|

市场调查报告书

商品编码

1683997

北美农药:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)North America Insecticide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

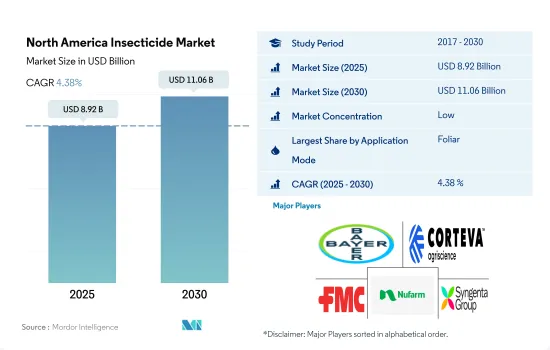

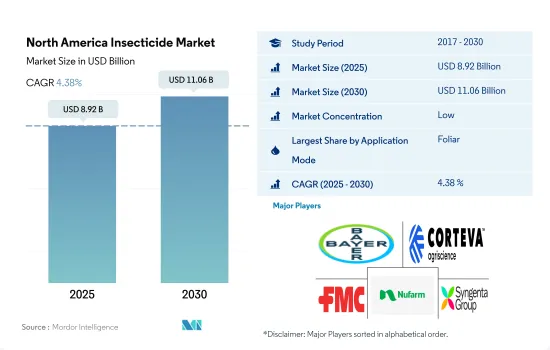

北美农药市场规模预计在 2025 年将达到 89.2 亿美元,预计到 2030 年将达到 110.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.38%。

害虫问题加剧预计将推动市场成长

- 2022 年,北美农药市场将占全球农药市场价值的 25.2%。预计北美杀虫剂市场各个细分领域都将实现成长。由于作物保护需求不断增加以及农业生产率不断提高,预计 2023 年至 2029 年期间的复合年增长率将达到 4.8%。

- 在北美杀虫剂市场中,叶面喷布因其较高的病虫害防治效果占据了较大的市场份额,2022年占比为41.2%。

- 2022 年,化学灌溉部分占北美农药市场的 14.4%。化学灌溉部分农药市场的发展受到其潜在优势的驱动,例如精准统一地施用农药、降低人事费用和提高害虫防治效果。

- 种子处理方法在该地区越来越受欢迎,预计将成为成长最快的领域之一,预测期内(2023-2029 年)杀虫剂市场的复合年增长率为 4.8%。种子处理包括在种植前用杀虫剂涂覆种子,保护新生的幼苗免受早期害虫的压力和疾病。其针对性的、有效的害虫管理方法使其成为对农民有吸引力的选择。

- 预计 2023 年至 2029 年期间,土壤处理农药市场复合年增长率将达到 4.8%。土壤处理的成长可能是由于其具有许多好处,例如可以提供对特定害虫的长期保护,并透过针对生命週期不同阶段的害虫来促进更好的害虫管理。

害虫压力的增加、种植面积的扩大以及对优质农产品的需求不断增长正在推动市场成长。

- 2022 年,北美占全球杀虫剂市场的 24.0%。由于对作物保护解决方案的需求不断增加,该地区正在经历显着增长。人口增长、粮食需求增加、农业活动扩大以及保护作物免受虫害的需要增加等因素正在推动市场的发展。

- 美国是北美农药市场的主导者。该国拥有世界上规模最大、技术最先进的农业部门之一,生产各种各样的作物和商品。因此,美国对杀虫剂的需求很大,以保护作物免受有害昆虫和害虫的侵害。

- 预计墨西哥在预测期(2023-2029 年)的复合年增长率将达到 6.2%,成为北美杀虫剂市场成长最快的国家。农业活动的扩大、作物的多样化以及气候条件的变化促使墨西哥使用农药来保护作物并确保最佳产量。

- 预计预测期内(2023-2029 年)加拿大的复合年增长率将达到 3.0%。大规模栽培作物的害虫压力不断增加以及保护作物免受害虫侵害的需求日益增长,预计将推动加拿大农药市场的成长。

