|

市场调查报告书

商品编码

1684038

欧洲MLCC:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Europe MLCC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

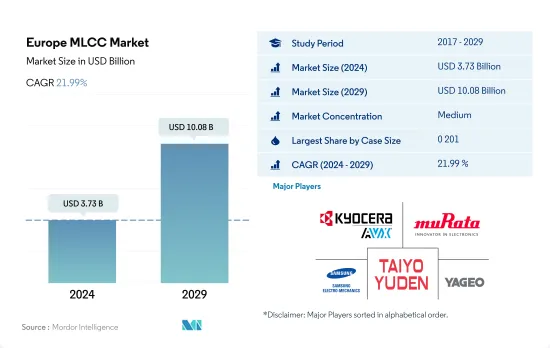

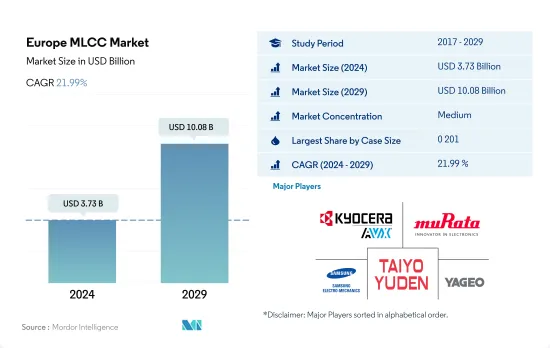

预计 2024 年欧洲 MLCC 市场规模将达到 37.3 亿美元,到 2029 年将达到 100.8 亿美元,在市场估计和预测期(2024-2029 年)内复合年增长率为 21.99%。

5G基地台的部署和该地区军事开支的增加将推动对 MLCC 的需求

- 0.201 型已成为领先者,在 2022 年占据了 34.55% 的最大市场占有率,其次是 0.402 型,占 19.57%,0.603 型占 14.10%。

- 外壳尺寸 0 402 最紧凑,可实现电路基板更大的元件密度。随着欧洲航太和国防领域对通讯设备和无人机(UAV)等先进技术和系统的投资,预计对中间电容范围从 100uF 到 1000uF 的 X7R 电介质 0 402 MLCC 的需求将会成长,这些产品在维持可靠和高效的电源性能方面着至关重要的作用。医疗设备设计师目前正在致力于创新的设备设计,以进一步缩小 ICD 和心律调节器的尺寸。由于所有这些设备都将安装在人体内,因此它们必须尽可能小。无铅心律调节器目前正在研发中,预计其尺寸约为传统心律调节器的十分之一。这可能需要进一步缩小这些设备中使用的电气元件(包括电容器)的小型化。

- 0 603 MLCC 的需求由通讯业推动。欧洲通讯产业正致力于5G基地台的快速部署,对采用X5R电介质的0603外壳尺寸的MLCC的需求不断增加。

5G 智慧型手机等家用电子电器的使用日益增多,以及 AR 和 VR 等新技术的进步,正在推动 MLCC 的需求。

- 德国将成为领跑者,到 2022 年将占据最大的市场占有率,达到 25.07%,其次是英国,占 14.99%。

- 英国的家电製造业处于领先地位。预计未来几年英国等国家的家电市场将快速成长。 5G 网路、智慧家庭、AR 和 VR 技术以及功能增强的家用电器的不断发展也可能促进这一成长。因此,预计对 0201 外壳尺寸、电容低于 100uF 的表面黏着技术型接地积层陶瓷电容(MLCC) 的需求将会成长。

- 德国汽车工业是该国经济成长的最大贡献者之一。因此,对 X7R MLCC 的需求正在上升。不具备自动驾驶功能的汽油动力车通常需要约 3,000 个 MLCC,而电动车 (EV) 通常需要 8,000 到 10,000 个 MLCC。从德国汽车产业的快速技术发展可以看出当前的状况。此外,德国政府法规、奖励、折扣以及日益增强的电动车意识正在鼓励消费者购买电动车。

欧洲MLCC市场趋势

严格的政府法规推动电动轻型商用车的普及

- 2019 年至 2022 年,轻型商用车 (LCV) 产量表现不一。 2019 年产量为 252 万辆,2020 年略降至 211 万辆。不过,预计 2021 年将回升至 218 万辆,2022 年将稳定在 214 万辆,四年复合年增长率约为 4.6%。

