|

市场调查报告书

商品编码

1683862

亚太地区 NMC 电池组市场占有率分析、产业趋势与统计、成长预测(2025-2029 年)Asia-Pacific NMC Battery Pack - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

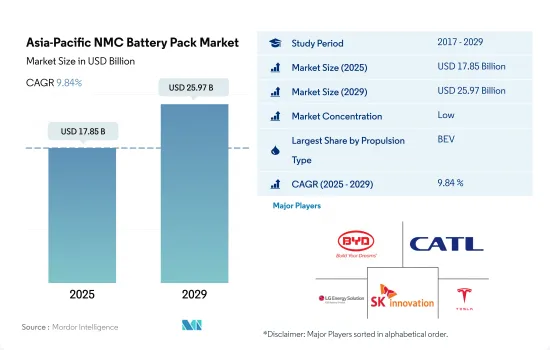

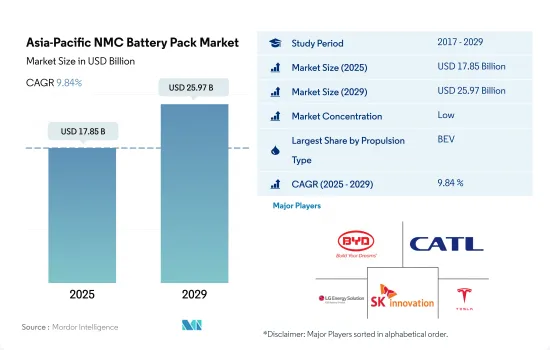

预计 2025 年亚太地区 NMC 电池组市场规模将达到 178.5 亿美元,预计到 2029 年将达到 259.7 亿美元,预测期内(2025-2029 年)的复合年增长率为 9.84%。

政府监管和不断增长的纯电动车和插电式混合动力车市场推动了亚太地区对 NCM 电池的需求,其中 CATL、LG Chem 和三星 SDI 等亚洲製造商占据主导

- 过去几年,亚太许多地区电动车的快速成长导致对不同类型电池的需求增加。儘管一些汽车製造商为其 BEV 和 PHEV 车型选择了 NCM 电池,但与 LFP 和 NMC 等其他电池相比,这种电池类型仍处于车辆部署的早期阶段。随着政府监管的严格和对石化燃料汽车的禁令即将出台,越来越多的个人选择 BEV 和 PHEV。这些考虑因素导致2017年至2021年亚太地区部分车辆的NCM电池类型略有增加。

- 日本和中国是亚太地区对插电式混合动力车和纯电动车 NCM 电池需求不断增长的国家之一。此外,一些主要的NCM电池生产商来自亚洲,包括CATL、LG Chem和三星SDI。印度、泰国和韩国等多个国家对 BEV 和 PHEV 的需求正在逐渐增加,这也有助于增加全部区域NCM 电池的需求。因此,与 2021 年相比,2022 年电动车使用的 NCM 电池区域市场有所成长。

- 各汽车製造商纷纷发布新产品,预计将增强电池产业的发展。 2023 年 2 月,中国汽车製造商比亚迪推出了 2023 年唐,该车型将搭载由 NCM 电池组动力来源的插电式混合动力系统。预计其他国家的此类公告将在预测期内加速该地区 BEV 和 PHEV 对 NCM 电池的需求和销售。

日本、韩国、印度和泰国助力亚太NCM电池组市场成长

- 由于政府支持、强劲的国内需求以及对电动车应用的重视等因素,亚太地区的电池组市场正在蓬勃发展。随着电动车需求的不断增长和电池组技术的进步,亚太地区预计将在塑造全球电动车产业的未来方面发挥关键作用。

- 中国在电池组市场占据主导地位,并且一直拥有较高的市场价值。中国的快速成长得益于多种因素,包括政府对电动车的支持、庞大的消费市场以及强劲的国内製造业生态系统。中国正在大力投资电动车生产,导致对电池组的需求增加。

- 日本和韩国也是亚太电池组市场的重要贡献者。多年来,两国的市场价值都稳定成长。这些国家拥有成熟的汽车工业、技术专长以及政府对电动车应用的大力支持,从而推动了对电池组的需求。随着人们对电动车普及和可再生能源目标的关注,印度电池组市场正在获得发展动力。由于政府的支持政策和消费者意识的增强,对电池组的需求正在上升。此外,泰国努力成为电动车领域的区域领导者,为电池组市场的成长提供了充足的机会。