- 2022 年,北美其他地区杀虫剂市场价值为 6,550 万美元。当年水果和蔬菜作物部门占据了市场主导地位,市场占有率为 4.3%。人们越来越意识到保护作物免受虫害侵害所带来的经济效益,从而推动了该区域市场的发展。因此,预计预测期内(2023-2029 年)北美以外杀虫剂市场的复合年增长率将达到 4.7%。

北美杀虫剂市场趋势

预计保护作物免受害虫侵害和提高产量的需求将推动对农药的需求

- 在北美国家中,美国每公顷杀虫剂消费量最高,2022 年为 791.7 克。这是由于作物种植面积大,且全球暖化等因素导致气候条件不断变化的,增加了害虫侵扰的机会。气温升高导致害虫越冬存活率提高,主要体现在美国玉米穗瘟和棉铃虫的案例。

- 这种现象对作物产量构成了重大风险,并且给管理这些害虫带来了重大挑战,尤其是对美国主要作物玉米而言。这种情况导致每公顷农地的农药消费量增加。

- 墨西哥是北美第二大农药消费国,2022 年每公顷农药消费量为 606 公克。该国农药使用量的增加可归因于害虫侵扰增加导致作物产量下降。根据粮农组织统计部提供的资料,茄子是墨西哥种植最广泛的作物之一,产量从2019年的每公顷793.0公斤下降到2021年的785.0公斤,导致农药消费量减少。提高农作物产量是该国使用农药的主要驱动力。

- 据报导,美国和加拿大87.6%的玉米产量损失是由于无脊椎动物害虫的侵扰造成的。预计这些因素将推动北美农药使用量的增加。

农药价格可能受原物料价格波动的影响。

- 2022 年,Cypermethrin的价格为每吨 21,100 美元。Cypermethrin因其能够控制多种昆虫(包括蚜虫、介壳虫、斑甲虫、粉红甲虫、早斑虫和毛虫)的能力而被广泛应用于农业。其已被证实的有效性使其越来越受到希望保护农作物免受虫害并确保丰收的产量的欢迎。

- Imidacloprid是一种强效的新烟碱类杀虫剂,具有系统性和持久性作用。它能够控制多种昆虫,包括蚜虫、猎蝽、蓟马、臭虫、蝗虫和其他多种破坏作物的害虫。它也可用作种子处理,保护幼苗免受伤害,特别是免受威胁发芽和发育植物的地下害虫的伤害。Imidacloprid产品有多种形式,包括浓缩液和固态。由于它与植物的兼容性以及减少喷药需求,它在农民中很受欢迎。 2022 年该活性化合物的价格为每吨 17,200 美元。

- Malathion是一种有机磷酸酯杀虫剂,用于控制蚜虫、跳蚤、叶蝉、粉蚝和许多其他作物害虫。在美国广泛种植且经常用Malathion处理的五种作物是樱桃番茄、绿花椰菜、桑葚、蔓越莓和无花果。 2022 年的价格估计为每吨 12,600 美元。

北美农药产业概况

北美杀虫剂市场较为分散,前五大公司占了39.62%的市场。市场的主要企业是:拜耳股份公司、科迪华农业科技、FMC 公司、Nufarm 有限公司和先正达集团(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第二章 报告要约

第 3 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 每公顷农药消费量

- 有效成分价格分析

- 法律规范

- 加拿大

- 墨西哥

- 美国

- 价值链与通路分析

第五章 市场区隔

- 如何使用

- 化学灌溉

- 叶面喷布

- 熏蒸

- 种子处理

- 土壤处理

- 作物类型

- 经济作物

- 水果和蔬菜

- 粮食

- 豆类和油籽

- 草坪和观赏植物

- 原产地

- 加拿大

- 墨西哥

- 美国

- 北美其他地区

第六章 竞争格局

- 主要策略趋势

- 市场占有率分析

- 业务状况

- 公司简介(包括全球概况、市场层级概况、主要业务部门、财务状况、员工人数、关键资讯、市场排名、市场占有率、产品和服务、最新发展分析)

- ADAMA Agricultural Solutions Ltd.

