|

市场调查报告书

商品编码

1683978

非洲农药:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Africa Insecticide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

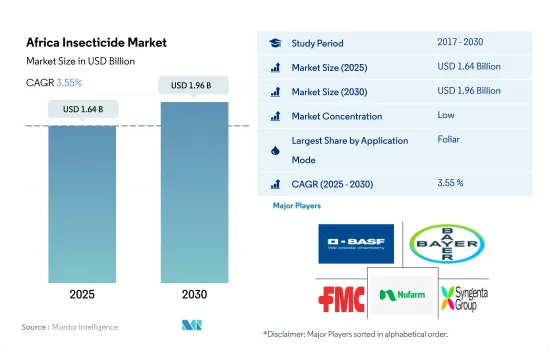

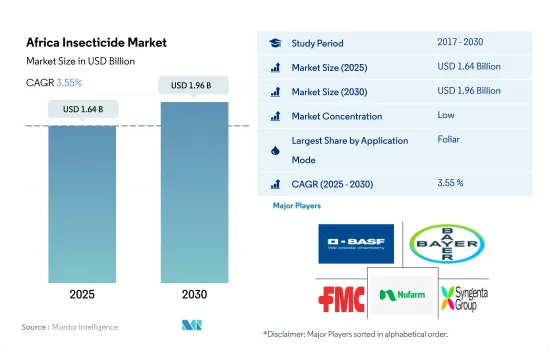

预计 2025 年非洲杀虫剂市场规模为 16.4 亿美元,到 2030 年将达到 19.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.55%。

叶面喷布因其快速起效而占据市场主导地位

- 在非洲,农药的使用方法多种多样,包括化学灌溉、叶面喷布、种子处理、土壤处理和熏蒸。这些农药施用方法正在促进整个市场的成长。

- 2022年,叶面喷布法占据市场主导地位,占有57.6%的份额。叶面喷布喷洒杀虫剂通常是 IPM 策略的一个组成部分,可以有针对性地精准施用以控制害虫,同时最大限度地减少对环境的影响。噻虫胺、呋虫胺、Imidacloprid和Thiamethoxam等杀虫剂都是最常用作叶面喷布的系统性杀虫剂。

- 继叶面喷布之后,种子处理将在 2022 年占非洲杀虫剂市场的 16.9%。土传昆虫,如香蕉象鼻虫 Cosmopolites sordidus Germar、甘薯象鼻虫 Cylas formicarius Fabricius、豆蛆 Ophiomyia spencerella Greathead、O. phaseoli Tryon 和 O. centrosematis de Meij 经常被报道为影响东非国家(卢旺达、肯尼亚、坦桑迪利亚、乌旺达、肯亚经济和农业作物的农业作物。这些可以透过种子处理来有效控制。

- 气候变迁导致新型作物害虫的大量出现,对非洲农民的粮食和经济构成了严重的威胁。气候变迁导致的干旱和高温为病虫害的滋生提供了理想条件,对农作物造成了毁灭性的破坏。气温升高会增加植物害虫的繁殖成功率,因为它们对温度变化变得更加敏感。因此,预计预测期内市场复合年增长率将达到 3.7%。

气候,特别是温度,对害虫族群的发展和成长有强烈而直接的影响。

- 非洲国家高度依赖农业,传统上容易受到不可预测的气候条件变化的影响。气候变迁导致的气温上升,加上降雨减少,将对作物生产和粮食安全产生严重的直接和间接影响。平均而言,害虫造成农业产量损失的30-50%。温度对害虫族群的发展和成长有直接而强烈的影响。虫害日益严重推动了该地区杀虫剂市场的发展。

- 2022年,南非占非洲杀虫剂市场的31.4%。玉米、大米、小麦和高粱是该国种植的最重要的作物。在南非,主要害虫有蚜虫、粉蝨、红蜘蛛、蓟马等。此外,其中一些害虫是破坏性病毒病原体的载体。历史时期内(2017年至2022年),南非农药市值显着增长,市值增加了1.47亿美元。

