|

市场调查报告书

商品编码

1683993

印尼农药:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Indonesia Insecticide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

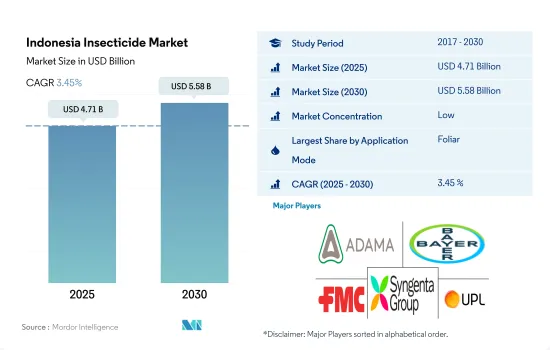

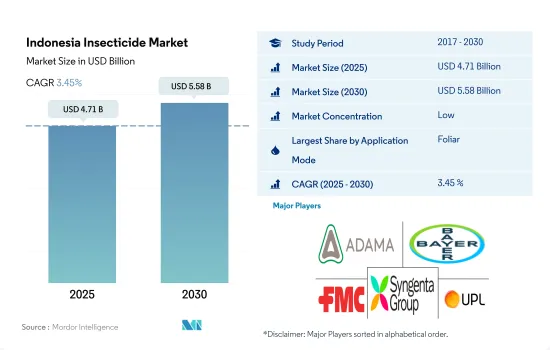

预计 2025 年印尼农药市场规模将达到 47.1 亿美元,到 2030 年预计将达到 55.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.45%。

病虫害防治及减少喷药量将降低生产成本,促进杀虫剂市场叶面喷布模式的推广。

- 叶面喷布杀虫剂越来越受欢迎,因为它能够有效地控制目标害虫,同时所需的喷洒量较少。叶面喷布杀虫剂在 2022 年占比最高,为 55.9%,同年的市值为 240 万美元。

- 叶面喷布杀虫剂被广泛采用,因为它能有效对抗害虫的威胁并保护作物,尤其是水稻,它是大多数印尼人的主食。

- 杀虫剂种子处理在印尼越来越重要,因为它们可以控制种子和幼苗害虫并防治种子和土壤传播的害虫。使用杀虫剂处理种子可以有效地防止或减少这些生物在作物生长早期造成的有害影响,从而促进作物更好地生长并改善整体健康。截至2022年,该方法占市场价值的16.7%,约7.522亿美元。

- 由于茎象鼻虫和大麦蝗虫的侵害,印尼的油棕榈作物产量损失严重,最高可达 30%。使用Imidacloprid、Thiamethoxam、西维因和Bifenthrin等杀虫剂进行土壤处理可以有效控制这些害虫。受此影响,预计预测期内土壤处理的应用模式将达到 3.4% 的复合年增长率。

- 熏蒸产业取得了令人瞩目的成长,到 2022 年将达到 3.799 亿美元。熏蒸方法的有效性使其成为越来越受欢迎的行业,它可以有效保护农产品免受害虫损害,并最终提高其品质和市场价值。

印尼农药市场趋势

害虫造成的农作物损失增加、农药使用量增加以及农药产品的进步可能会推动市场

- 农药主要用于消灭和控制侵害农作物的害虫。昆虫、螨虫和其他节肢动物等害虫会对农作物造成严重破坏,导致产量下降和品质下降。杀虫剂有助于减少害虫造成的损害,保护作物并确保足够的粮食产量。近几十年来,印尼的杀虫剂使用量有所增加。 2017年至2022年,印尼每公顷农药消费量将增加25.2%。

- 昆虫也能作为植物疾病的传播媒介,传播危害作物的疾病。昆虫透过进食直接损害植物,并且透过将病原体传播到植物受损区域间接损害植物,然后病原体从该区域传播到整个植物。杀虫剂用于控制昆虫媒介和最大限度地减少疾病传播,以保护作物健康并减少生产损失。

- 截至 2021 年 2 月,印尼註册的杀虫剂品牌共有 1,059 个,包含 80 种不同有效成分,适用于 67 种作物/目标。在印尼登记的有效成分中,90%以上是拟除虫菊酯、有机磷酸盐、阿维菌素和米尔贝霉素、新烟碱、氨基甲酸酯、沙蚕毒素类似物和苯基吡唑类(fiproles)的组合。杀虫剂品牌和有效成分的多样性意味着农民可以透过多种选择来满足不同作物和农业系统的昆虫管理需求。註册农药的种类繁多,反映了病虫害防治在印尼农业中的重要性,以及为农民提供有效工具保护作物的努力。

