|

市场调查报告书

商品编码

1683859

印度车床产业:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)India Lathe Machines Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

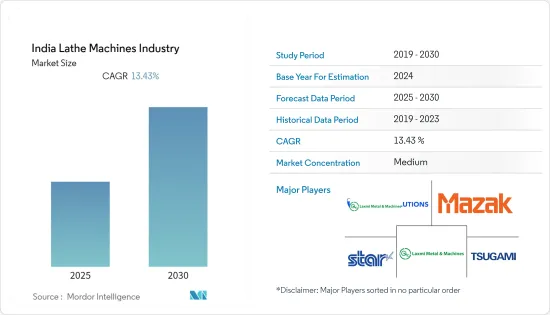

预计预测期内印度车床产业复合年增长率将达到 13.43%。

製造业对技术先进的车床的需求不断增长,推动了市场成长。

主要亮点

- 近年来,电动车、家用电器等需求激增,带动各产业对先进工具机的需求。随着全球製造业的不断增长,对瑞士型自动车床等工具机生产成品的需求也不断增加。随着製造流程变得越来越复杂,对精度和准确度更高的高阶工具机的需求也随之增加。

- 瑞士型车床通常比传统车床更灵活、更有效率、更精确。瑞士型车床的首次使用是为了生产手錶零件。如今,瑞士型车床广泛应用于国防、医疗设备、航太、电子等产业。瑞士型自动车床生产液压阀门零件、医疗植入、微型电子连接器、手錶零件、轴和乐器支架。

- 工具机产业正受到自动化、人工智慧和机器人等新技术的严重影响。这些新技术提高了生产力、提高了精度、降低了人事费用,工具机在许多终端用户行业中得到了更广泛的应用。例如,印度是一个热衷于采用机器人解决方案的国家。

- 根据国际机器人联合会 (IFR) 的数据,2021 年印度工业机器人销售达到了前所未有的里程碑,安装量达到了惊人的 4,945 台。与 2020 年安装的 3,215 台相比,这一数字大幅增加了 54%。这些因素正在为该地区的主要供应商带来商机。

- 自动车床广泛应用于汽车、家电、医疗保健、IT/通讯、航太/国防等多个行业,而引入自动车床需要大量的前期投资。这限制了车床市场的成长。

印度车床产业趋势

製造业的技术进步预计将推动市场

- 印度製造业为该国的经济成长做出了贡献,创造了就业机会和GDP成长。然而,要想在瑞士型自动车床市场上成功竞争,印度製造商必须采用最新的技术和工艺。

- 工业 4.0 时代正在彻底改变 CNC 机械车间的日常业务。借助所有可用的智慧技术和内建软体,更快的周转和更少的停机时间可提高效率。此外,CNC工具机还可以降低营业成本、提高效率并减少零件错误,从而促进製造业的发展。工业4.0标誌着印度製造业的转捩点。

- 印度等新兴市场製造业的数位转型正在加速。后疫情时代,全球製造业尤其是印度製造业正在拥抱新一代自动化和以软体为基础的技术。

- 物联网、人工智慧、区块链显着提高了製造业和工业发展的生产力。多种最尖端科技支援端到端自动化、分析和即时决策,将手动製造单位转变为智慧工厂。

- 政府在该国物联网的应用中发挥关键作用。物联网将透过引入创新方式来维持製造组织的永续,从而极大地造福「印度製造」宣传活动。物联网 (IoT) 允许CNC车床操作员和机器操作员透过智慧型手机和平板电脑与他们的机器互动。基于物联网的 CNC 机器追踪允许 CNC 操作员随时远端监控其机器的状态。

- 物联网系统和即时警报可以帮助工厂减少机器停机时间并提高整体设施效率。机器对机器警报有助于防止工具或CNC工具机的任何零件意外发生故障。除了减少工厂的伤害之外,物联网技术还可以减少材料浪费并提高CNC工具机的生产率,从而在更短的时间内生产出更精确的零件。

