|

市场调查报告书

商品编码

1683980

亚太地区农药:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Asia Pacific Insecticide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

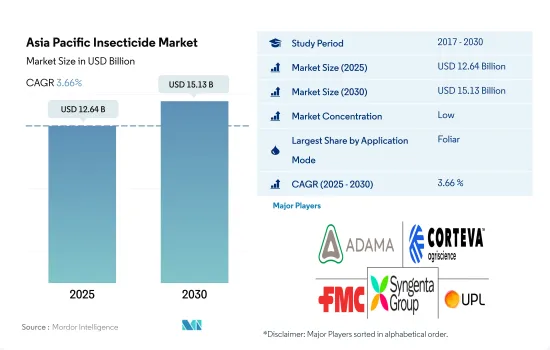

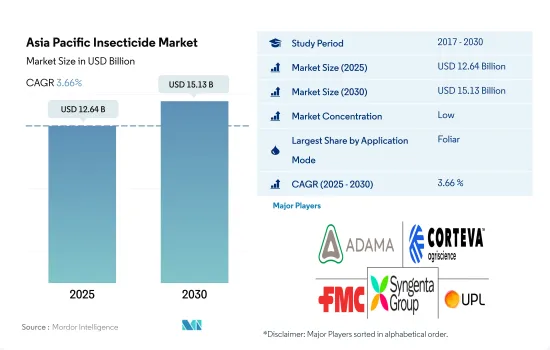

预计 2025 年亚太地区杀虫剂市场规模为 126.4 亿美元,到 2030 年将达到 151.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.66%。

由于病虫害侵袭导致产量损失不断增加,推动了市场的发展。

- 在该地区大多数国家中,农业发挥着至关重要的作用并对 GDP 贡献巨大。然而,病虫害对农作物生产的风险很大,导致产量下降、农民经济损失和对粮食安全的担忧。亚太地区气候和土壤多样,适合种植多种作物。

- 该地区采用各种喷洒方法来控制虫害。 2022年,叶面喷布占比最高,以金额为准计算为57.0%。作为综合害虫管理策略的一部分,使用Chlorantraniliprole、Emamectin benzoate和乙基多杀菌素进行叶面喷布已被证明在该地区非常有效。

- 土壤治疗方法在 2022 年以以金额为准计算占比第三高,为 9.9%。人们发现,向土壤喷洒杀虫剂是控制昆虫最简单、最安全、最有效的方法。说到农业害虫,大约 95% 的生命阶段的一部分是在地下度过的,所以正如我们已经说过的,把它们留在地下是至关重要的。

- 然而,使用叶面喷布杀虫剂对消费者、工人和环境的健康和危害有几个。化学灌溉,即利用滴灌系统在土壤中施用杀虫剂,可以消除叶面喷布杀虫剂的一些通用缺点。 2022 年化学灌溉的以金额为准份额为 7.4%。

- 由于旨在创造最安全、最有效的喷涂方法的研究和创新不断增加,预计市场在预测期内(2023-2029 年)的复合年增长率将达到 3.9%。

气候变迁导致害虫威胁加剧,推动市场成长

- 2022年,亚太地区将占全球市场占有率的34.8%。亚太地区农业规模庞大,害虫数量较多,是农药的主要市场之一。该地区广泛使用杀虫剂来保护作物免受昆虫和害虫的侵害并确保更高的产量。

- 由于广泛采用杀虫剂保护农作物以及人们越来越意识到昆虫对作物产量和生产力的影响,印度、中国、日本和澳洲等国家占据了大部分市场份额。

- 采用现代农业实践和增加耕地面积等农业活动的扩大促进了市场的成长。该地区的耕地面积将从2019年的6.245亿公顷增加到2022年的6.622亿公顷。随着农业的增长,需要有效的解决方案来保护作物免受病虫害的侵害。

- 气候变迁导致破坏作物的害虫蔓延。因此,未来几年对杀虫剂的需求可能会增加。

- 中国预计将成为各地区中成长速度最快的地区,预测期内(2023-2029 年)的复合年增长率为 5.7%,因为由于病虫害威胁加剧和农作物损失增加,预计中国农民将增加农药使用量。

