身成本。东欧地区的家庭对此感受特别深刻,那里的中位数收入较低,儘管基础设施完善,但电动自行车的普及率仍然很低。虽然分期付款方式有所帮助,但由于文化上对消费信贷的抵触情绪,许多买家只能等待价格下降或收入增加后再购买。

细分市场分析

预计2025年,欧洲电动式自行车市场规模将占全球市场的77.35%。助力自行车因其操作简单、骑行体验熟悉而广受欢迎,是通勤和休閒旅行的主要需求来源。在所有类别中,高速辅助自行车的复合年增长率最高,达到3.88%,这主要得益于企业对时速可达45公里/小时的通勤和高效配送的需求。

监管协调仍然是关键因素。如果欧盟关于统一头盔要求和车道使用规则的立法草案得以实施,预计将会促进大规模生产并降低单位成本。 Riese & Müller即将推出的配备齿轮传动装置的车型表明,原始设备製造商(OEM)正致力于拓展高端高速电动式自行车。随着保险产品的成熟和基础设施的完善,预计动力传动系统的构成比将逐渐转向高功率等级。

到2025年,都市区通勤将占欧洲电动自行车市场的73.62%。这是因为电动自行车在10公里以内的短途出行中尤为有利,而停车难和拥堵费等因素会抑制汽车的使用。配备长货架和货箱的货运和实用型电动自行车正以3.84%的复合年增长率增长,这主要得益于零售商、宅配业者和年轻家庭的需求,他们希望用电动自行车取代第二辆汽车。配备双儿童安全座椅的家庭货运型电动自行车不仅吸引了送货员,也吸引了更多人,例如短途汽车出行的替代者,以及注重环保的父母。此外,汽车製造商(OEM)透过重新设计车架,使电动自行车在不超过250瓦法定功率限制的情况下,能够承载200公斤的负载容量,进一步模糊了个人用途和商业用途之间的界限。

由于车架坚固、配备双电池和高扭矩电机,旅行自行车和山地自行车的价格居高不下,但季节性天气和预算限制了它们的普及。市政气候行动计画和最后一公里配送合约正在推动有效负载容量优化、再生煞车和模组化配件的研发,使自行车从休閒设备转变为商用设备。

到2025年,锂离子电池将占欧洲电动自行车市场99.86%的份额,成本降低和能量密度提高将支撑市场规模。化学成分的不断改进以及向镍锰钴混合物和磷酸锂铁(LFP)的转变以稳定成本,将推动市场以与整体市场相似的年均3.76%的增长率逐步扩张。

铅酸电池将仅存在于替换市场和超低成本进口市场。采用固态电池或半固态电池组的测试车辆可望达到15-20%的充电速度提升,并在低温环境下拥有更佳的耐久性。在固态超级工厂规模化生产之前,电池机壳设计、电池管理系统(BMS)演算法以及再生阴极材料的逐步改进将延长保固期并提升电池的转售价值,从而确保锂离子电池在预测期内保持主导地位。

其他福利:

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章执行摘要主要发现

第二章 报告

第三章 引言

- 研究假设和市场定义

- 调查范围

- 调查方法

第四章 主要产业趋势

- 年度自行车销售额

- 平均销售价格和价格范围构成

- 电动自行车及零件的跨境贸易

- 电动自行车在自行车总销量中所占的百分比

- 5-15公里通勤共享

- 自行车和电动式自行车租赁市场规模

- 电动自行车电池组价格

- 电池化学价格比较

- 最后一公里配送量

- 受保护的自行车道(公里)

- 健行和户外活动的参与率

- 电动自行车电池容量(瓦时)

- 都市交通壅塞指数

- 法律规范

- 身份验证和授权

- 进出口和贸易法规

- 分类和道路法规

- 电池和充电器安全

第五章 市场情势

- 市场概览

- 市场驱动因素

- 企业自行车租赁的蓬勃发展

- 采购补贴和税收优惠

- 电动货运车辆在最后一公里运输中的成长

- 扩建自行车道

- 欧盟区域化製造地的搬迁

- 固体微型电池的进展

- 市场限制

- 与传统自行车相比,初始成本较高

- 经销商库存估值降低

- 行人超速的监管灰色地带

- 中国投入品关税变化

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 产业间竞争

- 定价分析

第六章 市场区隔分析

- 依推进类型

- 踏板辅助

- 速度踏板

- 附油门辅助

- 透过使用

- 货物/多用途

- 城市/都市区

- 健行/登山

- 依电池类型

- 铅酸电池

- 锂离子电池

- 其他的

- 按下马达安装位置

- 轮毂(前/后)

