|

市场调查报告书

商品编码

1683806

铝回收-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Aluminum Recycling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

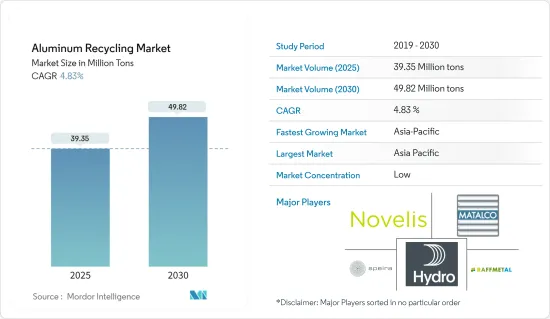

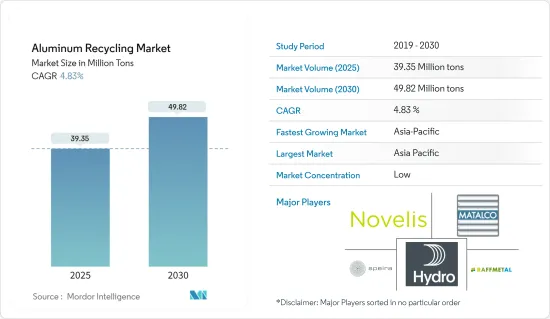

预计2025年铝回收市场规模为3,935万吨,预计2030年将达到4,982万吨,预测期内(2025-2030年)的复合年增长率为4.83%。

新冠疫情对铝回收市场产生了重大影响。建筑业是铝的主要消耗行业,因住宅房地产限製而受到的打击尤其严重,导致住宅登记停止和房屋抵押贷款偿还延迟。然而,自从限制解除以来,该行业已经恢復良好。由于各终端用户产业消费增加,铝市场在 2021-22 年显着復苏。

主要亮点

- 短期内,汽车和建设产业对再生铝的使用不断增长预计将推动市场需求。

- 相反,铁等不良杂质的存在可能会阻碍市场成长。

- 电动车产业的成长和对减少碳足迹的日益关注可能为市场提供新的成长机会。

- 预计亚太地区将主导市场,并在预测期内以最高的复合年增长率成长。

铝回收市场趋势

建筑和建设产业的需求不断增加

- 铝是建设产业中第二大广泛使用的金属。建筑中使用的铝约60%是由回收材料製成的。

- 回收的铝铸造合金、挤压材和其他产品可用于浮动天花板、窗户、门、楼梯、墙板、屋顶瓦片和各种其他应用。

- 使用再生铝还能带来显着的能源效益。重新熔化废铝所需的能量仅为生产原生金属所需能量的 5%。因此,铝不但不会加剧社会日益严重的废弃物问题,反而可以透过重新熔化和重新加工来生产新一代建筑零件。

- 再生铝产品/再生铝产品广泛用于建筑建筑幕墙、帷幕墙、屋顶、覆层、遮阳棚、太阳能板、扶手、楼梯、架子和其他临时结构。它也用于高层建筑、高层建筑和桥樑的建设。

- 根据牛津经济研究院的报告,到2030年,全球建筑业产出预计将在亚太地区成长最快,约40%,其次是北美,约16%。

- 全球建设活动的活性化是推动近期研究的市场发展的关键因素之一。尤其是亚太地区、北美和中东地区的建设产业呈现正成长率。因此,预测期内铝回收市场的需求可能会增加。

- 在亚太地区,中国正在经历建筑热潮。从全球来看,中国是最重要的建筑市场,占全球建筑投资的20%左右。预计到 2030 年,光是中国在建设上就将投入约 13 兆美元。

- 建筑业是印度第二大行业。 2022年的成长率为10.7%。到预测期结束时,印度建筑业很可能成为世界第三大市场,规模约 1 兆美元。

- 根据加拿大建筑协会的资料,建筑业是加拿大最大的雇主之一,也是加拿大经济成功的主要贡献者。该行业对该国内生产总值(GDP) 贡献了 7%。

- 作为「投资加拿大」计画的一部分,加拿大政府宣布计画在2028年在该国关键基础建设上投资约1,400亿美元。 2019-2020年,政府预计将核准在全国新的基础设施计划中投资56亿美元。

- 沙乌地阿拉伯「2030愿景」和国家转型计画(NTP)的公布,带动了教育、医疗等各个领域的投资增加,以支持该国的经济成长。沙乌地阿拉伯政府对该国社会基础设施的发展有广泛的规划。政府和私人对该国各个领域的投资可能会导致商业建筑建设活动的增加。

- 因此,由于上述因素,预测期内再生铝的需求将受到正面影响。

亚太地区占市场主导地位

- 预计预测期内亚太地区将成为再生铝最大的成长市场。中国、印度和日本等国家在电子、汽车、建筑、航太和国防等产业正在经历成长。

- 中国自 1970 年代起就开始在国内进行铝回收。此外,近年来我们也着重在铝的二次利用。为此,中国计划在2030年将原生铝冶炼产能限制在4,500万吨左右。

- 根据国际贸易管理局(ITA)的资料,中国无论按年销售量或产量来看,仍是全球最大的汽车市场。预计2025年国内产量将达近3,500万辆。为因应新冠疫情,中国政府正在刺激汽车消费。中国占全球新电动车销量的一半以上(58%)。根据国际能源总署(IEA)预测,2022年全国新电动车销量将达590万辆,较2021年成长80%以上。