- 由于农业部门的不断扩大、作物保护需求的不断增长以及气候变迁导致的农药需求增加,预计亚太地区农药市场在 2023 年至 2029 年期间的复合年增长率将达到 3.9%。

亚太农药市场趋势

气温升高会促进臭虫等各种害虫的生长,从而增加每公顷土地的杀虫剂消费量。

- 在亚太地区,日本每公顷农药消费量最高,从 2017 年到 2022 年增加了约 7%。这一增长可归因于害虫数量的显着增加。根据农林水产省报告,臭虫危害严重,近年来日益猖獗。专家表示,臭虫等害虫氾滥的主要因素是全球暖化。控制臭虫和其他害虫侵扰的主要方法是使用化学杀虫剂,喷洒频率和喷洒量增加是越南每公顷农药消费量增加的主要原因。

- 以每公顷农药使用量来看,越南是该地区第二大国家。每公顷农药使用量将大幅增加,从 2017 年的 750 克增加到 2022 年的 1,200 克。这一增长可归因于采用集约化作物生产技术来提高生产力和控制害虫。越南属于热带气候,高温、高湿、降雨频繁,为农业生产提供了有利条件,但也促进了害虫的快速繁殖。因此,该国每公顷土地的农药消费量正在增加。

- 整体来看,亚太地区其他国家每公顷农药消费量与前一年同期比较也有所增加。气候变迁导致害虫数量增加是造成此趋势的主要原因。

甘蔗、棉花、水果和蔬菜等主要作物对杀虫剂的需求不断增加,有利于有效成分价格上涨。

- 除了气候变迁之外,害虫对该地区的农业部门构成了重大威胁,造成平均产量损失高达 73% 至 100%。为了有效对抗这些害虫,农民严重依赖化学农药。

- 该地区使用最广泛的杀虫剂是Cypermethrin,它具有合成除虫菊酯的特性,可以有效控制多种害虫,包括鳞翅目、鞘翅目、双翅目和半翅目。在印度、中国和越南等国家,Cypermethrin主要用于防治各种作物的害虫。中国和越南是Cypermethrin的主要进口国。截至2022年,该有效成分的价格已上涨至每吨21,037.7美元,自2017年以来大幅上涨了21.1%。此次价格大幅上涨主要是因为甘蔗、棉花、水果和蔬菜等作物对Cypermethrin的需求增加。

- Imidacloprid是一种新烟碱类杀虫剂,用于多种作物的种子披衣、土壤处理和叶面处理,包括棉花、水稻、油籽、水果、蔬菜和种植作物,如茶、咖啡和豆蔻。其主要目的是消灭吸食汁液的害虫。中国是Imidacloprid的主要出口国,而印度和越南则是该杀虫剂的主要进口国。活性成分价格为每吨17,105.7美元,较2017年大幅上涨21.2%。

- 需求增加、进口关税和外汇波动等各种因素导致活性成分价格波动。

亚太农药产业概况

亚太地区杀虫剂市场较为分散,前五大公司占了21.92%的市场。该市场的主要企业是:ADAMA Agricultural Solutions Ltd、Corteva Agriscience、FMC Corporation、Syngenta Group 和 UPL Limited(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第二章 报告要约

第 3 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 每公顷农药消费量

- 有效成分价格分析

- 法律规范

- 澳洲

- 中国

- 印度

- 印尼

- 日本

- 缅甸

- 巴基斯坦

- 菲律宾

- 泰国

- 越南

- 价值链与通路分析

第五章 市场区隔

- 如何使用

- 化学灌溉

- 叶面喷布

- 熏蒸

- 种子处理

- 土壤处理

- 作物类型

- 经济作物

- 水果和蔬菜

- 粮食

- 豆类和油籽

- 草坪和观赏植物

- 国家

- 澳洲

- 中国

- 印度

- 印尼

- 日本

- 缅甸

- 巴基斯坦

- 菲律宾

- 泰国

- 越南

- 其他亚太地区

第六章 竞争格局

- 主要策略趋势

- 市场占有率分析

- 业务状况

- 公司简介(包括全球概况、市场层级概况、主要业务部门、财务状况、员工人数、关键资讯、市场排名、市场占有率、产品和服务、最新发展分析)

- ADAMA Agricultural Solutions Ltd

- BASF SE

- Bayer AG

- Corteva Agriscience

- FMC Corporation

- Jiangsu Yangnong Chemical Co. Ltd

- Nufarm Ltd

- Rainbow Agro

- Syngenta Group

- UPL Limited

第七章:执行长的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源和进一步阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 50001682

The Asia Pacific Insecticide Market size is estimated at 12.64 billion USD in 2025, and is expected to reach 15.13 billion USD by 2030, growing at a CAGR of 3.66% during the forecast period (2025-2030).