亚太地区 NMC 电池组市场趋势

丰田、特斯拉、五菱领衔市场,多家汽车製造商进入市场

- 亚太地区电动车市场竞争激烈,但推动其发展的动力主要来自五大主要企业,它们在 2022 年总合占据超过 50% 的市场占有率。比亚迪处于领先地位,占该地区电动车销量的 20.93%。比亚迪拥有强大的财务基础,加上其先进的研发基础设施,使其成为实力雄厚的企业。有竞争力的定价和庞大的销售及售后服务网路有效地吸引了新消费者。

- 排在比亚迪之后的第二位的是丰田集团,市占率约12.88%。比亚迪在亚太地区享有盛誉,广泛的销售和服务网络赢得了消费者的信任,进一步巩固了其地位。排名第三的是特斯拉,市占率为8.27%。特斯拉以其前卫的技术主导产品而闻名,在包括中国和澳洲在内的国家拥有无缝的供应链。

- 排名第四的是五菱,市占率约7.10%。五菱汽车由母公司柳州五菱工业经营,在中国和印尼等国家占有一席之地,透过多样化的电动车产品线满足多样化的客户群。排名第五的是本田,市场占有率3.85%。在亚太地区电动车市场竞争的其他品牌包括日产、奇瑞、长安和凌达。

到2022年,五菱、特斯拉、比亚迪将成为亚太地区最大的电池组需求製造商。

- 近年来,电动车(包括轿车、巴士和卡车)在亚洲国家呈现出显着的成长势头。虽然不同地区和国家对电动车的兴趣各不相同,但很明显,SUV 已经在中国、印度和日本等主要市场占据了一席之地。与传统轿车相比,SUV 因其实用性和空间宽敞性而受到亚洲消费者越来越多的青睐。

- 紧凑型SUV近来越来越受亚洲人的欢迎。特斯拉 Model Y 凭藉全电动传动系统、五星 NCAP 安全评级、七人座和长续航里程脱颖而出,成为亚太地区尤其是中国主要市场的热门选择。比亚迪宋DM凭藉其极具竞争力的价格和高效的燃油经济性,受到了亚洲各地消费者的一致好评。

- 2022 年,特斯拉 Model 3 成为亚洲地区最畅销的车款之一,因其纯电动车和一系列吸引人的功能而受到认可。充满活力的亚太地区电动汽车产业也提供了来自知名全球製造商的众多电动 SUV 和轿车可供选择。 2022 年,我们预计丰田 Yaris Cross 和比亚迪 Dolphin 等汽车的销售将强劲。其他製造商如丰田的卡罗拉和五菱的宏光 MINIEV 在亚太地区电动车生态系统中也有强大的阵容。

亚太地区NMC电池组产业概况

亚太地区NMC电池组市场较为分散,前五大公司占29.02%。市场的主要企业有:比亚迪股份有限公司、宁德时代新能源科技股份有限公司(CATL)、LG 能源解决方案有限公司、SK Innovation 和特斯拉公司(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第二章 报告要约

第 3 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 电动汽车销售

- 电动车销量(按OEM)

- 最畅销的电动车车型

- 具有首选电池化学成分的OEM

- 电池组价格

- 电池材料成本

- 每种电池化学成分的价格表

- 谁供给谁?

- 电动车电池容量和效率

- 发布的电动车车型数量

- 法律规范

- 中国

- 印度

- 印尼

- 日本

- 泰国

- 价值链与通路分析

第五章 市场区隔

- 体型

- 公车

- LCV

- M&HDT

- 搭乘用车

- 推进类型

- BEV

- PHEV

- 容量

- 15 kWh~40 kWh

- 40 kWh~80 kWh

- 超过80度

- 少于15千瓦时

- 电池形状

- 圆柱形

- 小袋

- 方块

- 方法

- 雷射

- 金属丝

- 成分

- 阳极

- 阴极

- 电解

- 分隔符

- 材料类型

- 钴

- 锂

- 锰

- 天然石墨

- 镍

- 其他材料

- 国家

- 中国

- 印度

- 日本

- 韩国

- 泰国

- 其他亚太地区

第六章 竞争格局

- 主要策略趋势

- 市场占有率分析

- 业务状况

- 公司简介

- BYD Company Ltd.

- Contemporary Amperex Technology Co. Ltd.(CATL)

- EVE Energy Co. Ltd.

- Exide Industries Ltd.

- Gotion High-Tech Co. Ltd.

- GS Yuasa International Ltd.

- Hebei Chinaust Automotive Plastics Co. Ltd.

- LG Energy Solution Ltd.

- Ningbo Tuopu Group Co. Ltd.

- Panasonic Holdings Corporation

- Resonac Holdings Corporation

- Samsung SDI Co. Ltd.

- SK Innovation Co. Ltd.

- SVOLT Energy Technology Co. Ltd.(SVOLT)

- Tesla Inc.