- 根据国际贸易组织的报告,中国是全球最大的建筑市场,都市化居世界最高。根据美国建筑师协会(AIA)上海分会的资料,到2025年,中国自1990年代以来将建造一座相当于10个纽约规模的城市。

- 据印度品牌股权基金会(IBEF)称,民航业是近年来印度成长最快的产业之一。印度航空业预计将受到冠状病毒的影响,因为2023年(2022年4月至12月)的空中交通量预计为2.3671亿,而去年同期为1.3161亿。此外,2023 年 6 月,印度航空与空中巴士和波音签署协议,购买 470 架飞机,价值约 700 亿美元。

- 日本的家电产业是世界领先的产业之一。日本在电脑、游戏机、行动电话和其他关键零件的生产方面处于世界领先地位。此外,家用电器约占日本经济产出的三分之一。由于来自印度、中国和韩国等国家的激烈竞争,日本的整体电子产品产量正在下降。

- 根据日本电子情报技术产业协会(JEITA)统计,2023年1月日本消费性电子产品产值为234.25亿日圆(约1.65亿美元),较去年同期大幅成长79.8%。同时,2023年1月电子设备产值达到2,903.09亿日圆(20.42亿美元),年增89.6%。

- 因此,上述因素可能会在预测期内影响所研究市场的需求。

铝回收业概况

铝回收市场比较分散。主要参与者包括 Novelis Inc.、Speira GmbH、Norsk Hydro ASA、Matalco Inc. 和 Raffmetal(不分先后顺序)。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 扩大再生铝在建设产业的使用

- 汽车产业对再生铝的需求不断增加

- 限制因素

- 存在铁等不良杂质

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔

- 产品类型

- 铸造合金

- 挤压

- 床单

- 其他产品类型

- 最终用户产业

- 车

- 航太和国防

- 建筑和施工

- 电气和电子

- 包装

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 土耳其

- 俄罗斯

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 卡达

- 阿拉伯聯合大公国

- 奈及利亚

- 埃及

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率排名分析

- 主要企业策略

- 公司简介

- Alcoa Corporation

- Amag Austria Metall AG

- Constellium

- Kuusakoski OY

- Matalco Inc.

- Norsk Hydro Asa

- Novelis

- Raffmetal Spa

- Real Alloy

- Speira Gmbh

- Stena Metall AB

- Ye Chiu Group

第七章 市场机会与未来趋势

- 电动车领域的成长

- 越来越重视减少碳足迹

The Aluminum Recycling Market size is estimated at 39.35 million tons in 2025, and is expected to reach 49.82 million tons by 2030, at a CAGR of 4.83% during the forecast period (2025-2030).

The COVID-19 pandemic had a substantial impact on the aluminum recycling market. Building and construction, a major sink for aluminum, was badly hit, especially due to curtailment in residential real estate resulting in the suspension of home registrations and slow home loan disbursements. However, the sector has been recovering well since restrictions were lifted. The aluminum market recovered significantly in the 2021-22 period, owing to rising consumption from various end-user industries.

Key Highlights

- Over the short term, the growing utilization of recycled aluminum in the automotive and construction industry is expected to drive demand for the market.

- On the contrary, the presence of undesirable impurities like iron is likely to hamper the market's growth.

- Growth in the electric vehicles segment and growing focus on the reduction of carbon footprint are likely to provide new growth opportunities for the market.

- The Asia-Pacific region is expected to dominate the market and is also likely to witness the highest CAGR during the forecast period.

Aluminum Recycling Market Trends

Increasing Demand from the Building and Construction Industry

- Aluminum is the second most widely used metal in the building and construction industry. Around 60% of the aluminum used in the buildings consists of recycled material.

- Recycled aluminum casting alloys, extruded sheets, and other products were used in floating ceilings, windows, doors, stairs, wall panels, roof sheets, and a variety of other applications.

- The use of recycled aluminum also offers substantial energy benefits. Remelting used aluminum requires only 5 percent of the energy needed to produce primary metal. Thus, rather than contributing to society's growing waste problem, aluminum can be remelted and reformed to produce a new generation of building parts.

- Secondary aluminum/recycled aluminum products are extensively used in building facades, curtain walls, roofing and cladding, solar shading, solar panels, railings, staircases, shelves, and other temporary structures. They are also used in the construction of high-rise buildings, skyscrapers, and bridges.

- According to the Oxford Economics report, global construction output is expected to grow the most in the Asia-Pacific region by around 40% by 2030, followed by the North American region by nearly 16%.

- Increasing construction activity worldwide is one of the key factors driving the market studied in recent times. Asia-Pacific, North America, and the Middle East, among others, are witnessing a positive growth rate in the building and construction industry. Hence, the demand for the recycling aluminum market is likely to increase over the forecast period.