The market is being driven by growing yield losses due to increasing pest infestations

- In most of the countries in the region, agriculture has a key role to play and contributes substantially to GDP. Nevertheless, there is a significant risk to crop production due to the infestations of insects that result in reduced yields, financial losses for farmers, and concerns about food security. The diversity of climate and soil in Asia-Pacific allows for the cultivation of different crops.

- Various application methods are adopted in the region to manage insect infestation. The foliar application method occupied the highest share of 57.0% by value in 2022. It has been observed that the use of foliar spraying with chlorantraniliprole, emamectin benzoate, and spinetoram as part of an integrated pest management strategy has been quite effective in the region.

- The soil treatment method occupied the third highest share of 9.9% by value in 2022. It has been observed that insecticide application on soil appeared to be the easiest, safest, and most efficient way of controlling insects. In terms of agricultural pests, approximately 95% have passed some portion of their lives in the soil, and therefore, it is essential for them to be held underground, as already mentioned.

- Nevertheless, there are several drawbacks to the health of consumers, workers, and the environment from using foliar pesticides. Chemigation uses pesticides in soil with drip irrigation systems and may remove several drawbacks common to foliar insecticide applications. Chemigation occupied a share of 7.4% by value in 2022.

- Owing to the increase in research and innovation, which are aimed to bring out the safest and most effective method of application, the market is anticipated to register a CAGR of 3.9% during the forecast period (2023-2029).

The rising threat of pests with changing climate is contributing to the growth of the market

- Asia-Pacific accounted for 34.8% of the market share of the global insecticide market in 2022. Asia-Pacific is one of the important markets for insecticides due to its large agricultural sector and the prevalence of pests in the region. Insecticides are widely used in the region to protect crops from insects and pests, ensuring higher yields.

- Countries such as India, China, Japan, and Australia hold a substantial share of the market due to the wide adoption of insecticides to protect crops and the rise in awareness about the effects of insects on crop yield and productivity.

- The expansion of agriculture activities, such as adapting modern agriculture practices and increasing the area under agricultural cultivation, contributes to the market's growth. The region witnessed an increase in acreage under cultivation to 662.2 million hectares in 2022 from 624.5 million hectares in 2019. As agriculture increases, effective solutions are needed to protect crops from pests.

- The changing climate is leading to the spread of insect pests that can damage crops. Due to this, the demand for insecticides may increase in the coming years.

- China is expected to grow fastest in the region at a CAGR of 5.7% during the forecast period (2023-2029) because the farmers in the country are expected to increase the usage of insecticide owing to the rising threat of pests and increasing crop losses.

- The Asia-Pacific insecticide market is forecasted to record a CAGR of 3.9% during 2023-2029 due to the increasing demand for insecticides due to the expansion of the agriculture sector, the rising need to protect crops, and the changing climate.

Asia Pacific Insecticide Market Trends

The rise in climate temperatures favors various insect pests like stink bugs to grow, increasing insecticide consumption per hectare

- In Asia-Pacific, Japan exhibits higher per-hectare consumption of insecticide, which witnessed approximately a 7% increase from 2017 to 2022. This rise may be attributed to the substantial growth in the population of insect pests. The Ministry of Agriculture, Forestry, and Fisheries reports that stink bugs, which pose significant threats to agricultural crops, have been increasingly prevalent in recent years. According to experts, the primary factor driving the proliferation of stink bugs and other pests is attributed to global warming. The principal approach to managing infestations of stink bugs and other pests involves the use of chemical insecticides, with the intensified frequency and dosages of the application being the primary factors contributing to the augmented consumption of insecticides per hectare in the country.

