|

市场调查报告书

商品编码

1684006

越南除草剂市场:份额分析、产业趋势与成长预测(2025-2030年)Vietnam Herbicide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

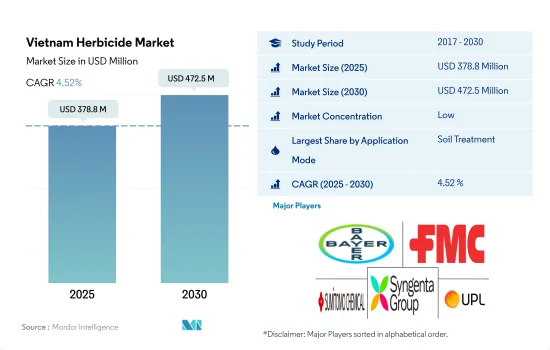

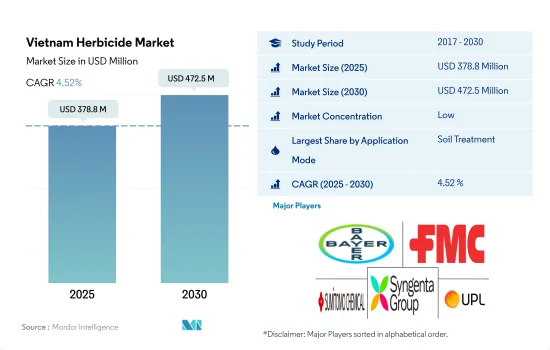

预计 2025 年越南除草剂市场规模将达到 3.788 亿美元,到 2030 年将达到 4.725 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.52%。

传统除草剂的土壤处理及其对保护主要作物品质的有效性可能会提高土壤处理的采用率。

- 在越南,人们以各种方式使用除草剂来有效控制农田中的杂草。透过采用正确的施用方法,农民可以施用除草剂,有效覆盖特定区域,并最大限度地减少浪费,从而节省成本。效率的提高将优化除草剂的使用,从而降低农民的投入成本。

- 2022年,土壤施用是农业除草剂喷洒的主流类型,占除草剂喷洒总量的46.4%。谷物和谷类产品占据最大的市场占有率,为 64.6%。土壤施用除草剂是优选的,因为它们有助于透过防止或减少杂草生长来保护作物和谷类的品质。

- 2022年,叶面喷布在除草剂施用领域排名第二,市场占有率为33.2%。这是因为叶面喷布除草剂具有快速起效的特性,可以快速破坏目标杂草的生理过程。这种快速作用会导致杂草枯萎、变黄并死亡。这种优势在处理侵略性强或竞争性强的杂草品种时非常有用,因为如果不加以有效控制,这些杂草品种很快就会占领作物的主导地位。

- 在越南的农业领域,使用除草剂的目的是最大限度地提高作物的生产力并提高作物的整体盈利。除草剂应用形式的市场占有率预计将实现 4.9% 的复合年增长率。

越南除草剂市场趋势

出于保护作物免受杂草侵害和提高产量的需求,耐除草剂作物的采用预计将推动除草剂的消费。

- 2021 年至 2022 年,越南的除草剂消费量预计将稳定成长。这种成长趋势可以归因于多种因素,包括采用抗除草剂作物、农业实践以及采用的杂草管理策略。此外,基改作物的传播也导致除草剂使用量激增。

- 越南基改耐除草剂玉米(GM玉米)的种植面积大幅扩大。 2019 年,越南农民在 92,000 英亩土地上种植了基改玉米,特别是抗除草剂玉米。与前一年(2018 年)相比,种植面积增加了 88%。基因改造耐除草剂作物的日益普及是 2018 年至 2019 年该国除草剂消费量增加的驱动力之一。

- 杂草的存在对作物产量构成重大威胁并造成重大损失。因此,农民严重依赖除草剂来控制杂草生长并尽量减少产量损失。预计这一因素将进一步推动除草剂市场的成长。

- 此外,杂草的持久性和适应性预计将需要增加除草剂的施用率和使用具有不同作用方式的多种除草剂。

- 因此,采用耐除草剂作物(包括基因改造品种)将导致更高的除草剂施用率和多种除草剂的使用,以满足控制杂草和减少产量损失的需求。预计这些因素将推动除草剂的消费。

越南农业模式的改变导致土壤劣化和杂草丛生

- 越南高地的农业正从短作长期休耕转变为短作短期休耕或永久种植。结果,经常出现土壤劣化和杂草过度生长的情况。水稻是越南的主要作物,而柿子(Echinochloa crus-galli)是稻田中最具破坏性的杂草之一。在湄公河三角洲地区,这种杂草导致 2021 年直播稻米区的产量损失了 46%。