- American Vanguard Corporation

- BASF SE

- Bayer AG

- Corteva Agriscience

- FMC Corporation

- Nufarm Ltd

- Sumitomo Chemical Co. Ltd

- Syngenta Group

- UPL Limited

第七章:执行长的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源和进一步阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 50001699

The North America Insecticide Market size is estimated at 8.92 billion USD in 2025, and is expected to reach 11.06 billion USD by 2030, growing at a CAGR of 4.38% during the forecast period (2025-2030).

The rising pest challenges are expected to propel the growth of the market

- The North American insecticide market accounted for 25.2% of the market value of the global insecticide market in 2022. The North American insecticide market is expected to witness growth in all segments. It is anticipated to register a CAGR of 4.8% during 2023-2029 due to the rising demand for crop protection and improved agriculture productivity.

- Foliar applications held a significant value share in the insecticide market of North America, accounting for 41.2% in 2022 due to their effectiveness in controlling insect pests.

- The chemigation segment accounted for 14.4% of North America's insecticide market value in 2022. The insecticide market in the chemigation segment is driven by its potential benefits, including the precise and uniform application of insecticides, reduced labor costs, and enhanced pest control efficacy.

- The seed treatment method has been gaining popularity in the region, and it is expected to be one of the fastest-growing segments at a CAGR of 4.8% in the insecticide market during the forecast period (2023-2029). Seed treatment involves coating seeds with insecticides before planting, which provides protection to emerging seedlings from early pest pressures and diseases. It has become an attractive option for farmers due to its targeted and efficient approach to pest management.

- The insecticide market in the soil treatment segment is anticipated to register a CAGR of 4.8% during 2023-2029. The growth in soil treatment can be attributed to its advantages, such as providing long-lasting protection against certain pests and promoting better pest management by targeting insects at different stages of their life cycles.

Increasing pest pressure, expansion of cultivation, and rising demand for quality produce are driving the growth of the market

- North America accounted for a 24.0% share in 2022 of the global insecticide market. The region is witnessing significant growth due to the increasing demand for crop protection solutions. Factors such as growing population, rising food demand, expanding agricultural activities, and the increasing need to protect crops from insect pests are driving the market.

- The United States is a dominant player in the North American insecticide market. It has one of the largest and most technologically advanced agricultural sectors in the world, producing a wide range of crops and commodities. As a result, the US demand for insecticides to protect crops from damaging pests and insects has been substantial.

- Mexico is expected to register a CAGR of 6.2% during the forecast period (2023-2029), making it the fastest-growing country in the North American insecticide market. The growing agricultural activities, a diverse range of crops, and changing climatic conditions are driving the use of insecticides in Mexico to protect crops and ensure optimal yields.

- Canada is anticipated to register a CAGR of 3.0% during the forecast period (2023-2029). The rising pest pressure in significantly cultivated crops and the growing need to protect crops from insect pests are anticipated to fuel the growth of the Canadian insecticide market.

- The insecticide market in the Rest of North America was valued at USD 65.5 million in 2022. The fruit and vegetable crops segment dominated the market, with a 4.3% market share in the same year. The market in this regional segment is being driven by the growing awareness of the economic benefits of protecting crops from insect pests. As a result, the Rest of North America insecticide market is expected to register a CAGR of 4.7% during the forecast period (2023-2029).

North America Insecticide Market Trends

The need for improved yield by protecting the crops from pests is anticipated to boost the demand for insecticides

- Among the North American countries, the United States witnessed the largest consumption of insecticides per hectare, with 791.7 g in 2022, attributed to the large area under the cultivation of crops and increased exposure to insect pest infestations due to constantly changing climatic conditions due to factors like global warming. Rising temperatures have caused the increased survival of insect pests during the winter seasons, which is mainly observed in cases of corn earworm and cotton bollworm in the United States.

