|

市场调查报告书

商品编码

1684000

南美洲农药:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)South America Insecticide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

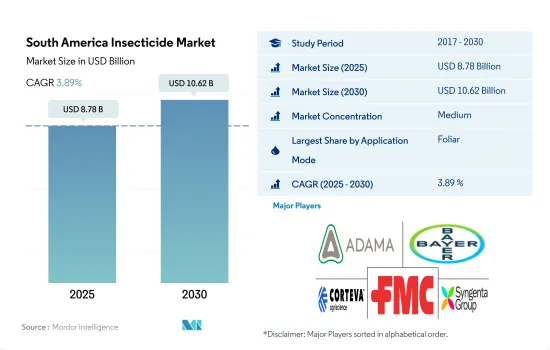

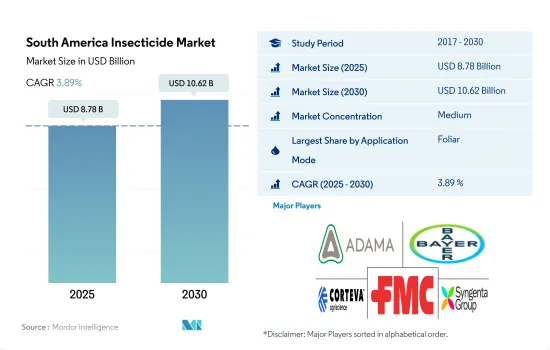

南美杀虫剂市场规模预计在 2025 年将达到 87.8 亿美元,预计到 2030 年将达到 106.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.89%。

叶面喷布因其有效性和施用时间的灵活性而占据市场主导地位。

- 叶面喷布杀虫剂因其能有效控制目标害虫以及与其他方法相比施用时间和数量的灵活性等因素而受到广泛欢迎。叶面喷布杀虫剂在 2022 年占比最高,为 53.8%,同年市场价值为 42.1 亿美元。

- 杀虫种子处理在控制植物感染蔓延方面的重要性已由其巨大的市场占有率体现出来。 2022 年,南美种子处理市场将以杀虫剂种子处理为主,占据所有应用的 64.9% 的惊人市场占有率。这项统计数据表明,人们越来越认识到种子处理在对抗昆虫媒介和保护作物生产力方面的有效性。

- 土壤施用杀虫剂针对的是严重影响植物根部和下部的土传害虫,这种方法在 2022 年占南美洲杀虫剂市场总量的 10.5%。已知甲虫等土传害虫的侵扰可使大豆根系减少约 25%,玉米根系减少约 64%。研究发现,Phyllophaga capillata 和 Aegopsis bolboceridus 对所有评估变数造成了损害,并使大豆的总产量降低了 58.62%,玉米的总产量降低了 59.76%。

- 南美洲使用杀虫剂熏蒸和化学喷洒的人数增加,这是基于各自的需求和有效性,因为它们是有效的害虫控制方法。

巴西在市场上占据主导地位,是由于有效的害虫防治需求导致对杀虫剂的需求不断增加。

- 南美洲农药市场呈现显着成长,该地区各国均呈现明显的扩张趋势。对杀虫剂的需求不断增加,主要是因为需要有效控制害虫并减少作物损失。截至 2022 年,南美洲在全球杀虫剂市场中占有 24.9% 的总市场占有率。

- 2022 年,巴西将以 87.7% 的显着份额占据南美杀菌剂市场的主导地位。巴西的农业区面积广阔,种类多样,不同地区种植多种不同的作物。这种多样性使得作物容易受到各种害虫的侵害,从而增加了对杀虫剂的需求。国内最常用的杀虫剂有效成分是氨基甲酸酯类和拟除虫菊酯类。

- 南美洲拥有9.0%的市场占有率,是第二大杀虫剂消费地区。厄瓜多、巴拉圭、秘鲁、乌拉圭和玻利维亚等国家的农民越来越意识到虫害造成的经济损失。然而,这种密集的做法为蚜虫、蛆、粉蝨、跳甲、地老虎、角蝉、蓟马等害虫的迅速蔓延创造了有利条件。这些害虫对谷物和谷类构成重大威胁,造成作物损害并降低产量。因此,使用农药对于保护作物和确保持续生产至关重要。