- 杀虫剂等农业农药使得非洲作物产量提高成为可能。目前非洲人口约13亿,预计2050年将增加一倍,将对非洲生产力低的粮食生产系统带来巨大压力。因此,人们对粮食生产的日益担忧,加上气候条件不稳定导致新害虫的出现,将导致该地区农药使用增加,预计在预测期内复合年增长率为 3.7%。

非洲杀虫剂市场的趋势

虫害侵扰和日益增长的粮食生产需求导致该地区每公顷土地的农药消费量不断增加。

- 非洲每公顷农药消费量因地区和作物不同而有很大差异。农药的使用量受多种因素影响,包括害虫的流行程度、作物类型、耕作方式和一个国家的农业发展水准。

- 在非洲,杀虫剂的使用对于各种农业系统的害虫管理至关重要,包括玉米、水稻和小麦等基本作物,以及棉花、咖啡和可可等经济作物。农药用于控制多种害虫,这些害虫会对作物造成严重损害、降低产量并影响粮食安全。 2017年至2022年间,非洲每公顷农药消费量预计将增加5.3%。

- 害虫对非洲的农业生产力构成重大威胁。非洲大陆存在各种害虫,对作物造成严重破坏。由于气候变迁、昆虫动态变化和贸易全球化等因素,昆虫面临的压力越来越大,因此必须使用杀虫剂来有效控制昆虫数量。例如,2019年至2021年,由于非洲之角沙漠爆发蝗虫,埃塞俄比亚和肯亚共使用广谱有机磷和拟除虫菊酯杀虫剂处理了总合万公顷土地。

- 随着非洲粮食需求的增加,非洲正不断努力提高农业产量。杀虫剂透过保护植物免受抑制生产的昆虫侵害,在提高农业产量发挥着至关重要的作用。满足人口的食物需求导致了对杀虫剂的依赖增加。

虫害日益增多导致对Cypermethrin和Imidacloprid等活性成分的需求增加,而有限的生产能力则推高了价格。

- 气候变迁对非洲农业生产有重大影响,为粉蝨等各类害虫的滋生创造了有利条件。如果不加以控制,这些害虫平均会导致25-40%的作物损失。为了解决这个问题,农民严重依赖杀虫剂来更好地控制这些有害昆虫。因此,农药的使用是该地区农业实践的重要组成部分。

- 与其他活性成分相比,Cypermethrin是较昂贵的活性成分之一。 2022 年的价格为每吨 21,023 美元。过去一段时间,Cypermethrin的价格大幅上涨,2022 年的价格与 2017 年的价格相比每公吨上涨了 3,186.2 美元。这种价格上涨趋势主要是由于它广泛用于各种作物上以控制介壳虫、甘蓝夜蛾、甘蓝夜蛾、粘虫蛾、果蝇、毛虫、介壳虫和茎虫等害虫。该地区Cypermethrin产量有限也是造成价格高涨的原因之一。

- Imidacloprid属于新烟碱类系统性杀虫剂,可有效控制多种害虫。这些害虫包括吸食汁液的昆虫、土壤昆虫甚至白蚁,这使它成为一种可应用于多种作物的多功能解决方案。 2022年Imidacloprid价格为每吨17,120.8美元。

- 活性成分的价格波动主要受原物料成本上涨的影响,是推动市场成长的主要因素之一。

非洲农药产业概况

非洲农药市场较为分散,前五大企业占比为24.69%。市场的主要企业是:BASF公司、拜耳公司、FMC 公司、Nufarm 有限公司和先正达集团(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第二章 报告要约

第 3 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 每公顷农药消费量

- 有效成分价格分析

- 法律规范

- 南非

- 价值链与通路分析

第五章 市场区隔

- 如何使用

- 化学灌溉

- 叶面喷布

- 熏蒸

- 种子处理

- 土壤处理

- 作物类型

- 经济作物

- 水果和蔬菜

- 粮食

- 豆类和油籽

- 草坪和观赏植物

- 原产地

- 南非

- 非洲其他地区

第六章 竞争格局

- 主要策略趋势

- 市场占有率分析

- 业务状况

- 公司简介(包括全球概况、市场层级概况、主要业务部门、财务状况、员工人数、关键资讯、市场排名、市场占有率、产品和服务、最新发展分析)

- ADAMA Agricultural Solutions Ltd.

