|

市场调查报告书

商品编码

1683947

德国LED照明:市场占有率分析、产业趋势与成长预测(2025-2030年)Germany LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

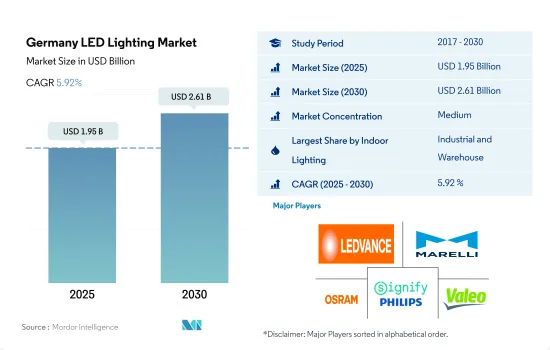

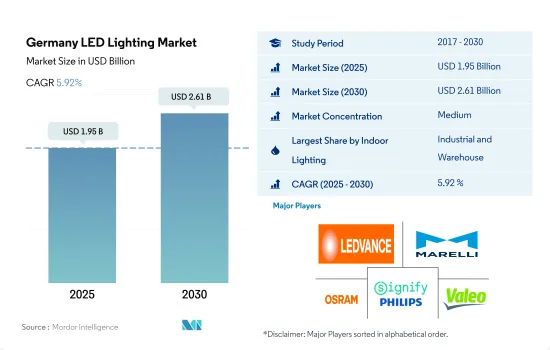

预计2025年德国LED照明市场规模为19.5亿美元,到2030年将达到26.1亿美元,预测期间(2025-2030年)的复合年增长率为5.92%。

工业领域的发展和住宅数量的增加预计将推动 LED 照明市场的成长。

- 就以金额为准,预计2023年工业和仓库照明将占据最大份额,其次是住宅、商业和农业照明。德国工业企业占总研发支出的60%左右,为国家繁荣做出了重大贡献。公司也参与策略发展。例如,2023 年,Osvetleni Cernoch sro 建造了一个新的生产和仓储大厅,以提高其工业生产能力。这表明工业和仓库数量的增加以及 LED 照明的使用量的增加。

- 以金额为准,2023年住宅照明将占最大份额,其次是商业、工业、仓库和农业照明。 2017年至2020年间,德国的房屋拥有率略有下降。 2021年,约有49.1%的人口居住在公寓中,但到了2022年,这一数字达到46.7%。这使得德国成为欧洲住房拥有率最低的国家之一,同时也是最大的租赁公寓市场。这导致租赁住宅数量显着增加,并加速了该国对 LED 的采用。

- 在创新方面,飞利浦推出了适用于2023年的全新飞利浦TrueForce LED高棚通用灯,它易于安装、初期投资低、节能,适合工业应用,特别是仓库和零售区。 2019 年,我们开设了 TRILUX 灯光园区,扩大了我们在大教堂城市科隆的业务。这些发展正在推动LED照明市场的成长。

德国LED照明市场趋势

家庭数量增加和政府补贴导致的电动车销售增加将推动 LED 市场成长

- 截至2021年,德国人口为8,324万人。比上年增加0.08人。德国每1000人粗出生率增加0.3人(与前一年同期比较增加3.23%)。结果,出生率在观察期内达到峰值,达到每千人生育9.6人。德国每1,000名活产婴儿的死亡人数与前一年相比减少了0.1人(-3.23%)。结果,2021年,德国婴儿死亡率创下每千名新生儿死亡3人的历史新低。出生率上升和死亡率下降推动了住宅销售的增加,并增加了对 LED 照明的需求。

- 2021年,德国共有4,160万户家庭。 2021年,德国家庭数量年增率为0.2%。 2010年至2021年间,家庭数增加了3.2%。与十年前相比,单人家庭的数量增加。 2021年,德国将有16,619套住房由一个人居住。因此,德国家庭数量的成长将推动 LED 照明的需求。

- 2022年,德国汽车产量接近340万辆。这一数字比前一年的 310 万台有所增加。汽车产业是德国经济的基石之一。德国政府也希望加快向电动车转变。德国计划透过增加 9,000 欧元(9,872.41 美元)的购买补贴来促进电动车销售。政府希望到2030年道路上有1500万辆电动车。未来几年销售更多汽车的计划可能会推动市场扩张。

移民增加、消费者购买力增强以及能源效率计划将推动 LED 照明的成长。

- 预计 2022 年德国人口将成长 1.3%(112.2 万人),而前一年德国人口仅成长 0.1%(8.2 万人)。到2022年终,德国人口将达到约8,440万。这一发展趋势是由净移民人数大幅增加 145.5 万人(2021 年:329,000 人)所推动的,这主要是由于来自乌克兰的难民流动。因此,预计移民数量和人口成长将增加 LED 在该国照明需求中的普及率。 2017年至2020年间,德国的住宅率略有下降。 2021年,约有49.1%的人口拥有自己的房屋,2022年这一比例达到46.7%。这使得德国成为欧洲房屋自有率最低的国家之一,也是最大的租赁住宅市场之一。这显示租赁住宅的成长以及该国LED普及率的快速上升。