- This phenomenon has posed a notable risk to crop yields and presented a significant challenge in managing these pests, particularly in corn cultivation, which is a fundamentally grown food crop in the United States. These kinds of circumstances have increased the need for heavy insecticide consumption per hectare of cropland.

- Mexico is the second-largest consumer of insecticides in North America, and in 2022, the country consumed 606 g of insecticides per hectare. The increased usage of insecticides in the country may be attributed to the reduction in the harvested crop yield due to increased infestation of insect pests. According to the data provided by the FAO Statistics, the yield of eggplant, which is one of the most largely grown crops in Mexico, decreased from 793.0 kg per hectare in 2019 to 785.0 kg per hectare in 2021, leading to reduced insecticide consumption. The aim to increase the yield of the crops is majorly driving the usage of insecticides in the country.

- It was reported that 87.6% of the yield loss from the total corn produced in the United States and Canada was due to invertebrate pest infestation. These factors are anticipated to drive the usage of insecticides in North America.

The prices of insecticides may be impacted by the fluctuation of raw material prices

- In 2022, cypermethrin was valued at USD 21.1 thousand per metric ton. Its widespread utilization in agriculture owes to its proficiency in managing diverse insect varieties, such as aphids, beetles, spotted ball worms, pink ball worms, early spot borers, and hairy caterpillars. Its proven efficacy has elevated its popularity among farmers aiming to protect their crops from pests and secure a fruitful yield.

- Imidacloprid stands as a potent neonicotinoid insecticide, displaying effective systemic and enduring characteristics. It boasts the ability to manage a broad spectrum of insects, such as aphids, cane beetles, thrips, stink bugs, locusts, and an array of other crop-damaging pests. It is also used as a seed treatment that shields young plants from harm, especially against subterranean pests that can threaten germinating and growing plants. Imidacloprid products are available in various forms, such as liquid concentrates and solids. Owing to its compatibility with plants and minimal application needs, it has gained popularity among farmers. The pricing of this active compound was recorded at USD 17.2 thousand per metric ton in 2022.

- Malathion is an organophosphate insecticide that is used to control a wide variety of food and feed crops to control many types of insects such as aphids, fleas, leafhoppers, Japanese beetles, and other insect pests on a number of crops. Five crops that are extensively grown in the United States that use malathion frequently are cherry tomato, broccoli, mulberry, cranberry, and fig. It is valued at a price of USD 12.6 thousand per metric ton in 2022.

North America Insecticide Industry Overview

The North America Insecticide Market is fragmented, with the top five companies occupying 39.62%. The major players in this market are Bayer AG, Corteva Agriscience, FMC Corporation, Nufarm Ltd and Syngenta Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 Canada

- 4.3.2 Mexico

- 4.3.3 United States

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Application Mode

- 5.1.1 Chemigation

- 5.1.2 Foliar

- 5.1.3 Fumigation

- 5.1.4 Seed Treatment

- 5.1.5 Soil Treatment

- 5.2 Crop Type

- 5.2.1 Commercial Crops

- 5.2.2 Fruits & Vegetables

- 5.2.3 Grains & Cereals

- 5.2.4 Pulses & Oilseeds

- 5.2.5 Turf & Ornamental

- 5.3 Country

- 5.3.1 Canada

- 5.3.2 Mexico

- 5.3.3 United States

- 5.3.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ADAMA Agricultural Solutions Ltd.

- 6.4.2 American Vanguard Corporation

- 6.4.3 BASF SE

- 6.4.4 Bayer AG

- 6.4.5 Corteva Agriscience

- 6.4.6 FMC Corporation

- 6.4.7 Nufarm Ltd

- 6.4.8 Sumitomo Chemical Co. Ltd

- 6.4.9 Syngenta Group

- 6.4.10 UPL Limited

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219