- 在截至 2019 年的几年中,该行业的轻型商用车产量呈现最高的复合年增长率。然而,接下来的几年充满了动盪和不确定性,包括对整个汽车产业产生重大影响的新冠疫情。供应链中断和消费者需求减少导致产量下降。儘管如此,该行业仍保持了一定的生产水平,展现了韧性。

- 作为「Fit for 55」计画的一部分,欧洲议会核准了针对乘用车和轻型商用车的新排放减排目标,这可能会对汽车产业(包括MLCC市场)产生重大影响。随着汽车行业努力实现二氧化碳零排放以及电动车变得越来越普及,MLCC 的需求预计会增加。

- 欧盟委员会强制安装OBFCM预计将进一步刺激MLCC的需求。这些组件可实现车辆系统内的精确测量、资料处理和通讯,并支援监测二氧化碳排放和能源消费量。 ZLEV奖励机制的调整以反映销售趋势将鼓励零排放汽车的生产和购买,从而增加对 MLCC 的需求。

欧洲广泛采用 OBFCM 设备也促进了乘用车的产量。

- 在欧洲,乘用车产量下降。 2019年产量为1,870万台,预计2022年产量将下降至1,372万台,四年复合年增长率约为-8.7%。

- 产量下降可归因于多种因素,包括製造工厂暂时关闭、消费者购买力下降以及疫情导致的整体市场不确定性。然而,值得注意的是,欧洲汽车产业在逆境中展现了其韧性和适应能力。

- 轻型车辆二氧化碳排放法规于 2019 年生效,重新将重点放在减少排放气体和应对气候变迁。该法规强调了对道路燃料和电能消耗进行精确监控的必要性,并促使在新车上安装车载燃料和能源消耗监控器(OBFCM)。该法律规范为在欧洲 MLCC 市场运营的公司创造了机会。 MLCC 是汽车电子等各种应用领域中不可或缺的电子元件。随着汽车越来越先进,整合了 OBFCM 和其他监控设备,MLCC 的需求预计会增加。这些组件在实现汽车系统的精确测量、资料处理和通讯方面发挥着至关重要的作用。

- 随着业界致力于整合 OBFCM 等先进技术,MLCC 将在实现真正的二氧化碳减排和确保车辆在实际驾驶条件下按预期运行方面发挥关键作用。

欧洲MLCC产业概况

欧洲MLCC市场适度整合,前五大企业占51.04%。市场的主要企业有:京瓷AVX元件株式会社(京瓷株式会社)、村田製作所、三星电机、太阳诱电和国巨株式会社(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 价格趋势

- 铜价走势

- 镍价趋势

- 白银价格趋势

- 锌价趋势

- 家电销量

- 空调销售

- 桌上型电脑销量

- 游戏机销售

- 笔记型电脑销售

- 冰箱销售

- 智慧型手机销量

- 仓储设备销售

- 平板电脑销量

- 电视销售

- 汽车製造

- 客车生产

- 重型卡车生产

- 轻型商用车生产

- 乘用车生产

- 汽车製造

- 电动汽车生产

- BEV(纯电动车)生产

- PHEV(插电式混合动力汽车)产量

- 工业自动化销售

- 工业机器人销售

- 服务机器人销售

- 法律规范

- 价值炼和通路分析

第五章市场区隔

- 介电类型

- 1级

- 2级

- 錶壳尺寸

- 0 201

- 0 402

- 0 603

- 1 005

- 1 210

- 其他的

- 电压

- 500V~1000V

- 小于500V

- 1000V以上

- 电容

- 100uF~1,000uF

- 小于100uF

- 超过 1,000uF

- Mlcc安装类型

- 金属盖

- 径向引线

- 表面黏着技术

- 最终用户

- 航太和国防

- 车

- 家用电子电器

- 工业设备

- 医疗设备

- 电力和公共产业

- 通讯设备

- 其他的

- 国家

- 德国

- 英国

- 其他的

第六章竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- Kyocera AVX Components Corporation(Kyocera Corporation)

- Maruwa Co ltd

- Murata Manufacturing Co., Ltd

- Nippon Chemi-Con Corporation

- Samsung Electro-Mechanics

- Samwha Capacitor Group

- Taiyo Yuden Co., Ltd

- TDK Corporation

- Vishay Intertechnology Inc.

- Walsin Technology Corporation

- Wurth Elektronik GmbH & Co. KG

- Yageo Corporation

第 7 章 CEO 的关键策略问题CEO 的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 50001980

The Europe MLCC Market size is estimated at 3.73 billion USD in 2024, and is expected to reach 10.08 billion USD by 2029, growing at a CAGR of 21.99% during the forecast period (2024-2029).