- 甲草胺是一种选择性、系统性除草剂,透过抑制光合作用用于控制玉米、甘蔗、马铃薯和番茄等主要国内作物中的阔叶杂草。 2022 年,其价值为每吨 16,600 美元。

- 2022 年,越南常见的系统性除草剂2,4-二氯苯氧乙酸(2,4-D) 的价格为每吨 2,300 美元。 2,4-D 用于控制草皮、草坪、田间作物和果菜中的阔叶杂草。

- 同样,二甲戊灵是一种选择性出苗前除草剂,2022 年的价格为每吨 3,300 美元。可广谱防治马铃薯、烟草、高粱、水稻和甘蔗中的一年生杂草和阔叶杂草。 2022年,越南将从印度进口约3,000吨二甲戊灵。

- 不同的天气条件会对植物造成损害和压力,这会对植物的健康产生负面影响,因为它们无法忍受极端的压力。气温、湿度和降雨的极端变化以及冰雹、干旱和颱风等天气条件促进了杂草的生长。这将进一步导致除草剂需求增加,从而推高国内活性成分的价格。

越南除草剂产业概况

越南除草剂市场较为分散,前五大公司占了24.69%的市场。市场的主要企业有:拜耳股份公司、FMC株式会社、住友化学、先正达集团和UPL有限公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 每公顷农药消费量

- 活性成分价格分析

- 法律规范

- 越南

- 价值炼和通路分析

第五章市场区隔

- 执行模式

- 化学喷涂

- 叶面喷布

- 熏蒸

- 土壤处理

- 作物类型

- 经济作物

- 水果和蔬菜

- 粮食

- 豆类和油籽

- 草坪和观赏植物

第六章 竞争格局

- 关键策略趋势

- 市场占有率分析

- 业务状况

- 公司简介(包括全球概况、市场层级概况、主要业务部门、财务状况、员工人数、关键资讯、市场排名、市场占有率、产品和服务、最新发展分析)

- ADAMA Agricultural Solutions Ltd.

- BASF SE

- Bayer AG

- Corteva Agriscience

- FMC Corporation

- Nufarm Ltd

- Sumitomo Chemical Co. Ltd

- Syngenta Group

- UPL Limited

第七章:CEO面临的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 50001708

The Vietnam Herbicide Market size is estimated at 378.8 million USD in 2025, and is expected to reach 472.5 million USD by 2030, growing at a CAGR of 4.52% during the forecast period (2025-2030).

Traditional herbicide soil treatments and their effectiveness in protecting the quality of major crops may raise soil treatment adoption

- In Vietnam, herbicides are applied through various modes to control weeds in agricultural practices effectively. Farmers can achieve cost savings by utilizing suitable modes of application, allowing them to apply herbicides, effectively covering specific areas, and minimizing wastage. This increased efficiency leads to optimized herbicide usage, resulting in reduced input costs for farmers.

- In 2022, the dominant mode of herbicide application in agricultural practices was soil application, accounting for 46.4% of the overall herbicide application segment. The grains & cereals segment held the largest market share at 64.6%. The preference for soil treatment herbicides is attributed to their effectiveness in protecting the quality of grains and cereals by preventing or reducing weed growth.

- In 2022, foliar application was the second leading and held a market share of 33.2% in the segment of herbicide application. This is due to foliar herbicides being beneficial due to their fast-acting properties, which can rapidly disrupt the physiological processes of targeted weeds. This swift action results in symptoms like wilting, yellowing, or necrosis in the weeds. This advantage is valuable when tackling aggressive or competitive weed species that have the potential to rapidly dominate the crops if not effectively controlled.

- In the Vietnamese agricultural sector, the utilization of herbicides is aimed at maximizing crop productivity and improving overall crop profitability. The mode of application of herbicides is projected to register a CAGR of 4.9% in terms of market share.