汽车产业是快速成长的终端用户

- 电动车技术的重大进步和连结性的增强正在刺激印度汽车产业的销售。此外,印度政府于 2016 年推出了新的排放标准,使印度成为第一个实施 BS-VI 排放标准的国家。印度完全跳过了 BS-V,而是从更高的标准开始。短短四年间,印度透过使其燃料和车辆符合 BS-VI 标准,将挑战转化为机会。 BS-VI 标准与报废计划相结合可以改善空气品质并增强印度人的健康。

- 据印度汽车工业协会(SIAM)称,印度是世界上最大的汽车生产国之一。 2010财年汽车产量为2,293万辆,与前一年同期比较成长1%。在印度,两轮车是最受欢迎的车辆类型,占国内市场销售车辆的大多数。

- 受国内汽车市场对高价值零件需求不断增长的推动,印度汽车零件产业预计将在 2022-23 年创下 697 亿美元的创纪录销售收入。 2023 财年,汽车零件製造商对OEM 的销售额成长了 33%。印度正在成为汽车零件采购的全球中心。

- 公司拥有多家生产厂家,在轴、轴承、紧固件等汽车零件方面具有竞争优势。据IBEF称,印度汽车零件出口预计将成长,并在26财年达到300亿美元。由于这些因素,预计印度对瑞士製造的自动车床的需求庞大。

- 汽车轴和车轴作为动力传动系统传动系统的关键部件正受到越来越多的关注。客户对混合动力汽车和电动车的需求不断增长以及先进技术在汽车中的整合正在推动需求。同样,加强执行印度第六阶段排放标准、倾向于缩小引擎尺寸和减轻车辆重量,也有望对燃油喷射系统的成长产生积极影响,从而支持所研究市场的成长。

- ECASS(电子控制主动悬吊系统)由于其运动部件更少、反应时间更快,因此得到越来越多的采用,从而产生了对悬吊部件的需求。

印度车床产业概况

印度车床市场半固体,主要企业包括 Tsugami Corporation、Mazak Corporation、Star Micronics、DN Solutions 和 Laxmi Metal &Machines。市场参与者正在采取联盟和收购等策略来加强其产品供应并获得永续的竞争优势。

- 2023年9月,Star Micronics宣布开发CNC瑞士型自动车床“SP-20/23”,可支援汽车、液压气压机械等多种产业的零件加工。预计年内发布。

- 2023年3月,Yamazaki Mazak马扎克株式会社宣布,将于2023年在印度马哈拉施特拉邦普纳建设製造工厂(名为Yamazaki Mazak Machine Tools 马哈拉斯特拉邦 Limited),新工厂将开始生产在日本开发设计的面向印度国内市场的立式加工中心。加上这家新工厂,该公司现在总合有 11 个生产基地,其中 5 个在日本,6 个在海外。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 分析师说明

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响

第五章 市场动态

- 市场驱动因素

- 製造业的技术进步

- 印度智慧工厂的成长

- 市场挑战

- 初期投资高

第六章 关键绩效指标分析

- 汽车产业分析

- 电动车普及及需求分析

- 5G产业分析

- 医疗设备产业分析

- 半导体产业分析

第七章银行业与监理环境

第 8 章 消费者偏好—国产与进口

第九章市场区隔

- 按最终用户产业

- 车

- 航太和国防

- 一般製造业

- 金属工业

- 其他最终用户产业

第十章 竞争格局

- 供应商排名分析

- 瑞士型自动车床供应商排名 - 2022 年

- 瑞士型自动车床供应商排名 - 2021 年

- 瑞士型自动车床供应商排名 - 2020 年

- 公司简介

- Tsugami Corporation

- Mazak Corporation

- Star Micronics Co. Ltd

- DN Solutions

- Laxmi Metal & Machines

- Arrow Machine Tools

- Tornos Group

- Citizen Machinery Co. Ltd

- Galaxy-Tajmac

第十一章 各地区最低工资分析

第十二章 市场展望

The India Lathe Machines Industry is expected to register a CAGR of 13.43% during the forecast period.

The growing demand for advanced technology-enabled lathe machines in the manufacturing industry drives market growth.

