|

市场调查报告书

商品编码

1683808

北美二次包装:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)North America Secondary Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

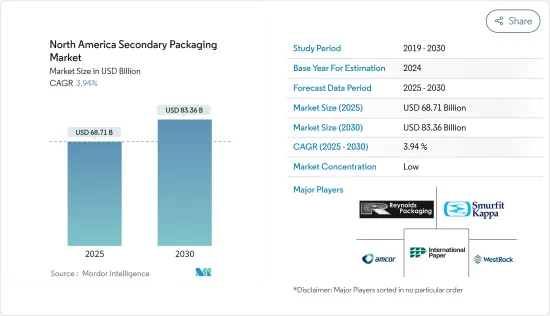

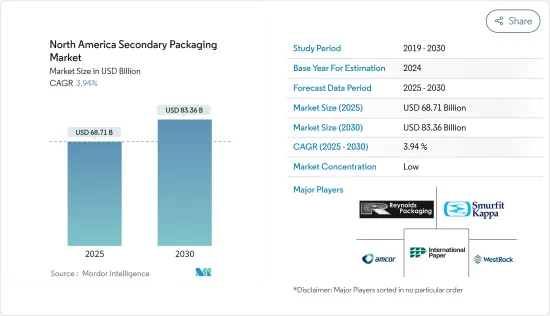

北美二次包装市场规模预计在 2025 年为 687.1 亿美元,预计到 2030 年将达到 833.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.94%。

美国和加拿大是庞大的消费市场,人口购买力强,对任何包装供应商来说都是利润丰厚的市场。因此,由于食品包装需求的不断增长、电子商务交易的持续成功以及包装运输安全的需求,北美二次包装市场预计在未来一年将实现成长。

主要亮点

- 包装中环保材料的使用越来越多地推动了北美二次包装市场的发展。可回收、生物分解性、可重复使用、无毒且对环境影响较小的包装被视为环保包装。最终用户(包括食品和饮料行业以及家庭护理产品製造商)对环保包装材料的需求越来越明显。折迭式纸盒和瓦楞纸箱等包装形式不会对环境产生负面影响,因为它们是由纸板等可回收和生物分解的材料製成的。

- 由于人们的生活方式忙碌,对方便食品的需求日益增加。由于瓦楞包装可以防止产品受潮并能承受长时间的运输,越来越多的企业采用瓦楞包装来为客户提供更好的效果,特别是在二次和三级包装中。麵包、肉品和其他生鲜产品等加工食品需要一次性使用这些包装材料,这就是它们需求量很大的原因。

- 由于纸板易于回收,而且纸浆和造纸行业已经擅长转换为新一代纸板,随着整个价值链对永续性的关注日益增加,纸板正成为一种越来越受欢迎的包装材料。这些优点使得纸板保护泡棉比发泡聚苯乙烯 (EPS) 等聚合物基替代品更受欢迎。

- 此外,宅配和信使收益的增长表明在将产品从一个地方运输到另一个地方时使用了纸板和折迭纸箱包装等二次包装。根据美国商务部统计,2021年美国宅配和信差营业收入近1,379.1亿美元。 UPS是美国最大的宅配和配送服务公司,控制着约40%的宅配市场。

- 虽然二次包装仍带来环境问题,但还有其他问题需要解决。在网上购物时,我们都经历过由于二次包装不良或不充分而收到有缺陷、不完整或错误的产品的麻烦和失望。然而,由于二次包装发生在一次包装之后,因此停机引起的任何问题都会影响其他生产线。生产和交货计划因停工而中断,增加了产品浪费,并将人事费用推回费用项目。理想情况下,生产计画将涉及透过提前规划来预测和减少停机。

北美二次包装市场的趋势

消费性电子产品强劲成长

- 电子产品製造商受到消费者主导的永续包装以及政府和立法压力的推动。这在美国尤其明显,美国正在考虑立法扩大生产者责任计画、限制一次性包装等议题。

- 折迭式纸箱和瓦楞纸箱等二次包装用于包装重物和小型电气元件。瓦楞纸箱用于包装家用电器、冰箱和暖通空调设备等消费品。除此之外,小型电器元件和配件(如电路断流器、胶带、灯泡等)也使用纸质材料作为二次包装。