第七章:执行长的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源和进一步阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 50001513

The Asia-Pacific NMC Battery Pack Market size is estimated at 17.85 billion USD in 2025, and is expected to reach 25.97 billion USD by 2029, growing at a CAGR of 9.84% during the forecast period (2025-2029).

Growing demand for NCM batteries in APAC due to government regulations and increase in BEV and PHEV markets, with Asia-based producers such as CATL, LG Chem, and Samsung SDI Leading the charge

- The demand for different types of batteries has increased as a result of the rapid growth of electric mobility in numerous APAC nations over the past few years. Few automakers are choosing NCM batteries for BEV and PHEV models, although the battery type is still in the early stages of deployment to vehicles compared to other batteries like LFP and NMC. Due to government regulations that are strict and the impending prohibition on fossil fuel vehicles, more individuals are choosing BEVs and PHEVs. These considerations have led to a small increase in the NCM battery type in a few vehicles in the APAC region from 2017 to 2021.

- Japan and China are among the countries with a growing demand for NCM batteries for PHEV and BEV in Asia-Pacific. In addition, some of the leading producers of NCM batteries, such as CATL, LG Chem, and Samsung SDI, are from Asia. The demand for BEV and PHEV is rising gradually in various countries, including India, Thailand, and South Korea, which has also helped to increase the demand for NCM batteries throughout the APAC region. As a result, the regional market for NCM batteries used in electric vehicles increased in 2022 over 2021.

- Various automakers are launching new products which are expected to enhance the battery industry. In February 2023, Chinese automaker BYD unveiled the 2023 model Tang, which is equipped with a plug-in hybrid system powered by the NCM battery pack. Such launches in other countries are expected to accelerate the demand and sales of NCM batteries in BEV and PHEV during the forecast period in the region.

Japan, South Korea, India, and Thailand contribute to the expansion of the Asia-Pacific NCM battery pack market

- Asia-Pacific presents a thriving market for battery packs, driven by factors such as government support, strong domestic demand, and a focus on electric vehicle adoption. As the demand for electric vehicles continues to rise and technology advancements in battery packs continue, Asia-Pacific is expected to play a pivotal role in shaping the future of the global electric vehicle industry.

- China stands out as a dominant player in the battery pack market, with consistently high market values. China's rapid growth can be attributed to several factors, including government support for electric vehicles, a large consumer market, and a robust domestic manufacturing ecosystem. The country has made substantial investments in electric vehicle production, leading to increased demand for battery packs.

- Japan and South Korea also contribute significantly to the Asia-Pacific battery pack market. Both countries have experienced steady growth in market value over the years. These countries have well-established automotive industries, technological expertise, and strong government support for EV adoption, driving the demand for battery packs. India's battery pack market is gaining momentum as the country focuses on electric vehicle adoption and renewable energy targets. With supportive government policies and increasing consumer awareness, the demand for battery packs is on the rise. Additionally, Thailand's commitment to becoming a regional leader in electric mobility presents ample opportunities for the growth of the battery pack market.

Asia-Pacific NMC Battery Pack Market Trends

A VARIETY OF AUTOMAKERS ARE PRESENT IN THE MARKET, MAJORLY DRIVEN BY TOYOTA, TESLA, AND WULING

- The APAC electric vehicle market is bustling with numerous competitors, but its momentum is chiefly steered by five dominant corporations, collectively grasping over 50% of the 2022 market share. Leading the charge is BYD, securing a remarkable 20.93% of EV sales in the region. Its potent financial standing, coupled with its advanced R&D infrastructure, has positioned BYD as a powerhouse. The company's competitive pricing, coupled with its vast sales and after-sales network, effectively appeals to new consumers.

- Following BYD, the Toyota Group clinches the second spot, with about 12.88% of the market. Its well-established reputation across the APAC region, bolstered by its extensive sales and service framework, instills trust among consumers, further cementing its footprint. Tesla claims the third position, seizing 8.27% of the market. Renowned for its avant-garde, tech-driven offerings, Tesla enjoys a seamless supply chain across nations, notably China and Australia.

- Wuling comes in fourth, holding approximately 7.10% of the market. Operating under its parent company, Liuzhou Wuling Automobile Industry Co. Ltd, Wuling has carved a niche in countries like China and Indonesia, catering to a diverse clientele with its varied EV lineup. Rounding out the top five is Honda, with a 3.85% market share. Other notable contenders in the APAC EV market encompass brands like Nissan, Chery, Changan, and Neta, among others.