- 中置马达

- 透过驱动系统

- 链传动

- 皮带传动

- 透过马达输出

- 小于250瓦

- 251-350 W

- 351-500 W

- 501-600 W

- 600瓦或以上

- 按价格范围

- 低于 1000 美元

- 1,000-1,499 美元

- 1500-2499美元

- 2,500-3,499 美元

- 3,500 美元至 5,999 美元

- 超过6000美元

- 按销售管道

- 在线的

- 离线

- 按最终用途

- 商业航运

- 零售和商品分销

- 食品和饮料配送

- 服务供应商

- 个人及家庭用途

- 对机构而言

- 其他的

- 商业航运

- 按国家/地区

- 德国

- 荷兰

- 法国

- 义大利

- 西班牙

- 英国

- 瑞士

- 奥地利

- 比利时

- 丹麦

- 瑞典

- 挪威

- 波兰

- 捷克共和国

- 葡萄牙

- 其他欧洲地区

第七章 竞争情势

- 关键策略倡议

- 市占率分析

- 公司简介

- Accell Group

- Pon Holdings BV

- Giant Manufacturing Co. Ltd.

- Trek Bicycle Corporation

- Riese & Muller GmbH

- Brompton Bicycle Limited

- CUBE Bikes

- Yamaha Motor Co., Ltd.

- Merida Industry Co. Ltd.

- VanMoof BV

- Volt Electric Bikes

- Pedego Electric Bikes

- KTM Fahrrad GmbH

- Fritzmeier Systems GmbH & Co. KG(M1 Sporttechnik)

第八章:CEO们需要思考的关键策略问题

The European e-bike market is expected to grow from USD 21.28 billion in 2025 to USD 22.08 billion in 2026 and is forecast to reach USD 26.56 billion by 2031 at 3.76% CAGR over 2026-2031.

Healthy underlying demand from corporate fleets, last-mile logistics, and commuter substitution offsets the post-pandemic inventory correction. Expansion of protected cycle networks, the five-year extension of anti-dumping duties on Chinese e-bikes, and battery technology upgrades collectively sustain pricing power and shield margins. Leasing models that convert large one-time purchases into predictable operating expenses accelerate penetration among employers, while localized EU manufacturing mitigates tariff risk and shortens lead times. Gradual regulatory alignment on speed-pedelecs, combined with solid-state micro-battery breakthroughs, is expected to widen the total addressable base for higher-performance models.

Europe E-Bike Market Trends and Insights

Corporate Bike-Leasing Boom

Tax-advantaged leasing turns e-bikes into employee benefits rather than discretionary buys. Payroll deductions cut effective outlay by 30-50% and open premium tiers without sticker shock. Fleets give OEMs volume visibility, enabling just-in-time production and lower inventory risk. Platforms like NAVIT unify cross-border HR rules, accelerating rollouts in France and the Netherlands under tight labor markets.

Purchase Subsidies and Tax Incentives

Generous national and municipal incentives compress effective prices and pull demand forward. France still grants up to EUR 4,000 (~USD 4,646) per unit, the Netherlands lets employers depreciate e-bike costs, and Belgium couples payroll credits with leases, slicing significant savings from sticker prices. Because renewals follow predictable cycles, manufacturers time production runs to subsidy windows, smoothing inventories and protecting mid-range volume tiers. These measures sustain growth.

High Upfront Cost vs Acoustic Bikes

Average prices are significantly higher, commanding a substantial premium over conventional bicycles. Even after a German price retreat, entry models rarely dip, while high battery replacements add lifetime expense. Eastern European households, with lower median wages, feel the gap most, slowing mainstream adoption despite better infrastructure. Financing helps, yet cultural resistance to consumer credit leaves many buyers waiting for price cuts or income growth.