大多数活性成分都是从其他国家进口的,因此该国活性成分的价格取决于外汇、进口税和关税。

- 印尼是世界主要农业国家之一。但该国面临基本农业投入品短缺的问题,尤其是本土农药产业的短缺。该国严重依赖进口农药。大部分的农药和有效成分都是从中国进口。因此,价格受外汇、进口税和关税的影响。

- 2022 年,Cypermethrin的价格为每吨 20,600 美元。由于它能有效控制多种昆虫,包括斑点甲虫、粉红甲虫、早期斑螟和毛虫,因此被农业行业广泛采用。由于其有效性,Imidacloprid成为农民保护农作物免受虫害、确保丰收的热门选择。

- Imidacloprid是一种强效的新烟碱类杀虫剂,具有有效的系统性和残留性。它可以控制多种昆虫,包括吸食汁液的昆虫、介壳虫、苍蝇、潜叶虫和白蚁。由于它适用于农作物并且施用量小,因此在农民中得到广泛应用。预计2017年至2022年该活性成分的价格将上涨77.9%,达到每吨17,000美元。

- Malathion属于有机磷酸酯类。它们通常用于控制植物、水果、蔬菜、园林绿化和灌木上的各种害虫。Malathion基产品有多种形式,包括液体、粉末、可湿性粉剂和乳液。印尼有多种含有Malathion的产品出售。

- 活性成分的价格会影响杀虫剂市场的竞争格局。能够以更具竞争力的价格购买活性成分的公司可能比其他公司更具优势。

印尼农药产业概况

印尼农药市场较为分散,前五大企业市占率合计为1.68%。该市场的主要企业是:ADAMA Agricultural Solutions Ltd、Bayer AG、FMC Corporation、Syngenta Group 和 UPL Limited(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第二章 报告要约

第 3 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 每公顷农药消费量

- 有效成分价格分析

- 法律规范

- 印尼

- 价值链与通路分析

第五章 市场区隔

- 如何使用

- 化学灌溉

- 叶面喷布

- 熏蒸

- 种子处理

- 土壤处理

- 作物类型

- 经济作物

- 水果和蔬菜

- 粮食

- 豆类和油籽

- 草坪和观赏植物

第六章 竞争格局

- 主要策略趋势

- 市场占有率分析

- 业务状况

- 公司简介(包括全球概况、市场层级概况、主要业务部门、财务状况、员工人数、关键资讯、市场排名、市场占有率、产品和服务、最新发展分析)

- ADAMA Agricultural Solutions Ltd

- BASF SE

- Bayer AG

- Corteva Agriscience

- FMC Corporation

- Nufarm Ltd

- PT Biotis Agrindo

- Syngenta Group

- UPL Limited

- Wynca Group(Wynca Chemicals)

第七章:执行长的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源和进一步阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 50001695

The Indonesia Insecticide Market size is estimated at 4.71 billion USD in 2025, and is expected to reach 5.58 billion USD by 2030, growing at a CAGR of 3.45% during the forecast period (2025-2030).

Targeted pest controlling and reduction in application rates reduce the production cost, which will drive the foliar application mode of the insecticide market

- The foliar mode of insecticide application has gained popularity due to its effectiveness in controlling target pests and lower dosage rates. The foliar method of insecticide application accounted for the highest share of 55.9% in 2022, with a market value of USD 2.4 million in the same year.

- The widespread adoption of the foliar application method of insecticides stems from its ability to safeguard food crops, notably rice, which serves as a staple for most Indonesians, by effectively combating the menace of pests.

- Insecticide seed treatment is gaining importance in Indonesia as it can manage pests in seeds and young seedlings, protecting seed and soil-borne insect pests. Treating seeds with insecticides effectively prevents or reduces the harmful impacts caused by these organisms in the initial stage of crop growth, resulting in enhanced crop establishment and overall health. As of 2022, this method accounted for 16.7% of the market value, approximately USD 752.2 million.

- Severe yield losses of up to 30% of oil palm crops in Indonesia are attributed to stem weevils and white grubs. These insect pests can be controlled by performing soil treatment using insecticides like imidacloprid, thiamethoxam, carbaryl, and bifenthrin. Thus, the soil treatment application mode is expected to register a CAGR of 3.4% during the forecast period.