- 根据美国消费科技协会统计,2015年至2022年,美国市场消费性电子产品(CE)零售额稳定成长。预测显示,2023年美国家电零售额预计将成长4,850亿美元。其中OLED电视销售额预计2023年将达23亿美元。

- 电子包装防伪措施的强劲需求正在推动北美市场的发展。包装采用条码、全像图、封箱胶带和无线射频识别设备等正面和背面技术来保护产品的完整性。新兴经济体电子商务的快速成长正使全球防伪电子产品包装产业受益。

- 此外,环保包装在电气设备中越来越普遍。政府和监管机构正在大力推动采用绿色包装。品牌和客户都开始意识到环保包装以及保护环境免受生物分解性包装废弃物的影响的重要性。

加拿大:预计将大幅成长

- 去年加拿大二次包装市场价值为 67.9 亿美元。瓦楞包装是保护和运输各种货物的经济的方式。瓦楞纸板的重量轻、生物分解性和可回收的特性使其成为包装业务的重要组成部分。希悦尔致力于在 2025 年实现其包装 100% 可回收或重复使用。该公司约 50% 的解决方案已采用可回收材料製成。

- 为了提高市场影响力和地位,加拿大供应商正致力于成长、伙伴关係和合作措施。同样,2022 年 12 月,Titan Corrugated 及其附属公司 All Boxed Up 被美国控股公司 UFP Industries 旗下的部门 UFP Packaging 收购。被收购的公司生产标准尺寸的产品并透过 All Boxed Up 在美国各地分销。

- 新兴国家的电子商务市场正在产生对纸板和纸製品的需求,尤其是来自运输和物流领域的参与者。纸质包装适应性强且价格实惠,已用于运输、保护和保存许多物品。

- 据Worldpay称,到2021年,行动电子商务将在加拿大创造超过280亿美元的收益,而桌面电子商务的收入则为530亿美元。他们进一步预测,到 2025 年,行动装置的金额将成长到 570 亿美元,桌上型电脑的数字将成长到 810 亿美元。预计这一增长将表明该国在指定时间内对瓦楞包装箱的需求将成比例增加。

- 加拿大的电子商务基础设施高度发达,与美国紧密结合。加拿大主要的线上零售商包括亚马逊、沃尔玛、加拿大轮胎、好市多、百思买、哈德逊湾和 Etsy。

- 加拿大消费者依赖网路订购。过去十年,网路消费销售额的成长速度超过了传统零售额。许多加拿大零售商正在采用无线技术和基于互联网的系统来改善企业对企业和企业对消费者的关係。

- 加拿大是网路普及程度最高的国家之一,在零售通路遭遇重大衝击的背景下,消费者也开始接受电子商务。根据 Ascential's Edge 的数据,2022 年加拿大零售连锁店的电子商务总销售额将达到 473 亿美元。到 2027 年,零售电子商务销售额预计将达到 739 亿美元。

北美二次包装产业概况

北美二级包装市场较为分散,主要参与者包括 Amcor PLC、国际纸业公司、雷诺包装、Westrock 公司和 Smurfit Kappa 集团。市场现有企业采取了强而有力的竞争策略,其特征是收购、伙伴关係活动、重视研发和创新活动。

- 2023 年 3 月:Amcor 和 Nfinite Nanotechnology Inc. 启动一项合作研究倡议,将 Nfinite 的奈米涂层技术应用于可回收和生物分解性的包装。

- 2022 年 6 月:Mondi 以 6.15 亿欧元(6.8117 亿美元)的企业价值出售 Nitto Denko 的个人护理组件业务 (PCC)。此次出售使 Mondi 能够合理化其持有并专注于扩大永续包装的策略目标。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 产业影响评估

第五章 市场动态

- 市场驱动因素

- 快速消费品产业需求不断成长

- 对安全性和追踪解决方案的需求不断增加

- 市场挑战

- 缺乏普遍标准、安全隐忧、缺乏对恶劣天气条件的抵抗力

第六章 市场细分

- 依产品类型

- 瓦楞纸箱

- 折迭式纸盒

- 塑胶盒

- 包装和薄膜

- 其他产品类型

- 按最终用户产业

- 食物

- 饮料

- 卫生保健

- 家电

- 个人护理及家居产品

- 其他最终用户产业

- 按国家

- 美国

- 加拿大

第七章 竞争格局

- 公司简介

- Amcor PLC

- International Paper Company

- Reynolds Packaging

- WestRock Company

- Smurfit Kappa Group

- Berry Global Group Inc.