Other drivers and restraints analyzed in the detailed report include:

- Growth of Last-Mile E-Cargo Fleets

- Protected Bicycle-Lane Expansion

- Dealer Inventory Write-Downs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The European e-bike market size for pedal-assist propulsion accounted for 77.35% share in 2025. Pedal-assist thrives on regulatory simplicity and a familiar ride feel, anchoring commuter and leisure volumes. Speed-pedelecs outpaced all categories at 3.88% CAGR, leveraging commuter appetite for 45 km/h capability and fleet demand for quicker deliveries.

Regulatory convergence remains the swing factor: draft EU proposals aiming to synchronize helmet and path-access rules could unlock scale manufacturing and lower unit costs. Riese & Muller's forthcoming Pinion-equipped models reflect OEM bets on premium speed-pedelec expansion . As insurance products mature and infrastructure adapts, the propulsion mix is likely to tilt gradually toward higher-power classes.

City/urban commuting generated 73.62% of the European e-bike market share in 2025, because e-bikes excel on sub-10 km trips where parking scarcity and congestion charges penalize cars. Cargo/utility formats, purpose-built with long racks or boxes, expand at a 3.84% CAGR as retailers, couriers, and young families replace second cars. Family cargo variants with dual-child seating broaden the appeal beyond couriers, substituting short car trips and capturing sustainability-minded parents. OEMs redesign frames for 200 kg payloads without exceeding 250 W legal limits, further blurring lines between personal and commercial use.

Trekking and mountain bikes command premium ASPs through rugged frames, dual batteries, and high-torque motors, but remain limited by discretionary budgets and seasonal weather. Municipal climate plans and last-mile contracts tilt R&D toward payload optimization, regenerative braking, and modular accessories that transform bikes from leisure gear into professional equipment.

Lithium-ion holds 99.86% of the European e-bike market share in 2025, anchoring market size through cost erosion and energy-density gains. Continuous chemistry tweaks, shift toward nickel-manganese-cobalt blends or LFP for cost stability, drive incremental 3.76% CAGR, mirroring total market.

Lead-acid survives only in replacement sales and ultra-budget imports. Pilot fleets with lithium-carbon or semi-solid packs promise 15-20% faster charging and better low-temperature resilience. Until solid-state gigafactories scale, incremental gains in housing design, BMS algorithms, and recycled-content cathodes will lengthen warranties and lift resale values, keeping lithium-ion unchallenged during the forecast window.

The Europe E-Bike Market Report is Segmented by Propulsion Type (Pedal Assisted, Speed Pedelec, and More), Application Type (Cargo/Utility, City/Urban, and More), Battery Type (Lead-Acid Battery, Lithium-Ion Battery, and More), Motor Placement (Hub (Front/Rear), Mid-Drive), Drive Systems, Motor Power, Price Band, Sales Channel, End Use, and Country. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- Accell Group

- Pon Holdings B.V.

- Giant Manufacturing Co. Ltd.

- Trek Bicycle Corporation

- Riese & Muller GmbH

- Brompton Bicycle Limited

- CUBE Bikes

- Yamaha Motor Co., Ltd.

- Merida Industry Co. Ltd.

- VanMoof BV

- Volt Electric Bikes

- Pedego Electric Bikes

- KTM Fahrrad GmbH

- Fritzmeier Systems GmbH & Co. KG (M1 Sporttechnik)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Executive Summary & Key Findings

2 Report Offers

3 Introduction

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 Key Industry Trends

- 4.1 Annual Bicycle Sales

- 4.2 Average Selling Price & Price-Band Mix

- 4.3 Cross-Border Trade in E-Bikes & Parts

- 4.4 E-Bike Share of Total Bicycle Sales

- 4.5 5-15 km Commuter Share

- 4.6 Bicycle/E-Bike Rental Market Size

- 4.7 E-Bike Battery Pack Price

- 4.8 Battery Chemistry Price Comparison

- 4.9 Last-Mile Delivery Volume

- 4.10 Protected Bicycle Lanes (km)

- 4.11 Trekking/Outdoor Activity Participation

- 4.12 E-Bike Battery Capacity (Wh)