5G base station rollouts and the growing military spending in the region are driving the need for MLCCs

- The 0 201 case size segment emerged as the frontrunner, capturing the largest market share of 34.55%, followed by the 0 402 case size segment with 19.57% and the 0 603 case size segment with 14.10% in terms of volume in 2022.

- The case size of 0 402 is among the most compact available, thus increasing the component density of the circuit board. As the European aerospace and defense sector invests in advanced technologies and systems, such as communication equipment and unmanned aerial vehicles (UAVs), the need for 0 402 MLCCs with X7R dielectric with a mid capacitance of 100uF-1000uF is expected to grow due to their essential role in sustaining dependable and efficient power performance. Medical device designers are currently working to develop innovative device designs to reduce the size of ICDs and pacemakers further. These devices must be as small as possible, as they are both contained within the human body. The development of lead-free pacemakers is currently underway, and they are estimated to be approximately one-tenth the size of a traditional pacemaker. Therefore, further miniaturization of the electrical components used in these devices, including capacitors, may be necessary.

- The demand for 0 603 MLCCs is being driven by the telecommunications industry. The European telecommunications sector is focusing on rapid 5G base station deployment, thus increasing the demand for 0 603 case size MLCCs with X5R dielectric.

The increasing usage of consumer electronics like 5G-enabled smartphones and new technological advancements like AR and VR are driving the MLCC demand

- Germany emerged as the frontrunner, capturing the largest market share of 25.07%, followed by the United Kingdom, with 14.99%, in terms of volume in 2022.

- The United Kingdom's consumer electronics manufacturing sector is gaining traction. Consumer electronics markets in countries like the United Kingdom are expected to grow rapidly in the coming years. 5G networks, smart homes, AR and VR technologies, and the constant evolution of consumer electronics devices with enhanced features may also contribute to this growth. As a result, the demand for installed multi-layer ceramic capacitors (MLCCs) of the surface-mount type of 0 201 case size, with a low capacitance below 100uF, is expected to grow.

- The German automotive sector is one of the biggest contributors to the country's economic growth. As a result, the demand for X7R MLCCs is on the rise. An engine-powered vehicle without an automatic driving feature typically needs around 3,000 MLCCs, whereas an electric vehicle (EV) typically requires 8,000-10,000 MLCCs. The current state of the automotive sector can be seen in the rapid technological development taking place in Germany. In addition, the German government's regulations, incentives, and discounts, as well as the growing awareness of e-mobility, are driving consumers to purchase EVs.

Europe MLCC Market Trends

Stringent government regulations increase the penetration of electric LCVs

- Light commercial vehicles (LCVs) production exhibited a mixed performance between 2019 and 2022. Starting at 2.52 million units in 2019, it experienced a slight decline in 2020 to 2.11 million units. However, there was a rebound in 2021 with a production volume of 2.18 million units, followed by stability at 2.14 million units in 2022, indicating a CAGR of around 4.6% over the four years, reflecting the challenging and volatile nature of the market.

- In the years leading up to 2019, the industry witnessed the highest CAGR in LCV production. However, subsequent years were marked by disruptions and uncertainties, including the COVID-19 pandemic, which significantly impacted the overall automotive industry. Supply chain disruptions and reduced consumer demand contributed to the decline in production. Nonetheless, the industry demonstrated resilience by maintaining a certain level of production.

- The approval of new CO2 emissions reduction targets for passenger cars and light commercial vehicles by the European Parliament as part of the "Fit for 55" package will have a substantial impact on the automotive industry, including the market for MLCCs. As the industry moves towards zero CO2 emissions and increased adoption of electric vehicles, the demand for MLCCs is expected to rise.

- The installation of OBFCMs, as mandated by the European Commission, will further drive the demand for MLCCs. These components enable accurate measurement, data processing, and communication within vehicle systems, supporting monitoring of CO2 emissions and energy consumption. Adapting the ZLEV incentive mechanism to reflect sales trends will incentivize the production and purchase of zero-emission vehicles, increasing demand for MLCCs.

The increased adoption of OBFCM devices in Europe also increased the production of passenger vehicles

- In Europe, the production of passenger vehicles witnessed a decline. Starting at a production volume of 18.70 million units in 2019, it decreased to 13.72 million units in 2022, with a CAGR of approximately -8.7% over the four years, mirroring the difficult market conditions and disruptions encountered by the European automotive sector.

- This decline in production can be attributed to various factors, including the temporary closure of manufacturing facilities, reduced consumer purchasing power, and overall market uncertainty caused by the pandemic. However, it is important to note that the European automotive sector has shown resilience and adaptability in the face of adversity.

