|

市场调查报告书

商品编码

1683957

中东和非洲室内 LED 照明:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Middle East and Africa Indoor LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

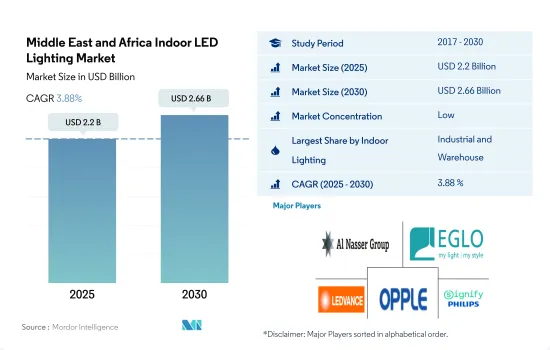

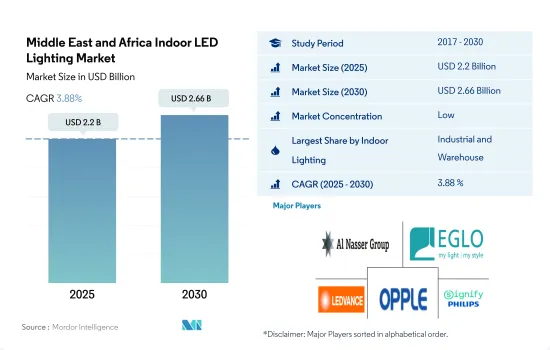

中东和非洲室内 LED 照明市场规模预计在 2025 年为 22 亿美元,预计到 2030 年将达到 26.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.88%。

工业和住宅领域的不断发展推动着市场的成长

- 从金额份额来看,2023年工业和仓储业将占据大部分市场份额,其次是商业和住宅业。中东经济高度依赖专用的加工、生产和物流设施。此外,强劲的消费品需求和优惠的税收政策使得当地市场对外国工业和製造业的吸引力越来越大。随着我们摆脱对石油和天然气出口的依赖,转向更多元化的经济,健康的工业、製造业和物流业对于我们地区经济的未来至关重要。

- 从2023年的成交量份额来看,住宅领域将占大多数,其次是商业、工业和仓储。非洲各国政府正加强推动製造业和工业化发展,以刺激疫情后的经济成长。因此,外商投资竞争加剧,新的产业政策相继出台,经济特区在非洲大陆不断扩张。

- 由于油价上涨和经济成长,预计 2023 年中东房地产市场将保持活跃。目前规划或正在建设的房地产计划总价值估计为1.36兆美元。其中沙乌地阿拉伯占64.5%,约8,770亿美元,其次是阿联酋,占21.6%,约2,930亿美元。同样,乌干达政府也加强了工业化的力度,宣布计划将坎帕拉工业和商业园区(KIBP)扩大 400 万平方公尺。由于上述案例,预计未来几年室内LED的需求将会成长。

中东和非洲室内LED照明市场趋势

人口成长和能源永续性宣传活动推动 LED 照明的使用增加

- 在中东和非洲,阿拉伯联合大公国、沙乌地阿拉伯和南非是收入和人口最多的国家。 2015年阿联酋平均家庭规模约4.2人,2022年将上升至4.9人。 2021年南非人口约6,050万,人口成长率为1.2%至1.3%。同年,家庭数量估计为 1800 万个,平均每个家庭有 3.34 人。人口不断增长和家庭规模不断缩小产生了对更多住宅的需求,从而推动了该地区对 LED 照明的需求。

- 在中东和非洲,典型的家庭规模超过五人。沙乌地阿拉伯近一半的人口拥有自己的住房,2020 年统计的家庭数量为 546 万户。截至 2020 年,以色列有 5 人或 5 人以上的家庭 681,500 户。如果五个人住在一间房子里,那至少要有两个房间。以色列大多数人居住在单间公寓。随着家庭人口的增加,LED的销售量也在上升。

- 阿联酋最新的永续性宣传活动对精选品牌的 LED 灯泡提供高达 25% 的折扣,以鼓励当地人改用节能、环保的照明。南非政府的 S&L 计划旨在透过实施最低能源性能标准 (MEPS)、标籤计划和奖励计划等措施和干预措施,从市场上淘汰低效电子产品,并鼓励采用包括 LED 在内的高效技术。预计此类案例将进一步刺激该国对 LED 照明的需求。