Vietnam Herbicide Market Trends

The adoption of herbicide-tolerant crops with the need to protect the crops from weeds and improve yield is expected to drive the consumption of herbicides

- The consumption of herbicides in Vietnam witnessed a steady upward trend between 2021 and 2022. This increasing trend can be attributed to various factors, including the adoption of herbicide-tolerant crops, agricultural practices, and strategies employed for weed management. Furthermore, the expansion of genetically modified (GM) crops has contributed to the surge in herbicide usage.

- The cultivation of genetically modified herbicide-tolerant maize (GM corn) grew on a significant scale in Vietnam. In 2019, farmers in the country cultivated GM corn, specifically herbicide-tolerant maize, on an expansive 92,000 acres of land. This represented an 88% increase in acreage compared to the previous year, 2018. The increased adoption of GM herbicide-tolerant crops was one of the driving factors behind the rise in herbicide consumption in the country between 2018 and 2019.

- The presence of weeds poses a significant threat to crop yields, causing substantial damage. Consequently, farmers heavily rely on herbicides to regulate weed growth and minimize yield losses. This factor is further expected to bolster the growth of the herbicide market.

- Furthermore, the persistent and adaptable nature of weeds is expected to necessitate higher rates of herbicide application and the utilization of multiple herbicides with diverse modes of action.

- Therefore, due to the adoption of herbicide-tolerant crops, including genetically modified varieties, the need to control weeds and minimize yield losses leads to higher application rates and the use of multiple herbicides. These factors are expected to fuel the consumption of herbicides.

Changing agriculture patterns in Vietnam are leading to soil degradation and high weed infestation

- Agriculture in the uplands of Vietnam is changing from short cultivation-long fallow periods to short cultivation-short fallow periods or even permanent cropping. Soil degradation and high weed infestation are often the consequences. Rice is the major crop in Vietnam, and barnyard grass (Echinochloa crus-galli) is one of the most devastating weeds in the rice fields. In the Mekong Delta, this weed caused 46% rice yield losses in direct-seeded rice areas in 2021.

- Metribuzin is a selective and systemic herbicide that is used to control broadleaved weeds in major crops in the country, like corn, sugarcane, potatoes, and tomatoes, by inhibiting photosynthesis. In 2022, it was valued at USD 16.6 thousand per metric ton.

- In 2022, 2,4-dichlorophenoxyacetic acid (2,4-D), a common systemic herbicide, was valued at USD 2.3 thousand per metric ton in Vietnam. It is used to control broadleaf weeds in turf, lawns, field crops, and fruit and vegetable crops.

- Similarly, pendimethalin is a selective pre-emergence herbicide valued at USD 3.3 thousand per metric ton in 2022. It has broad-spectrum control of annual grasses and broadleaf weeds in potato, tobacco, sorghum, rice, and sugarcane. Vietnam imported around 3.0 thousand metric tons of pendimethalin from India in 2022.

- A variety of weather conditions can cause damage and stress to plants and thus be detrimental to plant health as they cannot survive extreme stress. These conditions, including extremes of temperature, humidity, and rain, as well as hail, drought, and typhoons, lead to increased weed growth. This will further lead to increased herbicide demand, thereby inflating the prices of active ingredients in the country.

Vietnam Herbicide Industry Overview

The Vietnam Herbicide Market is fragmented, with the top five companies occupying 24.69%. The major players in this market are Bayer AG, FMC Corporation, Sumitomo Chemical Co. Ltd, Syngenta Group and UPL Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 Vietnam

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Application Mode

- 5.1.1 Chemigation

- 5.1.2 Foliar

- 5.1.3 Fumigation

- 5.1.4 Soil Treatment

- 5.2 Crop Type

- 5.2.1 Commercial Crops

- 5.2.2 Fruits & Vegetables

- 5.2.3 Grains & Cereals

- 5.2.4 Pulses & Oilseeds

- 5.2.5 Turf & Ornamental

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ADAMA Agricultural Solutions Ltd.

- 6.4.2 BASF SE

- 6.4.3 Bayer AG

- 6.4.4 Corteva Agriscience

- 6.4.5 FMC Corporation

- 6.4.6 Nufarm Ltd

- 6.4.7 Sumitomo Chemical Co. Ltd

- 6.4.8 Syngenta Group

- 6.4.9 UPL Limited

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219