- BASF SE

- Bayer AG

- Corteva Agriscience

- FMC Corporation

- Nufarm Ltd

- Sumitomo Chemical Co. Ltd

- Syngenta Group

- UPL Limited

- Wynca Group(Wynca Chemicals)

第七章:执行长的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源和进一步阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 50001680

The Africa Insecticide Market size is estimated at 1.64 billion USD in 2025, and is expected to reach 1.96 billion USD by 2030, growing at a CAGR of 3.55% during the forecast period (2025-2030).

The foliar method of application dominates the market due to its quick action

- Insecticides are applied through multiple methods in Africa, including chemigation, foliar application, seed treatment, soil treatment, and fumigation. These methods of pesticide application are contributing to the overall expansion of the market.

- The foliar method of application dominated the market in 2022, accounting for a share of 57.6%. The foliar application of insecticides is often a component of IPM strategies, allowing for targeted and precise application to manage pests while minimizing environmental impact. Insecticides like clothianidin, dinotefuran, imidacloprid, and thiamethoxam are the most commonly used systemic insecticides applied through the foliar method.

- Following the foliar application, seed treatment accounted for 16.9% of the African insecticide market in 2022. Soil-borne insects like the banana weevil Cosmopolites sordidus Germar, the sweet potato weevil Cylas formicarius Fabricius, the bean maggots Ophiomyia spencerella Greathead, O. phaseoli Tryon, and O. centrosematis de Meij are frequently reported as common agricultural pests impacting economic crops in countries across East Africa (Rwanda, Kenya, Tanzania, Uganda, and Burundi). These can be effectively controlled by seed treatment.

- Climate change is encouraging the proliferation of new insect pests affecting crops that pose a serious food and financial threat to African farmers. Climate change-induced droughts and high temperatures have provided optimal conditions for pests and diseases to thrive, unleashing destruction on crops. As temperatures rise, the reproduction success of plant pests increases as they are sensitive to temperature changes. Owing to this, the market is anticipated to register a CAGR of 3.7% during the forecast period.

Climate, especially temperature, has a strong and direct influence on the development and growth of insect pest populations

- Countries in Africa are highly dependent on agriculture, an activity traditionally vulnerable to unpredictable changes in climatic conditions. Any increase in temperature caused by climate change, coupled with a decline in rainfall, will have direct and indirect drastic effects on crop production and food security. On average, 30-50% of the yield losses in crops are caused by pests. Temperature has a strong and direct influence on the development and growth of insect pest populations. An increase in pest infestation is driving the insecticide market in the region.

- South Africa accounted for 31.4% of the African insecticides market in 2022. Maize, rice, wheat, and sorghum are the most important food crops grown in the country. In South Africa, the major pest outbreaks were aphids, whiteflies, red spider mites, and thrips. Moreover, some of these pests are vectors of destructive viral pathogens. There has been significant growth observed in the South African insecticide market value during the historical period (between 2017 and 2022), and the market value increased by USD 147.0 million.

- Agricultural pesticides like insecticides have made it possible to increase production in crop yields in Africa. Africa's population, currently estimated at 1.3 billion people, is expected to double by 2050, placing enormous pressure on African food production systems that are plagued by low productivity. Therefore, the increasing concerns over food production, coupled with the emergence of new pests due to erratic climatic conditions, is expected to boost the usage of insecticides in the region, and the market is anticipated to register a CAGR of 3.7% during the forecast period.

Africa Insecticide Market Trends

Growing insect pest infestations and the need for higher food production are raising the consumption of insecticides per hectare in the region

- The consumption of insecticides per hectare in Africa can vary significantly across different regions and crops. Insecticide usage is influenced by several factors, such as the prevalence of insect pests, crop types, farming practices, and the level of agricultural development in each country.