Key Highlights

- The need for electric vehicles and consumer electronics has skyrocketed in recent years, which created demand for advanced machine tools across the industry. As the world's manufacturing industry continues to grow, so does the need for machine tools such as the Swiss Type Automatic Lathe Machine to manufacture finished products. As manufacturing processes become more advanced, the need for high-end machine tools with greater accuracy and precision increases.

- Swiss-type lathes are typically more flexible, productive, and accurate than traditional lathes. The first use of Swiss-type machines was in the production of watch parts. Today, Swiss-type machines are used by companies in defense, medical devices, aerospace, electronics, and other industries. Swiss-type automatic lathes produce hydraulic valve parts, medical implants, miniature electronic connectors, watch parts, shafts, musical instrument posts, and more.

- The machine tools industry has been significantly impacted by the emergence of new technologies, including automation, AI, and robotics. These new technologies have improved productivity, increased precision, and decreased labor costs, making machine tools more widely used in many end-user industries. For instance, India stands out as a nation committed to embracing robotic solutions.

- According to the International Federation of Robotics (IFR), the sales of industrial robots in India achieved an unprecedented milestone in 2021, with a staggering installation of 4,945 units. This represents a remarkable 54% growth compared to 2020, which witnessed the installation of 3,215 units. Such factors are driving opportunities for key vendors in the region.

- A significantly high initial investment is required to deploy automatic lathe machines in manufacturing facilities as required by different industries such as automotive, consumer electronics, healthcare, IT and telecommunication, and aerospace and defense. This is restricting the growth of the lathe machine market.

India Lathe Machines Industry Trends

Technological Advancements in the Manufacturing Industry are Expected to Drive the Market

- The Indian manufacturing industry has contributed to the country's economic growth, providing employment and GDP growth. However, to stay ahead of the competition in the Swiss-type automatic lathe machine market, Indian manufacturers must adopt modern technology and processes.

- The Industry 4.0 era is revolutionizing the day-to-day operations of CNC machine shops. With all the available intelligent technologies and embedded software, faster turnarounds and reduced downtimes increase efficiency. Further, CNC machines boost manufacturing by reducing operating costs, improving efficiency, and reducing component errors. Industry 4.0 is at a turning point in Indian manufacturing.

- Digital transformation in manufacturing has been accelerating in emerging markets such as India. In the post-pandemic era, the manufacturing industry worldwide, particularly in India, has adopted a new generation of technology based on automation and software.

- IoT, AI, and Blockchain have significantly increased manufacturing and industrial development productivity. Several cutting-edge technologies support end-to-end automation, analytics, and real-time decision-making and have transformed manual manufacturing units into intelligent factories.

- The government plays a vital role in implementing IoT in the country. IoT immensely benefits the Make in India campaign by introducing innovative ways to sustain manufacturing organizations' sustainable development. The Internet of Things (IoT) enables CNC lathe machine operators and machine handlers to interact with their machines via smartphones or tablet devices. With IoT-based CNC machine tracking, CNC operators can monitor the status of their machines remotely at any time.

- With the help of IoT systems and the real-time alert function, factories can reduce machine downtime and improve overall equipment efficiency. Machine-to-machine alerts can prevent the accidental failures of tools or any part of a CNC machine. Besides reducing workshop injuries, IoT technology reduces material waste and increases CNC machine productivity, resulting in more accurate parts being manufactured in less time.

Automotive Industry to be the Fastest Growing End User

- Major technological advancements in electric vehicles and increased connectivity fuel auto industry sales in India. In addition, new emissions standards were implemented by the Government of India in 2016, the first country to implement BS-VI emissions standards. India skipped BS-V entirely and started with a higher level of standards. In just four years, India faced a challenge and turned it into an opportunity by making its fuel and vehicles compliant with BS-VI. When combined with the scrappage scheme, BS-VI standards could improve air quality and the health of the people of India.