使用节能的 LED 照明替换旧路灯正在推动市场成长。

- 在中东和非洲,工业部门是能源消耗最大的部门(6,120 千兆焦耳)。此外,2019 年,住宅部门消耗了 3.68 千兆焦耳,商业部门消耗了 1.52 千兆焦耳。此外,中东和非洲的商业建筑数量正在成长,特别是沙乌地阿拉伯、阿联酋和卡达。沙乌地阿拉伯政府已经实施了一系列计划,以实现经济多元化,摆脱对石油的依赖,其中包括「2030愿景」和「2020国家计划」。

- 商业部门的电力需求约为10至12小时。工业部门的用电量在一天和一年中往往更加稳定。住宅用电需求在4-6小时左右波动。此外,世界各国政府都在采取措施,保护其公民的夜间安全。例如,沙乌地阿拉伯已启动路灯维修计划第一阶段,从2021年开始,将以LED照明取代38,000盏老旧路灯。该计划将减少70%的能源使用,并防止23,000吨二氧化碳排放。此LED照明性能良好,且电力消耗量。

- 该地区各国政府正在采取措施增加 LED 照明的使用。例如,阿布达比市政当局(阿布达比市政和交通管理局的一个分支机构)于 2021 年 5 月在阿布达比岛启动了一项全面的宣传宣传活动,以强调从传统照明转换为节能 LED 路灯对环境的好处。

中东和非洲室内 LED 照明产业概况

中东和非洲室内LED照明市场较为分散,前五大企业占比为18.37%。市场的主要企业是:Al Nasser Group、EGLO Leuchten GmbH、LEDVANCE GmbH(MLS)、OPPLE Lighting 和 Signify(飞利浦)(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第二章 报告要约

第 3 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 人口

- 人均收入

- LED进口总量

- 照明电力消耗量

- 家庭数量

- LED渗透率

- 园艺区

- 法律规范

- 波湾合作理事会

- 南非

- 价值链与通路分析

第五章 市场区隔

- 室内照明

- 农业照明

- 商业照明

- 办公室

- 零售

- 其他的

- 工业/仓库

- 住宅

第六章 竞争格局

- 主要策略趋势

- 市场占有率分析

- 业务状况

- 公司简介(包括全球概况、市场层级概况、主要业务部门、财务状况、员工人数、关键资讯、市场排名、市场占有率、产品和服务、最新发展分析)

- ACUITY BRANDS, INC.

- Al Nasser Group

- ams-OSRAM AG

- Current Lighting Solutions, LLC.

- EGLO Leuchten GmbH

- LEDVANCE GmbH(MLS Co Ltd)

- Nardeen Light Company

- OPPLE Lighting Co., Ltd

- Signify(Philips)

- Thorn Lighting Ltd.(Zumtobel Group)

第七章:执行长的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源和进一步阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

The Middle East and Africa Indoor LED Lighting Market size is estimated at 2.2 billion USD in 2025, and is expected to reach 2.66 billion USD by 2030, growing at a CAGR of 3.88% during the forecast period (2025-2030).

Increasing development in the industrial sector and residential sector drives market growth

- In terms of value share, in 2023, the industrial and warehouse segment accounted for the majority of the share, followed by commercial and residential. The Middle East economy relies heavily on purpose-built processing, production, and logistics facilities. In addition, the local market is becoming a magnet for foreign industrial and manufacturing companies due to strong demand for consumer goods and tax incentives. Healthy industrial, manufacturing, and logistics industries are critical for the future of the region's economy as it continues to transition from dependence on oil and gas exports to a more diversified economy.

- In terms of volume share, in 2023, the residential segment accounted for the majority of the share, followed by commercial and industrial and warehouse. Governments across Africa have stepped up efforts to boost manufacturing and industrialization to spur economic growth after the pandemic. This intensified competition for foreign investment, introducing new industrial policies and the subsequent expansion of Special Economic Zones (SEZs) across the continent.

- The Middle East real estate market was expected to remain strong in 2023 due to high oil prices and economic growth. The total value of real estate projects currently planned or under construction is estimated at USD 1.36 trillion. Saudi Arabia accounts for 64.5% of the total, or about USD 877 billion, followed by the United Arab Emirates, with 21.6% or USD 293 billion. Similarly, the Ugandan government has stepped up its efforts to promote industrialization by announcing plans to expand the Kampala Industrial and Business Park (KIBP) by 4 million square meters. The above instances are expected to create more demand for indoor LEDs in the coming years.