- Vietnam is the second country in the region in terms of insecticide usage per hectare. The amount of insecticide used per hectare significantly increased from 750 g in 2017 to 1,200 g in 2022. This rise may be attributed to the adoption of intensive crop production techniques aimed at improving productivity and pest control. Vietnam's tropical climate, characterized by high temperatures, humidity, and frequent rainfall, provides favorable conditions for agriculture but also promotes the rapid proliferation of insect pests. As a result, insecticide consumption per hectare has increased in the country.

- In overall, other countries in Asia-Pacific are also experiencing a YoY increase in insecticide consumption per hectare. Climate changes leading to an increase in the population of insect pests' infestations are primary reasons for this trend.

Increased demand for insecticides in major crops like sugarcane, cotton, and fruits and vegetables favors the active ingredient price growth

- In addition to climate changes, insect pests present a significant threat to the agriculture sector in the region, causing average yield losses of up to 73% to 100%. To combat these insect pests effectively, farmers are heavily relying on chemical insecticides.

- Cypermethrin holds a dominant position as the most widely used insecticide in the region, known for its synthetic pyrethroid properties that effectively control various insect pests, including Lepidoptera, Coleoptera, Diptera, and Hemiptera. Countries like India, China, and Vietnam predominantly rely on cypermethrin for pest control across various crops. China and Vietnam are the primary importers of cypermethrin. As of 2022, the price of the active ingredient increased to USD 21,037.7 per metric ton, reflecting a significant rise of 21.1% since 2017. This notable price increase was primarily attributed to the escalating demand for cypermethrin in crops such as sugarcane, cotton, and fruits and vegetables.

- Imidacloprid, a neonicotinoid insecticide, finds application as a seed dressing, soil treatment, and foliar treatment in various crops, including cotton, rice, oilseeds, fruits, and vegetables, and plantation crops like tea, coffee, and cardamom. Its primary purpose is to control sucking insect pests. China serves as the major exporter of Imidacloprid, while India and Vietnam are the main importing countries for this insecticide. The price of the active ingredient stood at USD 17,105.7 per metric ton, representing a significant increase of 21.2% compared to 2017.

- Various factors, such as rising demand, import tariffs, and fluctuations in exchange rates, contribute to the fluctuation in the price of the active ingredients.

Asia Pacific Insecticide Industry Overview

The Asia Pacific Insecticide Market is fragmented, with the top five companies occupying 21.92%. The major players in this market are ADAMA Agricultural Solutions Ltd, Corteva Agriscience, FMC Corporation, Syngenta Group and UPL Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 Australia

- 4.3.2 China

- 4.3.3 India

- 4.3.4 Indonesia

- 4.3.5 Japan

- 4.3.6 Myanmar

- 4.3.7 Pakistan

- 4.3.8 Philippines

- 4.3.9 Thailand

- 4.3.10 Vietnam

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Application Mode

- 5.1.1 Chemigation

- 5.1.2 Foliar

- 5.1.3 Fumigation

- 5.1.4 Seed Treatment

- 5.1.5 Soil Treatment

- 5.2 Crop Type

- 5.2.1 Commercial Crops

- 5.2.2 Fruits & Vegetables

- 5.2.3 Grains & Cereals

- 5.2.4 Pulses & Oilseeds

- 5.2.5 Turf & Ornamental

- 5.3 Country

- 5.3.1 Australia

- 5.3.2 China

- 5.3.3 India

- 5.3.4 Indonesia

- 5.3.5 Japan

- 5.3.6 Myanmar

- 5.3.7 Pakistan

- 5.3.8 Philippines

- 5.3.9 Thailand

- 5.3.10 Vietnam

- 5.3.11 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ADAMA Agricultural Solutions Ltd

- 6.4.2 BASF SE

- 6.4.3 Bayer AG

- 6.4.4 Corteva Agriscience

- 6.4.5 FMC Corporation

- 6.4.6 Jiangsu Yangnong Chemical Co. Ltd

- 6.4.7 Nufarm Ltd

- 6.4.8 Rainbow Agro

- 6.4.9 Syngenta Group

- 6.4.10 UPL Limited

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219