- According to the Society of Indian Automobile Manufacturers (SIAM), India has one of the highest vehicle production in the world. In FY22, the total vehicle production in India stood at 22.93 million units, registering a year-on-year (YoY) growth of 1%. In India, two-wheelers are the most popular type of vehicle manufactured and account for the majority of vehicles sold on the domestic market.

- The Indian automotive components sector witnessed a record turnover of USD 69.7 billion in 2022-23, driven by increased demand for high-value-added components for the domestic automotive market. The sales of automotive parts suppliers to OEMs increased by 33% in FY 23. India is emerging as a global hub for automotive component sourcing.

- The country has a competitive advantage in auto components such as shafts, bearings, and fasteners due to the presence of several manufacturers. According to IBEF, India's auto component exports are projected to grow and reach USD 30 billion in FY 2026. This factor is expected to create significant demand for Swiss automatic lathe machines in India.

- Automotive shafts and axles are gaining traction as they serve as the backbone of the powertrain systems. The demand is accelerated due to the growing customer demand for hybrid and electric vehicles and the integration of advanced technologies in automobiles. Similarly, the rise in implementation of emissions rules such as Bharat Stage VI and an increase in preference for engine downsizing and vehicle weight reduction is anticipated to positively impact fuel injector growth, which supports the growth of the market studied.

- The rise in adoption of ECASS (Electronically Controlled Active Suspension System) due to its fewer moving parts and shorter reaction time creates demand for suspension components, which is expected to increase the demand for advanced Swiss automatic lathe machines.

India Lathe Machines Industry Overview

The Indian lathe machines market is Semi-Consolidated, with the presence of major players like Tsugami Corporation, Mazak Corporation, Star Micronics Co. Ltd, DN Solutions, and Laxmi Metal & Machines. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- September 2023: Star Micronics announced the development of SP-20/23, a CNC Swiss-type automatic lathe capable of supporting parts machining in various industries, including automobiles, hydraulic/pneumatic equipment, and general machinery. This product is expected to be launched by the end of this year.

- March 2023: The Yamazaki Mazak Corporation announced the building of a manufacturing plant (name: Yamazaki Mazak Machine Tools Private Limited) in Pune, Maharashtra, India, in 2023. This new manufacturing setup will start producing a new vertical machining center developed and designed in Japan for the Indian domestic market. Therefore, with this new plant, the company will have 11 production bases, five in Japan and six overseas.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.1.1 Analyst's Commentary

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyer

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Technological Advancements in the Manufacturing Industry

- 5.1.2 Growing Smart Factories in India

- 5.2 Market Challenges

- 5.2.1 High Initial Investments

6 KEY PERFORMANCE INDICATOR ANALYSIS

- 6.1 Automotive Industry Analysis

- 6.2 EV Penetration and Demand Analysis

- 6.3 5G Industry Analysis

- 6.4 Medical Device Industry

- 6.5 Semiconductor Industry Analysis

7 BANKING AND REGULATORY LANDSCAPE

8 CONSUMER PREFERENCES - DOMESTIC VS. IMPORTS

9 MARKET SEGMENTATION

- 9.1 By End-user Industry

- 9.1.1 Automotive

- 9.1.2 Aerospace and Defense

- 9.1.3 General Manufacturing

- 9.1.4 Metal Industry

- 9.1.5 Other End-user Industries

10 COMPETITIVE LANDSCAPE

- 10.1 Vendor Ranking Analysis

- 10.1.1 Swiss-type Automatic Lathe Machine Vendor Ranking - 2022

- 10.1.2 Swiss-type Automatic Lathe Machine Vendor Ranking - 2021

- 10.1.3 Swiss-type Automatic Lathe Machine Vendor Ranking - 2020

- 10.2 Company Profiles

- 10.2.1 Tsugami Corporation

- 10.2.2 Mazak Corporation

- 10.2.3 Star Micronics Co. Ltd

- 10.2.4 DN Solutions

- 10.2.5 Laxmi Metal & Machines

- 10.2.6 Arrow Machine Tools

- 10.2.7 Tornos Group

- 10.2.8 Citizen Machinery Co. Ltd

- 10.2.9 Galaxy-Tajmac