- 因此,预计预测期内(2023-2029 年)市场复合年增长率将达到 4.2%,这主要是由于对农产品的需求不断增加以及农药对保护农作物的重要性日益增加。

南美洲杀虫剂市场趋势

智利人均农药消费量居南美洲首位

- 昆虫以植物的叶子、茎、根和果实等组织为食,直接对作物造成损害。这种进食损害会导致植物光合作用降低、生长受阻、畸形,甚至死亡。这些不利影响可能导致严重的产量损失并影响整体作物产量。

- 南美洲种植多种作物,包括大豆、玉米、咖啡、小麦、甘蔗、香蕉和柑橘类水果等作物。这些作物的主要害虫是臭虫、尺蠖、黏虫、蚜虫和粉蝨。

- 在南美洲,智利是最大的农药消费国,2022年的消费量为1.6公斤/公顷。智利是农产品的主要出口国,尤其是水果和葡萄酒。出口市场通常有严格的植物检疫法规和品质标准,以防止害虫传播并确保食品安全。使用杀虫剂对于遵守这些要求和保障智利农产品在国际市场上的市场进入至关重要。

- 巴西南部地区,包括巴拉那州和南里奥格兰德州以及巴西中部的塞拉多地区,以大规模的大豆、玉米和棉花农业生产而闻名。巴西受草地贪夜蛾、根虫、棉铃虫、玉米螟等秋季害虫侵害较大,是南美洲杀虫剂消费量第二大的国家,杀虫剂消费量765.6克/公顷。

- 南美洲的气候条件多样,从热带雨林到干旱和半干旱地区。这些不同的农业生态学条件影响害虫的数量和动态。为了提供最佳的作物保护,使用杀虫剂是必要的,这将进一步推动杀虫剂市场的发展。

Cypermethrin是最昂贵的杀虫剂,每吨 21,080 美元

- Cypermethrin属于拟除虫菊酯类杀虫剂,是一种非合成化学品,旨在模仿菊花中提取的除虫菊酯的天然杀虫剂特性。在南美洲,Cypermethrin用于控制多种害虫,包括蚜虫、介壳虫、毛虫、叶蝉和粉蝨。Cypermethrin的作用方式是破坏昆虫的神经系统,导致瘫痪并最终死亡。 2022年Cypermethrin价格为每吨21,080美元。

- Imidacloprid是一种新烟碱类杀虫剂,属于新烟碱类化学类别。新烟碱类杀虫剂对昆虫神经系统的作用方式与尼古丁相同,会导致神经细胞过度刺激,最终导致瘫痪和死亡。 2022 年该活性成分的价格为每吨 17,170 美元。Imidacloprid在南美洲被广泛使用,可有效控制多种害虫,包括蚜虫、叶蝉、粉蝨、蓟马和某些甲虫。

- Malathion是一种有机磷酸酯杀虫剂,是一种有机磷酸盐。它被广泛用于控制多种害虫。在南美,它被有效地用于控制各种作物上的蚜虫、红蜘蛛、蓟马、果蝇和叶蝉等害虫。Malathion的作用机制是抑制乙酰胆碱酯酶,这种酶对于昆虫的正常神经功能至关重要。透过破坏神经系统,它会过度刺激神经细胞,导致目标害虫瘫痪并最终死亡。 2022 年的价格为每吨 12,500 美元,它是三种化学品中最便宜的。

南美洲农药产业概况

南美洲杀虫剂市场格局中等整合,前五大公司占46.80%的市场。该市场的主要企业是:ADAMA Agricultural Solutions Ltd、Bayer AG、Corteva Agriscience、FMC Corporation和Syngenta Group(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第二章 报告要约

第 3 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 每公顷农药消费量

- 有效成分价格分析

- 法律规范

- 阿根廷

- 巴西

- 智利

- 价值链与通路分析

第五章 市场区隔

- 如何使用

- 化学灌溉

- 叶面喷布

- 熏蒸

- 种子处理

- 土壤处理

- 作物类型

- 经济作物

- 水果和蔬菜

- 粮食

- 豆类和油籽

- 草坪和观赏植物

- 原产地

- 阿根廷

- 巴西

- 智利

- 南美洲其他地区

第六章 竞争格局

- 主要策略趋势

- 市场占有率分析

- 业务状况

- 公司简介(包括全球概况、市场层级概况、主要业务部门、财务状况、员工人数、关键资讯、市场排名、市场占有率、产品和服务、最新发展分析)