- In Africa, the use of insecticides is critical for managing insects in a variety of agricultural systems, including basic food crops like maize, rice, and wheat, as well as cash crops like cotton, coffee, and cocoa. Insecticides are used to manage a wide variety of insect pests that can cause considerable crop damage, lower yields, and have an impact on food security. Between 2017 and 2022, insecticide consumption per hectare in Africa witnessed a growth of 5.3%.

- Insect pests pose a significant threat to agricultural productivity in Africa. The continent is home to a diverse range of insect pests that can cause extensive damage to crops. The increasing insect pressure, driven by factors such as climate change, changing insect dynamics, and globalization of trade, has necessitated the use of insecticides to manage insect populations effectively. For instance, a total of 1.6 million hectares in Ethiopia and Kenya were treated with broad-spectrum organophosphate and pyrethroid insecticides as a result of the locust outbreak in the Horn of Africa's desert between 2019 and 2021.

- The increasing demand for food in Africa has led to a concerted effort to enhance agricultural output. Insecticides serve an important role in increasing agricultural yields by protecting plants from insects that might disrupt output. The necessity to fulfill the population's food requirements drives the reliance on insecticides.

Increasing pest infestations resulted in high demand for active ingredients like cypermethrin and imidacloprid, and their limited production capacities are raising the prices

- Climate change is significantly impacting agricultural production in Africa, providing favorable conditions for the proliferation of various insect pests like whiteflies. If left unmanaged, these pests can lead to an average crop loss of 25-40%. To combat this issue, farmers heavily rely on insecticides to gain better control over these harmful insects. As a result, the use of insecticides has become a crucial component of agricultural practices in the region.

- Cypermethrin stands out as one of the pricier active ingredients compared to others. In 2022, it recorded a price of USD 21,023.0 per metric ton. Over the historical period, the price of cypermethrin has seen a substantial increase, surging by USD 3,186.2 per metric ton in 2022 compared to its price in 2017. This escalating price trend can be primarily attributed to its extensive usage across various crops to control a wide range of insect pests, such as American bollworms, weevils, codling moths, leafrollers, fruit flies, caterpillars, cutworms, stalk borers, and more. The limited production of cypermethrin within the region also contributes to the upward price trajectory.

- Imidacloprid, classified as a systemic insecticide within the neonicotinoid family, effectively controls an extensive array of insect pests. These pests encompass sucking insects, soil insects, and even termites, making it a versatile solution applicable to various crops. The price of imidacloprid stood at USD 17,120.8 per metric ton in 2022.

- The fluctuations in the prices of active ingredients are primarily influenced by the rising costs of raw materials, which constitutes one of the significant contributing factors to the growth of the market.

Africa Insecticide Industry Overview

The Africa Insecticide Market is fragmented, with the top five companies occupying 24.69%. The major players in this market are BASF SE, Bayer AG, FMC Corporation, Nufarm Ltd and Syngenta Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 South Africa

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Application Mode

- 5.1.1 Chemigation

- 5.1.2 Foliar

- 5.1.3 Fumigation

- 5.1.4 Seed Treatment

- 5.1.5 Soil Treatment

- 5.2 Crop Type

- 5.2.1 Commercial Crops

- 5.2.2 Fruits & Vegetables

- 5.2.3 Grains & Cereals

- 5.2.4 Pulses & Oilseeds

- 5.2.5 Turf & Ornamental

- 5.3 Country

- 5.3.1 South Africa

- 5.3.2 Rest of Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ADAMA Agricultural Solutions Ltd.

- 6.4.2 BASF SE

- 6.4.3 Bayer AG

- 6.4.4 Corteva Agriscience

- 6.4.5 FMC Corporation

- 6.4.6 Nufarm Ltd

- 6.4.7 Sumitomo Chemical Co. Ltd

- 6.4.8 Syngenta Group

- 6.4.9 UPL Limited

- 6.4.10 Wynca Group (Wynca Chemicals)

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219