- 德国较高的可支配收入赋予了人们更强的消费能力,使他们能够将更多的钱投入新的住宅空间。 2022年12月,德国的人均收入达到48,562.1美元,而2021年12月为51,202.9美元。与一些已开发国家相比,儘管其人均收入较上年有所下降,但其购买力较高。例如,截至2021年,巴西为7,732.4美元,法国为25,337.7美元。 2021年1月,德国启动「联邦高效建筑资助」计画。任何在德国拥有房产或想要在德国购买房产的人都可以申请这项经济援助。该能源效率计划还包括照明节能建筑。预计此类案例将进一步刺激该国对 LED 照明的需求。

德国LED照明产业概况

德国LED照明市场格局中度整合,前五大企业占比54.03%。市场的主要企业有:LEDVANCE GmbH(MLS)、Marelli Holdings、OSRAM GmbH.、Signify(飞利浦)和Valeo。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第 3 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 汽车产量

- 人口

- 人均收入

- 汽车贷款利率

- 充电站数量

- 行驶车辆数

- LED进口总量

- 照明功耗

- #家庭数量

- 道路网络

- LED渗透率

- #体育场数量

- 园艺区

- 法律规范

- 室内照明

- 德国

- 户外照明

- 德国

- 汽车照明

- 德国

- 室内照明

- 价值炼和通路分析

第五章 市场区隔

- 室内照明

- 农业照明

- 商业照明

- 办公室

- 零售

- 其他的

- 工业/仓库

- 住宅照明

- 户外照明

- 公共设施

- 路

- 其他的

- 汽车实用照明

- 日间行车灯 (DRL)

- 方向指示器

- 头灯

- 倒车灯

- 红绿灯

- 尾灯

- 其他的

- 汽车照明

- 二轮车

- 商用车

- 搭乘用车

第六章竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介(包括全球概况、市场层级概况、主要业务部门、财务状况、员工人数、关键资讯、市场排名、市场占有率、产品和服务、最新发展分析)

- Dialight PLC

- GRUPO ANTOLIN IRAUSA, SA

- HELLA GmbH & Co. KGaA(FORVIA)

- LEDVANCE GmbH(MLS Co Ltd)

- Liper Elektro GmbH

- Marelli Holdings Co., Ltd.

- OSRAM GmbH.

- Signify(Philips)

- TRILUX GmbH & Co. KG

- Valeo

第七章:执行长的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源和进一步阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 50001645

The Germany LED Lighting Market size is estimated at 1.95 billion USD in 2025, and is expected to reach 2.61 billion USD by 2030, growing at a CAGR of 5.92% during the forecast period (2025-2030).

Increasing development in the industrial sector and an increase in the number of residential houses are expected to drive the growth of LED lighting market

- In terms of value, industrial and warehouse lighting was expected to hold the largest share in 2023, followed by residential, commercial, and agricultural lighting. German industrial companies make a significant contribution to the country's prosperity at around 60% of total R&D expenditure. Companies are also involved in strategic development. For instance, in 2023, Osvetleni Cernoch s.r.o. built a new production and storage hall to increase its industrial production capacity. This indicated an increase in the number of industries and storage areas and an increase in the use of LED lighting.

- In terms of value, residential lighting accounted for the largest share in 2023, followed by commercial, industrial and warehouse, and agricultural lighting. From 2017 to 2020, Germany's homeownership rate declined slightly. About 49.1% of the population lived in apartments in 2021, and in 2022 it reached 46.7%. This made Germany one of the countries with the lowest home ownership rates and the largest market for rental apartments in Europe. This marked the growth of rental accommodation, which also accelerated the adoption of LEDs in the country.

- In the area of innovation, Philips unveiled the new Philips TrueForce LED high bay universal lamp in 2023. It is easy to install, has a low initial investment, saves energy, and is especially suitable for industrial applications in warehouses and retail areas. In 2019, the company expanded its presence in the cathedral city of Cologne with the opening of the TRILUX Light Campus. These developments are driving the growth of the LED lighting market.

Germany LED Lighting Market Trends

Increase in the number of household and government subsidies to increase EV sales and drive the growth of LED market

- In 2021, there were 83.24 million people living in Germany. When compared to the previous year, it went up by 0.08. The crude birth rate in Germany grew over the previous year by 0.3 live births per 1,000 people (+3.23%). The rate thus reached its peak during the observed period at 9.6 live births per 1,000 people. In Germany, there were 0.1 fewer infant deaths per 1,000 live births (-3.23%) than the year before. As a result, in 2021, Germany's infant mortality rate reached its all-time low of three fatalities per 1,000 live births. The rise in birth rates and decline in death rates encourage selling more homes, increasing the need for LED lighting.