- Packaging Corporation of America

- Deufol SE

- Mondi PLC

- Tranpak Inc.

第八章投资分析

第九章:市场的未来

The North America Secondary Packaging Market size is estimated at USD 68.71 billion in 2025, and is expected to reach USD 83.36 billion by 2030, at a CAGR of 3.94% during the forecast period (2025-2030).

The United States and Canada are massive consumer markets, and the population's considerable buying power makes it a lucrative market for all package suppliers. As a result, the North American secondary packaging market is anticipated to grow over the upcoming year due to the growing demand for food packaging, a string of successful e-commerce transactions, and the demand for safety in packaging transportation.

Key Highlights

- The rising use of environment-friendly materials in packaging is driving the secondary packaging market in North America. Packaging that is recyclable, biodegradable, reusable, non-toxic, and has a minimal environmental impact is considered eco-friendly. The need for environment-friendly packaging materials is becoming increasingly apparent to end users, including the food and beverage industry and manufacturers of household care products. Packaging formats like folding cartons and corrugated boxes have no adverse effects on the environment because they are constructed of recyclable and biodegradable materials, such as paperboard.

- The demand for convenience foods is on the rise due to the busy lifestyle of people. As corrugated board packaging keeps moisture from the products and withstands long shipping times, companies are increasingly adopting it to offer customers better outcomes, especially secondary or tertiary packaging. Processed foods, such as bread, meat products, and other perishable items, need these packaging materials to be used once, thereby driving the demand.

- Since the corrugated board is easy to recycle and the pulp and paper industry is already skilled at converting it into new generations of containerboard, it is becoming increasingly common in packaging as sustainability concerns become more relevant across the value chain. Due to these benefits, corrugated protective forms have gained popularity over polymer-based substitutes, such as expanded polystyrene (EPS) foams.

- Additionally, increasing courier and messengers' revenue indicates the use of secondary packagings, such as corrugated boards and folding cartons packaging, in transiting the products from one place to another. According to the US Department of Commerce, in 2021, the US couriers and messengers generated almost USD 137.91 billion in operating revenue. UPS is the largest courier and delivery service provider in the United States, with around 40% of the courier market.

- Secondary packaging still raises environmental questions, but there are also other challenges to solve. In online purchasing, all have encountered the bother and disappointment of receiving a flawed, incomplete, or inaccurate product due to subpar or insufficient secondary packaging. However, since secondary packaging comes after primary packaging, any issues resulting from a stoppage impact the rest of the production line. Production and delivery plans are disrupted by downtime, which also increases product waste and brings labor expenses back into the expense column. Production planning should ideally include anticipating and reducing stoppages through advanced planning.

North America Secondary Packaging Market Trends

Consumer Electronics to Witness Significant Growth

- Consumer electronics firms are being pushed by government and legislation in addition to consumer-driven sustainable packaging. This is notably true in the United States, where legislation for expanded producer responsibility programs, single-use packaging limitations, and other issues is being examined.

- Secondary packaging, such as folding cartons and corrugate boxes, is used for heavy and small electrical component packaging. Corrugated boxes pack consumer products, such as home appliances, refrigerators, HVAC units, etc. Apart from these, smaller electrical components and accessories, such as circuit breakers, tapes, light bulbs, etc., also use paper-based materials for secondary packaging.

- According to Consumer Technology Association, the retail sales of consumer electronics (CE) in the US market increased steadily from 2015 to 2022. According to forecasts, retail sales of consumer electronics are expected to grow by USD 485 billion in the United States in 2023. Revenue from OLED Televisions is expected to reach USD 2.3 billion in 2023.

- A strong need for anti-counterfeiting in electronics packaging drives the North American market. The packaging uses overt and covert technology, such as barcodes, holograms, sealing tapes, and radiofrequency identifying devices, to protect the integrity of items. The rapid growth of e-commerce in emerging economies has benefited the worldwide anti-counterfeit electronics packaging industry.