IN 2022, WULING, TESLA, AND BYD WERE THE BIGGEST BATTERY PACK DEMAND GENERATORS IN APAC

- The electric vehicle landscape, encompassing cars, buses, and trucks, has witnessed a notable upswing across various Asian countries in the past few years. While the appetite for electric vehicles fluctuates across regions and nations, it is evident that SUVs have carved a niche in major markets like China, India, and Japan. As a direct reflection of Asia's growing preference for SUVs over traditional sedans, due to their enhanced utility and spaciousness, electric SUVs have seen a parallel surge across the Asia-Pacific belt.

- Recent times have spotlighted a burgeoning affinity for compact SUVs among the Asian populace. Tesla's Model Y stands out with its all-electric drivetrain, sterling 5-star NCAP safety rating, seven-seat capacity, commendable range, and other features, making it a sought-after option in pivotal APAC markets, notably China. BYD's Song DM, with its competitive pricing and efficient fuel dynamics, has resonated well with customers across several Asian territories.

- The year 2022 saw Tesla's Model 3 clinching accolades as one of the top sellers in the Asian domain, a testament to its purely electric mechanism, paired with an array of attractive functionalities. The dynamic APAC EV arena also presents a myriad of electric SUV and sedan alternatives from established global manufacturers. The year 2022 anticipated robust sales for vehicles like Toyota's Yaris Cross and BYD's Dolphin. Other players, such as the Toyota Corolla and Wuling's Hongguang MINIEV, also form a robust lineup in the APAC EV ecosystem.

Asia-Pacific NMC Battery Pack Industry Overview

The Asia-Pacific NMC Battery Pack Market is fragmented, with the top five companies occupying 29.02%. The major players in this market are BYD Company Ltd., Contemporary Amperex Technology Co. Ltd. (CATL), LG Energy Solution Ltd., SK Innovation Co. Ltd. and Tesla Inc. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Electric Vehicle Sales

- 4.2 Electric Vehicle Sales By OEMs

- 4.3 Best-selling EV Models

- 4.4 OEMs With Preferable Battery Chemistry

- 4.5 Battery Pack Price

- 4.6 Battery Material Cost

- 4.7 Price Chart Of Different Battery Chemistry

- 4.8 Who Supply Whom

- 4.9 EV Battery Capacity And Efficiency

- 4.10 Number Of EV Models Launched

- 4.11 Regulatory Framework

- 4.11.1 China

- 4.11.2 India

- 4.11.3 Indonesia

- 4.11.4 Japan

- 4.11.5 Thailand

- 4.12 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Body Type

- 5.1.1 Bus

- 5.1.2 LCV

- 5.1.3 M&HDT

- 5.1.4 Passenger Car

- 5.2 Propulsion Type

- 5.2.1 BEV

- 5.2.2 PHEV

- 5.3 Capacity

- 5.3.1 15 kWh to 40 kWh

- 5.3.2 40 kWh to 80 kWh

- 5.3.3 Above 80 kWh

- 5.3.4 Less than 15 kWh

- 5.4 Battery Form

- 5.4.1 Cylindrical

- 5.4.2 Pouch

- 5.4.3 Prismatic

- 5.5 Method

- 5.5.1 Laser

- 5.5.2 Wire

- 5.6 Component

- 5.6.1 Anode

- 5.6.2 Cathode

- 5.6.3 Electrolyte

- 5.6.4 Separator

- 5.7 Material Type

- 5.7.1 Cobalt

- 5.7.2 Lithium

- 5.7.3 Manganese

- 5.7.4 Natural Graphite

- 5.7.5 Nickel

- 5.7.6 Other Materials

- 5.8 Country

- 5.8.1 China

- 5.8.2 India

- 5.8.3 Japan

- 5.8.4 South Korea

- 5.8.5 Thailand

- 5.8.6 Rest-of-Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 BYD Company Ltd.

- 6.4.2 Contemporary Amperex Technology Co. Ltd. (CATL)

- 6.4.3 EVE Energy Co. Ltd.

- 6.4.4 Exide Industries Ltd.

- 6.4.5 Gotion High-Tech Co. Ltd.

- 6.4.6 GS Yuasa International Ltd.

- 6.4.7 Hebei Chinaust Automotive Plastics Co. Ltd.

- 6.4.8 LG Energy Solution Ltd.

- 6.4.9 Ningbo Tuopu Group Co. Ltd.

- 6.4.10 Panasonic Holdings Corporation

- 6.4.11 Resonac Holdings Corporation

- 6.4.12 Samsung SDI Co. Ltd.

- 6.4.13 SK Innovation Co. Ltd.

- 6.4.14 SVOLT Energy Technology Co. Ltd. (SVOLT)

- 6.4.15 Tesla Inc.

7 KEY STRATEGIC QUESTIONS FOR EV BATTERY PACK CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219