- In Asia-Pacific, China is amid a construction mega-boom. Globally, China has the most significant building market, making up around 20% of all construction investments across the world. The country alone is likely to spend about USD 13 trillion on buildings by 2030.

- The construction industry is the second-largest in India. It grew at 10.7% in 2022. By the end of the forecast period, India's construction industry may emerge as the third-largest market across the world, with a size of around USD 1 trillion.

- As per the Canadian Construction Association data, the construction sector is one of largest employers in Canada and a significant contributor to the country's economic success. The industry contributes to 7% of the country's GDP.

- As part of the 'Investing in Canada Plan,' the Canadian government has announced plans to invest around USD 140 billion for significant infrastructure developments in the country by 2028. In 2019-20, the government plans to approve investments valuing USD 5.6 billion for new infrastructure projects in the country.

- The announcement of Vision 2030 and the National Transformation Plan (NTP) in Saudi Arabia have increased investments in different sectors, such as education and healthcare, to support the economic growth of the country. The government has expansive plans for the development of social infrastructure in the country. Government and private investments in various sectors of the country are likely to lead to a rise in commercial building construction activities.

- Therefore, owing to the factors mentioned above, the demand for recycled aluminum will be positively impacted during the forecasted period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to be the largest growing market for recycled aluminum during the forecast period. Industries such as electronics, automotive, building and construction, aerospace and defense, etc., are growing in countries such as China, India, and Japan, among others.

- China has been recycling aluminum domestically since the 1970s. Additionally, It has increased its focus on secondary Aluminum in recent years. In this regard, It is planning to cap the primary aluminum smelting capacity at around 45 million tons by 2030.

- As per the International Trade Administration (ITA) data, China remains the largest auto market globally in annual sales and production. Domestic production is anticipated to reach nearly 35 million units by 2025. The Chinese government is boosting car consumption following the COVID-19 pandemic. China accounts for over half (58%) of all new electric vehicles sold worldwide. According to the International Energy Agency (IEA), 5.9 million new electric cars will be sold nationwide in 2022, an increase of more than 80% compared to 2021.

- According to the report of the International Trade Organization, China is the largest construction market across the world and has the highest rate of urbanization globally. According to data from the American Institute of Architects (AIA) Shanghai, by 2025, China will have built a city equivalent to 10 in New York since the 1990s.

- According to the Indian Brand Equity Foundation (IBEF), the civil aviation industry has become one of India's fastest-growing industries in recent years. The aviation industry in India is expected to be affected by the new coronavirus, as can be seen from the fact that the air traffic volume in 2023 (April to December 2022) was 236.71 million, compared to 131.61 million in the same period of the previous year. Furthermore, In June 2023, the Indian company Air India signed agreements with Airbus and Boeing to purchase 470 planes for an estimated cost of USD 70 billion.

- The consumer electronics industry in Japan is one of the world's leading industries. The country is a world leader in producing computers, gaming stations, cell phones, and other vital components. Further, consumer electronics account for around one-third of the Japanese economic output. Japan's overall electronics production has declined due to stiff competition from countries such as India, China, and South Korea.

- According to the Japanese Electronics and Information Technology Industries (JEITA), the production value of consumer electronic equipment in the country stood at JPY 23,425 million (USD 165 million) in January 2023, increasing by a significant 79.8% during the same period last year. Meanwhile, the production value of electronic devices stood at JPY 290,309 million (USD 2,042 million) in January 2023, increasing by 89.6% annually.

- Thus, the factors above will likely affect the market demand studied during the forecast period.

Aluminum Recycling Industry Overview

The aluminum recycling market is fragmented in nature. Some major players include Novelis Inc., Speira GmbH, Norsk Hydro ASA, Matalco Inc., and Raffmetal, among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Utilization of Recycled Aluminum in the Construction Industry

- 4.1.2 Growing Demand for Recycled Aluminum from the Automotive Industry

- 4.2 Restraints

- 4.2.1 Presence of Undesirable Impurities Like Iron

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Casting Alloys

- 5.1.2 Extrusion

- 5.1.3 Sheets

- 5.1.4 Other Product Types

- 5.2 End-user Industry

- 5.2.1 Automotive

- 5.2.2 Aerospace and Defense

- 5.2.3 Building and Construction

- 5.2.4 Electrical and Electronics

- 5.2.5 Packaging

- 5.2.6 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Nordic Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Qatar

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Nigeria

- 5.3.5.5 Egypt

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle-East and Africa

- 5.3.1 Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Alcoa Corporation

- 6.4.2 Amag Austria Metall AG

- 6.4.3 Constellium

- 6.4.4 Kuusakoski OY

- 6.4.5 Matalco Inc.

- 6.4.6 Norsk Hydro Asa

- 6.4.7 Novelis

- 6.4.8 Raffmetal Spa

- 6.4.9 Real Alloy

- 6.4.10 Speira Gmbh

- 6.4.11 Stena Metall AB

- 6.4.12 Ye Chiu Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growth in the Electric Vehicles Segment

- 7.2 Growing Focus on Reduction of Carbon Footprint