- The fumigation segment experienced impressive growth and reached a value of USD 379.9 million in 2022, primarily driven by farmers' growing acceptance of fumigation practices. This surge in popularity can be credited to the effectiveness of fumigation methods, which effectively protect agricultural products from pest-related damages, ultimately elevating their quality and market value.

Indonesia Insecticide Market Trends

Growing crop losses by insect pests, rise in the adoption of pesticides, and advancements in insecticide products may drive the market

- Insecticides are primarily used to control and manage pests that attack agricultural crops. Pests such as insects, mites, and other arthropods can cause significant damage to crops, leading to yield losses and reduced quality. Insecticides help mitigate these pest pressures, protecting crops and ensuring sufficient food production. The level of insecticide use in Indonesia has increased over the last few decades. The consumption of insecticides in Indonesia per hectare increased by 25.2% from 2017 to 2022.

- Insects also act as vectors for plant diseases, transferring diseases that can harm crops. They damage plants directly by feeding and indirectly by delivering pathogens to wounded places of plants, from where pathogens spread throughout the plant. Insecticides are used to control insect vectors and minimize disease transmission, hence protecting crop health and reducing production losses.

- Until February 2021, there were 1,059 insecticide brands registered in Indonesia consisting of 80 different active ingredients for 67 crops/targets. More than 90% of the active ingredients registered in Indonesia consisted of a combination of pyrethroids, organophosphates, avermectins and milbemycins, neonicotinoids, carbamates, nereistoxin analogs, and phenylpyrazoles (fiproles). Having a diverse range of insecticide brands and active ingredients indicates that farmers have a wide variety of options for addressing insect management needs in various crops and agricultural systems. The wide range of registered insecticides reflects the importance of pest control in Indonesian agriculture and the efforts to provide farmers with effective tools to protect their crops.

Active ingredient prices in the country are dependent on currency exchange rates, import tariffs, and duties because most of the active ingredients are imported from other countries

- Indonesia is a prominent agricultural nation globally. However, it faces a shortage of basic agricultural inputs, notably in its indigenous pesticide industry. The country relies heavily on importing insecticides. Most of the insecticides and active ingredients are imported from China. Consequently, their prices are dependent on currency exchange rates, import tariffs, and duties.

- In 2022, cypermethrin was valued at USD 20.6 thousand per metric ton. It has been widely adopted in the agricultural industry for its effectiveness in controlling various types of insects, including spotted ball worms, pink ball worms, early spot borers, and hairy caterpillars. Its effectiveness has made it a popular choice for farmers seeking to protect their crops from pests and ensure a successful harvest.

- Imidacloprid is a powerful neonicotinoid insecticide with effective systemic and residual properties. It can control a wide range of insects, including sucking insects, beetles, flies, leaf miners, and termites. It is suitable for crops and has low application rates, hence widely popular among farmers. The price of this active ingredient increased by 77.9% to USD 17.0 thousand per metric ton from 2017 to 2022.

- Malathion belongs to the organophosphate family. It is often utilized to manage various insect infestations that target plants, fruits, vegetables, landscaping, and shrubs. Malathion-based products come in various forms, such as liquids, dust, wettable powders, or emulsions. In Indonesia, there are a variety of products available that contain malathion.

- Active ingredient prices can influence the competitive landscape of the insecticide market. Companies that can source active ingredients at more competitive prices may have a competitive advantage over others.

Indonesia Insecticide Industry Overview

The Indonesia Insecticide Market is fragmented, with the top five companies occupying 1.68%. The major players in this market are ADAMA Agricultural Solutions Ltd, Bayer AG, FMC Corporation, Syngenta Group and UPL Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 Indonesia

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Application Mode

- 5.1.1 Chemigation

- 5.1.2 Foliar

- 5.1.3 Fumigation

- 5.1.4 Seed Treatment

- 5.1.5 Soil Treatment

- 5.2 Crop Type

- 5.2.1 Commercial Crops

- 5.2.2 Fruits & Vegetables

- 5.2.3 Grains & Cereals

- 5.2.4 Pulses & Oilseeds

- 5.2.5 Turf & Ornamental

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ADAMA Agricultural Solutions Ltd

- 6.4.2 BASF SE

- 6.4.3 Bayer AG

- 6.4.4 Corteva Agriscience

- 6.4.5 FMC Corporation

- 6.4.6 Nufarm Ltd

- 6.4.7 PT Biotis Agrindo

- 6.4.8 Syngenta Group

- 6.4.9 UPL Limited

- 6.4.10 Wynca Group (Wynca Chemicals)

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219