- ADAMA Agricultural Solutions Ltd

- American Vanguard Corporation

- BASF SE

- Bayer AG

- Corteva Agriscience

- FMC Corporation

- Rainbow Agro

- Sumitomo Chemical Co. Ltd

- Syngenta Group

- UPL Limited

第七章:执行长的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源和进一步阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 50001702

The South America Insecticide Market size is estimated at 8.78 billion USD in 2025, and is expected to reach 10.62 billion USD by 2030, growing at a CAGR of 3.89% during the forecast period (2025-2030).

Foliar mode of application dominated the market due to its effectiveness and flexibility in the time of application.

- The foliar application of insecticides gained much popularity owing to factors like its effectiveness in controlling the target pests, and flexibility in the time and dosage of application compared to other methods. The foliar method of insecticide application accounted for the highest share of 53.8% in the year 2022, with a market value of USD 4.21 billion in the same year.

- The significance of insecticide seed treatment in controlling the spread of plant infections is exemplified by its substantial market share. In 2022, the South American seed treatment market witnessed a notable dominance of insecticide seed treatments, holding an impressive market share of 64.9% of all the application modes. This statistic underlines the growing recognition of the effectiveness of seed treatments in combatting insect vectors and safeguarding crop productivity.

- Soil application of insecticides aims to target soilborne insect pests that can cause severe effects on the root and lower parts of the plants and this method accounted for 10.5% of the total insecticides market in South America in the year 2022. The infestation of soil borne pests like white grub is known to reduce the root system by approximately 25% in soybean and 64% in maize. It was observed that Phyllophaga capillata and Aegopsis bolboceridus damaged all evaluated variables, reducing overall soybean productivity by 58.62% and maize productivity by 59.76%, which can effectively be treated with soil treatment.

- The adoption of fumigation and chemigation of insecticides in South America is increasing based on the need and effectiveness of each method based on the requirement as different methods are effective in controlling different pests.

Brazil's dominance in the market is fueled by the increasing demand for insecticides driven by the necessity for effective insect control

- The insecticide market in South America is witnessing significant expansion, with various countries in the region witnessing remarkable expansion. This increased demand for insecticides is driven by the necessity to effectively manage insect pests and minimize crop losses. As of 2022, South America accounted for 24.9% of the total market share value in the global insecticide market.

- In 2022, Brazil held a significant share of 87.7% in the South American fungicide market, asserting its dominance. Brazil has a vast and diverse agricultural landscape, cultivating a wide array of crops across different areas. This diversity makes crops more vulnerable to a variety of insect pests, resulting in an increased need for insecticides. The most frequently utilized insecticide active ingredients in the country are carbamates and pyrethroids.

- With a significant market share of 9.0%, the Rest of South America ranks as the second largest consumer of insecticides. Farmers in countries like Ecuador, Paraguay, Peru, Uruguay, and Bolivia are increasingly recognizing the economic losses caused by insect infestations. However, this intensive approach also creates favorable conditions for the rapid spread of insect pests, such as aphids, maggots, whiteflies, flea beetles, cutworms, hornworms, and thrips. These pests pose a substantial threat to grains and cereals, resulting in crop damage and diminished yields. Therefore, the use of insecticides becomes essential to safeguard crops and ensure continued productivity.

- As a result, the market is expected to experience a CAGR of 4.2% during the forecast period (2023-2029), primarily driven by the increasing demand for agricultural products and the rising significance of insecticides in protecting crops.

South America Insecticide Market Trends

Chile recorded the highest per capita consumption rate of insecticides in South America

- Insects can cause direct damage to crops by feeding on plant tissues such as leaves, stems, roots, or fruits. This feeding can result in reduced photosynthesis, stunted growth, deformities, or even plant death. These adverse effects can lead to substantial yield losses and affect the overall productivity of the crops.