- Furthermore, environmental-friendly packaging is becoming popular for electrical devices. Government authorities and regulators have made a strong push for the adoption of green packaging. Both brands and customers are becoming more aware of environmentally friendly packaging and the importance of safeguarding the environment from non-biodegradable packaging trash.

Canada Expected to Witness Significant Growth

- The Canadian secondary packaging market was valued at USD 6.79 billion the year before. Corrugated board packaging is an economical way to safeguard and transport various goods. The corrugated board's qualities, such as light weightiness, biodegradability, and recyclability, have made it a vital component in the packaging business. Sealed Air will focus on creating 100% recyclable or reused packaging by 2025. Around 50% of its solutions have already been made with recycled material.

- To improve their presence and position in the market, vendors in Canada have focused on growth, partnership, and collaboration initiatives. Similarly, in December 2022, Titan Corrugated and its associate All Boxed Up were acquired by UFP Packaging, a branch of UFP Industries, a US-based holding firm. The acquired company manufacture standard-sized distributed across the United States via All Boxed Up.

- The country's developing e-commerce market generates demand for corrugated and paper goods, notably from players in the transportation and logistics sectors. Paper-based packaging, which is adaptable and affordable, has been used to carry, protect, and preserve many items.

- According to Worldpay, mobile e-commerce earned over USD 28 billion in Canada in 2021, compared to USD 53 billion from desktop e-commerce. Additionally, it predicts that these amounts will rise to USD 57 billion and USD 81 billion in mobile and desktop sales by 2025. This growth is anticipated to show a proportionate rise in the nation's demand for corrugated packing boxes within the specified time frame.

- Canada's e-commerce infrastructure is highly developed and closely integrated with the United States. The major online retailers in Canada include Amazon, Wal-Mart, Canadian Tire, Costco, Best Buy, Hudson's Bay, and Etsy.

- Canadian consumers rely upon the internet to place orders. Internet consumer sales have risen more in the past decade than traditional retail sales. Most Canadian retail firms have adopted wireless technologies and internet-based systems to improve business-to-business and business-to-consumer relations.

- As Canada is one of the heaviest internet users, consumers have embraced electronic commerce amid a significant disruption in retail channels. According to Edge by Ascential, retail chain e-commerce gross sales in Canada accounted for USD 47.3 billion in 2022. Retail e-commerce sales are estimated to total USD 73.9 billion by 2027.

North America Secondary Packaging Industry Overview

The North American secondary packaging market is fragmented, with the presence of major players like Amcor PLC, International Paper Company, Reynolds Packaging, Westrock Company, and Smurfit Kappa Group. The market incumbents are adopting powerful competitive strategies characterized by acquisitions, partnerships activities, a strong emphasis on R&D, and innovative activities.

- March 2023: Amcor and Nfinite Nanotechnology Inc. launched a collaborative research initiative to test the application of Nfinite's nanocoating technology to improve recyclable and biodegradable packaging.

- June 2022: Mondi sold Nitto Denko Corporation its Personal Care Components business (PCC) for an enterprise value of EUR 615 million (USD 681.17 million). The sale allowed Mondi to streamline its holdings and concentrate on its strategic goal of expanding in sustainable packaging.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Defnition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Demand in FMCG Industries

- 5.1.2 Increased Demand for Security and Tracking Solutions

- 5.2 Market Challenges

- 5.2.1 Lack of Ubiquitous Standards, Safety Concerns, and Inability to Withstand Harsh Climatic Conditions

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Corrugated Boxes

- 6.1.2 Folding Cartons

- 6.1.3 Plastic Crates

- 6.1.4 Wraps and Films

- 6.1.5 Other Product Types

- 6.2 By End-user Industry

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.3 Healthcare

- 6.2.4 Consumer Electronics

- 6.2.5 Personal Care and Household Care

- 6.2.6 Other End-user Industries

- 6.3 By Country

- 6.3.1 United States

- 6.3.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor PLC

- 7.1.2 International Paper Company

- 7.1.3 Reynolds Packaging

- 7.1.4 WestRock Company

- 7.1.5 Smurfit Kappa Group

- 7.1.6 Berry Global Group Inc.

- 7.1.7 Packaging Corporation of America

- 7.1.8 Deufol SE

- 7.1.9 Mondi PLC

- 7.1.10 Tranpak Inc.