- 4.13 Urban Traffic Congestion Index

- 4.14 Regulatory Framework

- 4.14.1 Homologation & Certification

- 4.14.2 Export-Import & Trade Rules

- 4.14.3 Classification & Road-Access Rules

- 4.14.4 Battery & Charger Safety

5 Market Landscape

- 5.1 Market Overview

- 5.2 Market Drivers

- 5.2.1 Corporate Bike-Leasing Boom

- 5.2.2 Purchase Subsidies and Tax Incentives

- 5.2.3 Growth of Last-Mile E-Cargo Fleets

- 5.2.4 Protected Bicycle-Lane Expansion

- 5.2.5 Regionalized EU Manufacturing Shift

- 5.2.6 Solid-State Micro-Battery Advances

- 5.3 Market Restraints

- 5.3.1 High Upfront Cost vs Acoustic Bikes

- 5.3.2 Dealer Inventory Write-Downs

- 5.3.3 Speed-Pedelec Regulatory Grey-Zones

- 5.3.4 Tariff Volatility on Chinese Inputs

- 5.4 Value / Supply-Chain Analysis

- 5.5 Regulatory Landscape

- 5.6 Technological Outlook

- 5.7 Porter's Five Forces

- 5.7.1 Threat of New Entrants

- 5.7.2 Bargaining Power of Suppliers

- 5.7.3 Bargaining Power of Buyers

- 5.7.4 Threat of Substitutes

- 5.7.5 Industry Rivalry

- 5.8 Pricing Analysis

6 Market Segmentation Analysis (Market Size & Growth Forecasts -Value (USD) and Volume (Units))

- 6.1 By Propulsion Type

- 6.1.1 Pedal Assisted

- 6.1.2 Speed Pedelec

- 6.1.3 Throttle Assisted

- 6.2 By Application Type

- 6.2.1 Cargo / Utility

- 6.2.2 City / Urban

- 6.2.3 Trekking / Mountain

- 6.3 By Battery Type

- 6.3.1 Lead-Acid Battery

- 6.3.2 Lithium-ion Battery

- 6.3.3 Others

- 6.4 By Motor Placement

- 6.4.1 Hub (Front / Rear)

- 6.4.2 Mid-Drive

- 6.5 By Drive Systems

- 6.5.1 Chain Drive

- 6.5.2 Belt Drive

- 6.6 By Motor Power

- 6.6.1 Below 250 W

- 6.6.2 251-350 W

- 6.6.3 351-500 W

- 6.6.4 501-600 W

- 6.6.5 Above 600 W

- 6.7 By Price Band

- 6.7.1 Less than/Equals USD 1,000

- 6.7.2 USD 1,000-1,499

- 6.7.3 USD 1,500-2,499

- 6.7.4 USD 2,500-3,499

- 6.7.5 USD 3,500-5,999

- 6.7.6 Greater than/Equals USD 6,000

- 6.8 By Sales Channel

- 6.8.1 Online

- 6.8.2 Offline

- 6.9 By End Use

- 6.9.1 Commercial Delivery

- 6.9.1.1 Retail and Goods Delivery

- 6.9.1.2 Food and Beverage Delivery

- 6.9.2 Service Providers

- 6.9.3 Personal and Family Use

- 6.9.4 Institutional

- 6.9.5 Others

- 6.9.1 Commercial Delivery

- 6.10 By Country

- 6.10.1 Germany

- 6.10.2 Netherlands

- 6.10.3 France

- 6.10.4 Italy

- 6.10.5 Spain

- 6.10.6 United Kingdom

- 6.10.7 Switzerland

- 6.10.8 Austria

- 6.10.9 Belgium

- 6.10.10 Denmark

- 6.10.11 Sweden

- 6.10.12 Norway

- 6.10.13 Poland

- 6.10.14 Czech Republic

- 6.10.15 Portugal

- 6.10.16 Rest of Europe

7 Competitive Landscape

- 7.1 Key Strategic Moves

- 7.2 Market Share Analysis

- 7.3 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 7.3.1 Accell Group

- 7.3.2 Pon Holdings B.V.

- 7.3.3 Giant Manufacturing Co. Ltd.

- 7.3.4 Trek Bicycle Corporation

- 7.3.5 Riese & Muller GmbH

- 7.3.6 Brompton Bicycle Limited

- 7.3.7 CUBE Bikes

- 7.3.8 Yamaha Motor Co., Ltd.

- 7.3.9 Merida Industry Co. Ltd.

- 7.3.10 VanMoof BV

- 7.3.11 Volt Electric Bikes

- 7.3.12 Pedego Electric Bikes

- 7.3.13 KTM Fahrrad GmbH

- 7.3.14 Fritzmeier Systems GmbH & Co. KG (M1 Sporttechnik)