- South America cultivates a wide range of crops, including major commodities such as soybeans, corn, coffee, wheat, sugarcane, bananas, and citrus fruits. The major pests in these crops include stink bugs, loopers, armyworms, aphids, and whiteflies.

- In South America, Chile is the largest consumer of insecticides, with a consumption of 1.6 kg/ha in 2022. Chile is a major exporter of agricultural products, particularly fruits and wine. Export markets often have stringent phytosanitary regulations and quality standards to prevent the spread of pests and ensure food safety. Insecticide use is crucial to comply with these requirements, safeguarding market access of Chilean produce in international markets.

- The southern regions of Brazil, including the states of Parana, Rio Grande do Sul, and Cerrado region in central Brazil, are known for extensive agricultural production of soybeans, corn, and cotton. They face major concerns with pests like the fall armyworm, rootworm, bollworm, and corn earworm, contributing to Brazil's rank as the second-highest consumer of insecticides in South America, with a consumption rate of 765.6 g/ha.

- South America exhibits a wide range of climatic conditions, from tropical rainforests to arid and semi-arid regions. These diverse agroecological conditions influence pest populations and dynamics. The use of insecticides is necessary to provide the best crop protection, which will further drive the insecticide market.

Cypermethrin is the highest-priced insecticide at USD 21.08 thousand per metric ton

- Cypermethrin belongs to the class of pyrethroid insecticides, which are non-synthetic chemicals designed to mimic the natural insecticidal properties of pyrethrins derived from chrysanthemums. In South America, cypermethrin is used to effectively manage a wide range of pests, including, but not limited to, aphids, beetles, caterpillars, leafhoppers, and whiteflies. The mode of action of cypermethrin involves disrupting the nervous systems of insects, leading to paralysis and, ultimately, their death. In 2022, cypermethrin was priced at USD 21.08 thousand per metric ton.

- Imidacloprid is a neonicotinoid insecticide belonging to the chemical class of neonicotinoids. Neonicotinoids act on the nervous system of insects in a similar way to nicotine, causing overstimulation of nerve cells and ultimately leading to paralysis and death. This active ingredient was priced at USD 17.17 thousand per metric ton in 2022. In South America, imidacloprid is widely used to effectively manage various pests, including aphids, leafhoppers, whiteflies, thrips, and certain beetle species.

- Malathion is an organophosphate insecticide belonging to the chemical class of organophosphates. It is widely used to control a variety of insect pests. In South America, malathion is used to effectively manage pests, such as aphids, spider mites, thrips, fruit flies, and leafhoppers in various crops. Malathion's mode of action involves inhibiting acetylcholinesterase, an enzyme essential for proper nerve function in insects. By disrupting the nervous system, it causes overstimulation of nerve cells, leading to paralysis and, ultimately, death of the target pests. This is the most affordable chemical among the three, with a price of USD 12.5 thousand per metric ton in 2022.

South America Insecticide Industry Overview

The South America Insecticide Market is moderately consolidated, with the top five companies occupying 46.80%. The major players in this market are ADAMA Agricultural Solutions Ltd, Bayer AG, Corteva Agriscience, FMC Corporation and Syngenta Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 Argentina

- 4.3.2 Brazil

- 4.3.3 Chile

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Application Mode

- 5.1.1 Chemigation

- 5.1.2 Foliar

- 5.1.3 Fumigation

- 5.1.4 Seed Treatment

- 5.1.5 Soil Treatment

- 5.2 Crop Type

- 5.2.1 Commercial Crops

- 5.2.2 Fruits & Vegetables

- 5.2.3 Grains & Cereals

- 5.2.4 Pulses & Oilseeds

- 5.2.5 Turf & Ornamental

- 5.3 Country

- 5.3.1 Argentina

- 5.3.2 Brazil

- 5.3.3 Chile

- 5.3.4 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ADAMA Agricultural Solutions Ltd

- 6.4.2 American Vanguard Corporation

- 6.4.3 BASF SE

- 6.4.4 Bayer AG

- 6.4.5 Corteva Agriscience

- 6.4.6 FMC Corporation

- 6.4.7 Rainbow Agro

- 6.4.8 Sumitomo Chemical Co. Ltd

- 6.4.9 Syngenta Group

- 6.4.10 UPL Limited

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219