- With the implementation of the light-duty vehicle CO2 regulation in 2019, there was a renewed focus on reducing emissions and addressing climate change. This regulation emphasizes the need for accurate monitoring of on-road fuel and electric energy consumption, leading to the installation of onboard fuel and energy consumption monitoring devices (OBFCMs) in new vehicles. This regulatory framework creates opportunities for businesses operating in the European MLCC market. MLCCs are essential electronic components used in various applications, including automotive electronics. As vehicles become more sophisticated with the integration of OBFCMs and other monitoring devices, the demand for MLCCs is expected to increase. These components play a crucial role in enabling accurate measurement, data processing, and communication within the vehicle's systems.

- As the industry works toward the integration of advanced technologies, such as OBFCMs, it will play a crucial role in achieving real-world CO2 reductions and ensuring vehicles perform as expected in real-world driving conditions.

Europe MLCC Industry Overview

The Europe MLCC Market is moderately consolidated, with the top five companies occupying 51.04%. The major players in this market are Kyocera AVX Components Corporation (Kyocera Corporation), Murata Manufacturing Co., Ltd, Samsung Electro-Mechanics, Taiyo Yuden Co., Ltd and Yageo Corporation (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Price Trend

- 4.1.1 Copper Price Trend

- 4.1.2 Nickel Price Trend

- 4.1.3 Silver Price Trend

- 4.1.4 Zinc Price Trend

- 4.2 Consumer Electronics Sales

- 4.2.1 Air Conditioner Sales

- 4.2.2 Desktop PC's Sales

- 4.2.3 Gaming Console Sales

- 4.2.4 Laptops Sales

- 4.2.5 Refrigerator Sales

- 4.2.6 Smartphones Sales

- 4.2.7 Storage Unit Sales

- 4.2.8 Tablets Sales

- 4.2.9 Television Sales

- 4.3 Automotive Production

- 4.3.1 Buses and Coaches Production

- 4.3.2 Heavy Trucks Production

- 4.3.3 Light Commercial Vehicles Production

- 4.3.4 Passenger Vehicles Production

- 4.3.5 Total Motor Production

- 4.4 Ev Production

- 4.4.1 BEV (Battery Electric Vehicle) Production

- 4.4.2 PHEV (Plug-in Hybrid Electric Vehicle) Production

- 4.5 Industrial Automation Sales

- 4.5.1 Industrial Robots Sales

- 4.5.2 Service Robots Sales

- 4.6 Regulatory Framework

- 4.7 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Dielectric Type

- 5.1.1 Class 1

- 5.1.2 Class 2

- 5.2 Case Size

- 5.2.1 0 201

- 5.2.2 0 402

- 5.2.3 0 603

- 5.2.4 1 005

- 5.2.5 1 210

- 5.2.6 Others

- 5.3 Voltage

- 5.3.1 500V to 1000V

- 5.3.2 Less than 500V

- 5.3.3 More than 1000V

- 5.4 Capacitance

- 5.4.1 100µF to 1000µF

- 5.4.2 Less than 100µF

- 5.4.3 More than 1000µF

- 5.5 Mlcc Mounting Type

- 5.5.1 Metal Cap

- 5.5.2 Radial Lead

- 5.5.3 Surface Mount

- 5.6 End User

- 5.6.1 Aerospace and Defence

- 5.6.2 Automotive

- 5.6.3 Consumer Electronics

- 5.6.4 Industrial

- 5.6.5 Medical Devices

- 5.6.6 Power and Utilities

- 5.6.7 Telecommunication

- 5.6.8 Others

- 5.7 Country

- 5.7.1 Germany

- 5.7.2 United Kingdom

- 5.7.3 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Kyocera AVX Components Corporation (Kyocera Corporation)

- 6.4.2 Maruwa Co ltd

- 6.4.3 Murata Manufacturing Co., Ltd

- 6.4.4 Nippon Chemi-Con Corporation

- 6.4.5 Samsung Electro-Mechanics

- 6.4.6 Samwha Capacitor Group

- 6.4.7 Taiyo Yuden Co., Ltd

- 6.4.8 TDK Corporation

- 6.4.9 Vishay Intertechnology Inc.

- 6.4.10 Walsin Technology Corporation

- 6.4.11 Wurth Elektronik GmbH & Co. KG

- 6.4.12 Yageo Corporation

7 KEY STRATEGIC QUESTIONS FOR MLCC CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219