- In 2021, Germany had 41.6 million households. In Germany, the number of households increased by 0.2% on an annual basis in 2021. The number of households increased by 3.2% between 2010 and 2021. There are now more one-person families than there were ten years ago. 16,619 German houses only had one person in 2021. As a result, Germany's demand for LED lighting will be aided by an increase in the number of households.

- In 2022, almost 3.4 million German automobiles were produced. This was an increase from the 3.1 million cars sold the year before. One of the foundations of the German economy is the auto sector. The German government also wants to speed up the transition to more electric vehicles on the road. Germany will increase electric vehicle sales by increasing the help-to-buy subsidy by EUR 9,000 (USD 9872.41). By 2030, the government wants 15 million all-electric vehicles on the road. The market's expansion will be facilitated by the plan to sell more cars in the upcoming years.

Rise in number of immigrants, high purchasing power of consumers, and energy efficient programs to drive the growth of LED lights

- Germany's population increased by 1.3% (+1,122,000 people) in 2022, following only 0.1% (+82,000 people) the year before. At the end of 2022, there were about 84.4 million people living in Germany. This development is due to a substantial increase in net immigration to 1,455,000 people (2021: 329,000), mainly caused by the refugee movements from Ukraine. Thus, the growing number of immigrations and population is expected to create more LED penetration for the need for illumination in the country. Between 2017 and 2020, the homeownership rate in Germany decreased slightly. In 2021, about 49.1% of the population lived in an owner-occupied dwelling, and in 2022, it reached 46.7%. This makes Germany one of the countries with the lowest homeownership rate and the biggest rental residential real estate market in Europe. This indicates the growth of rental accommodations, which also surges the LED penetration in the country.

- In Germany, disposable income is high, which results in the rising spending power of individuals and affording more money on new residential spaces. Germany's per Capita income reached USD 48,562.1 in December 2022, compared to USD 51,202.9 in December 2021. Compared to some developed nations, it has high purchasing power even though per capita income was decreasing compared to the previous year. For instance, as of 2021, Brazil had USD 7732.4, and France had USD 25,337.7. In January 2021, the "Federal Funding for Efficient Buildings" program was launched in Germany. Anyone who owns property in Germany or who is looking to buy property in Germany can apply for the funding. The energy efficiency program also includes lighting energy efficiency building. Such instances are further expected to surge the demand for LED lighting in the country.

Germany LED Lighting Industry Overview

The Germany LED Lighting Market is moderately consolidated, with the top five companies occupying 54.03%. The major players in this market are LEDVANCE GmbH (MLS Co Ltd), Marelli Holdings Co., Ltd., OSRAM GmbH., Signify (Philips) and Valeo (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Automotive Production

- 4.2 Population

- 4.3 Per Capita Income

- 4.4 Interest Rate For Auto Loans

- 4.5 Number Of Charging Stations

- 4.6 Number Of Automobile On-road

- 4.7 Total Import Of Leds

- 4.8 Lighting Electricity Consumption

- 4.9 # Of Households

- 4.10 Road Networks

- 4.11 Led Penetration

- 4.12 # Of Stadiums

- 4.13 Horticulture Area

- 4.14 Regulatory Framework

- 4.14.1 Indoor Lighting

- 4.14.1.1 Germany

- 4.14.2 Outdoor Lighting

- 4.14.2.1 Germany

- 4.14.3 Automotive Lighting

- 4.14.3.1 Germany

- 4.14.1 Indoor Lighting

- 4.15 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Indoor Lighting

- 5.1.1 Agricultural Lighting

- 5.1.2 Commercial

- 5.1.2.1 Office

- 5.1.2.2 Retail

- 5.1.2.3 Others

- 5.1.3 Industrial and Warehouse

- 5.1.4 Residential

- 5.2 Outdoor Lighting

- 5.2.1 Public Places

- 5.2.2 Streets and Roadways

- 5.2.3 Others

- 5.3 Automotive Utility Lighting

- 5.3.1 Daytime Running Lights (DRL)

- 5.3.2 Directional Signal Lights

- 5.3.3 Headlights

- 5.3.4 Reverse Light

- 5.3.5 Stop Light

- 5.3.6 Tail Light

- 5.3.7 Others

- 5.4 Automotive Vehicle Lighting

- 5.4.1 2 Wheelers

- 5.4.2 Commercial Vehicles

- 5.4.3 Passenger Cars

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 Dialight PLC

- 6.4.2 GRUPO ANTOLIN IRAUSA, S.A.

- 6.4.3 HELLA GmbH & Co. KGaA (FORVIA)

- 6.4.4 LEDVANCE GmbH (MLS Co Ltd)

- 6.4.5 Liper Elektro GmbH

- 6.4.6 Marelli Holdings Co., Ltd.

- 6.4.7 OSRAM GmbH.

- 6.4.8 Signify (Philips)

- 6.4.9 TRILUX GmbH & Co. KG

- 6.4.10 Valeo

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219