Middle East and Africa Indoor LED Lighting Market Trends

Increasing population and energy sustainability campaign to promote higher use of LED lights

- In the Middle East & Africa, the United Arab Emirates, Saudi Arabia, and South Africa are the largest countries in terms of revenue and population. The United Arab Emirates' average size of households was around 4.2 persons in 2015, and by 2022, it had increased to 4.9 people per household. In 2021, South Africa had a population of approximately 60.5 million people, and the population has been growing at a rate between 1.2% and 1.3%. In the same year, the country had an estimated 18 million households, with an average household size of 3.34 persons. The growing population and reduced household size are generating the need for more houses, which is boosting the demand for LED illumination in the region.

- In MEA, the typical household size exceeds five people. In Saudi Arabia, about half of the population owns a home, and 5.46 million households were counted in 2020. In Israel, there were 681.5 thousand homes with five or more people as of 2020. There must be more than two rooms in a house to accommodate five people. The majority of people in Israel live in studio apartments. Sales of LEDs have increased as a result of the growth in household sizes.

- To encourage local people to switch to more energy-efficient and environmentally friendly lights, the UAE's latest sustainability campaign involves giving discounts of up to 25% on selected brand LED bulbs. The South African government's S&L program aims to remove inefficient electronic appliances from the market and encourage the adoption of efficient technologies, which include LEDs, by implementing measures/interventions such as minimum energy performance standards (MEPS), labeling programs, and incentive programs. Such instances are further expected to boost the demand for LED lighting in the country.

The market's growth is being driven by the replacement of old streetlights with energy efficient LED lights

- In the Middle East & Africa, the industrial sector consumed the most energy (6.12 thousand petajoules) compared to other sectors. Additionally, in 2019, the residential sector consumed 3.68 petajoules, while the commercial sector consumed 1.52 petajoules. Additionally, there has been an increase in the number of commercial buildings throughout the MEA, particularly in Saudi Arabia, the UAE, and Qatar. The Saudi Arabian government has implemented a number of programs like Vision 2030, NTP 2020, and other changes to diversify the economy away from oil.

- Electricity demand in the commercial sector tends to be around 10-12 hours. Electricity use in the industrial sector tends not to fluctuate through the day or year. Electricity demand in the residential sector varies for about 4 to 6 hours. Further, to protect the people at night, the governments of various countries have been taking action. For instance, in Saudi Arabia, Phase 1 of a street light retrofitting project that was initiated in 2021 to replace 38,000 old street lights with LED lights has already begun. This project will save 70% of the energy used and prevent 23,000 tonnes of carbon emissions. These LED lights perform better and use less electricity.

- Governments of countries in the region are taking steps to enhance their use of LED lighting. For instance, Abu Dhabi Municipality, which is a division of Abu Dhabi's Department of Municipalities and Transport, launched a comprehensive awareness campaign on Abu Dhabi Island in May 2021 to highlight the advantages for the environment of switching from conventional lighting to energy-efficient LED streetlights.

Middle East and Africa Indoor LED Lighting Industry Overview

The Middle East and Africa Indoor LED Lighting Market is fragmented, with the top five companies occupying 18.37%. The major players in this market are Al Nasser Group, EGLO Leuchten GmbH, LEDVANCE GmbH (MLS Co Ltd), OPPLE Lighting Co., Ltd and Signify (Philips) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 Per Capita Income

- 4.3 Total Import Of Leds

- 4.4 Lighting Electricity Consumption

- 4.5 # Of Households

- 4.6 Led Penetration

- 4.7 Horticulture Area

- 4.8 Regulatory Framework

- 4.8.1 Gulf Cooperation Council

- 4.8.2 South Africa

- 4.9 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Indoor Lighting

- 5.1.1 Agricultural Lighting

- 5.1.2 Commercial

- 5.1.2.1 Office

- 5.1.2.2 Retail

- 5.1.2.3 Others

- 5.1.3 Industrial and Warehouse

- 5.1.4 Residential

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ACUITY BRANDS, INC.

- 6.4.2 Al Nasser Group

- 6.4.3 ams-OSRAM AG

- 6.4.4 Current Lighting Solutions, LLC.

- 6.4.5 EGLO Leuchten GmbH

- 6.4.6 LEDVANCE GmbH (MLS Co Ltd)

- 6.4.7 Nardeen Light Company

- 6.4.8 OPPLE Lighting Co., Ltd

- 6.4.9 Signify (Philips)

- 6.4.10 Thorn Lighting Ltd. (Zumtobel Group)

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms